Incrementally, The Case Is Strengthening For a Year-End Rally. Fears Easing of Dual Issues of “Supply-Chain Glitches” + Vaccines= Shifting Away From “Ping Pong”

FDA advisers endorse Moderna booster

Yesterday, the FDA outside panel of advisers endorsed Moderna’s request for a booster shot. This was largely expected but still an incremental positive. After all, there was a modicum of risk, and more importantly, the combination of booster vaccines and COVID-19 therapeutics (Merck pill) are important steps in eventually pushing COVID-19 towards “endemic” status. And this allows the US economy, policymakers, and private enterprises to push towards a path of normalization.

Supply chain glitches are easing = beginning of the end

One of the my favorite headlines this week is the statement from Jamie Dimon, CEO of JPMorgan, he predicts the supply chain disruptions will be eased into 2022. It is a common sense statement, but an important perspective. Many investors fret about the near-term impact on margins, delivery times, visibility, etc. due to the glitches in the supply chain. There are multiple factors driving this, including:

- production delays overseas and in the US

- backups at the ports of entry (ships offshore)

- lack of supply of drivers and workers to move goods from the ports

- marginal labor shortages everywhere

This is creating distortions in CPI and economic data, as these are not normal conditions and yet, forecasters and economists are making necessary conclusions from these conditions. In an obvious way, Jamie’s statement is correct but also a reminder that into 2022, we will be facing a different set of conditions.

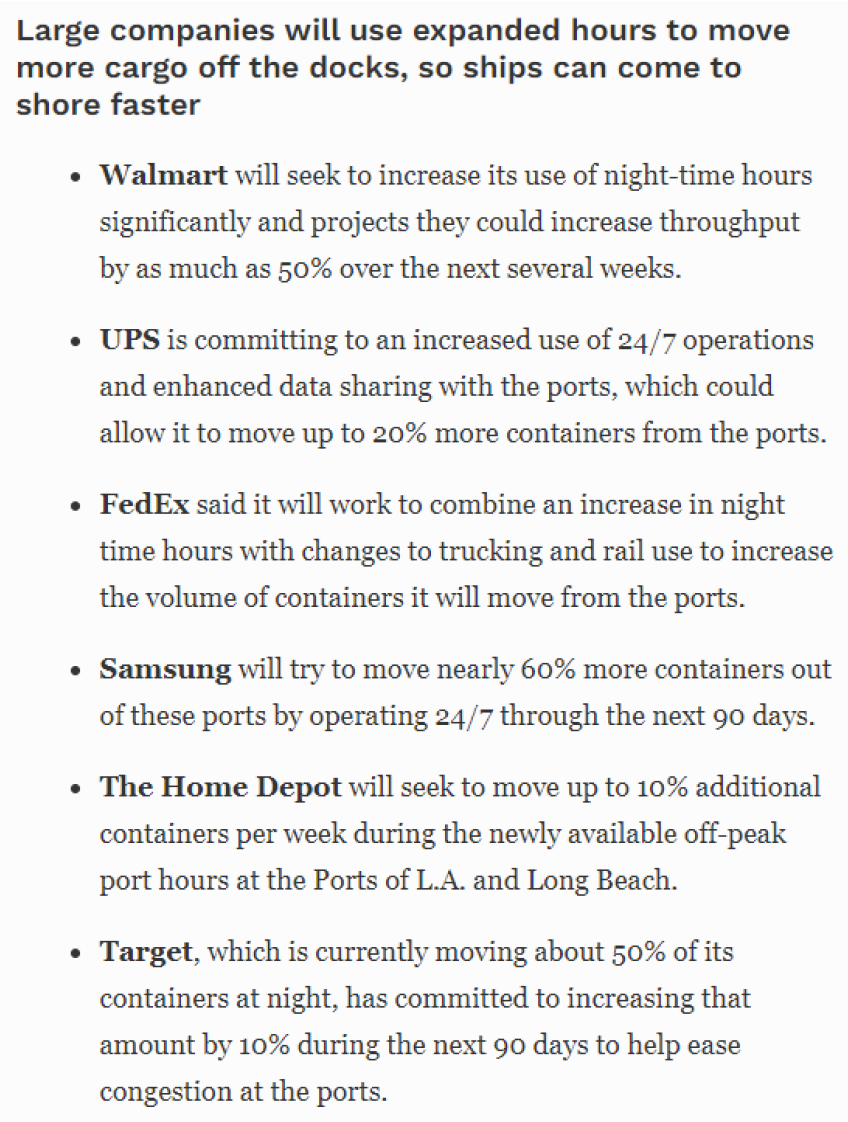

And on Wednesday, the actions taken to operate the Los Angeles ports 24/7 is a positive incremental step. This was widely reported over the past few days, but again, consider this an additional step to ease these glitches. More than 80 ships are waiting to dock and nearly 40% of inbound cargo comes through these two ports. So this will eventually chip away at that backlog.

