Sushi for Christmas

Key Takeaways

- Alpha Opportunity: Despite a broad market shift away from DeFi, we think Sushiswap (SUSHI) presents an intriguing opportunity for investors at its current price. We discuss this further below.

- We note that leverage in the Bitcoin market is increasing, which may signal near-term volatility.

- Bullish indicators, including exchange outflows, increasing short-term SOPR, and a decreasing put/call ratio point toward a bullish breakout upon any liquidation event.

- Bottom Line: As Bitcoin’s leverage increases, investors should anticipate a bout of volatility at some point over the next couple of weeks. The current on-chain setup and options market activity point toward a bullish breakout. We maintain our positive outlook for Bitcoin, see the potential for Ethereum outperformance and view our altcoin baskets as an opportunity for those venturing further out on the risk curve as we head into the new year.

Value Investing in DeFi with Sushiswap

Since 2020 we’ve observed the emergence of two core “killer apps” for smart contract platforms, which started on Ethereum and have since spread to almost all others. DeFi was first – cementing its roots during DeFi Summer and garnering widespread excitement. Prices reflected this excitement even after DeFi Summer came to an end.

From September 2020 to May 2021, the DeFi Pulse Index (a tokenized index fund that tracks the performance of the top DeFi projects) rallied ~680%. However, since then, NFTs have emerged as the second significant use-case for blockchains – prompting a shift of excitement towards NFT marketplaces, virtual worlds, and blockchain games – but away from DeFi. Since May, the DeFi pulse index is down ~56%.

Structurally, the sector remains sound with decentralized exchanges (DEXs), in particular, showing resilience. After the blow-off top in May, DEX trading volume has increased every month for the past four and is on track to notch a fifth consecutive month of positive growth. The largest DEX by trading volume is Uniswap (UNI), commanding a fully diluted market cap of just under $15 billion with $2.19 billion of annualized revenue based on the last 30 days. Because of Uniswap’s size, the token has benefited from being included in several leading brokerage-traded index funds like the Bitwise 10 Crypto Index Fund (BITW) – which currently allocates $1 billion in AUM across the top 10 largest tokens – and the Grayscale Digital Large Cap Fund (GDLC) which has $527 million allocated across the top 8 largest tokens. The Uniswap token has also benefited from being amongst the most widely held tokens by crypto venture and hedge funds.

One of Uniswap’s competitors in the AMM DEX space is Sushiswap (SUSHI) – a fork of the Uniswap code base – with the core difference being a portion of fees generated accrue to token holders. While Uniswap has outperformed the broader index YTD, Sushi has underperformed, which can be attributed to two circumstances.

(1)High inflation following incentive programs. In late 2020, Sushi implemented incentive programs to bootstrap liquidity and usage on the platform – which were successful in doing so. However, the tokens earned via incentive programs were subject to a 6-month lock-up ending in March 2021. Approximately 47 million tokens hit the market following the lock-up, prompting their value to fall over 70% from March to June.

(2) Organizational and management challenges within the development team. The most recent sell-off of 60%, which started in November, can be attributed to concern regarding the organization and structure of the Sushiswap development team. With the recent release of a new governance proposal that outlines an improved organizational structure – co-sponsored by prominent DeFi builder Daniele Sesta and crypto fund manager Arca – we expect this negative catalyst to be temporary, as well.

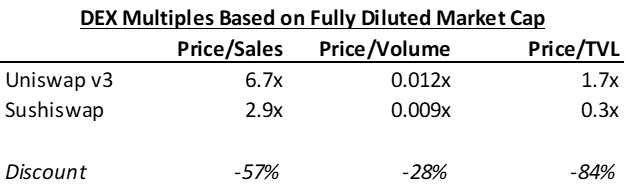

Sushi’s poor price performance is not enough to consider it undervalued – so we turn to fundamentals. Compared to Uniswap, Sushiswap trades at significantly lower revenue, volume, and total value locked multiples, as seen below.

