The Final Countdown

Key Takeaways

- Just a few days out from the Merge, we discuss why in addition to being fundamentally constructive, there are tactical reasons to be bullish ahead of next week.

- In the face of an admittedly uncertain macro picture and in the wake of a traumatizing string of liquidations throughout the crypto industry, we continue to believe that the long-ETH trade is undercrowded.

- We examine ETH price action in the 180 days leading up to and following historical network upgrades to test the probability of a “sell-the-news” event.

- Despite those bearish on the Merge due to tight correlations between ETH and macro, data shows that short-term deviations between ETH and tech stocks happen more frequently than many think.

- Strategy – We continue to be long BTC, ETH, and SOL into year-end and think that Merge-adjacent names, including LDO, RPL, OP, and MATIC, still present attractive opportunities for high-beta exposure into the Merge. Investors should look to use any dips as buying opportunities.

Fasten Your Seatbelts

Just like that, we are less than a week away from one of the most consequential events in crypto history. If you are tired of hearing us talk about the Merge, trust us when we say we are also somewhat fatigued and are excited for what lies ahead for crypto in the post-Merge era.

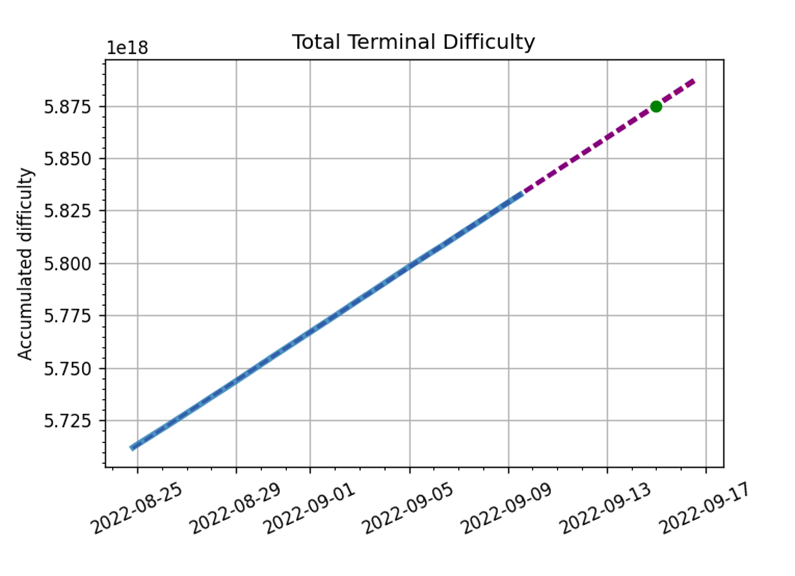

As of writing, the Merge is scheduled to take place on Wednesday, September 14th. However, as you probably know, this is subject to change since the Merge is enacted at a cumulative difficulty level (Total Terminal Difficulty) and not on a specific calendar date.

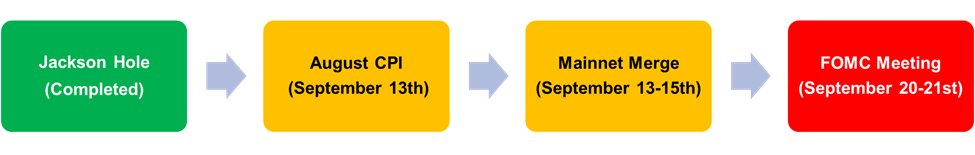

Regardless of the exact timing of the Merge, next week should be eventful.

Below is the timeline we have repeatedly referenced in our weekly notes. We can see that the August CPI and Mainnet Merge continue to move closer together. Based on how the TTD has moved this week, there is a realistic scenario in which the Merge transpires on the same day as the August CPI print, which would undoubtedly make for a wild trading session.

For those wishing to track the projected Merge date in real-time, you can do so here.

Sentiment Has Taken a Beating

Despite simply reiterating the Fed’s message from the preceding six months, Fed Chair Powell’s concise speech at Jackson Hole a couple of weeks ago took the wind out of the market’s sails and has led to a sizeable pullback in both crypto and equity markets.

