The "Great Resignation" --> 6 supply reasons labor market tightness is "transitory"

Click HERE to access the FSInsight COVID-19 Daily Chartbook.

We are shifting to a 4-day a week publication schedule:

Monday

Tuesday

Wednesday

SKIP THURSDAY

Friday

STRATEGY: The “Great Resignation” –> 6 supply reasons, labor market tightness is “transitory”

Labor cost is a key question, but 6 supply reasons we see as transitory

The focus of this note is primarily focused on the shortage of workers. Earlier this week, my co-founder John Bai and I met with DJ, a portfolio manager in NYC, and her team. DJ works for a large asset manager in NYC and is one of the earliest clients of Fundstrat (signing up in 2014, when we first launched). So, we were glad to sit down with DJ. On her team was her colleague from London, Marina, and Marina asked about our perspective on the “Great Resignation.”

This is the term being applied to the millions of Americans who decided to “quit” (often rage quit) and this turnover is amplifying what is already a shortage in the US labor markets.

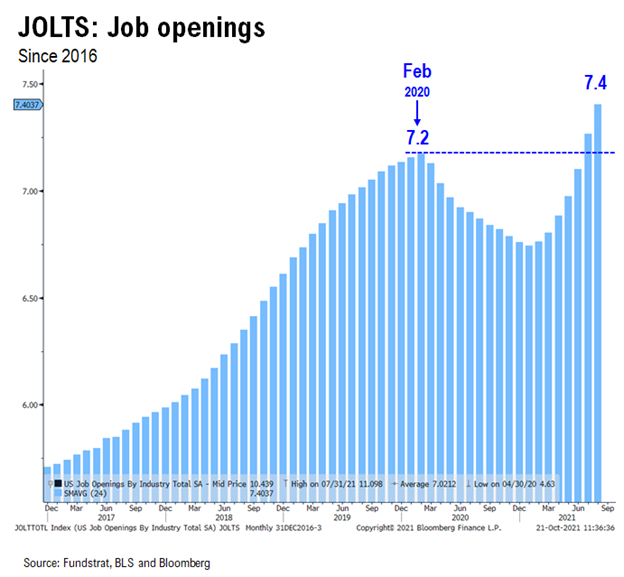

– this high quit rate contributes to labor shortage, JOLTS (BLS jobs opening) shows record openings

– labor shortage is driving higher wages

– “inflationists” see this as structurally higher wages –> inflation risk

– we believe this “great resignation” effect is transitory –> effects will be transitory

– https://news.harvard.edu/gazette/story/2021/10/harvard-economist-sheds-light-on-great-resignation/

– https://www.theatlantic.com/ideas/archive/2021/10/great-resignation-accelerating/620382/

Record job openings… 7.4 million openings > Feb 2020 of 7.2 million

The question of the whether this tightness in the labor market is transitory, as noted above, is key. After all, labor costs impact the entire supply chain and also many businesses operate on already thin margins. Thus, this higher labor cost, if structural, will result in a rise in inflation. Now reflation, or a rise in the level of inflation, is different than an inflation problem.

– an inflation problem is an escalation and maybe continuous escalation of inflation conditions

– thus, the question of how long the labor market stays tight is important.

The most recent tabulation of job openings, or the JOLTS survey, shows there are 7.4 million job openings. This is above the 7.2 million shown in Feb 2020.

– on the surface, record openings means businesses are having difficulty hiring

– like we noted above, in “normal times” this would be a sign of a tight labor market

– which means wages need to move higher

– BUT the key question is whether this record ‘job openings’ jibes with the current state of the labor market

6 Supply reasons this labor market tightness is “transitory” –> Supply of Labor will rise in 2022 and beyond

The question of whether this labor market tightness is transitory or structural is important, for obvious reasons. I know there is a general “impression” that the workforce feels empowered, or doesn’t want to return to the office. Thus, this is simply the new conditions and thus, labor will be tight. But this sort of defies logic.

Ultimately, the labor market conditions will be a function of “supply” and “demand” of labor. We have 6 reasons to expect the “supply” of labor to rise in 2022 and beyond.

6 reasons “supply rises:

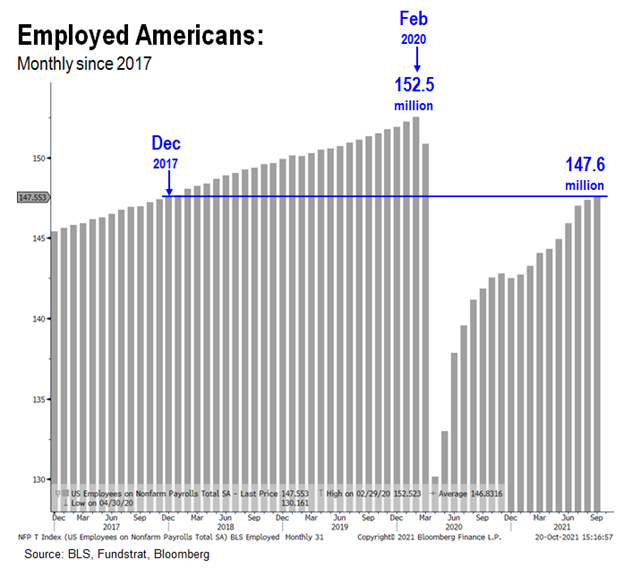

1. Number of “employed” Americans is 147.6 million, down 4.9 million from Feb 2020

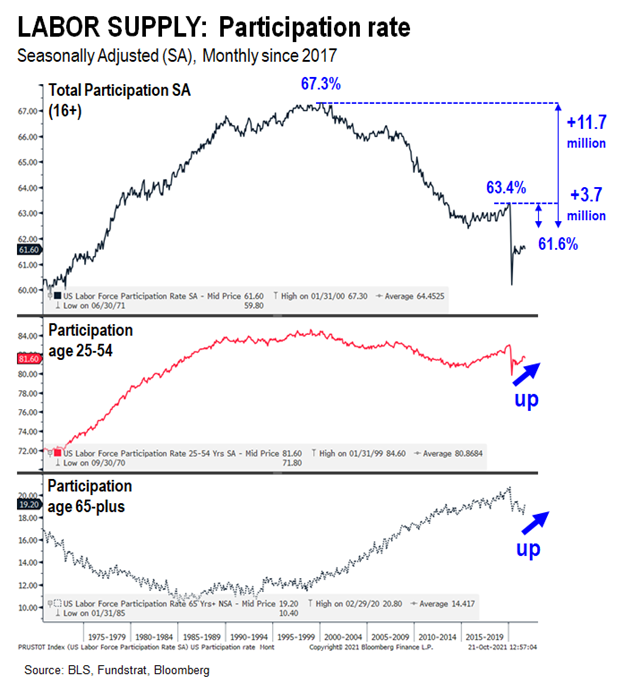

2. Participation rate is only 61.6% compared to 63.4% Feb 2020 and 67.3% in Feb 2000

– Implies +3.7mm additional workers to match Feb 2020

– Implies +11.7mm additional workers to match Feb 2000

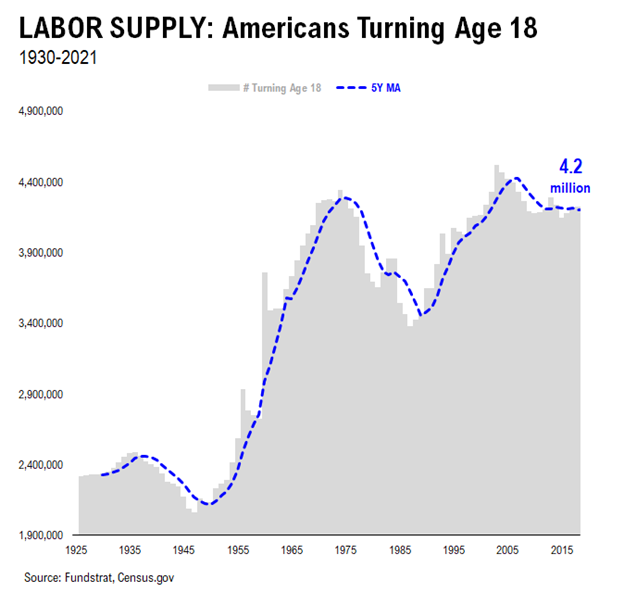

3. Organic “growth” –> 4.2 million Americans turn age 18 every year

4. GenZ supply growth –> GenZ so large, they contribute to acceleration of labor force starting 2025

5. Legal immigration –> US still adds +1.1 million “legal permanent residents” (LPR) annually –> supply growth

– Ben Casselman, of Fivethirtyeight.com, shows majority of “Great Resignation” is labor with less than college education

– This labor shortage can be met with LPR supply growth

6. COVID-19 impact –> 4.7 million Americans not working due to COVID-19 or caring for someone with COVID-19

– this is a “supply” impact that will mitigate as COVID-19 becomes endemic

#1 EMPLOYED: Labor utilization is 4.9 million less now than Feb 2020

This is an obvious statement and self-evident:

– 152.5 million Americans employed in Feb 2020

– 147.6 million Americans employed now

Labor usage is actually 4.9 million lower now than pre-COVID-19. Has the economy permanently changed during COVID-19 that somehow less people working means a tighter labor market?

