Crypto takes on Capitol Hill; Recent price action characterized by supply crunch and low exchange volume; Macro picture is uncertain but presents opportunity; Ethereum upside from EIP-1559

Crypto takes on Capitol Hill

Last week, news outlets began reporting on a curious provision tucked away in the 2,700-page, $1 trillion bipartisan infrastructure bill compiled by the Senate. The bill, which is now subject to the Senate amendment process, featured a last-minute, crypto-specific addition that detailed $28 billion of incremental tax revenue resulting from enhanced crypto tax reporting rules.

The focal point of the controversial provision was its definition of “broker.” It defined a broker as any person who provides a service “effectuating transfers of digital assets on behalf of another person.” This definition was viewed by those in crypto as too broad and would likely leave intermediaries such as miners and software developers vulnerable to impractical reporting requirements.

Source: CoinDesk

We wanted to address this issue since it has garnered plenty of mainstream press and, consequently, many of our clients have inquired about it. While we understand why this news seems disconcerting, rest assured we have our ears pressed firmly against the ground on this issue, and based on industry sentiments, it is not clear that Congress was prepared for the backlash it is facing. Through the tireless work of crypto lobby groups such as Coin Center and the Blockchain Association, we are already seeing progress towards amending the passage. As of Tuesday afternoon, Democratic Senator Ron Wyden and Republican Senator Pat Toomey have committed to drafting a proposal that will overhaul the questionable crypto tax reporting provision.

Source: Twitter

What is the bigger implication for crypto here?

Stepping back, we want to be sure to express our view that this event, on balance, is bullish for the industry. It was just a few short years ago that the term “crypto” would garner nothing but dismissive smirks and contemptuous eye-rolls from those on Capitol Hill. Fast forward to today, and the Senate just snuck a crypto-related provision into a monumental and highly scrutinized bipartisan bill at the eleventh hour. This signals to us that crypto is a new but formidable asset class in the eyes of lawmakers and will be treated as such going forward. We are certain there will be additional battles over legislation in the future, but regulation and lawmaker scrutiny were always on the roadmap for most reputable market participants.

Summarizing Recent Price Action

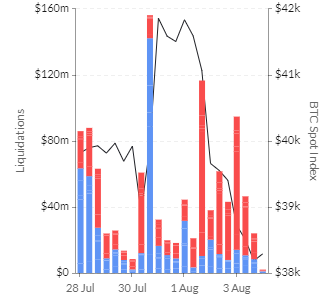

Bitcoin continued its tear this past weekend, recording another sizeable short liquidation on Sunday, sending the BTC price north of $41,000. This bullish move was followed up on Monday and Tuesday by long liquidations that would be considered nominally sized in an active market, but since we continue to operate in a low volume environment, even small liquidations are having an outsized impact on price. Liquidations on Monday and Tuesday brought BTC’s price back down below $40,000 and is finding resistance around $38,500 level, at the time of writing.

Below, we see recent liquidations and their corresponding effects on bitcoin’s price.

Source: Skew

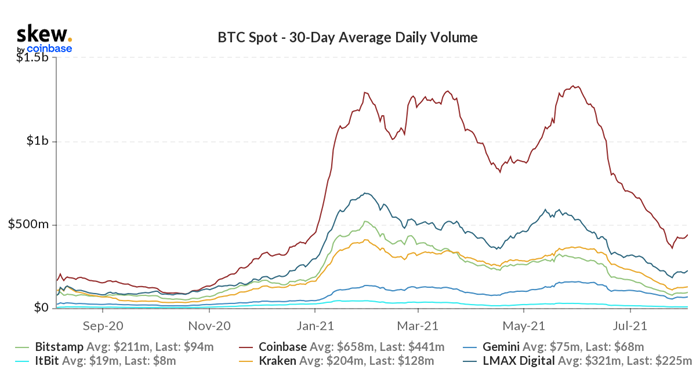

Below we observe that spot exchange volumes are still relatively modest but are starting to inch higher. Current volume levels mirror those seen toward the end of 2020.

