An ugly week but the S&P is nearing support as are social distancing stocks

This week’s equity sell-off was damaging to many charts BUT we also view the pullback as a normal correction form overbought levels reached at the end of the week.

S&P sell-off from short-term overbought levels nearing important broad support band -The S&P 500, along with many stocks, notably cyclicals, were overbought at resistance heading into the beginning of this week. So, while we were certainly not expecting the intensity of Thursday’s sell-off, the S&P has pulled back to the upper end of a very broad support band beginning at its 200-dma at 3013 just above two important support levels defined by the retracement levels of the Q1 sell-off. The first is at the 62% retracement (2935) and the second at the 50% retracement (2792). Call it a band between 2800-2935 with the rising 50-dma at 2900, a reasonable proxy for the uptrend of the market. We expect that support band to hold on any near-term weakness, should it develop.

Short-term momentum indicators are still early in downturns from overbought levels reached last week. Normally, we would not focus investor’s attention on daily momentum indicators but given the unusual market environment and high volatility, short-term swings are materially impacting all portfolios. Most daily momentum indicators, tracking 2-4 directional shifts, are only 2-4 days into their downturns from overbought levels. In general, a downturn from overbought level signals 2+ weeks of weak/sloppy trading suggesting choppiness into next week’s option expiration.

Bottom line: It’s always a risk to prejudge technical indicators but given the velocity of recent moves, we have to weigh the odds of whether an entirely new downside move is developing or whether equity markets are merely unwinding a very overbought short-term condition and are now quickly nearing support bands. Our expectation is markets will find support near current levels (slide 2). Could a multi-month, intermediate-term correction be taking hold. Yes, that is definitely a possibility that we would be we cannot ignore but it is not our base case believe it is premature to draw that conclusion based on one short-term correction. We continue to view the March lows as defining another major 4-year cycle and do not expect new lows.

What about stocks? We continue to favor a barbell strategy of secular and cyclical growth using pullbacks in each to further accumulate exposure. Bellwether stocks at each extreme of the bar-bell remain attractive technically for long-term investors despite recent weakness.

