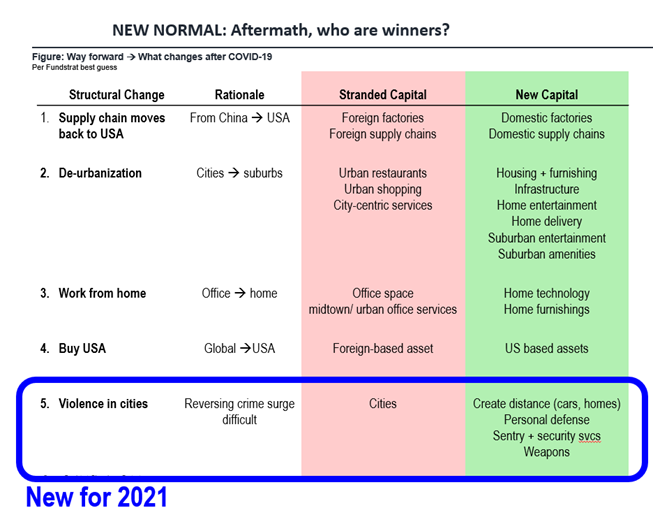

COVID-19 UPDATE: COVID-19 cases could be rolling over hard and hospitalizations down. Energy 2021 FOMO could be akin to 2020 Tesla FOMO given many institutions ZERO weighting

Click HERE to access the FSInsight COVID-19 Daily Chartbook.

We are shifting to a 4-day a week publication schedule:

- Monday

- Tuesday

- Wednesday

- SKIP THURSDAY

- Friday

STRATEGY: Energy 2021 FOMO akin to 2020 TSLA FOMO could be happening…

It might be too early to call the COVID-19 rollover DECISIVELY happening, but the signs sure seem to be there:

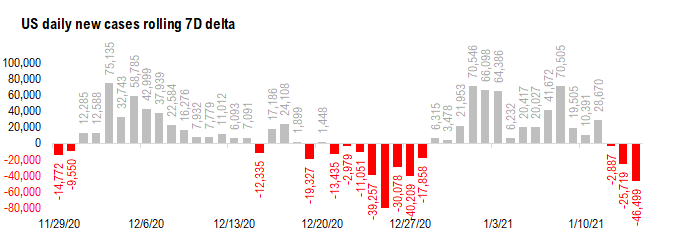

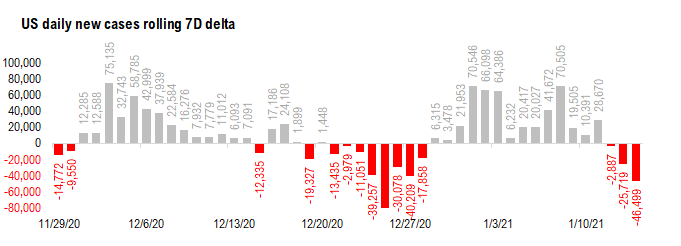

– 7D delta in cases accelerating to downside and -46,499 on Thursday

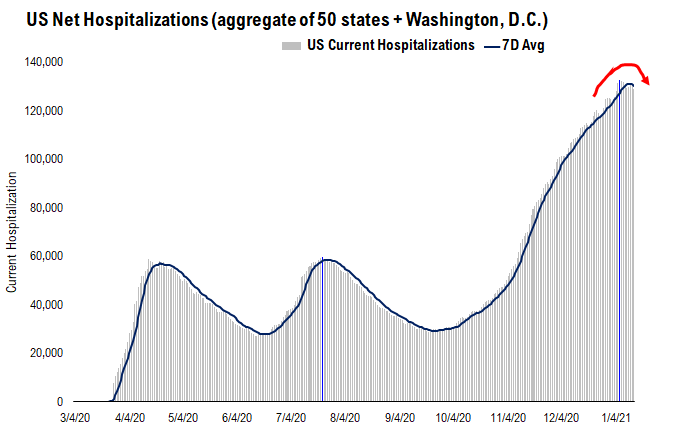

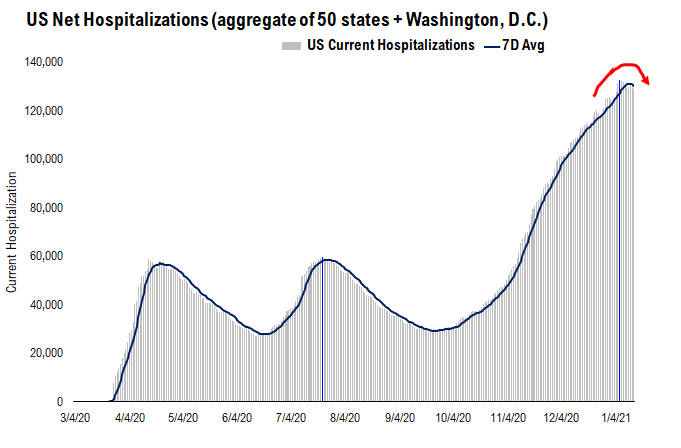

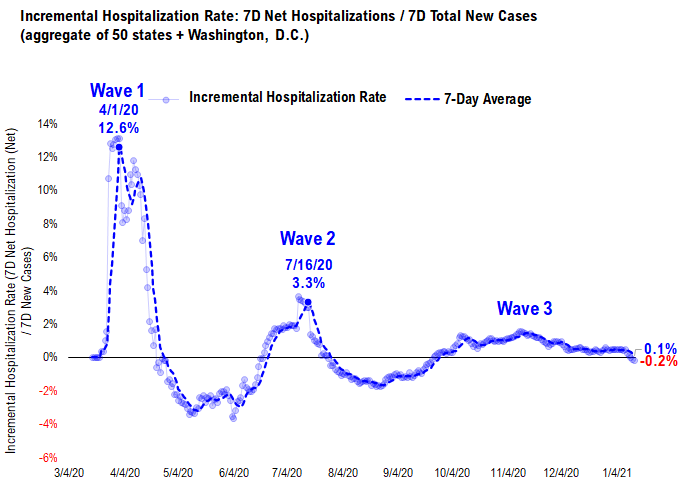

– net hospitalizations have turned negative and the incremental hospitalization rate is negative for the first time since September

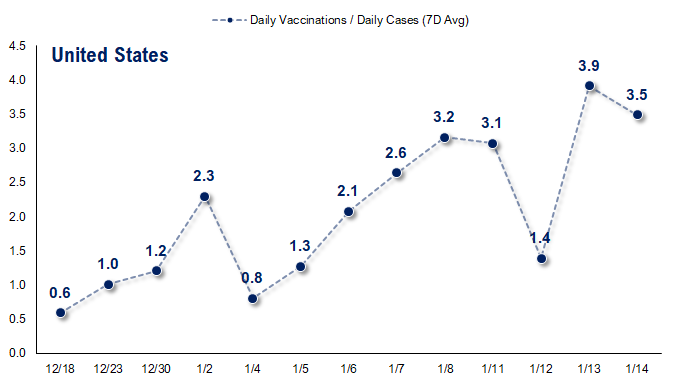

– daily vaccinations hit >900,000 Wednesday and the ratio of vaccinations/cases is >3.5X which is good

So, even as the US in the midst of winter, it seems like COVID-19 case trends have improved considerably. But the holiday distortions could still be in effect (making 7D delta look better than it should be). However, hospitalizations turning down is a very good sign.

– down 7D delta is good. and accelerating!

Source: COVID-19 Tracking and Fundstrat

– net hospitalizations turning negative, the first time since Sept!