…Labor market tightness and wage pressures remain a complex combination of worker hesitation and practical factors

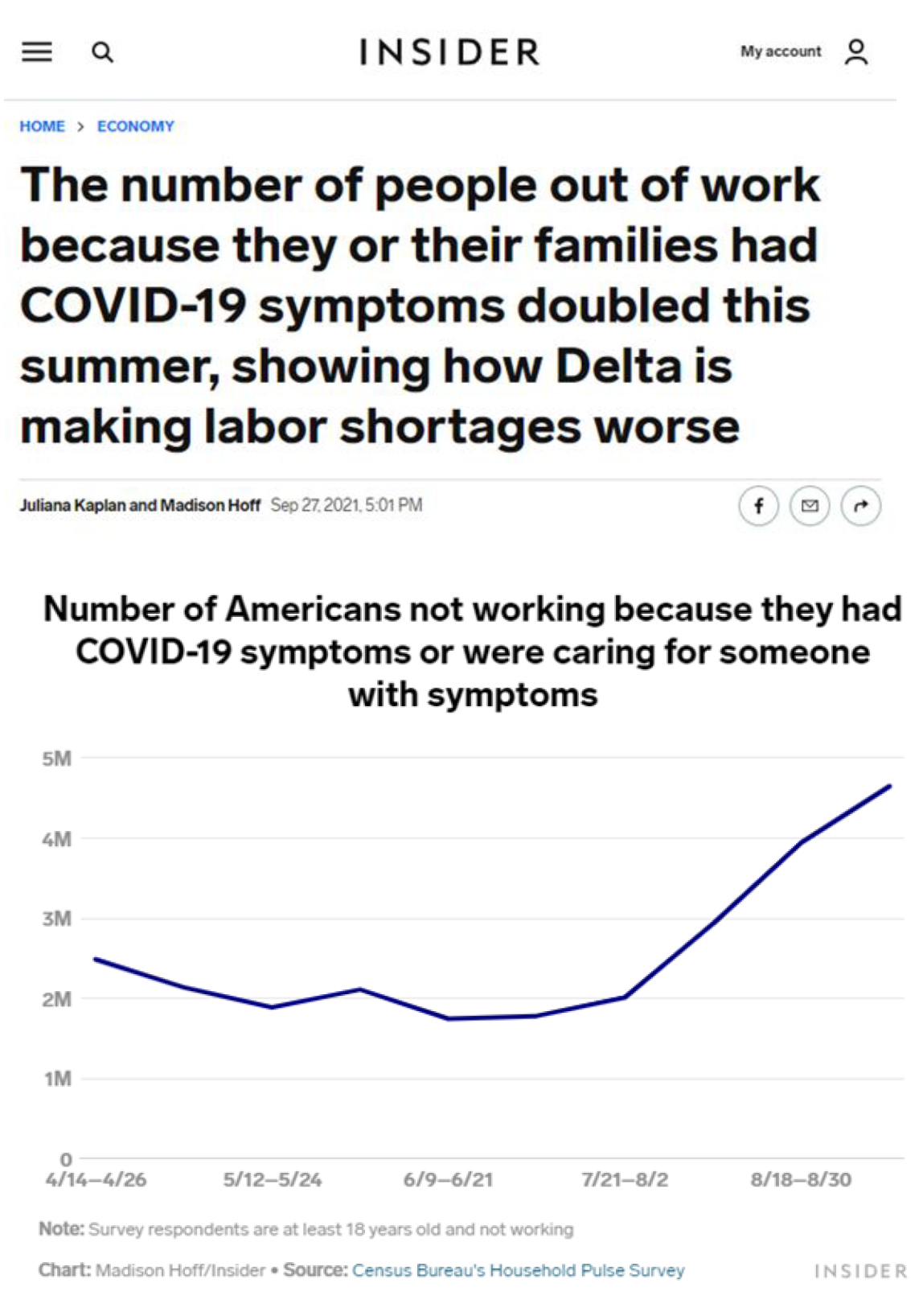

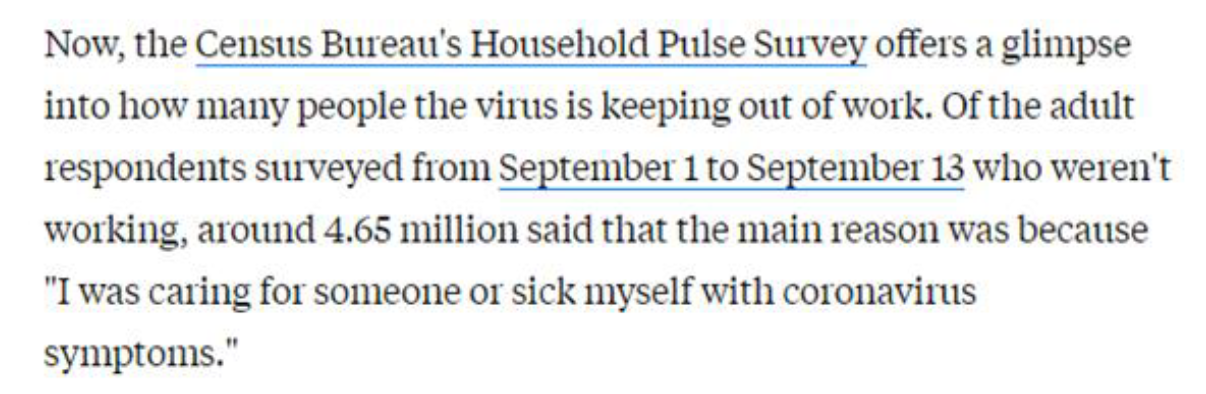

And while many factors have been behind the sizable labor shortages during this pandemic — wariness of returning to work, opportunity cost given higher wages, sickness, etc. — the Census Bureau data shows that caring for someone with COVID-19 itself is a major factor:

- Census Bureau Household Pulse Survey has asked respondents whether someone is not working because of COVID-19 symptoms

- or caring for someone with symptoms

- This figure was about 4.65 million in latest survey

- This has doubled since April

- The US labor market adds about 400,000 jobs per month – Thus, 4.65 million workers is about 10 months worth of jobs

I am stating the obvious, but reducing COVID-19 spread via boosters, anti-virals, and natural immunity, will surely improve conditions in the labor market.

Other nations pursuing “containment” or “zero cases” have mitigated COVID-19 but not eliminated This article in the Straits Times interested me because it looks like New Zealand is making a shift in policy framework around COVID-19. For most of the pandemic, New Zealand pursued a strategy of zero cases, successfully for most of the time.

- but even with potentially reaching 90% vaccination rates (NZ is not there now)

- their healthcare models forecast as many as 5,000 cases per week.

- this is still far lower than the US proportionately

- but far higher than NZ saw at any time in the past 18 months

