Part 5

Impacts on Inflation and Portfolios

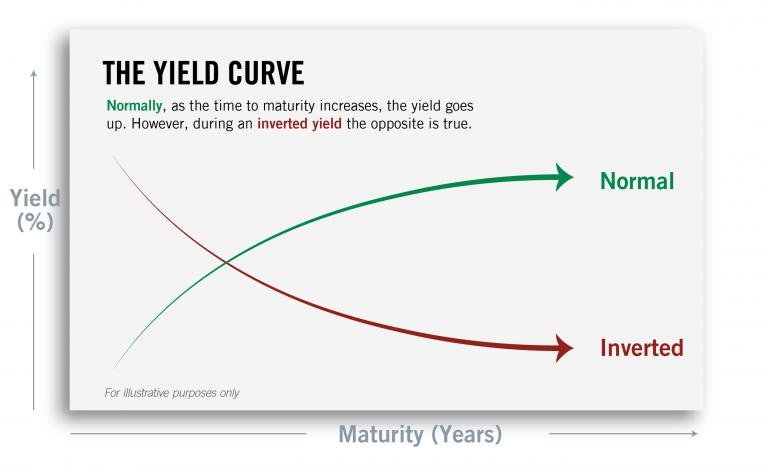

Inflation is a perennial portfolio threat. Equities have been consistently one of the best ways to beat it over time. Asset-intensity has to do with how a business makes its money. Is a company selling a flat-subscription for a service? Or are they selling smart-phones. How these different companies will respond to rising inflation is very different. You see companies that sell goods and use a high-asset intensity and significant investment in capital to achieve production goals will be more naturally hedged against inflation than the former.

Even prior to COVID-19, we were predicting a secular period of the ‘return of inflation’. For reasons not entirely known, inflation has been subdued over the past years. We believe it will be returning with a vengeance in the coming years and it certainly won’t be slowed down by the Federal Reserve’s new AIT framework in which the FOMC stated it would not let inflation run high than in the past, like perhaps even as high as 2.5%. While inflation is incredibly difficult to predict with reliability or to ‘market-time’, you can protect yourself by owning companies that use assets efficiently to achieve profitability. One good metric to evaluate how effectively a management team is using assets to get to the finish line is Return on Assets. A higher number on this reading will mean companies are using their assets efficiently.

Interested in investing with ETFs?  FSI Sector Allocation Rebalanced Monthly

|

Unprecedented government spending levels are another factor that motivate our call for using certain equity strategies to hedge against a reflating macroeconomic environment. How do we advise doing this? We suggest owning companies with high asset intensity, meaning their business models favor investment in capital and assets over operating leverage to achieve profitability. We think the upcoming period of reflation will boost asset-heavy companies.

-

How to Pick Stocks? The birth of “Granny Shots”?

-

How We Apply 'Granny Shots' To The Stock Market?

-

How Does The 'Granny Shot' Work In Investing?

-

Impact on Technology, Digital transformation and Artificial Intelligence in the Stock Market

-

Impacts on Inflation and Portfolios

-

How to allocate and create Tactical Portfolios?

-

How to create Seasonality allocations and portfolios?

-

How Do Granny Shots Bring it all Together?