Inflation is having its "Volcker moment" as 34% of CPI (by weight) in deflation, the same point in Oct '82. As for "cash is a great alternative," S&P 500 in 10 days exceeds 4% return of cash, "cash"-ites have to wait another 355 days to match the return of stocks.

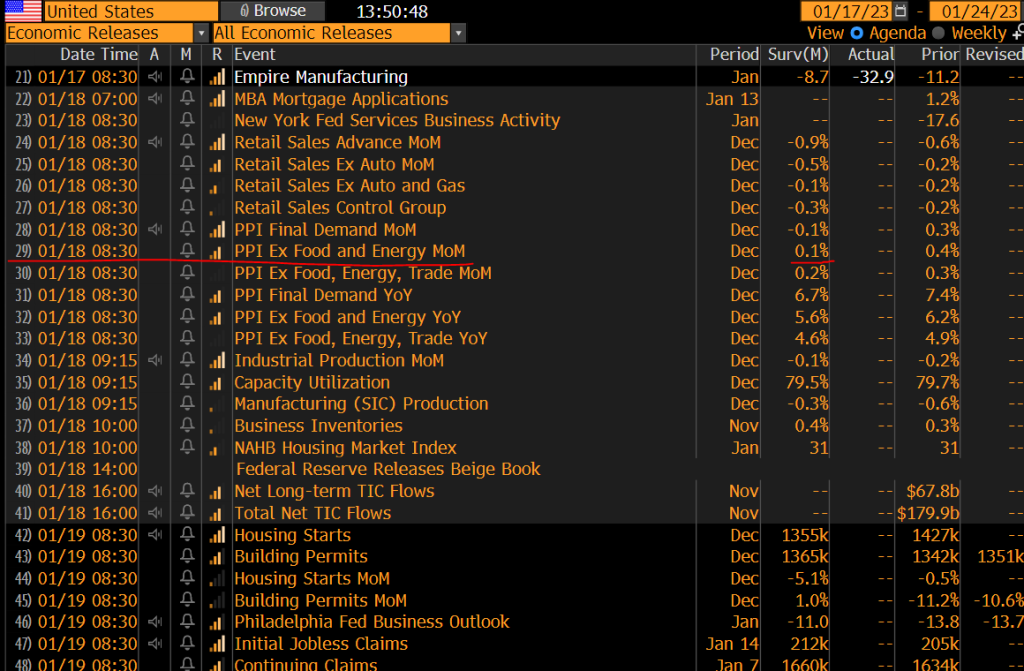

MACRO CATALYST WATCH: Wednesday

8:30am ET: Dec PPI (Producers Price Index) Core Street +0.1% MoM (was +0.4% last month)

- PPI Core (ex-food and ex-Energy) should show same type of continual improvement seen in CPI.

- If Dec is +0.1% or so, this takes 3M annualized to 2.39%, down from 2.69% last month. In our view, another data point showing inflation trajectory slowing sharply.

YTD S&P 500 ~4% means the “cash is a great alternative”-ites need to wait another 355 days

The S&P 500 is up 4% YTD, meaning in the first 10 trading sessions, equities have exceeded the annual expected return of bonds (3.5%) and cash (~4%). Meaning those who say “cash is a great alternative” have to wait another 355 days to match the return of stocks. Stocks have posted a solid start to 2023, and many investors view this warily.

Fed made an “unforced error” in December — which is the setup for a >20% rally in 2023

But what if investors are supposed to respect this rally (our view). Is there a rationale/narrative that justifies this? Yes, here is a perspective aligned with stocks gaining YTD:

- Inflation visibly peaked in October (first CPI to show demonstrable declines)

- Since October, inflation has taken several legs down and is now effectively running below 3% annualized (core CPI and core PCE)

- And the normalization of China, supply chains, falling commodities, sating of consumer demand all are further “disinflation” forces in the pipeline

- Hence, the S&P 500 bottomed on October 13, at 3,491

- If this is true, why did stocks get hammered in December? And why did Fed’s Powell and FOMC pushes terminal rates hawkishly higher for 2023?

