COVID-19 trends in USA are looking very promising (pre-winter). Financial conditions are easing = incongruent with downside for stocks

Click HERE to access the FSInsight COVID-19 Daily Chartbook.

We are shifting to a 4-day a week publication schedule:

Monday

Tuesday

Wednesday

SKIP THURSDAY

Friday

STRATEGY: Financial conditions are easing = incongruent with downside for stocks

As we inch past the Labor Day distortions, it sure looks like cases are rolling hard…

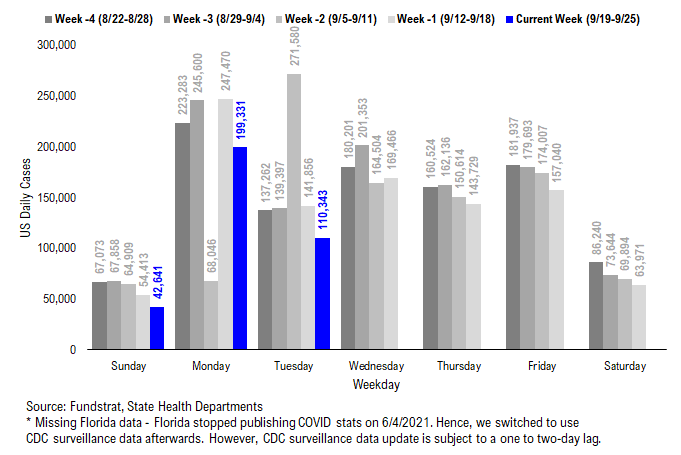

We are exiting, or nearly exiting, the period of case distortion due to the multiple holidays. The trends look very good, both on the daily cases and 7D delta:

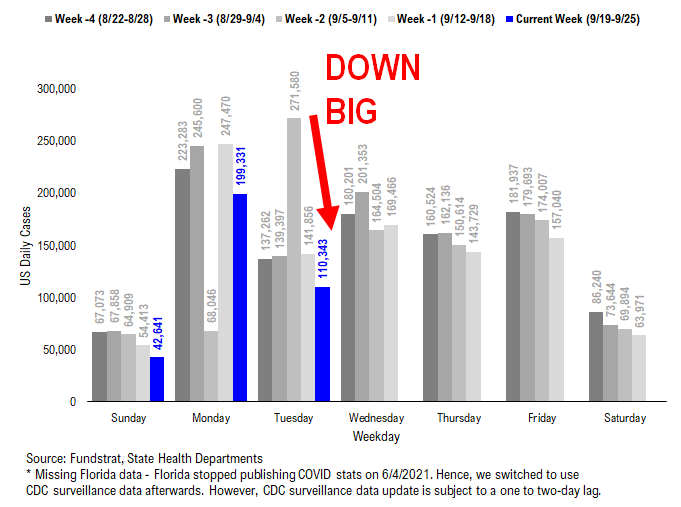

– daily cases came in at 110,343 for Tuesday

– this is the lowest for a Tuesday in > 10 weeks

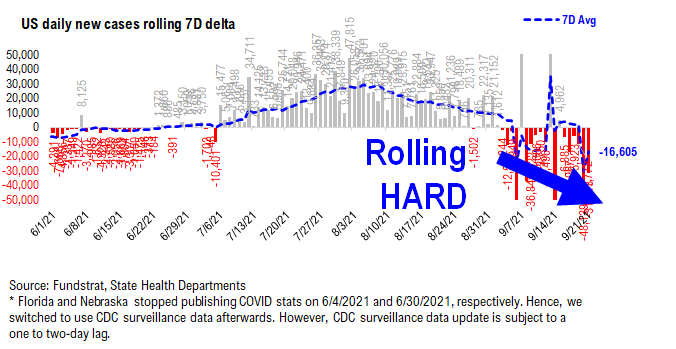

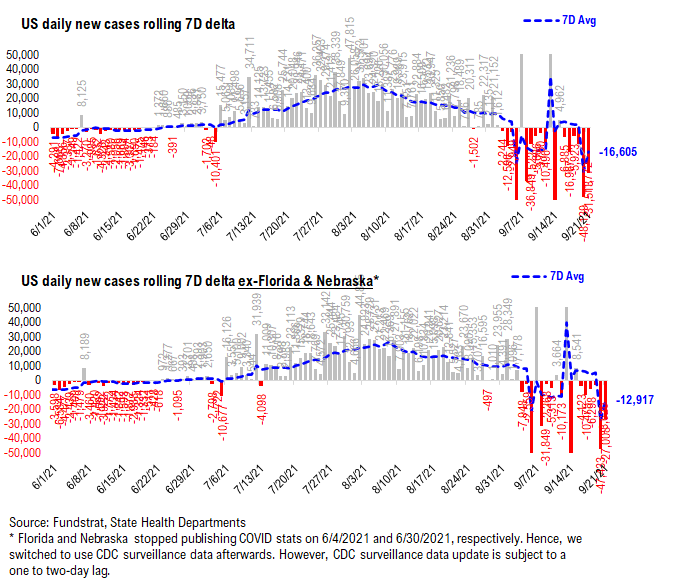

– 7D delta is -16,605

– as the lower chart shows, it is rolling over hard

So, for now, it looks like the Delta-variant driven surge in the US is past its apex. Sure, there are plenty of states with a lot of cases like in the Northeast, etc. But, the overall figures in the US show improvement.

– more importantly, COVID-19 Delta surge has an “end date” in each geography

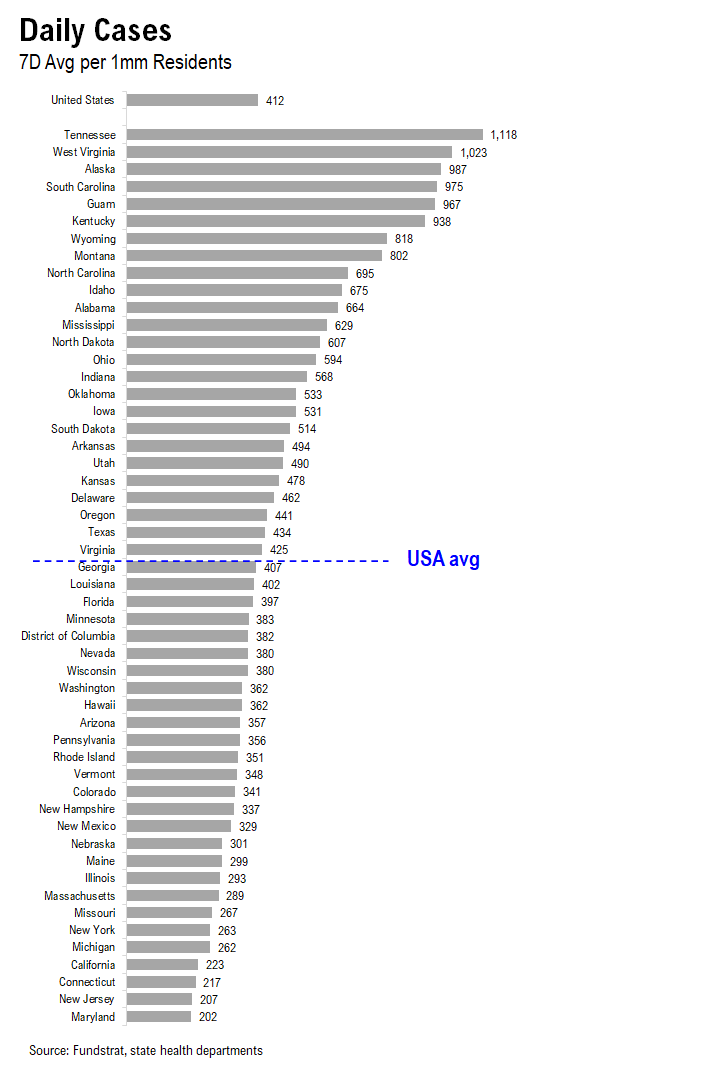

…TN, WV, Alaska are worst in daily cases per 1mm residents

And to put this mix of states in perspective, our data science team is showing daily cases per 1mm residents (7D avg), sorted highest to lowest

– TN is the highest at 1,118 daily cases per 1mm residents

– USA overall is 412

– FL is actually below the USA average now at 397

– surprisingly, NJ and CT are better than CA at 207, 217 vs 223

Increasing signs people are getting “unhinged” due to COVID-19 restrictions

In many of my recent conversations with friends and with clients, there is not surprisingly, a general fatigue around COVID-19. After all, we all had some hope that by Fall 2021, COVID-19 would have receded in its significance. But > 18 months into the pandemic, restrictions are still in place, not just the US, but globally.

