COVID-19 UPDATE: Bonds of many "epicenter" stocks are back to par. Wow. FYI, Bars not reason millennials spreading COVID-19.

Click HERE to access the FSInsight COVID-19 Daily Chartbook.

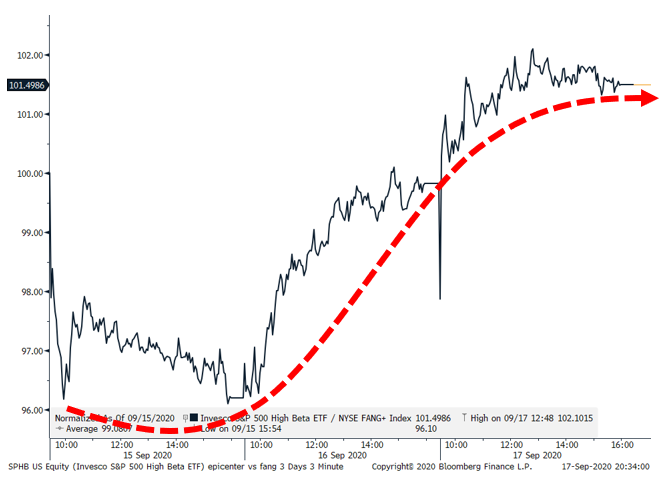

STRATEGY: Very telling that “epicenter” stocks rise during choppy market week

It has been a really choppy week for markets, and stocks still remain ~7% off their recent highs. And we soon enter the seasonal trade “sell Rosh Hashanah, buy Yom Kippur” (9/19-9/28) so this bumpy ride might continue. Stocks have risen relentlessly since March, so any pullback is not entirely surprising to us. And for the past few days, we have highlighted multiple reasons why stocks still have positive risk/reward into YE.

If I had to cite a few curiosities this week, two stand out:

– foremost, epicenter stocks have outperformed. This is interesting because it is telling that “epicenter” stocks are showing strength during a broader sell-off. Certainly, in my opinion, a change in market character

– second, the VIX has really backed off its highs. It was 40 a week ago and even yesterday, closed at the lows

In all, I would interpret this as selling seems closer to an end than a beginning.

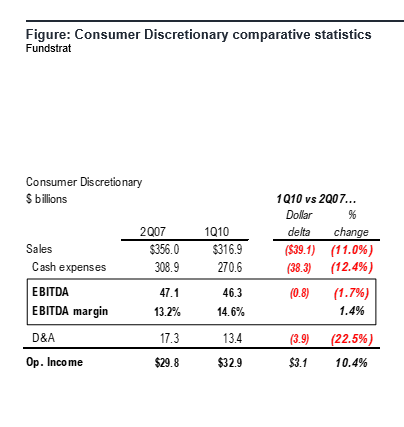

Epicenter stocks, who survive this economic depression, are stronger biz = higher margin = higher P/E multiple

This global pandemic gauntlet is a true test for any company, but the cyclicals (aka “epicenter”) are particularly tested. After all, these companies are expected to suffer severe losses in an economic downturn. And this downturn is an outright global depression.

Even during the 2008 GFC, Consumer Discretionary companies managed to generate 10% more operating income with 11% less sales. Yup, lower sales but way higher operating income. This, we believe, is happening today at multiple times the speed.

