Crypto Weekly (Okt. 2nd, 2019)

Weekly recap…

- EOS settled with the SEC related to the sale of its ERC-20 tokens.

- ETH testnet split into two chains – shouldn’t affect upgrade timeline

Center Story

1. EOS emerges from ICO era a survivor

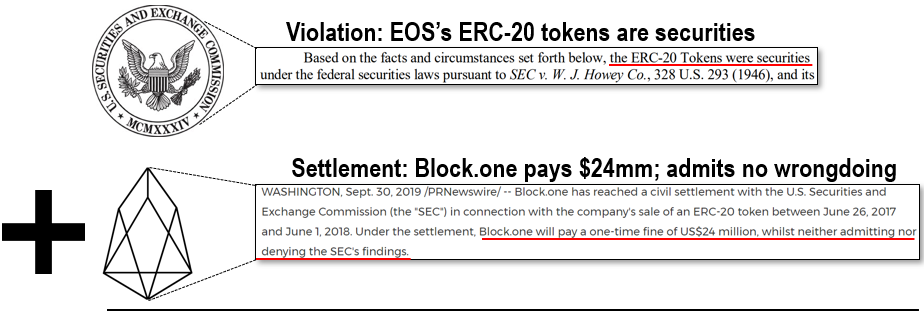

Block.one (EOS) announced a settlement with SEC for $24 million

Block.one (organization backing EOS) settled with the SEC for conducting an unregistered securities offering in 2017-2018. Specifically, the SEC judged EOS’ ERC-20 tokens were sold to investors with the expectation of profit.

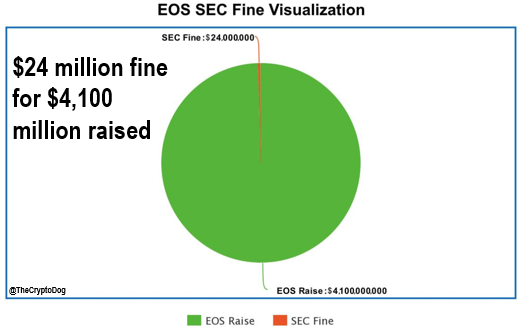

The settlement was for $24 million. This pales in comparison to the ~$4 billion EOS raised but that’s how much was raised globally. Hard to say how much of that came from US investors.

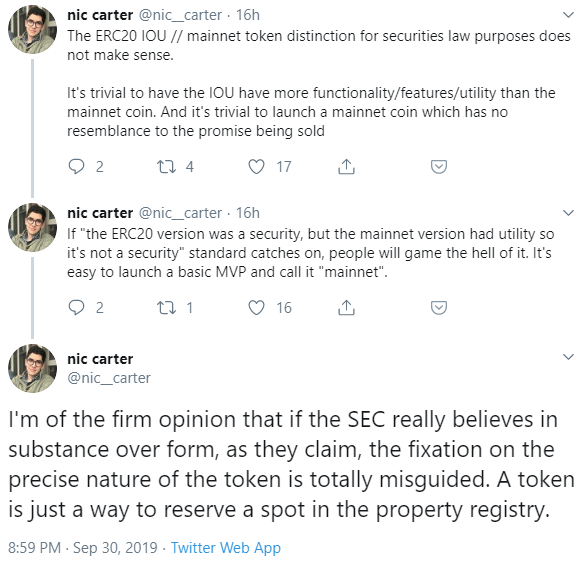

The ERC-20 tokens were what the SEC deemed to be securities, not the underlying EOS blockchain tokens that were subsequently launched.

EOS’ settlement with the SEC shows…

- Good lawyers matter. And cooperating with regulatory bodies > not cooperating with regulatory bodies (see: Kik).

- Don’t expect the old ICO market to return, despite what some say was a lenient settlement.

- One lawyer believes that the SEC has implicitly deemed EOS to be non-securities. If true, this means EOS has come out of the ICO era a suvivor with a very big war chest.(Source: BitcoinExchangeGuide)

Network Monitor

2. ETH testnet forked into two chains after “Istanbul” upgrade came earlier than expected

“Istanbul” is the first of a two-part Ethereum network upgrade (aka planned hard fork). To ensure everything goes smoothly, a testnet (this time dubbed “Ropsten”) is activated prior to the mainnet.

Ropsten was scheduled to activate around October 2nd, but because activation is based on a specified block number rather than actual date, there is a margin of error around the activation window.

In this case, the testnet was expected on 10/2, but instead activated on 9/30 due to faster than anticipated block fonfirmation times. Some miners therefore continued mining the old chain while others mined the new one. This has resulted in a testnet chain split. ETH core developers will discuss Istanbul’s testnet activation on 10/4.

- This shows the difficulty involved in managing large, distributed POW projects such as ETH. The current split was the result of an inability to coordinate between miners due to an unanticipated early activation of the testnet.

- Istanbul is planned in two stages. First comes the integration of six EIP’s scheduled for this month. The second phase is the activation of the main net, planned for 2020.