– so we are tired of COVID-19 and disappointed it is still here

– but it seems like many citizens are turning this into increasingly violent behavior

Ok, I might be anecdotal here. But it seems like this COVID-19 fatigue is leading to increasingly unhinged behavior. I have just highlighted 3 instances below of such “unhinged” examples:

– NYC, 3 tourists attack Carmine’s host over vaccine requirements

– Australia, Melbourne construction workers turn violent over vaccine protocols

– Germany, a convenience store clerk is shot over asking a customer to wear a mask

Take a look at these horrific headlines below. I know some of you might roll your eyes saying these things happened pre-COVID. Perhaps, but on the broader question, have you also noticed how more of us are simply “done with COVID?”

…FYI, more people are sociopathic than you realize — 1 in 25

Lately, I have wondered if COVID-19 fatigue is somehow releasing/triggering more sociopathic/psychopathic behavior. A psychopath is generally a person who lacks some key social mechanisms. And as a result, a psychopath has a tougher time distinguishing societal right vs wrong (if one is religious, these are absolute). In short, they can kill or lie without remorse.

– roughly 1 in 25 is borderline (see below)

– that is surprising percentage, at least to me it is

– like there was a psychopath in every classroom when I was in school

– or there are at least 2 in every subway car –> yikes

Is COVID-19 unleashing these behaviors?

FYI, NYC might possibly have a larger share of psychopaths. As the Atlantic article below highlights, some researchers estimate that 1 in 10 Wall Street employees is a psychopath — roughly 2.5X greater than the population overall.

– it is a reminder that the stock market has no moral compass

– so investors should not project their emotions or bias onto the market

STRATEGY: Is market getting “unhinged” due to COVID-19 fatigue? Maybe

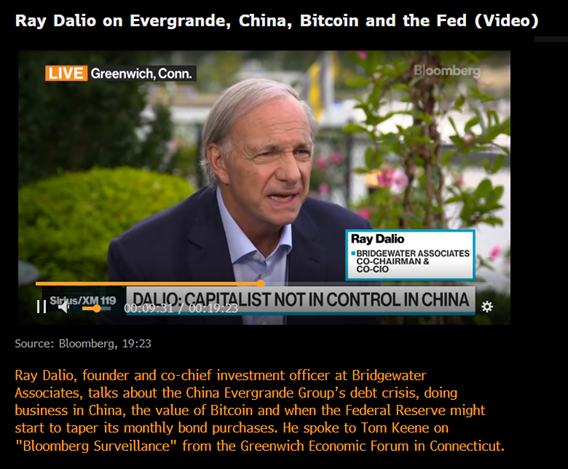

I found Ray Dalio’s morning interview on Bloomberg TV very useful. Mr Dalio is the founder of Bridgewater Associates, one of the most innovative and largest hedge funds in the world. And Dalio has extensive experience and exposure to China. So his take on Evergrande, in my view, is useful insight. If you missed the interview, here is the link (Bloomberg Dalio). Key points from this 20 minute interview:

– Bridgewater profited handsomely from 2007-2008 turmoil

– Evergrande is not Lehman

– Lehman produced pervasive structural damage

– China will let lenders to get “stung” – that is what happens

– Evergrande crisis is “manageable” because debt is in China’s currency

– Local crises are solved by the gov’t

– China is not reverting back to communism

– China is more capitalist than Europe

– China does not mind capitalism, as long as it “catches mice”

– “mice” is produce wealth, and capitalism does that handsomely

– China’s goal is now common prosperity

– China wants to raise standards of living for all citizens

– FYI, China has low taxes

So, Dalio’s take overall, is that this is an unfortunate episode because it will lead to losses for China investors. But he hardly sees this mirroring a debt crisis that has triggered larger global market declines.

Stocks fell into the close, likely “margin calls”

Tuesday was one of those “half-full” or “half-empty” days. The S&P 500 opening higher but closed weaker:

– those half-empty –> no bounce? dip buyers are gone

– those half-full –> Evergrande is seismic shock –> flat is good on day 2

I am in that second camp. After all, the ripple effects of the Evergrande are still out there. And Wednesday we get the FOMC meeting. So why would anyone be buying with “abandon” Tuesday?

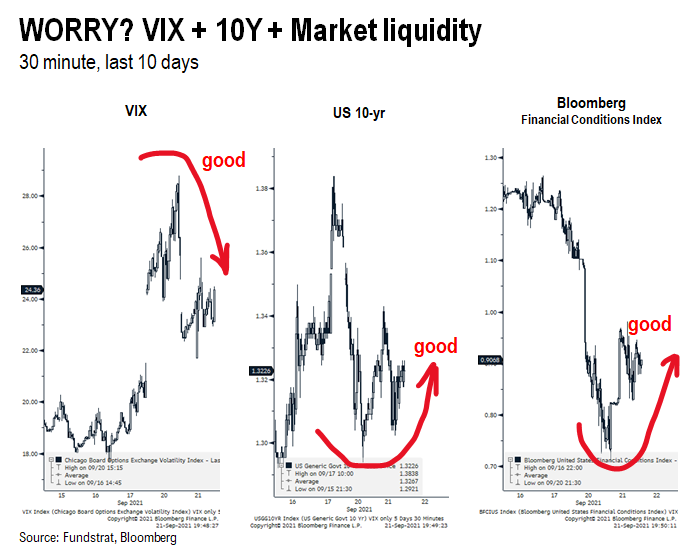

…Other markets are signaling strength for equities

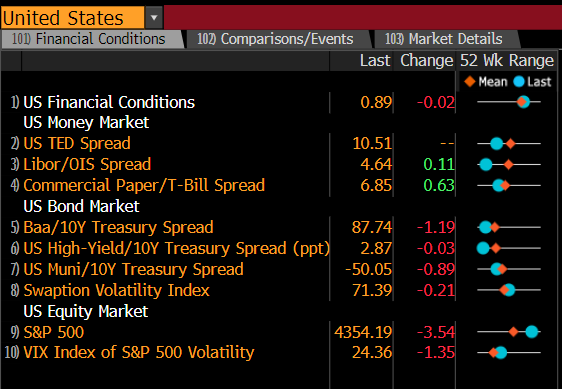

As many of you know, we follow the VIX and credit closely. And on Tuesday a few clients asked about financial conditions (aka liquidity). As shown below, all 3 showed promising moves on Tuesday:

– VIX fell > 10% = good

– US 10-yr yield crept higher = reflationary = good

– BBG FCI (financial conditions) rose Tuesday = good

So, overall, I would rate it as a risk-on day for financial markets broadly. But it was a flat day for stocks. Why did this happen? We can think of 3 reasons:

– margin calls are made at 2pm and many investors had to complete

– FOMC meeting Wed, nobody wants to front run Fed

– retail sentiment still stinks –> just look at twitter

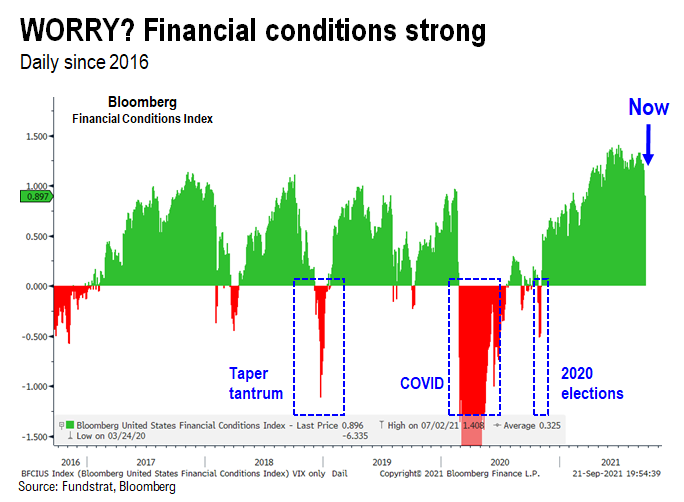

The Bloomberg Financial Conditions Index is made of the components listed below and is an attempt to be a broad measure of market depth and liquidity. Many brokerage firms also publish their own version but they are all similar, in function.

And for perspective, you can see that BBG FCI was sharply negative into periods heading into larger market downturns.