Source: Fundstrat

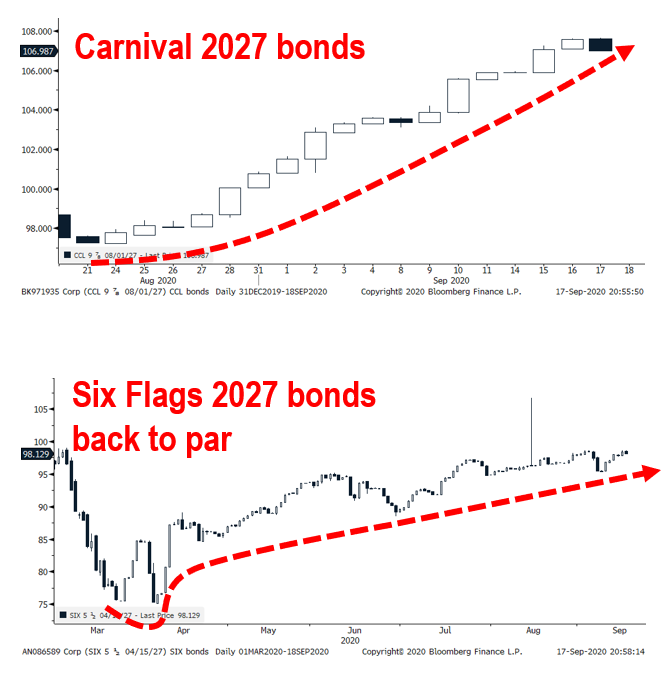

Moreover, the bond market has been considerably more optimistic about the prospects for “epicenter” companies. I list two examples below for Carnival 2027 bonds and Six Flag 2027 bonds. These two companies are among the hardest hit industries, as travel and leisure have been obliterated by COVID-19.

– Carnival bonds look like the chart for FANG

– Six Flags bonds traded to 75 in March and are now back to par — WOW!