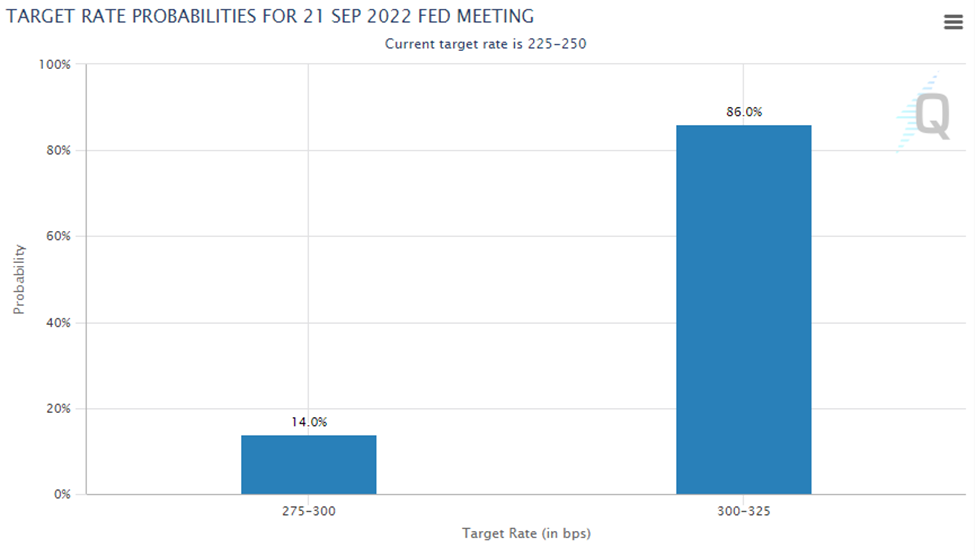

Since then, we have seen rates rise, and the dollar gain strength in concert with falling asset prices. As one would expect, the market is now pricing in a 75-bps rate hike at the September FOMC meeting by a comfortable margin.

Sentiment, while not necessarily constructive to begin with, took a nosedive as well.

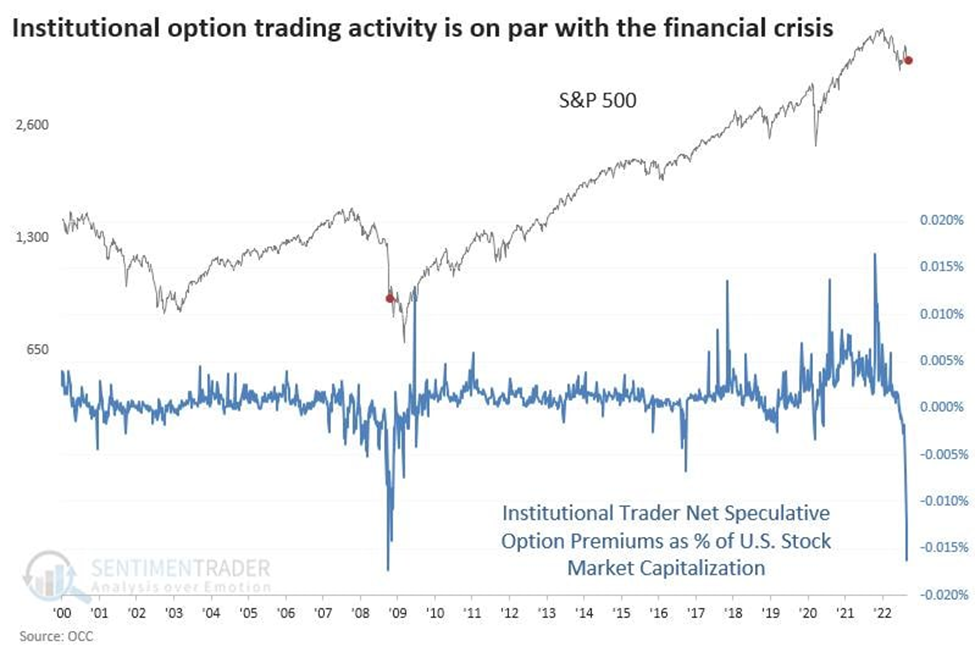

We found the chart below shared on Twitter by @SentimenTrader particularly astonishing. Options positioning last week was the most bearish since the GFC as investors seemingly rushed to buy downside protection.