– So, the question is whether a 10% sell-off in stocks can happen when FCI are easy?

– As far as I can recall, this has never happened

– So, for this weakness to translate into a rout, BBG FCI and VIX and US 10-yr would all have to get worse.

__________________________

26 Granny Shot Ideas:

26 Granny Shot Ideas: We performed our quarterly rebalance on 07/30. Full stock list here –> Click here

___________________________

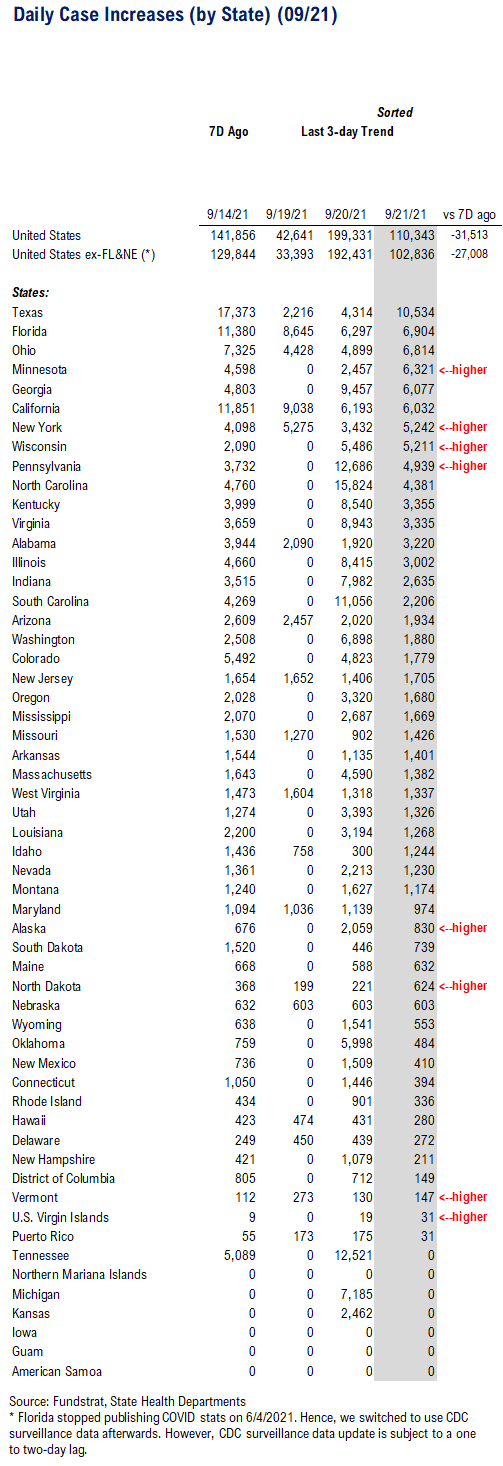

POINT 1: Daily COVID-19 cases 110,343, down -31,513 vs 7D ago…

_____________________________

Current Trends — COVID-19 cases:

– Daily cases 110,343 vs 141,856 7D ago, down -31,513

– Daily cases ex-FL&NE 102,836 vs 129,844 7D ago, down -27,008

– 7D positivity rate 6.7% vs 8.3% 7D ago

– Hospitalized patients 83,417, down -9.0% vs 7D ago

– Daily deaths 2,252, up +21.8% vs 7D ago

_____________________________

*** Florida and Nebraska stopped publishing daily COVID stats updates on 6/4 and 6/30, respectively. We switched to use CDC surveillance data as the substitute. However, since CDC surveillance data is subject to a one-to-two day lag, we added a “US ex-FL&NE” in our daily cases and 7D delta sections in order to demonstrate a more comparable COVID development.

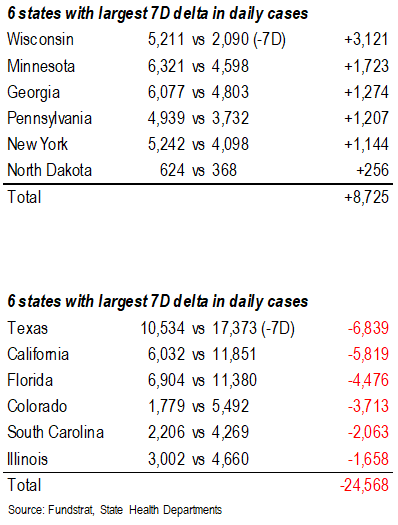

The latest COVID daily cases came in at 110,343, down -31,513 vs 7D ago. As per Tuesday’s data, the 7D delta appears to be accelerating to the downside. This week’s data still contains remnants of distortion from Labor Day, but we expect the distortion to fully clear out Wednesday evening. Nonetheless, the average 7D delta since Labor Day is negative and has been decreasing, suggesting that cases are currently rolling over.

At the individual state level, we’ve recently been at the critical stage of case rollover. We will continue to monitor all relevant data closely, but as long as 7D deltas remain negative, case rollover will continue.

Rolling 7D delta in daily cases is once again negative, but still distorted…

As shown in the chart below, the rolling 7D delta in daily cases is once again negative. We expect the distortion to fully clear out Wednesday evening. As such, we expect the rolling 7D delta to remain negative and accelerate to the downside.

Tuesday’s negative rolling 7D delta suggests that cases appear to be rolling over despite the distortion. We will continue to monitor all relevant data closely, but as long as 7D deltas remain negative, case rollover will continue.

Low vaccinated states seem to have a larger increase in daily cases compared to their recent low…

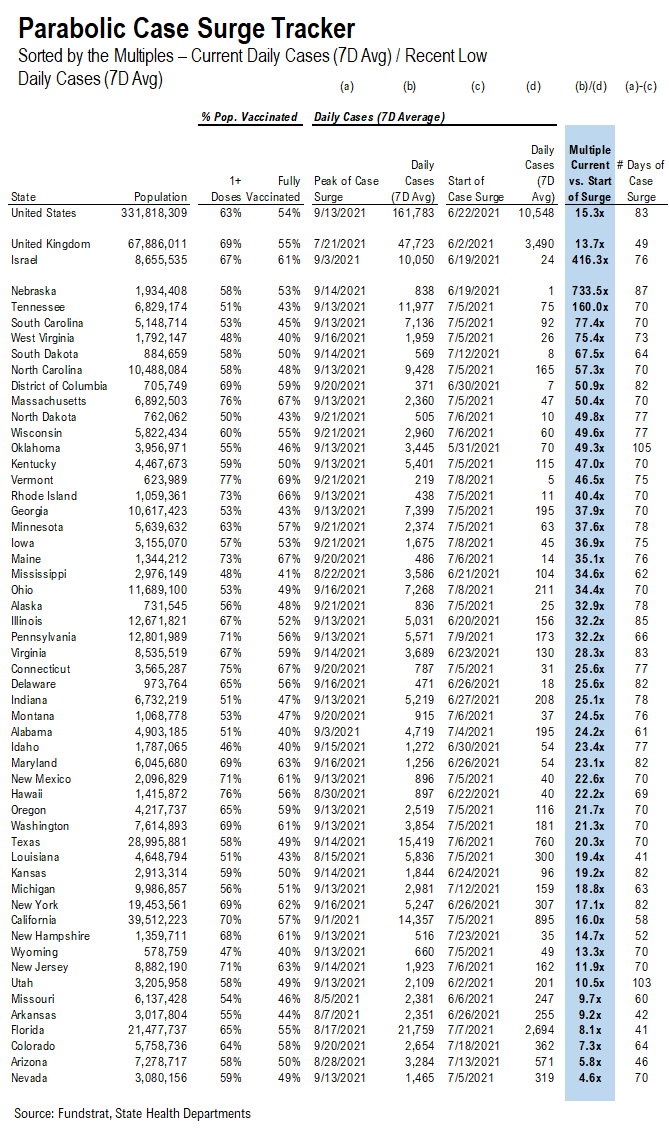

The “Parabolic Case Surge Tracker” monitors the possible parabolic surge in daily case figures. In the table, we included both the vaccine penetration and the recent case trend for 50 US states + DC. The table is sorted by the multiple of their recent peak daily cases divided by the daily cases when their case surges started.