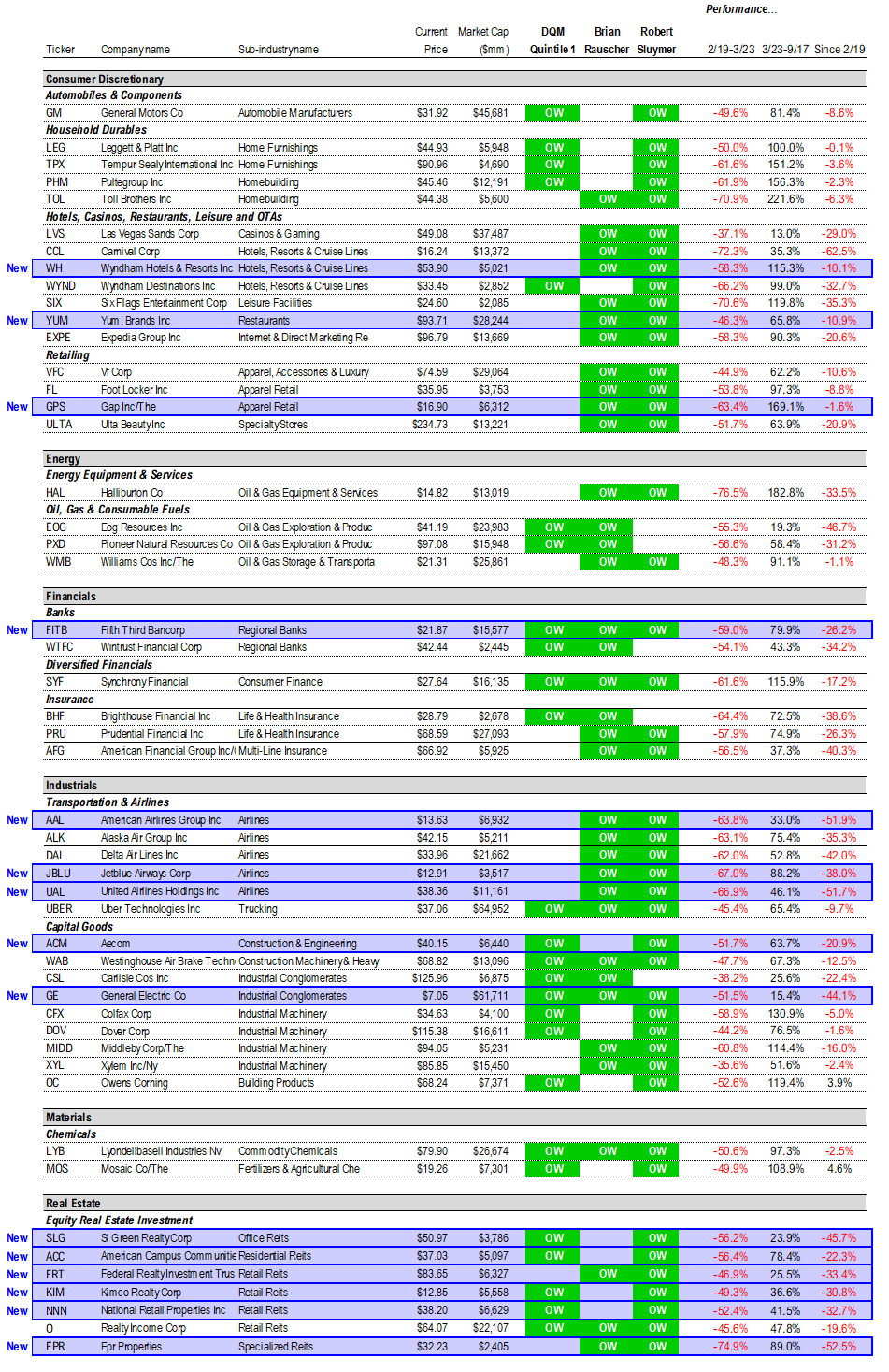

Updating our trifecta epicenter stock list — 50 names. 10 deletions and 15 new names

We are updating our list of trifecta epicenter stocks. This list is based upon favorable views from the three-way: (i) Global Portfolio Strategy (Rauscher); (ii) Technicals (Sluymer) and (iii) Quant DQM (tireless Ken).

15 additions:

Consumer Discretionary: WH, YUM, GPS

Industrials: AAL, JBLU, UAL, ACM, GE

Real Estate: SLG, ACC, FRT, KIM, NNN, EPR

Financials: FITB

10 Deletions:

Consumer Discretionary: LEA, HLT, DRI, COLM, SCI

Industrials: LUV

Real Estate: STOR

Financials: C, CFG

Energy: HFC

The full list of 50 epicenter stocks is below.

(*) Please note that the stocks rated OW on this list meet the requirements of our investment theme as of the publication date. We do not monitor this list day by day. A stock taken off this list means it no longer meets our investment criteria, but not necessarily that it is neutral rated or should be sold. Please consult your financial advisor to discuss your risk tolerance and other factors that characterize your unique investment profile.

Source: Fundstrat

_____________________________________

Tune into our webinar TODAY at 3:30pm ET with IHME head science researcher, Christopher Murray…

But the future is uncertain. And we wanted to get the perspective of one of the leading COVID-19 healthcare researchers. We are hosting a webinar with one of the founders of IHME (IHME website healthdata.org), you may know as healthdata.org, and is one of the forecasters for COVID-19 used by the White House. We will be speaking with Christopher J.L. Murray who is the lead researcher there. FYI, the IHME is forecasting a brutal flu season, with daily deaths rising to as much as 12,000 per day in December (peaked at ~2,000 in April 2020).

– TODAY at 3:30pm ET.

– the time is odd but Murray of IHME is based on the West Coast

Similar to our broader work on COVID-19, we want to make this available to the public, so you are welcome to share this webinar invitation (except not to CNN). The details of this webinar are below:

Details and Specifics

Date: TODAY, September 18th, 2020

Time: 3:30 pm Eastern Time

Duration: 45-60 minutes (including live Q&A)

Link –> Click here to register

- Registration is required to receive dial-in details.

- You will receive a copy of the presentation before the Webinar. The call will be accessible via computer, phone or both. If you login, you can view the presentation during the Webinar. If you call in only, we recommend having a copy on hand if possible.

- To request a replay of the call, please email inquiry@fsinsight.com.

Should you have any questions, please do not hesitate to contact us at (212) 293-7140 or email inquiry@fsinsight.com.

