FOMC decision -- tapering will not be a killer of the "YE everything rally"

Click HERE to access the FSInsight COVID-19 Daily Chartbook.

We publish on a 4-day a week schedule:

Monday

Tuesday

Wednesday

SKIP THURSDAY

Friday

STRATEGY: FOMC decision — tapering will not be a killer of the “YE everything rally”

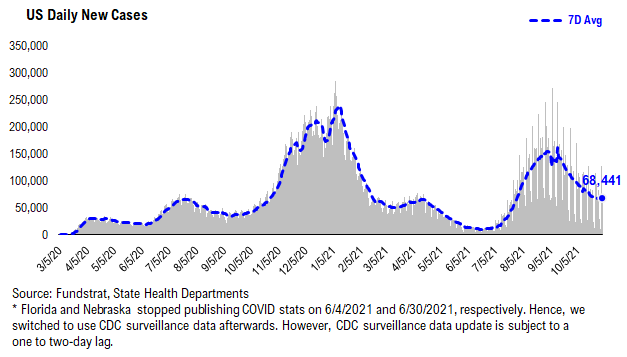

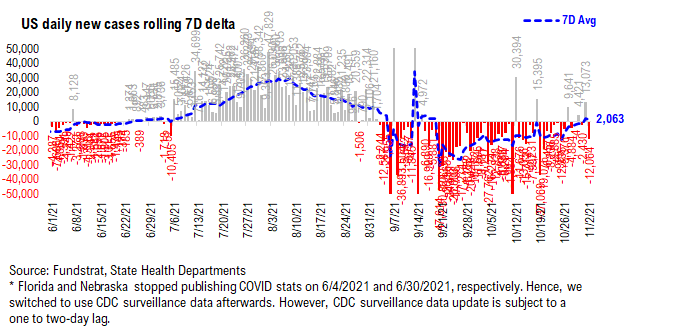

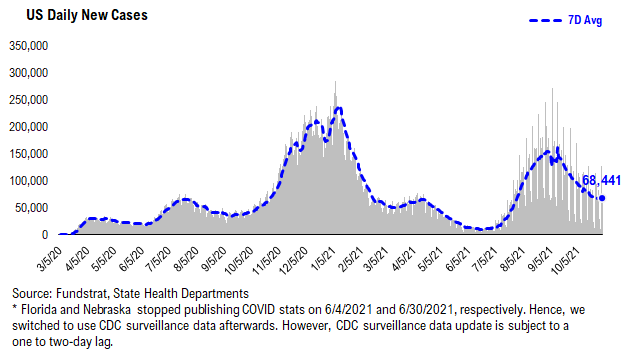

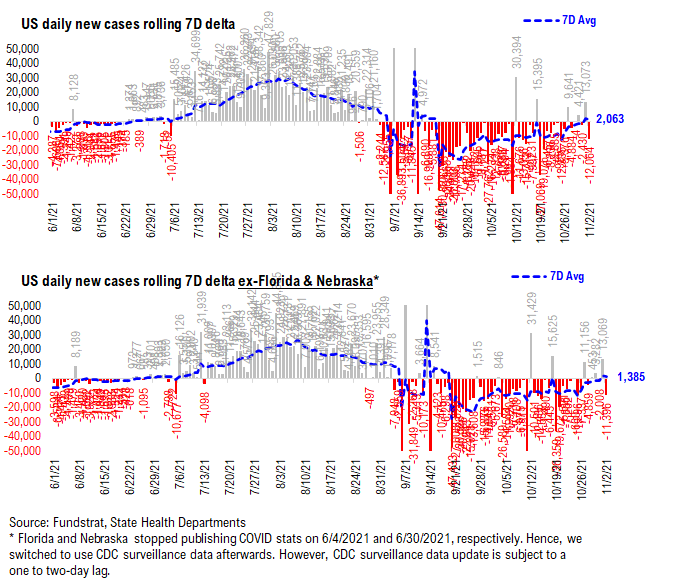

The “rate of improvement” is slowing for COVID-19 cases, as the 7D delta is approaching flat

While COVID-19 cases remain sub-70,000 solidly, the rate of improvement is slowing. It is not necessarily “alarming” yet:

– 7D delta is +2,063 and as the lower chart shows, was -5,000 just a week ago

– this is a mix shift, as many states are improving, but a few new states are seeing rises

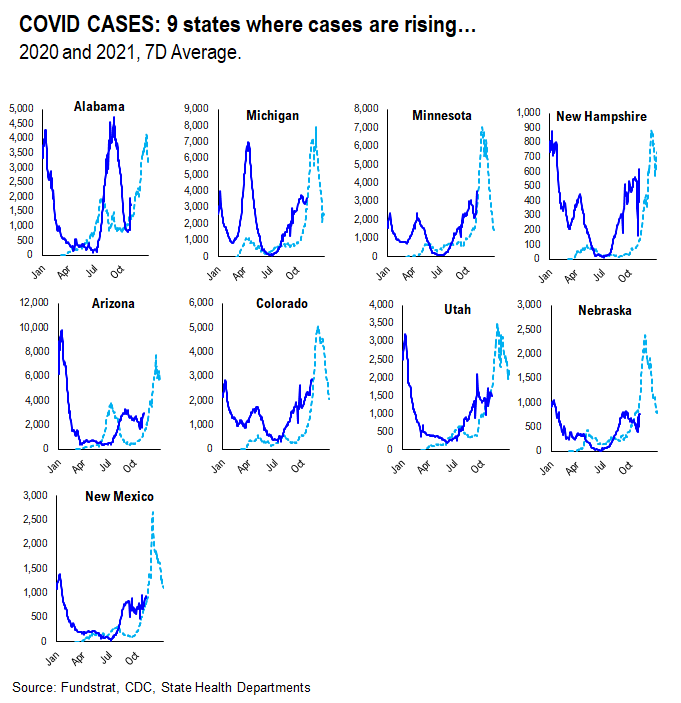

9 states where cases are rising…

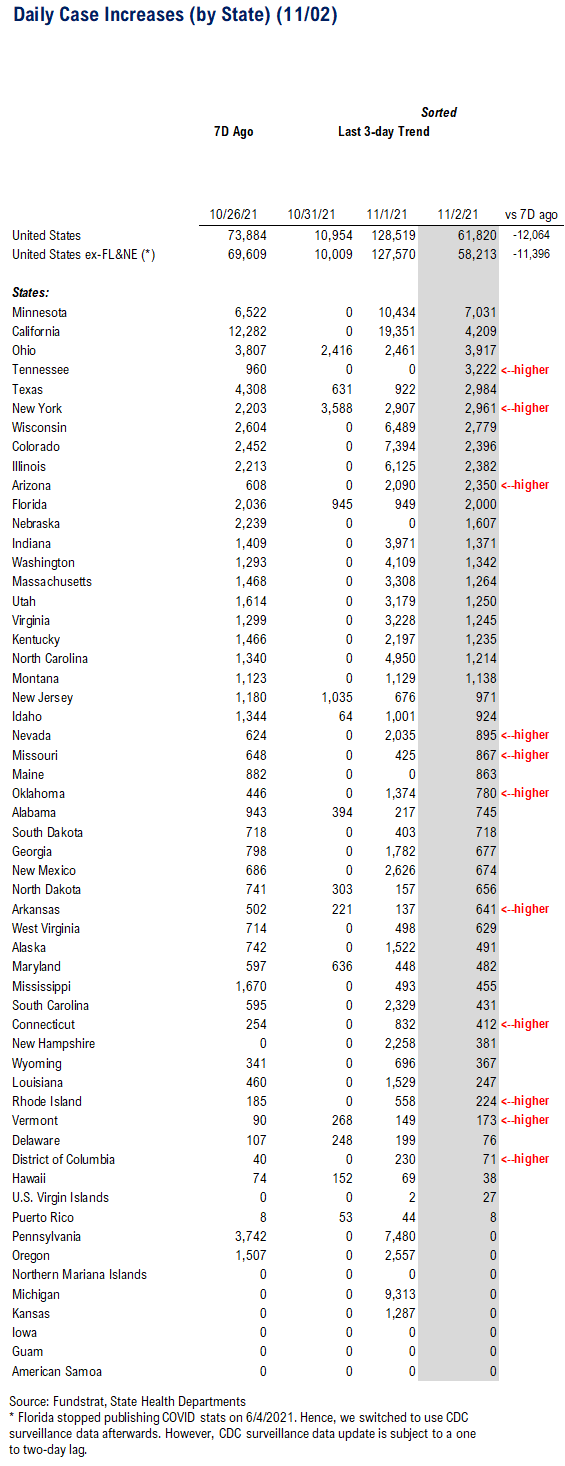

Below are the 9 states where the 7D trend in cases is rising and therefore, these states are contributing to a rise in overall USA cases:

– AL, MI, MN, NH, AZ, CO, UT, NE and NM

– Alabama is sort of the exception, to the extent it had a massive summer surge and a mini-one arises

– Among the other 8 states, it looks like the Delta variant is still surging through those states

