Digital Assets Weekly: August 5th

Market Analysis

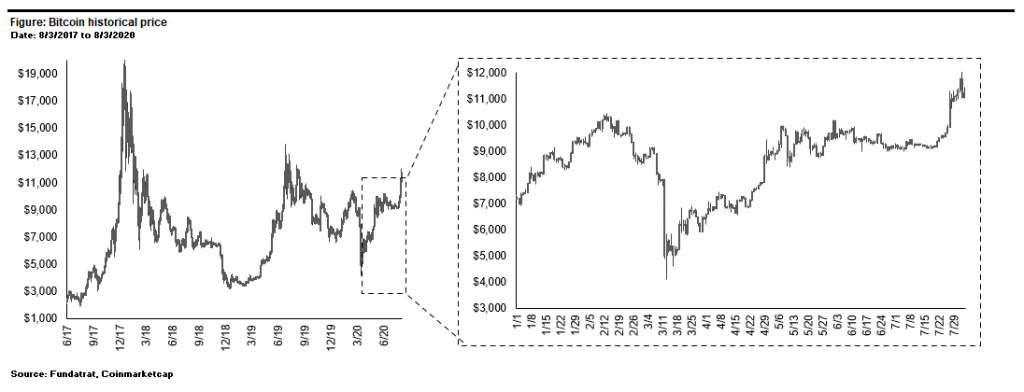

After last week’s spike, BTC continued its rise nearing $12,000 before a $1 billion liquidation event caused the price to crash $1,500 and then stabilize above $11,000. BTC finished the 7-day period ending August 3rd up 1.7%.

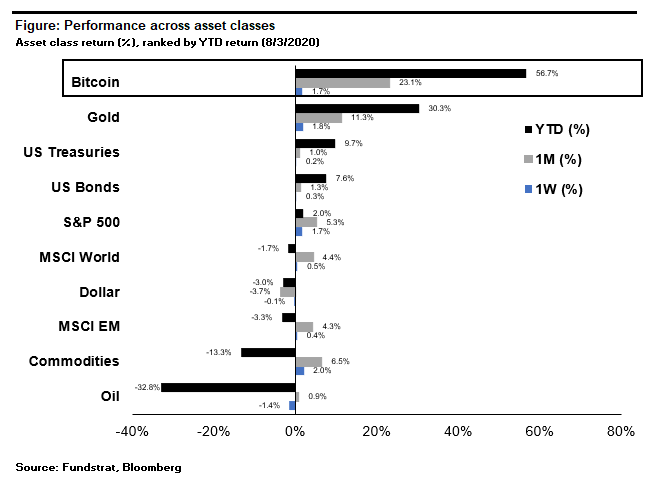

As the dollar suffered this week (measured by the DXY), Bitcoin and gold continued their outperformance compared to all other asset classes.

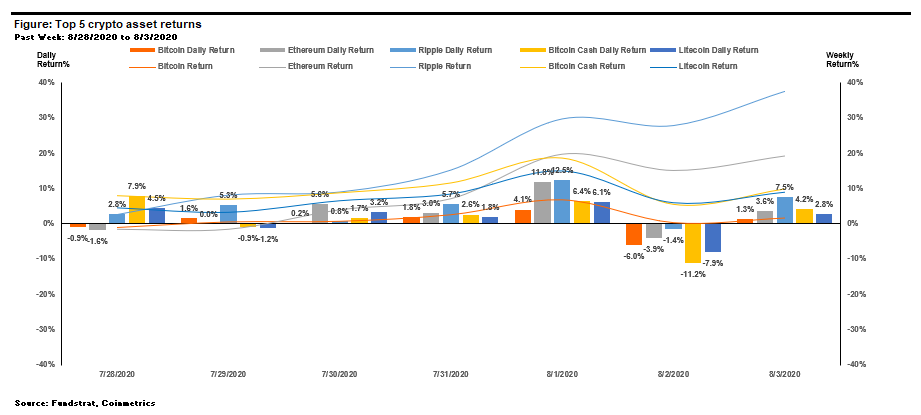

Ripple and Ethereum both surged this week up 37% and 19%, respectively. Ripple disclosed they purchased an undisclosed amount of XRP in Q2 and also sold $32.55 million worth of XRP tokens in the OTC market, mostly to institutional buyers.