_____________________________________

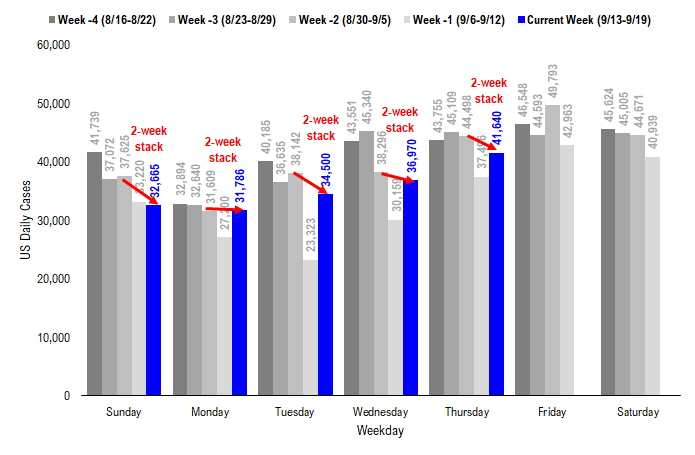

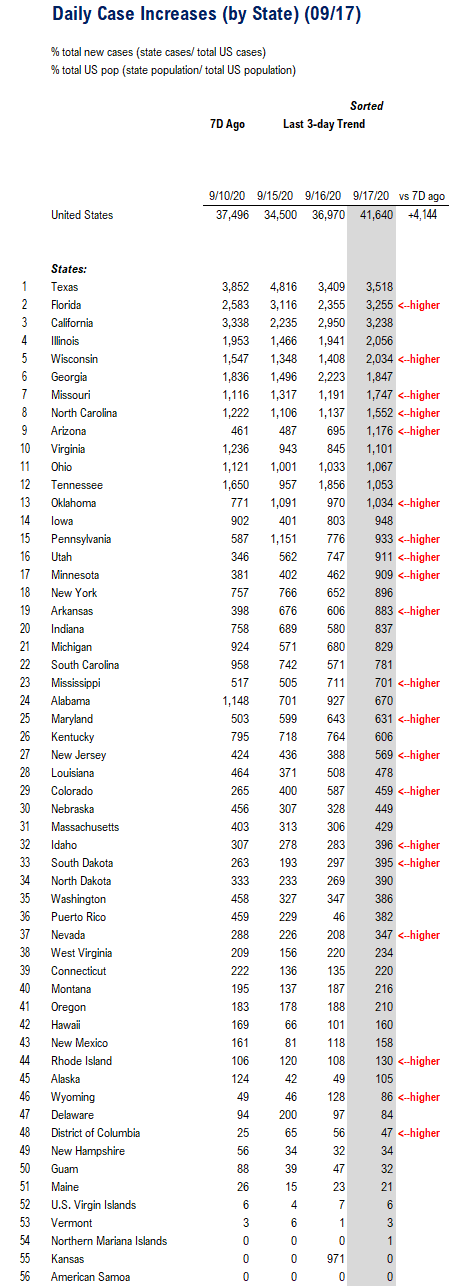

POINT 1: Next week better baseline for trends. US daily cases 41,640 up +4,144 vs 7D ago.

We can’t help thinking that there is very likely some type of distortion in trends due to last week’s Labor Day holiday — that is, long weekend and closures mean reported data was less complete last week and this week, we are seeing a catch up of this data. And for now, the best way to put this in perspective is to look at 2-week trends (see red arrows).

– Next week, therefore, is a better baseline, because the Labor Day effects will be gone

– Daily cases on Thursday came in at 41,640 and +4,144 vs 7D ago.

Source: COVID-19 Tracking Project

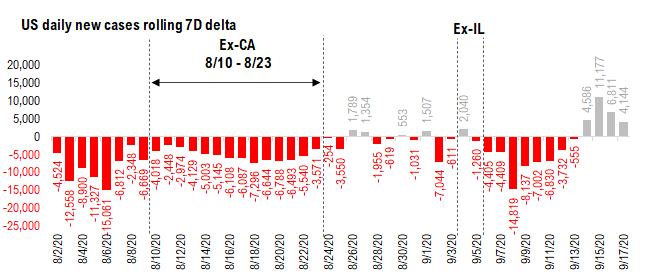

Next week will give us a clearer picture…

Again, the daily change vs 7D ago, in our view, is the leading indicator as it is what influences the 7D moving average. The 7D delta is up, meaning cases are higher vs 7D ago, but the level of increase is slowing. It was +11,177 on Tuesday.