Source: COVID Tracking Project and Fundstrat

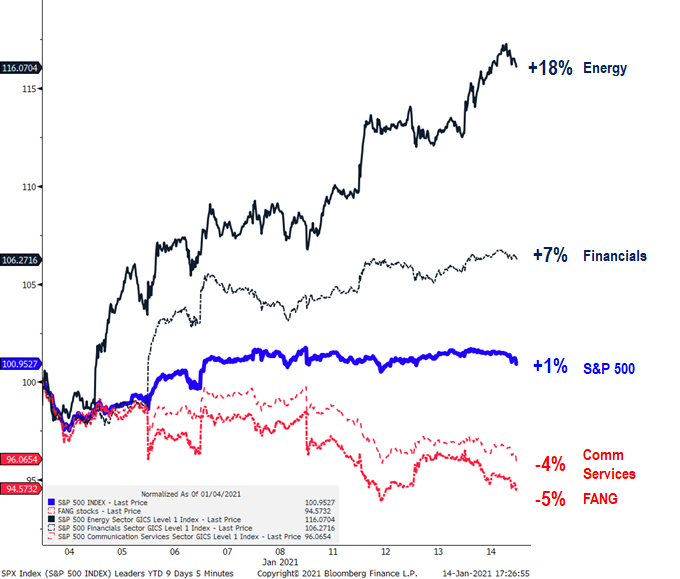

2020 so far, the start of rotation out of FANG into Energy + Financials

The S&P 500 is up 1% in the first two weeks in 2021, essentially a flat market. But this flat YTD belies a dramatic bifurcation in sector performance. YTD:

– Energy +18%

– Financials +7%

– Comm Services -4%

– FANG -5%

Source: Bloomberg

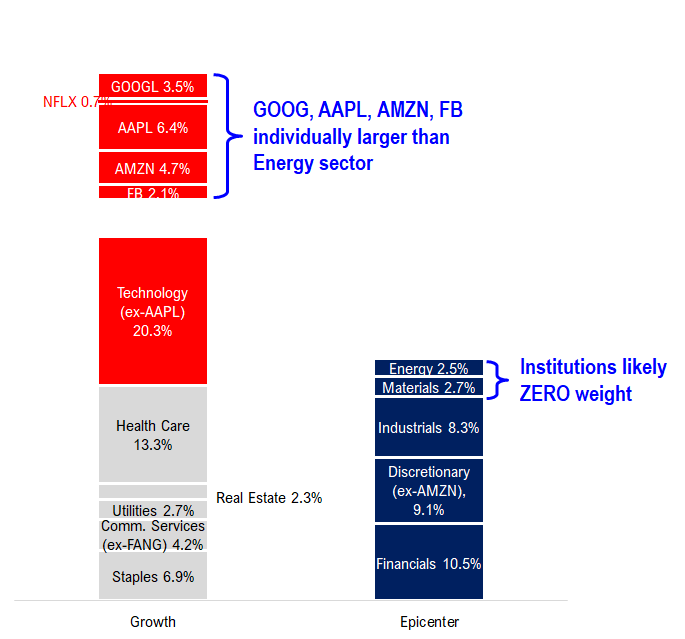

Institutions likely ZERO weight in both Energy and Basic Materials

Over the past decade, institutional investors have concentrated their holdings in more liquid stocks, a function of both:

– big funds gained share = requires larger position size

– divergent market liquidity = requires larger position size

As a consequence, smaller stocks and smaller sectors have become less relevant. Take a look at the chart below. Energy is now the smallest sector in the S&P 500 with a 2.5% weight. The troubles with this sector are well-known but Energy’s weighting is tiny:

– GOOG, AAPL, AMZN, FB and other stocks individually have a weighting greater than Energy

– In the past 5 years, getting these stocks right have mattered more than getting the Energy “call” right

– In fact, many institutions likely have a zero weighting (why bother)

Source: Bloomberg

But as we wrote in our 2021 Outlook, the re-alignment of the supply/demand outlook for Energy is the most dramatic of any sector. The new White House is likely to limit future supply growth. Capital availability is limited as private equity unlikely to bailout the sector like they did in 2016. And demand is set to recover as the global economy accelerates.