– The states with higher ranks are the states that have seen a more significant rise in daily cases

– We also calculated the number of days during the recent case surge; a state with a high multiple but low number of days since its low means the state is facing a relatively rapid surge in daily cases

– The US as a whole, UK, and Israel are also shown at the top as a reference

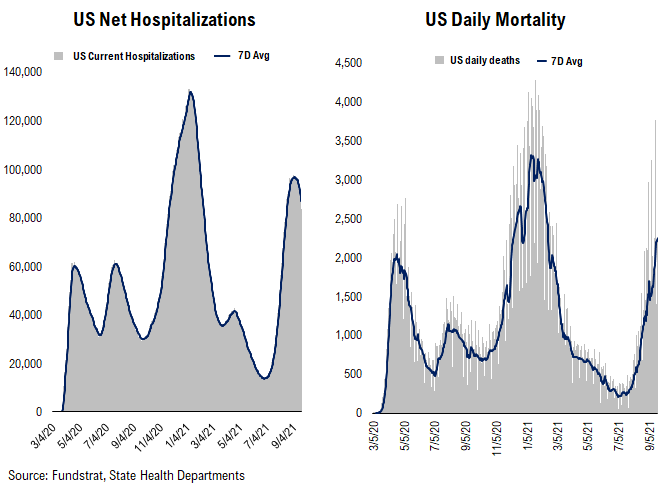

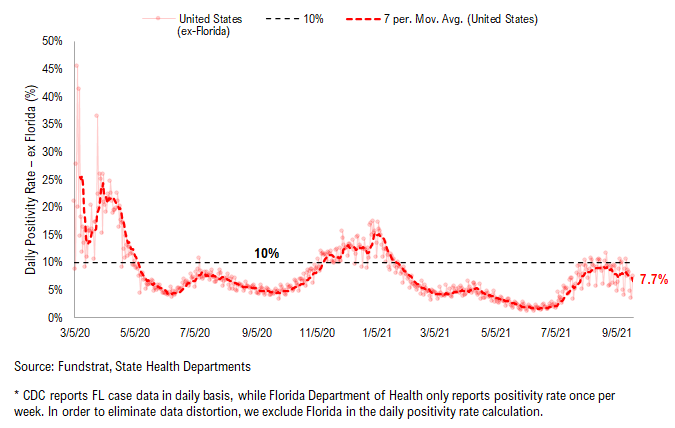

Hospitalization continues rising, while positivity rate has plateaued… Daily deaths also start to surge now…

Below we show the aggregate number of patients hospitalized due to COVID, daily mortality associated with COVID, and the daily positivity rate for COVID.

– Hospitalization has exceeded the peak level we’ve seen in Wave 1 and 2 in 2020 and continues surging.

– With the increasing number of daily tests, positivity rate has plateaued over the past week. As daily cases have already start to roll over in some states, the positivity rate could roll over soon.

– Daily deaths have been surging recently, but less “dramatic” than the cases or hospitalization trends. Currently, daily death has surpassed the peak we have seen in Wave 2.

POINT 2: VACCINE: vaccination pace has been steadily rising…

_____________________________

Current Trends — Vaccinations:

– avg 0.8 million this past week vs 0.8 million last week

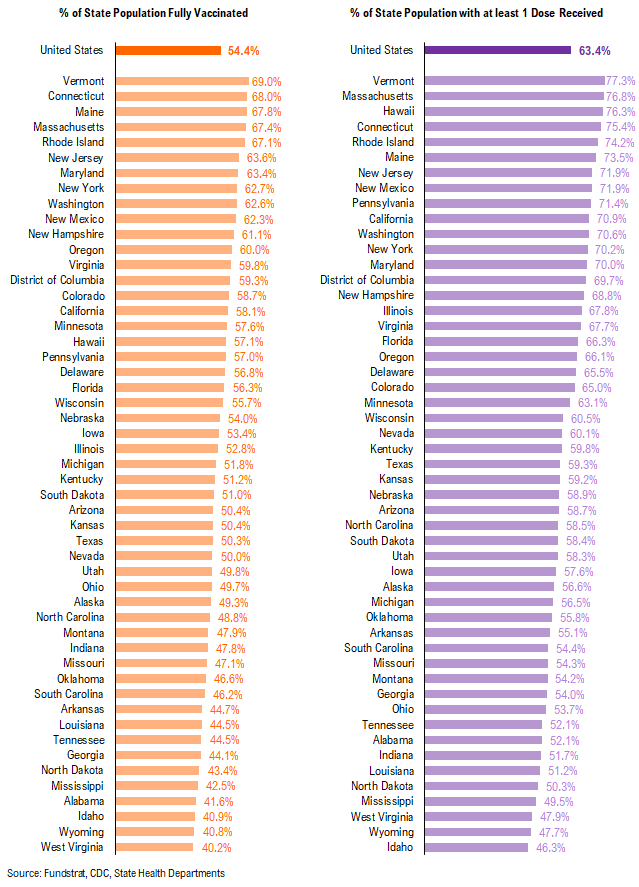

– overall, 54.4% fully vaccinated, 63.4% 1-dose+ received

_____________________________

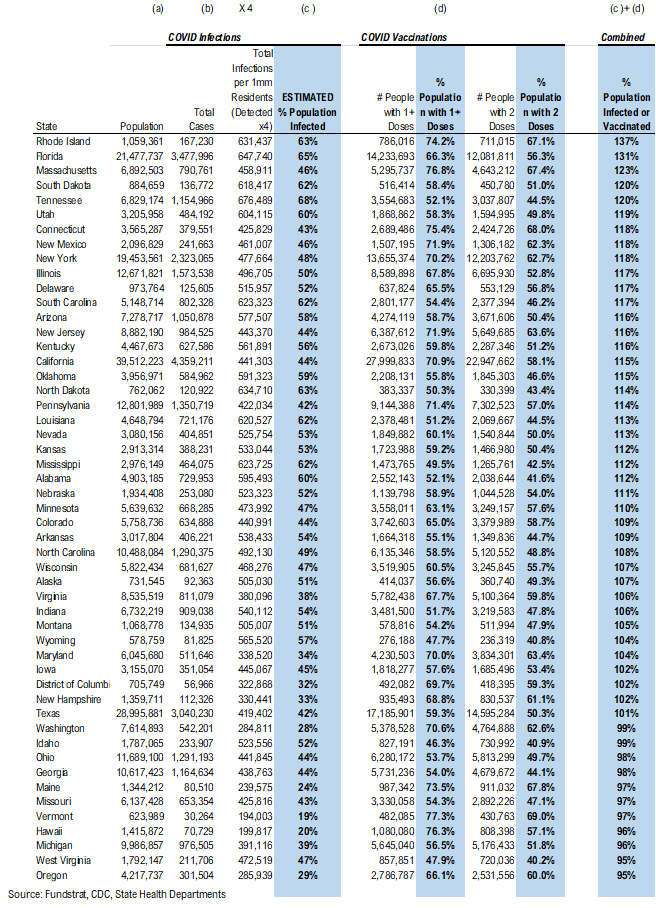

Vaccination frontier update –> all states now near or above 90% combined penetration (vaccines + infections)

Below we sorted the states by the combined penetration (vaccinations + infections). The assumption is that a state with higher combined penetration is likely to be closer to herd immunity, and therefore, less likely to see a parabolic surge in daily cases and deaths. Please note that this “combined penetration” metric can be over 100%, as infected people could also be vaccinated (actually recommended by CDC).

– Currently, all states are near or above 90% combined penetration

– RI, MA, FL, CT, SD, NJ, IL, NY, DE, NM, UT, PA, ND, NV, KY, ND, CO, KS, TN, OK, WI, SC, AZ, MN, CA, NE, LA, DC, MT, AK, MD, ID, VI, AR, AL, MS, and NC are now above 100% combined penetration (vaccines + infections). Again, this metric can be over 100%, as infected people could also be vaccinated. But 100% combined penetration does not mean that the entire population within each state is either infected or vaccinated.

