Merge vs Macro

Key Takeaways

- The Merge was wildly successful and marked a groundbreaking achievement in open-source development.

- Ethereum’s inflation rate went from 4% to 1% overnight and was deflationary on its first day as a PoS network.

- The unfortunate CPI report last week put a major dent in the tactically bullish view detailed last week. We discuss the larger implications and reasons why it might counterintuitively expedite the current tightening cycle.

- There are signs that the supply overhang from Bitcoin miners seems to be improving, meaning the leading cryptoasset may return to performing as beta to risk.

- Strategy – We are still constructive on select assets (core: BTC, ETH, SOL, merge-adjacent: LDO, RPL, OP, MATIC) through the balance of the year, however, we acknowledge that the most recent CPI report has put the market on an uneasy footing and reduced the probability of any immediate-term idiosyncratic benefits from the Merge. Our clients/members will recall us viewing downside protection as appropriate in late Q1 and Q2 of this year. The next few weeks are likely to require a similar level of risk management.

The Good

In what was undoubtedly one of the greatest instances of long-term collaboration and a celebration of human ingenuity, the Ethereum network finally converted from Proof-of-Work to Proof-of-Stake in the early morning hours on Thursday. Contrary to most of the Testnet Merges, there were essentially no hiccups, as the execution layer seamlessly merged with the Beacon Chain and miners powered down their GPUs for the final time (or migrated to another GPU-mined network).

This was an endeavor nearly seven years in the making, with countless iterations, roadblocks, and route changes along the way. As mentioned in our previous notes, regardless of price action through the rest of this year, those with an interest in crypto and who are long innovation should take a few moments to appreciate the work done by the core developers of the Ethereum network. It was a hallmark achievement for open-source development.

As anticipated, the daily issuance of ETH dropped precipitously as the inflation rate for the new PoS network is hovering just north of 1%, as compared to the 4% annualized inflation rate as of just a few days ago.

Given the uptick in activity on the network in the wake of the Merge, gas fees ticked higher. This user behavior resulted in a deflationary supply of Ethereum.

While we do not think it is reasonable to expect the network to sustain deflationary supply dynamics moving forward, this instance sheds light on how little activity will be required for the network to reach its pro-cyclical deflationary levels.

The Bad

The unfortunate news is that the Merge transpired immediately after a giant miss on CPI.

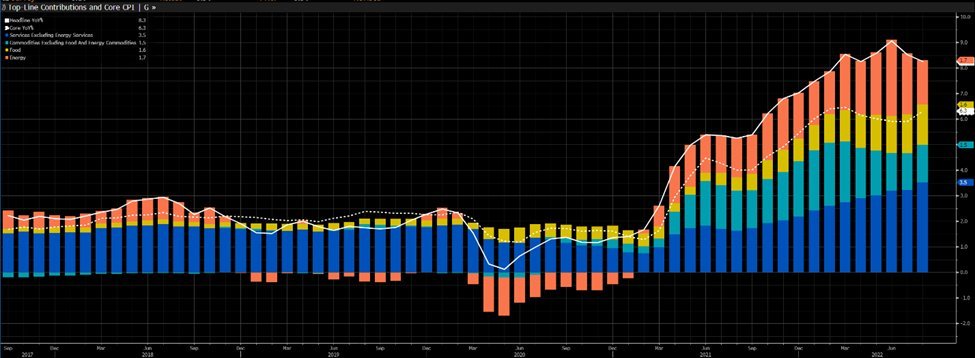

The market consensus just prior to the August CPI print was anticipating a month-over-month decline of 0.1% and a YoY topline figure of 8.1%. However, actuals missed to the upside with a monthly increase of 0.1% and a YoY CPI increase of 8.3%.

As we all know by now, what happens doesn’t matter so much as the market’s expectations of what should have happened. Therefore, despite this being the lowest annual inflation figure since April and another month of declining energy prices, the market reacted violently, selling off in a fashion not seen since June 2020.

Naturally, this put a dent in our tactically bullish outlook that we highlighted last week.

Immediately following the CPI print, we saw rates skyrocket, and the dollar regained its prowess over the rest of the world’s flailing currencies, and risk assets went without a bid.