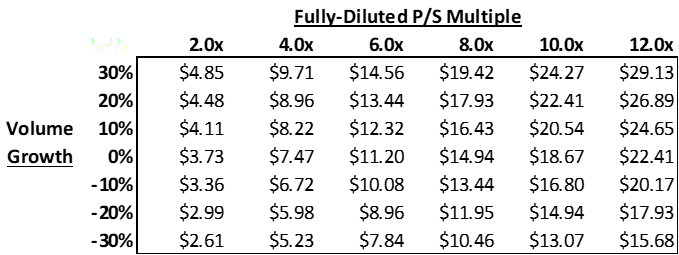

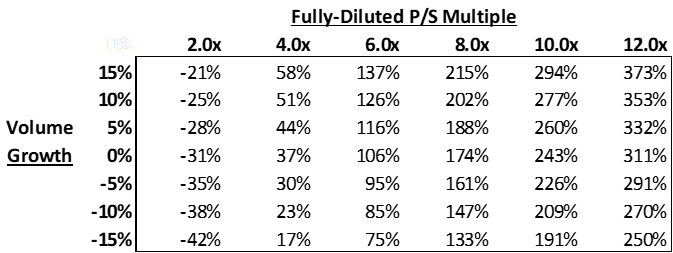

Sales and volumes go hand in hand. Both DEXs charge a 0.30% fee for transactions that comprises the protocols’ sales. Thus we can associate an increase in volumes with an increase in sales and conduct a sensitivity analysis between volume growth and price/sales multiple expansion as shown below. If Sushi were to trade at a multiple similar to Uniswap, between a 6.0x and 8.0x multiple of sales, without any volume growth, we could expect the token to appreciate to low to mid-teens. Volume growth would, of course, help the cause.

Price Per Token

Returns

As mentioned above, Sushi differentiates itself through its tokenomics by allocating a portion of fees to tokenholders in the form of dividends – which Uniswap does not. Tokenholders can stake their Sushi tokens at the SushiBar to receive dividends that compound daily. Currently, 0.05% of the total 0.30% fee goes towards dividends implying a dividend payout ratio of 16.67%.

The last metric we want to highlight is user growth. While Uniswap boasts 847k monthly active users versus Sushi’s 172k, Uniswap’s lead is shrinking.

Over the past five months, Sushi active users have increased 281% on an annualized basis compared to Uniswap’s 48%.

In summary, despite a broad market shift towards NFTs and away from DeFi, Sushi’s discounted multiples, favorable dividend payout tokenomics, and faster user growth relative to Uniswap lead us to believe that Sushiswap is undervalued at its current price. That being said, we will be paying close attention to the recently published restructuring proposal as it enters the voting period.

Ranging = Bitcoin Cost Basis Increasing

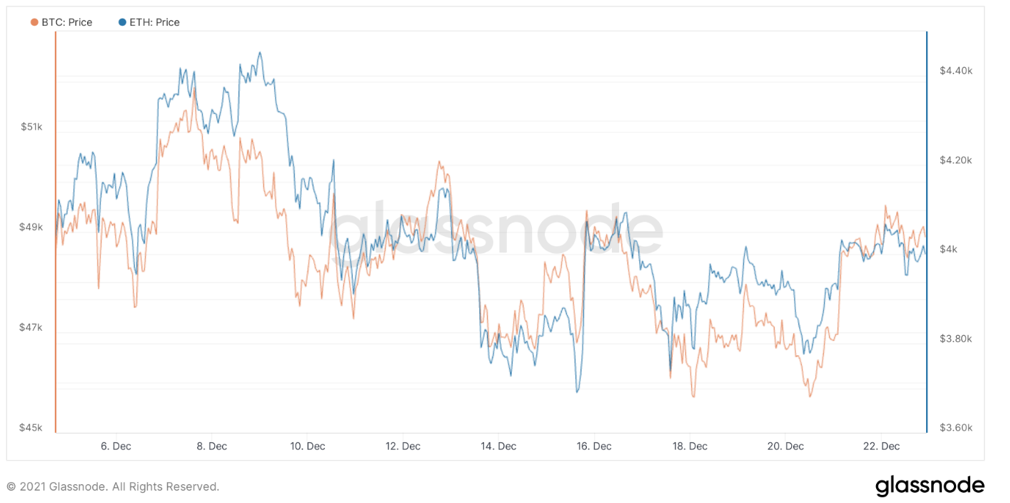

In crypto, folks are accustomed to volatility. The market often moves in long sustained upswings coupled with subsequent drawdowns. Since the industry underwent its deleveraging event in early December, both Bitcoin and Ethereum have been rangebound – with BTC generally trading between $46k and $50k and ETH generally trading between $3.7k and $4.1k.