This is likely why we have seen some immediate-term relief in equities as we speculate that there has been a good deal of short covering the past couple of days.

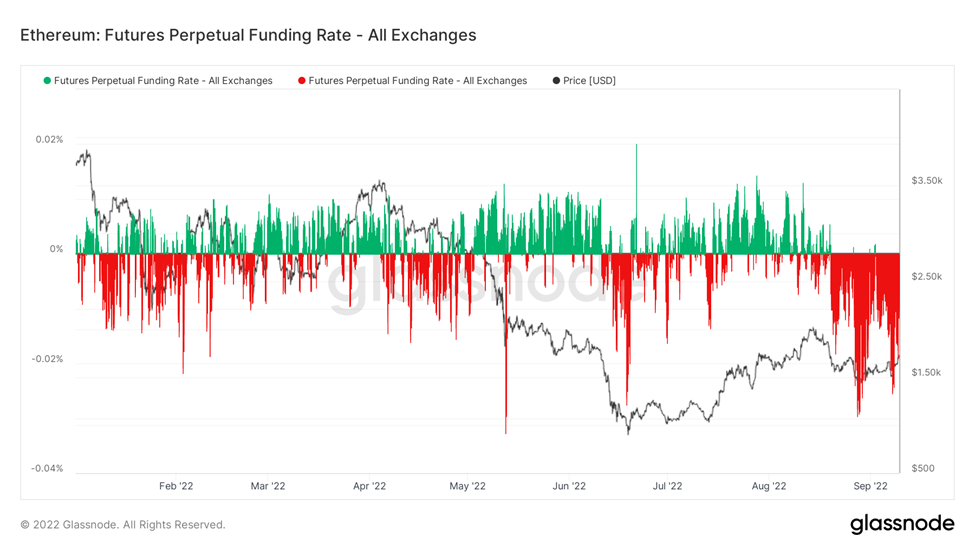

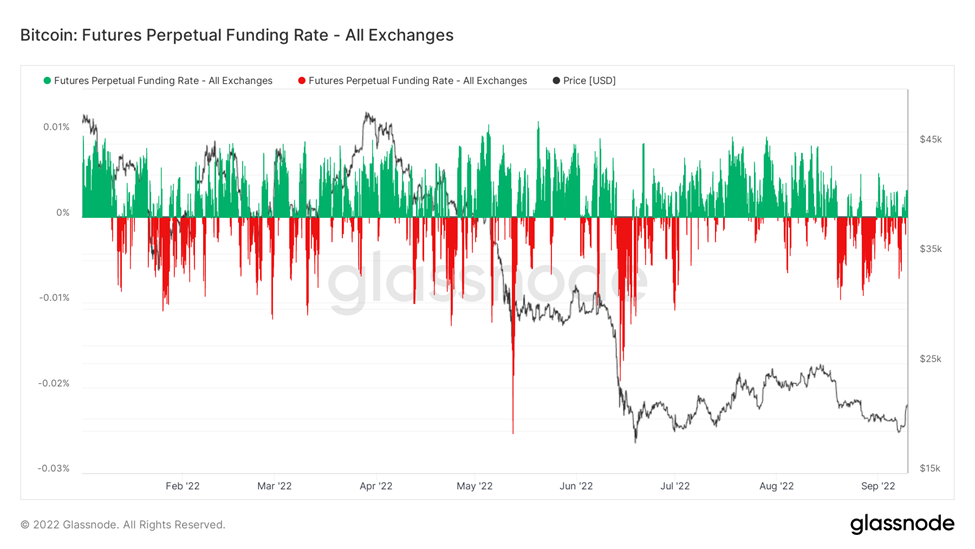

In crypto markets, we see a similar desire to hedge to the downside, as aggregate funding for ETH continues to skew negatively. Indeed, a portion of the negative funding can be attributed to the desire to remain delta neutral into the Merge and farm for a potential forked ETH token.

However, this is an incredibly expensive hedge that we think traders would not pay if they were remotely constructive on asset prices.