Source: Skew

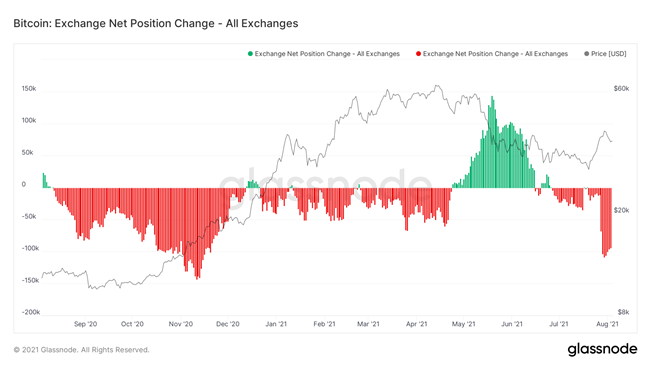

Looking ahead, it is important to keep in mind that many of these outsized moves in the past couple of weeks were largely attributable to a lack of liquidity on centralized exchanges. Since the massive drawdown in mid-May, investors have been steadily removing coins from exchanges and placing them in non-custodial wallets. While several factors may be contributing to this behavior, we view this as generally bullish for the crypto industry, as it leads to a supply crunch on exchanges and signifies an orientation toward long-term holding by investors.

As evidenced by the chart below, net outflows from exchanges normally indicate a bullish market sentiment.

Source: Glassnode

Macro Picture: Uncertainty = Opportunity

A Delta Scare is ripping through the nation. Many states are upping campaigns to get people vaccinated, and some cities are even reinstating mask mandates. The S&P 500 continues a “choppy” behavior due to a combination of summer doldrums and concerns related to a stymied reopening. 10-year interest rates are lower, an indication to many investors that the bond market is signaling a slower economic recovery.

We note that the current macro picture, while seemingly precarious, is setting up nicely for a potential bitcoin run. To summarize the uncertainty in the current macro picture:

Despite this fact pattern, we identify the following opportunity:

The Delta scare is leading to improved vaccination rates as states that were lagging have rallied to increase the number of citizens vaccinated, and according to data presented by Fundstrat, there is reason to believe that cases will peak in August. To us, the recent Delta scare is just enough uncertainty for the Fed to forego any rate hikes, and to continue bond purchases through the fall. An easy money environment is ideal for crypto as a higher money supply and a weaker dollar have historically been macro tailwinds for the asset class.

Below we can see recent decreases in the dollar index and 10-year treasury yields.

Source: Bloomberg

Keeping all of this in mind, we would not be surprised to see continued “chop” higher (between $35,000 and $45,000) over the next month as the uncertainty shakes out, but we sense that there is a good chance that people are overreacting to Delta concerns. If this is the case, there is a possibility that the market is risk-off in the fall. In our view, low rates, increasing money supply, and a risk-off market could set us up for a nice run at our all-time high.

Ethereum Upside from EIP-1559

Bitcoin is normally the main character of this weekly note since it continues to dominate the crypto market and generally maintains a high correlation to most cryptoassets. However, we want to spend some time today highlighting an opportunity in Ethereum that may not be appropriately priced in by most investors on the street.

The Ethereum Improvement Proposal 1559 (EIP-1559) is scheduled to go into effect today as a part of the London Hard Fork. This upgrade aims to improve user experience and solve the problem of high transaction or “gas” fees on the Ethereum network. The nature of the upgrade also affects Ethereum’s “monetary policy” which may have implications for the price of ETH.

EIP-1559 as a Much-Needed UX Upgrade

EIP-1559 removes the opaque bidding process for gas and replaces it with an algorithmically determined “base fee”. Pre-upgrade, users bid on how much gas they were willing to spend to have their transaction included in an upcoming block. Miners then decided which transactions they would facilitate based on bid amounts. The issue with this system is that the bids were mere estimates suggested to users by their wallets and may or may not have represented the correct gas needed. This caused users to overpay for gas – a problem that rapidly compounds in an active market and results in highly volatile fees and network congestion.