- As we wrote many times since early Dec, we think the Fed made an “unforced error” by raising 2022 Core PCE inflation forecast to 4.8% (from 4.5%), when in fact, Core PCE inflation tracking towards 4.2%, or 60bp LOWER.

- How did this happen? We believe this stems from the Haver Analytics hack and the Fed unwittingly made the Dec FOMC policy decision with “stale” and non-updated data

- Inflation itself has hit a wall, as 59% of CPI components are in outright deflation. On a weighted-basis, this is now 34%, solidly above the 30% 50-year average

- Fed’s Volcker ended his war on inflation in October 1982, when this diffusion measure rose above 30% (see below), so Fed is now in the same place.

- So, this means two things need to happen

- First, inflation data needs to continue to track at this “leg down” level and we expect <3% annualized inflation for next 6 months

- Second, the Fed needs to own up to this “leg down” (which bond market sees). This is not true if Fed is willing to push economy off a cliff needlessly.

The odds for a >20% rise in equities is very strong in 2023. In fact, it might arguably be the “base case”:

- The bond market already agrees with this inflation view, evidenced by the collapse in bond volatility (MOVE Index) and the VIX itself is below 20.

- Given 2022 was a negative return year, 53% of all post-negative years are up >20%, meaning high odds of >20% rise for S&P 500 in 2023.

- The probability rises to essentially 90% if the S&P 500 is up >1.5% in the first 5 days, or if the VIX averages below 25 in 2023.

- Pick your poison, but both of above conditions seem to be coming together

But as much as stocks have been resilient in 2023, they are now running into the resistance line that has repelled the S&P 500 since the start of 2022. See below.

But as @PeterLBrandt notes, trendlines are meant to be broken. And we think the driver for this upside breakout is the fundamental rationale outlined above.

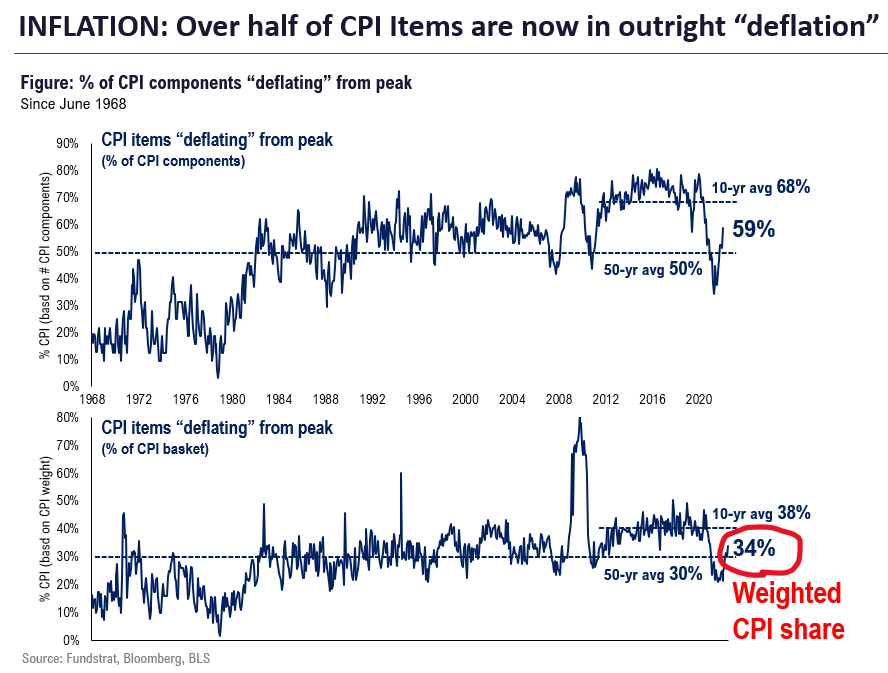

INFLATION: Volcker ended inflation war when 34% of items (by weighted CPI) in deflation, crossed that point in Dec 2022

