Crypto Thrives as a Global Payments System and an Escape Pod

Key Takeaways

- We continue to focus on the key narratives surrounding bitcoin and assess recent adoption trends driven by Russia’s invasion of Ukraine.

- We review on-chain data (realized cap, STH SOPR, and wallet addresses) to determine whether there is a sustained level of organic demand supporting the recent uptick in bitcoin’s price.

- Recent price action gives us some confidence that there will be buyers that step up in the $34k-$35k area should we witness another bout of downward pressure on BTC price.

- Bottom Line: With global momentum building for 3 out of 4 of our potential catalysts for 2022, we think it is irresponsible to have 0% allocation to bitcoin at this juncture. It is wise to maintain any existing long positions in BTC and ETH and look to add on dips as ongoing geopolitical conflict and macro uncertainty could result in continued volatility. We will continue to monitor demand-side metrics for signs of a more sustained bull market run.

Headwinds Turn into Tailwinds

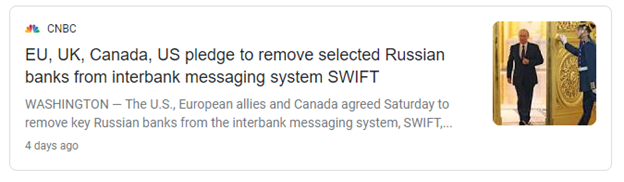

Bitcoin and the broader crypto industry took center stage this week as violence escalated in Ukraine. In the wake of a turbulent week for digital asset prices, the global crypto market experienced a significant bounce following sanctions issued against Russia last Thursday afternoon. Strong bids were placed around $34k, catalyzing short liquidations and launching bitcoin 10% higher (More on this seemingly critical $34k price below). This exaggerated price movement was consistent with the low volume spot market and active derivatives environment discussed in recent weeks.

Over the weekend, the U.S. and its allies ramped up sanctions on Russia, cutting the nation of over 140 million off from SWIFT, the global communications network connecting financial institutions across 200 countries. This effectively cut Russian banks from transacting with the rest of the world, resulting in devastating consequences to the Russian economy and the Russian Ruble.

Despite trepidation in legacy equity markets, we saw bitcoin perform well at market open on Monday and sustained its bullish price action throughout the week. This was mainly because the world was finally forced to acknowledge Bitcoin as a force for financial freedom and censorship resistance. Several data points indicated substantial volume driven by Eastern Europeans seeking an offramp from their local economy. We must also assume that some of this volume was driven by those speculating about the impending increase in adoption among both Russians and Ukrainians—more details on this below.

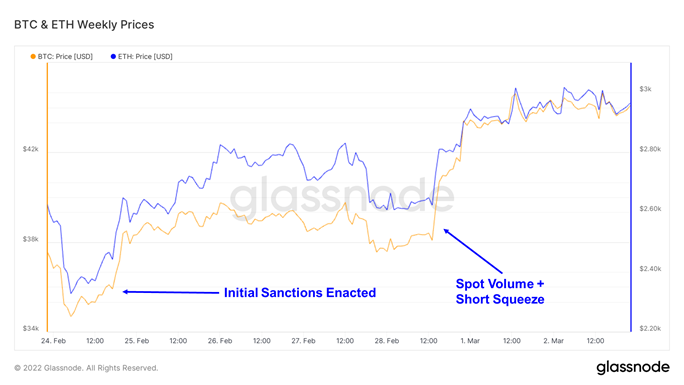

Bitcoin’s outperformance had ripple effects throughout the industry as all sectors were up at least 10% on the week. However, once again, we see that crypto-native investors are still “risk-off” as currencies and privacy coins were the top-performing sectors for the week.

Source: Messari

Bitcoin dominance at the time of writing is above 44% for the first time since mid-December as the word “haven” is now being thrown around cavalierly to describe its usefulness to Russian citizens.

Source: TradingView

Crypto Provides Relief to Ukraine

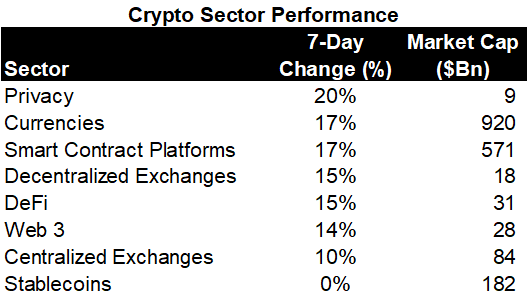

Before the West dropped the SWIFT hammer on Putin’s regime, Ukraine tapped into the crypto industry’s philanthropic spirit. The official Twitter account of the Ukrainian government posted Bitcoin and Ethereum addresses to its page, soliciting donations to assist war efforts.