…the Rest of the World is beginning to move towards normalization

Even Malaysia, which largely shut its nation for the past 18 months is planning to lift its interstate travel ban. This will take place after 90% of the population is vaccinated.

- 88.5% of Malaysians are vaccinated

- so the nation is close to 90%

But the larger story, in my view, is that restrictions are easing around the world.

STRATEGY: Incrementally, the case is strengthening for a year-end rally –> beyond “supply chain glitch” winners

It has been a rough 4-6 weeks for equity investors. Granted, those invested in “winners from a supply chain glitch” have done well. That is, rising commodity prices have benefitted shares of Energy, Uranium and other commodity stocks. But the broader market has been ping-pong-ing as investors have weighed whether the half-full or half-empty views will prevail. But this week, we believe this detente is coming to an end:

- 3Q2021 earnings have been strong so far, alleviating concerns about “margin pressures”

- OK, its early

- Supply chain glitches are easing (see above)

- Labor shortages persist but this is not conclusively hurting demand

- COVID-19 cases continue to retreat meaningfully (see below)

- Boosters and therapeutics for COVID-19 coming

- Other nations are lifting travel bans

- Washington averted another “made in DC crisis”

And according to our Head of Technical Strategy, Mark Newton, the market internals have improved. And with this improvement, comes improving investor confidence and inflows.

