Crypto Never Sleeps

Key Takeaways

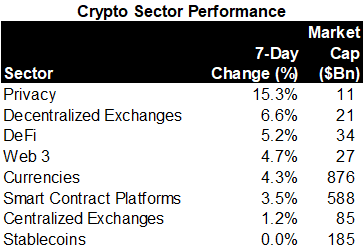

- This week, crypto investors ventured further out on the risk curve as DeFi and Web3 sectors outperformed currencies.

- The latest BofA Global Fund Manager Survey presents a subtle but encouraging sign for Bitcoin’s journey down the risk curve. Despite long tech positions being marginally less popular among fund managers this month than last, “Long Bitcoin” grew in popularity over the same period.

- We break down bitcoin’s behavior in different geographical markets, as implied by the market hours for each significant trading zone around the globe. Since bitcoin’s last ATH, European trading hours have led, Asian hours have dragged prices down, and US trading hours have been directionally positive but much choppier than European market hours.

- This week, Israel, a known ally to the West, shifted a portion of its reserves into the Chinese Yuan. We discuss the implications.

- Strategy - Applying the framework outlined in our previous Weekly, it is reasonable to expect downside volatility around QT. We think purchasing medium-term (1-3 months) put protection on long crypto positions and reducing exposure to more speculative altcoins are valuable measures to mitigate this risk. Despite this, we remain constructive on cryptoasset prices for 2022 and expect tides to shift in early 2H.

Weekly Recap

Outside of a Sunday-night dip, cryptoassets have performed robustly, with bitcoin reclaiming the $40k level and ether reestablishing its perch above $3k.

This week, crypto investors ventured further out on the risk curve as DeFi and Web3 sectors outperformed currencies.

Interestingly, the privacy sector recorded another green weekly candle, as privacy-focused names including Monero ($XMR), Zcash ($ZEC), and Decred ($DCR) each increased more than 15% over the last seven days.

Source: Messari

A Tale of Two Halves?

In light of the constant sideways chop that seems to have persisted for the past several months, we revisit the meme below, pulled from our 2022 annual outlook. Given the macro uncertainty and intermittent on-chain demand, we thought this would be a tough Q1 and Q2 for strictly long-only investors. This memetic prognostication has undoubtedly come to fruition as crypto prices have struggled to find directional consistency.

Applying the framework outlined in the previous Weekly, it is reasonable to expect downside volatility around QT, and buying put protection on long crypto positions could be a helpful way to mitigate this risk.

Source: Fundstrat Digital Asset Annual Outlook 2022

As our clients are aware, a big reason that $BTC is trading in such a volatile manner is that its short-term correlations with tech stocks are essentially at 1.

We expect that at some point, Bitcoin and the broader crypto market will break its chains from the traditional equity markets. The timeline for the great “decoupling” remains up in the air. We have had brief stints of zero correlation between BTC and tech stocks, but those episodes have been short-lived.

Any decoupling will start with a change in investor perspective and be supported by individual and institutional adoption. When Bitcoin moves from being viewed mainly as a bet on a future store-of-value to a global macro insurance policy and ultimately to a functioning store-of-value, we will see the correlations between QQQ, cloud companies, and BTC go to zero. But until then, we should still view bitcoin as a risk-on asset progressively moving down the risk curve with each incremental adopter.

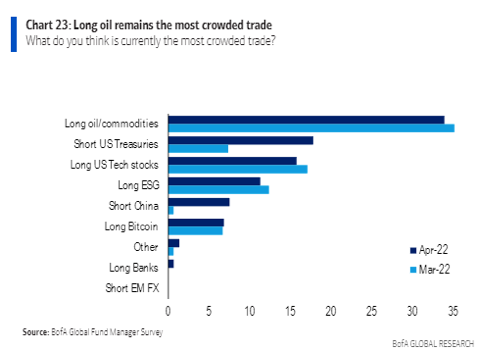

Below is the most recent BofA Global Fund Manager Survey, which asks Fund Managers what trades they perceive as the most crowded. This presents a subtle but encouraging sign for Bitcoin’s journey down the risk curve. Impending QT, the possibility of consecutive 50 bps rate hikes, and the looming risk of recession have caused large-cap tech stocks to be viewed as marginally less popular among fund managers this month compared to last. However, “Long Bitcoin” is now considered a more popular trade over the same period.

This means that a cohort of investors believe their peers are maintaining long positions in bitcoin in the face of macro uncertainty while reducing exposure to long US tech stocks. We think this is a critical narrative to keep an eye on moving forward.

Crypto Never Sleeps

Those who have worked, traded, or invested in crypto are familiar with the feeling – you wake up, palms are already sweaty, your heart is beating fast, and your mind is racing faster than Lewis Hamilton around Silverstone, tiring to anticipate every possible thing that might have happened to your crypto portfolio while you were sleeping.