To corroborate the fact that the negative funding can at least partially be attributed to bearish sentiment, we can see that funding for bitcoin, while certainly more mixed than ether, has skewed negative over the past few weeks as well.

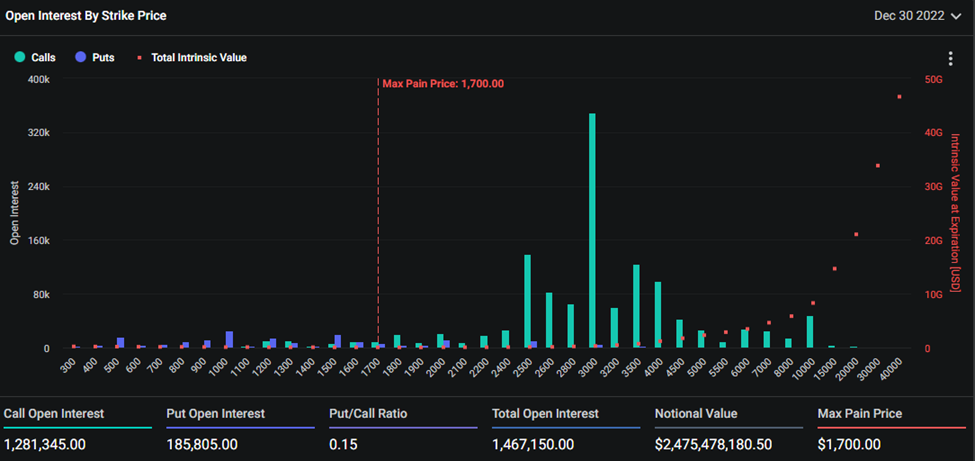

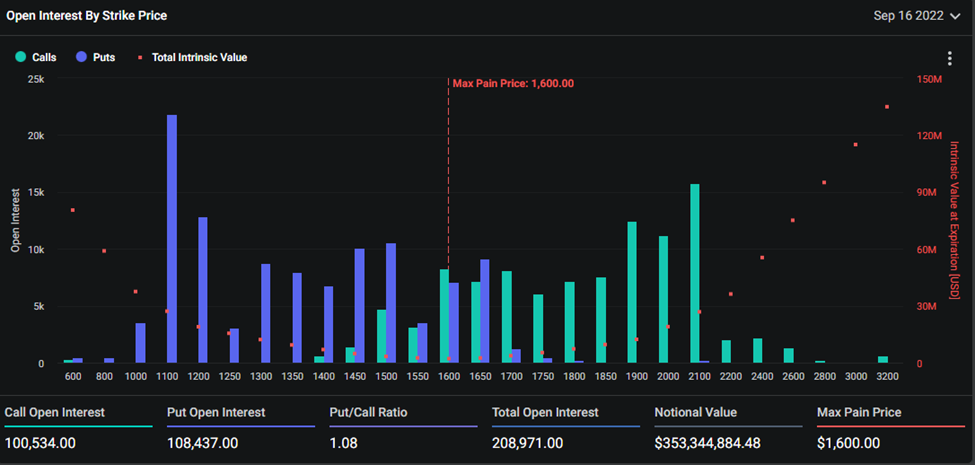

Many cite a decreasing put/call ratio in the ETH options market as a sign that traders are positioned for bullish price action around the Merge. While it is true that open interest (OI) for calls has been increasing at a greater rate than the OI for puts, a significant portion of the notional value outstanding is for December contracts. Interestingly, December OI features a put/call ratio of 0.15.

Looking at how traders are positioning for next week specifically, we see a much more balanced picture, with weekly contracts expiring September 16th with a put/call ratio of 1.08.

Thus, we are still confused at the notion that there is a horde of capital leveraged long into the Merge.

In the face of an admittedly uncertain macro picture and in the wake of a traumatizing string of liquidations throughout the crypto industry, we continue to believe that the long-ETH trade is undercrowded.

Tactically Constructive Setup

Given the recent rise in the US dollar, increase in interest rates, and dire sentiment throughout both equity and crypto markets, we think this presents a tactically constructive outlook over the short term.