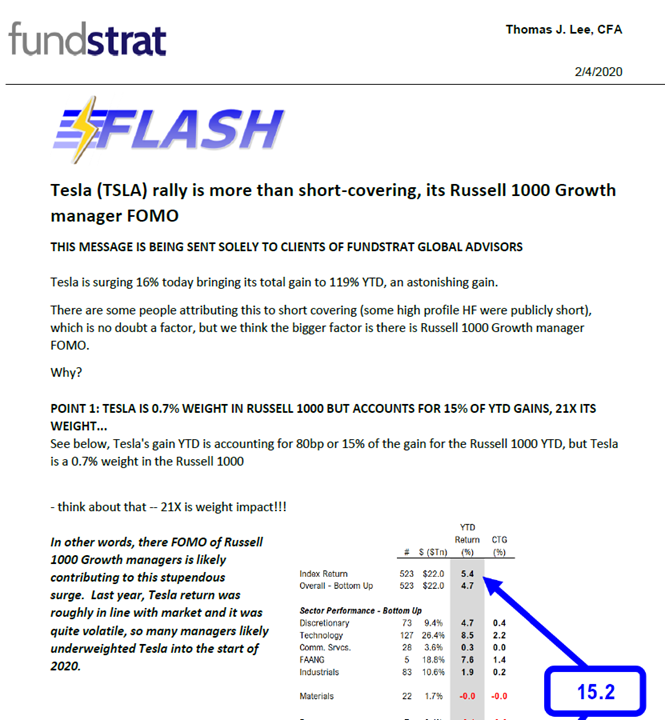

FOMO scenario –> Energy in 2021 somewhat akin to Tesla in early 2020

Early in 2020 (Feb 4, 2020), our clients might recall we wrote about how TSLA was likely to cause Russell 1000 Growth manager FOMO. At that time, we noted that the many Russell 1000 Growth managers had a zero weighting in TSLA but TSLA’s early 2020 surge was causing fund manager underperformance.

– and we posited that if Russell 1000 managers went to a benchmark weighting of 0.7% (from 0%), it would likely cause a parabolic surge

– We see a similar set-up for Energy stocks in 2021

Source: Fundstrat

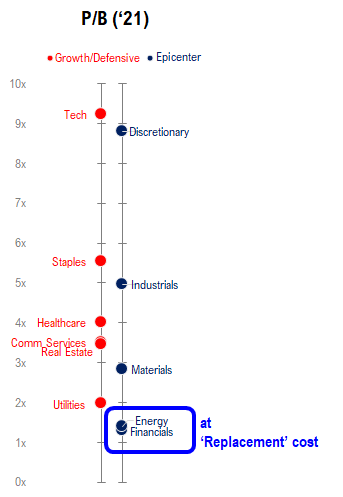

This is where the 2021 FOMO set up can take place.

– Energy stocks ~20% surge driving fund manager underperformance

– Many institutional investors have ZERO weighting in Energy

– Energy fundamentals could improve in 2021, reversing 4-years of misery

– Energy stocks trade below replacement cost = P/B ~1.0 similar to Financials

If this happens, Energy stocks could go parabolic in 2021.

Source: Fundstrat

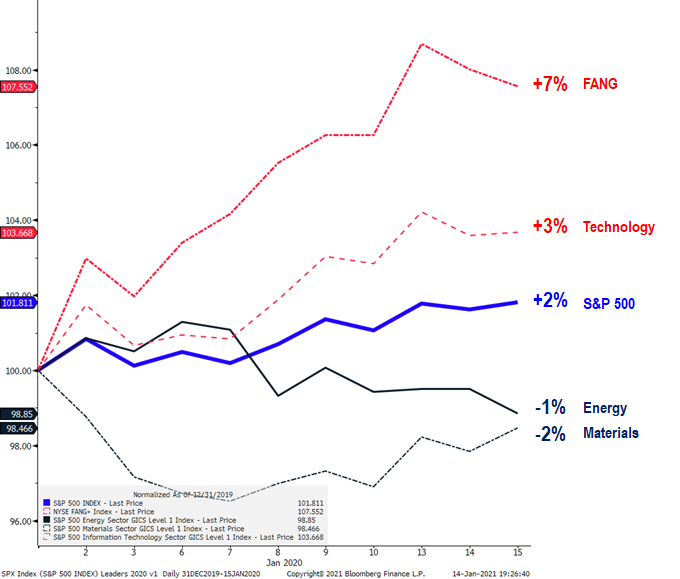

Sector divergence in the first two weeks of 2020 was a good leading indicator of full year leadership

In 2020, the sector divergence by mid-Jan 2020 proved to be a leading indicator of full year sector leadership. As shown below, FANG and Technology led early in 2020. While Energy and Materials were the worst.

– guess what sectors were the worst for 2020?