Markets

3. Market Movers (over past 7 days)

Cryptocurrencies

Bitcoin -14.8% to $8293.87

Ethereum -10.9% to $179.87

XRP -4.7% to $0.255933

EOS -20.0% to $2.96

Litecoin -16.1% to $56.06

Bitcoin Cash -22.2% to $228.12

Binance Coin -18.6% to $15.86

Stellar -1.8% to $0.06144

TRON -9.7% to $0.014524

Dash -18.7% to $71.09

Fiat Currencies

Dollar Index (DXY) +0.81% to 99.13

EUR -0.74% to 1.09 USD/EUR

GBP -1.34% to 1.23 USD/GBP

JPY -0.60% to 0.0093 USD/JPY

CNY Onshore -0.44% to 0.1399 USD/CNY

CNH Offshore -0.50% to 0.14 USD/CNH

CHF -0.85% to 1.0062 USD/CHF

Commodities

Gold -3.2% to $1483.2

WTI Crude -6.6% to $53.51

Brent Crude -6.7% to $58.86

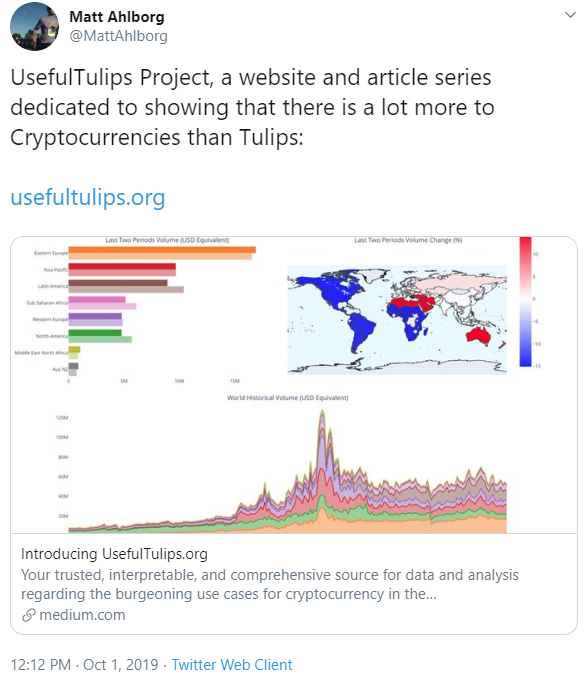

4. Top Tweets

Education

5. Required Reading

Dissecting the Block.one settlement – Katherine Wu

I compiled both the SEC settlement order AND the settlement letter that their lawyer sent to the SEC. And annotated it. Trust me, you’re going to want to read this.

Coin Metrics’ State of the Network: Issue 19 – Coin Metrics

A double header this week: This week’s issue has two weekly features. The first is about the recent market sell-off, and the second is about the recent BTC hash rate dip.

About Our Asset Rating Framework – Crypto Rating Council

Because digital assets are generally distinct from traditional securities, determination of whether a digital asset be deemed a security typically focuses on whether or not the digital asset is an “investment contract”.

Maker Dai: Stable, but not scalable – Hasu

The least understood thing about stablecoins is how they come into existence. Who creates the supply of Tether, USDC or Dai that you can buy on your favorite exchange?

Proof of Stake’s security model is being dramatically misunderstood – Viktor Bunin

The biggest obstacle to understanding its security model is applying existing security frameworks to it. More specifically, the only security model we’ve come close to understanding is Proof of Work (PoW) so we take its security characteristics and transfer them over to Proof of Stake (PoS) to try and compare. This article will go into how these security models are different, why PoW attacks are ineffective in PoS systems, and what some of the real risks to PoS look like.

Events

6. What’s happening in next week

Wednesday, October 2

b.Tokyo Blockchain Conference

Disrupt SF 2019

Thursday, October 3

Global Blockchain Summit Denver

Friday, October 4

—

Monday, October 7

Japan Blockchain Week

API:WORLD

Tuesday, October 8

Devcon 5

Wednesday, October 9

Blockchain DApp Expo 2019

Reports you may have missed

Fiscal Dominance, Flows from China, Plus Some Thoughts on Global Conflict (Core Strategy Rebalance)

WHAT BTC SHRUGGING OFF CPI SAYS ABOUT CURRENT FISCAL SITUATION The most significant piece of macro data this week was the CPI. Headline CPI registered at 3.5%, surpassing the anticipated 3.4%, while core CPI remained steady from last month at 3.8%, also above the expected 3.7%. This increase was largely attributed to rising costs in auto insurance and shelter. Consequently, interest rates saw a sharp rise, with the 10-year Treasury...

INFLOWS RESUME On Monday, market sentiments were rattled by a surprisingly strong manufacturing PMI figure, marking the first expansionary reading in 18 months. This led to a rise in rates, with risk assets across the board experiencing selloffs amid renewed inflation concerns and fears that the Federal Reserve might need to implement further measures to cool the economy. However, in our crypto comments video on Tuesday, we outlined a couple...

Adding RON and IMX As a Different Flavor of ETH-beta and Gaming Exposure (Core Strategy Rebalance)

MARKET SHRUGS AT HOT CPI The latest Consumer Price Index (CPI) data indicated a hotter inflationary environment than forecasted for February. Despite the surprise in the numbers, market participants appeared largely unmoved, suggesting that the potential impact had already been factored into their calculations prior to the release. This resilience reflects a broader sentiment that a rates-driven selloff, in response to the CPI figures, is not a significant near-term risk....