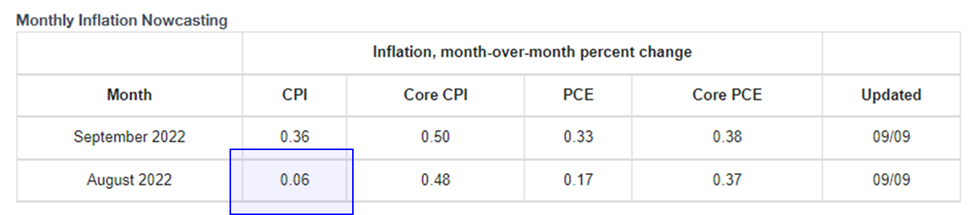

Despite rate expectations increasing, we see below that inflation is now forecast to come in virtually flat for the second consecutive month.

Obviously, YoY CPI is still elevated and will take some time to recede. But we care about the rate of change and results relative to market expectations. It is difficult for us to imagine a market that does not look favorably upon another flat CPI print.

Beyond economic data that might lead to relief in the dollar’s recently acquired strength, we have good reason to be short-term bearish on merely a technical basis.

Our Head of Technical Strategy Mark Newton noted this week that despite a longer-term pattern that remains constructive, the relentless surge in the $DXY is due for a much-needed pullback.

From his report:

US Dollar strength has continued nearly unabated in 2022 and is one of the few things that have worked whether it’s due to interest rate differentials or the threat of weaker economic growth in Europe due to Energy woes (which is thought to be detrimental to $EURUSD but looks to be largely baked into prices at this point).

It looks likely that recent strength will not continue unabated, as $DXY has arrived at important levels which require some consolidation. Charts of $USDJPY, $EURUSD and $GBPUSD all have arrived at levels which likely produce reversals of trend in the month of September.

While a Dollar peak is likely to prove short-term in nature, (1-2 months maximum potentially for now) markets might greet that favorably in the weeks/months to come. It’s expected that once a selloff happens over the next couple months, that $DXY likely pushes back higher into next year before a more meaningful intermediate-term peak.

Daily $USDJPY charts show Dollar/Yen to have arrived at important short-term resistance near $145. The area of red channel resistance should provide strong overhead resistance which causes a retreat in $USDJPY to under 140 but should not violated $135 before turning back higher. It’s thought that potentially ultimate targets might arrive near $147.50-$148.50 and provide a chance to finally buy Japanese Yen.