– this could be a repeat in 2021 –> look at who is leading

Source: Bloomberg

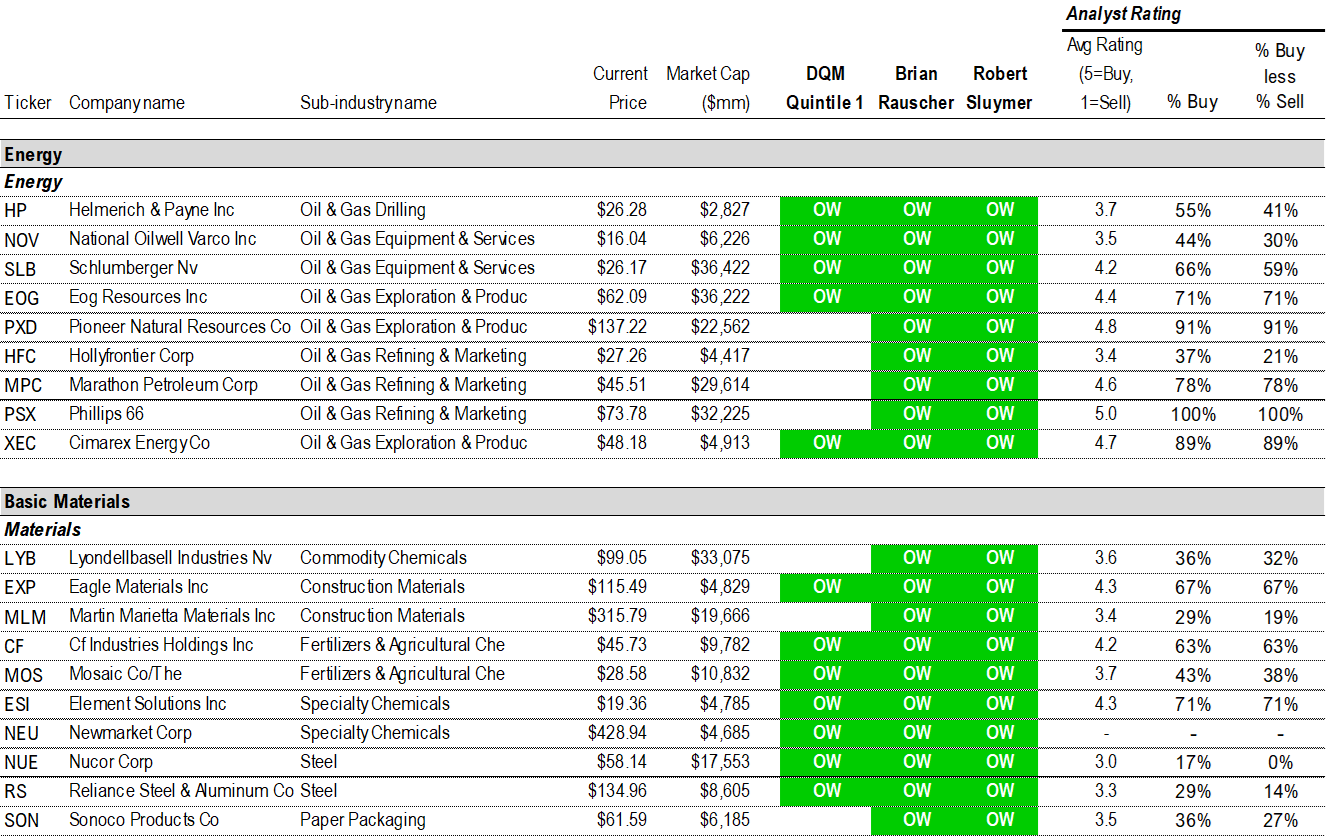

Energy remains one of our top 3 sectors for 2021…

Thus, we see a catch-up trade coming. Energy remains one of our top 3 sectors for 2021 (others are Industrials and Discretionary). But as we warned, Energy is the least consensus and most risky/tricky.

– Energy is 2.5% of the S&P 500 index

– Anything above 2.5% of your portfolio is an “overweight” in Energy

– Most institutions have ZERO weight, so there is upside

Below is our trifecta stock lists (*) for Energy and Basic Materials (since copper up). These are trifecta because it is OW by: DQM (quant by tireless Ken), Global Strategy (Rauscher) and Technicals (Sluymer).