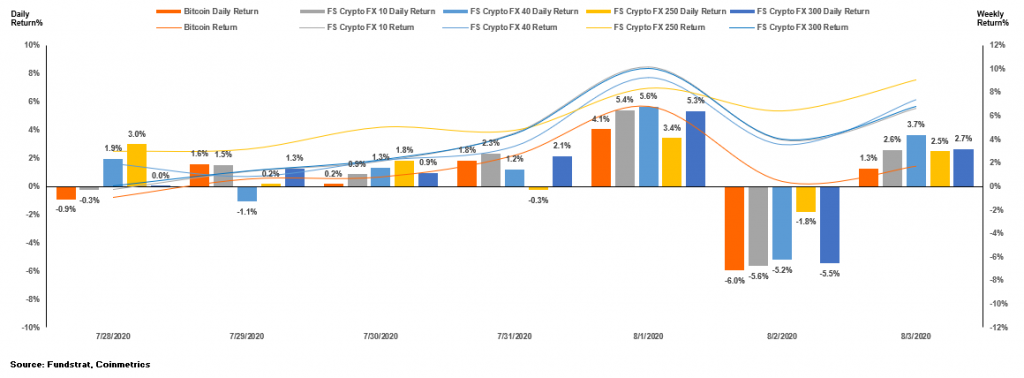

Following BTC’s last week lead, all of the FS Crypto FX indices had positive performance this week with the small-caps (FS Crypto FX 250) achieving the greatest gain of +9.1%.

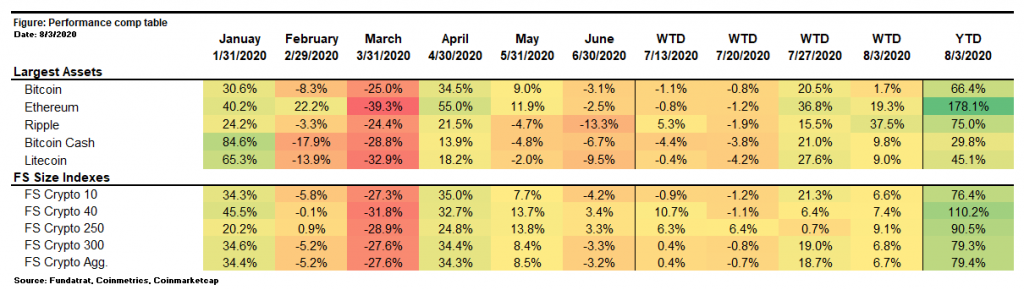

The table below shows the returns of the largest assets and the FS Size Indexes over the year.

Fundamental Valuations

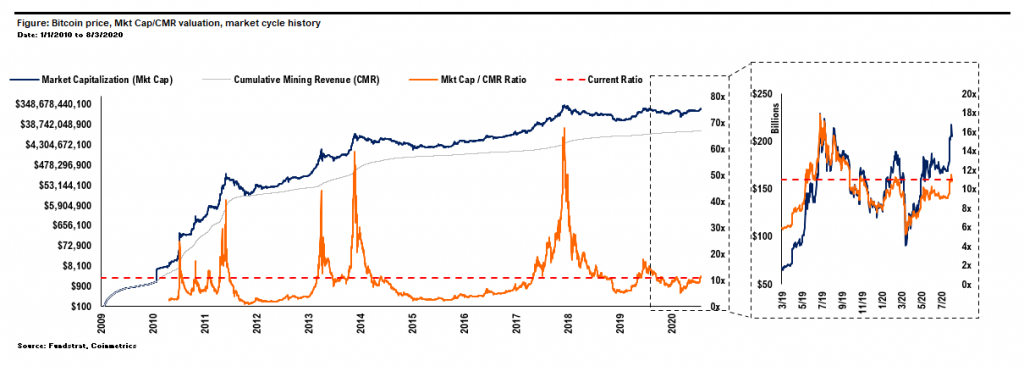

Week over week, Bitcoin’s P/CMR valuation increased slightly 1.3% from 10.8x to 11.0x.