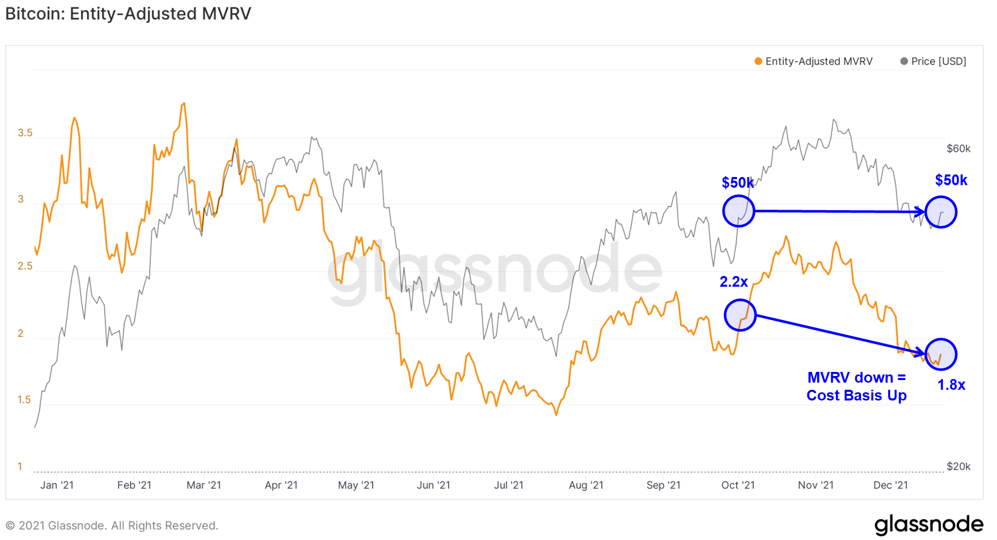

A significant benefit of this consolidation period has been the rising cost basis for Bitcoin. As demonstrated by market-value-to-realized-value (MVRV), which measures the profitability of coins presently held across the entire network, the cost-basis for BTC holders has increased considerably since October.

We can observe that MVRV has fallen over the past several weeks as the price has decreased. However, we can infer that the realized value of coins on-chain has not fallen as rapidly since MVRV has also decreased since MVRV is lower now than in October at comparable BTC prices.

As demonstrated by the chart below, the current BTC price of approximately $50k corresponds to an MVRV of 1.8x, whereas a couple of months ago, this same price compared to an MVRV of 2.2x.

This is a positive dynamic for Bitcoin holders as it points toward the asset’s maturity.