….Remarkable Technical improvements in the past few days

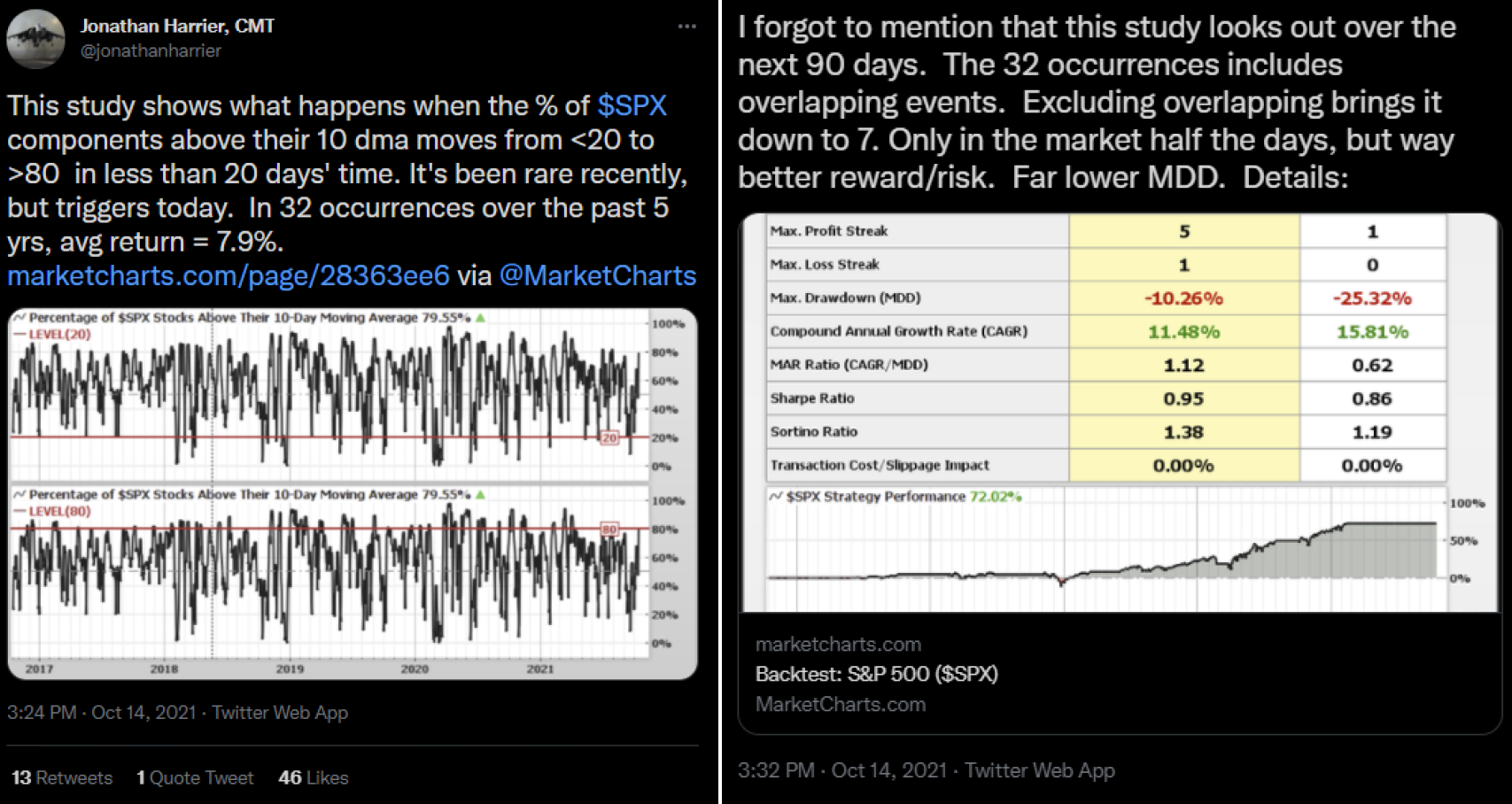

So we see the case stronger for stocks to rally into YE. In other words, we think investors need to shift away from “caution” and towards risk-on. While we understand the caution, there has been some positive technical improvements that often are harbingers of big gains ahead:

- Jonathan Harrier, CMT, posted an interesting tweet yesterday

- % S&P 500 stocks above the 10-day moving average

- rose from under 20% to >80% in last than 20 days

- this happened 32 times in the past 5 years

- Avg 3-month forward return +7.9%

- This implies S&P 500 could add +300 points before year-end

- Excluding overlaps, this was only 6 instances

- 5 of 6 times, market was higher next 3 months

So, an interesting technical development. I would not consider this “bullet-proof” data, but it highlights the potential technical significance of the market improvement in the past few days.