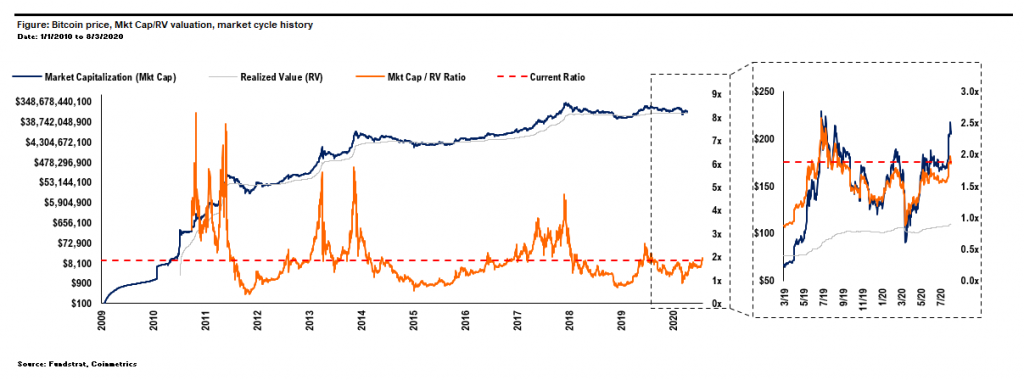

Bitcoin’s market cap to realized value (MV/RV) multiple remained flat at 1.9x.

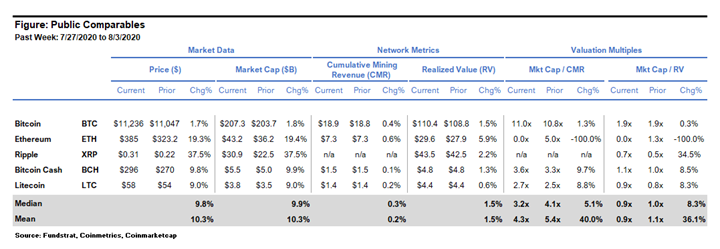

The comp table for major crypto asset prices and fundamental valuations is shown below.

Valuation Methodology

The P/CMR ratio is a fundamental valuation method I invented in December 2017 that has historically been a strong predictor of price movements. It functions like a Price/Book (Crypto P/B) ratio by telling investors if a crypto asset is relatively cheap or expensive. It’s calculated by comparing the Market Cap to Cumulative Mining Revenue (Mkt Cap/CMR). The ratio can be calculated on a per coin basis (P/CMR) by adjusting the Mkt Cap and CMR by outstanding supply. Read more.

The MV/RV ratio is another method later developed that takes a similar approach but adjusts the denominator value based on the last time coins were moved. Read more.

The P/CMR and MV/RV metrics gives an approximate measure of unrealized profit, and therefore an investors incentive to sell or hold. The P/CMR ratio gives a measure closer to the absolute floor value of sunk costs for all investors while the MV/RV ratio gives the highest end of the range. Its best to take multiple approaches when valuing any asset. These two have been the best for crypto assets in my experience, and the answer probably lies in the middle.