Leverage Increasing = Volatility Incoming

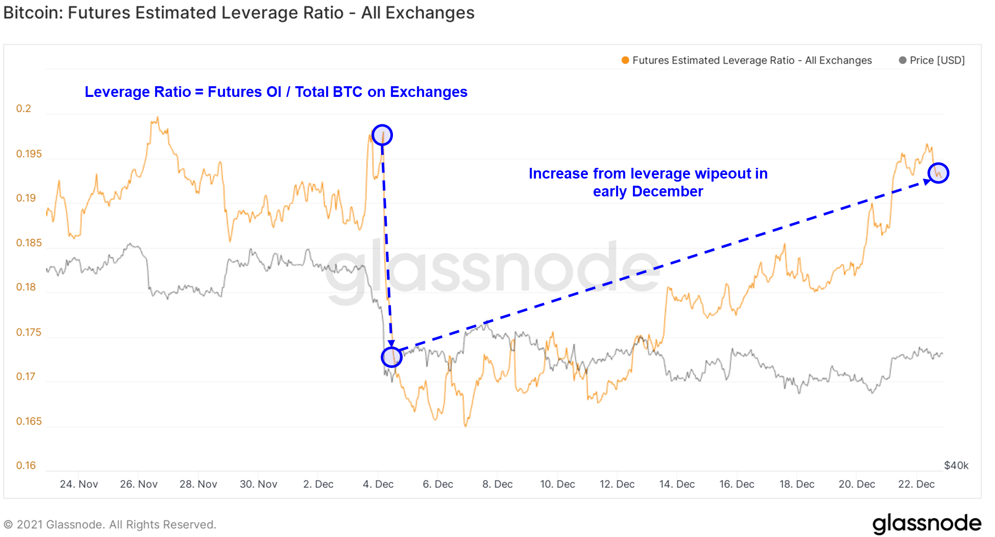

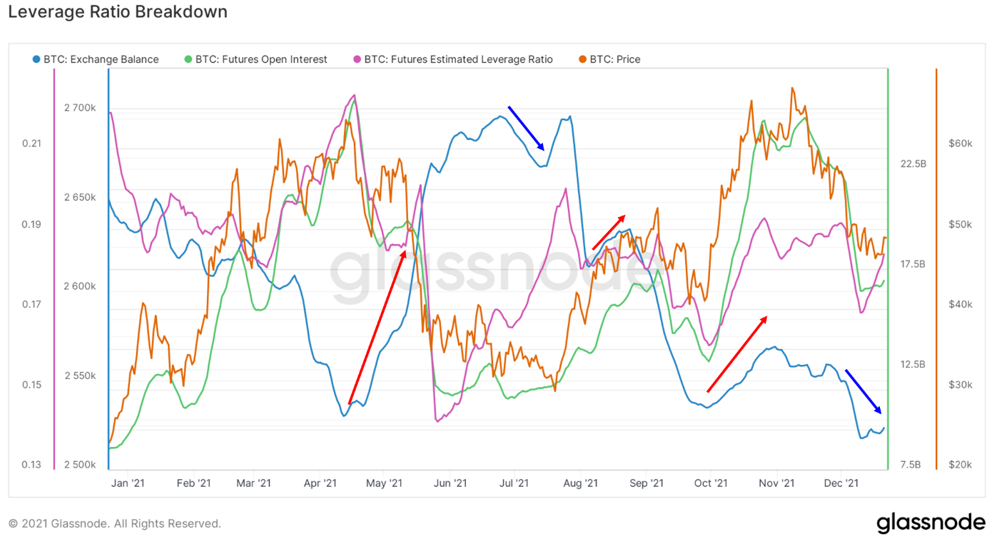

As year-end approaches, we are watching the Bitcoin futures leverage ratio spring back to life. As a reminder, this measures the ratio of total futures open interest contracts and the aggregate BTC balance across exchanges. This measure is nearly back to where it was in early December, before the massive industry-wide leverage washout.

An increase in leverage often precedes volatility due to the outsized effects of any potential dislocations between the spot and derivatives markets.

For instance, in early December, Bitcoin’s price dropped sharply in the wake of cascading liquidations of leveraged positions across multiple exchanges. This occurred because traders were piling into leveraged long positions without underlying bullish volumes to support the bullish sentiment in the derivatives markets. Once traders began liquidating, the low-volume environment caused outsized price movements to the downside, forcing even more selling.

We may run into a similar dynamic as year-end approaches and investors are less active during the holidays than usual.

The good news is (1) leveraged liquidations can work in both directions, and (2) there are two sides to the leverage ratio equation, and the other side might point to a more bullish outcome from this leverage upswing.