Most times, you open your portfolio, and not much has changed, but sometimes it does, and a valuable lesson has been learned. This is all part of investing in assets that trade 24-hours per day, 365 days per year. This morning routine wanes over time as you get used to how these markets ebb and flow, but it never totally dissipates.

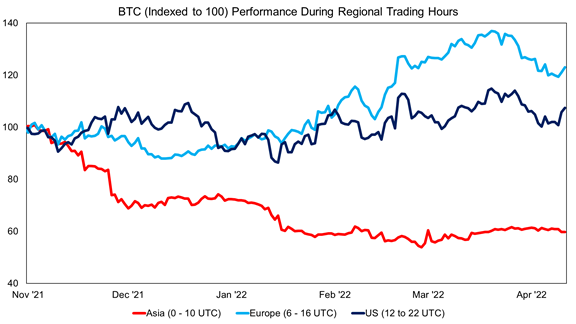

With that in mind, it is often helpful to look at how assets are behaving in different geographical markets, as implied by the market hours for each of the significant trading zones around the globe. Below we map these regional trading patterns out and try to highlight some interesting takeaways from recent price action.

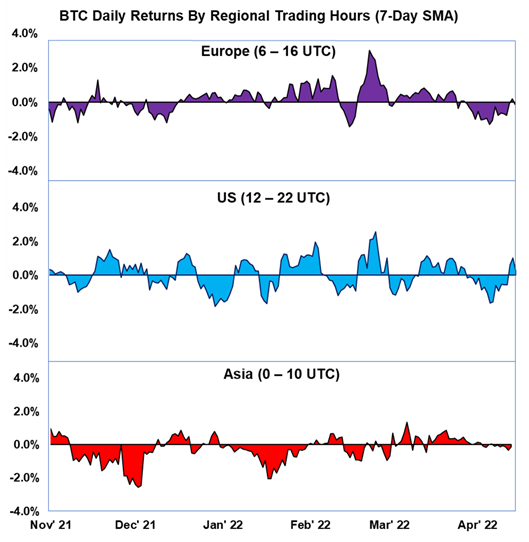

Below are daily returns for BTC since its all-time high in November.

Source: Fundstrat, TradingView

While this chart is admittedly busy, we can qualitatively ascertain a few things:

- The most conclusive selling pressure following the last BTC ATH came during Asian trading hours. Since November, Asia has generally not seen any sustained bullish price action.

- Traders in the Americas have been subjected to very choppy waters with 7-day SMA oscillating frequently and somewhat evenly around 0.0%.

- Europe, while also visually choppy, appears to feature the most conclusively positive price action over this period.

This is consistent with the current macro backdrop – risk assets have had a rough few months in the US (BTC has been able to buck this trend periodically), Europe correlates strongly with US markets, but the region has found itself embroiled in warfare and geopolitical conflict that has necessitated the use of cryptoassets (bullish for prices). In contrast, China has experienced outsized turmoil due to feeble economic growth prospects coupled with a burdensome zero-COVID policy.

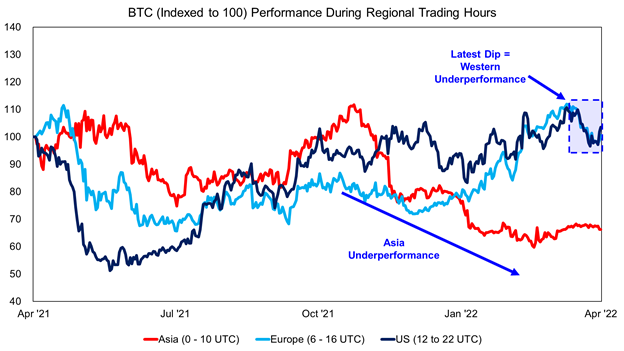

If we zoom out to a 12-month timeframe and index regional price changes to 100, we can see how stark the difference is in price action during each trading period.

While each line is directionally consistent following last summer’s significant drawdown and into the latest all-time high, we can see that Asia has significantly underperformed since Q3 2021.

Source: Fundstrat, TradingView

Zoom in tighter, and we start to see an even clearer picture of regional price action since Bitcoin’s peak in November. European trading hours have led, Asian hours have dragged prices down, and US trading hours have been directionally positive but much choppier than European market hours.

Source: Fundstrat, TradingView

What does this all mean?

Beyond merely understanding market dynamics for the sake of learning, the patterns observed here could be usefully employed in daily trading strategies (which we do not offer advice on) and perhaps even allow for the optimization of the time of day that one schedules their repeat crypto purchases if they abide by the time-tested strategy of dollar-cost averaging (although, the benefits of the DCA “precision” are likely negligible).

More importantly, it’s valuable to understand how globally traded assets are subject to a vast and diverse range of variables.

Suppose sentiment (and volume, which we did not dive into but may visit in a subsequent weekly) and investor behavior are remarkably different across different time zones. In that case, it may be more challenging to sustain trends in either direction.