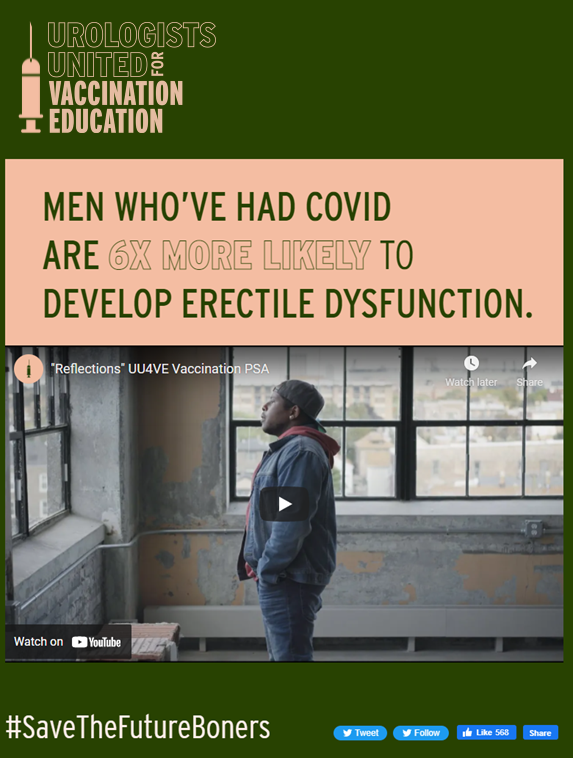

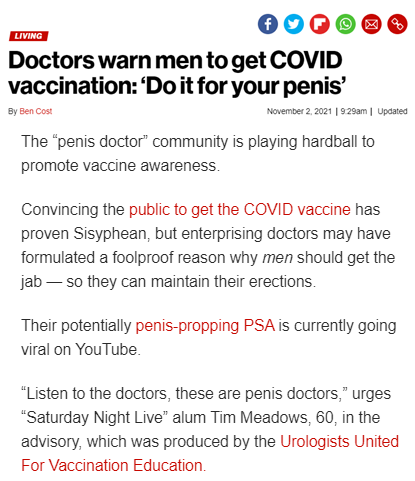

VACCINE CASE FOR MEN: Urologists warn of ED for those infected

I want to start this commentary with a NYPost article that I initially thought was satire. The headline:

– Doctors warn men to get COVID vaccination: ‘Do it for your penis’

– turns out, this is not a joke

I apologize for those who might be offended by this story, but the content of the article seems important enough for us to want to share its insights. A media and TV campaign has been started by Urologists United for Vaccination Education (UUVE) and their purpose is to warn men that getting COVID-19 could have serious side effects:

– TV/Youtube spot features SNL alum Tim Meadows

– A study has shown that ED is 5.5X more likely in men who got infected with COVID-19

Thus, this PSA (public service announcement) is designed to warn men of the dangers of getting infected. By transitive logic, the PSA is urging men to get vaccinated.

The article has been linked, where you can find a video of an actual commercial. Call me a ‘boomer’ (I am a GenX) but the whole tone of this seems strange to me. Perhaps this is designed to appeal to a specific age demographic? Like, GenZ or Millennials?

– I mean, even the hashtag tagline (see below)

– it is corny, or crude, or is it funny enough to trigger a reaction?

Then again, I watched a lot of Seinfeld in my younger years. And the above campaign made me think of a very funny scene when George got a massage from a male masseuse.

– The episode is “The Note” Season 3, Episode 18

– First aired September 18, 1991 –> I graduated college in May 1991

– If you have not seen this episode, it is very funny

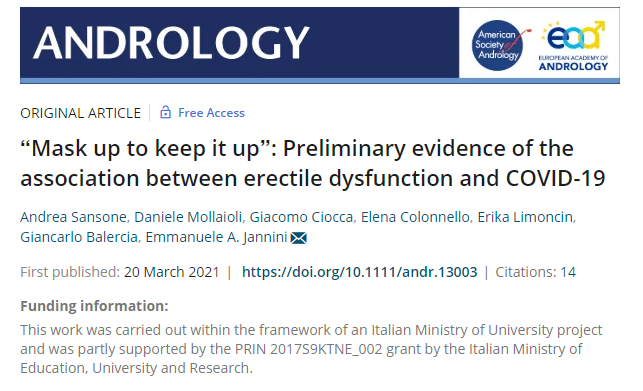

…Italian study is basis for the UUVE campaign message

The Italian study, the basis for this UUVE campaign, was published in March of this year. The conclusion was a sizable increase of men reporting ED. But the study was based upon 100 participants. Perhaps there will be other studies that could support these conclusions.

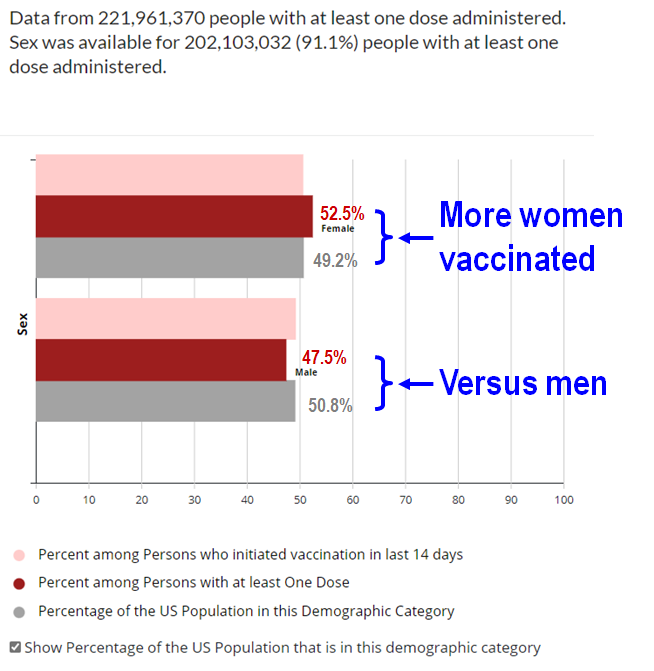

…Greater share of women vaccinated compared to men

From a gender perspective, there is a sizable gap in vaccinations between men and women:

– From CDC

– At least 1 dose, 52.5% women and 47.5% men

– General population, 49.2% women and 50.8% men

So proportionately, woman are getting vaccinated at a higher rate since they are 330bp more share of vaccine doses compared to the general population. I am sorry I don’t have the vaccination rates by gender. But it can be calculated by taking these shares X vaccination rates. The only thing I don’t know is whether this general population is “adults” or “all Americans.”

STRATEGY: FOMC decision — tapering will not be a killer of the “YE everything rally”

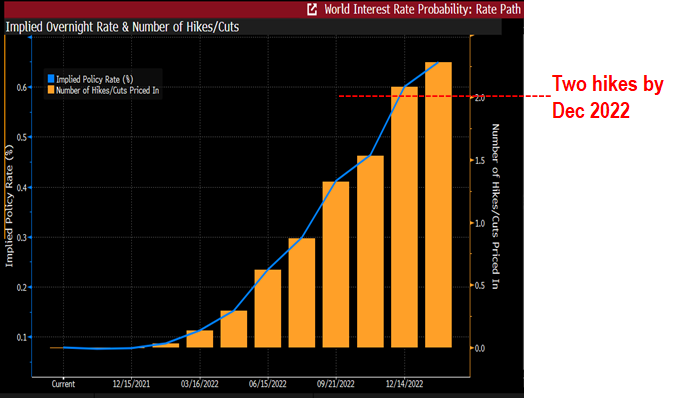

The FOMC completes its two day meeting Wednesday and any announcements will be made in the afternoon. I don’t know how markets will react if the Fed makes the anticipated decision to begin bond tapering ($120 billion/month) and possibly update the market on its timeline for rate hikes (Fed sees these as two separate decisions).

– using the Bloomberg implied probabilities

– Fed futures market is pricing in two hikes in 2022

– that is well ahead of official Fed commentary

So, financial markets have already priced in the likelihood of an accelerated timeline — this is an obvious statement, I am aware, since this is widely tracked. Financial market reaction to FOMC and Fed decisions is unpredictable near term, but this is unlikely to have adverse effects into YE. Why?

– It is most worrisome if Fed makes a decision that is viewed as “policy error”

– that is 2018, when Fed was hiking while markets argued against it

– Bond market is pricing in two hikes in 2022, so it has a hawkish tilt vs Fed

Inflation: Transitory versus Structural depends on pricing trends in 4 categories

Fundstrat is generally in the “reflation” camp with regard to inflation — that is, we expect inflation to be higher than pre-2019, but this is not a level of inflation that is alarming. That is, the surge in CPI and PCE seen in 2021, running 5% or more, has more transitory components, and long-term factors, suggests this level should abate.