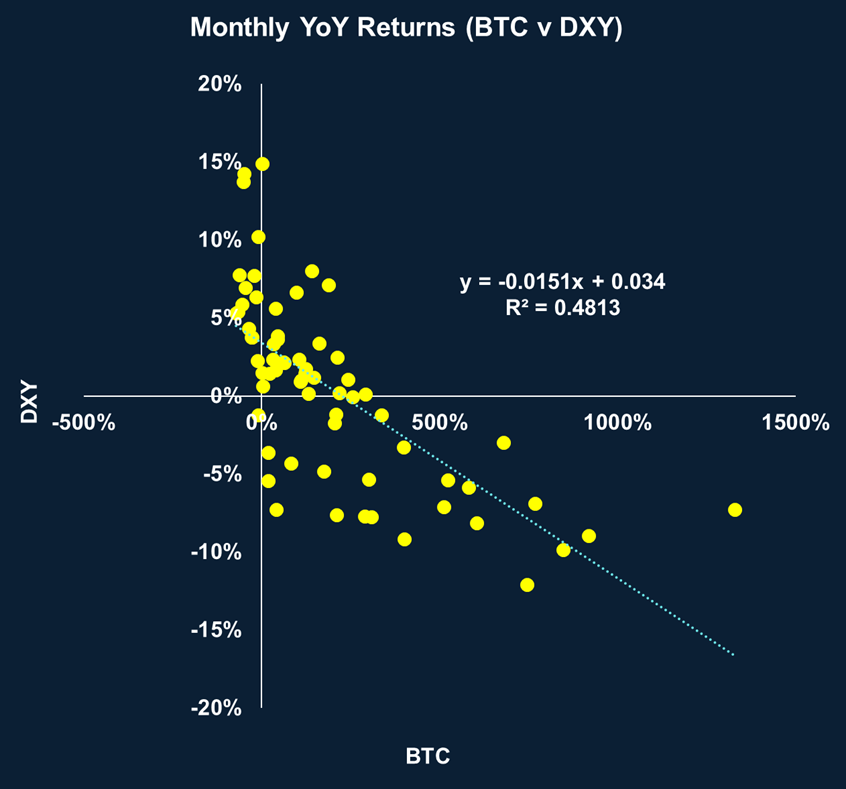

As a reminder, the dollar is one of the more important factors in assessing the environment for crypto. Below is a chart we like to roll out quite frequently. It charts monthly YoY returns for the dollar and bitcoin since 2016. Needless to say, the relationship between the dollar and bitcoin is quite strong.

Post-Merge Strategy

We certainly do not want to put the cart before the horse. We still think the next few weeks will be a time to read the market and react based on new information. However, that shouldn’t preclude us from making a plan. After the Merge, assuming it goes well, how should we think about playing our hand?

The media and the louder voices on Twitter have universally proclaimed it a sell-the-news event.

On its surface, this perspective does make a lot of sense. If we used bitcoin, the asset that has historically led crypto markets, as a proxy, we would agree that anticipating a sell-the-news event is entirely rational. After all, bitcoin has sold off on significant news events in the past.

For example, the Coinbase IPO in 2021 marked the local top of the crypto bull market before selling off over the summer, and the highly anticipated launch of bitcoin futures on the CME in 2017 marked the pico-top of the prior crypto cycle.

However, we would push back against this logic since no prior “sell-the-news” event for bitcoin was as material to the underlying protocol as the Merge is to Ethereum. We could look to bitcoin halvenings as reasonable comparison tools, but since Ethereum has its own history of material network upgrades, we can simply analyze price action around those.