– Nope

#2 PARTICIPATION RATE: Participation rate matching Feb 2020 means 3.7 million people looking for work

Look at the participation rate, fyi, we also show this by age.

– Participation rate is 61.6% now vs 63.4% Feb 2020, down 1.8% points

– This is 3.7 million in additional labor supply

– Why should participation rate by 180bp lower permanently?

#3 NEW ORGANIC SUPPLY: 4.2 million Americans turn age 18 every year

The labor market would be tight if there was no “organic” growth of labor supply. This is not true in the US. The increase in # Americans turning age 18 in America is 4.2 million annually:

– we use age 18 as an arbitrary “add to labor supply” year

– this figure of 4.2 million is fairly consistent over past decade

– all things being equal, the US labor supply grows every year

– granted, there are retirements (see next section)

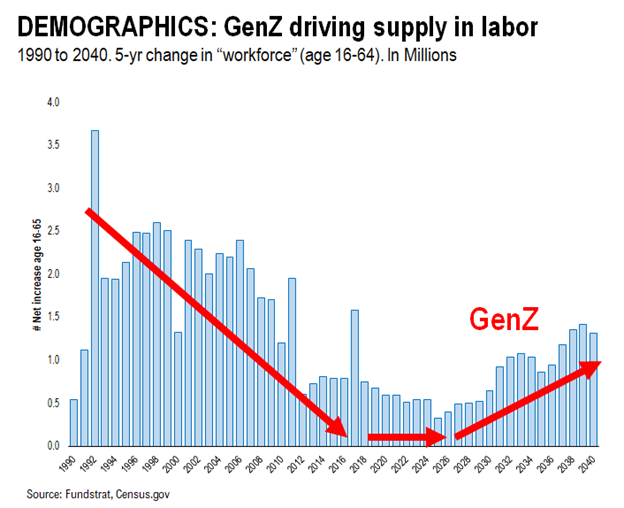

#4 GenZ ACCELERATING LABOR SUPPLY: Total labor force set to grow at a faster pace in 2025-2040 vs today

GenZ are folks born year 2001 to 2021, roughly. (Is the next generation called GenAA?). Our data science team plotted the growth of the workforce (age 16-64):

– 5 year increase in Americans age 16-64

– since 1990 to 2040

– this pace of supply growth slowed in the 2000s to today

– this is due to the small size of GenX, but is recovering due to Millennials

– but a real kicker is coming from GenZ

– their strongest impact will be felt in 2025

– I realize this feels like an eternity to folks

But this shows that the US labor force organically is set to grow nicely over the next decade. If the labor market is growing at a faster pace, how can anyone really think labor inflation is sticky and structural?

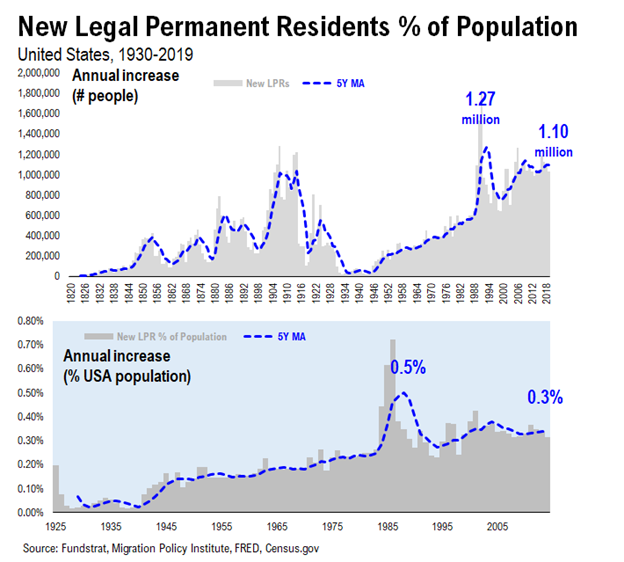

#5 LEGAL IMMIGRATION: Legal immigration is adding 1.1 million to the labor force annually.

Despite the movement to limit immigration, there is still a healthy supply of labor force growth coming from New Legal Permanent Residents, or LPR. Again, our data science team pulled this together (thanks John Bush) and shows the annual LPR increase by year, since 1820:

– this figure has been 1.1 million annually roughly over the past decade

– This works out to about 0.3% total US population increase due to immigration

– This was 0.5% in the mid-1990s

It may not be a popular idea, but increasing the number of LPR will increase the labor supply. This increase mitigates pressure on wages, as this directly increases the workforce.

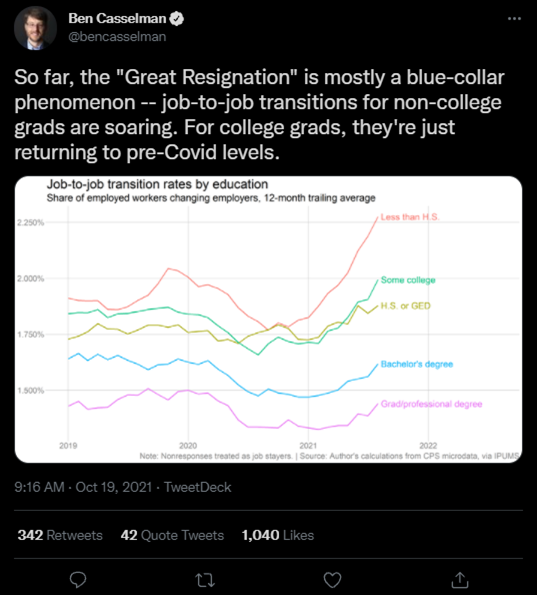

…Ben Casselman of Fivethirtyeight.com notes that “blue-collar” is driving the “Great Resignation”

The question is whether LPR additions to the workforce can mitigate the “Great Resignation.” In short, I believe the answer is YES.

Ben Casselman has a useful thread walking through the data. I included this snip as it is the most pertinent. As he shows, the transition rate (quit rate between jobs):

– highest transition rates among “less than high school”

– way above pre-COVID levels

– Bachelors and Graduate degree holders –> same to lower vs pre-COVID-19

So this data shows that this “Great Resignation” is among those more non-White Collar jobs. Thus, LPRs could be one solution to address this shortage in workforce with “less than high school” education (see below).

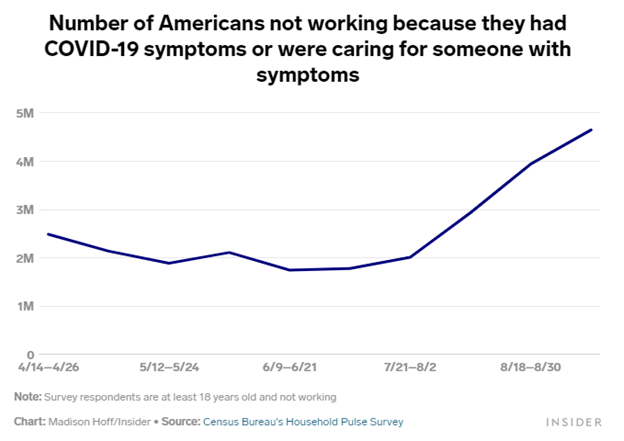

#6 WORKERS HIT DIRECTLY BY COVID: Nearly 5 million of existing workforce now

Lastly, we have to be mindful of the direct impacts of COVID-19 itself. We wrote about this last week, so this might sound familiar. The Census Bureau Household Pulse Survey looks at how many workers are at home caring for someone with COVID:

– Someone at home caring for someone with COVID is someone not “working”

– This figure is nearly 5 million

– It has been surging due to the Delta variant

– This is nearly 10 months worth of jobs growth

– Is it any wonder that there are labor shortages?