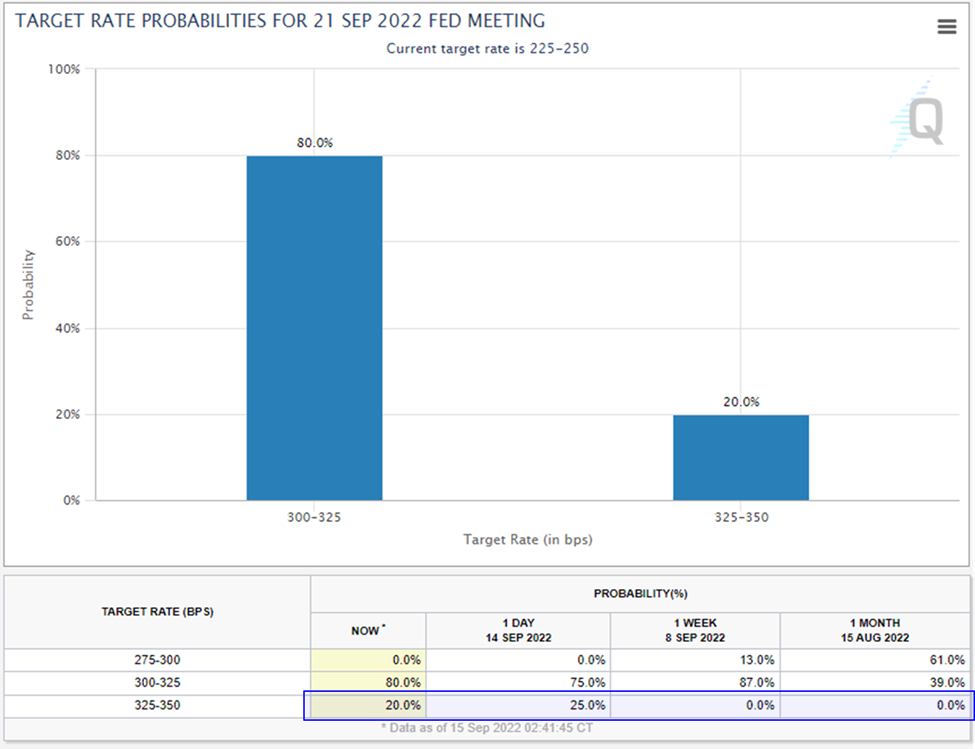

Below we see that the Fed futures market shifted its prediction for next week’s rate hikes dramatically – now pricing in a slight probability of a 100-bps hike.

Macro was back in the driver seat, a dynamic that made a divergence post-Merge less likely. Unfortunately, it took until yesterday to understand the breadth of overall market weakness. We continue to stand by the notion that ETH and the wider crypto market can diverge from equities in short stints (This is why ETH has aggressively outperformed the Nasdaq since the market bottom in June).

However, it was not to be, as ETH price action remained steady from the hours just following the event up until a few hours after the US market open.

Below we can see that there was a liquidations-fueled candle downwards from $1.6k to just under $1.5k, where ETH price currently remains.

A Reason to Be Optimistic

A topic we have talked about this year has been the supply overhang from distressed miners weighing down bitcoin relative to both Nasdaq and ETH, particularly since June.

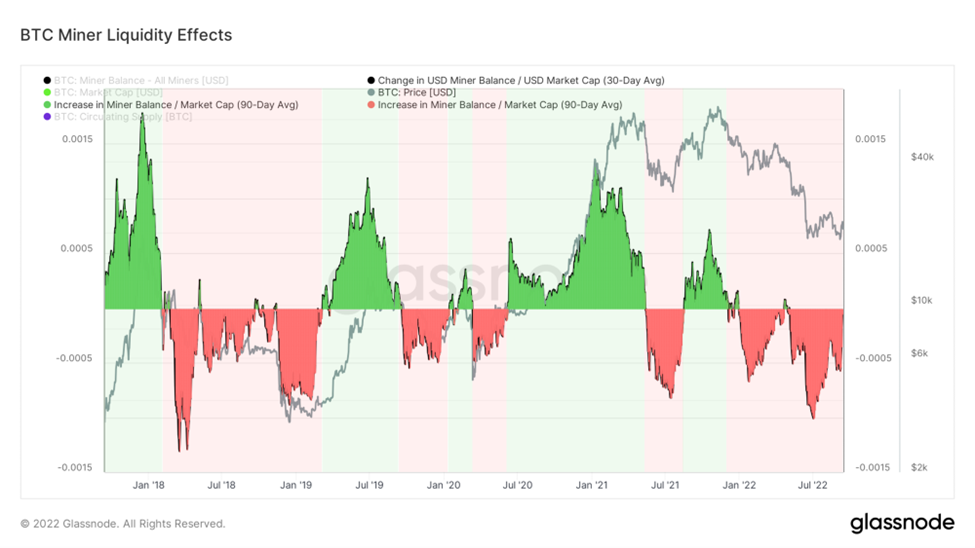

We think the chart below speaks to the importance of miner liquidity as it relates to bitcoin price action. Often, we are shown charts that show miner balance changes. These charts will show miners selling into strong markets and HODLing when prices are lower. What this metric fails to capture are miner trends relative to the current market cap (e.g. a net change of 10,000 BTC over 90 days at the height of a bull market is less impactful than a net change of 10,000 BTC when the price is lower.

The chart below represents the 90-day average of the change in miner balances in USD terms divided by the bitcoin market cap. Adjusting miner balances for price paints a picture in which miner selling is tightly correlated with price weakness. One could even reason that miner selling is a major impetus for drawdowns in BTC price.

The prior few months show a pronounced net-negative change in miner balance relative to BTC market cap. But importantly, we can see that the line is trending higher, meaning the impact relative to the current market cap is decreasing. This could be a sign that BTC may cease underperforming other risk assets moving forward.