Energy (9 stocks):

HP, NOV, SLB, EOG, PXD, HFC, MPC, PSX, XEC

Basic Materials (11 stocks):

LYB, EXP, MLM, CF, MOS, ESI, NEU, NUE, RS, SON

Source: Fundstrat and Bloomberg and FAMA

(*) These 20 Energy+Material Trifecta stock ideas are the subset of the “Epicenter” Trifecta stock list we published on December 11th, 2020. To view the full list of stock idea, click here. Please note that the stocks rated OW on this list meet the requirements of our investment theme as of the publication date. We do not monitor this list day by day. A stock taken off this list means it no longer meets our investment criteria, but not necessarily that it is neutral rated or should be sold. Please consult your financial advisor to discuss your risk tolerance and other factors that characterize your unique investment profile.

ADDENDUM: We are attaching the stock lists for our 3 portfolios:

We get several requests to give the updated list for our stock portfolios. We are including the links here:

– Granny Shots –> core stocks, based on 6 thematic/tactical portfolios

– Trifecta epicenter –> based on the convergence of Quant (tireless Ken), Rauscher (Global strategy), Sluymer (Technicals)

– Biden vs Trump –> based on correlation to either candidate odds

Granny Shots:

Full stock list here –> Click here

Tickers: AAPL, AMZN, AXP, BF.B, CSCO, EBAY, GOOG, GRMN, GWW, INTC, KLAC, LEN, LOW, MNST, MSFT, MXIM, NVDA, OMC, PM, PYPL, QCOM, TSLA, XLNX

Trifecta Epicenter (*):

Full stock list here –> Click here

Tickers: AN, GM, F, HOG, GRMN, LEG, TPX, PHM, TOL, NWL, HAS, MAT, PII, MGM, HLT, MAR, NCLH, RCL, WH, WYND, SIX, DRI, SBUX, FL, GPS, LB, CRI, VFC, GPC, BBY, FITB, WTFC, ASB, BOH, FHN, FNB, PB, PBCT, RF, STL, TFC, WBS, PNFP, SBNY, NYCB, MTG, AGNC, EVR, IBKR, VIRT, BK, STT, SYF, BHF, AGCO, OC, ACM, WAB, EMR, GNRC, NVT, CSL, GE, MMM, IEX, PNR, CFX, DOV, MIDD, SNA, XYL, FLS, DAL, JBLU, LUV, MIC, KEX, UNP, JBHT, R, UBER, UHAL, HP, NOV, SLB, EOG, PXD, HFC, MPC, PSX, XEC, LYB, EXP, MLM, CF, MOS, ESI, NEU, NUE, RS, SON, STOR, HIW, CPT, UDR, KIM, NNN, VNO, JBGS, RYN

Biden White House vs. Trump White House:

Full stock list here –> Click here

(*) Please note that the stocks rated OW on this list meet the requirements of our investment theme as of the publication date. We do not monitor this list day by day. A stock taken off this list means it no longer meets our investment criteria, but not necessarily that it is neutral rated or should be sold. Please consult your financial advisor to discuss your risk tolerance and other factors that characterize your unique investment profile.