- couple that with positive seasonals

- cash on the sidelines

- obvious investor caution

And one can see the case for upside into YE.

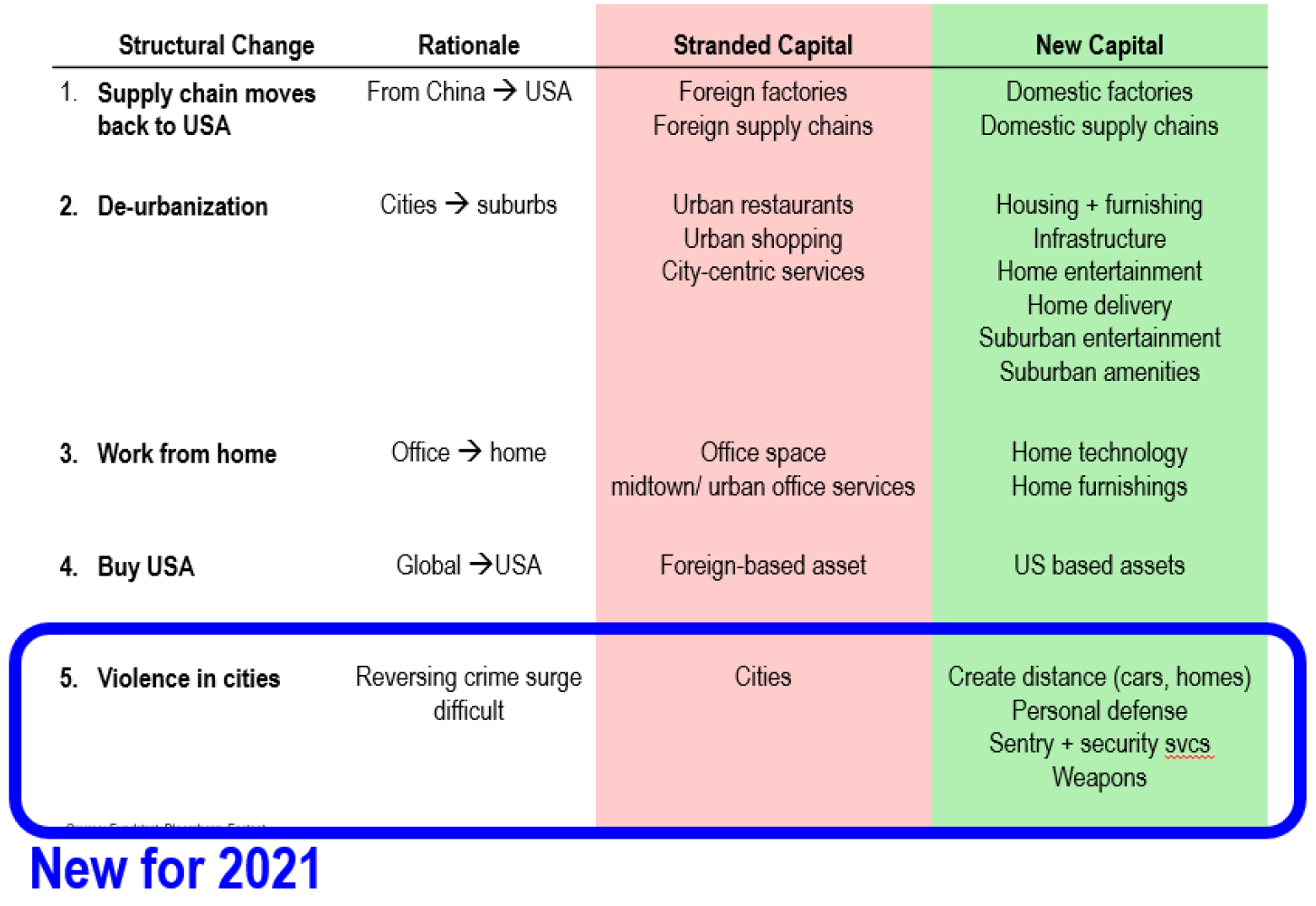

Figure: Way forward → What changes after COVID-19

