The bond market called inflation right in 2022 and now says Fed will be dovish in 2023... even if Fed doesn't know it yet

We hosted our 2023 Outlook webinar Wednesday and a replay is available (see banner above). The bottom line is we see the highest probability for double-digit gains since 2020. This call is fundamental (falling inflation) and Fed-based (Fed gets dovish).

The bond market called Fed right in 2022 and now says Fed will be dovish in 2023… even if Fed doesn’t know it yet

James Carville once famously said in the next life, he wants to be reborn as the bond market (because it scares everyone). And this year, the bond market again proved its storied ability to see the future path of the economy, well before equity markets and well before the Fed.

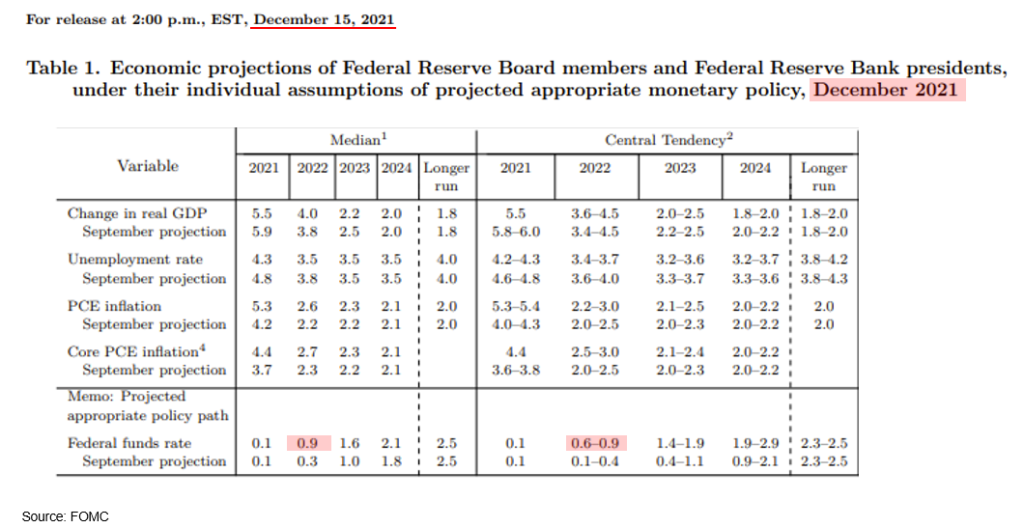

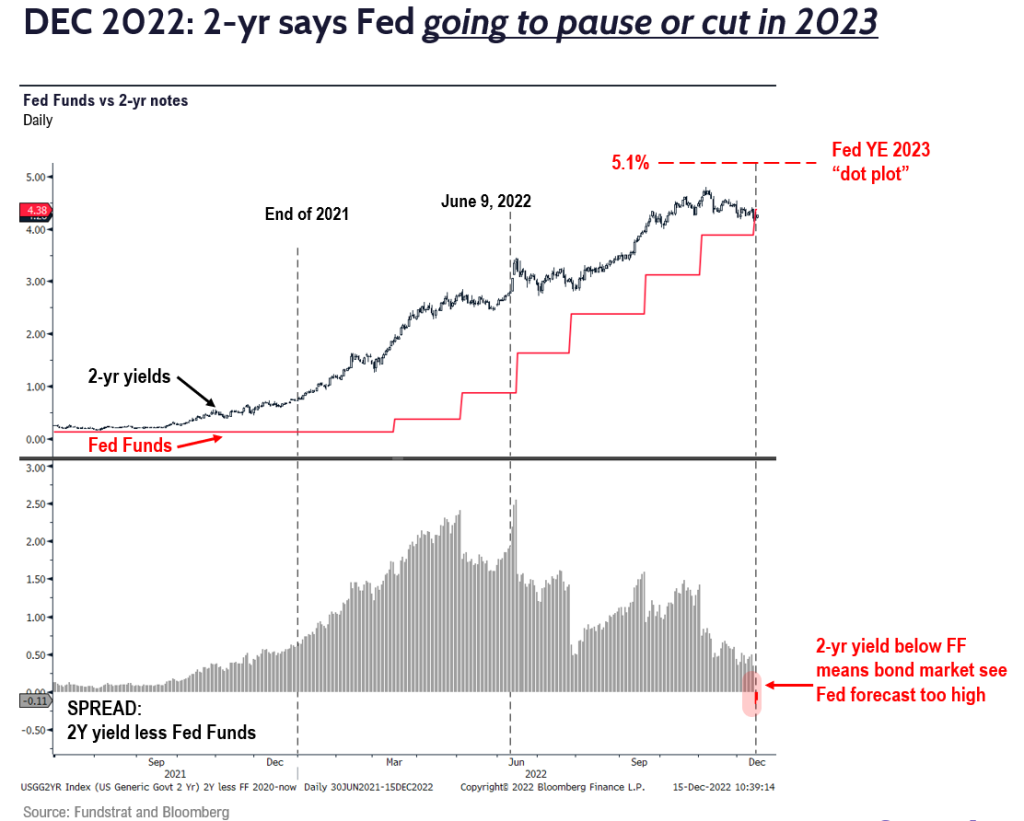

Take a look at the Fed’s forecast for Fed funds from its December 2021 SEP (Summary Economic Projections):

- FOMC anticipated YE 2022 Fed Funds of 0.9%, or 80bp of hikes in 2022

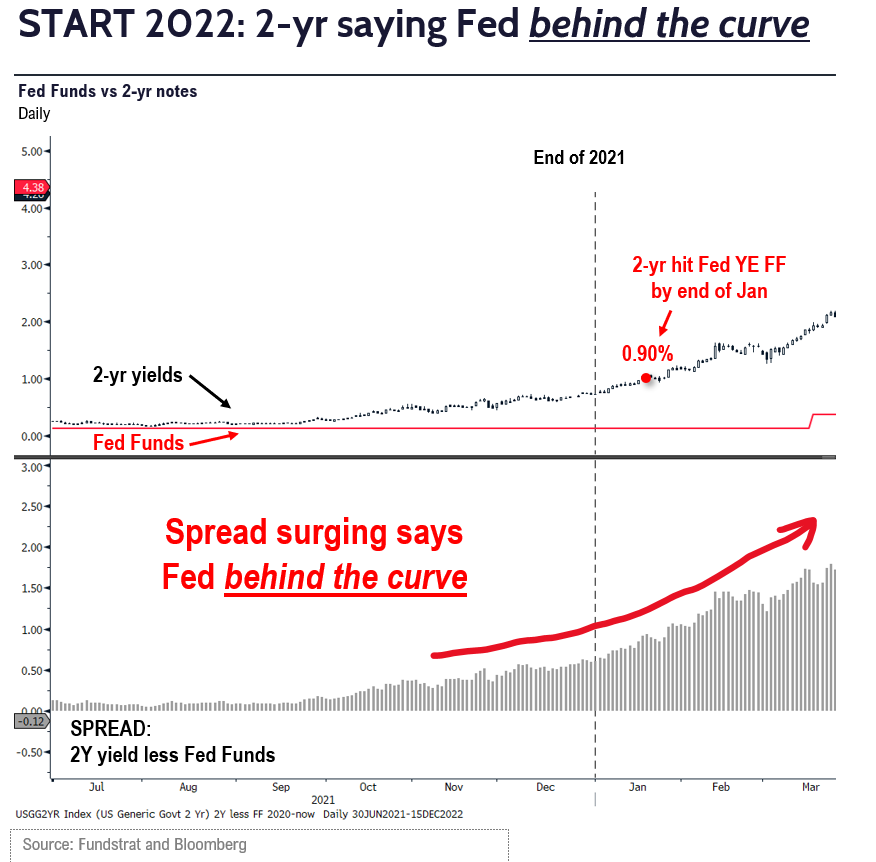

But by January 2022, the 2-yr yield (a proxy for where markets see Fed funds heading) was already at 0.90%.