Source: Twitter

At the time of posting, violence in Ukraine was intensifying, infrastructure was crumbling, supplies were dwindling, and the banks were closed. The besieged government knew that there was a tool that could aggregate funds from across the globe without the need for transactions to travel from thousands of different banks using thousands of varying transaction processing systems and that they wouldn’t have to wait days or weeks for those transactions to settle. Instead, they opened their smartphone, created a wallet, and copied & pasted their link to social media. Instantly, they were flooded with millions of dollars of donations in BTC, ETH, and USD stablecoins.

After adding addresses for Tron and Polkadot donations, the Ukrainian government and NGOs providing support to the military raised $42 million through Wednesday evening from over 59,000 transactions. This total includes a $5.8 million DOT donation by Polkadot founder Gavin Wood and a donated CryptoPunk NFT worth over $200,000.

Source: Elliptic.co

While most in crypto already understood the utility of decentralized crypto rails, many observed their value add for the first time on Saturday in a global, transparent, and consequential way.

Data Indicates Some Russians Used Crypto as an Escape Pod

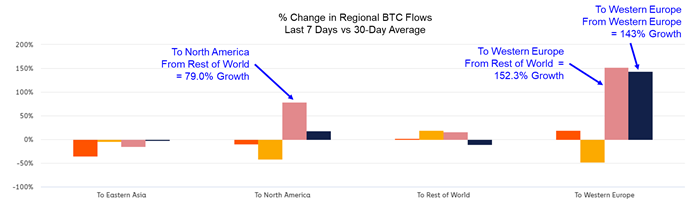

Chainalysis, a blockchain forensics company that can pinpoint the geographic location of specific wallets, presented interesting bitcoin flows over the previous week. The graph below shows the daily average flows of assets on the Bitcoin blockchain between services that Chainalysis has identified as predominantly serving customers in a particular region by combining analysis of transaction patterns, web traffic, and open-source Intelligence. This is not quite as conclusive as the data surrounding Ukrainian usage. Still, one could view these patterns as indicative of individuals moving wealth from a sanctioned jurisdiction to a non-sanctioned jurisdiction leading up to and immediately following the SWIFT sanctions from the West.

Source: Chainalysis as of 3/1/2022

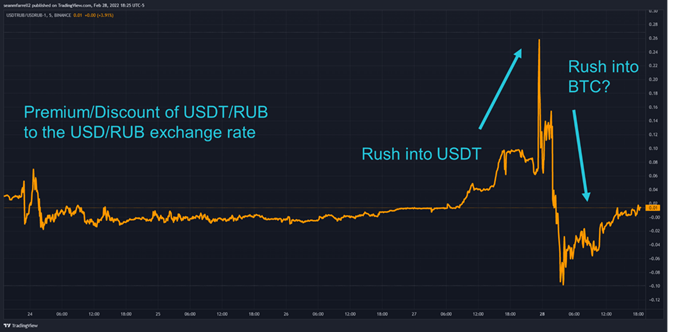

Data surrounding the USDT peg corroborates the thesis that many Russians fled to crypto following the crackdown. Below we can see that the USDT/RUB trading pair on leading crypto exchange Binance broke its peg to the upside on the 28th, indicating high demand for USDT among individuals whose accounts were denominated in RUB.

Why did many flee to USDT and not directly to BTC? Well, there are several possible reasons, but we think it’s likely USDT is a stablecoin that represents the second-most familiar currency to those holding rubles on Binance. Regardless, the sudden subsequent decrease in the USDT/RUB peg suggests that investors quickly dispensed of their tether and converted into another cryptoasset, potentially bitcoin.

Source: TradingView

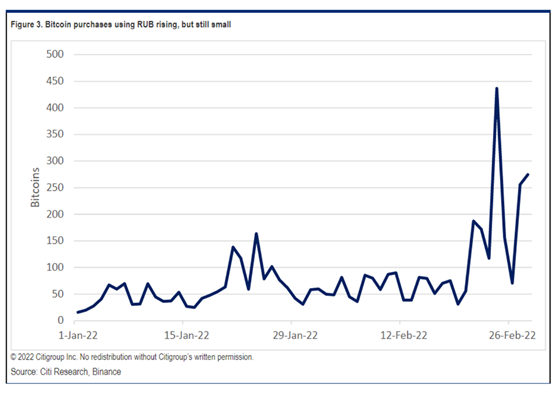

As evidenced by the chart below, we saw a spike in RUB/BTC volume on leading crypto exchange Binance following the increased sanctions. As Citi notes, this is a sizeable increase in volume but is a nominally limited amount. However, as alluded to above, we think there are other ways Russians could have purchased bitcoin, which this analysis does not contemplate.