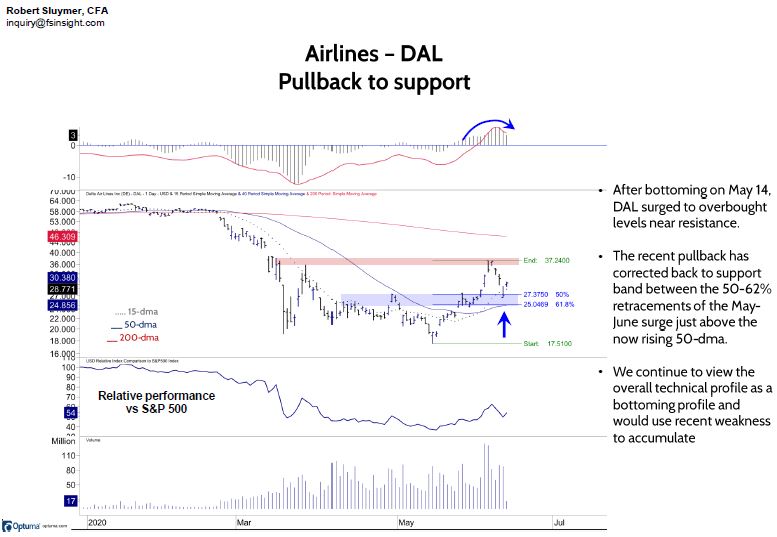

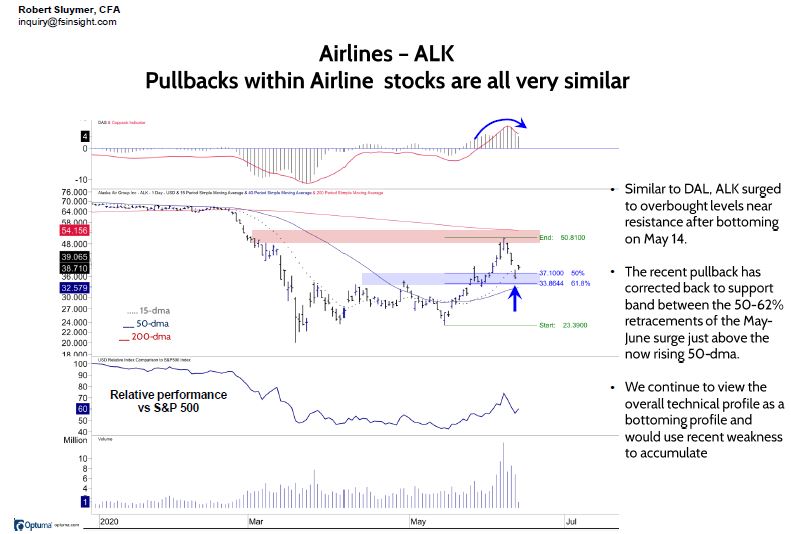

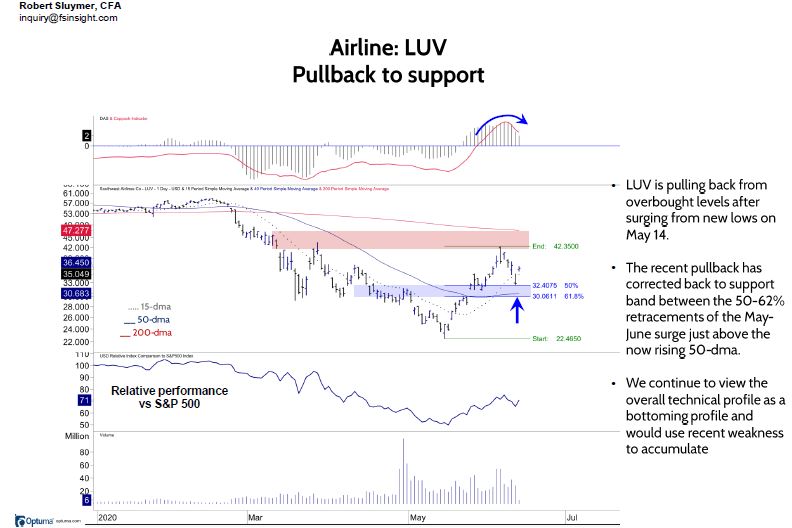

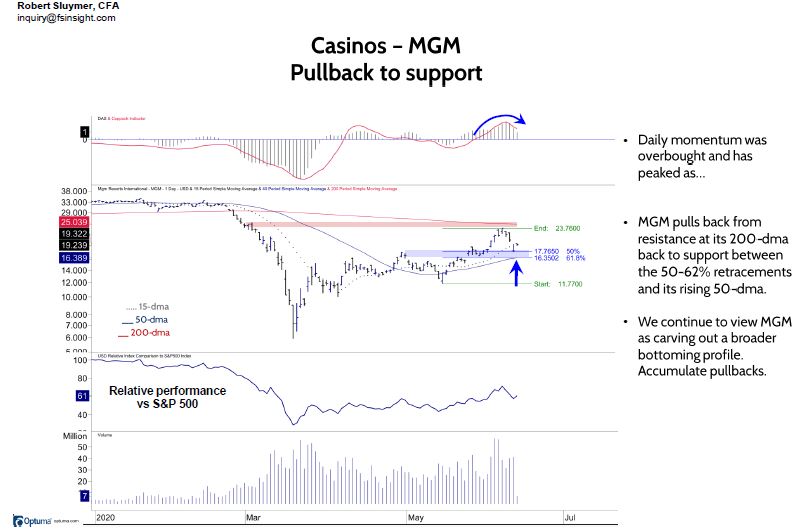

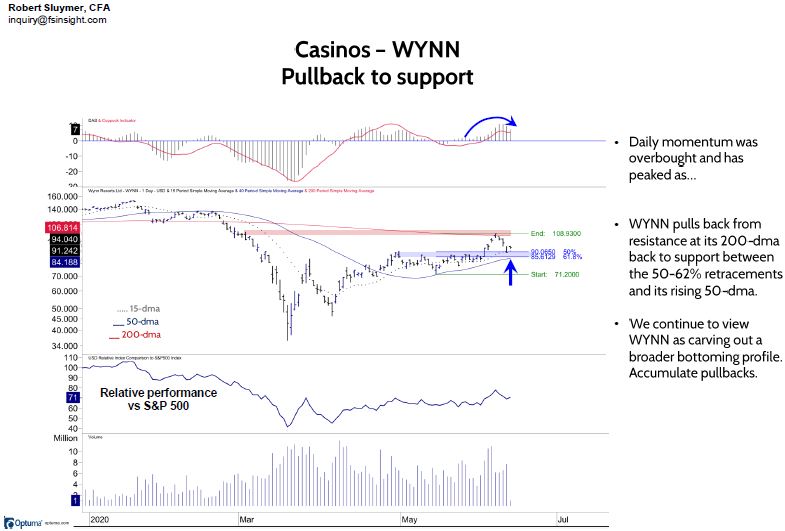

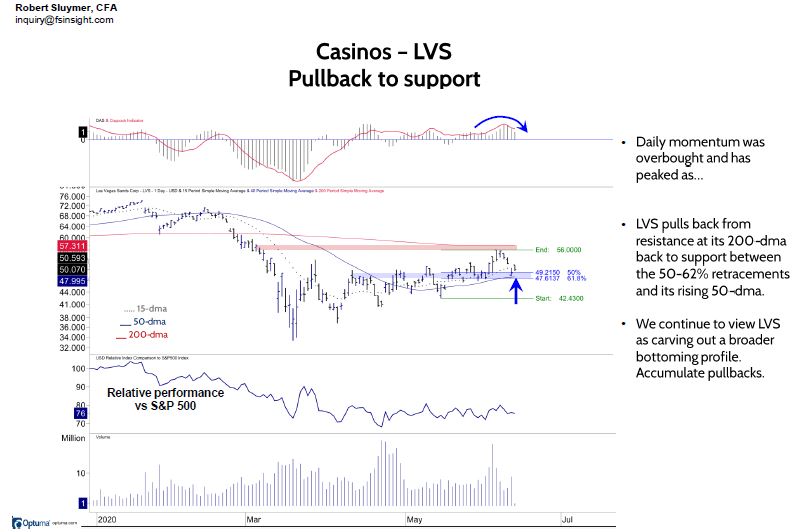

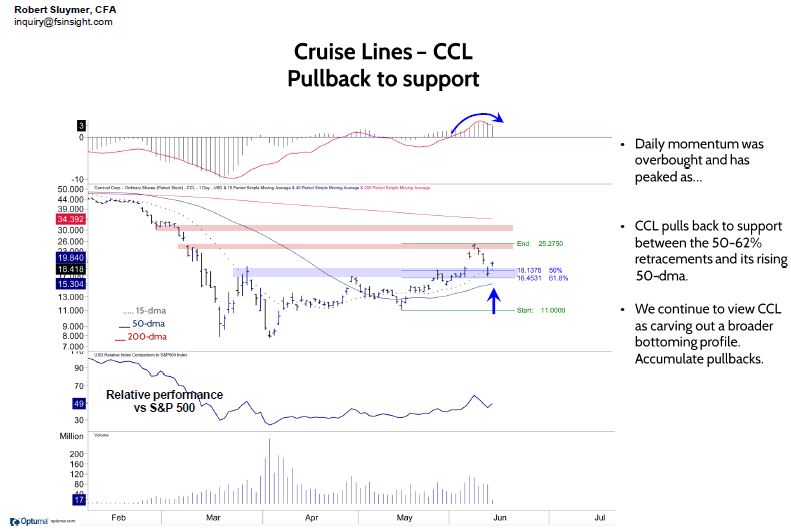

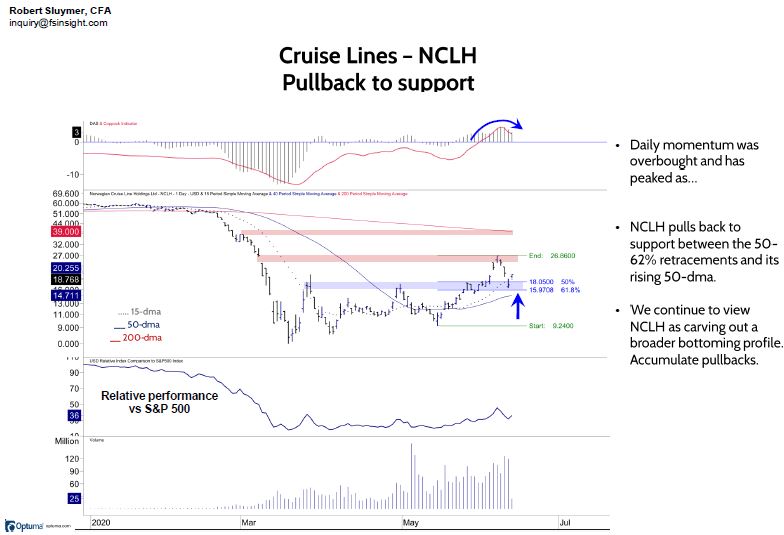

Cyclical bellwethers: Social distancing stocks – We fully appreciate many investors are not interested in this group of deeply oversold, higher risk stocks. However, they continue to represent the deep end of the cyclical barbell, and while extremely