Crypto Weekly (Oct. 23rd, 2019)

Weekly recap…

- Bakkt futures hit ATH, will launch options contracts on 12/9/19

- Is quantum computing a threat to BTC?

- Several hurdles expected to improve by year end; still risk-off for BTC

Center Story

1. Bakkt futures just needed a little time… options launch coming next

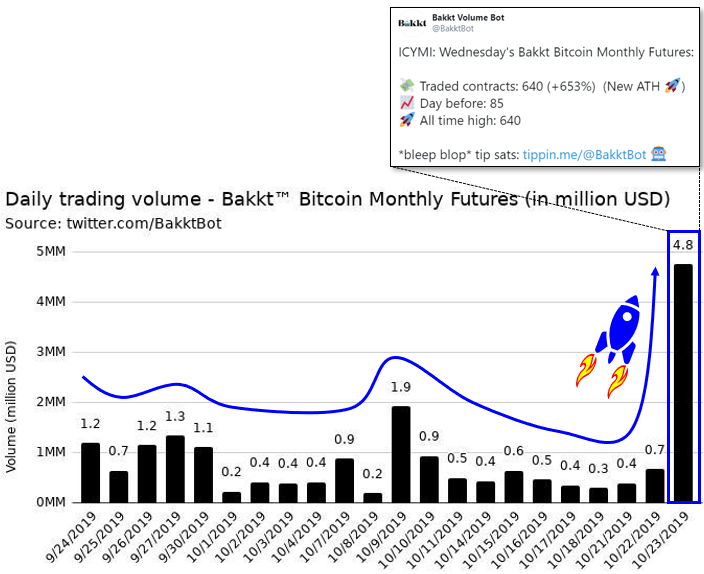

Bakkt futures daily trading volume has taken off. Was media too quick to judge? Wouldn’t be first time.

Variations of “Bakkt futures volume has been disappointing” have been a common refrain since Bakkt’s launch at the end of September. But, contract volume rocketed to 640 contracts (~$5mm) on Wednesday. Sustained volume growth will be a sign that price discovery mechanisms in crypto are improving.

One of the key benefits from Bakkt’s contract design outlined by Bakkt’s CEO, Kelly Loefller, is that prices do not rely on spot trade data:

It is widely reported that the vast majority of trading volume – greater than 90% – is impacted by manipulation, wash trades and other fraudulent activity. This means that for the first time, a benchmark futures price for bitcoin is being set without referencing the unregulated spot market.

Bakkt announced it will be launching the first regulation options contract for BTC futures on 12/9/19. Contract features below…

- Capital efficiency: Margined contracts, and cross-margining with the underlying futures contract

- Cash or physical settlement: Options will settle into Bakkt’s monthly bitcoin futures contract with time to roll, close out positions or take physical delivery

- European style option: This contract design avoids early exercise and reduces operational burdens

- Attractive fees: $1.25 per options contract (1 contract = 1 bitcoin) starting in January 2020, following the fee waiver in December 2019

- Broad distribution and liquidity: ICE Futures U.S. markets are accessible globally and have dedicated market makers to support liquidity

- Instant Messaging: Collaborate with other market participants using ICE Chat, which can be tailored to support your compliance requirements

- Block trades: Access more trading opportunities as block trades by leveraging ICE Block

- Options analytics: Use ICE Option Analytics to support options valuation, analysis and risk management

Network Monitor

2. Is quantum computing coming for Bitcoin?

One big step for computers, one scary future for crypto? From sciencenews.org:

“For the first time, a quantum computer has solved a problem that can’t be performed by a standard computer — at least not within a reasonable amount of time — Google announced October 23. This milestone, known as quantum supremacy, is a long-anticipated step toward useful quantum computers.”Quantum computers are occasionally discussed as a potential crypto killer because theoretically they may one day break the SHA-256 hashing algorithm used by proof of work cryptocurrencies. But, remember that SHA-2 (SHA-256 is a member of the SHA-2 family) is used in areas outside of crypto including government security and financial institutions. So there are a lot of incentives from stakeholders outside of crypto to develop the next evolution of the encryption algorithm. And if SHA-2 is broken, there will be a lot bigger issues than lost crypto value (bank passwords, government passwords).

As shown below, no hash lasts forever because computer power typically catches up to its security limits. Well before the time comes, BTC could transition to next-generation encryption algorithms, along with governments, banks, etc.