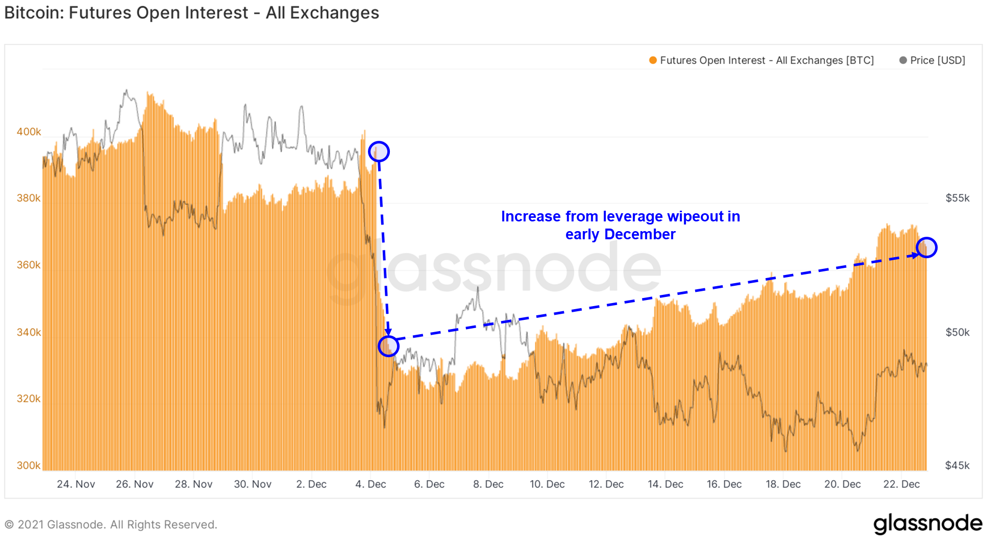

Below is the first part of the leverage equation – futures open interest. We can see that traders were not scared away entirely from the market, as this metric has recovered significant ground. However, this metric still trails its prior level, despite a leverage ratio (chart above) that is about even with the ratio in early December.

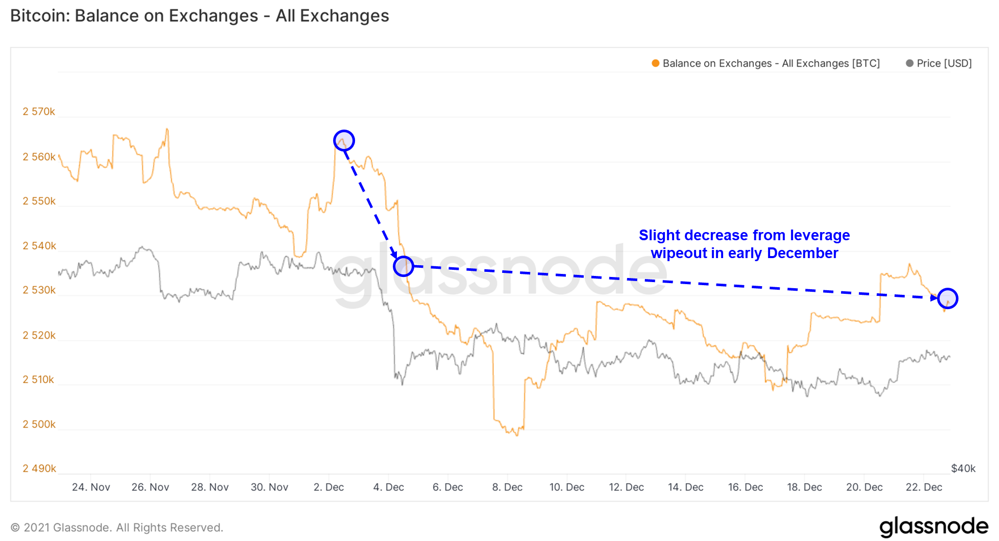

The second half of the leverage equation is the aggregate balance of BTC on exchanges. The coins being removed from exchanges (generally a bullish signal) appear to be having an outsized effect on the leverage increase we are seeing. The supply of BTC on exchanges is actually slightly lower compared to 3 weeks ago. This lower denominator in the leverage equation is leading to an outsized effect on leverage.