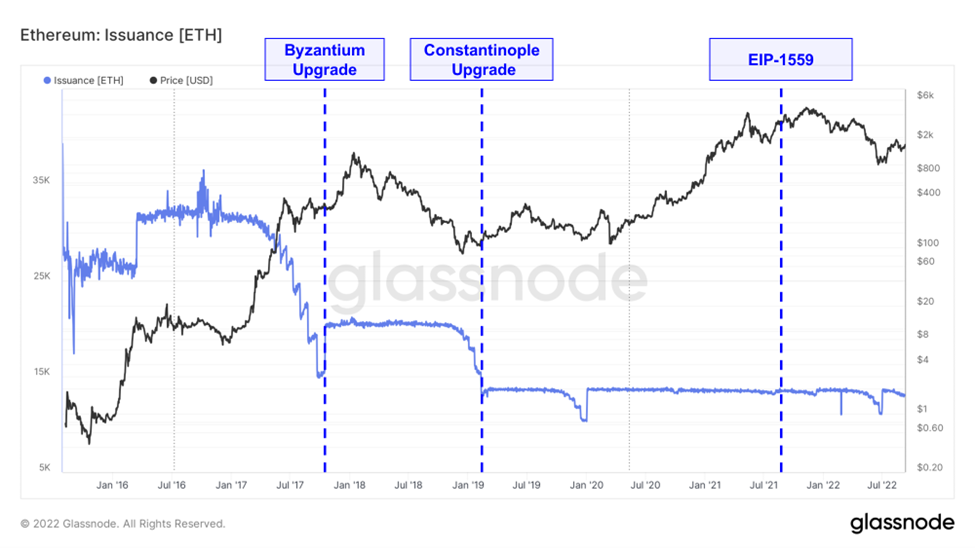

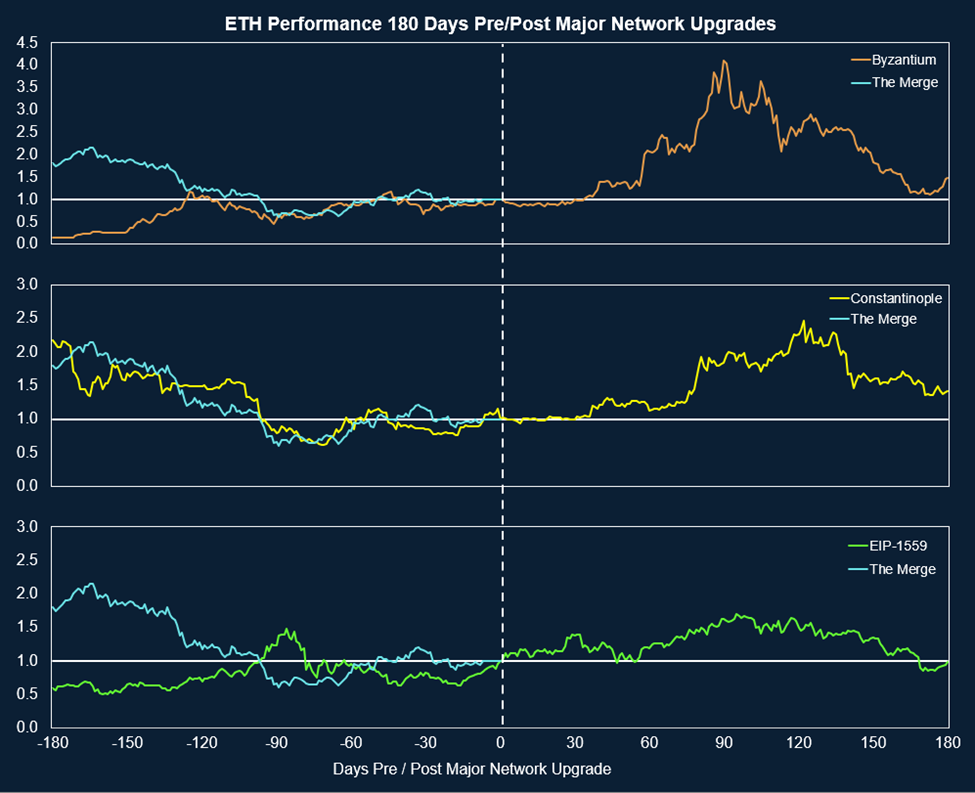

The three major network upgrades that have materially affected ETH supply dynamics:

- The Byzantium Upgrade in 2017 decreased the PoW block reward from 5 ETH/block to 3 ETH/block.

- The Constantinople upgrade in 2019 decreased the PoW block reward from 3 ETH/block to 2 ETH/block.

- EIP-1559, which enacted a fee burn mechanism, de/disinflating supply at a rate dependent upon network usage.

If we examine ETH price action in the 180 days leading up to and following these network upgrades, we see that none have been apparent “sell-the-news” events.

While all three events are built differently, all have generally had net-favorable price action following each network upgrade. We note that the Constantinople and Byzantium upgrades were quite positive for ETH price but did take nearly a month to materialize.

The obvious pushback here would be that these upgrades all took place during a different macro regime for risk assets. We did not have a Fed intent on stifling demand via restrictive policy coupled with rampant inflation and a war raging in the Ukraine leading to a potential energy crisis in Europe.

However, this assertion would be somewhat incorrect insofar as it lacks the important nuance that the Byzantium and Constantinople upgrades did take place during a Fed tightening regime. Rates were rising, and the Fed was attempting to wind down its balance sheet putting pressure on risk assets.

Short-term Correlations Deviate Frequently

One variable that we would agree is radically different now is the tight correlation between macro and crypto markets. Cryptoasset prices were not nearly as closely tied to macro data back in 2017 and 2019.

This leads to an important question commonly prompted by Merge bears – assuming the dollar doesn’t roll over, inflation doesn’t come in soft, and macro continues to flounder, does that mean that ETH will be unable to outperform other risk assets?