Lifetime of popular cryptographic hashes (red = “breakable”, green = “considered strong”. Many hashes that were once considered very strong have been broken by modern day computers.

Fundamentals

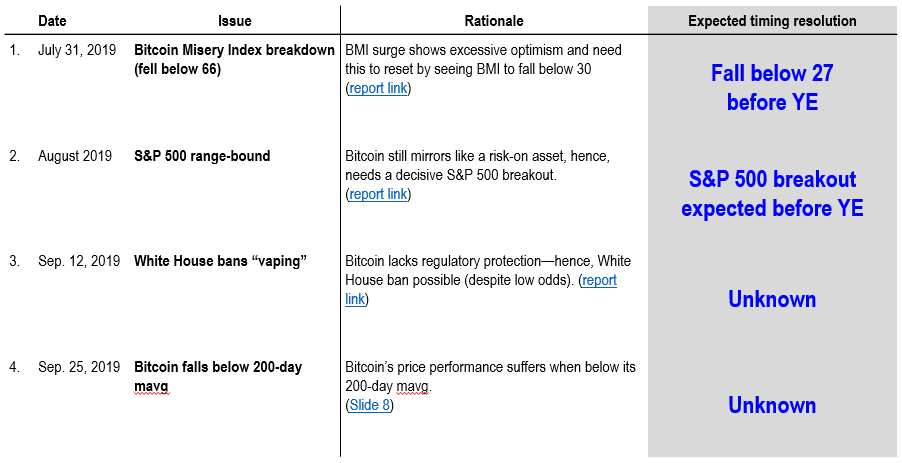

3. Several hurdles expected to improve by year end, but still risk-off for Bitcoin

Below are the primary issues we see as headwinds for Bitcoin currently and this has worsened because Bitcoin has fallen below its 200-day moving average.

Technicals

3. BTC – Daily – Corrective trend intact stress testing of next support at 7.2-7.5K

- BTC’s downtrend is intact following a break of 9K support in September and 7.7K support this week.

- BTC is now into its next minor support band between 7.2-7.5K

- BTC continues to face heavy resistance with 7.,7K now. resistance up to its 200-dma at 8.8K followed by the 9-9.3K coinciding with 50-dma at 9K.

- One minor silver lining is BTC’s RSI is showing early evidence of diverging with higher lows potentially developing. This divergence is insufficient to support.

BMI

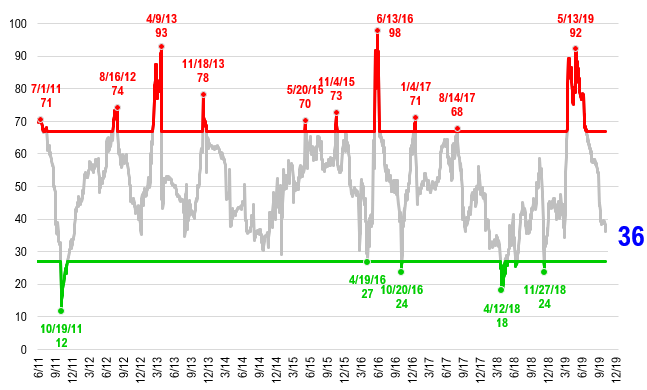

4. Bitcoin Misery Index at 36

What is the Bitcoin Misery Index (BMI)?

As a reminder, the BMI is designed to measure what we believe is the current sentiment of a holder of Bitcoin and ranges from 0 to 100. 100=euphoria and 0=misery. At the extremes, it tends to work well as a contrarian indicator (Slide 6), so readings below 27 are a “buy” signal. But when in the middle, it tends to be a coincident indicator

Markets

4. Market Movers (over past 7 days)

Prices as of 10/14/19

Cryptocurrencies

Bitcoin -1.5% to $8078.2

Ethereum -5.0% to $172.3

XRP +1.0% to $0.291607

Bitcoin Cash +2.3% to $228.04

Litecoin -2.2% to $53.74

EOS -3.0% to $2.9

Binance Coin -1.8% to $18.2

Bitcoin SV +18.8% to $106.35

Stellar -2.3% to $0.062811

TRON -3.4% to $0.015212

Fiat Currencies

Dollar Index (DXY) -1.5% down 0.41% to 97.6

EUR +0.40% to 1.11 USD/EUR

GBP +0.40% to 1.29 USD/GBP

JPY +0.15% to 0.0092 USD/JPY

CNY Onshore +0.35% to 0.1415 USD/CNY

CNH Offshore +0.50% to 0.1415 USD/CNH

CHF +0.47% to 1.0097 USD/CHF

Commodities

Gold +0.2% to $1493.3

WTI Crude +3.1% to $55

Brent Crude +1.2% to $60.14

5. Top Tweets

Education

6. Required Reading

Bitcoin Speculators Gain Upper Hand as Derivative Trading Surges – Bloomberg

As Bitcoin becomes boring for many in the get-rich-quick crowd with volatility ebbing, trading in derivatives of the largest cryptocurrency is exploding.