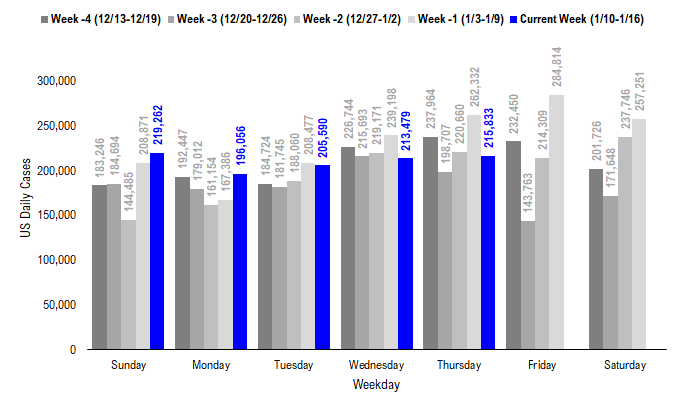

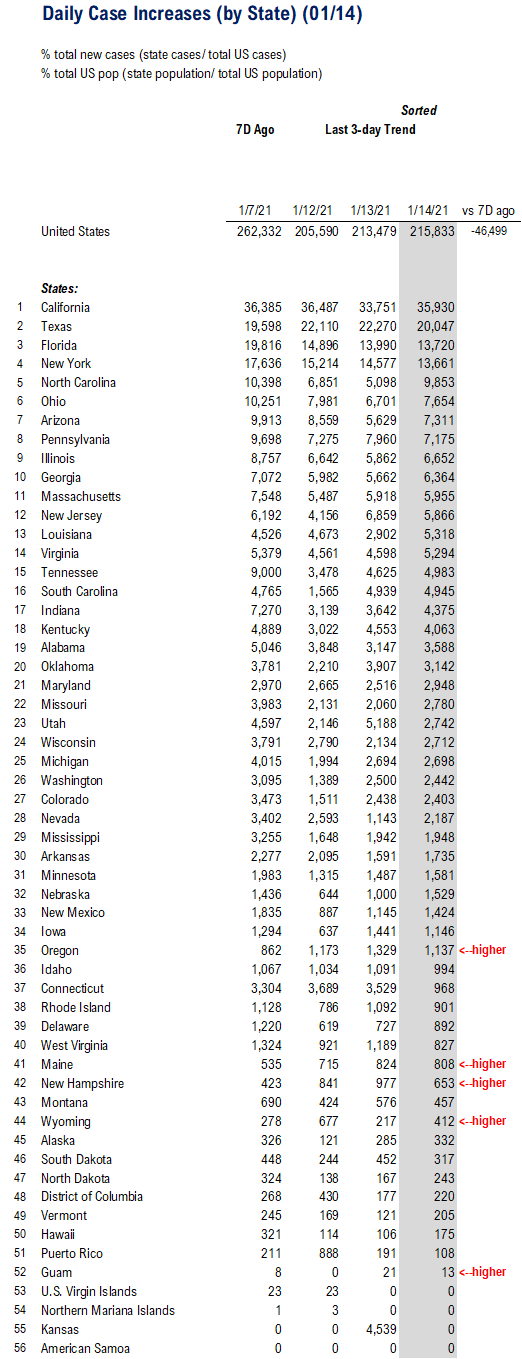

POINT 1: Daily cases rolling over HARD (holiday seasonality still at play)… daily cases 215,833, -46,499 vs 7D ago

The latest COVID-19 daily cases came in at 215,833, down -46,499 vs 7D ago.

– After turning negative two days ago, the 7D delta in daily cases continues to fall.

– Hard to tell how much is still holiday distortion.

Source: COVID-19 Tracking Project and Fundstrat

The 7D delta has turned negative for the past three days

– although we need more days of negative 7D delta to affirm this trend reversal in daily cases, the negative 7D delta is a positive sign.

Source: COVID-19 Tracking and Fundstrat

US hospitalization rolling over …

Below we show the aggregate patients who are currently hospitalized due to COVID. It certainly seems to be rolling over = good sign.

Source: COVID Tracking Project and Fundstrat

The incremental hospitalization rate has actually turned negative. So there are now more patients being discharged, than admitted. This is a great sign given the vaccines are just starting to be pervasive.

Source: COVID Tracking Project, Fundstrat

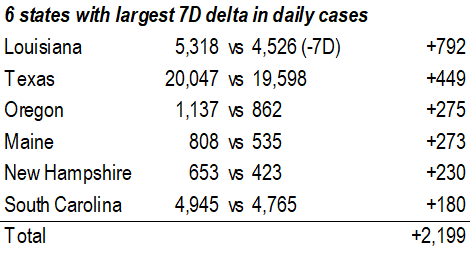

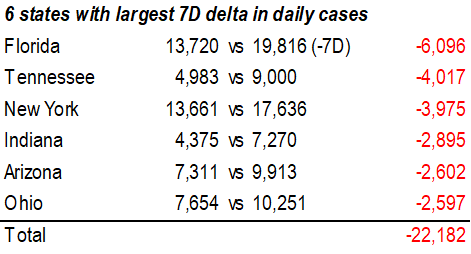

At the state level, the daily cases for almost all states are falling. Louisiana has the largest increase in daily cases vs. 7D ago. However, the increase is only +792.

FL, TN and NY all see huge declines in daily cases – all of them have ~4,000+ fewer cases vs. 7D ago.