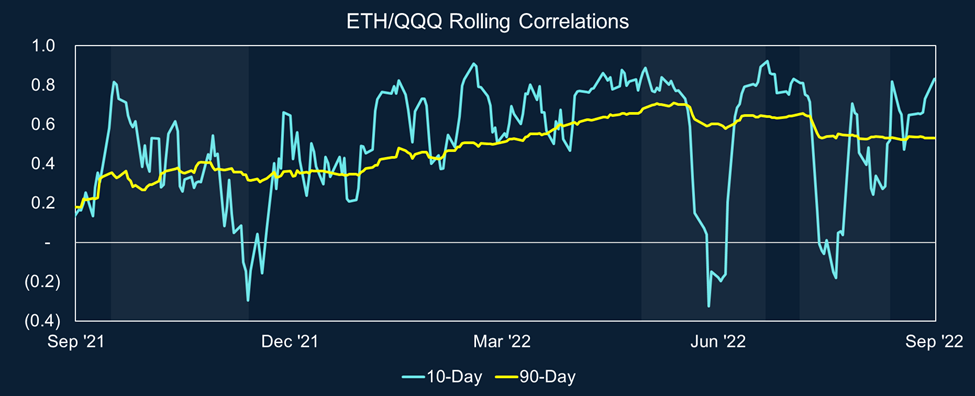

In short, we think a recent history of solid correlation to tech stocks does not preclude ETH from outperforming in the near term. Recent data shows that short-term deviations between ETH and tech stocks happen more frequently than many think.

Below we see that the rolling 90-day correlation between QQQ and ETH has been relatively strong over the prior 12 months. However, as represented by the shaded areas of the chart, we have seen periods of substantial short-term decoupling between equities and ETH.

Some decoupling events have been to the downside, others to the upside, but the point here is that a long-term correlative trend can persist while having repeated short-term deviations from that trend. Thus, if anyone tells you not to allocate ahead of an event due to tight macro correlations, this is missing a key variable in the equation.

Strategy

To summarize, we continue to be long ETH into the Merge, using dips as buying opportunities. Our approach following the Merge will be adaptive to new information, but at a high level, we have no reason to place confidence in a sell-the-news event.

If prices rip we will likely look to partially de-risk due to macro factors but will maintain a significant allocation due to impending favorable tailwinds from changing supply dynamics. Suppose ETH price pulls back due to technical complications (which we view as a low probability) or unforeseen macro news that causes a rush to cash (war escalation, CPI at 15%, etc.). In that case, we will use that opportunity to buy lower and wait for the constructive effects of flow dynamics.

We continue to be long $BTC, $ETH, and $SOL into year-end and think that Merge-adjacent names, including $LDO, $RPL, $OP, and $MATIC, still present attractive opportunities for high-beta exposure into the Merge. Investors should look to use any dips as buying opportunities.

Reports you may have missed

INFLOWS RESUME On Monday, market sentiments were rattled by a surprisingly strong manufacturing PMI figure, marking the first expansionary reading in 18 months. This led to a rise in rates, with risk assets across the board experiencing selloffs amid renewed inflation concerns and fears that the Federal Reserve might need to implement further measures to cool the economy. However, in our crypto comments video on Tuesday, we outlined a couple...

Adding RON and IMX As a Different Flavor of ETH-beta and Gaming Exposure (Core Strategy Rebalance)

MARKET SHRUGS AT HOT CPI The latest Consumer Price Index (CPI) data indicated a hotter inflationary environment than forecasted for February. Despite the surprise in the numbers, market participants appeared largely unmoved, suggesting that the potential impact had already been factored into their calculations prior to the release. This resilience reflects a broader sentiment that a rates-driven selloff, in response to the CPI figures, is not a significant near-term risk....

RESEND: Bitcoin ETF Equilibrium Price Dynamics: ETF likely to drive significant rise in daily demand

BY POPULAR DEMAND, WE ARE RE-SENDING THIS BITCOIN PRICE IMPACT OF SPOT ETF REPORT FROM JULY 24, 2023 The Bitcoin spot ETF was finally approved. And we are seeing the surge in price of Bitcoin because of attractive supply and demand dynamics.We received multiple requests to resend this report from July 24, 2023 which looked at supply and demand dynamics if a spot ETF was approved.In short, we believe a...

FLOWS BEGET MORE FLOWS We have recently discussed the potential return of crypto being correlated with equities due to the new category of market participants entering the fold. However, price action this week suggests that inflows into the BTC ETFs may be throwing water onto that theory. It seems apparent that, at least in the near-term, that the ETF flows narrative is gaining steam, and it is likely that the...