What Does September’s Rate Hike and Dot Plot Mean For Markets?

The FOMC met yesterday to announce their latest rate hike. As the market for Fed Funds Futures implied leading up to the meeting, the committee decided on a 75-bps hike. We wanted to provide a special update on where things stand with the Fed and markets after their third-to-last meeting of 2022. The next rate decision will be on November 1-2. The final of the year will be December 13-14. So, firstly we want to explain some of the reasons why Powell has changed his communication style recently. The Fed Chairman has found the pitfalls of openly opining on the future as a Fed chairman and we expect him to internalize this lesson going forward. After that, we will go over some of the key takeaways and consequences from this most recent meeting. Lastly, we will discuss our research heads' thoughts on the recent Fed meeting.

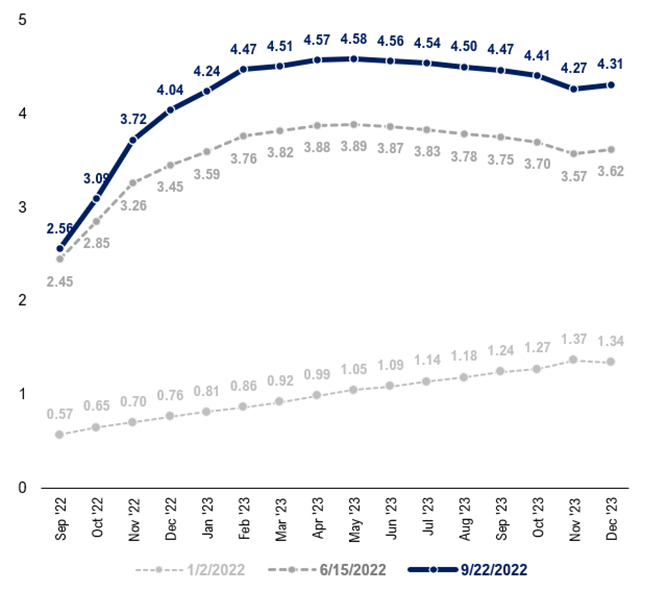

Below you can see the future rates as implied by Fed Futures, they currently suggest a terminal rate of just under 4.6% in April 2023.

We know reading about the Fed can be confusing and even unpleasant. So, we thought we’d give you some Fed poetry to summarize the events in a more fun and engaging way. It’s not meant to make light of the ominous economic situation we together face:

‘Twas the night before Fed Day and all through the Street,

Portfolio managers hoped for a sweet dovish treat,

But Powell and friends had their eye on the ball,

They’ll do whatever it takes to make inflation fall,

With visions of Volcker dancing in their head,

They didn’t allow inflation expectations to spread,

Of course, Powell would love to be Jolly St. Nick,

And pump liquidity like egg-nog til we’re all sick,

But accommodative posture has lasted too long,

His thesis of transitory proved to be so wrong,

But don’t fret because our research suggests,

That inflation’s rolling over and given its best,

How to Run the Press Gauntlet: Keep the Jawbone Strong

Very few financial commentators were alive and following markets during the last great inflation epoch in the 1970s and 1980s. Some may forget that the Fed has a very different set of tools today than it had back then. The interest rate ceilings of Regulation Q gave the Fed a much more direct mechanism to affect policy and make the economy heel to its policy objectives. Raising the Federal Funds rate high enough could cause a controlled financial crisis as money flowed out of bank accounts (meaning less private lending) into higher-yielding options. So, the psychological component was less important since they could directly affect financial conditions this way. The removal of Reg Q interest rate ceilings means this mechanism no longer exists, and the Fed is more dependent on "jawboning" than it was during Volcker's tenure.

So, when Powell's remarks were interpreted as more dovish than he intended after the July meeting, financial conditions began to loosen. This is an existential problem affecting the Fed’s ability to implement its mandate. Thus, those hoping for dovish green shoots were largely let down. Powell is a reasonable guy and a good communicator, but he made sure in this press conference not to distract from the same curt message he delivered at Jackson Hole. You can expect him to focus on not repeating this past unforced communication error as we advance. It is notable that after Jackson Hole, the Fed's leading dove Neel Kashkari broke with typical etiquette and cheered the market's downward slide in the wake of Powell's comments. Both doves and hawks want to see their primary tool of jawboning intact and effective.