– This does not seem permanent, to us, since COVID-19 case prevalence should drop in the future

Thus, COVID-19 itself is creating shortages in the labor market. If one believes COVID-19 will be generating 100,000 cases per day into the indefinite future, then this ~5 million jobs shortage is permanent.

– if COVID-19 recedes, this is merely a transitory shortage of labor

– we are in the transitory camp

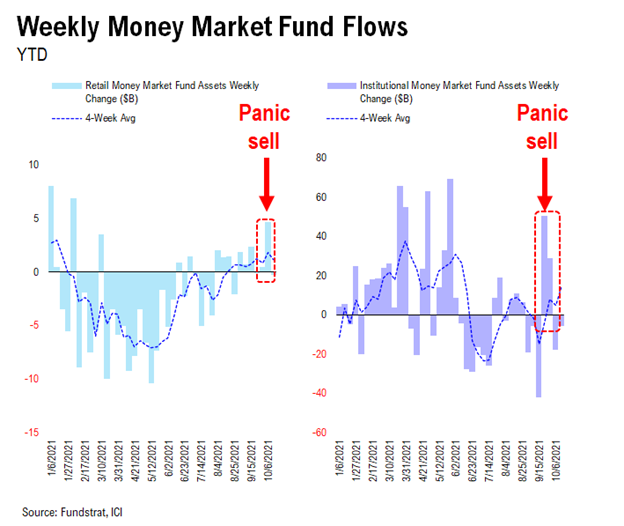

STRATEGY: Panic sellers…Investors raised a lot of cash in last 6 weeks and now uncomfortably underinvested

Last month, MIT researchers published a study looking at 600,000 brokerage accounts and trying to understand what type of person is a panic seller. The conclusion of the study is:

– many investors liquidate their accounts to 100%

– the most common archetype

– males, age >45 married

– males, age >45 and consider themselves “excellent investment experience”

So panic selling, basically, is older Americans.

This level of panic selling was on ample display in the past 6 weeks. We wrote previously about how we saw investors get progressively bearish over the past 4-6 weeks:

– the ICI money market fund flows show this clearly

– both retail and institutional cash balances spiked in late September

– investors were “panic selling”

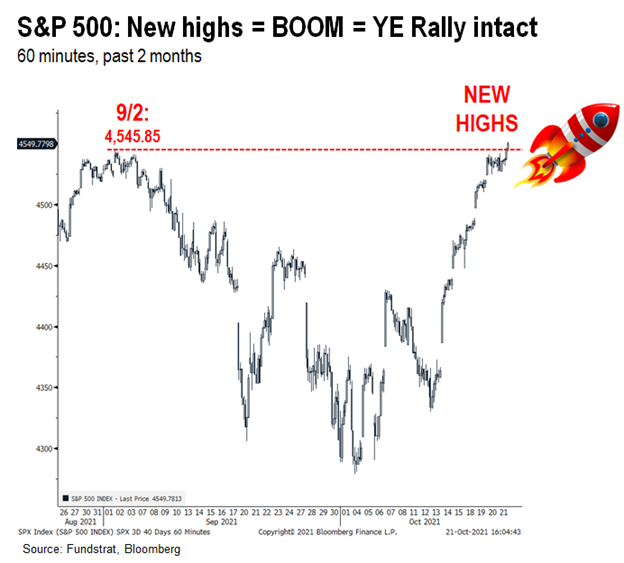

…S&P 500 makes new highs = affirming “everything rally” into YE intact

The S&P 500 made a new closing high yesterday as shown below:

– 9/2/2021 –> 4,545.85

– 10/21/2021 –> 4,549.78

A new closing high is a positive. This affirms the everything rally into YE is intact. Yesterday’s reversal is positive considering the weak open.

26 Granny Shot Ideas: We performed our quarterly rebalance on 07/30. Full stock list here –> Click here

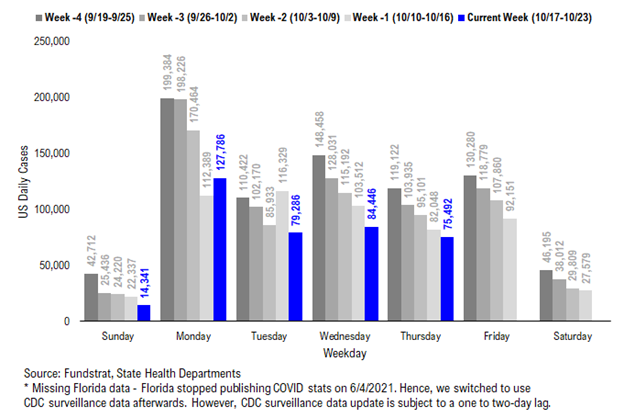

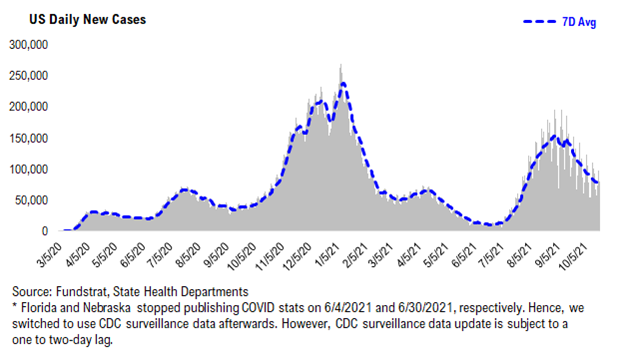

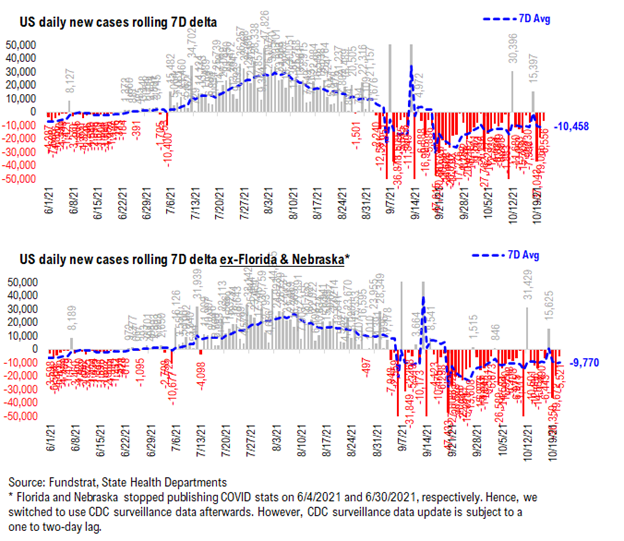

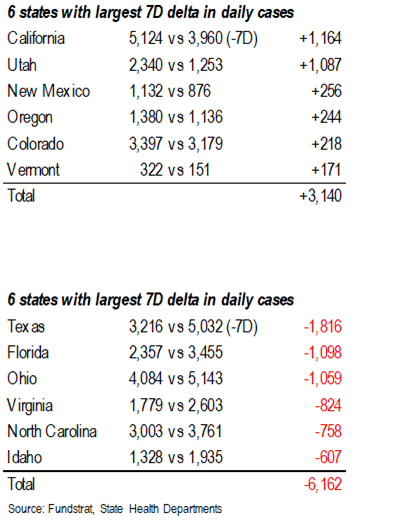

POINT 1: Daily COVID-19 cases 75,492, down -6,556 vs 7D ago…

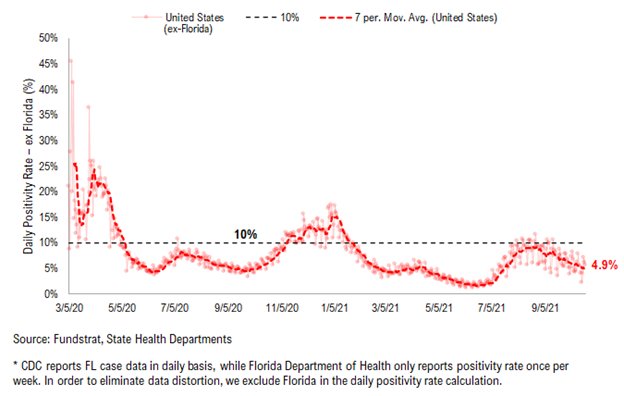

Current Trends — COVID-19 cases:

- Daily cases 75,492 vs 82,048 7D ago, down -6,556

- Daily cases ex-FL&NE 72,333 vs 77,854 7D ago, down -5,521

- 7D positivity rate 4.9% vs 5.4% 7D ago

- Hospitalized patients 50,008, down -9.3% vs 7D ago

- Daily deaths 1,505, up +18.7% vs 7D ago

*** Florida and Nebraska stopped publishing daily COVID stats updates on 6/4 and 6/30, respectively. We switched to use CDC surveillance data as the substitute. However, since CDC surveillance data is subject to a one-to-two day lag, we added a “US ex-FL&NE” in our daily cases and 7D delta sections in order to demonstrate a more comparable COVID development.

The latest COVID daily cases came in at 75,492, down -6,556 vs 7D ago. As evident by the once again consistently negative 7D deltas, Columbus Day distortion appears to be largely cleared out. And, as seen below, cases are currently rolling over.

Rolling 7D delta in daily cases remains negative…

The rolling 7D delta remains negative as the Columbus Day distortion is largely cleared out.

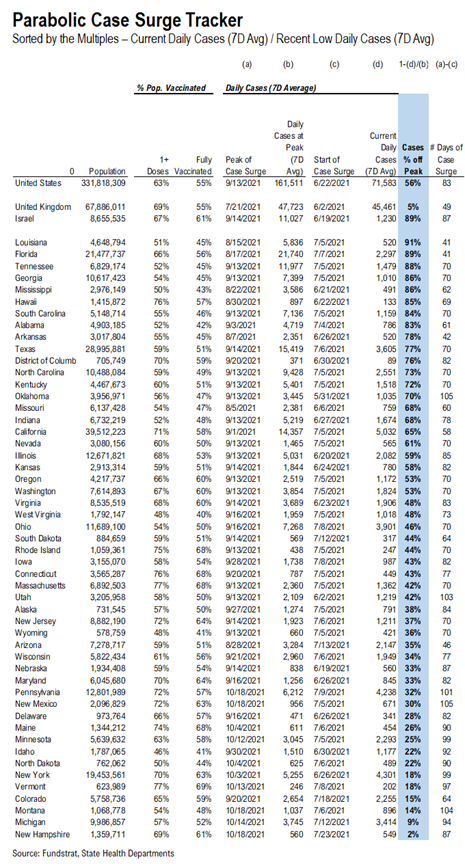

Low vaccinated states seem to have a larger increase in daily cases compared to their recent low…

*** We’ve updated the “Parabolic Case Surge Tracker” to measure case % off recent peak as the more recent “delta surge” is rolling over.

In the table, we’ve included both the vaccine penetration, case peak information, and the current case trend for 50 US states + DC. The table is sorted by case % off of their recent peak.

– The states with higher ranks are the states that have seen a more significant decline in daily cases

– We also calculated the number of days during the recent case surge

– The US as a whole, UK, and Israel are also shown at the top as a reference

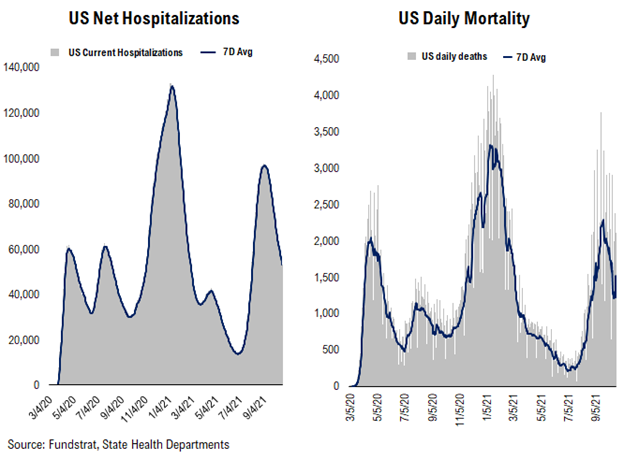

Hospitalizations, deaths, and positivity rates are rolling over amidst case rollover…

Below we show the aggregate number of patients hospitalized due to COVID, daily mortality associated with COVID, and the daily positivity rate for COVID.

– Net hospitalizations peaked below the Wave 3 peak and are currently rolling over

– Daily death peaked slightly above the Wave 2 peak and are currently rolling over

– As per the decline in daily cases, the positivity rate is currently rolling over

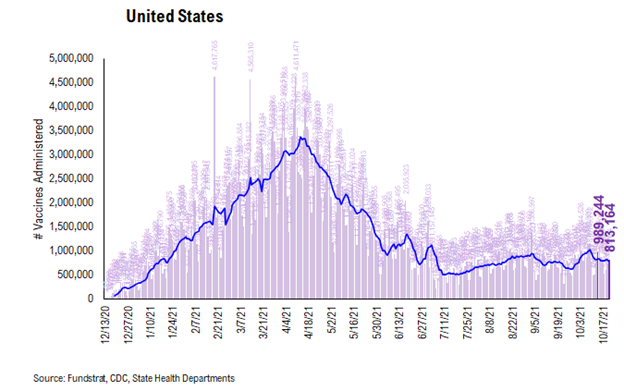

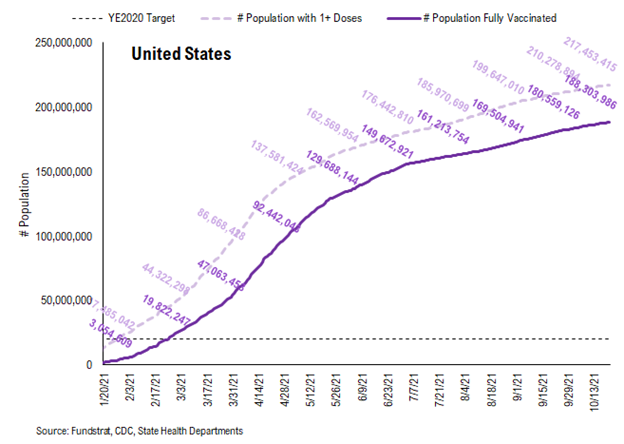

POINT 2: VACCINE: vaccination pace trending up once again…

Current Trends — Vaccinations:

- avg 0.8 million this past week vs 0.8 million last week

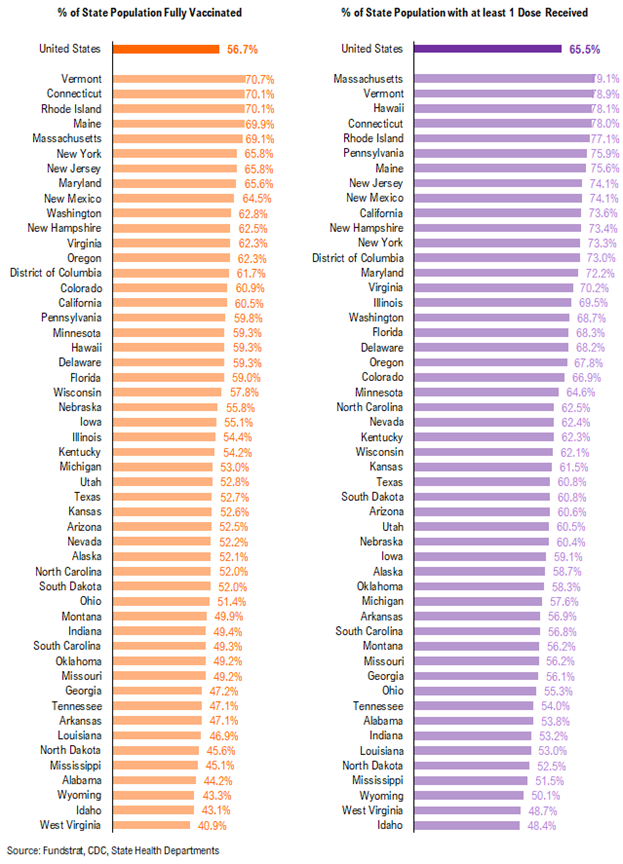

- overall, 56.7% fully vaccinated, 65.5% 1-dose+ received

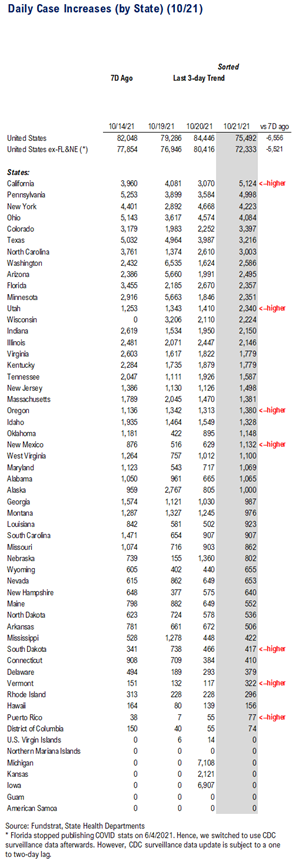

Vaccination frontier update –> all states now near or above 80% combined penetration (vaccines + infections)

*** We’ve updated the total detected infections multiplier from 4.0x to 2.5x. The CDC changed the estimate multiplier because testing has become much better and more prevalent.

Below we sorted the states by the combined penetration (vaccinations + infections). The assumption is that a state with higher combined penetration is likely to be closer to herd immunity, and therefore, less likely to see a parabolic surge in daily cases and deaths. Please note that this “combined penetration” metric can be over 100%, as infected people could also be vaccinated (actually recommended by CDC).

– Currently, all states are near or above 80% combined penetration

– Given the new multiplier. only RI, FL, MA, CT, NM, NY, NJ, IL, CA, PA, DE, SD, KY are now above 100% combined penetration (vaccines + infections). Again, this metric can be over 100%, as infected people could also be vaccinated. But 100% combined penetration does not mean that the entire population within each state is either infected or vaccinated

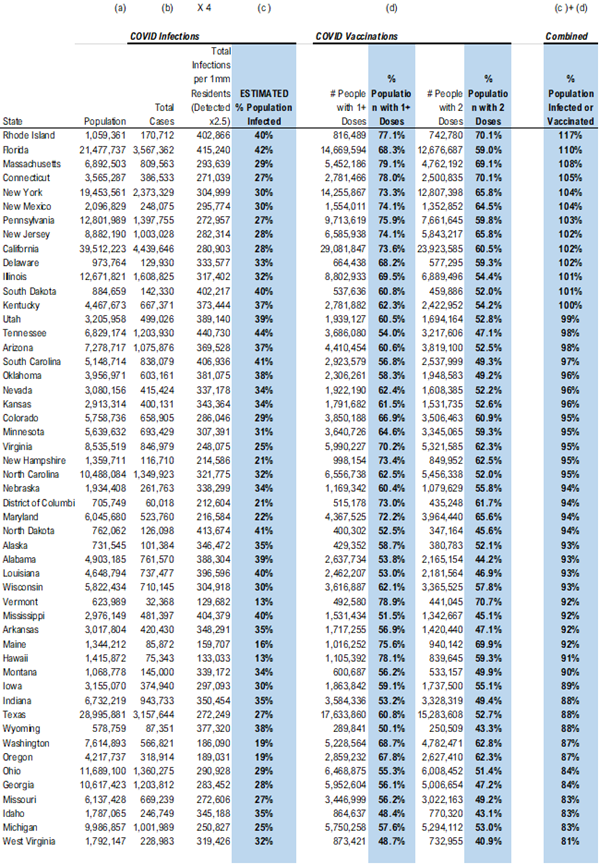

Below is a diffusion chart that shows the % of US states (based on state population) that have reached the combined penetration >60%/70%/80%/90%/100%. As you can see, all states have reached combined infection & vaccination >100% (Reminder: this metric can be over 100%, as infected people could also be vaccinated. But 100% combined penetration does not mean that the entire population within the state is either infected or vaccinated).

There were a total of 813,164 doses administered reported on Thursday, down 18% vs. 7D ago. While we are seeing the vaccination pace slow down, we believe it may soon pick back up as booster shots are becoming more widely available. Also, the same catalysts remain in place:

– Proof of vaccination required by many US cities and venues

– Booster shots

– Full FDA approval of Pfizer COVID vaccines (hopefully it could help overcome vaccine hesitancy)

– Biden’s vaccination plan

The daily number of vaccines administered remains the most important metric to track this progress and we will be closely watching the relevant data.

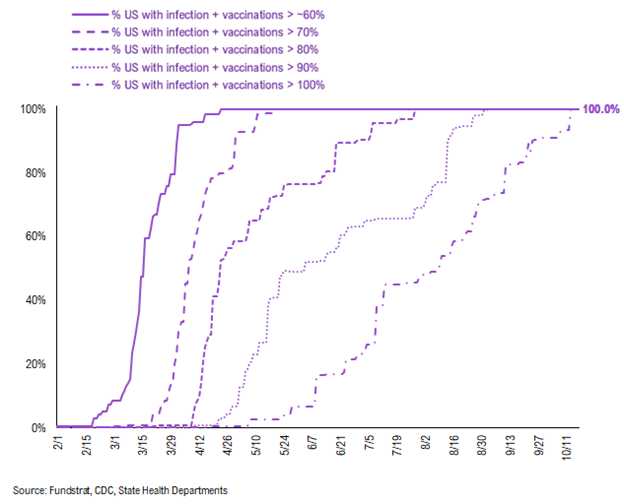

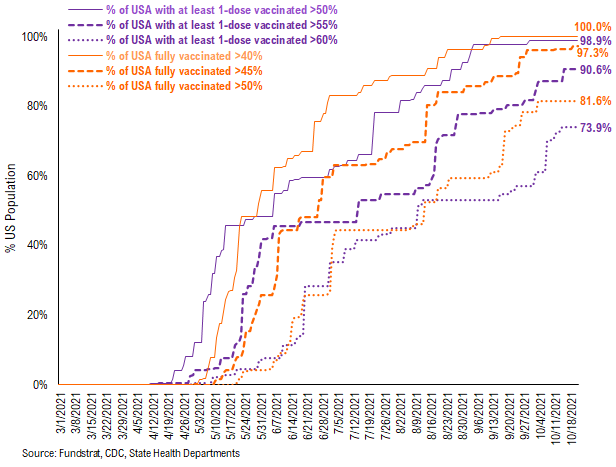

73.9% of the US has seen 1-dose penetration >60%…

To better illustrate the actual footprint of the US vaccination effort, we have a time series showing the percent of the US with at least 45%/45%/50% of its residents fully vaccinated, displayed as the orange lines on the chart. Currently, 100% of US states have seen 40% of their residents fully vaccinated. However, when looking at the percentage of the US with at least 45% of its residents fully vaccinated, this figure is 97.3%. And only 81.6% of US (by state population) have seen 50% of its residents fully vaccinated.

We have done similarly for residents with at least 1-dose of the vaccination, denoted by the purple lines on the chart. While 98.9% of US states have seen 1 dose penetration >50%, 90.6% of them have seen 1 dose penetration >55% and 73.9% of them have seen 1 dose penetration > 60%.

This is the state by state data below, showing information for individuals with one dose and two doses.