– the fact this 7D delta is falling is suggesting to us that this week’s rise is really due to last week’s under-reporting.

Source: COVID-19 Tracking and Fundstrat

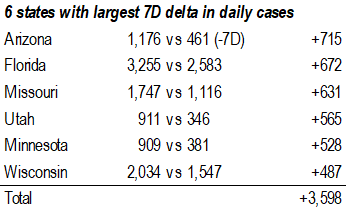

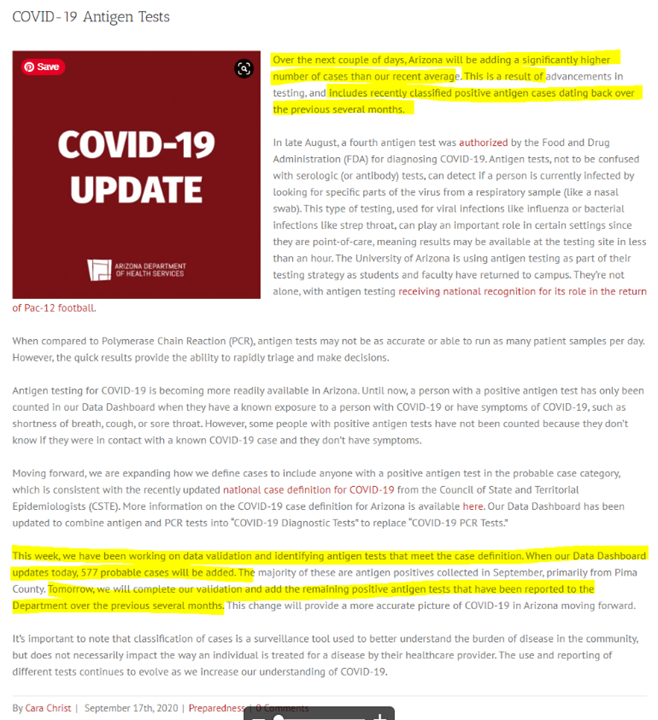

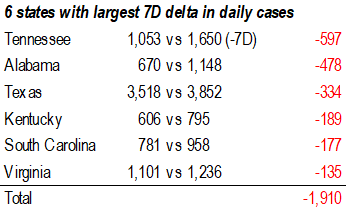

These are the 6 states with the highest 7D delta in daily reported cases. The top of the list is Arizona. Arizona’s rise, however, seems to be the result of new testing as noted below.

Arizona is going to roll out antigen testing (using saliva) and they will be including these cases in their daily results. So the state will be seeing a massive surge in cases over the next few days.

https://directorsblog.health.azdhs.gov/covid-19-antigen-tests/

Source: COVID-19 Tracking and Fundstrat

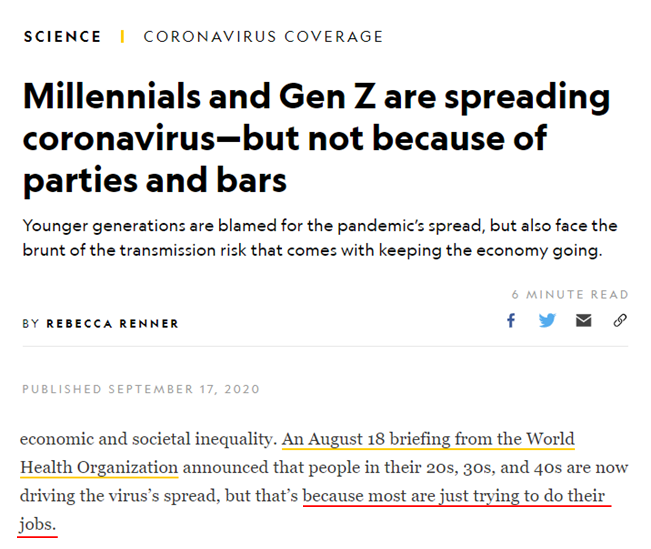

POINT 2: Don’t blame bars: Millennials + GenZ spreading COVID-19 because they work

