COVID-19 UPDATE: Granny shot re-balance. Add 5, delete 6 stocks. YTD relative = +2,470bp. US sees the first case of re-infection of total 7.7 million cases

Click HERE to access the FSInsight COVID-19 Daily Chartbook.

STRATEGY: Granny Shots re-balance. +5 stocks. -6 delete. 23 stocks in total. YTD outperformance +2,470bp

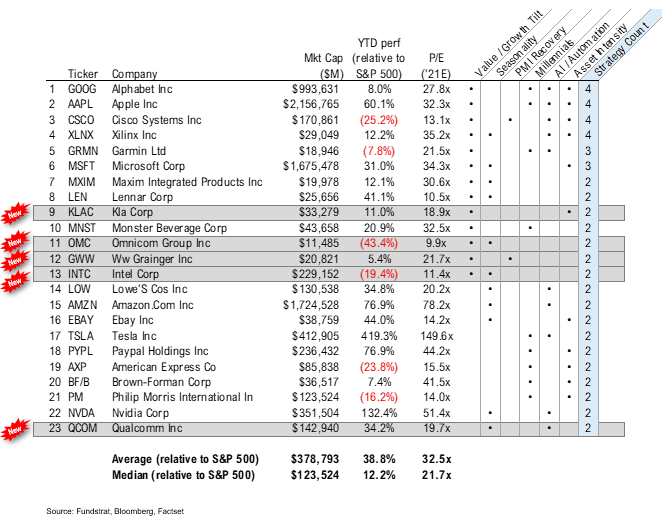

We are re-balancing our “Granny Shots” portfolio for 3Q2020. This rebalance is adding 5 stocks and deleting 6 names, leading to a net decline -1. There are now 23 stocks in the Granny Shots portfolio.

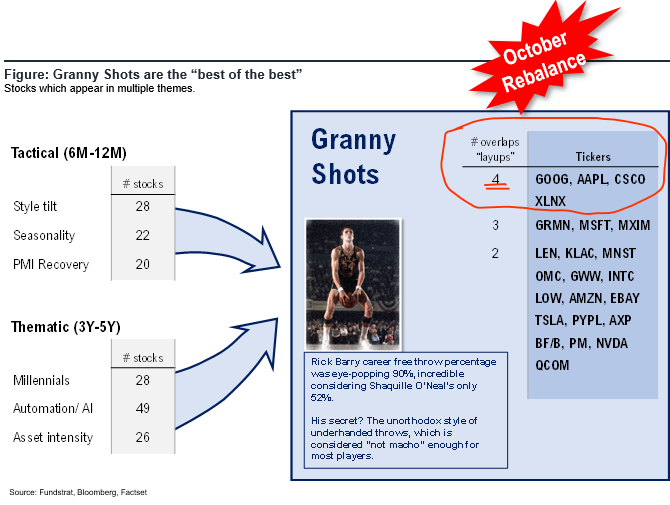

– In case you are wondering why we call this Granny Shots, it is named after NBA legend Rick Barry and refers to his unorthodox “free throw” method

– He had one of the highest free throw percentages, and our Granny Shots picks the stocks from 6 portfolios — getting the “best of the best”

– So this is why we call this our “Granny Shots”

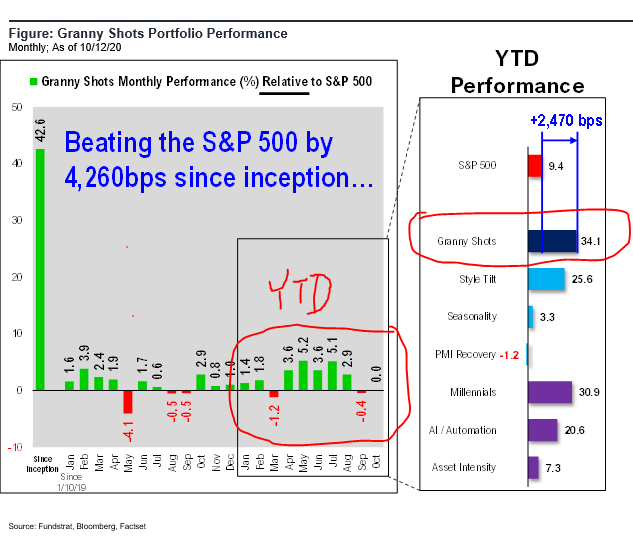

The re-balance for 3Q2020 is summarized below. We calculate the quarterly return for Granny Shots as if the portfolio was “equal weighted” at the start of the quarter. But as tireless Ken has calculated, if we let “winners ride,” the 2,470bp YTD outperformance of Granny would be even greater.