The new base fee is determined algorithmically by the protocol and will allow users to estimate transaction fees more accurately. The base fee will adjust upwards or downwards after every block (~13 seconds) depending on the level of network activity. The base fee will increase when block space utilization is greater than 50% and decrease when utilization falls below 50%. After each block, the greatest magnitude that a base fee can move is 12.5% in either direction, implying an ability to increase 10x in about 5 minutes (20 blocks). Implementing the base fee mechanism should increase transparency around transaction fees and, in turn, improve the network’s user experience.

EIP-1559 as an ETH Price Catalyst

In addition to improving user experience, we view EIP-1559 as a major update to Ethereum’s monetary policy. Pre-upgrade, transaction fees we’re paid to miners. Under EIP-1559, base fees are “burned” or permanently removed. Since the base fee must be paid in ETH the burn puts disinflationary pressure on ETH’s circulating supply. Theoretically, during times of high network activity, the amount of ETH burned could exceed new ETH issuance from block rewards (2 ETH every block) making the network net deflationary.

Earlier this year, average miner revenues topped out at ~28k ETH per day with ~50% being attributable to transaction fees. Under EIP-1559, this would result in a daily burn of ~14k ETH. With average new ETH issuance from block rewards at ~13k per day, ETH supply could very well decrease during times of high congestion and contribute to price appreciation.

Source: Glassnode

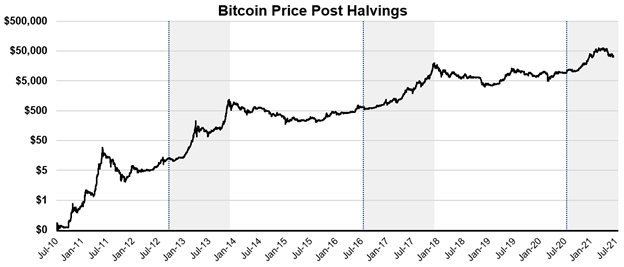

While this upgrade doesn’t explicitly put a hard cap on ETH like Bitcoin’s 21 million it should slow the net new issuance of ETH, decreasing its supply, and increasing the asset’s scarcity. From a supply perspective, the implementation of base fee burn is not dissimilar to Bitcoin’s halving events – when new BTC issuance is reduced by half at a predetermined block. Historically, the price of BTC has rallied following halvings as demand for BTC outstrips supply for some time.

Source: Glassnode

Reports you may have missed

Fiscal Dominance, Flows from China, Plus Some Thoughts on Global Conflict (Core Strategy Rebalance)

WHAT BTC SHRUGGING OFF CPI SAYS ABOUT CURRENT FISCAL SITUATION The most significant piece of macro data this week was the CPI. Headline CPI registered at 3.5%, surpassing the anticipated 3.4%, while core CPI remained steady from last month at 3.8%, also above the expected 3.7%. This increase was largely attributed to rising costs in auto insurance and shelter. Consequently, interest rates saw a sharp rise, with the 10-year Treasury...

INFLOWS RESUME On Monday, market sentiments were rattled by a surprisingly strong manufacturing PMI figure, marking the first expansionary reading in 18 months. This led to a rise in rates, with risk assets across the board experiencing selloffs amid renewed inflation concerns and fears that the Federal Reserve might need to implement further measures to cool the economy. However, in our crypto comments video on Tuesday, we outlined a couple...

Adding RON and IMX As a Different Flavor of ETH-beta and Gaming Exposure (Core Strategy Rebalance)

MARKET SHRUGS AT HOT CPI The latest Consumer Price Index (CPI) data indicated a hotter inflationary environment than forecasted for February. Despite the surprise in the numbers, market participants appeared largely unmoved, suggesting that the potential impact had already been factored into their calculations prior to the release. This resilience reflects a broader sentiment that a rates-driven selloff, in response to the CPI figures, is not a significant near-term risk....