With that in mind, it will be interesting to see whether supportive measures taken by the PBOC will reverse the apparent sour trend during Asian market hours. We do not think this alone can cause a rebound in cryptoasset prices, but it certainly removes a barrier.

Diversification of Reserve Assets

As discussed in our weekly titled “Apolitical Money,” recent seizures of foreign global reserves have brought the very existence of debt-based reserve assets into question. We noted both the US’ freezing of Afghanistan’s assets and the world’s freezing of Russian assets as examples of the complicated and politically charged environment created by debt-based reserves.

While we have yet to see central bankers or political leaders engage in outward discussion of hard-money (commodity-based) vs. soft-money (debt-based), economists and macro strategists have entertained that the world may be moving away from the USD as the ultimate reserve currency.

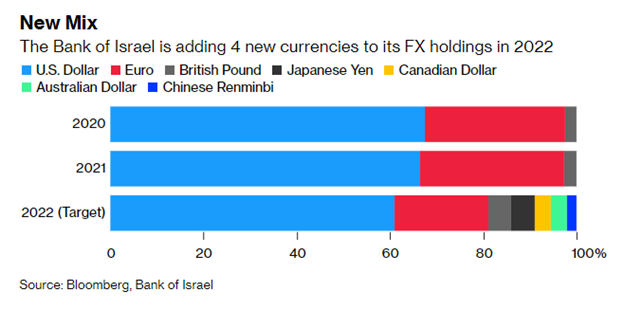

While a conclusive winner is still miles away, we are witnessing central banks start to take the first steps away from the USD, as reflected in the diversification of global reserve assets. Just the other day, Israel, a known ally to the West, shifted a portion of its reserves into the Chinese Yuan. While, on its surface, this merely brings Israel in line with the global mix of reserve assets, it still speaks to the growing trend of reserve asset diversification.

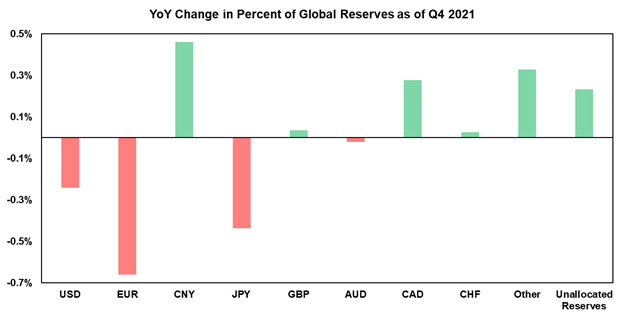

We can see below that in 2021, countries reduced the overall percentage of their global reserves denominated in USD, EUR, and JPY while increasing the CNY, CAD, and perhaps most notably, “Other.”

Source: Fundstrat, IMF

Those who have followed our work know that a significant catalyst that we expect to encounter in the next 12-24 months is the adoption of bitcoin as a reserve asset. We think this will be the most palatable option for countries looking to allocate to a “hard” commodity that lacks the political risk that encumbers every other fiat currency. If we had to bet, we think that the “Other” Column will be even higher this time next year. By that time, perhaps we need to add a new column entirely dedicated to bitcoin.

Reports you may have missed

INFLOWS RESUME On Monday, market sentiments were rattled by a surprisingly strong manufacturing PMI figure, marking the first expansionary reading in 18 months. This led to a rise in rates, with risk assets across the board experiencing selloffs amid renewed inflation concerns and fears that the Federal Reserve might need to implement further measures to cool the economy. However, in our crypto comments video on Tuesday, we outlined a couple...

Adding RON and IMX As a Different Flavor of ETH-beta and Gaming Exposure (Core Strategy Rebalance)

MARKET SHRUGS AT HOT CPI The latest Consumer Price Index (CPI) data indicated a hotter inflationary environment than forecasted for February. Despite the surprise in the numbers, market participants appeared largely unmoved, suggesting that the potential impact had already been factored into their calculations prior to the release. This resilience reflects a broader sentiment that a rates-driven selloff, in response to the CPI figures, is not a significant near-term risk....

RESEND: Bitcoin ETF Equilibrium Price Dynamics: ETF likely to drive significant rise in daily demand

BY POPULAR DEMAND, WE ARE RE-SENDING THIS BITCOIN PRICE IMPACT OF SPOT ETF REPORT FROM JULY 24, 2023 The Bitcoin spot ETF was finally approved. And we are seeing the surge in price of Bitcoin because of attractive supply and demand dynamics.We received multiple requests to resend this report from July 24, 2023 which looked at supply and demand dynamics if a spot ETF was approved.In short, we believe a...

FLOWS BEGET MORE FLOWS We have recently discussed the potential return of crypto being correlated with equities due to the new category of market participants entering the fold. However, price action this week suggests that inflows into the BTC ETFs may be throwing water onto that theory. It seems apparent that, at least in the near-term, that the ETF flows narrative is gaining steam, and it is likely that the...