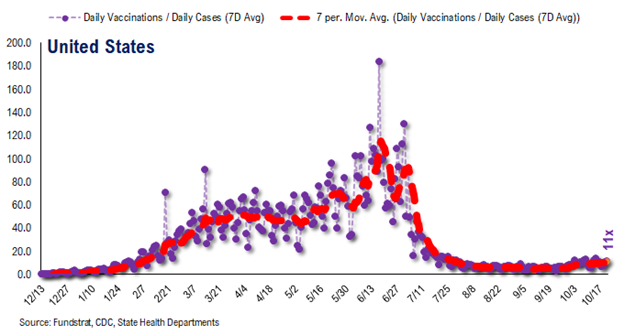

The ratio of vaccinations/ daily confirmed cases has been falling significantly (red line is 7D moving avg). Both the surge in daily cases and decrease in daily vaccines administered contributed to this.

– the 7D moving average is about ~11 for the past few days

– this means 5 vaccines dosed for every 1 confirmed case

In total, 405 million vaccine doses have been administered across the country. Specifically, 217 million Americans (66% of US population) have received at least 1 dose of the vaccine. And 188 million Americans (57% of US population) are fully vaccinated.

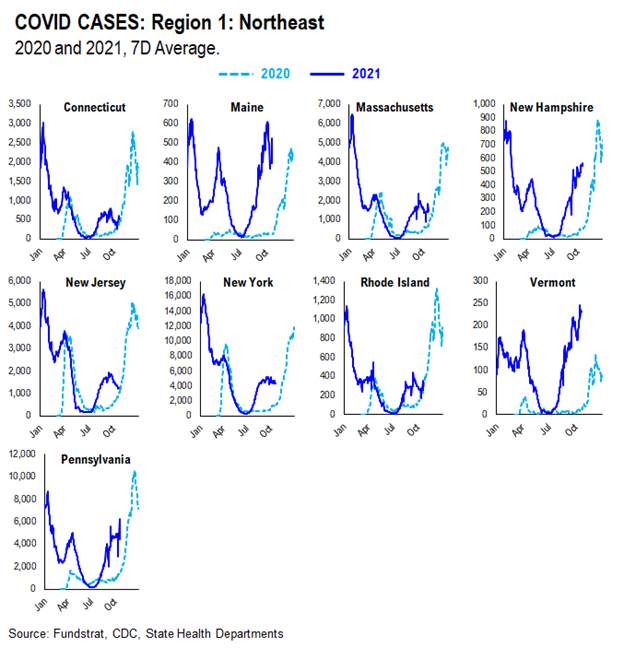

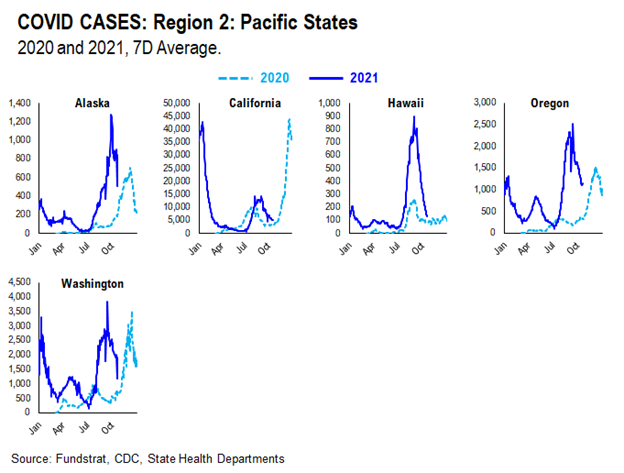

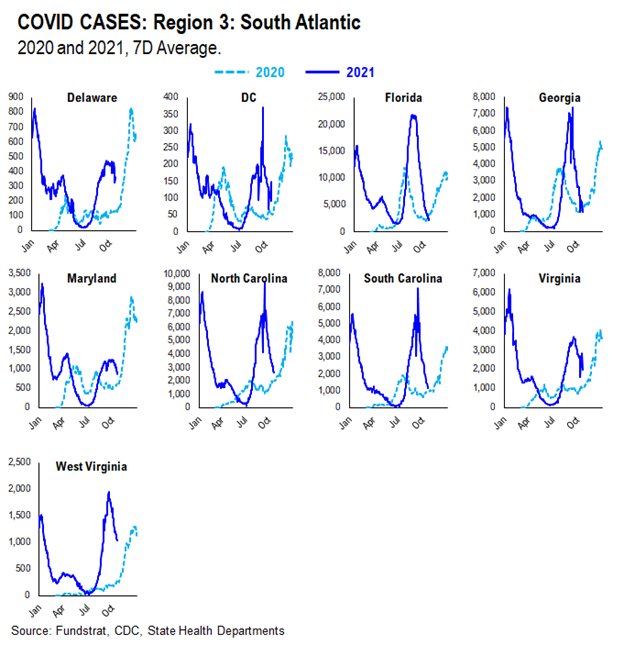

POINT 3: Tracking the seasonality of COVID-19

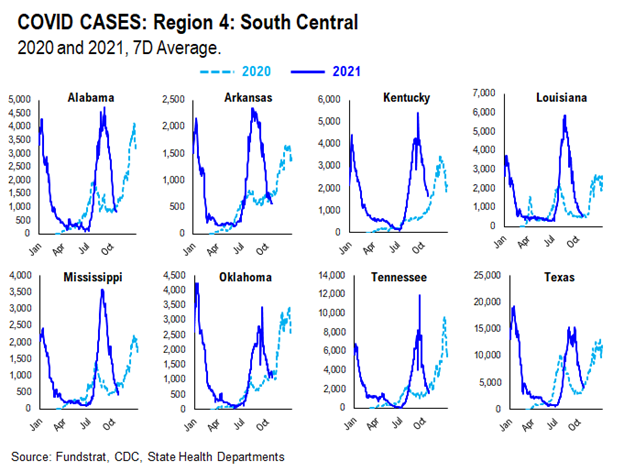

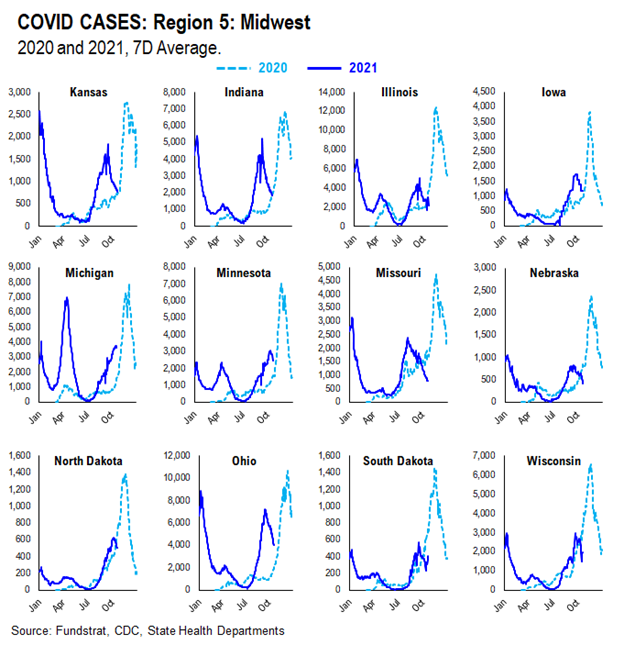

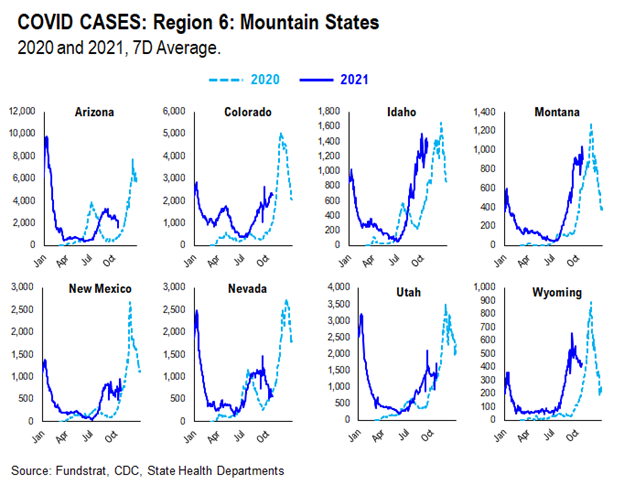

In July, we noted that many states experienced similar case surges in 2021 to the ones they experienced in 2020. As such, along with the introduction of the more transmissible Delta variant, seasonality also appears to play an important role in the recent surge in daily cases, hospitalization, and deaths. Therefore, we think there might be a strong argument that COVID-19 is poised to become a seasonal virus.