One of the storylines that I generally viewed as mostly correct is this: “millennials spread COVID-19 because of bars.” And there have been many media articles about this, including this latest one below from Kaiser Health News. I mean, KHN is as legit as they come. And they have a quote in this article from Dr. Fauci, who confirms this linkage of bars = COVID.

https://khn.org/news/deadly-mix-how-bars-are-fueling-covid-19-outbreaks/

But there seems to be a rethink about this. It is true that younger adults, Millennials and GenZ are in fact responsible for the July-July surge of COVID-19 across the US. But the WHO recently suggested this is not due to bars and socializing, but rather, because these people are employed in jobs that make them more vulnerable.

Source: National Geographic

The article has an interesting discussion about how younger adults are employed in jobs that require them to move around or be exposed to customers, hence raising their risk of exposure. In fact, they also quote a Cornell Professor who pretty much suggests this same notion again.

Source: https://www.nationalgeographic.com/science/2020/09/millennials-generation-z-coronavirus-scapegoating-beach-parties-bars-inequality-cvd/#close

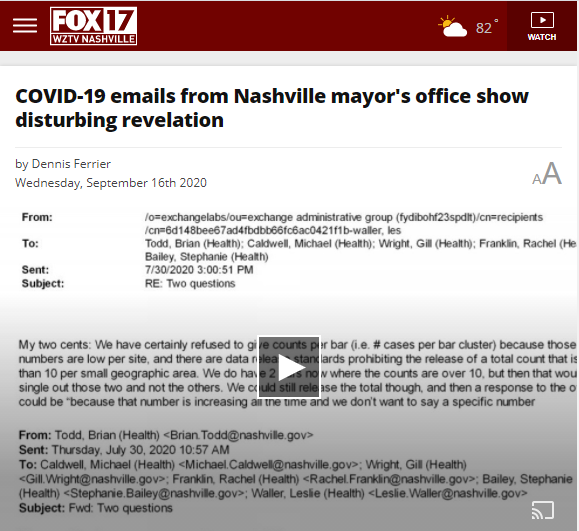

Emails suggest Nashville Mayor’s office hiding fact bars account for barely any cases in the city…

And this Fox 17 news story was forwarded to me by one of our clients in San Antonio, TX (thanks Mark!!!) about how it looks like the Nashville’s Mayor’s office found so few cases of COVID-19 caused by bars, they decided to keep that a secret.

Source: Fox17.com

Source: Fox17.com

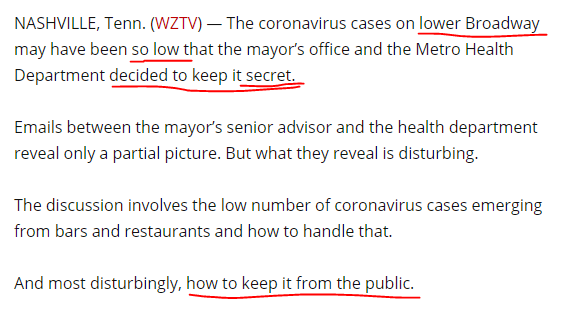

Nashville bars and restaurants responsible for 22 of >2,000 cases examined… or 1%

According to this story, of the >2,000 cases that were contact traced on June 30th, only 22, or 1% were traced to bars. That is a surprisingly low figure and really shockingly low.

– Of course, it could be different today?

Source: Fox17.com

POINT 3: Inflation “risk premia” highest in 3-years –> favors asset-heavy companies

The natural question on everyone’s mind is whether this massive level of money printing + fiscal stimulus leads to a surge in inflation. The Fed would like some inflation, but their message yesterday is rates low for long. And of course, BOJ and ECB have not had much success, even with their levels of monetary easing.