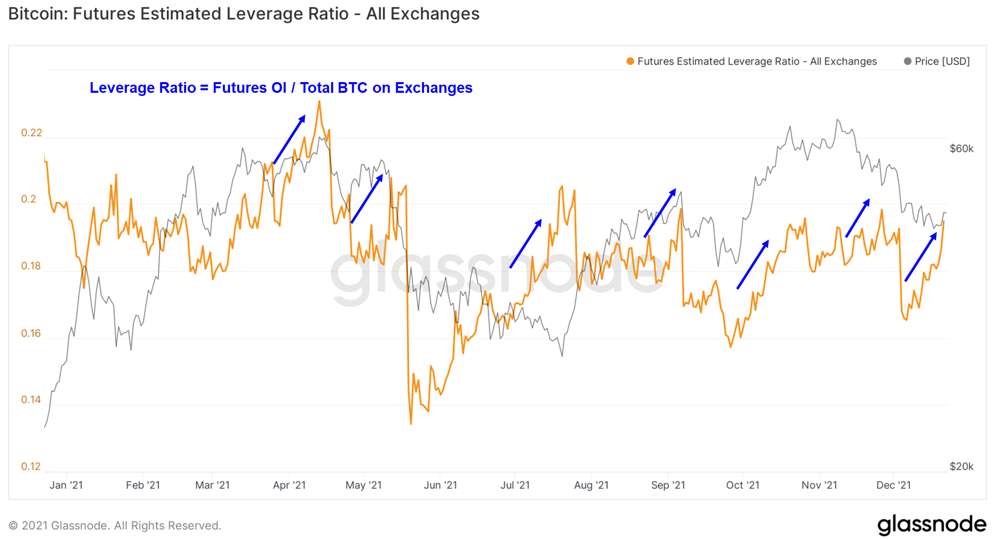

If the trend of higher leverage persists, we should expect volatility at some point in the next couple of weeks. The good news is that the prior few leverage wipeouts to the downside were preceded by net exchange inflows (red arrows), while net outflows have been positive leading indicators (blue arrows). We note that the exchange flows have been mildly less conclusive in recent days, but overall, we think the aggregate exchange flows lean bullish.

Have the Capitulators Been Weeded Out?

Having established that we may encounter near-term volatility and that exchange balances are low, we can turn to on-chain behavior to look for signals of changing market sentiment.

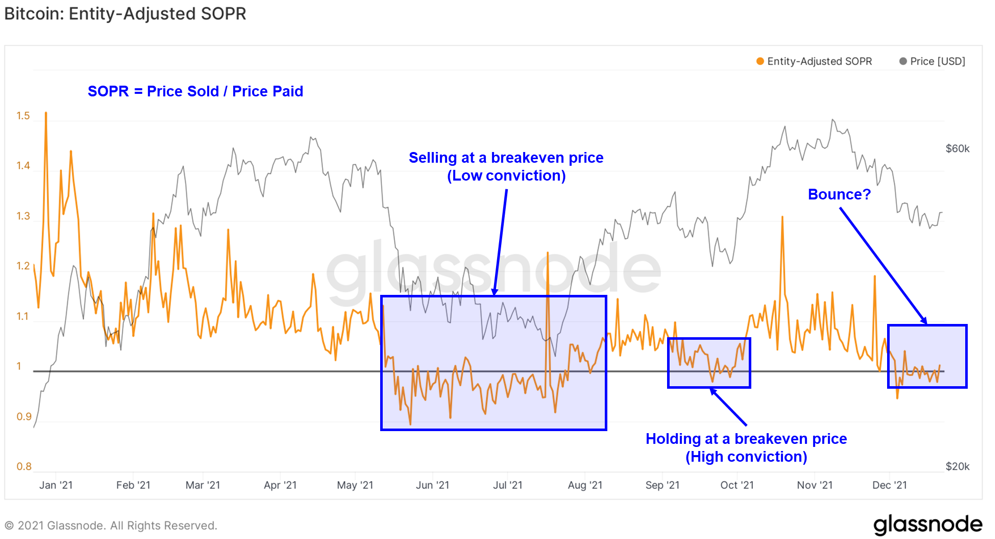

We continue the trend of reviewing SOPR – Spent Output Profit Ratio – to measure the willingness of traders to hold onto their BTC during times of price fluctuations. As a reminder, entity-adjusted SOPR measures the profitability of all coins sold. This metric paints a picture of on-chain profitability and the relative appetites of long-term and short-term holders to sell out of their positions during periods of volatility.

During periods of favorable price action, this metric tends to drift higher as holders maintain their positions with the objective of selling at an increased level of profitability. During times of consolidation or weakness, this metric will often either hit 1 (break-even) and return to negative levels or remain soundly in negative territory, an indication of capitulation among investors who choose to sell at a loss.

This week, we witnessed SOPR break through 1 for the second time in as many weeks and currently sits in profitable territory.

