The Tide Pulling Out

Key Takeaways

- The combination of macro forces and over-leveraged yield strategies has resulted in the forced selling of cryptoassets over the past couple of days, wiping over $200 billion in value from the crypto market. Yesterday was the single biggest decline for bitcoin since March 2020.

- We provide an update on the macro landscape, as the US 10Y bounces higher, the DXY strengthens, and oil reaches a level not seen since the GFC. Bids across all asset classes remain elusive as the market grapples with an impending 75 bps rate increase.

- We examine the unwind of Celsius, quasi-decentralized crypto lending and borrowing platform, which locked user funds on the platform on Sunday evening, causing market-wide distress. We address whether we think there is still contagion risk in the market.

- Strategy – In the near term, it is still smart to remain cautious and protect your downside. However, as we have discussed recently, we are approaching the area of deep value for bitcoin (and soon, potentially some other leading cryptoassets). To reiterate our current stance, we maintain that it is wise to reduce exposure to altcoins and hedge long exposure in the immediate term (1-month). However, we are still constructive on cryptoasset prices in 2H. Importantly, we think this is the time for medium and long-term investors (1+ year) to consider allocating to bitcoin more aggressively.

The Bloodbath

The bloodbath that has persisted for the better part of the past seven months continued this weekend, with the market shedding an additional $200 billion in total market cap, falling below the $1 trillion mark for the first time since late 2020. Yesterday was the single biggest decline for bitcoin (-16%) since March 2020. At the time of writing (early morning hours of June 14th), there have been a total of $1.2 billion in liquidations of leveraged positions in the futures market.

We are witnessing a combination of macro forces and over-leveraged positions in the market to result in the forced selling of BTC and ETH.

First, a couple of notes on the macro landscape.

Rates

On Monday, we saw the yield curve invert briefly, for the second time this year, as the 10Y-2Y went negative.

Meanwhile, the US10Y has climbed to above 3.3% for the first time in over a decade. This is a 560% increase in the 10Y rate since August 2020. When keeping in mind how rapidly rates have increased, it is no wonder that asset prices have tumbled so precipitously. Analysts around the globe are being forced to adjust their cash flow and credit risk models in response to the sudden reappearance of a cost of capital. Thus, risk assets are being repriced accordingly.

Perhaps the essential macro variable in this whole mess, oil, is now up to over $120 per barrel, a level last reached in March 2022, but before that not witnessed by the market since the GFC. The structural shortage of oil is not only sending energy and transportation prices sky-high but also the price of any finished goods that use oil in their production process.

Then there is the dollar index ($DXY), which has swung higher once again, eclipsing the 105-mark, on the back of further tightening from the Fed coupled with a weakening EUR and JPY. As we discussed a couple of weeks ago, the DXY is a good proxy for the level of liquidity in the market. The higher the DXY is, the lower the relative liquidity in the system. Given the rapid rate of change in liquidity conditions, there is no wonder that risk assets continue to sell off, and the dollar continues to perform strongly.

(As a side note, we still think that the dollar is in the process of peaking, and lower forward returns for the dollar should bode well for bitcoin.)

Because of the variables highlighted above, which all generally point to a shaky macro situation – tightening liquidity conditions, higher cost of goods, higher cost of capital – we have seen Nasdaq shed another 10% over the past week.

But it is not just risk assets that aren’t getting a bid anymore.

Yesterday, just five stocks out of the entire S&P 500 closed the day green.

Mortgage-backed securities, an asset class that is talked about much less, also signal further rate and default risk after going “no-bid” post-Friday’s outrageous CPI print.

Celsius Unwind

One could argue that the “bottom” for any crypto market cycle is never truly in until all unhealthy leverage is wiped clean from the system, and the market can start to rebuild more sustainably. We were all witnesses to the dramatic unwinding of $UST a short month ago, in which subsidized loans on Anchor led to leveraged positions stacked on top of leveraged positions, which all came to a head when the UST peg started to unravel.