Source: Citigroup

Following the apparent sanctions-driven price action, many were quick to throw mud at crypto. Which by now should not be a surprise to anyone. However, as we have stated before, a core principle of decentralized money is that it does not have a political affiliation. Therefore, just as it cannot serve as a weapon of a seemingly righteous liberator, it is also an immutable offramp for citizens (good and bad) of autocratic regimes.

Not to moralize too much, but, interestingly, for the first time, it seems that the world has found a way to create targeted sanctions that cripple an autocratic regime’s power while still allowing an escape route for regular citizens.

Above is a page from our Annual Outlook from over a month ago. We were unsure of the exact shape it would take, but we have been excited about the prospects of top-down and bottoms-up emerging market adoption as potential catalysts for this year. A few weeks ago, we discussed Canada and Afghanistan; now, it is Ukraine and Russia.

The momentum for bitcoin as a safe haven for assets in the developing world is certainly gaining steam.

Top-Buyers Sold to Dip-Buyers

We noted some interesting on-chain data coinciding with recent price action. Following each recent short-term price rebound, we have noted that organic demand has yet to come back into the picture. We wanted to see more capital inflows and new address increases.

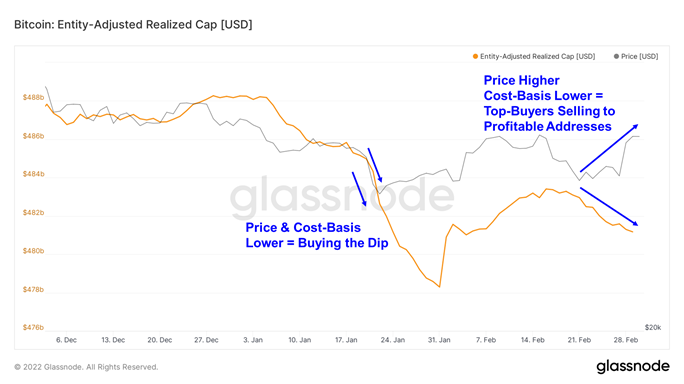

Below we look at the realized cap, which as a reminder, measures the overall cost basis of the Bitcoin blockchain and can serve as a proxy for inflows. We can see that despite the price increase, realized cost decreased, indicating to us that there were investors that were holding onto coins purchased at the top of the market in November that finally capitulated and sold off to wallets with a lower cost-basis.

This is bullish to the extent that there is less selling pressure among short-term holders, given that they are at a greater level of profitability. However, before calling this a sustained bull run, we would like to see realized cost increase along with the price to indicate strong inflows concurrent with the rise in price.

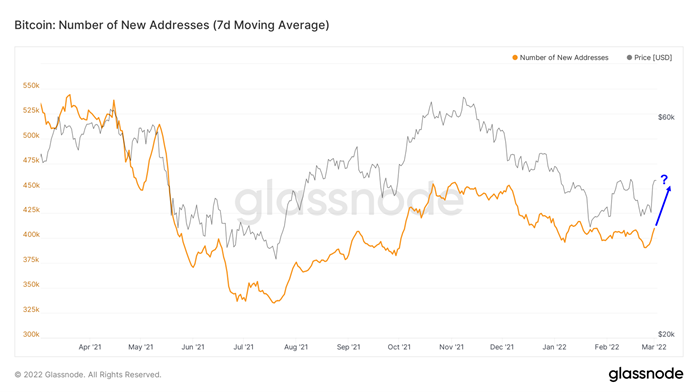

As previously mentioned, the number of new addresses is an excellent metric to gauge new demand coming into the fold. A sustained runup in new wallets coincides typically with a bull market. While we see below that there has been a quick uptick in new addresses, we have seen similar action sporadically throughout the past year. We would like to see this trend continue upwards before making any conclusions about a sustained bull run.

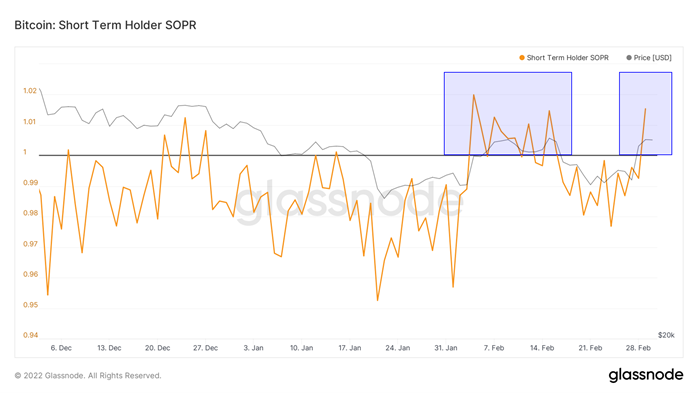

The last on-chain metric we wanted to highlight was short-term holder (STH) SOPR (Spent Profit Output Ratio). STH SOPR measures the profitability of all coins sold by short-term investors. We have been using this metric to understand on-chain profitability and the relative appetites of short-term holders to sell out of their positions during periods of volatility.

