Part 8

Is Bitcoin a Risk On Asset or is Bitcoin a Risk Off Asset?

Many investors think incorrectly in our opinion in ‘Bitcoin versus the dollar’, or simply of it as ‘Bitcoin instead of the dollar’. We think investing in Bitcoin is not binary. It is a growth asset in its own rite. Many investors incorrectly think of it as only good for a hedge asset. We do find it makes for an excellent uncorrelated hedge asset. However, most hedges typically don’t consistently outperform the wider markets returns in a variety of conditions, they are supposed to mitigate downside loss, not give extra risk adjusted return to your portfolio.

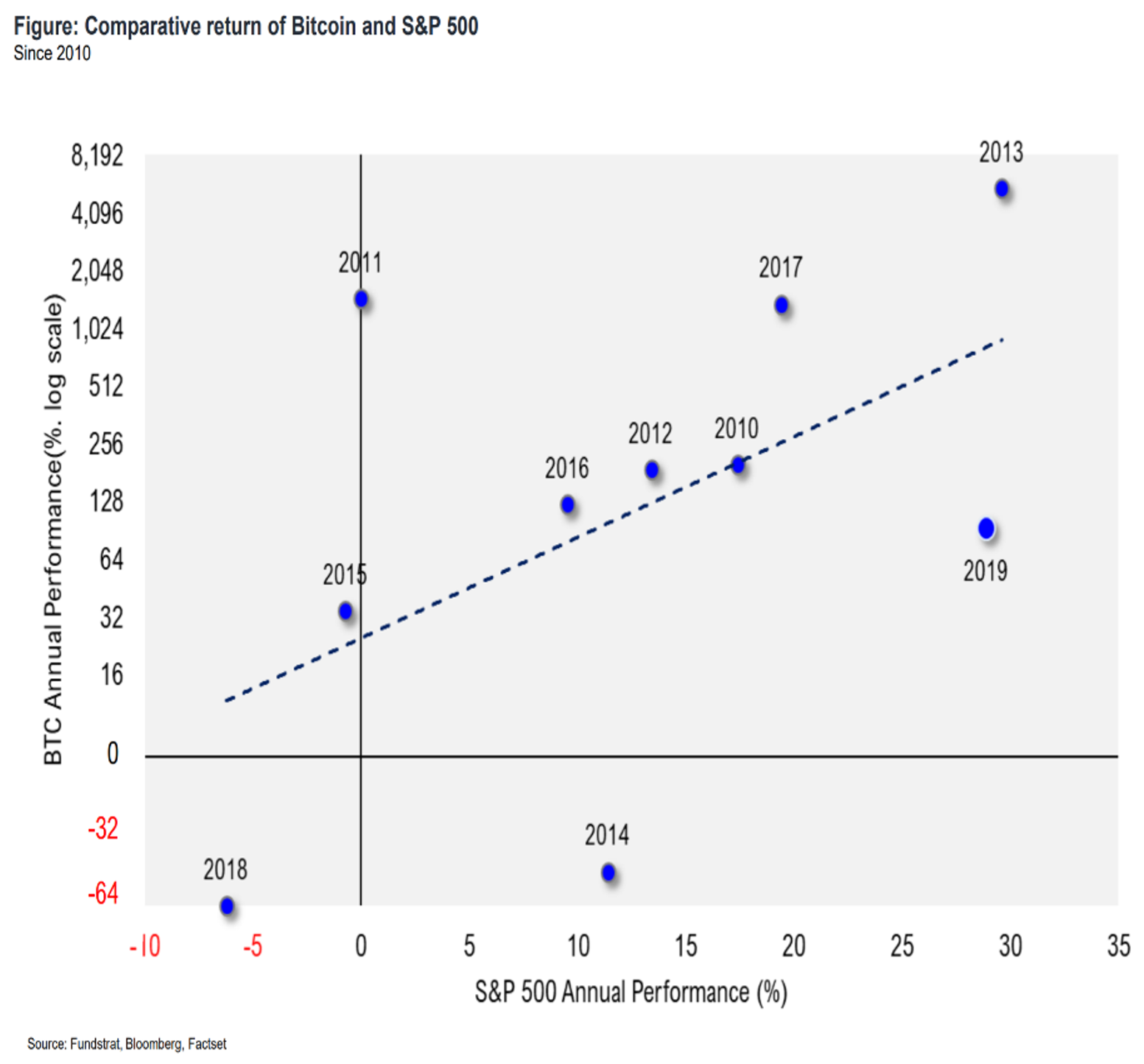

So, thinking of Bitcoin only as a hedge might not be the optimum portfolio strategy, particularly if you’re young and intend to follow our Hold On For Dear Life (HODL) strategy, which we greatly advise over getting fancy for those new to crypto. Investing in Bitcoin is hard without our tools. Despite the often infernal response we can receive from the notoriously cantankerous Bitcoin community, we maintain (and so does the data) that despite the previously observed counter-cyclical protective characteristics Bitcoin has had in the past, it is 100%, firmly and indisputably a risk-on asset.

Many people buy Bitcoin for an emotional reason, or perhaps as a political statement, but if you’re still thinking of it that way we urge you to stop. If you’re doing that, it is fine, but that’s not how your supposed to treat investments. We have firm rules of when to add to your position and when not to that will help keep your cost-basis low to gain exposure in your portfolio in the most quantitively driven way that is available to individual investors. Perhaps US monetary policy and the prospect of a future of Modern Monetary Theory makes you just about as mad as anything else in the world. That’s not a reason to invest in Bitcoin, sorry, it may have been in the beginning but it’s well passed time to stop considering this high-performing asset a toy or political statement. Political philosophy is not investment strategy, and we want to help make this incredible feat of computer engineering work for you and your portfolio. Let us help you. You won’t regret it.

We think it is highly unlikely that the Federal Reserve or fiscal authorities will blow up the dollar’s reserve currency status anytime soon. We pay a lot of attention to debt markets since equity, being junior in the capital structure tends to follow bonds. We constantly watch out for issues that could cause market panics, like potential negative interest rates, but as of now we see equity markets and the policymaker support of them on good and stable footing. Part of this is the