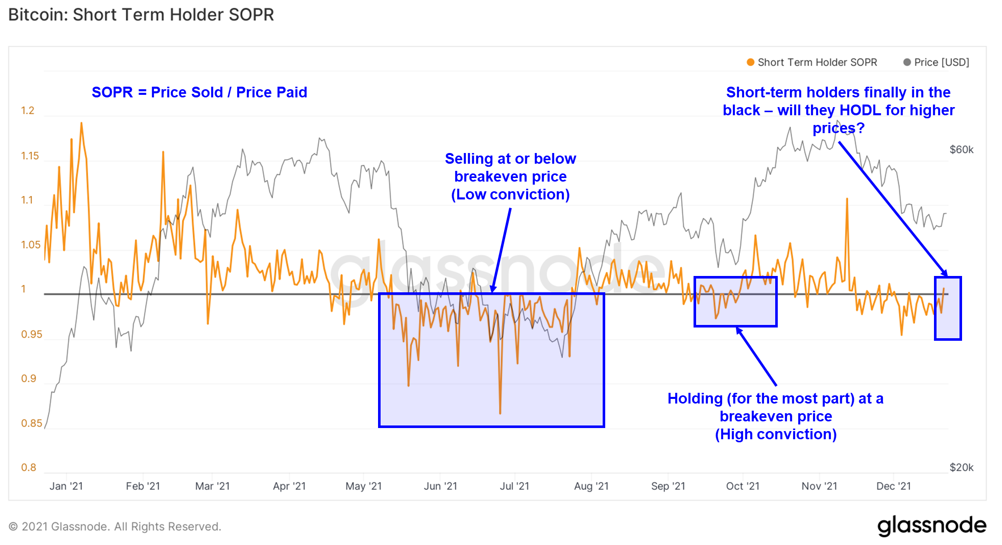

As we discussed the prior two weeks, we can further dissect SOPR to evaluate the behavior of short-term and long-term holders. Our interest during volatile periods is with short-term holders (STH) as they are the market participants known to trade in and out of positions quickly and often fuel the more speculative run-ups in price (such as last winter/spring).

When sentiment is high and the price is rising, we can observe that STH SOPR repeatedly tests 1 but generally remains above this level, as short-term holders remain active participants on the way up. However, as one would expect, this metric will dip below 1 and find resistance there when we experience weaker price action or diminished market sentiment.

For the first time in over a month, we see that STH SOPR has broken through 1, meaning that on balance, short-term investors are sitting on more unrealized gains than losses. This is encouraging and a possible sign that the market has shaken out short-term “top buyers.”

If the market is to march higher, we should see this metric either (1) retest 1 and bounce higher or (2) continue higher and achieve support above 1.

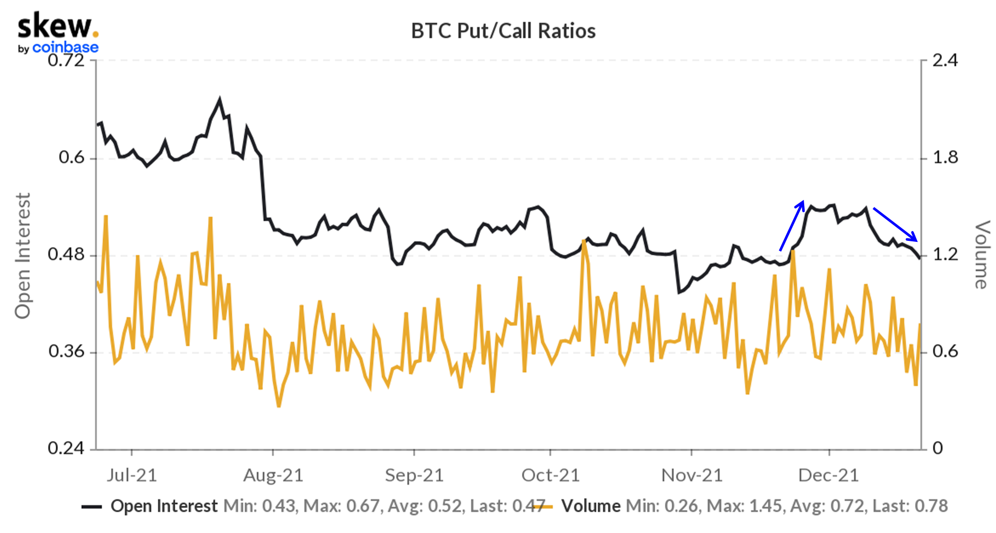

Put/Call Ratio Decreasing Again

Overall, we have not seen significantly elevated put/call ratios from options traders for this past year. However, there was a noticeable increase in puts following all-time highs in early November. This preceded the market turmoil on black Friday and on December 3rd.