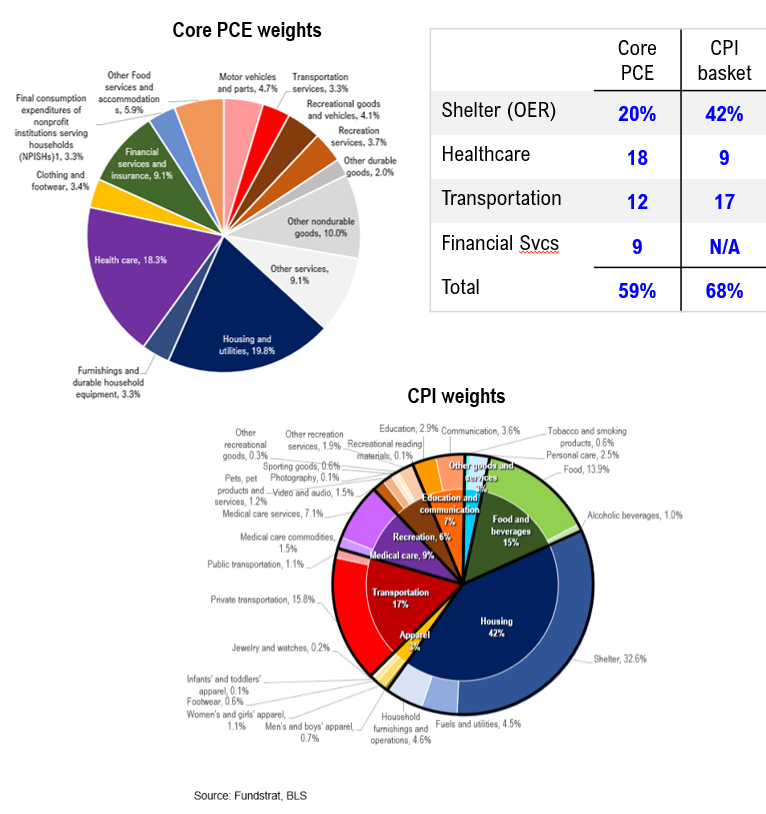

Our data science team compiled the components of both Core PCE (Personal Consumption Expenditures, preferred by Fed) and CPI. This is shown below:

– 4 components drive the majority of the inflation weight, representing 59%-68% of inflation measures

– Shelter is the largest

– Healthcare second

– Transport third

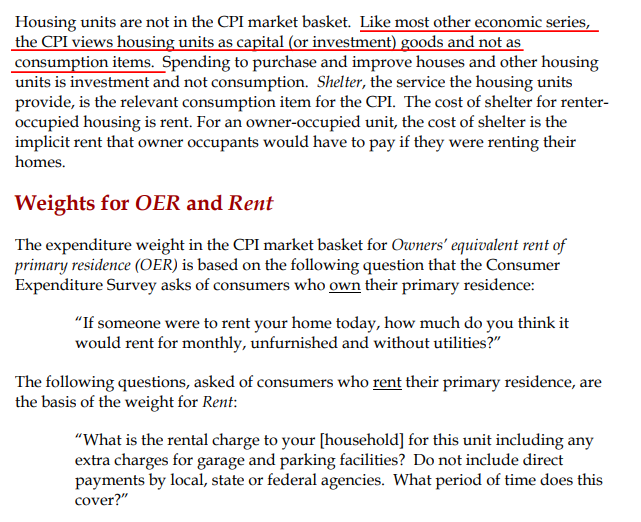

…”Shelter cost” aka “owners equivalent rent” is not the same as home prices

So, inflation is most dependent on the shelter calculation. But there is a point that needs some distinction. Shelter cost is not the same as the price of housing — they are related, but not the same:

– Housing is viewed as “capital” vs “consumption”

– Shelter is the consumption of housing

– For homeowners, this is calculated as “homeowner equivalent rent” or OER

– OER is literally this question:

– “If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?”

So OER does not have to track home prices, but eventually it should, right?

Loosely, this should track home prices. But as we all know, this is not true. The cost of rent is a market function:

– cost of capital (falling)

– demand for rental units (household formation)

– supply of rental units (supply)

– and does not have to match home price change, but over time, should be connected

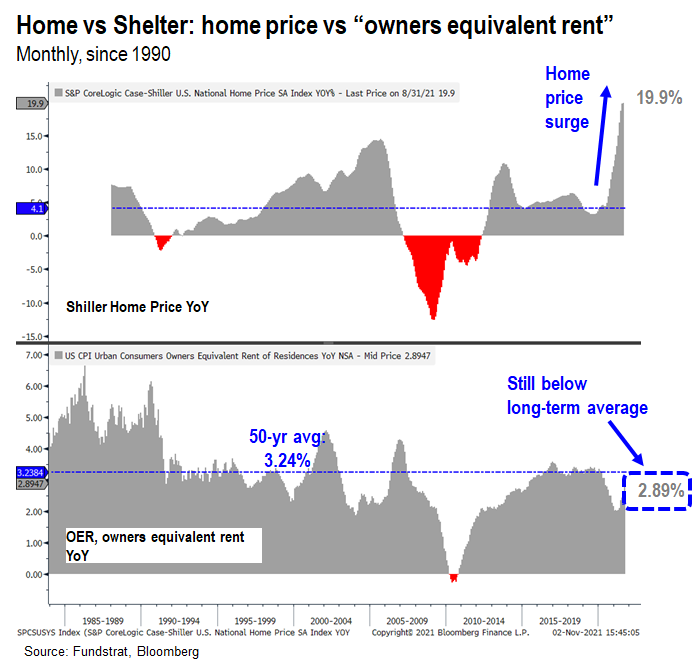

To look at how this relationship holds over time, there is some loose relationship, but the “magnitude” of OER never matches home price. Below are two series, Case Shiller home price (top) and the OER CPI component (lower).

– Both since 1990, or last 30 years

– Home prices have far larger swings

– OER mirrors the moves, eventually

– But long-term OER is 3.24%

– Long-term home price appreciation is 4.1%

TECHNICALS: Mark Newton notes that rally is broadening = strengthening case for “everything rally into YE”

Below is the commentary from Mark Newton, Head of Technical Strategy, and as he notes, there are signs of a broadening rally:

– Advance/decline new highs

– Transports and Small-caps new all-time highs

– Equal-weight Technology all-time highs

This looks to be a broadening rally. And is consistent with our view that stocks will rally strongly into YE.

BOTTOM LINE: Even if Fed announces “taper” this might be inline with market expectations

I realize it feels a bit consensus to be expecting a year-end rally. And it is better when there is a “wall of worry” to climb. The Fed and FOMC could inject some needed worry into the markets. And to an extent, this is a good thing, as long as underlying fundamentals are positive. Still, there are some reasons to remain positive:

– Market is broadening (above)

– Market has positive seasonals (above)

– Economic momentum is broadening as more nations open

– US vaccination efforts are expanding, with boosters and children

– Overall confidence of consumers is strengthening = improved spending

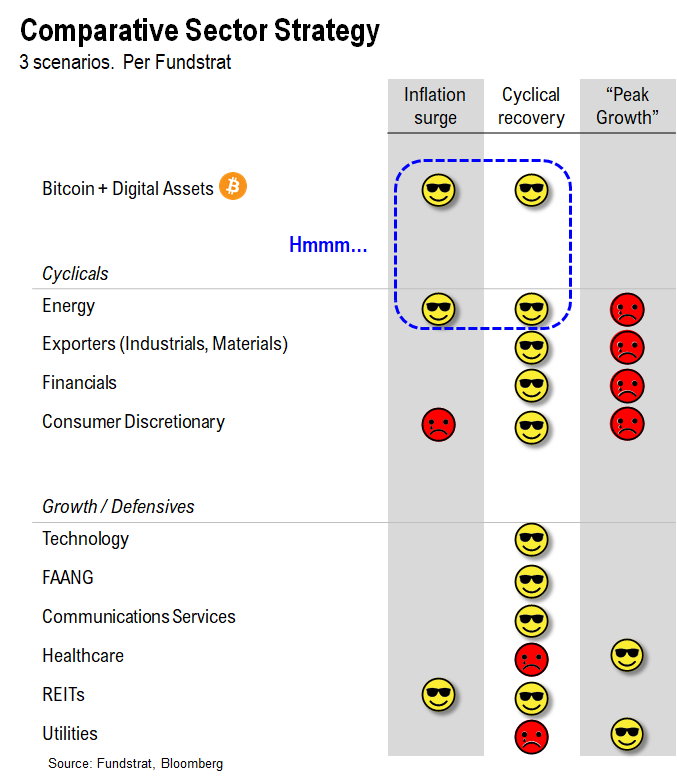

That said, we could see some short-term turmoil around the FOMC. But we would be buying that weakness. Our recommended strategies are:

– Energy

– Homebuilders (Golden 6 months) XHB

– Small-caps IWM-0.14%

– Epicenter XLI-0.33% XLF0.43% XLB0.06% RCD

– Crypto equities BITO3.94% GBTC4.29% BITW5.27%

Into 2022…

– Industrials

30 Granny Shot Ideas: We performed our quarterly rebalance on 10/25. Full stock list here –> Click here

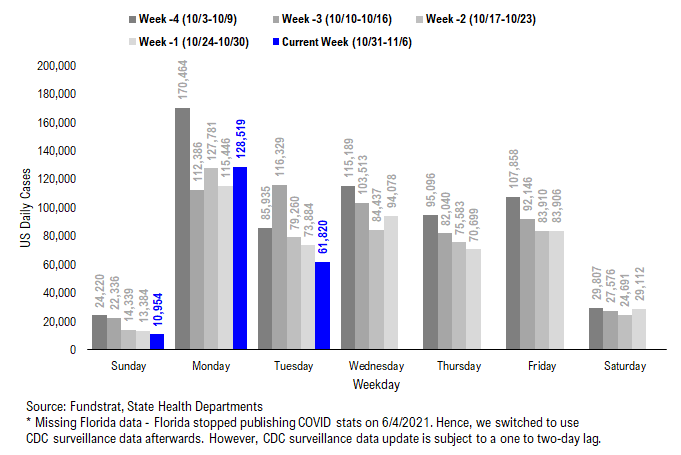

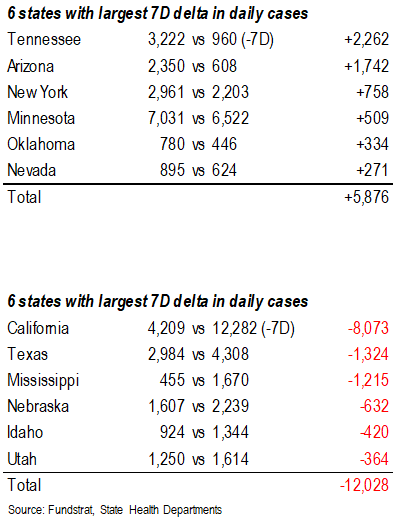

POINT 1: Daily COVID-19 cases 61,820, down -12,064 vs 7D ago…

Current Trends — COVID-19 cases:

- Daily cases 61,820 vs 73,884 7D ago, down -12,064

- Daily cases ex-FL&NE 58,213 vs 69,609 7D ago, down -11,396

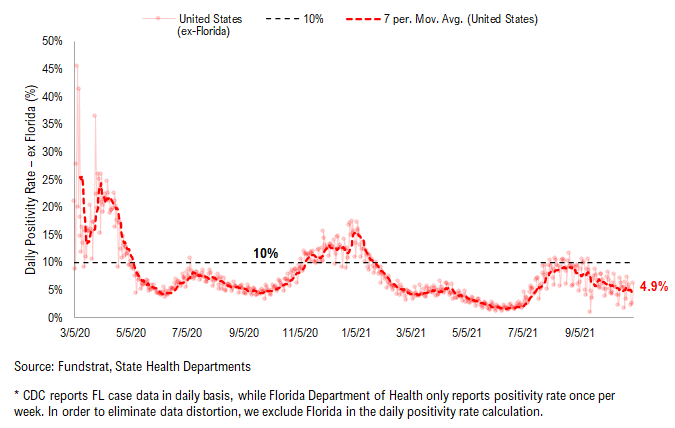

- 7D positivity rate 4.9% vs 4.8% 7D ago

- Hospitalized patients 44,184, down -7.5% vs 7D ago

- Daily deaths 1,210, down -10.5% vs 7D ago

*** Florida and Nebraska stopped publishing daily COVID stats updates on 6/4 and 6/30, respectively. We switched to use CDC surveillance data as the substitute. However, since CDC surveillance data is subject to a one-to-two day lag, we added a “US ex-FL&NE” in our daily cases and 7D delta sections in order to demonstrate a more comparable COVID development.

The latest COVID daily cases came in at 61,820, down -12,064. The 7D deltas have been somewhat flat recently, and as seen below,the speed of case rollover appears to be slowing. As booster shots are becoming more widely available, the speed of case rollover should increase once again.

Rolling 7D delta in daily cases turns positive…

The rolling 7D delta has turned positive as the speed of case rollover has slowed. As booster shots are becoming more widely available, the speed of case decline should resume and the rolling 7D delta should once again turn negative.

Low vaccinated states seem to have a larger increase in daily cases compared to their recent low…

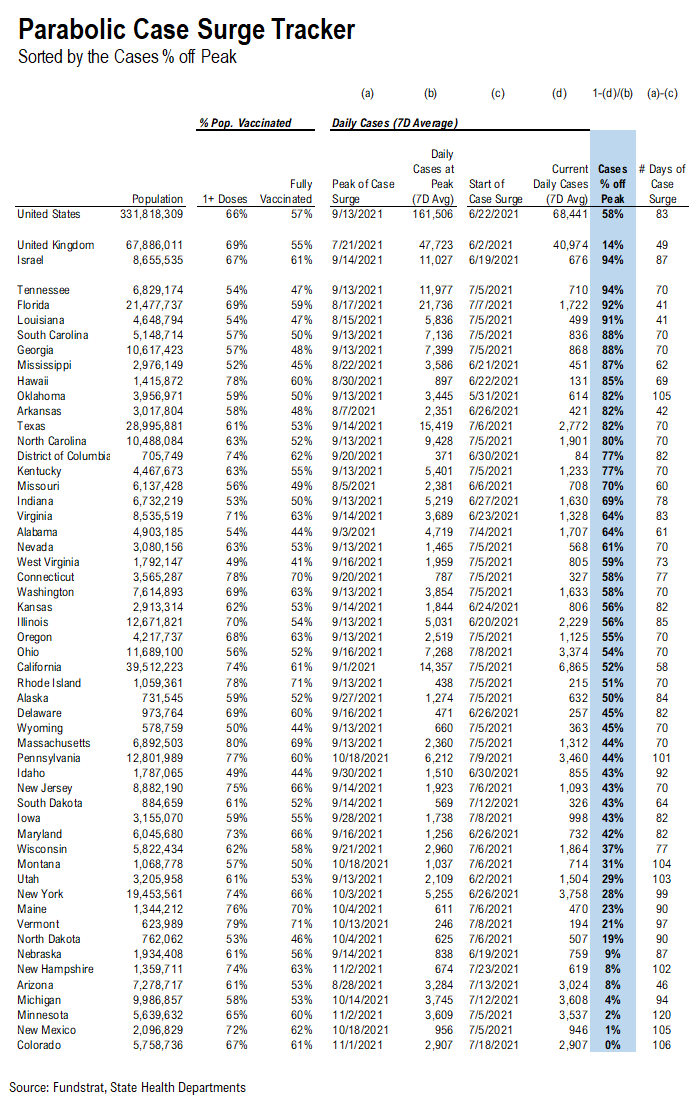

*** We’ve updated the “Parabolic Case Surge Tracker” to measure case % off recent peak as the more recent “delta surge” is rolling over.

In the table, we’ve included both the vaccine penetration, case peak information, and the current case trend for 50 US states + DC. The table is sorted by case % off of their recent peak.

- The states with higher ranks are the states that have seen a more significant decline in daily cases

- We also calculated the number of days during the recent case surge

- The US as a whole, UK, and Israel are also shown at the top as a reference

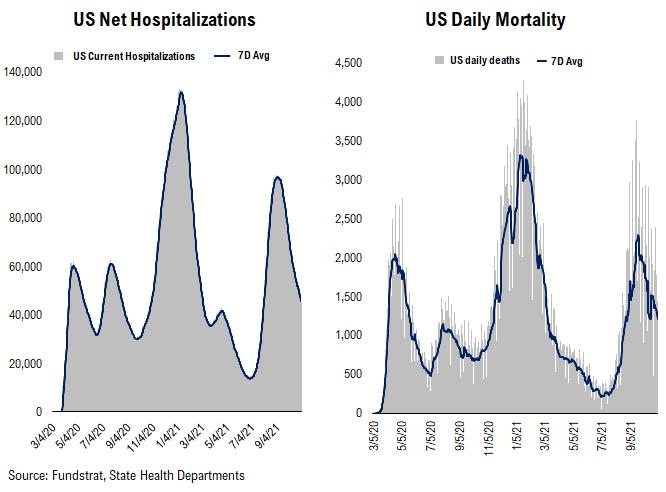

Hospitalizations, deaths, and positivity rates are rolling over amidst case rollover...

Below we show the aggregate number of patients hospitalized due to COVID, daily mortality associated with COVID, and the daily positivity rate for COVID.

– Net hospitalizations peaked below the Wave 3 peak and are currently rolling over

– Daily death peaked slightly above the Wave 2 peak and are currently rolling over

– As per the decline in daily cases, the positivity rate is currently rolling over

POINT 2: VACCINE: vaccination pace pickup begins as boosters become more widely available…

Current Trends — Vaccinations:

- avg 1.3 million this past week vs 0.8 million last week

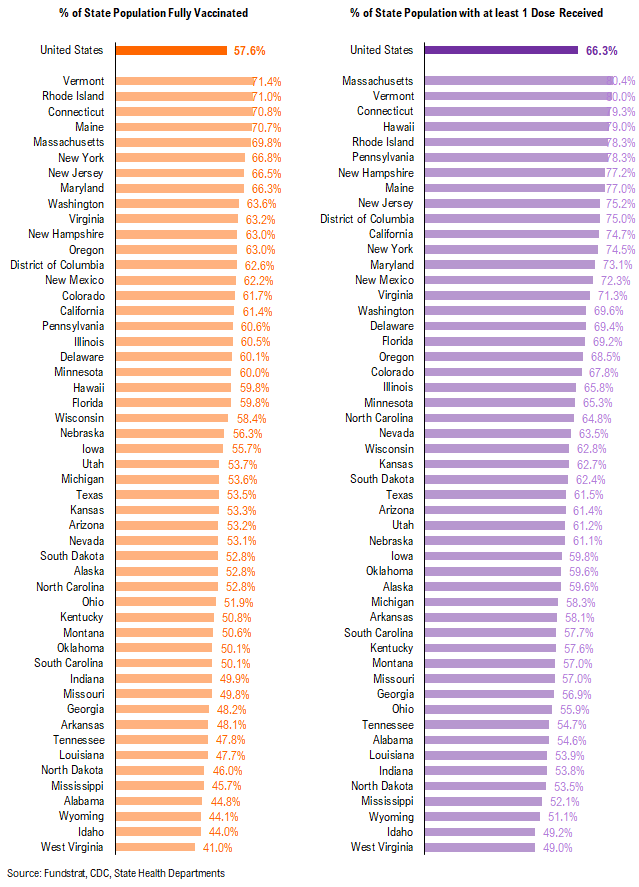

- overall, 57.6% fully vaccinated, 66.3% 1-dose+ received

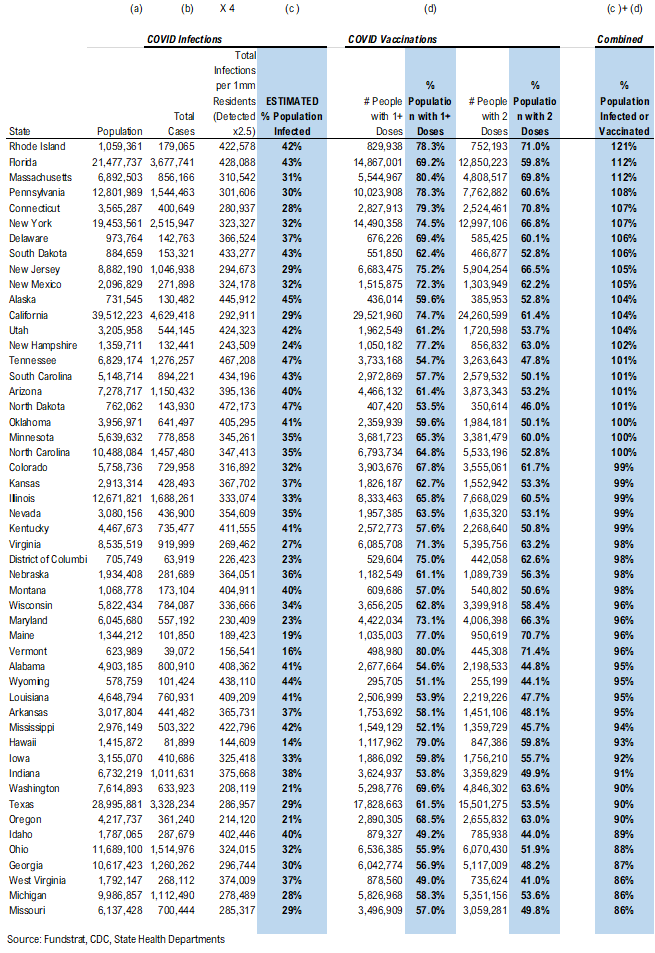

Vaccination frontier update –> all states now near or above 80% combined penetration (vaccines + infections)

*** We’ve updated the total detected infections multiplier from 4.0x to 2.5x. The CDC changed the estimate multiplier because testing has become much better and more prevalent.

Below we sorted the states by the combined penetration (vaccinations + infections). The assumption is that a state with higher combined penetration is likely to be closer to herd immunity, and therefore, less likely to see a parabolic surge in daily cases and deaths. Please note that this “combined penetration” metric can be over 100%, as infected people could also be vaccinated (actually recommended by CDC).

– Currently, all states are near or above 80% combined penetration

– Given the new multiplier. only RI, FL, MA, CT, NM, NY, NJ, IL, CA, PA, DE, SD, KY, UT, OK, ND, NH, AZ, SC, TN, AK, NC, and MN are now above 100% combined penetration (vaccines + infections). Again, this metric can be over 100%, as infected people could also be vaccinated. But 100% combined penetration does not mean that the entire population within each state is either infected or vaccinated

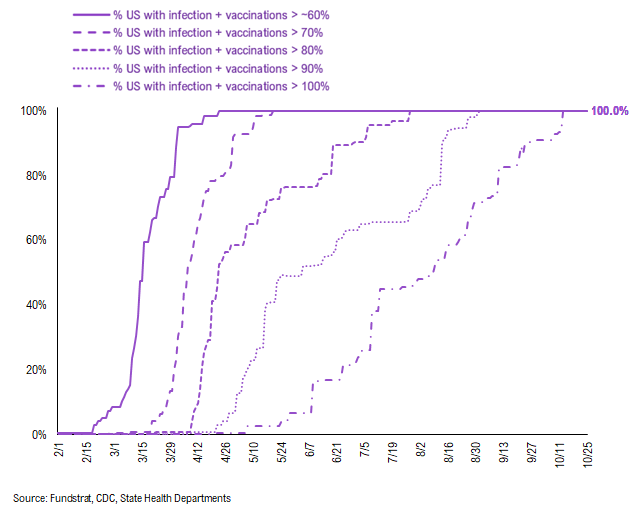

Below is a diffusion chart that shows the % of US states (based on state population) that have reached the combined penetration > 60%/70%/80%/90%/100%. As you can see, all states have reached combined infection & vaccination > 100% (Reminder: this metric can be over 100%, as infected people could also be vaccinated. But 100% combined penetration does not mean that the entire population within the state is either infected or vaccinated).

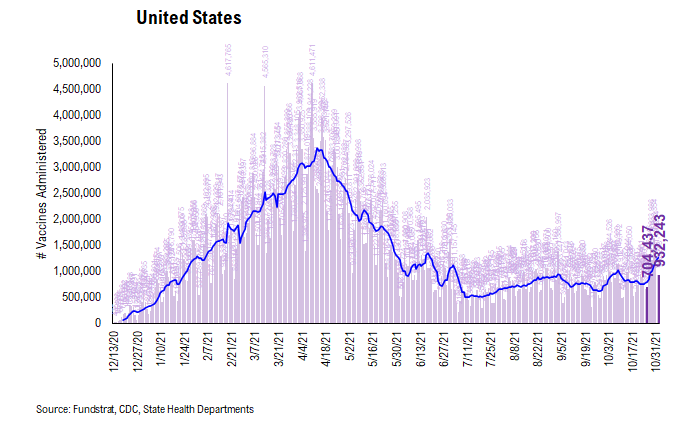

There were a total of 923,243 doses administered reported on Tuesday, up 31% vs. 7D ago. We are seeing the vaccination pace start to pick back up as booster shots are becoming more widely available. Also, the same catalysts remain in place:

- Proof of vaccination required by many US cities and venues

- Booster shots

- Full FDA approval of Pfizer COVID vaccines (hopefully it could help overcome vaccine hesitancy)

- Biden’s vaccination plan

The daily number of vaccines administered remains the most important metric to track this progress and we will be closely watching the relevant data.

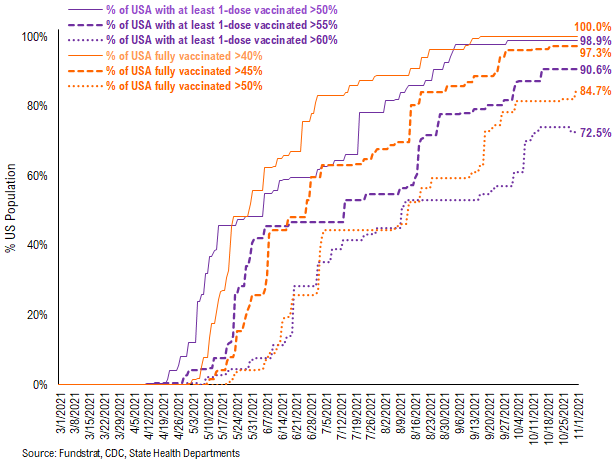

72.5% of the US has seen 1-dose penetration > 60%…

To better illustrate the actual footprint of the US vaccination effort, we have a time series showing the percent of the US with at least 45%/45%/50% of its residents fully vaccinated, displayed as the orange lines on the chart. Currently, 100% of US states have seen 40% of their residents fully vaccinated. However, when looking at the percentage of the US with at least 45% of its residents fully vaccinated, this figure is 97.3%. And only 84.7% of US (by state population) have seen 50% of its residents fully vaccinated.

We have done similarly for residents with at least 1-dose of the vaccination, denoted by the purple lines on the chart. While 98.9% of US states have seen 1 dose penetration > 50%, 90.6% of them have seen 1 dose penetration > 55% and 72.5% of them have seen 1 dose penetration > 60%.

This is the state by state data below, showing information for individuals with one dose and two doses.

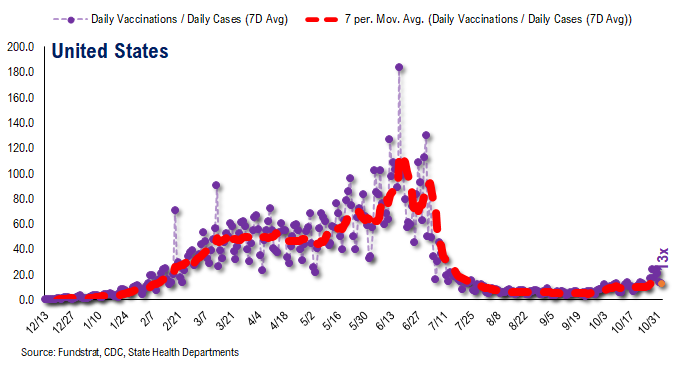

The ratio of vaccinations/ daily confirmed cases has been falling significantly (red line is 7D moving avg). Both the surge in daily cases and decrease in daily vaccines administered contributed to this.