Powell endured the typical post-meeting press gauntlet. Financial media were keen to find any cracks in the hawkish front, and Powell did not oblige. Presaging his answer to one question about what he would consider before ending tightening, he stressed that the media should not interpret his message as materially different from what he said at Jackson Hole. You've also seen less divergence from the core message from what Ed Yardeni refers to jokingly as the Federal Open Mouth Committee. It's high-noon, and the FOMC knows it. Thus, the Fed must talk tough right now because not doing so undermines the tightening of financial conditions they need to achieve to bring price stability back to the economy.

One journalist asked Powell why he didn't front-load with a more considerable 100-bps hike. He mentioned the respective downside and upside surprises in the last two CPI reports. He said he never wants to overreact to any one data point. He continued, "If you really look at this year's inflation, 3, 6, and 12-month trailing, you see inflation is running too high. It's running 4.5% or above. You don't need to know much more than that. If that's the one thing you know, you know that this committee is committed to getting to a meaningfully restrictive stance of policy and staying there until we feel confident inflation is coming down." This is a clear-cut response from Powell and should quell hopes of a dovish pivot anytime soon.

There had been some chirping amongst those who were hopeful for a dovish development that the Fed might slow the pace of quantitative tightening. One journalist asked if, given the housing market's weakness, the FOMC should reconsider the pace of shrinking the balance sheet. Powell was equally unequivocal in his response, saying that it was a possibility in the future, but he wasn't considering it and wouldn't be "anytime soon." If you take the Fed at face value, incremental improvement in inflation will not be enough to change course and give markets relief and they will be keeping rates elevated at restrictive levels for some time.