The preferred measure of inflation, for us, is this inflation breakevens and as you can see below, has begun to modestly recover after crashing earlier this year.

– But the trend is still not clear.

– We also like to look at “risk premia” for inflation implied by taking this less CPI (proxy).

Inflation risk premia has jumped to the highest level in 3 years…

The light blue line below is this adjusted inflation measure (inflation breakevens less CPI) and when it is falling, the market sees falling risk of inflation risk (left scale).

– this light blue line has jumped to the highest level in 3 years

– thus, while we have no inflation, markets are “sensing” inflation risk

Notably, notice how the relative performance of Financials versus Healthcare seems to track this inflation risk measure? This has been a pretty good tactical signal for the past 10 years.

– Financials are asset heavy while Healthcare is asset light

– Hence, when inflation risk is up, Financials outperform

– It looks like Financials have some “catching up” to do (rise)

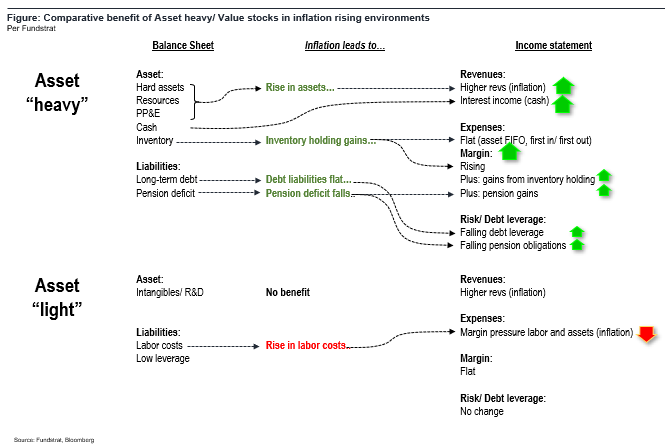

This is our stylized explanation for why inflation boosts the returns and equity of asset heavy companies:

– higher asset turns from inflation

– strengthens capital structure (real value debt falls)

– operating margin increase

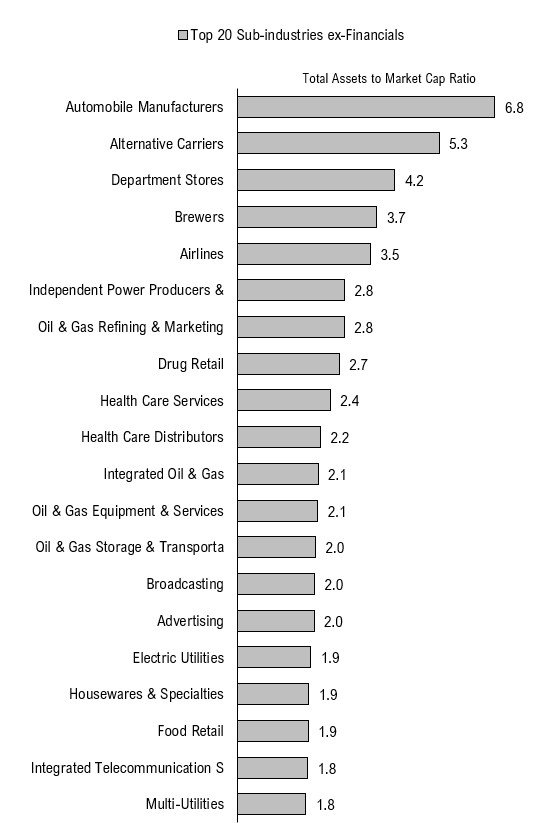

And our data scientist, tireless Ken, has put together the 20 industries with the highest asset intensity in the S&P 500.

Source: Fundstrat

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 3b2a03-5f1396-56751e-58bc56-54098d

Already have an account? Sign In 3b2a03-5f1396-56751e-58bc56-54098d