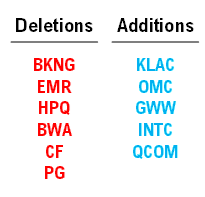

– Additions: KLAC, OMC, GWW, INTC, QCOM

– Deletions: BKNG, EMR, HPQ, BWA, CF, PG

Take a look at Point #3 for a fuller discussion.

We continue to view our Granny Shots as a way to construct a core portfolio. These are stocks which fall within our 3 thematic portfolios and 3 tactical portfolios. We will provide a full breakout of these portfolios later this week.

– Performance YTD is 34.1% compared to 9.4% for S&P 500

– Granny Shots has seen two tough months — March and September

– Not surprisingly, these were bad months for equities in general

It is probably helpful to see how often each of the stocks appears within each portfolio — thus, the more that appear, the greater the “attractiveness”

– 4 stocks appear 4 times –> GOOG, AAPL, CSCO and XLNX

– Consider these the names with the best margin of safety.

Below are the latest 23 Granny Shot stock ideas.

Turning our attention to the broader market, equities continue to show impressive resilience. Last week, the S&P 500 advance/decline line posted a new high, so that is certainly a good omen. And even the VIX seems like it is getting ready to make a decisive move below 25. This would be further confirmation that stocks indeed made their “pre-election” bottom — something that was signaled by holding 3,363.

Source: Bloomberg

Someone might ask how stocks could be surging, given the strong possibility of a contested election outcome? This election is <25 days away and 3 weeks can be an “eternity” for markets. I have heard differing views, from our clients, on why stocks are rising:

– Biden is going to win and we see a “Blue wave” leading to massive stimulus

– Trump is going to pull out a surprise win and Republicans keep the Senate, which leads to new tax cuts and massive stimulus

– Fed remains dovish –> don’t fight the Fed

– Vaccine is around the corner

– Investors are getting “pulled in” because $4.5 trillion is sitting on the sidelines

– Interest rates are low and supportive of equities

– US economy continues to recover and that matters more than election outcomes

The above is a kitchen-sink explanation of factors I have heard from our clients. And to an extent, I think all of the above is true. Whether Trump or Biden prevails, we get Washington to provide a needed bridge. And if you pick and choose from this above list, I can see multiple reasons supportive of stocks. Yet, ironically, only a few weeks ago, we had people suggesting stocks are “dead money” until election day. If anything, this is a reminder that markets never do what we expect.

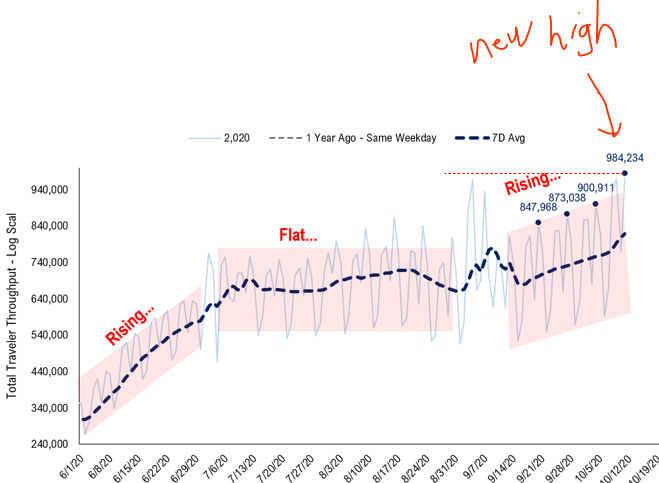

TSA traveler throughput is a sign consumers are still emerging from their bunkers = good

As for the economic recovery, consumers continue to emerge from their shell, even as US COVID-19 cases are surging. Take a look at the latest TSA traveler throughput. Total throughput hit a new high today, exceeding the Labor Day high. And Labor Day generally is a high water mark for travel. So, this is a good sign.

