BitDigest May 18 · Issue #904

- Seas are settling following latest crypto storm

- US legislation proposed protecting investors from IRS penalties on forked assets

- GLXY and RIOT report Q1 gains

Crypto Fear & Greed Index

The Fear & Greed Index for bitcoin and other large cryptocurrencies collapsed, dropping 40 points over the past 7-days, to a 13-month low not seen since last year’s COVID-crypto-selloff. It should be no surprise that the index is now in an ‘extreme fear’ range as FUD has returned to the digital currency market. Whether it is Elon, Tether, or taxes, crypto prices are down as the newly initiated crypto buyer decides whether they can handle the recent market weakness.

The ride continues…

I have not heard of a good term to describe the feeling in your stomach when you see crypto prices experience the first big drop. (Any suggestions?) Anxiety hits and FUD rushes in. Its often compared the bitcoin rollercoaster meme. You experience the first big drop on a rollercoaster and for a split second you want off. You have experienced 5-Gs at over 125 miles per hour, but at the end, you love the ride and go again and again till your mother (or wife) tells you it’s time to go home – you can always come back to ride the coaster another day.

The Headlines

Emmer Introduces Legislation Urging IRS to Provide Guidance on Forked Assets

FDIC Wants Information on Crypto Uses by IDIs

FTC Data Says $80 Million Lost to Crypto Scams

Crypto and Investment Gains Drive GLXY's Q1 Returns

Riot Reports Major Uptick in Q1

COIN Raising $1.25 Billion in Convertible Offering

BITF Announces CAD$75.0 Million Private Placement

BofA Moving to T+0

EY Reiterates Commitment to Blockchain Technology

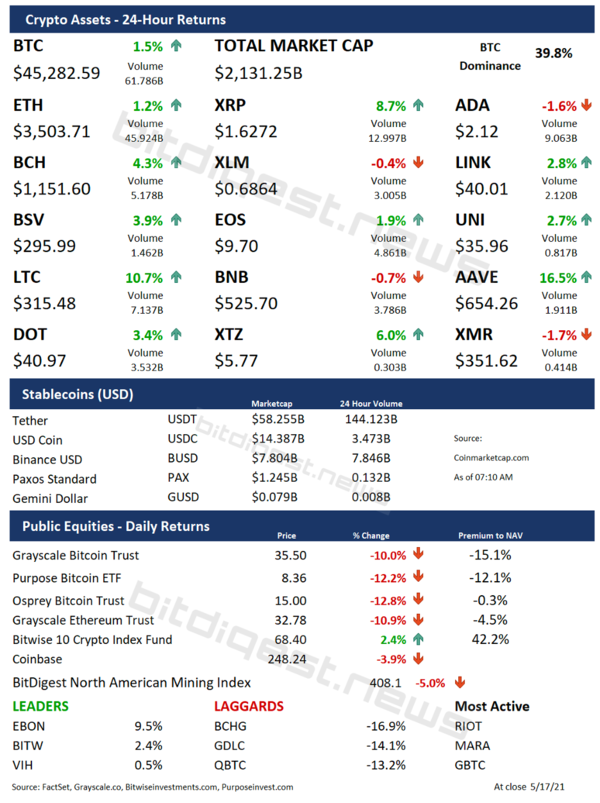

Market Data

Bitcoin Sees $100 Million in Fund Outflows

Exchange, Custody and Product News

Kraken to Support SAND, ENJ and LPT

Coinbase Releases DeFi Browser Extension

Thoughts on the Ecosystem

Fitch Issues Warning About CBDCs

Daily Cartoon

Reports you may have missed

After significantly outperforming equities leading up to its halving event on Friday, BTC0.17% continued its upward trend over the weekend, now trading just below $66k. ETH-1.42% has generally followed suit, although continuing to lag behind BTC, with its current price around $3200. SOL0.26% , meanwhile, has continued its strong rebound from the recent price slide, reaching $156 yesterday, currently trading slightly below that level. The crypto market is broadly performing well...

Happy Halving Day to all. It has been another volatile 24 hours for crypto markets, with war-related headlines sending risk assets lower overnight. BTC0.17% briefly dipped below the $60k mark but has since recouped all its losses and is now trading above $64k. ETH-1.42% followed BTC's initial drop, trading below $2900 last night, but it has now rebounded to above $3000. SOL0.26% has shown remarkable resilience amid the turmoil, now...

Tether Outlines New Organizational Structure, Aptos Partners with Microsoft, Brevan Howard, and SK Telecom

Traditional markets are finding some relief in Thursdayâs trading after four consecutive sessions of losses. The SPY and QQQ have gained approximately 0.30%, while the IWM (+0.99%) is showing outsized gains. Crypto markets are finding larger relief, with $BTC rising 3.92% to $63.7k, and $ETH gaining 2.71% to exceed $3,050. Injective ($INJ) is one of the leading tokens today, gaining 9.37% following news of a partnership with JamboPhone to bring blockchain-powered financial solutions to emerging markets. JamboPhone...

Equities and crypto assets are selling off in tandem today as inflation and geopolitical fears have spooked risk assets. The SPY and QQQ have decreased by 0.46% and 0.92%, respectively, while crypto is selling off more aggressively. $BTC (-5.49%) has tested the high $59,000s and $ETH (-4.42%) is trading below $3,000. Among a sea of red, $SUI is showing relative strength, gaining 6.44% on the back of a partnership announcement with...