We have been regularly updating the diffusion of CPI below. This index, created by our head of data science, “tireless Ken,”:

- tracks the % of CPI components in outright deflation

- the top is % of components and is at 59% vs 50% 50-yr average

- the bottom is % of CPI basket (by weight) is at 34% vs 30% 50-yr average

- both are well above the long-term average

The weighted basis is particularly eye catching. As shown below:

- % CPI in deflation is 34% and as shown below

- is a solid recovery of this difussion measure, after spending 2021-2022 at the 20% level

- at 20%, this means 80% of CPI components are inflating (weighted-basis) which is why inflation was so prevalent

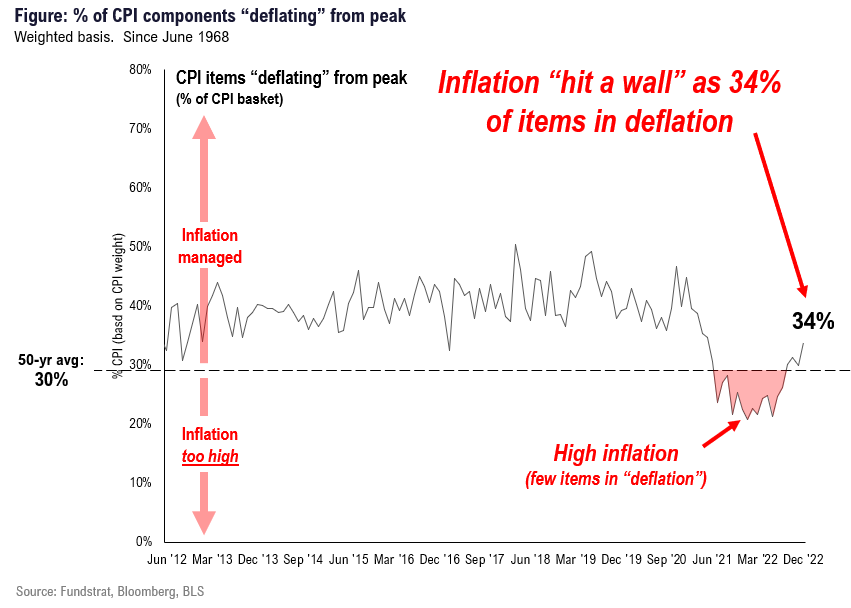

In October 1982, this figure crossed back above 30% and that is when Volcker ended the inflation war

Notably, this 30% level was important in 1982. As shown:

- this figure crossed back above 30% in Oct 1982

- after spending >12 years below this line

- Fed Chair Volcker (at the time) first posited ending the inflation war on Oct 1982

- so is this coincidence?

Ultimately, this argues the inflation of 2021-2022 was transitory

Take a look at the 50-year history of this series. And from this lens, the inflation of 2021-2022 surely looks transitory:

- in fact, it looks more akin to the short lived inflation episode of 2008

- unlike the structural inflation of the 1970-1980s

- hence, which inflation war should the Fed be fighting?