The possible explanations for the seasonality we observed are:

– Outdoor Temperature: increasing indoor activities in the South vs increasing outdoor activities in the northeast during the Summer

– “Air Conditioning” Season: similar to “outdoor temperature”, more “AC” usage might facilitate the spread of the virus indoors

If this holds true, seasonal analysis suggests that the Delta spike could roll over by following a similar pattern to 2020.

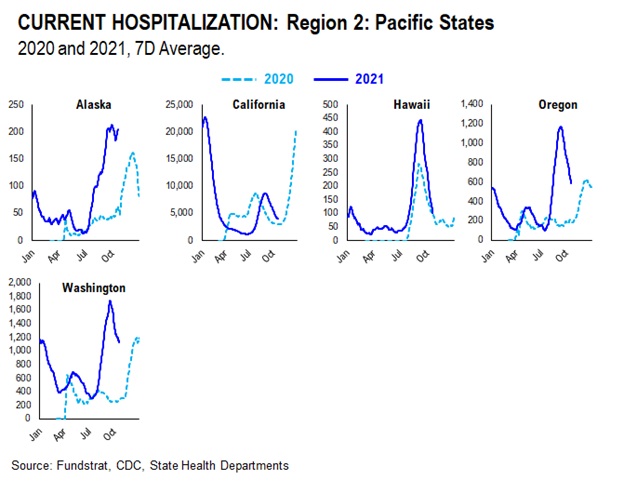

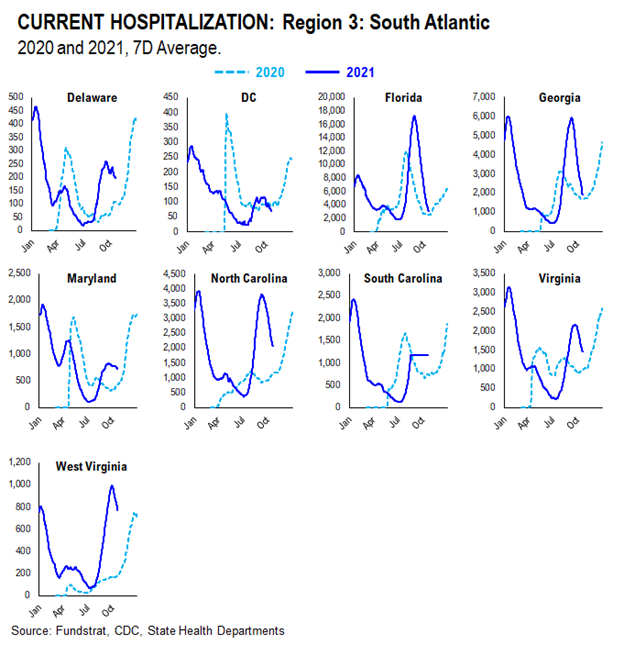

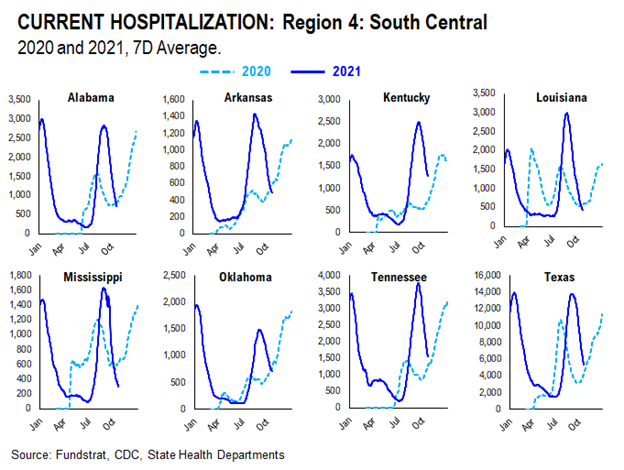

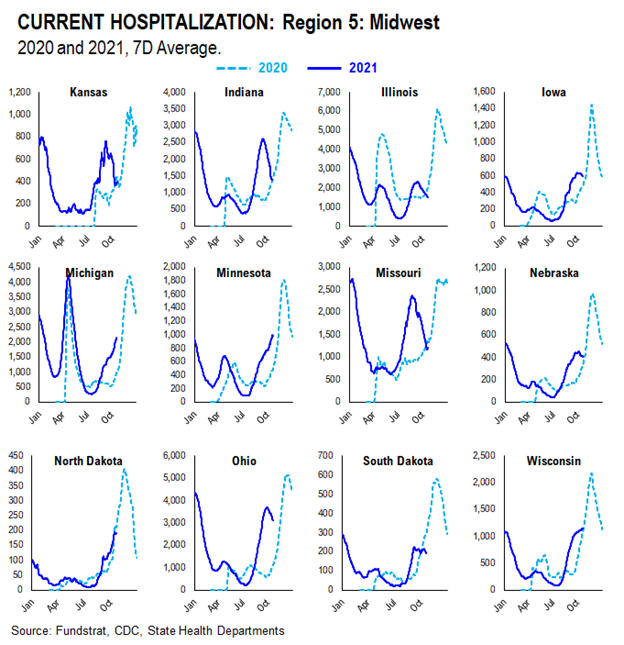

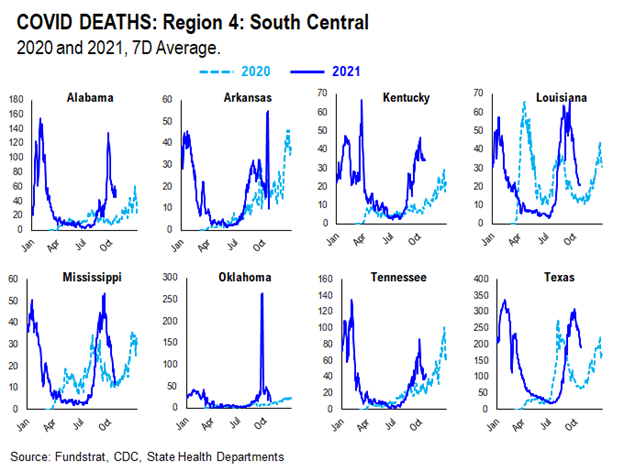

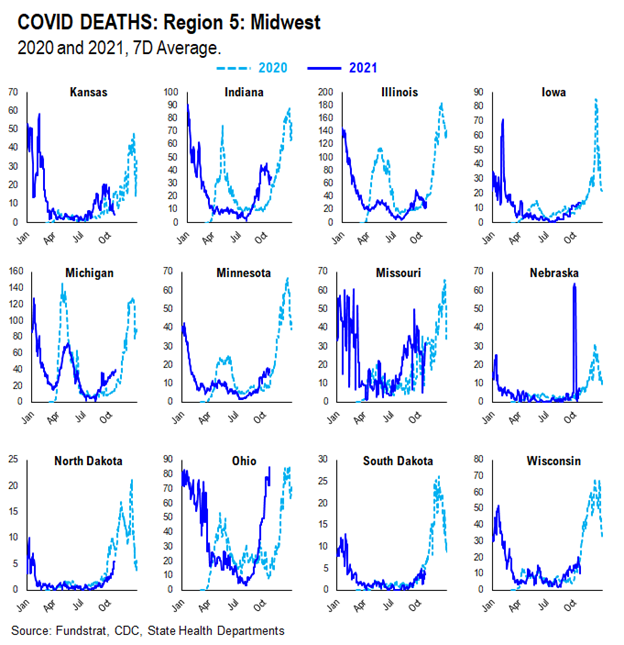

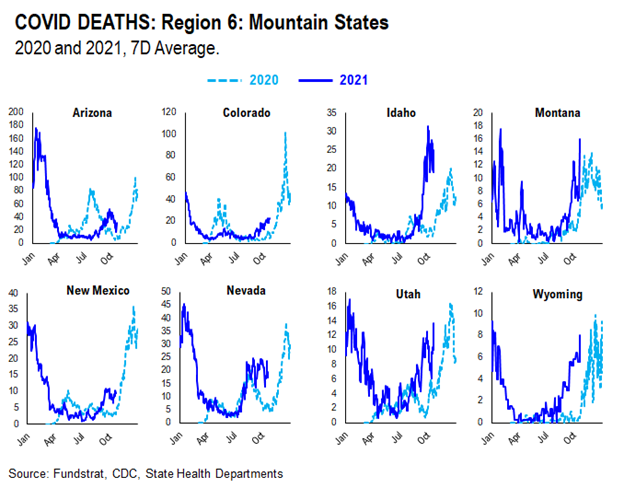

We created this section within our COVID update which tracks and compare the case, hospitalization, and death trends in both 2020 and 2021 at the state level. We grouped states geographically as they tend to trend similarly.