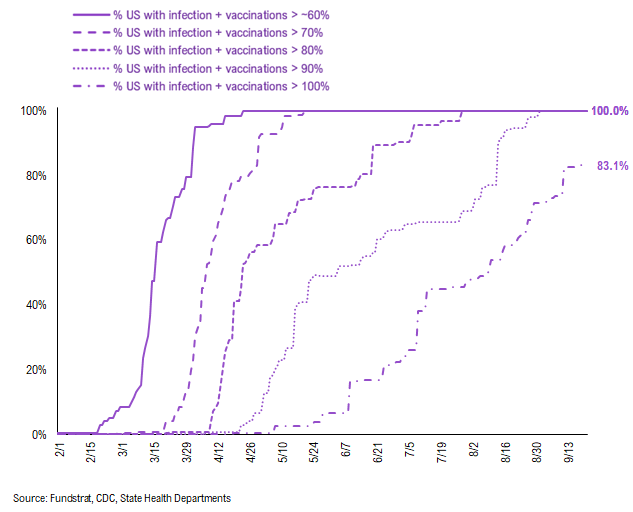

Below is a diffusion chart that shows the % of US states (based on state population) that have reached the combined penetration > 60%/70%/80%/90%/100%. As you can see, all states have reached 90% combined vaccination + infection. 83.1% of US states (based on state population) have seen combined infection & vaccination > 100% (Reminder: this metric can be over 100%, as infected people could also be vaccinated. But 100% combined penetration does not mean that the entire population within the state is either infected or vaccinated).

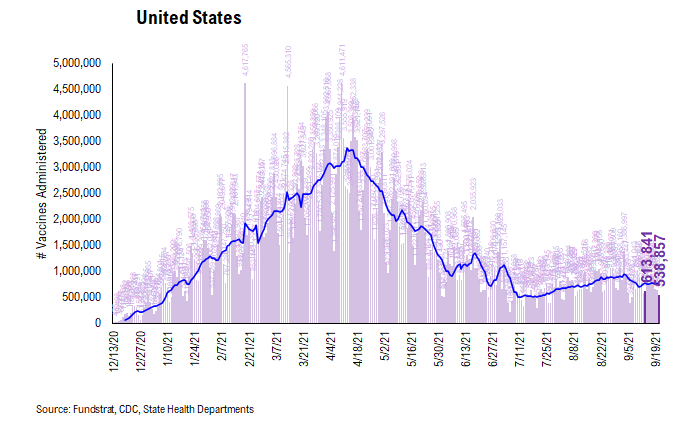

There were a total of 538,857 doses administered reported on Monday, down -12% vs. 7D ago. As more people are getting vaccinated, the vaccination trend is beginning to flatten out. Nonetheless, we believe many catalysts could push the vaccination pace even higher.

– Proof of vaccination required by many US cities and venues

– Booster shots

– Full FDA approval of Pfizer COVID vaccines (hopefully it could help overcome vaccine hesitancy)

– Biden’s vaccination plan

The daily number of vaccines administered remains the most important metric to track this progress and we will be closely watching the relevant data.

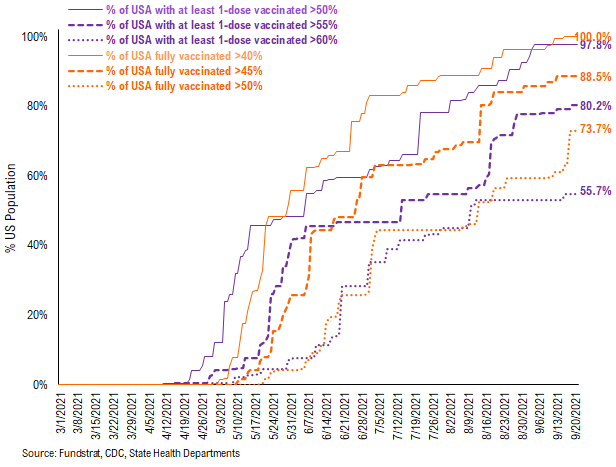

55.7% of the US has seen 1-dose penetration > 60%…

To better illustrate the actual footprint of the US vaccination effort, we have a time series showing the percent of the US with at least 45%/45%/50% of its residents fully vaccinated, displayed as the orange lines on the chart. Currently, 100% of US states have seen 40% of their residents fully vaccinated. However, when looking at the percentage of the US with at least 45% of its residents fully vaccinated, this figure is 88.5%. And only 73.7% of US (by state population) have seen 50% of its residents fully vaccinated.

We have done similarly for residents with at least 1-dose of the vaccination, denoted by the purple lines on the chart. While 97.8% of US states have seen 1 dose penetration > 50%, 80.2% of them have seen 1 dose penetration > 55% and 55.7% of them have seen 1 dose penetration > 60%.

This is the state by state data below, showing information for individuals with one dose and two doses.

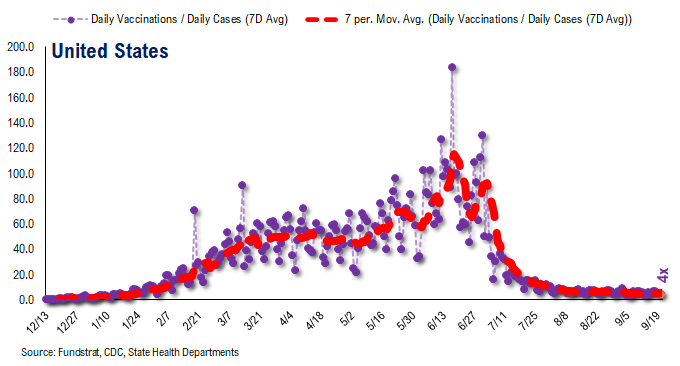

The ratio of vaccinations/ daily confirmed cases has been falling significantly (red line is 7D moving avg). Both the surge in daily cases and decrease in daily vaccines administered contributed to this.

– the 7D moving average is about ~4 for the past few days

– this means 6 vaccines dosed for every 1 confirmed case

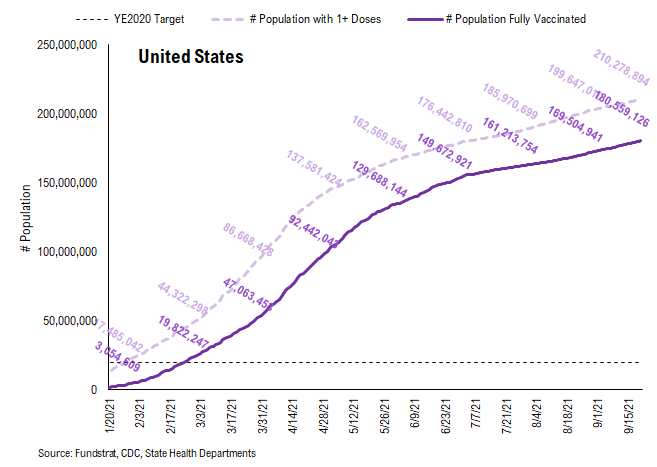

In total, 390 million vaccine doses have been administered across the country. Specifically, 210 million Americans (64% of US population) have received at least 1 dose of the vaccine. And 180 million Americans (55% of US population) are fully vaccinated.