– the 7D moving average is about ~13 for the past few days

– this means 5 vaccines dosed for every 1 confirmed case

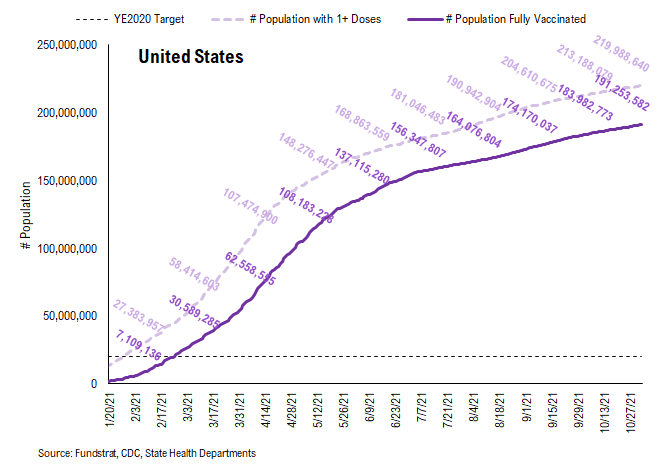

In total, 411 million vaccine doses have been administered across the country. Specifically, 220 million Americans (67% of US population) have received at least 1 dose of the vaccine. And 191 million Americans (58% of US population) are fully vaccinated.