Over the weekend, we saw the beginning of a second instance of a bad actor being taken to the woodshed in the lending platform Celsius.

Celsius was built as a platform for users to lend and borrow crypto. It is a centralized company with decentralized window-dressing that uses a token ($CEL) to promote user growth in a similar way that Anchor’s token $ANC was used to promote UST’s growth. When visiting their website, you are prompted with inflated earning rates that rival the rates touted on Anchor. And while the company also purported to be transparent, much of its activity was done off-chain and was purposely obfuscated to avoid scrutiny.

Celsius is also not a stranger to controversy. Exactly one year ago, leading custodian Prime Trust severed its relationship with the company due to the apparent “endless” rehypothecation of user collateral. While traditional broker-dealers regularly rehypothecate user collateral, there are limits and reporting requirements for this behavior.

While details remained undisclosed, it is likely that Celsius was double and triple-dipping their user collateral by staking it in illiquid assets (such as the $ETH beacon chain via Lido), borrowing additional capital using staked ETH ($stETH), and repeating that process until leverage was maximized so that it could make Celsius users whole on the promised APR of 18.6%.

The collateral tied up in these yield-generation strategies likely included a large UST position, which inevitably started the company’s woes. Further, it appears they also have a massive amount of user capital tied up in stETH, the derivative instrument investors receive when staking to the Ethereum beacon chain.

While stETH, which can be redeemed for 1 ETH upon the release of ETH from the beacon chain, has historically maintained pricing parity with the underlying ETH asset, recently forced selling of stETH has knocked the ratio out of whack, with stETH trading below the price of ETH. If this is tough to follow, just understand that Celsius had outstanding loans collateralized by stETH, and recent market dynamics have lowered the value of any collateral denominated in stETH, putting borrowers in a precarious position.

As asset prices continued to decline, the company faced a significant asset/liability mismatch as the collateral on all its loans fell in value. Given both the overall outlook for asset prices and some canaries in the coalmine, many users started withdrawing their assets from the platform. Thus, the assets Celsius would normally rehypothecate to true-up collateral were depleting. The company was forced to take dramatic action and suspend swaps, transfers, and withdrawals, leaving user assets stuck on the platform. Unfortunately, as asset prices continued to slip and negative sentiment created a positive feedback loop, many users were forced to commit additional capital so that they would avoid liquidation.

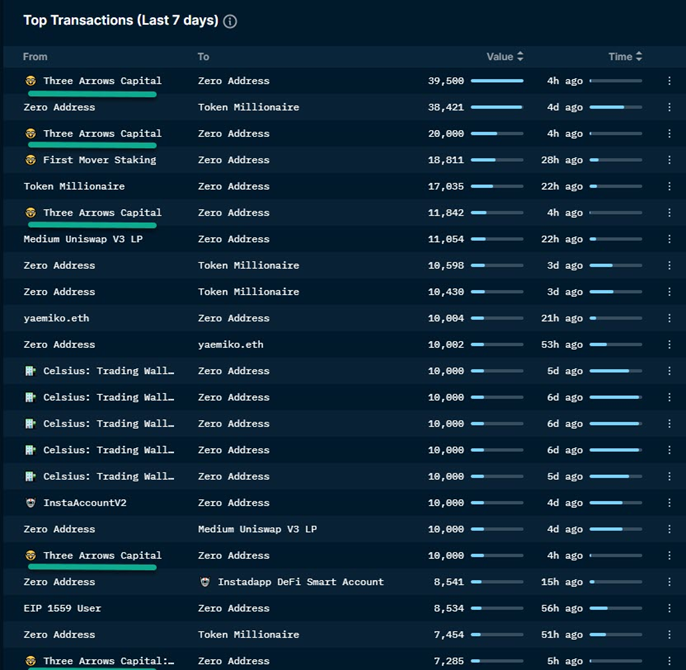

On Monday, Celsius’ publicly identified wallet addresses were starting to be monitored, which removed any bids from the market.