– It is also encouraging that this has not taken a downward hit, despite the surge in cases, which has been widely covered in the media.

Source: TSA

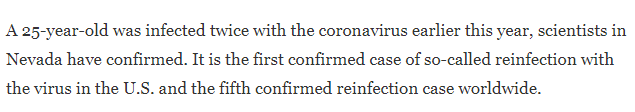

First ever US case of re-infection (of 7.5 million) and fifth confirmed Worldwide (of 38 million) — so it is very rare

The US has its first ever confirmed case of re-infection and the NPR story below details this case. Re-infection from COVID-19 would be concerning because this suggests there is no real immunity from this disease, and if so, then the only real way out of the pandemic is a vaccine, or a cure. By the way, both a vaccine and a cure are coming along, so there is reason to be optimistic about both.

https://www.npr.org/sections/coronavirus-live-updates/2020/10/12/922980490/scientists-confirm-nevada-man-was-infected-twice-with-coronavirus

This US citizen is 25 and was re-infected 6 weeks between infections. The second time he caught COVID-19, his symptoms were severe.

https://www.npr.org/sections/coronavirus-live-updates/2020/10/12/922980490/scientists-confirm-nevada-man-was-infected-twice-with-coronavirus

But I don’t think we should necessarily panic about this:

– 1 of 7.6 million Americans has been re-infected, clinically proven

– 5 of 38 million Worldwide has been re-infected, clinically proven

– this person was re-infected 6 weeks apart

– if it was easy to be re-infected, the majority of the 38 million infected would have seen re-infection by now (6 weeks later)

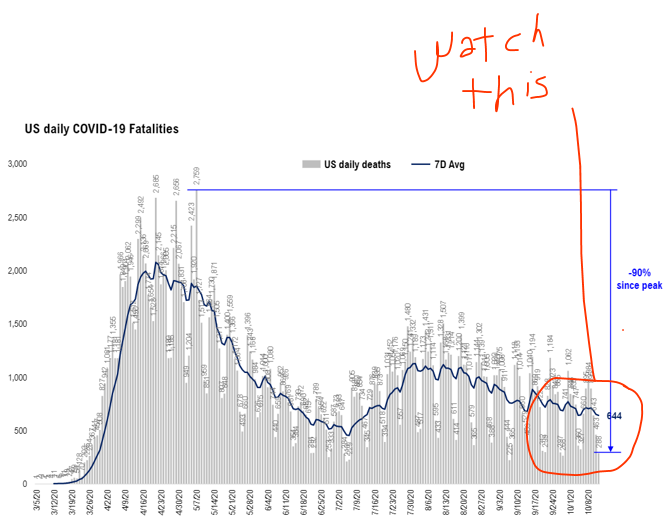

But COVID-19 cases are not going in the right direction in the US, but fortunately deaths and hospitalizations are muted

We discuss daily cases below and cases are rising. The rate of change (7D delta) has not gone exponential. So that is a good thing. And if it doesn’t go exponential, then we are in a waiting game to see where this level of cases peaks.

– but more importantly, we want to monitor mortality.

– daily deaths are still trending lower = good

– but the future is uncertain

Source: COVID-19 Tracking Project and Fundstrat

So at the moment, I don’t think COVID-19 is under control in the US. There is a rapid spread of cases. However, the key issues for me are:

– will daily cases surge exponentially? not yet = good

– 4 states with the fastest growth are: SD, ND, MO and WI –> when cases peak here, we can say the last of the “surge of new states” is over

– these 4 states are seeing higher daily cases per 1mm than NY did in its worst days, yet daily deaths are far, far lower

– if mortality remains low, this would be a good thing.