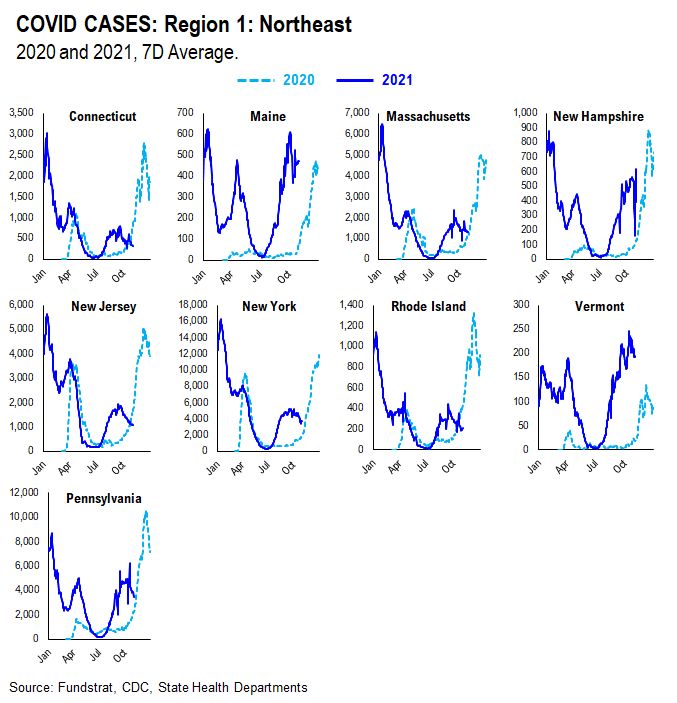

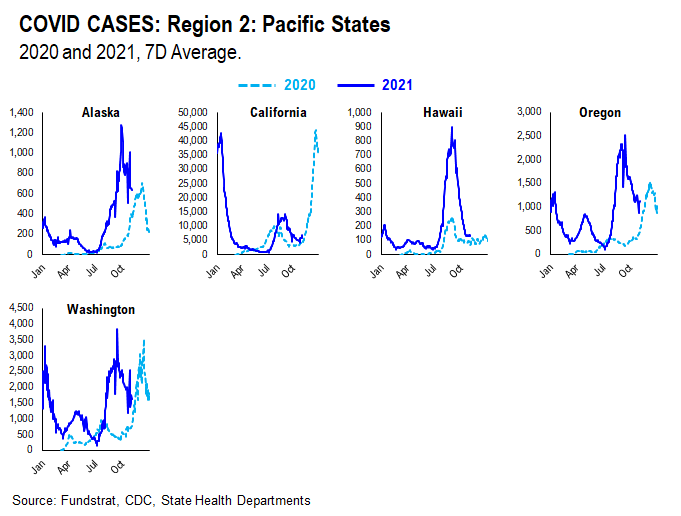

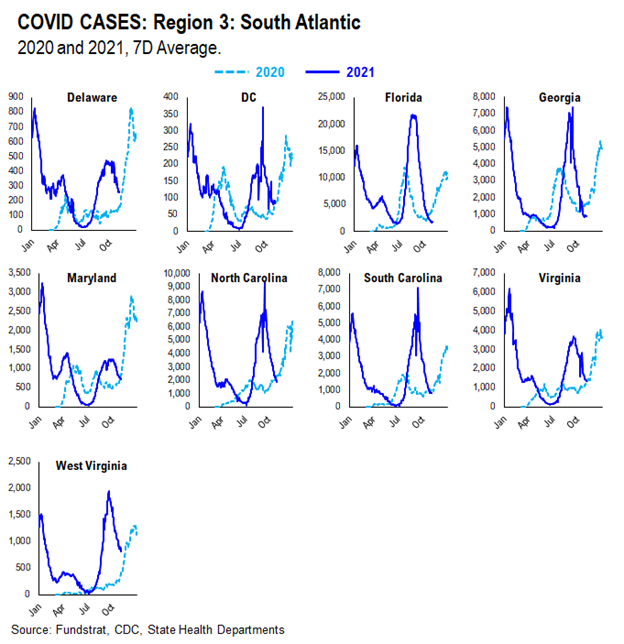

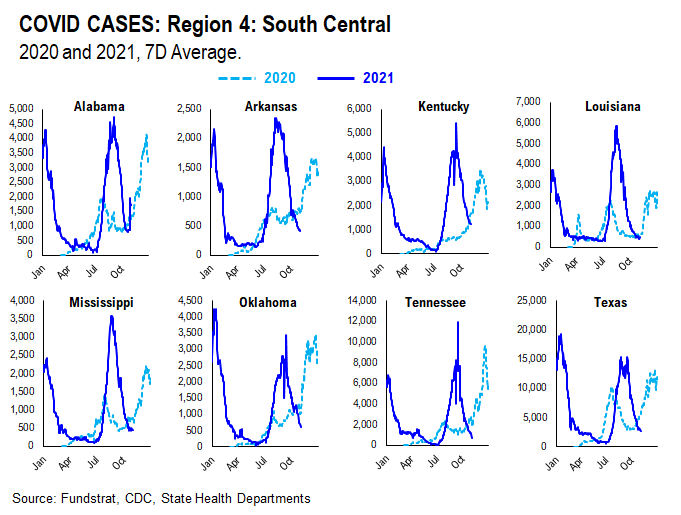

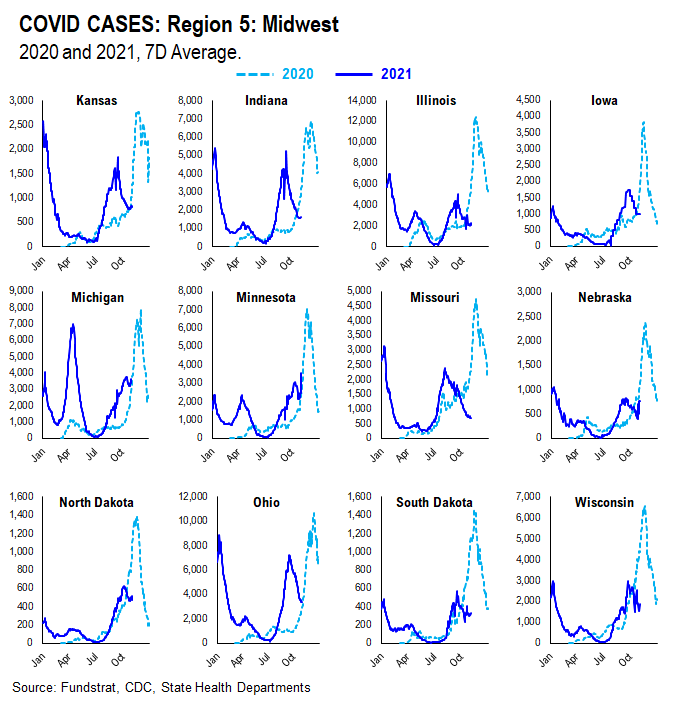

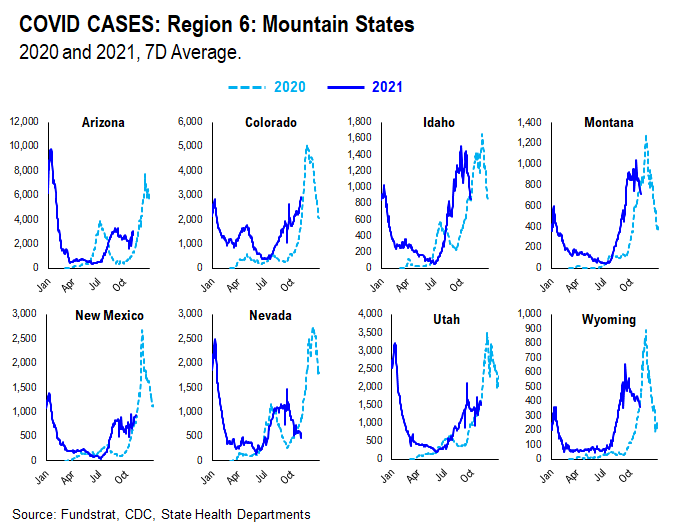

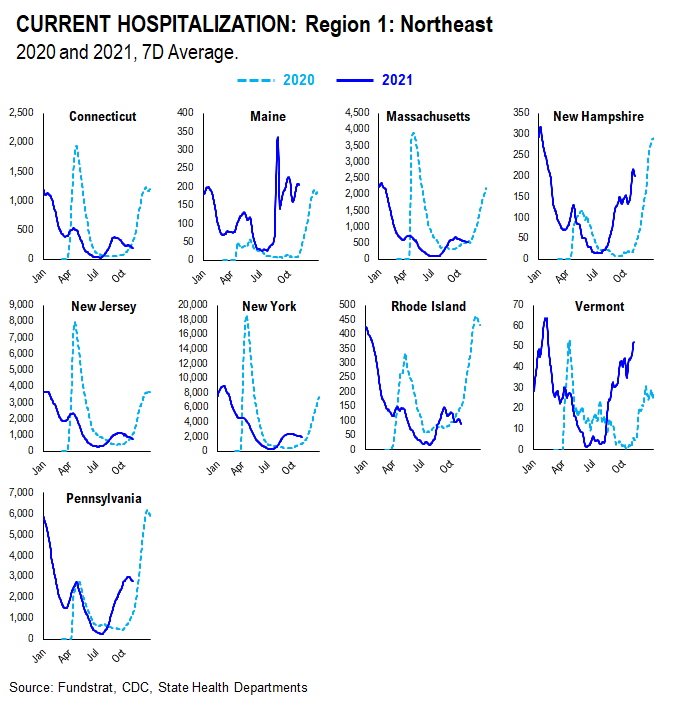

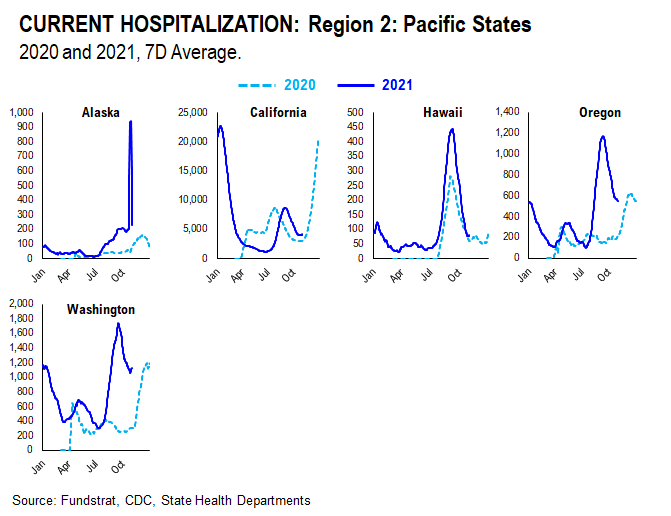

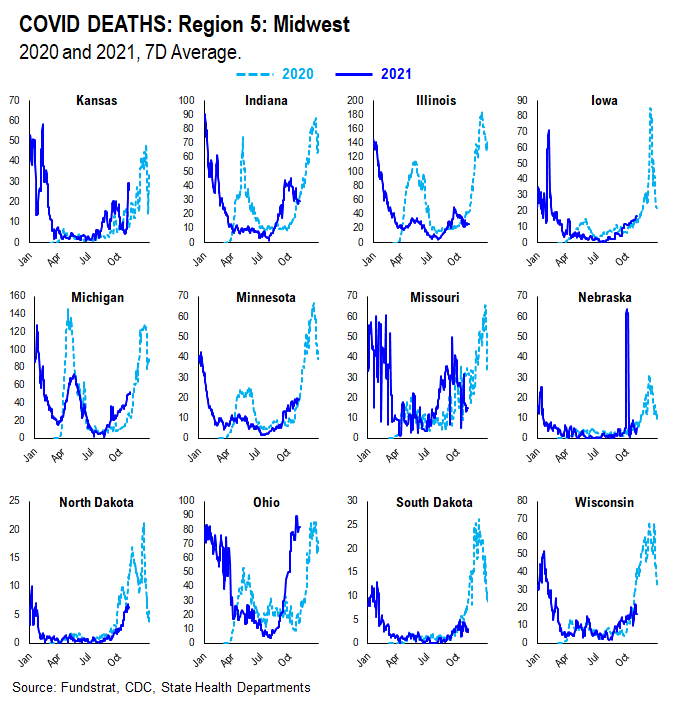

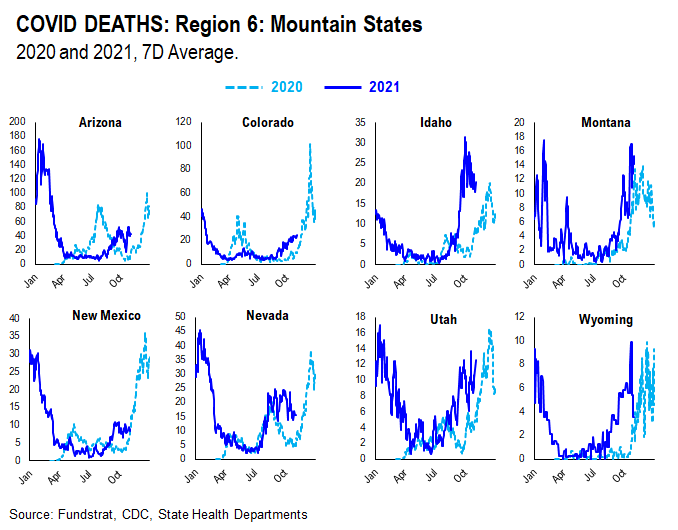

POINT 3: Tracking the seasonality of COVID-19

In July, we noted that many states experienced similar case surges in 2021 to the ones they experienced in 2020. As such, along with the introduction of the more transmissible Delta variant, seasonality also appears to play an important role in the recent surge in daily cases, hospitalization, and deaths. Therefore, we think there might be a strong argument that COVID-19 is poised to become a seasonal virus.

The possible explanations for the seasonality we observed are:

– Outdoor Temperature: increasing indoor activities in the South vs increasing outdoor activities in the northeast during the Summer

– “Air Conditioning” Season: similar to “outdoor temperature”, more “AC” usage might facilitate the spread of the virus indoors

If this holds true, seasonal analysis suggests that the Delta spike could roll over by following a similar pattern to 2020.