natural tendency of the reserve currency to be the asset investors prefer during flights-to-safety. What this effectively means is that the United States gets enormous capital inflows whenever markets are bad or uncertainty is high, even during the 2008 Financial Crisis which was largely a result of abuses and regulatory oversights within its national financial system. Another reality that many who make investment decisions off of political beliefs or apocalyptic predictions should remember is that many foretold that Japan’s Central Bank would surely not be able to operate effectively at the Debt/GDP ratio that the world’s third largest economy had. These predictions were wrong and BOJ showed Central Banks can defy gravity, at least for a time.

Tesla was considered a risky, millennial stock with a valuation way too high. It was also singled out in the 2012 election as the premier example of lousy government investment sense. The stock is a perfect example of an asset ‘of the future’ being priced in the ‘markets of today.’ We believe Bitcoin is one such asset, but because of unique characteristics it possesses, we understand the upside could significantly exceed what is traditionally available to investors in equity markets. That being said, we typically recommend that investors only comprise 1% to 2% of their total portfolio in cryptocurrency assets. Within the crypto-class, we are currently OW on blue-chip Cryptos, including investing in Bitcoin.

TSLA was dead money for a long time despite consistently improving sales, production and other key metrics. If the fundamental rules of stock valuation were the only thing driving price, then it should have been going up in line with those metrics. What was far more important for TSLA was when it would meet certain thresholds that would make it an appealing addition to the portfolios of Russel 1000 money managers. Many analysts and others wrote off the stock and management strategy as departed from reality, and in a way it was, it was departed with secular realities of the past. This can be hard for markets to spot, it may be a good predictor in other ways, but markets and investors often miss transformational moments.

A lot of people speculate the crypto institutional adoption is just around the corner. We think you should listen to us on this rather than other sources. We specifically service over 200 major institutional financial clients and we happen to know for a fact that they are constrained from participating in a way that many people theorize until the crypto market is much bigger. We estimate that the crypto market still has a long way to go and needs to increase by about ten-fold in size before major institutional adoption comes.