- 2-yr screamed Fed was behind the curve by January 2022

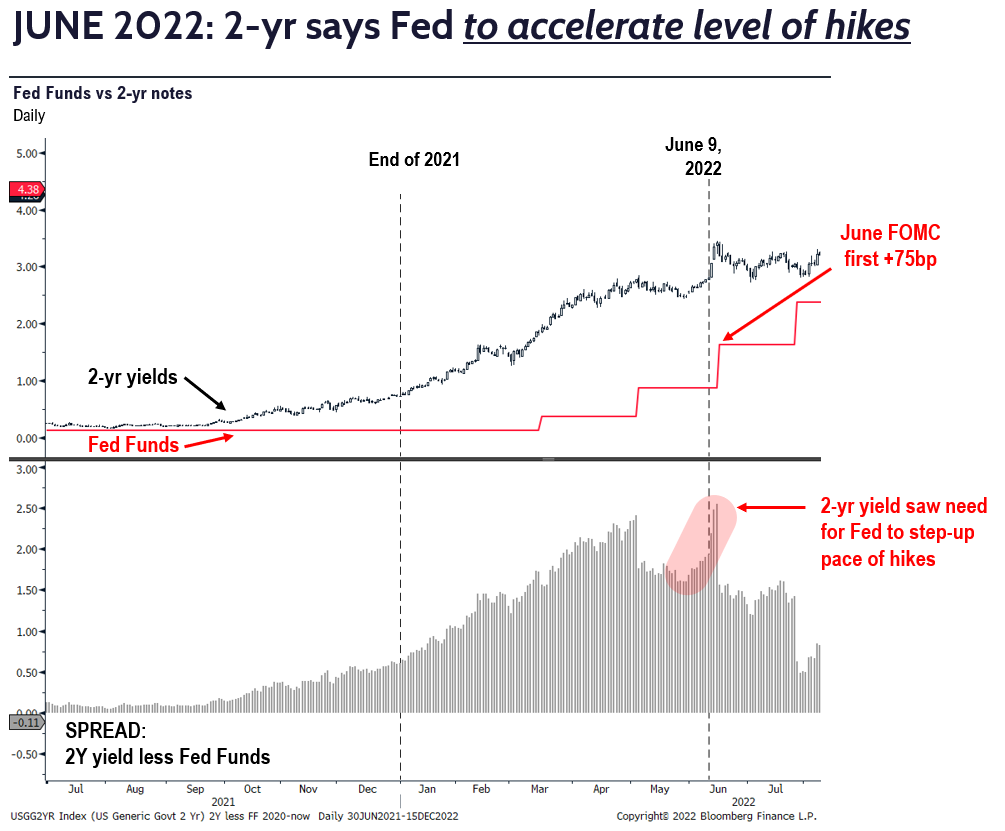

Bond market anticipated Fed would need to drastically step up pace of hikes to +75bp by June9th

And by early June, the 2-yr said Fed needed to step up the pace of hikes:

- notice the spread 2Y less FF jumped on June 9th

- this is right before Fed stepped up hikes to +75bp

- Nick Timiraos of WSJ wrote his +75bp article on June 12th, 3 days after the bond market priced in +75bp

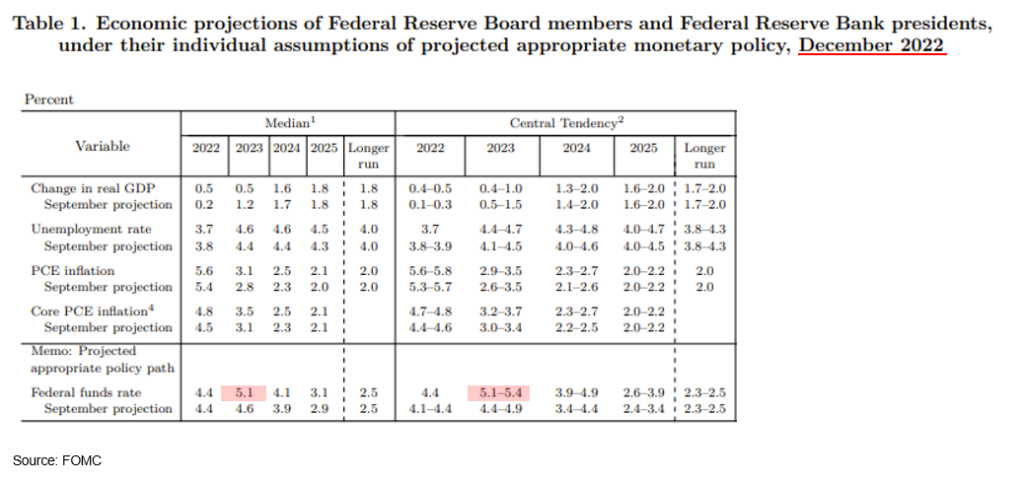

December 2022 FOMC Fed sees FF at 5.1% by YE 2023…

The latest FOMC dot plot (12/14/2022) sees Fed Funds at 5.1% by YE 2023.