volatile, their overall technical behavior will remain an important tell for the broad market. This week’s collapse interestingly retraced 50-62% of their May 14-early June rebounds, which are retracement levels that often provide support in corrections. We expect these levels to hold and would use recent weakness to accumulate these stocks for those accounts with flexibility to own deep cyclicals. Featured ideas: Airlines (DAL, ALK, LUV), Casinos (MGM, WYNN, LVS), Cruise Lines (CCL, RCLH) and DIS.

Featured ideas: Airlines (DAL, ALK, LUV)

Featured ideas: Casinos (MGM, WYNN, LVS)

Featured ideas: Cruise Lines (CCL, NCLH) and DIS

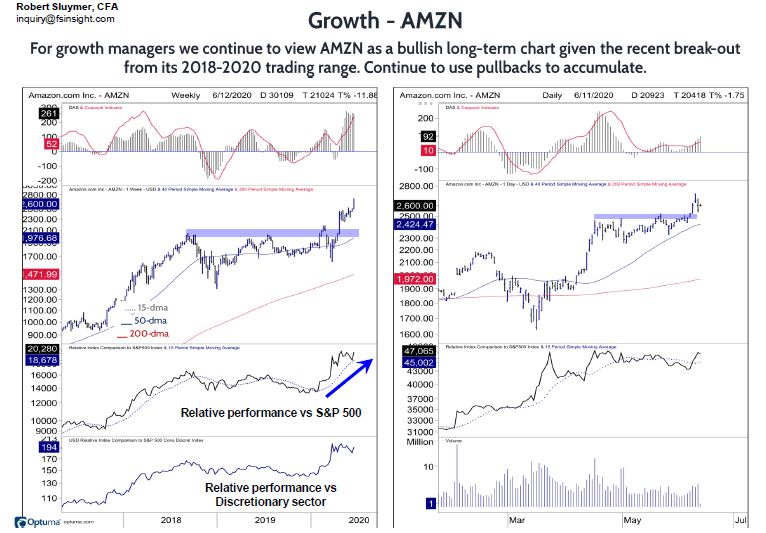

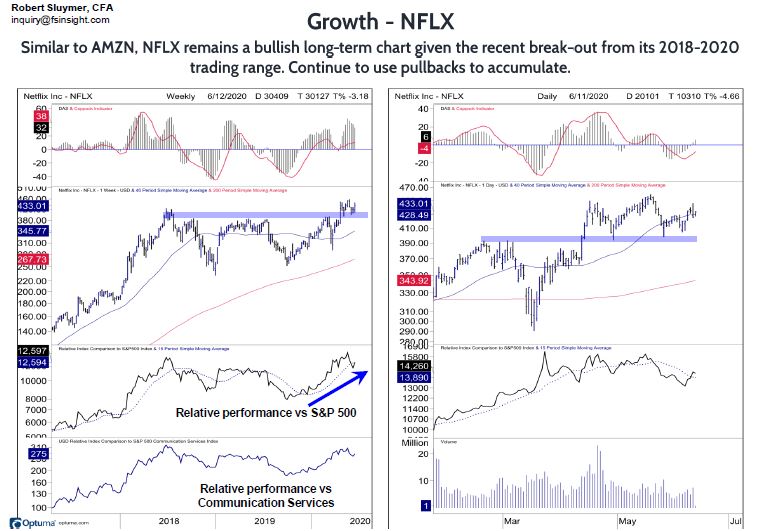

Growth bellwethers: We have had many growth managers ask whether growth stocks appear to be breaking technically. As two mega-cap bellwethers, AMZN and NFLX are early in new longer-term uptrends after breaking-out of their 2018-2020 trading ranges. Continue to accumulate weakness.

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 701d4f-bea95f-932de6-c80269-eec6a3

Already have an account? Sign In 701d4f-bea95f-932de6-c80269-eec6a3