Mutability in Crypto and Recent Moves by the SEC

Over the last few weeks, we’ve seen a number of SEC actions surrounding crypto that provide some meaningful insight into the regulatory posture of the agency. Last week, the SEC filed an action to enjoin Telegram (creators of the Telegram Open Network, or “TON”) from distributing tokens (called “Grams”) that it had promised to purchasers of a prior investment contract.

Zuck vs DC – Messari

Tomorrow may be the biggest day in crypto’s history (at least in the US) as Facebook CEO, Mark Zuckerberg heads back to Congress to testify about the company’s plans for Libra, every regulator’s favorite crypto punching bag.

Facebook’s Libra Is ‘Neat Idea That’ll Never Happen,’ Dimon Says – Bloomberg

“It was a neat idea that’ll never happen,” JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said Friday on a panel at a conference hosted by the Institute of International Finance in Washington.

Circle spinning out Poloniex; new exchange plans to spend $100M and not serve US clients – The Block

After just one year, Circle is parting ways with Poloniex, the cryptocurrency exchange it bought for a heaping $400 million. In a blog post, cryptocurrency exchange Poloniex announced that it is spinning out from Circle into a new company and planning to spend over $100 million to develop this new exchange platform.

Mark Zuckerberg’s annotated testimony to Congress – Nathaniel Whittemore

Chairwoman Waters, Ranking Member McHenry, and members of the Committee, thank you for the opportunity to testify today. There are more than a billion people around the world who don’t have access to a bank account, but could through mobile phones if the right system existed. This includes 14 million people here in the US. Being shut out of the financial system has real consequences for people’s lives—and it’s often the most disadvantaged people who pay the highest price.

Events

7. What’s happening in next week

Wednesday, October 23

4th Annual Blockstack Summit

World Blockchain Summit Dubai (through the 24th)

Thursday, October 24

—

Friday, October 25

—

Saturday, October 26

Crypto Expo Singapore

CoinAgenda Global

Sunday, October 27

Money 20/20 USA

Monday, October 28

CryptoEconomics Security Conference

Litecoin Summit 2019 (through the 29th)

San Francisco Blockchain Week 2019 (through Nov 3rd)

Tuesday, October 29

World Crypto Conference (through the 31st)

Wednesday, October 30

Decentralized 2019 (through Nov 1st)

Reports you may have missed

Fiscal Dominance, Flows from China, Plus Some Thoughts on Global Conflict (Core Strategy Rebalance)

WHAT BTC SHRUGGING OFF CPI SAYS ABOUT CURRENT FISCAL SITUATION The most significant piece of macro data this week was the CPI. Headline CPI registered at 3.5%, surpassing the anticipated 3.4%, while core CPI remained steady from last month at 3.8%, also above the expected 3.7%. This increase was largely attributed to rising costs in auto insurance and shelter. Consequently, interest rates saw a sharp rise, with the 10-year Treasury...

INFLOWS RESUME On Monday, market sentiments were rattled by a surprisingly strong manufacturing PMI figure, marking the first expansionary reading in 18 months. This led to a rise in rates, with risk assets across the board experiencing selloffs amid renewed inflation concerns and fears that the Federal Reserve might need to implement further measures to cool the economy. However, in our crypto comments video on Tuesday, we outlined a couple...

Adding RON and IMX As a Different Flavor of ETH-beta and Gaming Exposure (Core Strategy Rebalance)

MARKET SHRUGS AT HOT CPI The latest Consumer Price Index (CPI) data indicated a hotter inflationary environment than forecasted for February. Despite the surprise in the numbers, market participants appeared largely unmoved, suggesting that the potential impact had already been factored into their calculations prior to the release. This resilience reflects a broader sentiment that a rates-driven selloff, in response to the CPI figures, is not a significant near-term risk....