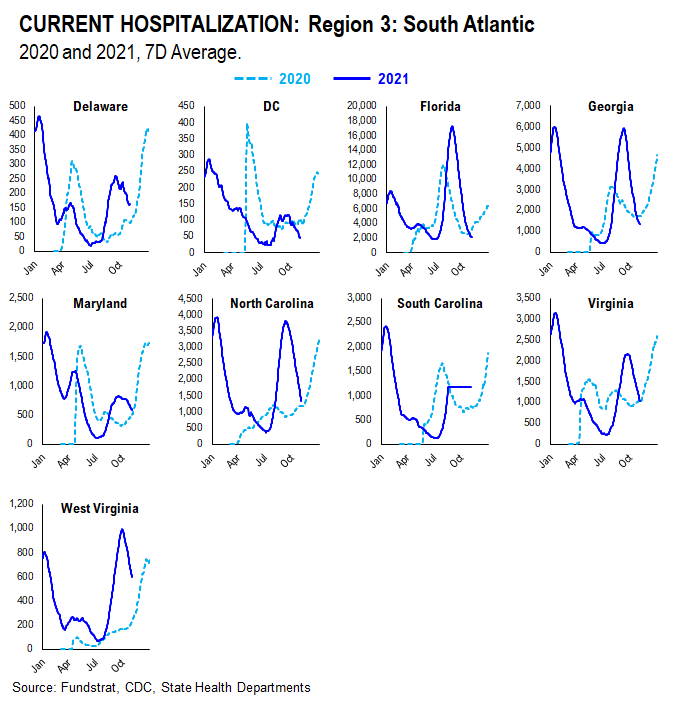

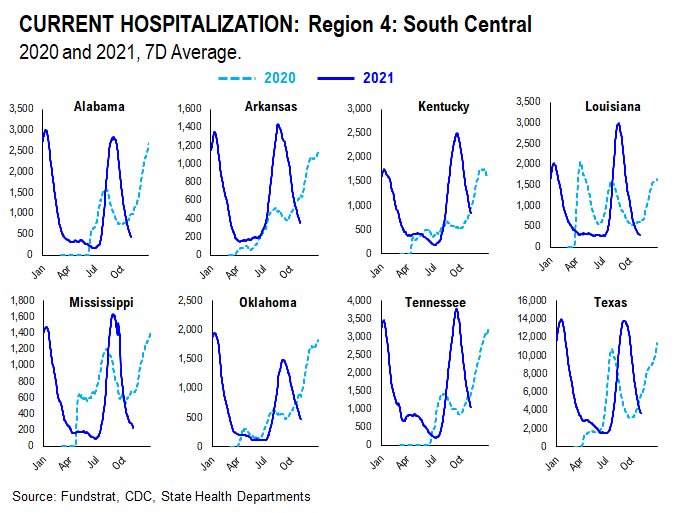

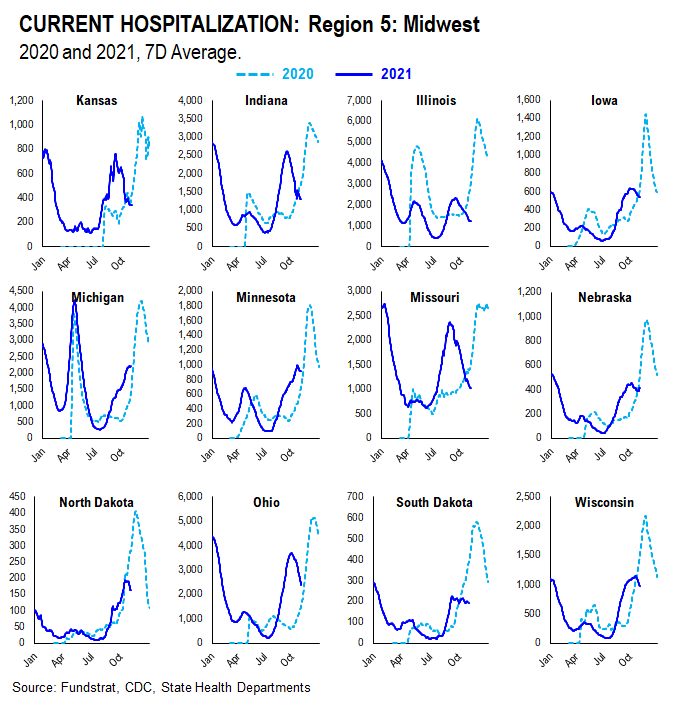

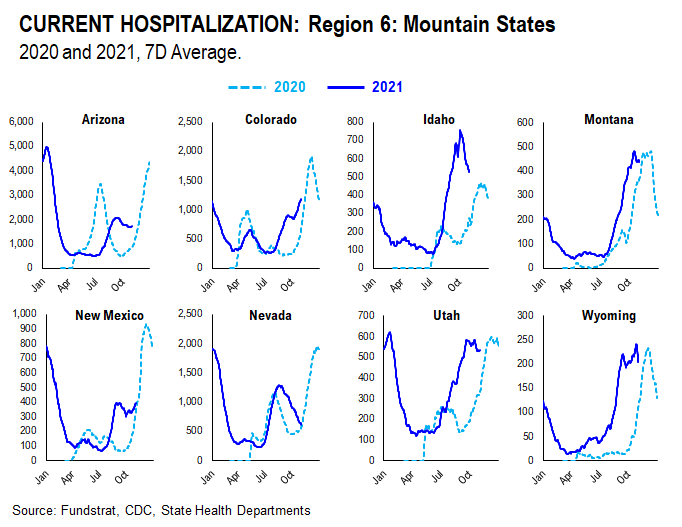

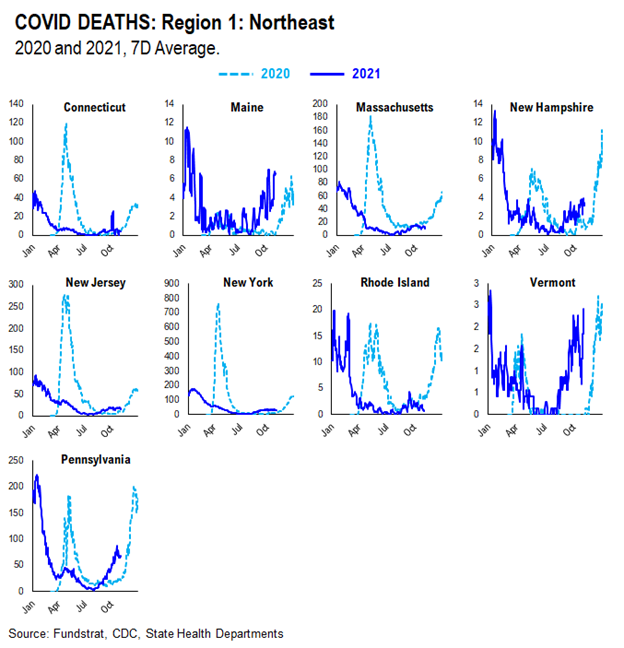

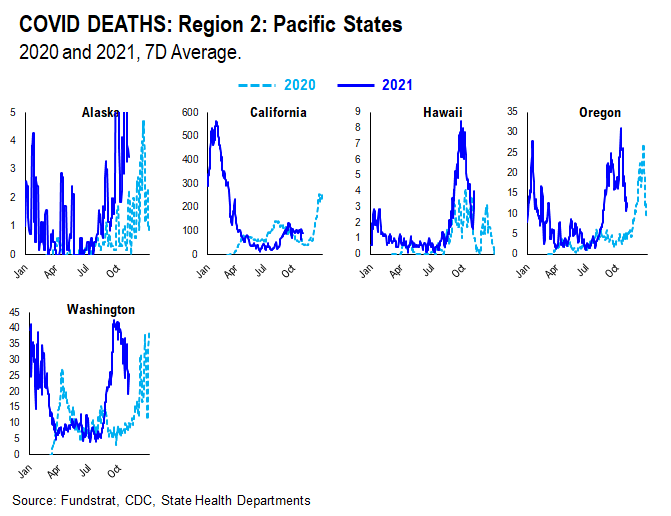

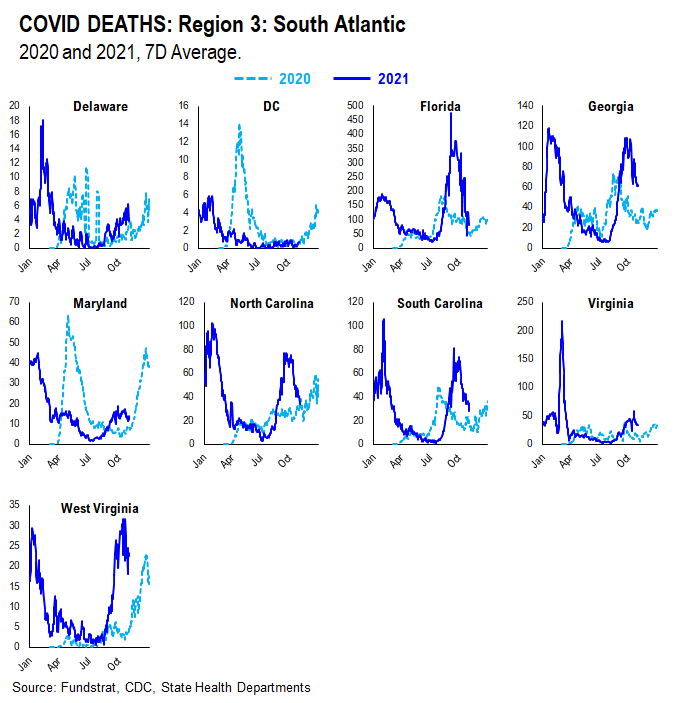

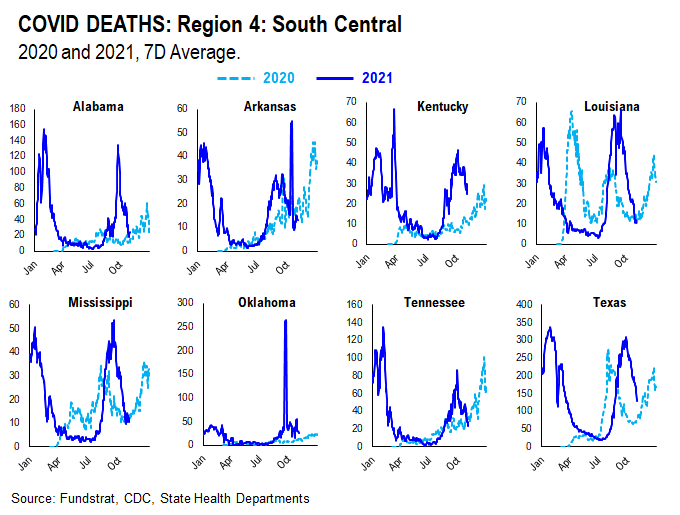

We created this section within our COVID update which tracks and compare the case, hospitalization, and death trends in both 2020 and 2021 at the state level. We grouped states geographically as they tend to trend similarly.

CASES

It seems as if the main factor contributing to current case trends right now is outdoor temperature. During the Summer, outdoor activities are generally increased in the northern states as the weather becomes nicer. In southern states, on the other hand, it becomes too hot and indoor activities are increased. As such, northern state cases didn’t spike much during Summer 2020 while southern state cases did. Currently, northern state cases are showing a slight spike, especially when compared to Summer 2020. This could be attributed to the introduction of the more transmissible Delta variant and the lifting of restrictions combined with pent up demand for indoor activities.

HOSPITALIZATION

Current hospitalizations appear to be similar or less than Summer 2020 rates in most states. This is likely due to increased vaccination rates and the vaccine’s ability to reduce the severity of the virus.

DEATHS

Current death rates appear to be scattered compared to 2020 rates. This is likely due to varying vaccination rates in each state. States with higher vaccination rates seem to have lower death rates given the vaccine’s ability to reduce the severity of the virus; states with lower vaccination rates seem to have higher death rates.

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 2e112f-6a0443-d861b3-8a558e-908227

Already have an account? Sign In 2e112f-6a0443-d861b3-8a558e-908227