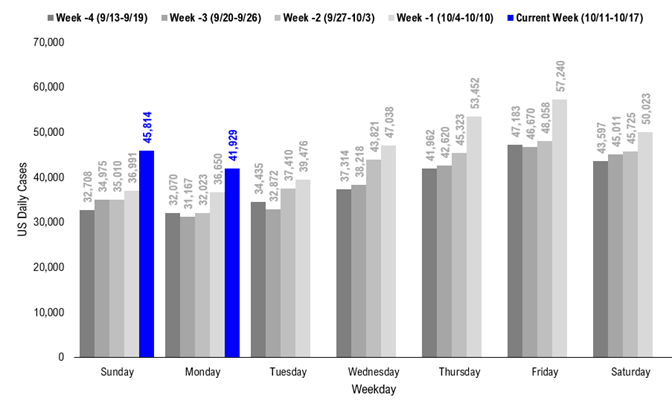

POINT 1: Daily cases 41,929 up +5,279 vs 7D ago, wary if 7D delta goes exponential

Daily new COVID-19 cases are rising, something apparent for the past few weeks, and rose to 41,929.

– Daily US cases are rising

– This looks like the second wave

– It has not gone exponential, which is a good thing

– But the key to watch is hospitalizations and deaths

Source: COVID-19 Tracking Project

Again, the daily change vs 7D ago, in our view, is the leading indicator as it is what influences the 7D moving average.

– As you can see below, the 7D delta in daily cases is rising, but it has not yet gone exponential

– Exponential means we are seeing rapid spread across the US, ala Feb/March

– This has not yet happened, but it could

Source: COVID-19 Tracking and Fundstrat

Source: COVID-19 Tracking and Fundstrat

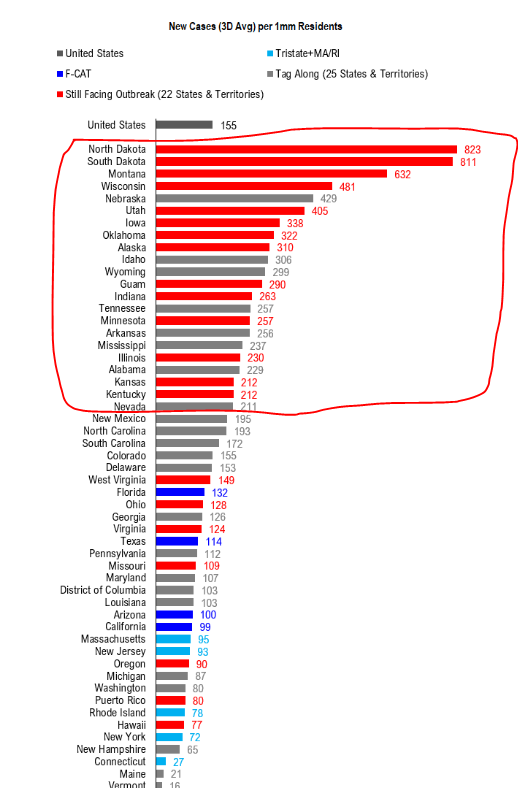

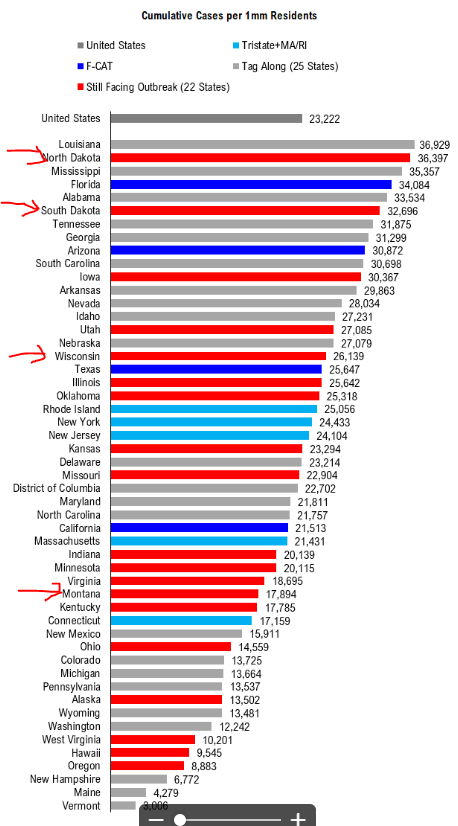

POINT 2: 4 states highest cases, ND, SD, MO, WI, surpass NY at worst, but deaths way lower