- the bond market argues the Fed needs to end the war soon

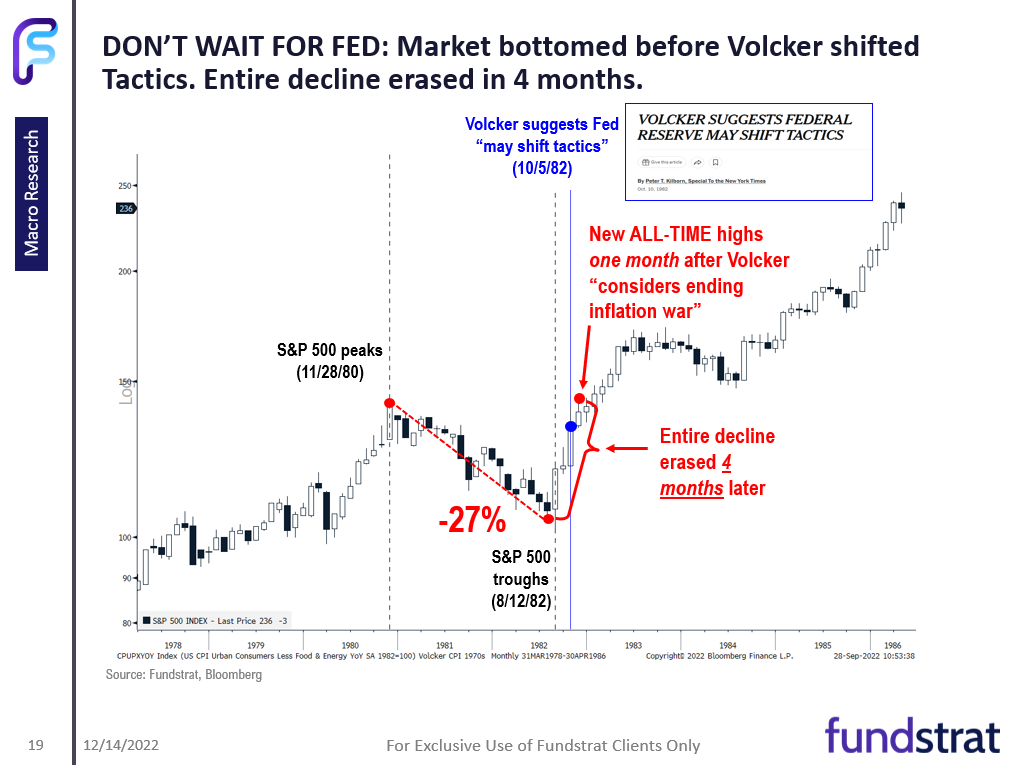

If this is a 1982-moment, the stock market was two months ahead of the Fed

And recall from our 2023 outlook, in 1982, the stock market rallied well ahead of the Fed:

- S&P 500 fell 27% over 27 months into August 1982

- Stocks made the “final low” on 8/12/82

- Fed Chair Volcker did not even posit ending the inflation war until Oct 1982, or 2 months later

- By the time Volcker spoke of this, the S&P 500 had nearly erased the entire 27 month bear market