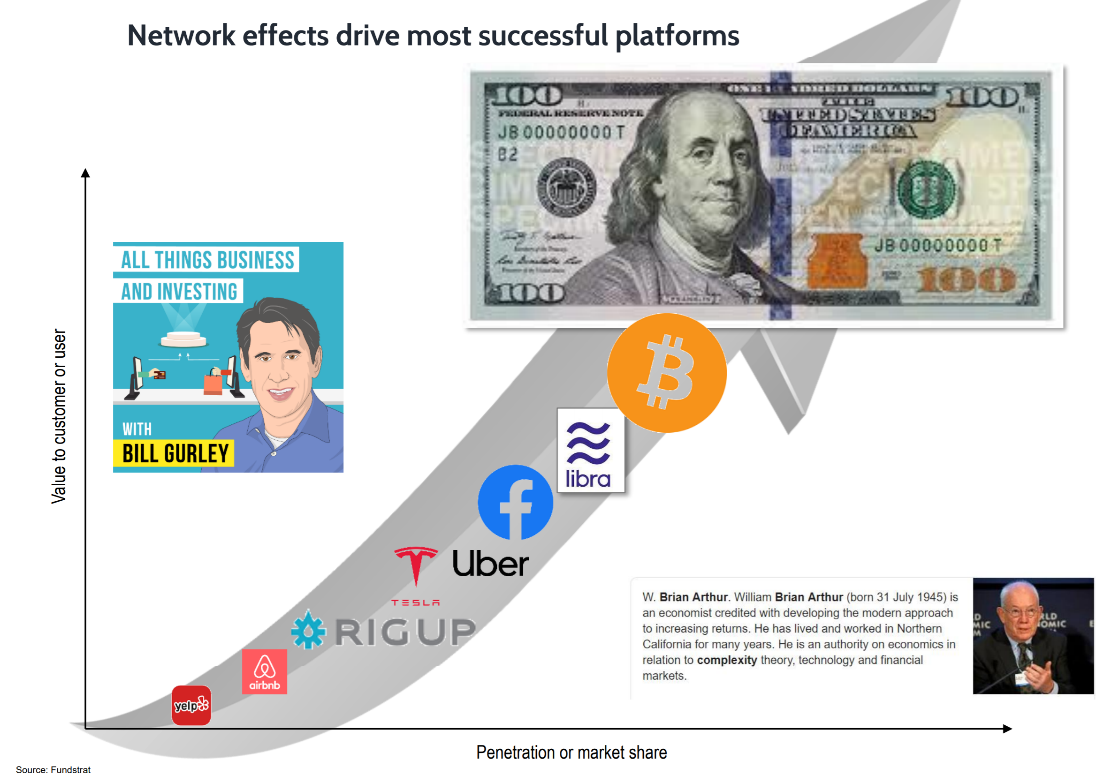

However, when this adoption does come, we think that Bitcoin’s price action will be similar to the recent parabolic moves upward for TSLA, or the long upward slog of the best growth stocks on the market. We think of Bitcoin as a major growth investment that will not replace currency, although it will for some transactions and in some communities, but what it will really do is create a lot of economic efficiency and replace a lot of the monopolistic services banks force customers to pay for.

And An Emerging Market Play?

Remember when BRICs were all the rage? We think investing in Bitcoin is similar. A basic tenet of economics is that capital flows from more developed economies to less developed, in many cases, because of something called the ‘catch up effect’ which essentially means capital will have higher returns, and will be more productive at of course the cost of greater risk, in developing economies compared to their more developed counterparts. This is why the first to brave the litany of risks that come with such investments often get wiped out or rich, and often not much in between. Certainly, wild swings and coup d’ etas give investors more heartburn then your typical plain vanilla ETF and have always been at the riskier end of the spectrum. We believe Bitcoin is literally an extension of the digital economy. Like many emerging market investments risks are plentiful and attention grabbing but returns and the ability to HODL made many bold investors very good, above-market returns. We believe this analogy captures our attitude toward Bitcoin as an investment and we would love to help you get exposure in the best way possible.

-

Bitcoin Investing: Is Bitcoin a Good Investment and How Much Should I Invest in Bitcoin?

-

What is All The Hype About Bitcoin?

-

Bitcoin compared to other assets

-

Bitcoin and inflation, how is Bitcoin related to inflation?

-

Cryptocurrency Investing in Modern Portfolios

-

Bitcoin as a Store of Value

-

The Bitcoin Halving and its impact

-

Is Bitcoin a Risk On Asset or is Bitcoin a Risk Off Asset?