Per FSInsight

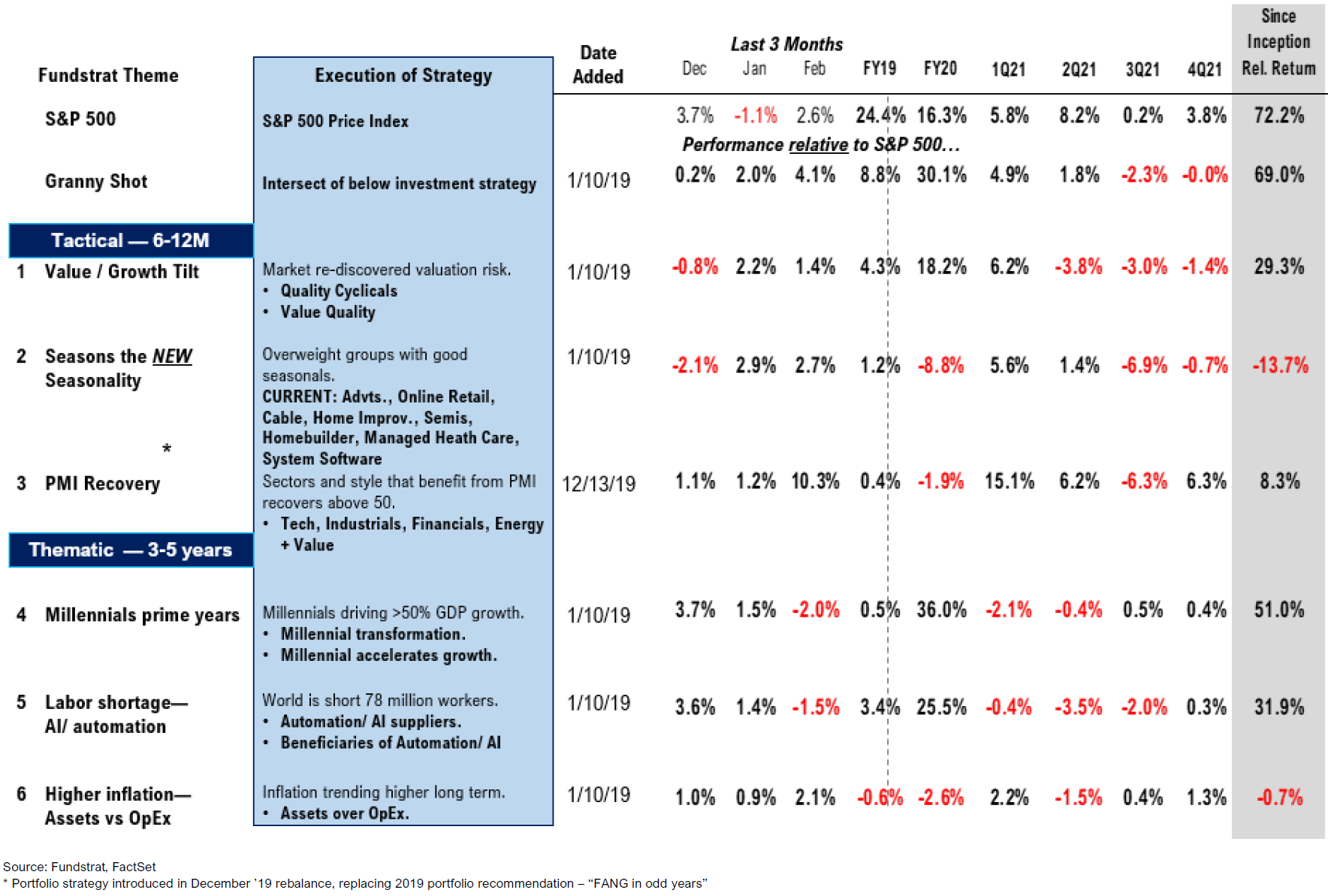

Figure: FSInsight Portfolio Strategy Summary – Relative to S&P 500

** Performance is calculated since strategy introduction, 1/10/2019