- A new all-time high was made within 4 months of the low

- This is a possible path for 2023

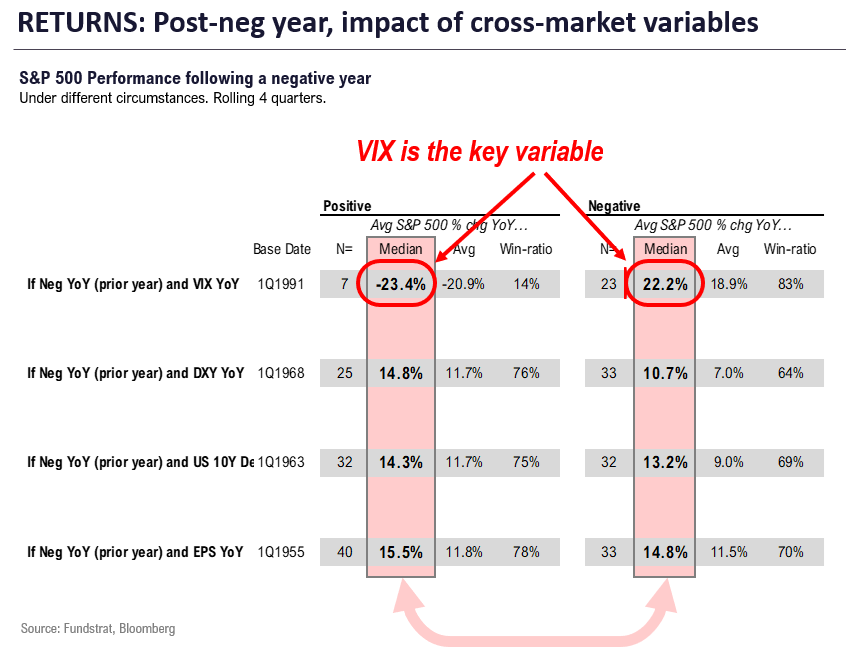

STRATEGY: VIX matters far more for 2023 returns than EPS growth

Our data science team compiled the impact on 2023 equity returns from variables:

- S&P 500 post-negative year (2022)

- the varying impacts of

- VIX or volatility

- USD change

- Interest rates

- EPS growth

- All of the 4 above, positive or negative YoY

- Data is based on rolling quarters and summarized below

The surprising math and conclusions are as follows:

- most impactful is VIX

- Post-negative year (rolling LTM)

- if VIX falls, equity gain is 22% (win ratio 83%, n=23)

- if VIX rises, equity lose -23% (win ratio 14%, n=7)

- I mean, this shows this all comes down to the VIX

- EPS growth has little impact

- If EPS growth is negative YoY (likely), median gain +14.8% (win-ratio 70% n=33)

- If EPS growth is positive YoY, median gain is 15.5% (win-ratio is 78%)

- Hardly a sizable bifurcation

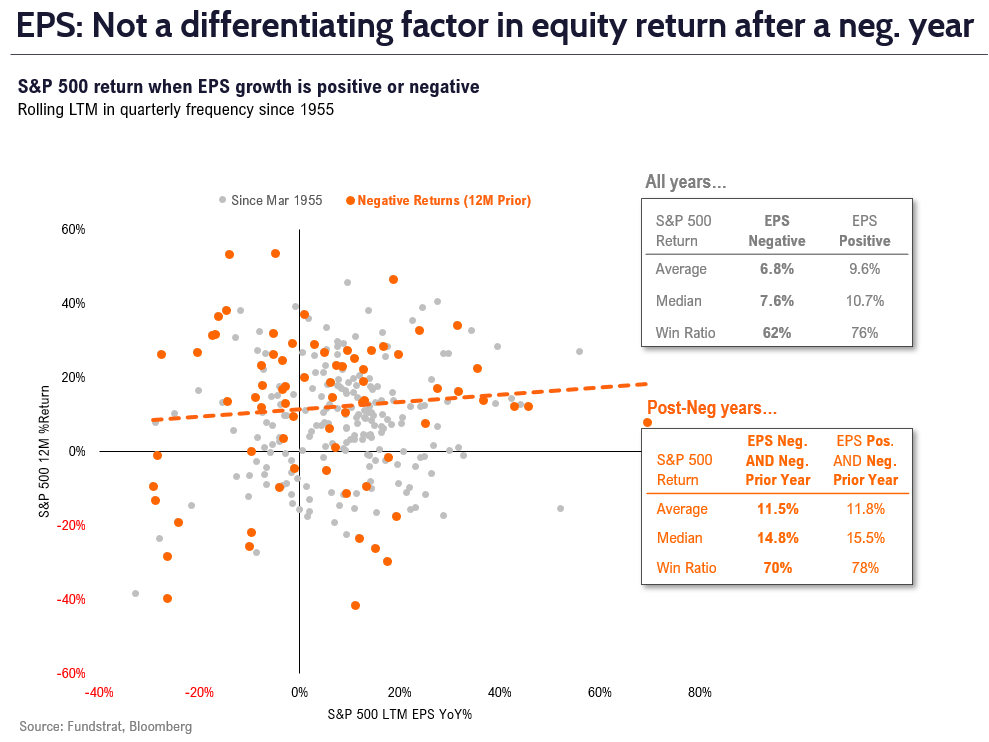

As the scatter below highlights, we can see the sizable influence of the VIX. Even in all years, the VIX is a key factor:

- in our view, if inflation falls sharply

- and wage growth slows

- Fed doesn’t have to cut, but this is a dovish development

- we see VIX falling to sub-20

- hence, >20% upside for stocks

And as shown below, EPS growth has a somewhat important correlation, but hardly as strong as VIX changes.