This trend has reversed since earlier this month, and the put/call ratio has decreased to below 0.50, below its average for the year. This may signal increasing confidence in the next big move in price.

Key Price Levels

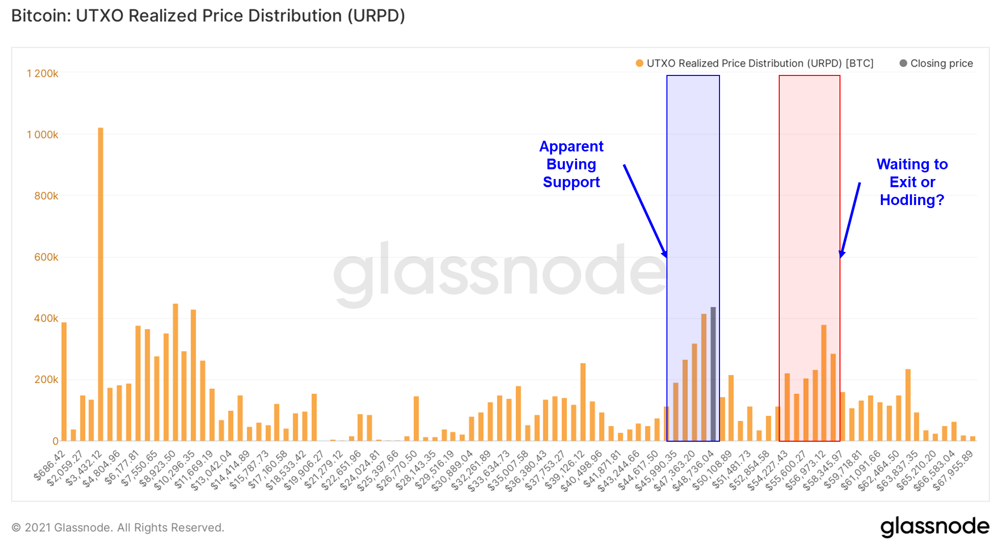

Finally, we would like to highlight Bitcoin’s current price distribution. UTXO Realized Price Distribution (URPD) displays the number of existing bitcoins that last moved within a specified price bucket. The prices on the x-axis refer to the lower bound of each bucket.

We note that URPD indicates considerable buying support around $45-49k and suggests that we may see some folks seek exit liquidity in the $54k – $58k range.

Bottom Line

As Bitcoin’s leverage increases, investors should anticipate a bout of volatility at some point over the next couple of weeks. We think exchange flows, on-chain behavior, and the options market point toward a bullish breakout upon any liquidation event. We maintain our bullish outlook for Bitcoin, see the potential for Ethereum outperformance and view our altcoin baskets as an opportunity for those venturing further out on the risk curve as we head into the new year.

Reports you may have missed

Fiscal Dominance, Flows from China, Plus Some Thoughts on Global Conflict (Core Strategy Rebalance)

WHAT BTC SHRUGGING OFF CPI SAYS ABOUT CURRENT FISCAL SITUATION The most significant piece of macro data this week was the CPI. Headline CPI registered at 3.5%, surpassing the anticipated 3.4%, while core CPI remained steady from last month at 3.8%, also above the expected 3.7%. This increase was largely attributed to rising costs in auto insurance and shelter. Consequently, interest rates saw a sharp rise, with the 10-year Treasury...

INFLOWS RESUME On Monday, market sentiments were rattled by a surprisingly strong manufacturing PMI figure, marking the first expansionary reading in 18 months. This led to a rise in rates, with risk assets across the board experiencing selloffs amid renewed inflation concerns and fears that the Federal Reserve might need to implement further measures to cool the economy. However, in our crypto comments video on Tuesday, we outlined a couple...

Adding RON and IMX As a Different Flavor of ETH-beta and Gaming Exposure (Core Strategy Rebalance)

MARKET SHRUGS AT HOT CPI The latest Consumer Price Index (CPI) data indicated a hotter inflationary environment than forecasted for February. Despite the surprise in the numbers, market participants appeared largely unmoved, suggesting that the potential impact had already been factored into their calculations prior to the release. This resilience reflects a broader sentiment that a rates-driven selloff, in response to the CPI figures, is not a significant near-term risk....