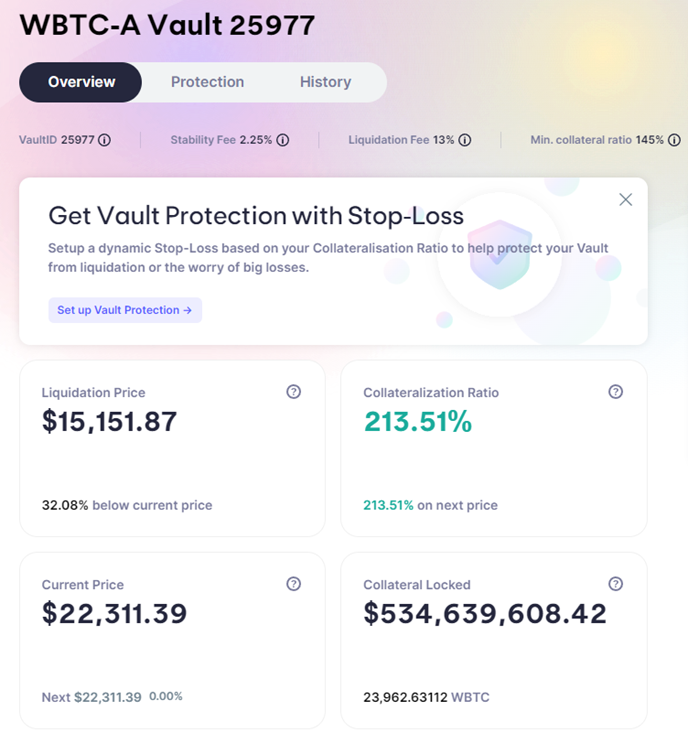

Below, we can monitor one of their on-chain loans collateralized by $WBTC (wrapped BTC on the Ethereum blockchain). Many traders observed this vault as the collateral ratio plummeted towards liquidation territory. Since halting withdrawals, the company has used capital from recent liquidations and additional committed user capital to avoid a complete wipeout.

With a liquidation price now around $15k WBTC, it looks like the company might remain solvent for the time being. Should we see prices continue to fall, this is a public vault that we will be monitoring for the next leg down.

The Lessons

In summary, the takedown of UST and Celsius is long-term constructive for the industry. Such public displays of ignorant capital destruction are often overlooked in the traditional financial industry (or take a very long time to unwind). Fortunately, we have the benefit of iterating and improving at a more rapid pace. Beyond asset prices, we think there are a few major takeaways from this event:

- If your yield-generation strategies are too good to be true, that is because they probably are. Celsius was notorious for promoting “risk-free” yields on client assets but requires massive amounts of leverage coupled with risky, illiquid staking mechanisms to deliver on this promise. Unfortunately, there will be many retail investors that are rekt as a result. We empathize with these people, especially because this was a centralized player in the space, not necessarily a degen DeFi app from which you might expect suboptimal risk management practices.

- Not your keys, not your cheese. This is a common phrase in crypto circles, but like insurance or an umbrella, the difference between owned and custodied assets only becomes apparent during times of distress. Many Celsius users who thought they owned their assets are now unable to withdraw during increased market turbulence and are getting a valuable lesson. For true, uncensored ownership of one’s cryptoassets, one must own and protect their private keys.

- Leverage is your friend until it’s not. When the going is good and the money is free, no one thinks leverage can hurt them (“If I can borrow at 5% and have a guaranteed 18% yield, what can go wrong!”). In a tight environment, leverage becomes a dangerous double-edged sword that can strike when you least expect it. Always keep your head on a swivel when levering up.

Strategy

The tide is pulling out and we are seeing who is wearing their swim trunks and who is left naked. It does appear that Celsius might be on its way back to solvency. They will likely need to wind up operations but will at least save the market from further forced-selling.