- Current Fed Funds is 4.375%

- This implies about +72bp of hikes in 2023, or 3 hikes

2-year says Fed will cut rates in 2023

As we enter 2023, the 2-yr is saying Fed will make a dovish turn.

- 2-yr is 4.2%

- BELOW current Fed funds of 4.375%

- Well BELOW FOMC dot plot of 5.1%

- In short, the bond market is more dovish than the Fed

In 2022, the bond market called the Fed actions well ahead of the Fed. And if this carries into 2023, the bond market says the Fed will soon turn dovish. That is good news for equities.

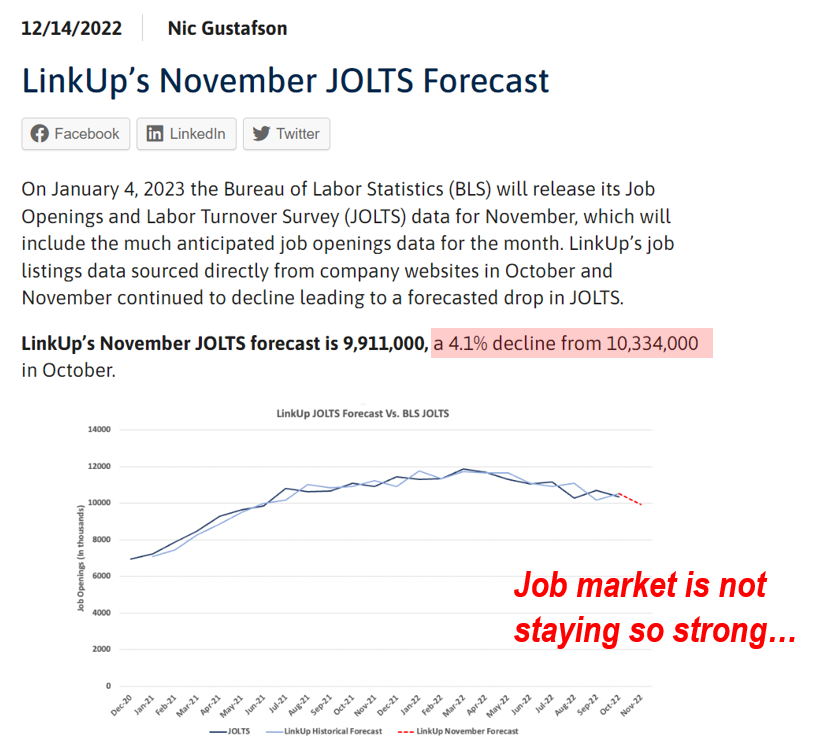

JOBS: Latest Linkup forecasts a 4% drop in job openings per JOLTS

It will be important for the labor market to soften and that is what is visible. The latest LinkUp November JOLTS forecast was published Wednesday:

- LinkUp sees a 4.1% decline in JOLTS for Nov (published early Jan)

- This takes total job openings BELOW 10 million to 9.9 million

- The lowest since early 2021

- That is a material weakening in job openings

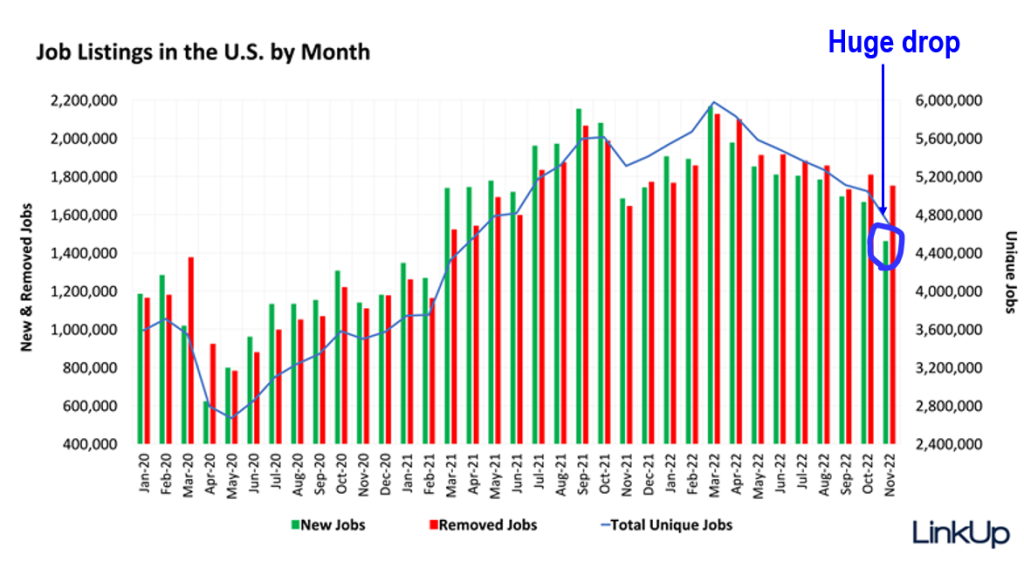

And as the composition chart shows, is because of a sizable drop in new postings:

- the number of new postings is the lowest since 2021

- this is an unwind of 2 years of job markets

- thus, it looks like wage growth should slow in 2023

- this would likely further catalyze the Fed to be more dovish

STRATEGY: Despite selling on hawkish ECB yesterday (among other factors), the tailwinds from Fed are building into 2023

Bottom line, while equity markets were soft yesterday on the heels of hawkish ECB and somewhat disappointing regional PMIs (mixed), the key is the trajectory of inflation which is softening:

- equities are up +25% since end of 2019

- EPS is up +35%

- earnings have exceeded price appreciation over past 3 years

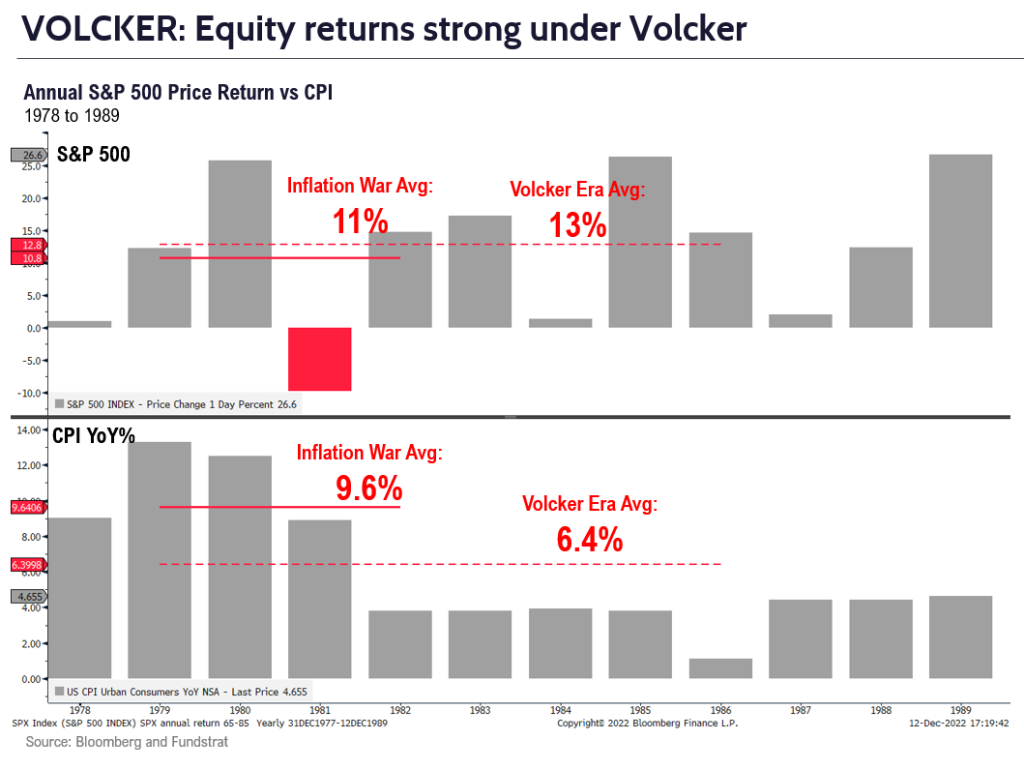

- and as we highlighted in our 2023 Outlook equities gained 13% during the Volcker years

- and during the Stagflation period 1978-1982, only posted 1 negative year

- investors are arguably exiting 2022 too pessimistic

Notice how equities posted fairly solid gains during the Volcker era:

- only 1981 was a negative return year

- stocks rarely post two consecutive annual declines

- thus, we see 2023 as setting up to be positive

We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday

_____________________________

37 Granny Shot Ideas: We performed our quarterly rebalance on 10/19. Full stock list here –> Click here

______________________________