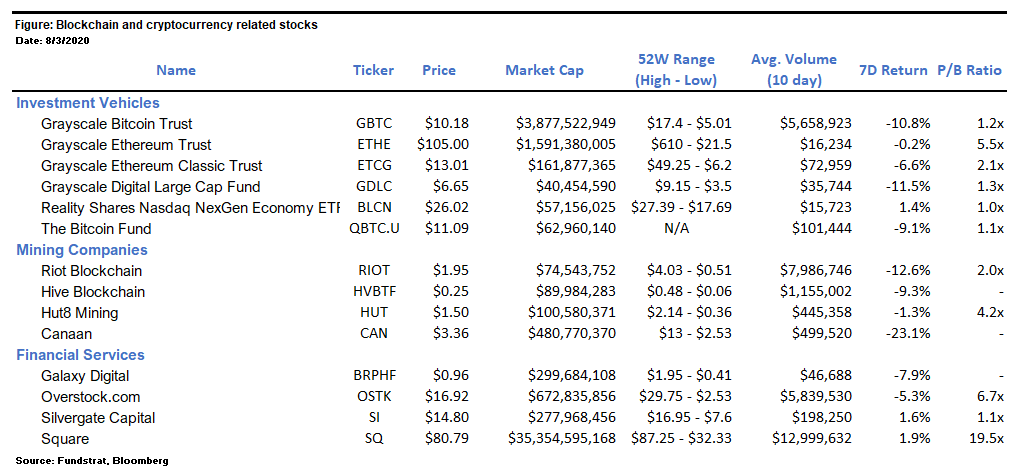

Blockchain & Crypto Stocks

The table above shows publicly traded blockchain and crypto related stocks, which offer a vehicle for investors who are constrained from owning underlying crypto assets themselves.

Noteworthy this week:

Canaan (NASDAQ: CAN) – Canaan announced that the terms of office of three of its independent directors, namely Mr. Hong Zhang, Mr. Xiaohu Yang, and Ms. Mei Luo, expired on August 1st. The nomination committee of the Board has confirmed the addition of Mr. Hongchao Du, Mr. Zhitang Shu, Mr. Wenjun Zhang and Ms. Yaping Zhang as independent directors to the Board. The newly appointed independent directors retain various experiences in the fields of Blockchain and Internet technologies, law, enterprise management, and financial management.

Grayscale Ethereum Trust (OTCQX: ETHE) – Despite Ethereum’s positive market performance in recent weeks, the OTC traded ETHE product has seen a reduction in its premium to NAV, which currently hovers at ~200%. The ETHE premium to NAV reached a peak of over 900% in early June and has since seen a steady decline. The ETHE premium is much greater than the GBTC premium to NAV which is currently ~24%.

Galaxy Digital Holdings Ltd. (TSX: GLXY) – The Block reported that Galaxy Digital is experiencing “near record levels” of trading volume amid Bitcoin’s current rally. Tim Plakas, sales lead for Galaxy Digital Trading, told the publication via email: “We’ve seen a strong increase in volumes through our desk since the start of the year as our institutional counterparty base has grown in size and sophistication. In terms of the recent move higher, the uptick in volumes we’ve seen will put this month on track to be at record levels in-line with what we saw during the climb out of crypto winter back in spring 2019.”

HIVE Blockchain Technologies Ltd. (TSXV: HIVE.V) – HIVE said it will delay the filing of its financial statements for the year ended March 31, 2020. HIVE’s earnings, originally scheduled to be released Wednesday, is expected to be filed by August 28th as the company relies on a 45-day extension period provided by Canadian regulators amid the pandemic. Meanwhile, HIVE agreed to become a development partner in the European Union-funded Boden Type Data Center research project, which aims to demonstrate highly innovative key engineering principles to construct the most cost and energy efficient data centers with minimal environmental impact.

Winners & Losers

Winner: CME and BAKKT Bitcoin Futures – Open interest in CME Group’s cash-settled bitcoin futures has hit an all-time high of $724 million amid bitcoin’s price rise. BAKKT also reported the largest single-day volumes for its physically-settled bitcoin futures, at around $114 million. The spike in open interest, or the value of outstanding derivative contracts that are yet to be settled, suggests that more money is flowing in the market and traders are expecting a near-term rise in bitcoin’s volatility.

Loser: Ledger – The crypto hardware wallet manufacturer reported this week that its e-commerce database was hacked in late June, compromising about one million email addresses. No user funds were affected by the breach. Ledger added that, for a subset of 9,500 customers, details such as first and last name, postal address, and phone number were leaked. The hack, which targeted the firm’s marketing and e-commerce database, has since been patched, the company said.