That said, there are now rumors that Three Arrows Capital, a prominent investment and trading firm in the crypto industry, is also on the brink of exiting the industry. Below are some of their recent sales of stETH, as highlighted by @MoonOverlord on Twitter.

To be clear, these rumors are unconfirmed but perhaps further demonstrate that risky strategies employed by the entities highlighted today are only doable during times of favorable price action. We think it is likely that most of the contagion is cleared, but there persists a risk of additional margin calls if global risk assets continue to go without a bid.

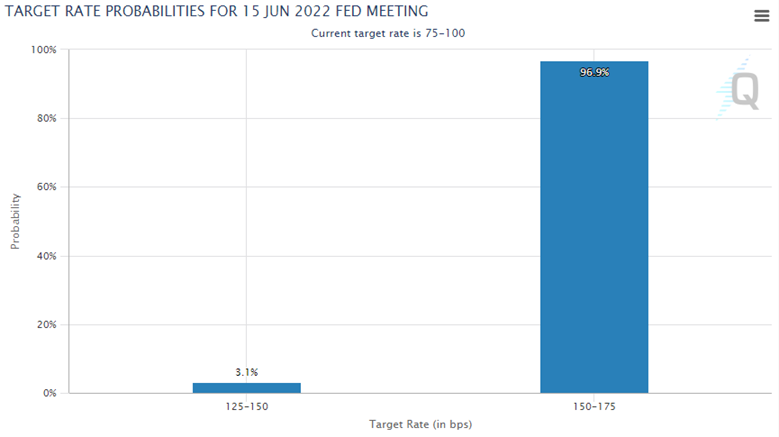

Our attention now returns to the macro landscape, which remains suspect. After a red-hot CPI print on Friday, the market is currently pricing in a 75 BPS hike tomorrow, an opportunity that the Fed will likely take advantage of. However, we have yet to see any clear signs of inflation wavering.

We think in the near term, it is still smart to remain cautious and protect your downside. However, as we have discussed recently, we are approaching the area of deep value for bitcoin (and soon, potentially some other leading cryptoassets). To reiterate our current stance, we maintain that it is wise to reduce exposure to altcoins and hedge long exposure in the immediate term (1-month). However, we are still constructive on cryptoasset prices in 2H. Importantly, we think this is the time for medium and long-term investors (1+ year) to consider allocating to bitcoin more aggressively.

Reports you may have missed

INFLOWS RESUME On Monday, market sentiments were rattled by a surprisingly strong manufacturing PMI figure, marking the first expansionary reading in 18 months. This led to a rise in rates, with risk assets across the board experiencing selloffs amid renewed inflation concerns and fears that the Federal Reserve might need to implement further measures to cool the economy. However, in our crypto comments video on Tuesday, we outlined a couple...

Adding RON and IMX As a Different Flavor of ETH-beta and Gaming Exposure (Core Strategy Rebalance)

MARKET SHRUGS AT HOT CPI The latest Consumer Price Index (CPI) data indicated a hotter inflationary environment than forecasted for February. Despite the surprise in the numbers, market participants appeared largely unmoved, suggesting that the potential impact had already been factored into their calculations prior to the release. This resilience reflects a broader sentiment that a rates-driven selloff, in response to the CPI figures, is not a significant near-term risk....

FLOWS BEGET MORE FLOWS We have recently discussed the potential return of crypto being correlated with equities due to the new category of market participants entering the fold. However, price action this week suggests that inflows into the BTC ETFs may be throwing water onto that theory. It seems apparent that, at least in the near-term, that the ETF flows narrative is gaining steam, and it is likely that the...

ETH GAINING RELATIVE MOMENTUM Given the success of Solana and Bitcoin's persistent dominance in this bull market, many have been quick to write off ETH. There is no doubt that ETH faces its own set of challenges, including a complex modular stack and potential cannibalization by Layer 2 solutions, which, while crucial to ETH's scaling roadmap, can sometimes fragment liquidity and users. Despite these issues, ETH continues to advance along...