Key Takeaways from September Fed Meeting

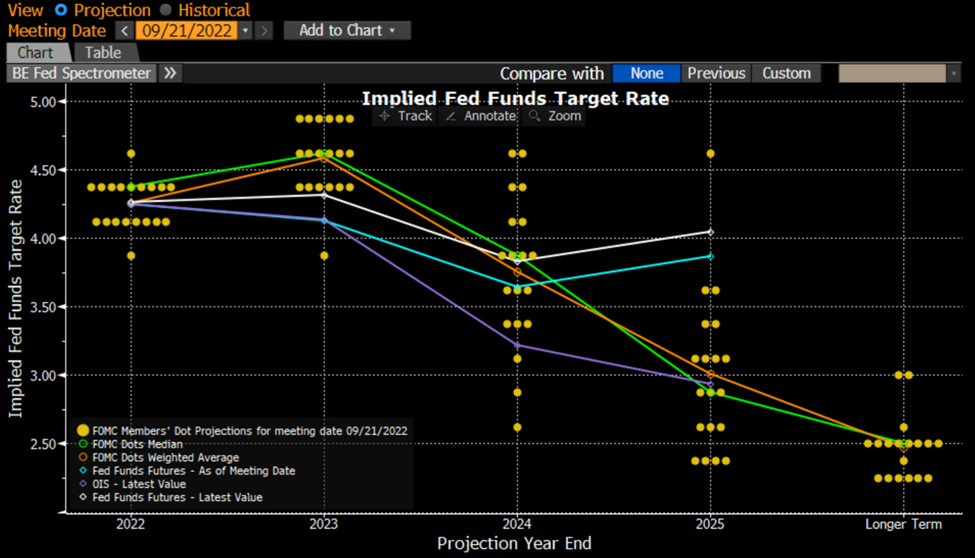

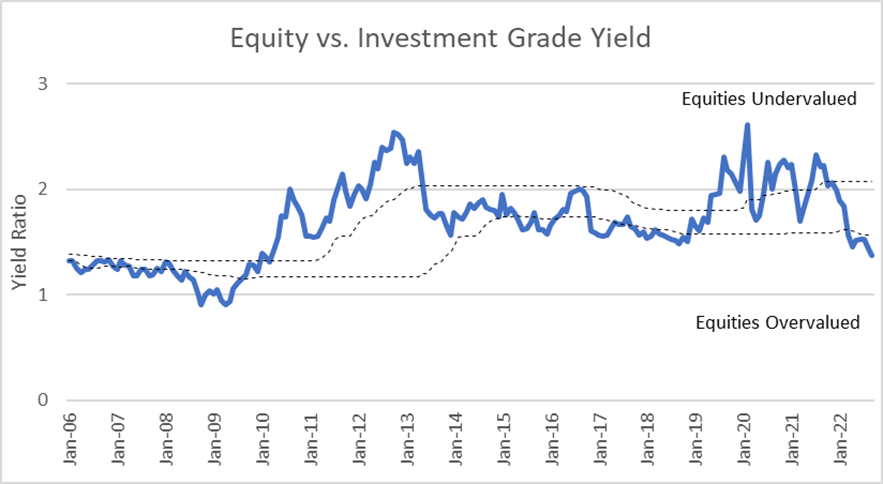

- The forecast for the federal funds rate was raised by 100-bps for 2022, from 3.4% to 4.4%. Importantly, the terminal rate for 2023 was higher than market expectations by a tenth of a percent, coming in at 4.6%. The terminal rate is the highest rate in the cycle. So, this means the Fed’s anticipated median peak rate was slightly higher than the market’s and this was one of the main reasons for stocks retreating after the decision. The SEP also showed that the committee expects to keep rates at an elevated and restricted level for a longer period than recent hiking cycles. Why is this important? This means that bonds have become, and will likely stay, attractive alternatives to equities for the foreseeable future. All else being equal, this is a bad thing for equities that enjoy extra price support when There is No Alternative (TINA). You can see this reflected in Our Head of Quantitative Strategy Adam Gould’s relative valuation model below. In Mr. Gould’s model, as the risk-free rate rises, it leads future earnings to be discounted more heavily which brings fair valuations down. His model is suggesting equities are overvalued at their current level.

- The Fed expects, and intends, for growth to be lower than the long-term average. The prospects for a soft-landing are dimming based on the numbers. Key economic indicators have not rolled over yet, though the second derivatives imply there could be trouble ahead. Deceleration doesn’t necessarily mean recession, but key indicators have slowed. However, the chances for recession are rising according to JP Morgan. The probability for a recession over the next year is basically a coin flip. The odds for a recession over two years is higher at 74%.

- The labor market is a key variable in the Fed’s decision-making going forward. The labor market remains persistently strong. The mortgage market has felt tightening very acutely and the cost of borrowing has gone up to multi-year highs. This is cooling that market significantly, which the Fed probably takes as a good sign. At the very least, the industry isn’t keeping the party going with problematic loans to borrowers that can’t afford them, like in the run-up to the Global Financial Crisis. Some have speculated that the Fed’s inability to break the labor market might lead them to tightening until “something breaks.”

However, Powell mentioned three reasons why the SEP showed a modest rise in the employment compared to the projected fall in inflation. Chairman Powell is aware that the situation is historically anomalous. He gave the three following reasons for the SEP discrepancy:

- There are about two job openings for every worker seeking a job. He thinks job openings could come down significantly without unemployment going up as much as it normally would.

- Long-term inflation expectations have remained “fairly well anchored.” Powell was careful to not indicate complacency here. He said if this remains the case “that should make it easier to restore price stability.”

- The final anomalous catalysts he mentioned were both the supply shocks from COVID-19 and more recently from Russia’s invasion of Ukraine. These both contributed to the rise in inflation and have been absent from previous business cycles. Powell noted he saw green shoots of alleviation from these catalysts and mentioned these could make the Fed’s job easier if progress continues.

Reading between the lines, this does suggest the current hawkish bent of the Fed could be mitigated if there is significant improvement on the supply-side. For the reasons we elaborated on earlier, the Fed has to take a hardline right now or risk getting its bazooka taken away.

