CPI Comes In Above Expectations, Powell Confirmed

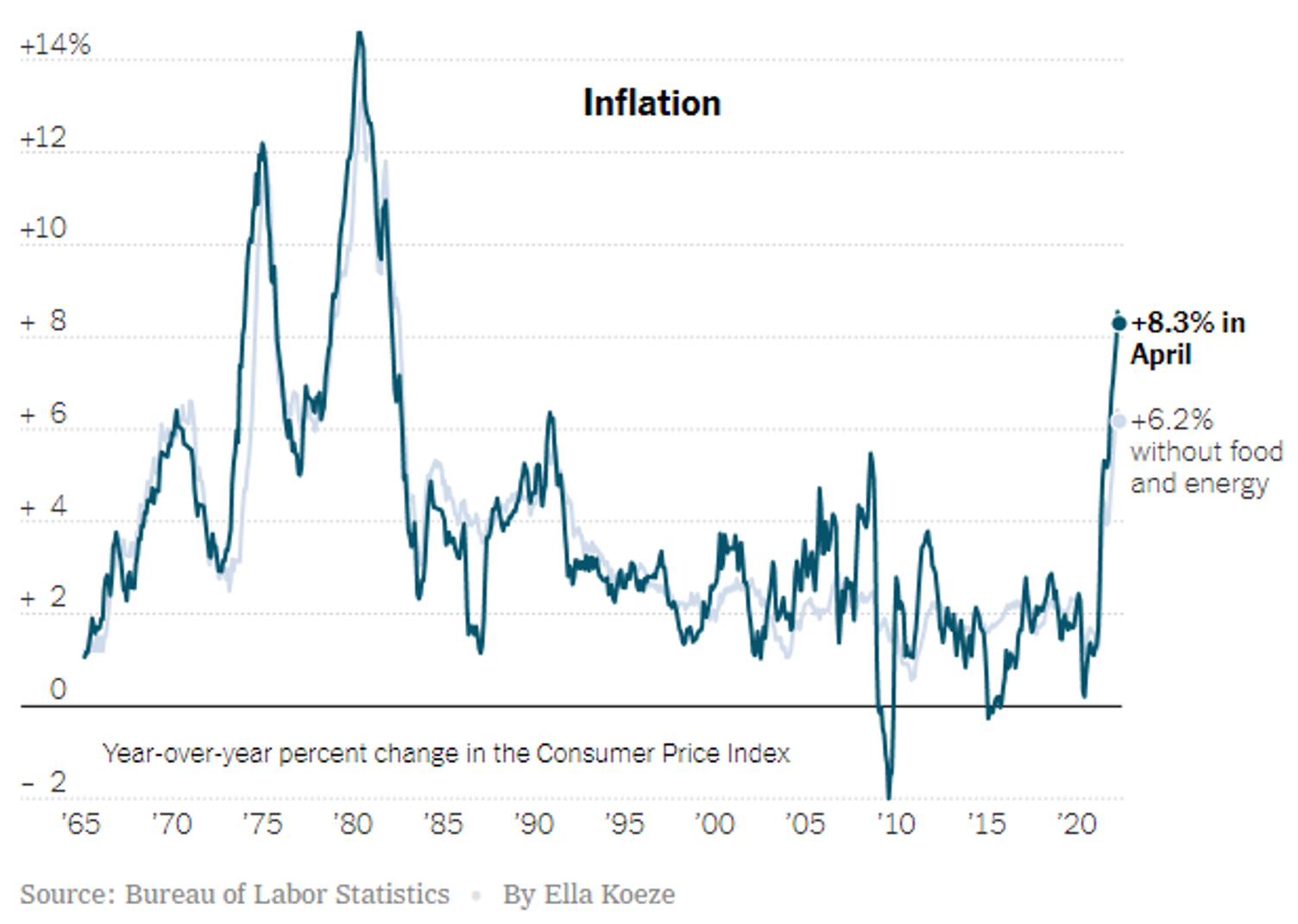

As inflation remains near its fastest rate in nearly 40 years, the Federal Reserve continues to signal its hawkish stance for 2022. Inflation began to accelerate last spring, but Fed policymakers initially thought price gains would quickly fade. Though it became clear in the fall that fast inflation was proving to be more lasting, the Fed pivoted toward rapidly removing policy support only in late November and didn’t raise rates until March.

Some Federal Reserve officials have begun to acknowledge that they were too slow to respond to rapid inflation. That delay is forcing them to constrain the economy more abruptly. Jerome Powell, the Federal Reserve chair, said this week that lowering inflation is likely to be painful, but that allowing price gains to persist would be the bigger problem. Powell, whom Senators confirmed to a second four-year term at the head of the central bank in an 80-19 vote on Thursday, holds one of the most consequential jobs in the United States and in a world economy with rapid inflation and deep uncertainty.

Consumer prices climbed 8.3 percent in April from the previous year, according to data reported on Wednesday. The Fed has already begun raising interest rates to try to cool the economy, making its largest increase since 2000 when it lifted borrowing costs by half a percentage point this month. Powell and his colleagues have signaled that they will continue to push rates higher to restrain spending and borrowing and drive down inflation.

“The process of getting inflation down to 2 percent will also include some pain, but ultimately the most painful thing would be if we were to fail to deal with it and inflation were to get entrenched in the economy at high levels,” Powell said this week in an interview with Marketplace. “That’s just people losing the value of their paycheck to high inflation and, ultimately, we’d have to go through a much deeper downturn.”

The U.S. economic outlook has continued to weaken, and inflation is set to remain higher than previously expected for a while, a Federal Reserve Bank of Philadelphia survey of professional economic forecasters showed Friday. Real GDP is forecast to grow at a 2.3% annual rate this quarter, down 1.9 percentage points from the last survey three months ago, with the annual rate seen falling to 2.3% next year and 2.0% in 2024, both lower than the previous estimate. All of this uncertainty has helped drive markets lower; the stock market abhors uncertainty. Here’s our Brian Rauscher, head of global portfolio strategy:

“I think it’s going to be very difficult for markets to run to the upside if the Fed is going to have more resolve. This is a very, very strong headwind the market will run into it. It will continue to pressure the markets to the downside…We’re going to get a great buying opportunity, it’s just still in front of us.”

Powell, who was chosen as a Fed governor by former President Barack Obama and then elevated to chair by former President Donald J. Trump, was renominated by President Joe Biden late last year. This is a midterm election year, of course, and numbers going back more than a century show that the second year in a president’s term has generally been the weakest for the stock market. Consider that the market soared early in Donald J. Trump’s presidency, but it hit a wall in 2018, the midterm year.

It’s clear the Fed has recognized that inflation has gotten out of control and must be significantly slowed by raising short-term interest rates and reducing its bond holdings.

This is how Powell put it on Wednesday. “Inflation is much too high and we understand the hardship it is causing, and we’re moving expeditiously to bring it back down,” he said. “We have both the tools we need and the resolve it will take to restore price stability on behalf of American families and businesses.”

Elsewhere, the Dallas Federal Reserve has named a new president to succeed its former one, who left the post last year following a controversy over stock trading. Lorie K. Logan will serve as head of the central bank branch, according to an announcement Wednesday. Central bank watchers know Logan’s name well, as she currently serves as head of the New York Fed’s trading desk.

The FOMC will meet on June 14th and 15th. The yield on the 10-yr closed Friday at 2.939%. Quantitative tightening begins in June as well.