- the difference in median gain is a mere 70bp (positive vs negative) post-negative year

- the importance of EPS growth is stronger in other years

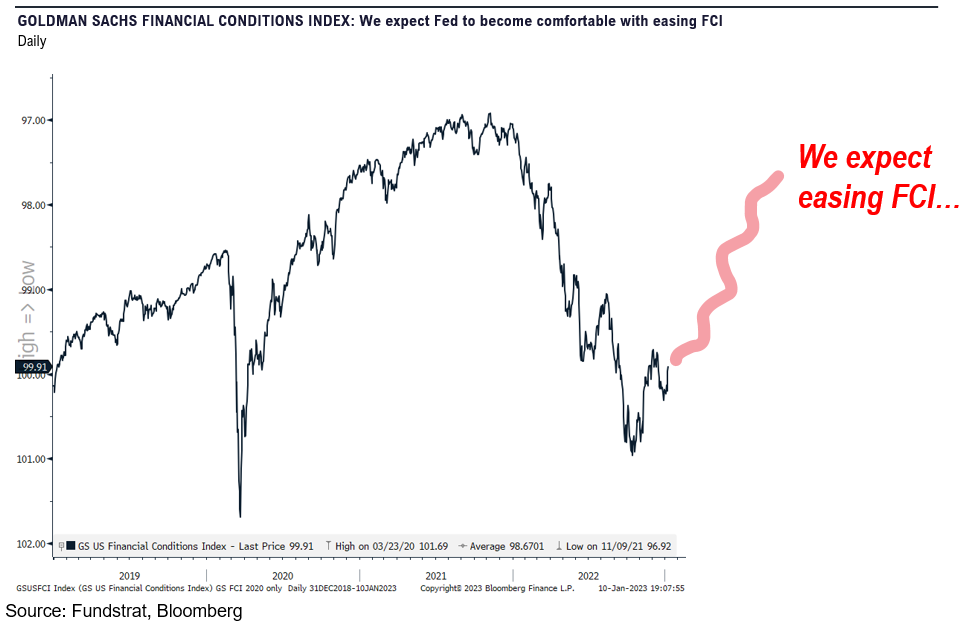

STRATEGY: Financial conditions should ease in 2023, driving higher equity prices. Technology, Discretionary and Industrials levered to easing FCI