During periods of positive sentiment and favorable price action, this metric tends to drift higher and remain above 1 as holders maintain their positions intending to sell at an increased level of profitability. During times of consolidation or weakness, this metric will often either hit 1 (break-even) and return to negative levels or remain soundly in negative territory, an indication of capitulation among investors who choose to sell at a loss.

This week, we witnessed an encouraging sign as STH SOPR broke through 1 and currently sits in profitable territory. If the market is to recover, we should see this metric either (1) retest 1 and bounce higher or (2) continue higher and achieve support above 1. Our interest during volatile periods is with short-term holders (STH) because they are the market participants known to trade in and out of positions quickly and often fuel the more speculative run-ups in price (such as last winter/spring).

In the week ahead, we should look for this metric to remain above 1, a sign that short-term holders are (1) profitable and (2) are anticipating higher prices, which when coupled with positive demand-side metrics could indicate a more sustained move higher.

Signs of a Floor

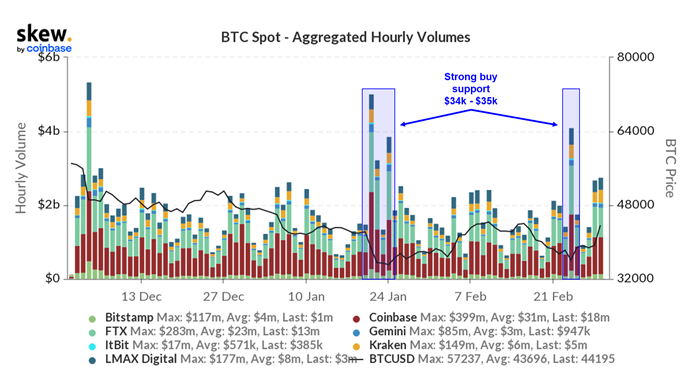

We think that there is considerable evidence of positive price action in the immediate term. Still, we believe that there will be opportunities to add on dips following the Fed’s increase in interest rates and potential trimming of its balance sheet holdings. That said, recent price action has provided interesting data that supports a price “floor” for bitcoin around the $33-$35k level.

For the second time since the market’s all-time high in November and subsequent drawdown, we have seen firm buying support in this area. The previous instance was at the market low around January 24th, and the second was last week around the issuance of sanctions on Russia. We think that if we see another significant bout of downward pressure on prices, recent precedent gives us some confidence that there will be buyers that step up in this area.

Bottom Line

With global momentum building for 3 out of 4 of our potential catalysts for 2022, we think it is irresponsible to have 0% allocation to bitcoin at this juncture. We believe it is wise to maintain existing long positions in BTC and ETH and look to add on dips as ongoing geopolitical conflict and macro uncertainty could result in continued volatility. We will continue to monitor demand-side metrics for signs of a more sustained bull market run.

Reports you may have missed

Fiscal Dominance, Flows from China, Plus Some Thoughts on Global Conflict (Core Strategy Rebalance)

WHAT BTC SHRUGGING OFF CPI SAYS ABOUT CURRENT FISCAL SITUATION The most significant piece of macro data this week was the CPI. Headline CPI registered at 3.5%, surpassing the anticipated 3.4%, while core CPI remained steady from last month at 3.8%, also above the expected 3.7%. This increase was largely attributed to rising costs in auto insurance and shelter. Consequently, interest rates saw a sharp rise, with the 10-year Treasury...

INFLOWS RESUME On Monday, market sentiments were rattled by a surprisingly strong manufacturing PMI figure, marking the first expansionary reading in 18 months. This led to a rise in rates, with risk assets across the board experiencing selloffs amid renewed inflation concerns and fears that the Federal Reserve might need to implement further measures to cool the economy. However, in our crypto comments video on Tuesday, we outlined a couple...

Adding RON and IMX As a Different Flavor of ETH-beta and Gaming Exposure (Core Strategy Rebalance)

MARKET SHRUGS AT HOT CPI The latest Consumer Price Index (CPI) data indicated a hotter inflationary environment than forecasted for February. Despite the surprise in the numbers, market participants appeared largely unmoved, suggesting that the potential impact had already been factored into their calculations prior to the release. This resilience reflects a broader sentiment that a rates-driven selloff, in response to the CPI figures, is not a significant near-term risk....