We highlighted yesterday that 4 states are leading the US breakout. These 4 states have the highest daily cases per 1mm residents:

– North Dakota

– South Dakota

– Montana

– Wisconsin

Source: COVID-19 Tracking and Fundstrat

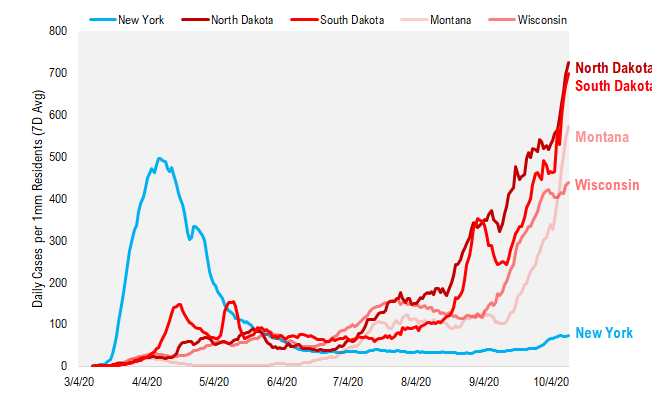

If you look at daily cases per 1mm residents, these 4 states have blown past NY state at NY state’s worst moments (April 2020). And in ND and SD, it is nearly 50% faster spread.

– these states are doing far worse than NY tristate in terms of the case spread

Source: COVID-19 Tracking and Fundstrat

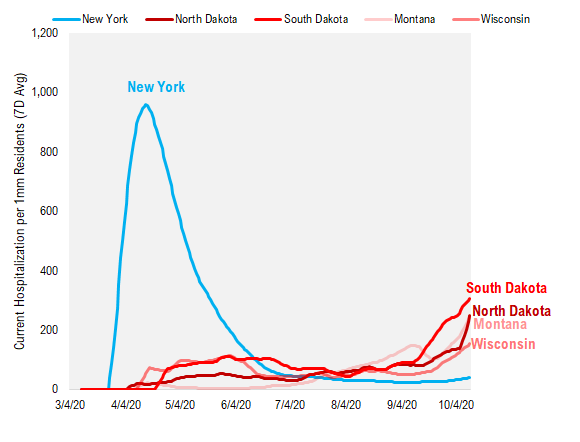

However, if you look at hospitalizations per 1mm residents, this is a far different story. Current hospitalizations per 1mm residents is far far lower. In other words, while there are far more cases in these 4 states, the number of infected persons needing hospitalizations is far far lower.

Source: COVID-19 Tracking and Fundstrat

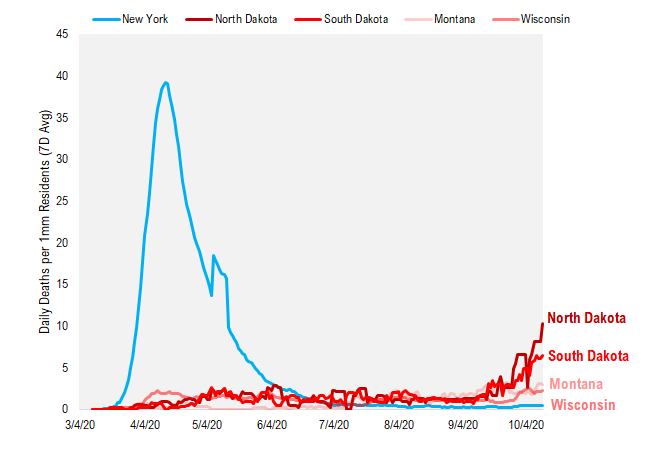

And similarly, when looking at mortality, there are far fewer daily deaths per 1mm residents. These level of deaths is rising, so COVID-19 is deadly and killing people in those states.

– but the level of mortality is much lower

Source: COVID-19 Tracking and Fundstrat

As for cumulative cases per 1mm residents, we know that many states with high prevalence have since seen daily cases slow. This was the case for:

– NY tristate

– FL, CA, AZ, TX, or F-CAT

And it hopefully applies to these 4 states seeing the most rapid breakouts. As shown below, SD and ND have really high case prevalence already exceeding that of even FL and AZ and TX. So unless these 4 states, ND, SD, MO and WI, have a different dynamic related to disease vulnerability, we should expect these states to see cases soon peak.