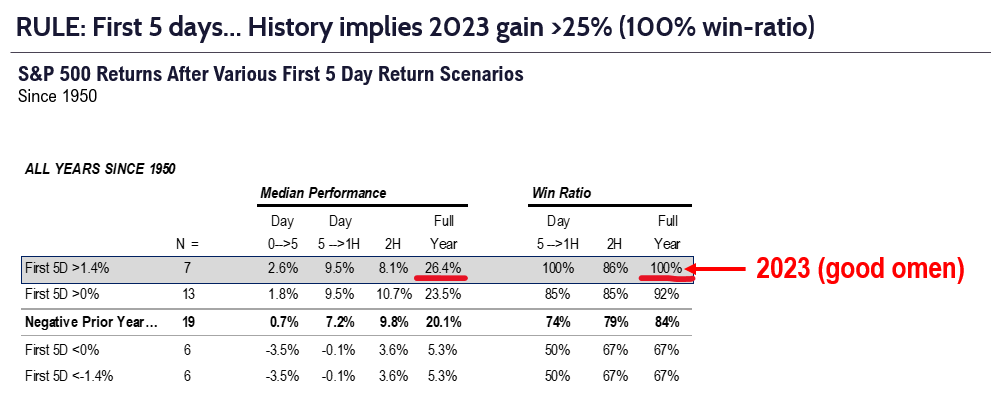

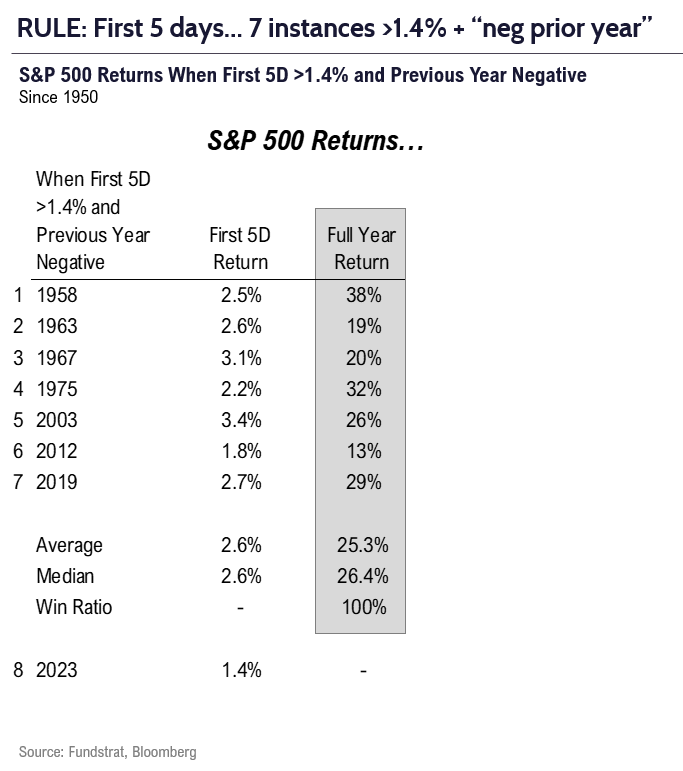

The “base” case for 2023 should be below. That stocks gained >1.4% in the first 5 trading days, and this portends strong gains for the full year:

- Post-neg year + up >1.4% on first 5 days

- Day 5 to first half median gain is 9.5%

- Full year median gain is 26%, implies >4,800 S&P 500

- 7 of 7 years saw gains.

Those 7 precedent years are shown below.

- the range of full year gains is +13% to +38%

- so, this is a VERY STRONG signal

- the two most recent are 2012 and 2019

- we think 2023 will track >20%

The path to higher equity prices is discussed above:

- core inflation falling faster than Fed and consensus expects

- wage inflation is already approaching 3.5% target of Fed (aggregate payrolls)