Source: COVID-19 Tracking and Fundstrat

Source: COVID-19 Tracking and Fundstrat

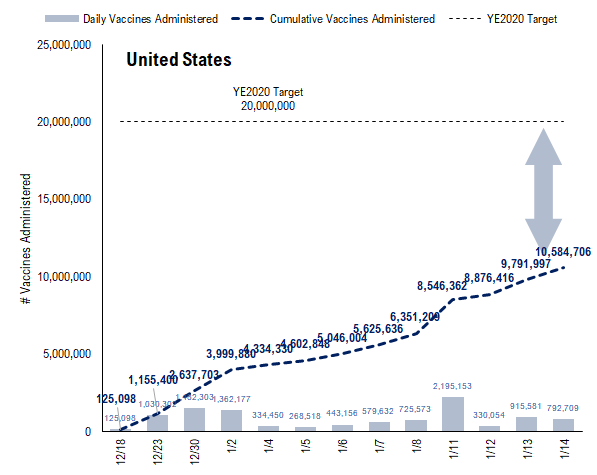

POINT 2: Pace of vaccinations reached >900k this week, and ratio vaccines/infections still >3.0

The CDC vaccination tracker shows 792,709 vaccinations were administered across the US. And total10.6 million Americans have received a vaccination

– a week ago, 5.6 million, so 2X in 1 week

– while not quite reaching 1 million Thursday, the pace is really picking up

Source: CDC and Fundstrat

The ratio of vaccinations/daily cases is still >3.0 and reached 3.9X this week. In any case, this ratio indicates more people are getting vaccinated than getting infected. So a higher number is better.

Source: CDC and Fundstrat

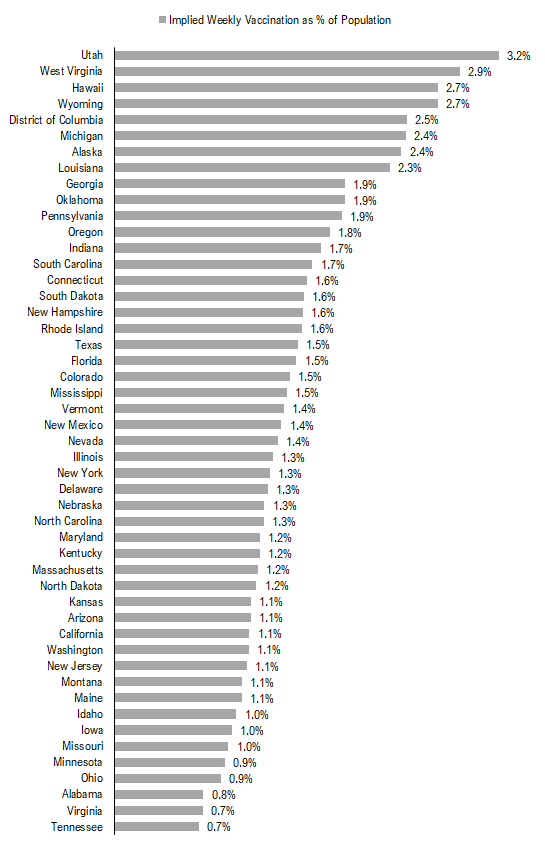

Weekly % of the population vaccinated by states…

And as we close out this week, below are the states with the highest weekly vaccination rates. That is the percentage of the population that was vaccinated in the past week. Utah was the highest at 3.2%.

Source: CDC and Fundstrat

POINT 3: Great idea –> US companies offering employees incentive to get vaccinated

USA Today has an insightful story of how companies are offering their employees bonuses/incentives to get the COVID-19. So far, it looks like 3 companies are doing this, but we expect the list to grow in the coming weeks, particularly as vaccine supplies increase. In this story, the companies are:

– Instacart $25 incentive

– Dollar General 4 hours of pay

– Trader Joe’s 2 hours of pay

https://www.usatoday.com/story/money/business/2021/01/14/covid-vaccine-dollar-general-instacart-pay-employees-getting-vaccine/4160708001/

The companies are offering these incentives to make sure employees do not have to choose between “working” or getting vaccinated. Thus, this payment is to cover the cost of taking the time to get this vaccine.

The employees of these firms are “essential workers” and indeed are providing a critical function for the US economy. And moreover, essential workers can be a focal point of spread — thus, offering incentives is a great idea.

Last week, we also noted that a hospital system in Texas was offering a large $500 payment to get the vaccine as well. This again has the same rationale.

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 404cef-c6df7c-416783-d51ed0-06ba67

Already have an account? Sign In 404cef-c6df7c-416783-d51ed0-06ba67