Financing & M&A Activity

Circle – Circle is partnering with Digital Currency Group subsidiary Genesis Global Trading to build out its USDC yield and lending services. As part of the arrangement, DCG is investing $25 million in Circle. Circle — which once was valued above $3 billion — pivoted to focus exclusively on the development of USDC at the end of 2020.

Diginex – Hong Kong-based crypto and blockchain solutions firm Diginex is set to list on NASDAQ via a reverse merger deal. Diginex is merging with 8i Enterprises Acquisition Corp, the NASDAQ-listed special purpose acquisition company, which will allow it to go public once the deal is completed in September. Founded in 2017, Diginex has launched its own crypto exchange called EQUOS.io, which will offer both spot and derivatives trading. The firm also operates an over-the-counter (OTC) crypto trading desk, Diginex Access, and a “hot and cold” custodian, Digivault.

Electric Capital – The venture capital investment firm has closed its second fund, lining up more than $100 million from a group of institutional investors to pour money into the next wave of crypto entrepreneurs, the firm announced Monday. The Palo Alto-based company boasts a wide-ranging portfolio of crypto investments, including non-custodial exchange dYdX, protocols like Maker, and asset manager Bitwise.

Infinite Fleet – A blockchain-based, sci-fi massively multiplayer online strategy game expected to be released next year, has raised $3.1 million via a security token sale. The SAFT sale saw participation from Litecoin creator Charlie Lee, Blockstream CEO Adam Back and Heisenberg Capital founder Max Keiser, among others. The INF token is issued on the Liquid Network, a sidechain-based settlement network developed and overseen by Blockstream, according to its website. The token is Infinite Fleet’s official game currency.

Polkadot – Blockchain project Polkadot, a challenger to Ethereum, has raised $43.4 million in a private token sale. The sale, which lasted for three days from July 24 to July 27, saw participation from several investors. They all contributed nearly 3,982 bitcoins via 1,059 transactions, according to an address associated with Polkadot. The Polkadot project was kickstarted in 2016, and its mainnet went live in May of this year. Polkadot claims to fix Ethereum’s scalability and interoperability issues.

Recent Research & Upcoming Events

Access Fundstrat’s recent crypto insights if you missed them by clicking below or visiting FS Insight.

• Leeor Shimron: Leeor will be moderating a panel on DeFi Yield Farming at the Global DeFi Summit free online event on August 6th

• FS Digital Asset Strategy Team: Business Use Cases of the Bitcoin SV Blockchain

• David Grider: Digital Assets Weekly: July 29th

Reports you may have missed

Fiscal Dominance, Flows from China, Plus Some Thoughts on Global Conflict (Core Strategy Rebalance)

WHAT BTC SHRUGGING OFF CPI SAYS ABOUT CURRENT FISCAL SITUATION The most significant piece of macro data this week was the CPI. Headline CPI registered at 3.5%, surpassing the anticipated 3.4%, while core CPI remained steady from last month at 3.8%, also above the expected 3.7%. This increase was largely attributed to rising costs in auto insurance and shelter. Consequently, interest rates saw a sharp rise, with the 10-year Treasury...

INFLOWS RESUME On Monday, market sentiments were rattled by a surprisingly strong manufacturing PMI figure, marking the first expansionary reading in 18 months. This led to a rise in rates, with risk assets across the board experiencing selloffs amid renewed inflation concerns and fears that the Federal Reserve might need to implement further measures to cool the economy. However, in our crypto comments video on Tuesday, we outlined a couple...

Adding RON and IMX As a Different Flavor of ETH-beta and Gaming Exposure (Core Strategy Rebalance)

MARKET SHRUGS AT HOT CPI The latest Consumer Price Index (CPI) data indicated a hotter inflationary environment than forecasted for February. Despite the surprise in the numbers, market participants appeared largely unmoved, suggesting that the potential impact had already been factored into their calculations prior to the release. This resilience reflects a broader sentiment that a rates-driven selloff, in response to the CPI figures, is not a significant near-term risk....