Source: COVID-19 Tracking and Fundstrat

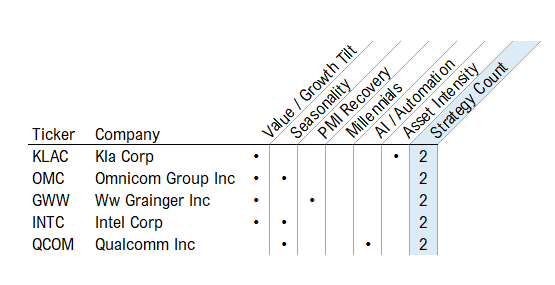

POINT 3: The 5 stocks Granny Shots re-balance

The 5 stocks that are added to the Granny Shots and their associated inclusion in one of our 6 active portfolios. As you can see, the Value/Growth tilt and seasonality are the primary reasons we are seeing these stock additions.

Source: Fundstrat

Over the past two years, when looking at the success rate of Granny Shot individual stock performance, measured as outperforming in a 3-month period, is ~50% (tireless Ken has the stats). But the Granny Shots collectively are based on finding names with a long-term thesis that is attractive and the turnover of these names is not that high. Thus, some of these stocks take time before they gain traction.

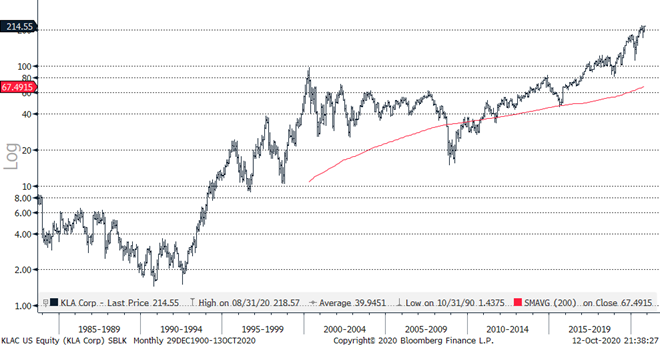

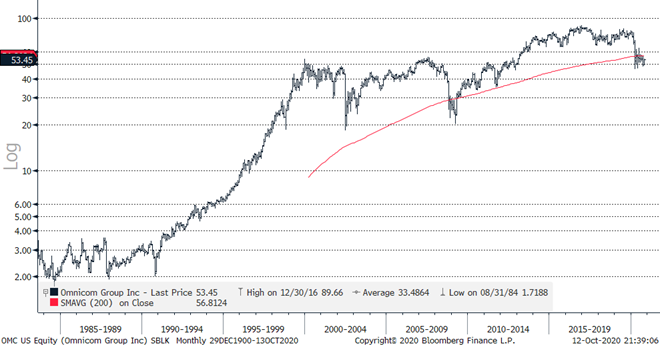

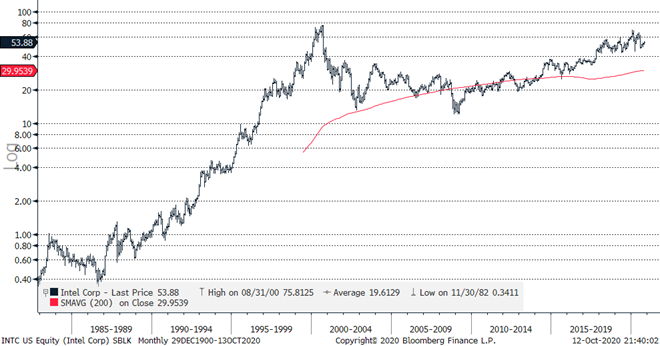

We thought it would be helpful to look at the 35-year price charts for these stocks.

KLAC — long term price chart = looking very good

Omnicom long-term chart highlights the massive headwinds from 2020…

WW Grainger, like other Industrials, suggest a vigorous economic recovery underway

Intel looks like it is shaking off its 2020 setbacks…

Qualcomm looks like it is waking up from a 20-year slumber…