POINT 3: Tracking the seasonality of COVID-19

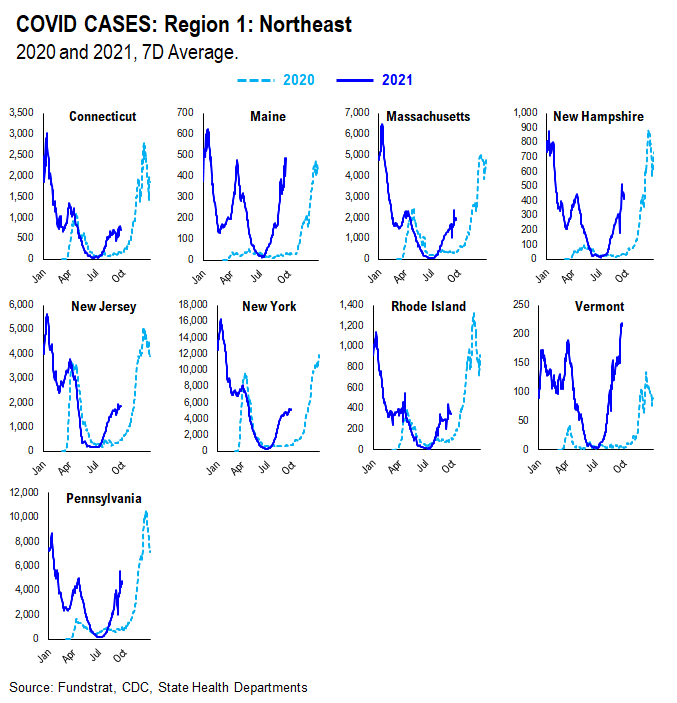

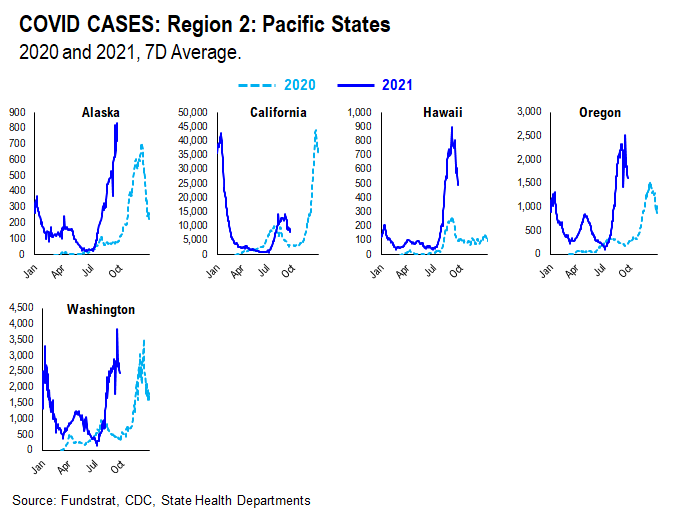

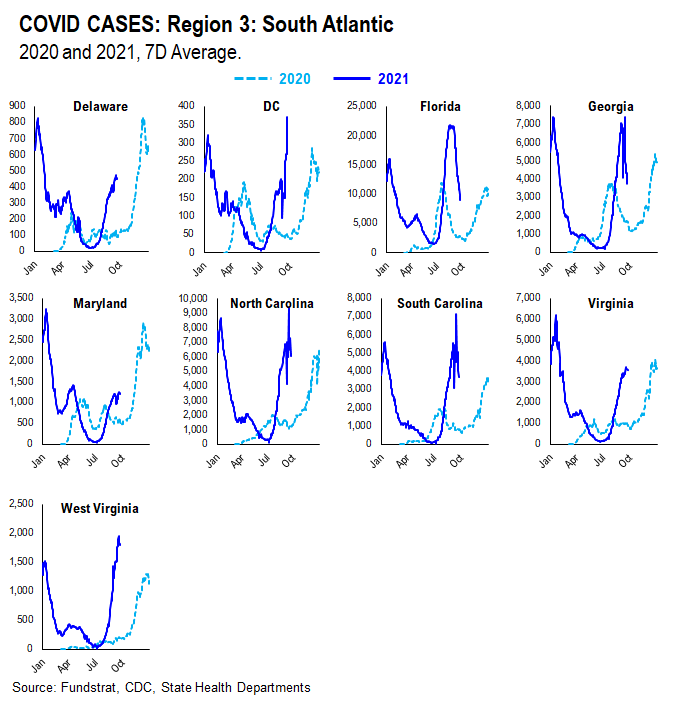

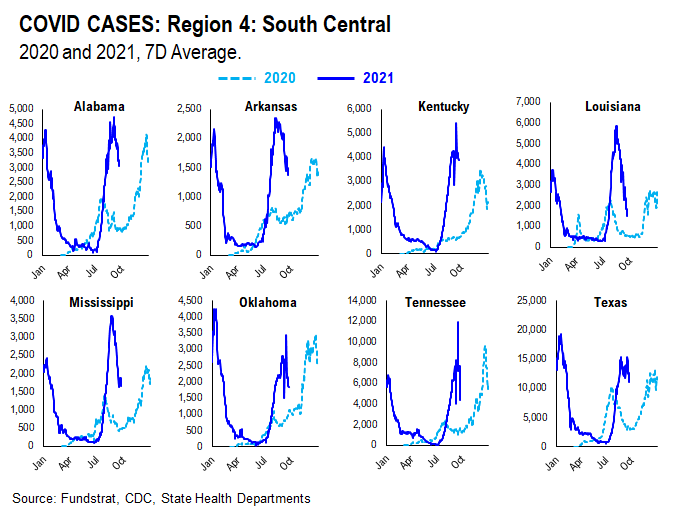

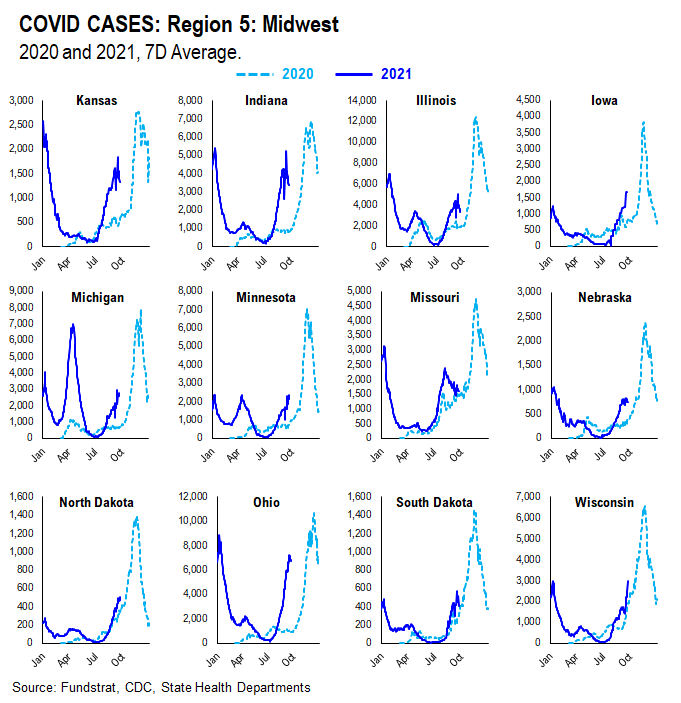

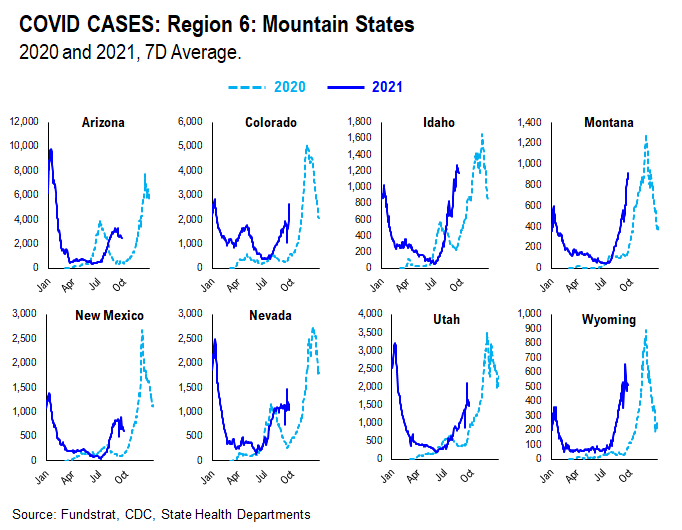

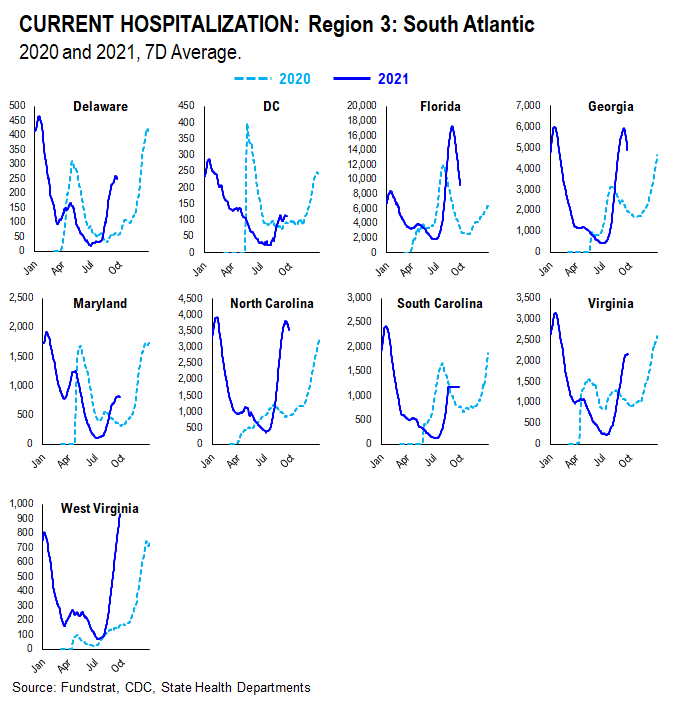

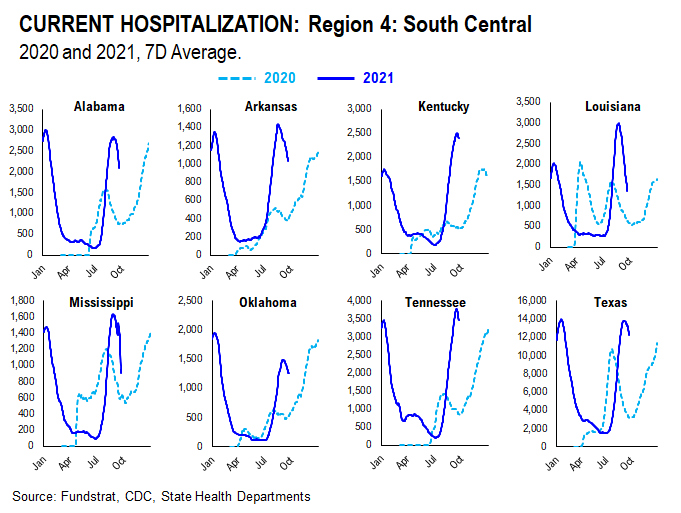

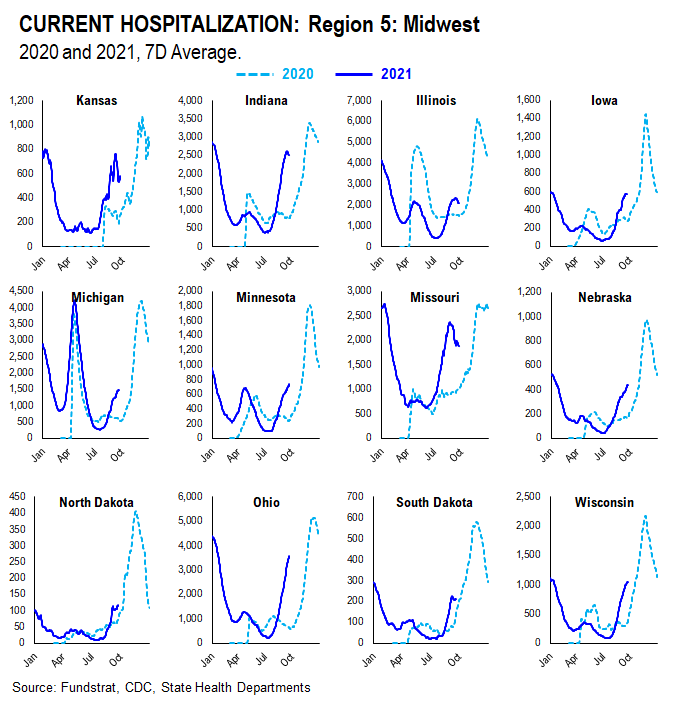

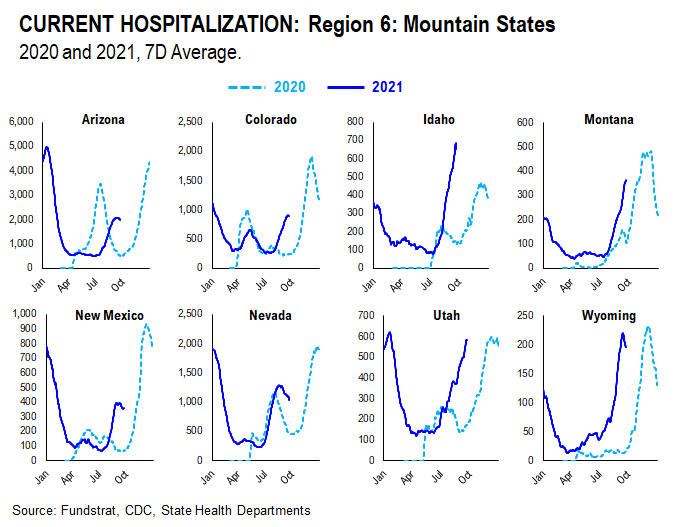

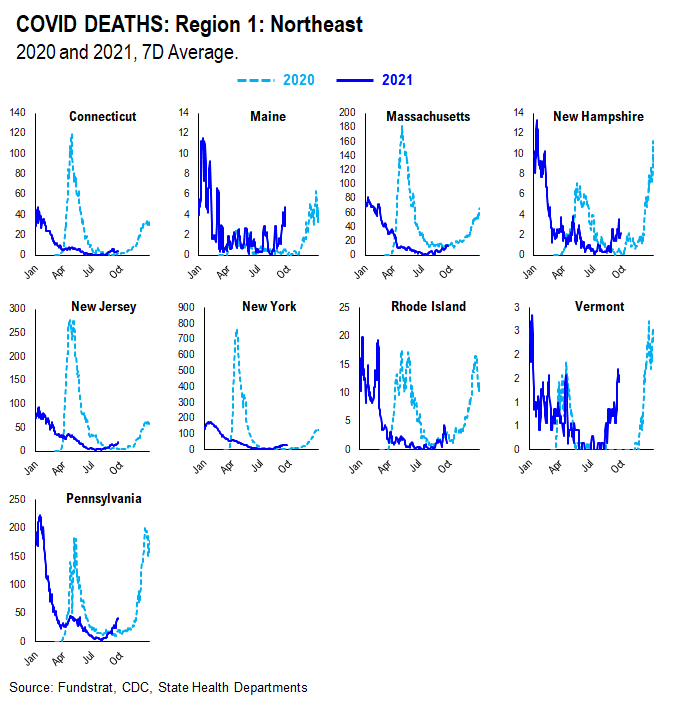

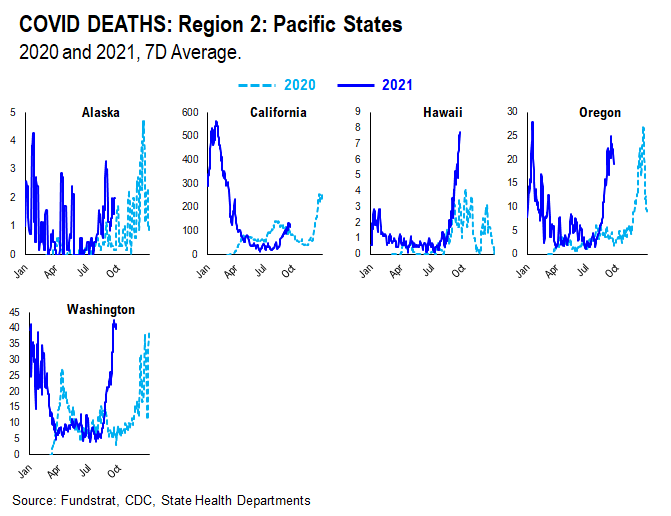

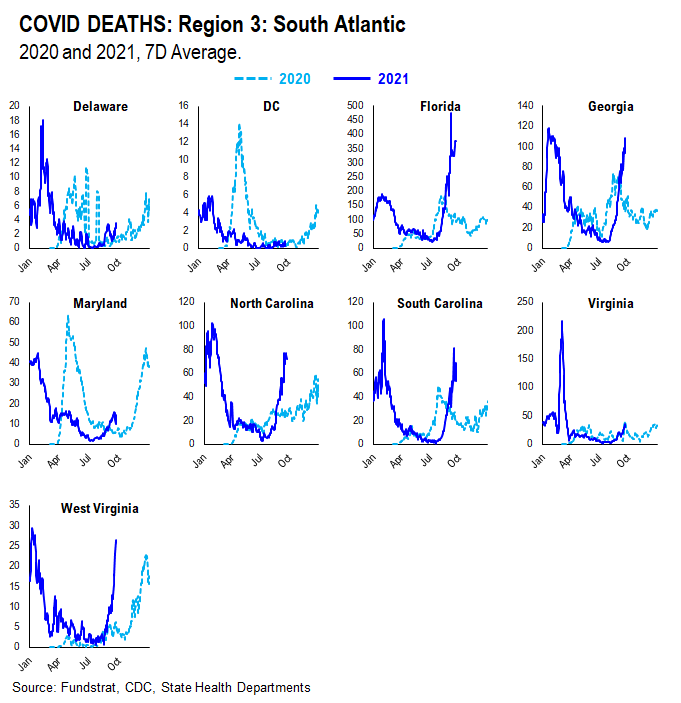

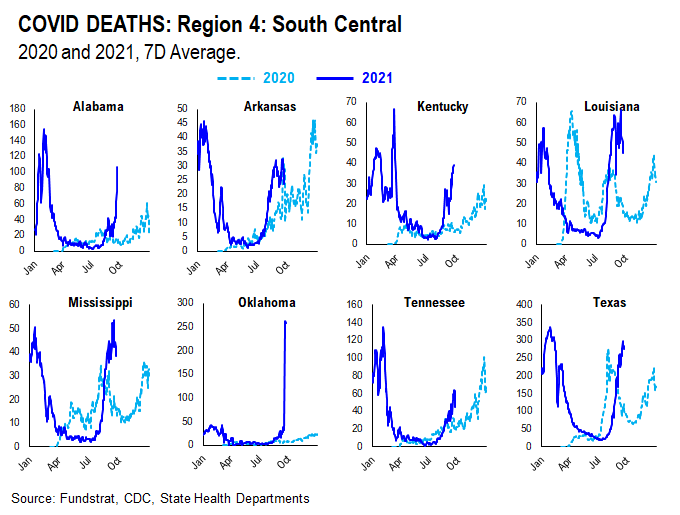

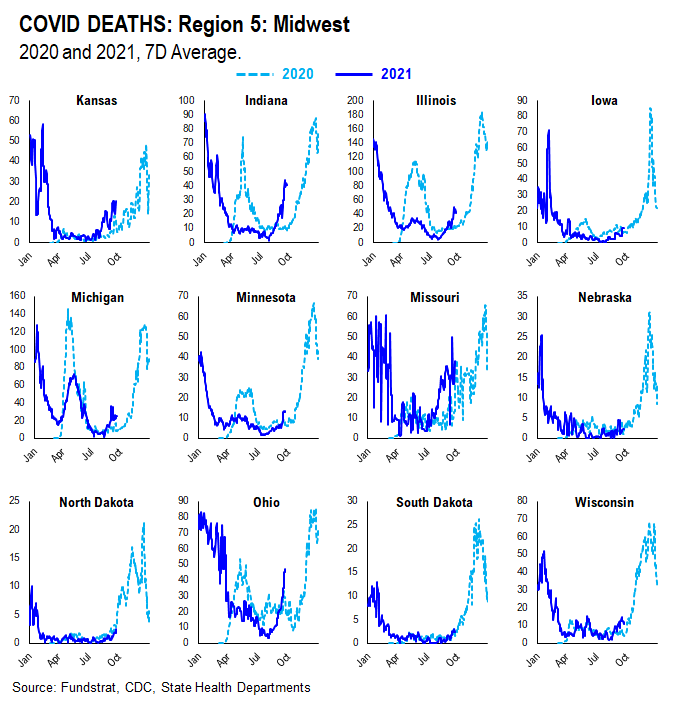

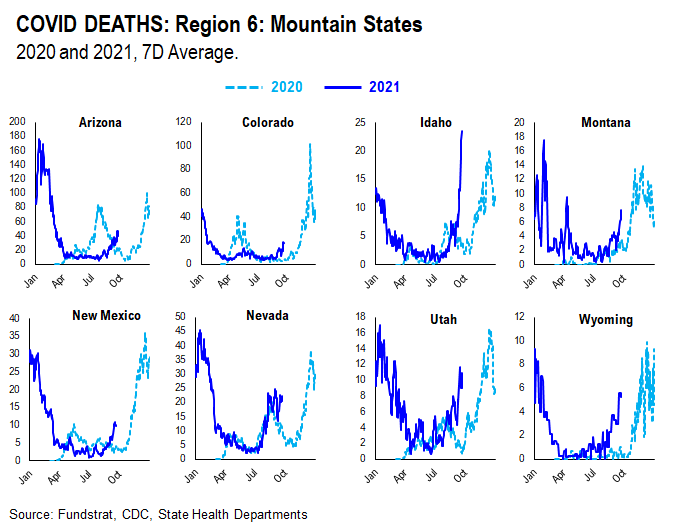

In July, we noted that many states experienced similar case surges in 2021 to the ones they experienced in 2020. As such, along with the introduction of the more transmissible Delta variant, seasonality also appears to play an important role in the recent surge in daily cases, hospitalization, and deaths. Therefore, we think there might be a strong argument that COVID-19 is poised to become a seasonal virus.