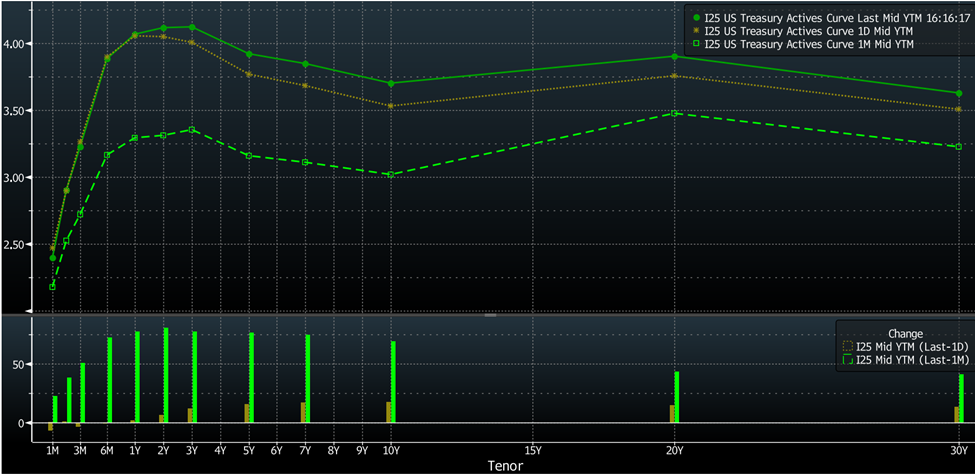

- The Fed is going to wait to see the effects of the tightening on the economy and inflation before reverting to an accommodative policy. Higher for longer is now a reality. Powell elaborated on some of the committee’s thinking. He said one prerequisite before turning the ship around would be positive real rates across the curve. He also mentioned he thought policy had just started to get restrictive and it has a long way to go. The current implication from the SEP is that we’re going to have one more 75-bps hike, followed by another 50 bps and then potentially one possibly one more 25-bps hike. Some respondents on the SEP thought 100 bps total was more likely. Powell said he’s not moved by the arguments they will over-tighten at this point. The opening of his statement reiterated that price stability is the main goal. If there’s some collateral damage, so be it. You can see below that conditions have tightened on the US curve over the last month, and even over the last day since the FOMC meeting.

- The effects on foreign economies of the Fed hiking will be significant and adverse. We tend to focus on the implications of Fed policy for US markets. When the Fed tightens it doesn’t just dampen economic activity here, but it also dampens economic activity across the world. It hurts general global risk appetite and the stronger dollar that results from it is a damper on activity and trade across much of the world. The dollar has risen 16% since the beginning of the year and 2.5% over the last month. Given geopolitical risks and supply dislocations, the flight of capital to America may be even more pronounced than in previous business cycles. This is compounded by other central banks in most of the developed world raising simultaneously. There has been a rise in global bond yields as this process plays out that will likely continue.

The 10-year yield has reached its highest level since before the financial crisis. The 10-year yields in Germany and South Korea have risen by 0.6% in the last month. In Britain, they rose a full percentage point. This activity can create potential for financial shocks, especially after a decade of anomalously low rates. You are already seeing the effects of this, but they are likely to mount as rates stay elevated and investors trim their risk exposures globally. South Korea’s central bank is trying to stave off a collapse of the won by deploying reserves in prodigious fashion. The government of South Korea wants to re-open the dollar-swap line with the US Federal Reserve. Today, the Japanese central bank intervened to prop up the dropping yen to prevent further deterioration. It is the first such action since the late 90’s. Countries lower on the development totem pole may face even more severe consequences.

What Are Our Research Heads Saying After the FOMC Meeting?

Head of Research Tom Lee

“If inflation starts to improve sharply, which a lot of leading indicators show that, I think markets are going to start to look at the Fed’s current path as sufficient to actually contain inflation… We may be surprised by the profit margin expansion of tech companies, even in a tougher revenue environment. That means there could be earnings surprises [for] tech.”

Head of Global Portfolio Strategy Brian Rauscher

“As we get closer to the upcoming September FOMC meeting, there is likely to be some noise and hopes that a glimmer of dovishness may present itself, which tactical investors view as a catalyst to try and start another trading rally. However, my key indicators are still unfavorable, the corporate share buyback window is closed, and as we go through the ongoing confession season moving towards the 3Q22 earnings season, it appears that the tug for the S&P 500 is still to the downside. Thus, I am still viewing tactical bounces as bear market rallies that will likely fail and advise not to chase them.”

Head of Technical Strategy Mark Newton

“The selling continues directly following the advance in Treasury yields, and US major benchmark indices have all fallen now to within striking distance of June lows. My thinking is that there’s a good likelihood of a retest of lows in QQQ, while SPX gets close, before rebounds happen starting the first week of October.”

Head of Quantitative Strategy Adam Gould

“Stocks are continuing to move in tandem, presenting a difficult environment for stock-picking. Pairwise correlations continue to rise, while idiosyncratic risk (the share of movement of the typical stock attributable to stock-specific drivers) was falling for the past few months, only turning up slightly in the past week (second chart). This is important for long only’s and long-short funds as it is more difficult for them to pick winners and beat the market when stocks are moving in tandem.”

Head of Digital Assets Sean Farrell

“The CPI print and subsequent Fed actions have led to an increase in correlations between crypto and equities. We note that October (next week) has been a historically bullish month for crypto. Relative strength in crypto compared to equities could signal a tactical bottom. Despite a partial reversion of the ETH/BTC relative value trade, governance tokens for liquid staking providers have held up quite well, and we would expect them to continue to do so as staking adoption continues into year-end.”