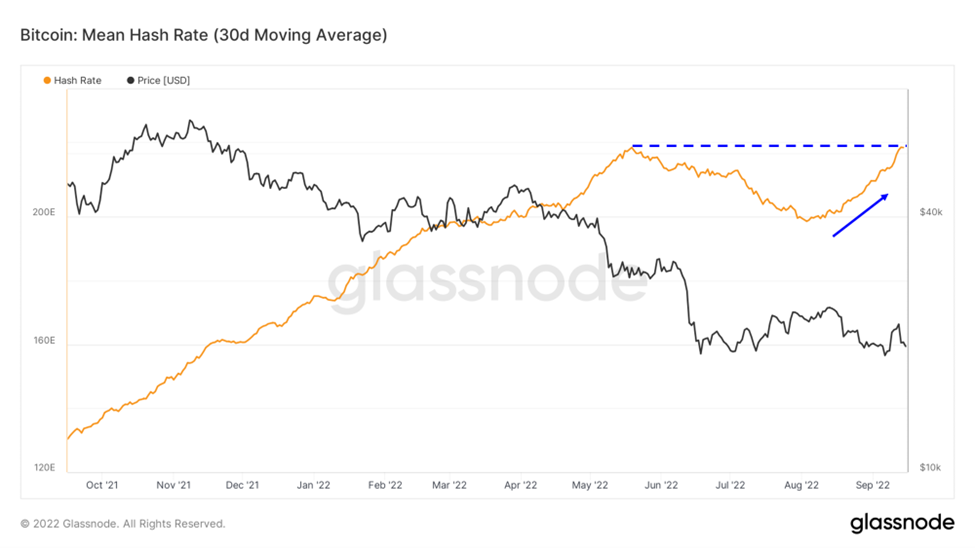

The chart above is corroborated by hash rate, which showed a sharp decrease from June through August as many unprofitable miners were forced to power down their ASICs and sell their BTC to service debt and pay for expenses.

In a positive turn of events, hash rate has reversed trend and, using a 30-day moving average, has reached a new all-time high.

In a similar light, mining difficulty has also reached a new ATH, indicating that the competition for bitcoin blocks is heating up again.

Closer to a Pivot?

Despite the increase in money supply over the past several years, it has become an accepted fact that supply-side constraints have played an outsized role in the unanticipated bout of sticky inflation over the previous few months. With that in mind, the Fed’s desire to reel in inflation can only be achieved via stifled demand. Interest rates are less about anchoring the market with a healthy cost of capital and more of a blunt tool that the Fed has at its disposal to get people to stop spending money. Thus, a market that expects demand to remain sticky is also a market that expects a prolonged tightening regime.

It is somewhat counterintuitive, but it is our view that this hot CPI print actually pulls forward the timeline of a Fed pivot because it resets the clock for the Fed to prove that inflation is falling at a substantial rate. With increased expectations of inflation come increased expectations of rate hikes, reduced liquidity in the bond market, and further volatility, which should, in theory, result in demand falling precipitously. This could end in rapid disinflation or even deflation in short order.

Strategy

We are still constructive on select assets (core: $BTC, $ETH, $SOL, merge-adjacent: $LDO, $RPL, $OP, $MATCI) through the balance of the year, however, we acknowledge that the most recent CPI report has put the market on an uneasy footing and reduced the probability of any immediate-term idiosyncratic benefits from the Merge. Our clients/members will recall us viewing downside protection as appropriate in late Q1 and Q2 of this year. The next few weeks are likely to require a similar level of risk management.

Reports you may have missed

INFLOWS RESUME On Monday, market sentiments were rattled by a surprisingly strong manufacturing PMI figure, marking the first expansionary reading in 18 months. This led to a rise in rates, with risk assets across the board experiencing selloffs amid renewed inflation concerns and fears that the Federal Reserve might need to implement further measures to cool the economy. However, in our crypto comments video on Tuesday, we outlined a couple...

Adding RON and IMX As a Different Flavor of ETH-beta and Gaming Exposure (Core Strategy Rebalance)

MARKET SHRUGS AT HOT CPI The latest Consumer Price Index (CPI) data indicated a hotter inflationary environment than forecasted for February. Despite the surprise in the numbers, market participants appeared largely unmoved, suggesting that the potential impact had already been factored into their calculations prior to the release. This resilience reflects a broader sentiment that a rates-driven selloff, in response to the CPI figures, is not a significant near-term risk....

RESEND: Bitcoin ETF Equilibrium Price Dynamics: ETF likely to drive significant rise in daily demand

BY POPULAR DEMAND, WE ARE RE-SENDING THIS BITCOIN PRICE IMPACT OF SPOT ETF REPORT FROM JULY 24, 2023 The Bitcoin spot ETF was finally approved. And we are seeing the surge in price of Bitcoin because of attractive supply and demand dynamics.We received multiple requests to resend this report from July 24, 2023 which looked at supply and demand dynamics if a spot ETF was approved.In short, we believe a...

FLOWS BEGET MORE FLOWS We have recently discussed the potential return of crypto being correlated with equities due to the new category of market participants entering the fold. However, price action this week suggests that inflows into the BTC ETFs may be throwing water onto that theory. It seems apparent that, at least in the near-term, that the ETF flows narrative is gaining steam, and it is likely that the...