The possible explanations for the seasonality we observed are:

– Outdoor Temperature: increasing indoor activities in the South vs increasing outdoor activities in the northeast during the Summer

– “Air Conditioning” Season: similar to “outdoor temperature”, more “AC” usage might facilitate the spread of the virus indoors

If this holds true, seasonal analysis suggests that the Delta spike could roll over by following a similar pattern to 2020.

We created this section within our COVID update which tracks and compare the case, hospitalization, and death trends in both 2020 and 2021 at the state level. We grouped states geographically as they tend to trend similarly.

CASES

It seems as if the main factor contributing to current case trends right now is outdoor temperature. During the Summer, outdoor activities are generally increased in the northern states as the weather becomes nicer. In southern states, on the other hand, it becomes too hot and indoor activities are increased. As such, northern state cases didn’t spike much during Summer 2020 while southern state cases did. Currently, northern state cases are showing a slight spike, especially when compared to Summer 2020. This could be attributed to the introduction of the more transmissible Delta variant and the lifting of restrictions combined with pent up demand for indoor activities.

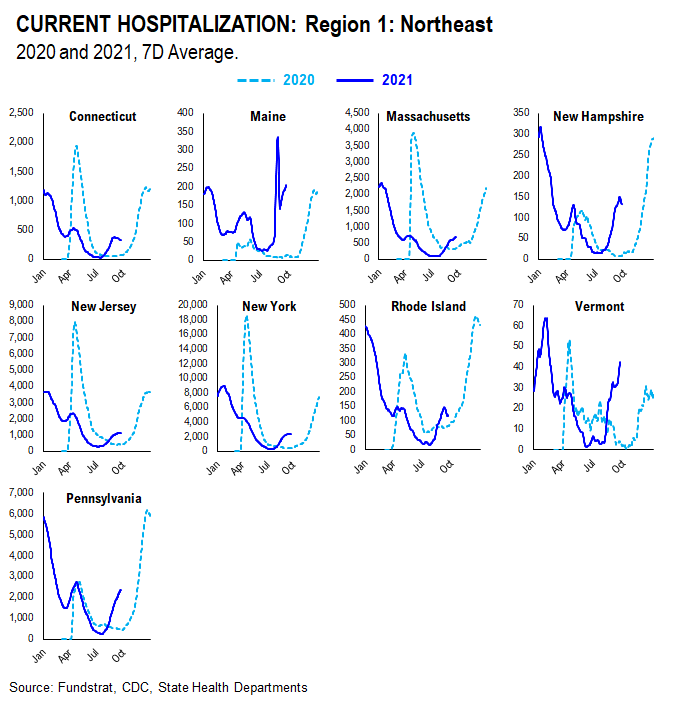

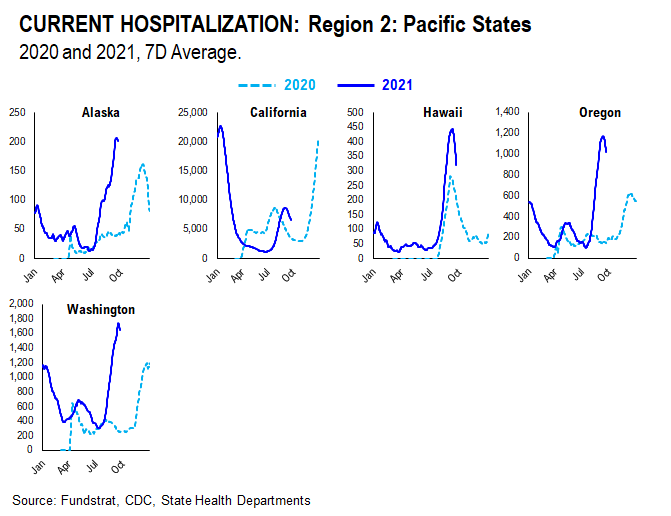

HOSPITALIZATION

Current hospitalizations appear to be similar or less than Summer 2020 rates in most states. This is likely due to increased vaccination rates and the vaccine’s ability to reduce the severity of the virus.

DEATHS

Current death rates appear to be scattered compared to 2020 rates. This is likely due to varying vaccination rates in each state. States with higher vaccination rates seem to have lower death rates given the vaccine’s ability to reduce the severity of the virus; states with lower vaccination rates seem to have higher death rates.