- Fed could “dovishly” leg down its inflation view

- allowing financial conditions to ease

- bond market has already seen this and is well below Fed on terminal rate

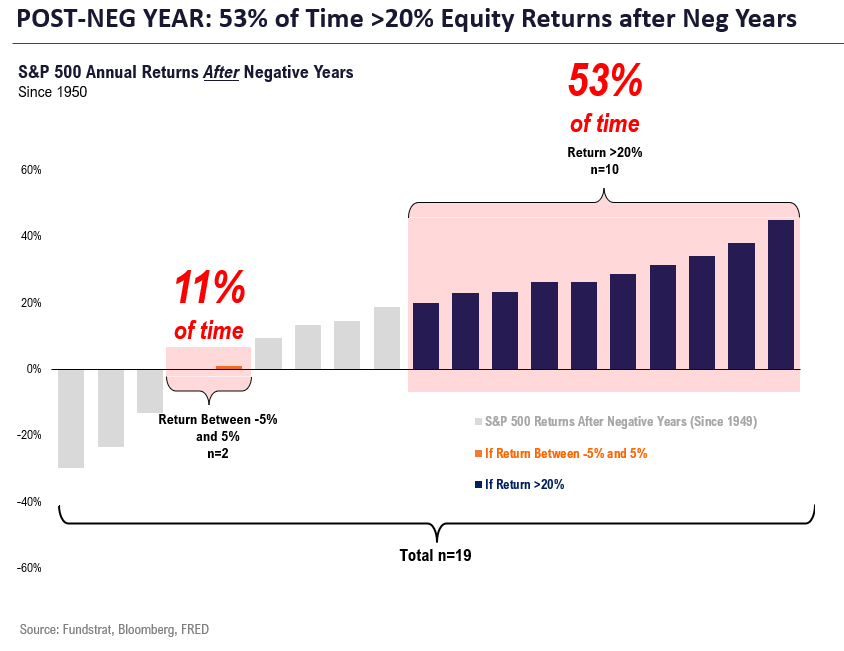

BASE CASE: The “maths” for what to expect in 2023, post a “negative return” year (2022)

Question: how common is a “flat” year? Our team calculated the data and it is shown below:

- since 1950, there are 19 instances of a negative S&P 500 return year. In the following year,

- stocks are “flat” (+/- 5%) only 11% of the time (n=2)

- stocks are up >20% 53% of the time (n=10)

- yup, stocks are 5X more likely to rise 20% than be flat

- and more than half of the instances are >20% gains

So, does a “flat year” still make sense?

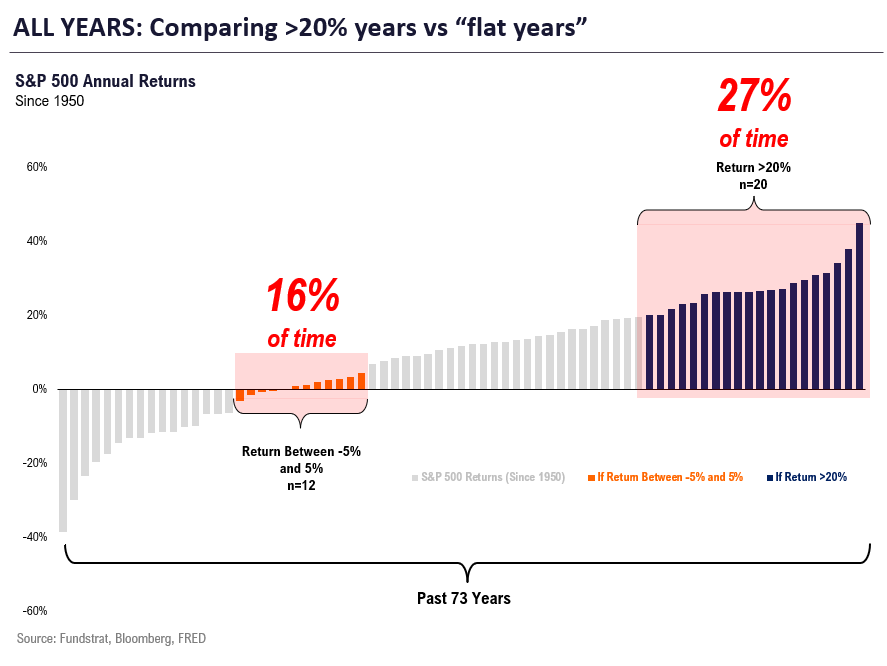

As shown below, these probabilities are far higher than compared to typical years:

- since 1950, based upon all 73 years

- stocks are “flat” 16% of the time vs 11% post-negative years — BIG DIFFERENCE

- stocks are up >20% 27% of the time vs 53% post-negative years — BIG DIFFERENCE

- see the point? The odds of a >20% gain are double because of the decline in 2022

We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday

_____________________________

37 Granny Shot Ideas: We performed our quarterly rebalance on 10/19. Full stock list here –> Click here

______________________________

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 51d1af-86fcf3-d8c1ff-f889e3-811413

Already have an account? Sign In 51d1af-86fcf3-d8c1ff-f889e3-811413