CASES

It seems as if the main factor contributing to current case trends right now is outdoor temperature. During the Summer, outdoor activities are generally increased in the northern states as the weather becomes nicer. In southern states, on the other hand, it becomes too hot and indoor activities are increased. As such, northern state cases didn’t spike much during Summer 2020 while southern state cases did. Currently, northern state cases are showing a slight spike, especially when compared to Summer 2020. This could be attributed to the introduction of the more transmissible Delta variant and the lifting of restrictions combined with pent up demand for indoor activities.

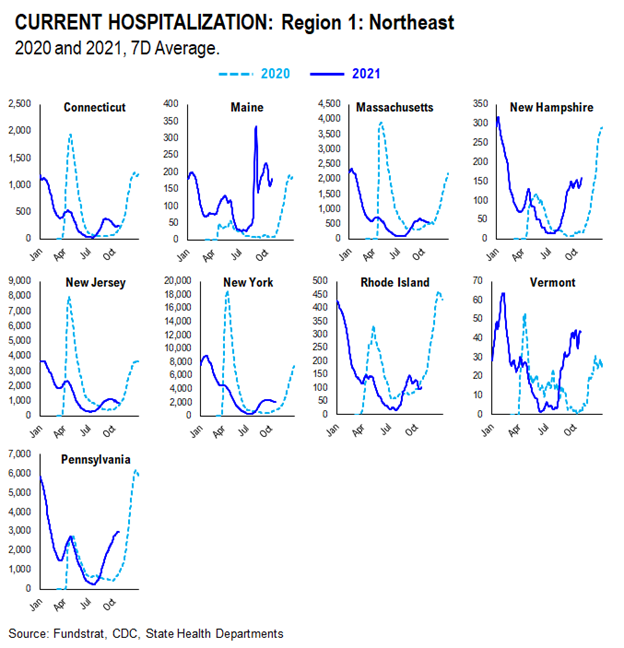

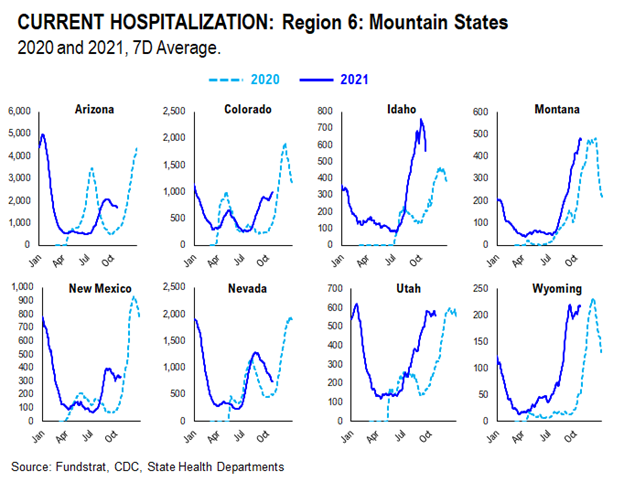

HOSPITALIZATION

Current hospitalizations appear to be similar or less than Summer 2020 rates in most states. This is likely due to increased vaccination rates and the vaccine’s ability to reduce the severity of the virus.

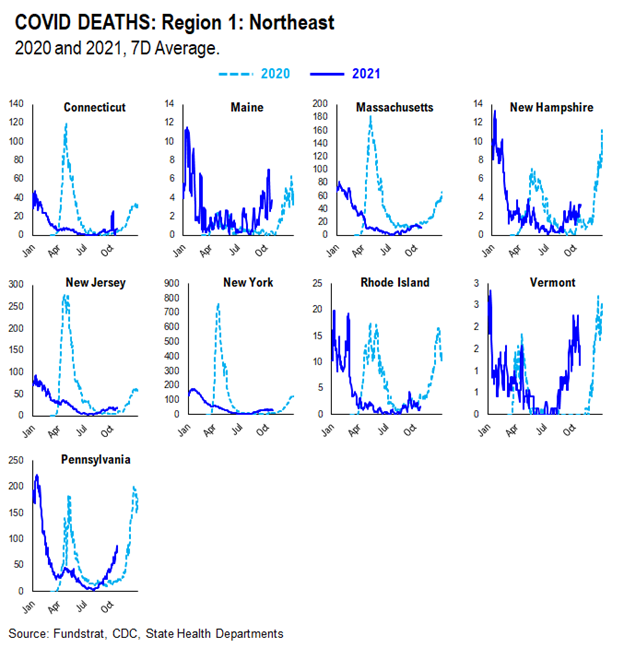

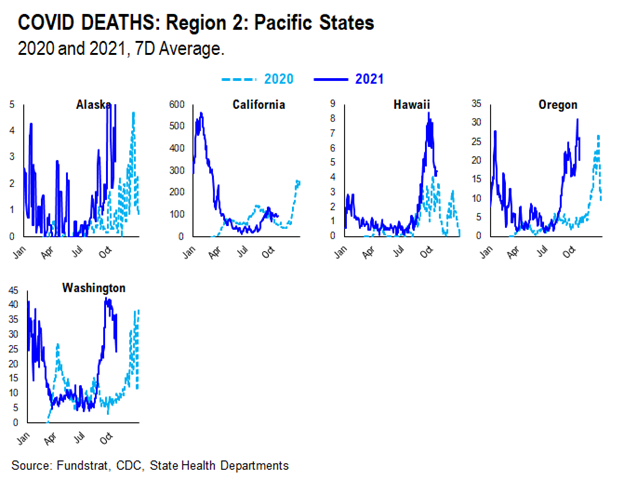

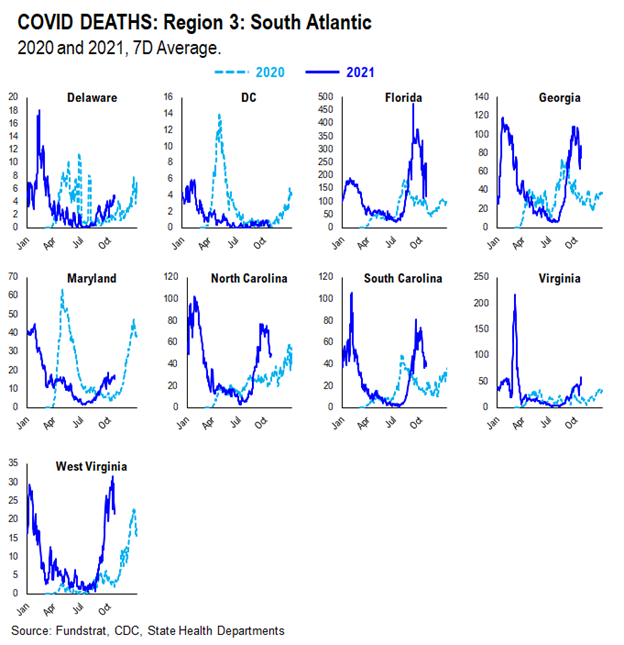

DEATHS

Current death rates appear to be scattered compared to 2020 rates. This is likely due to varying vaccination rates in each state. States with higher vaccination rates seem to have lower death rates given the vaccine’s ability to reduce the severity of the virus; states with lower vaccination rates seem to have higher death rates.