Funding is off to a Slow Start in 2023

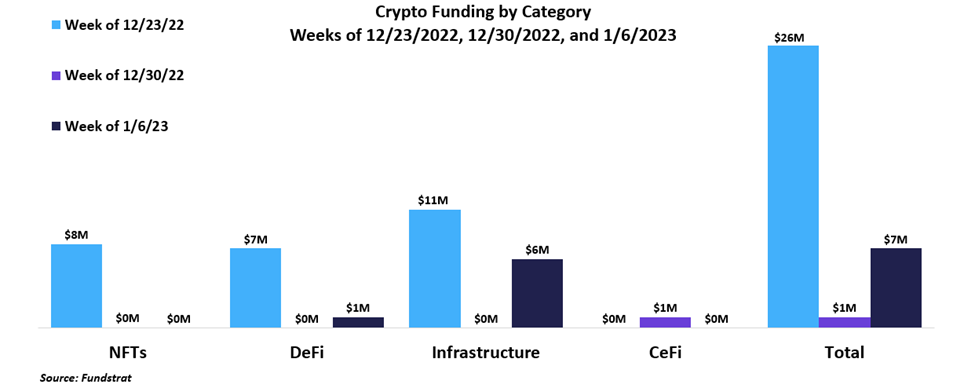

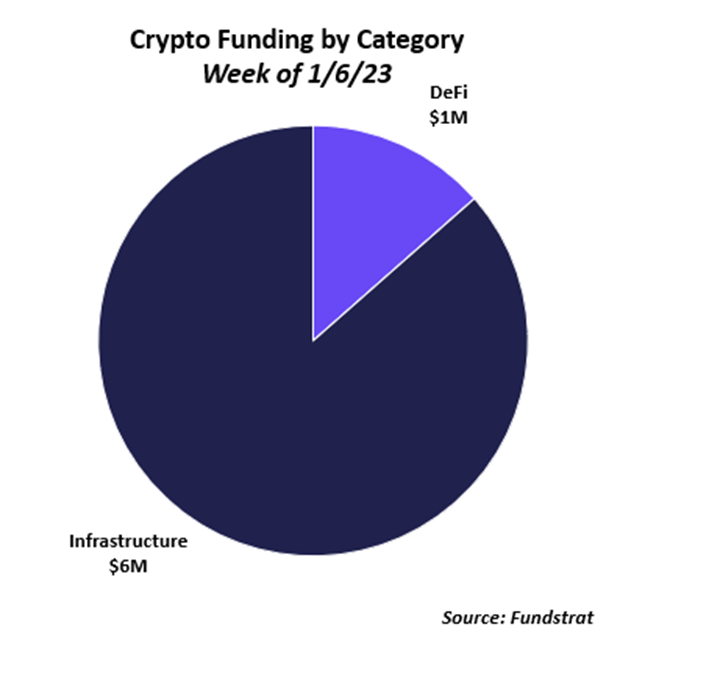

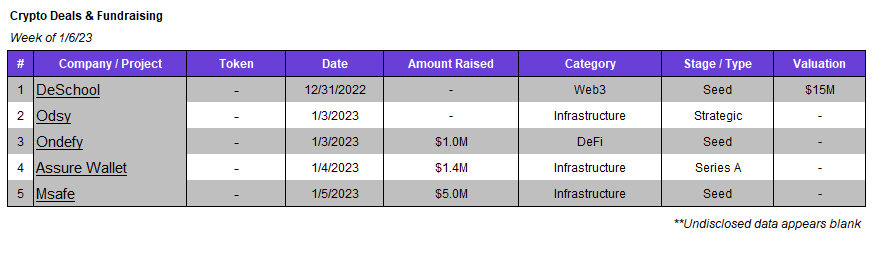

Crypto funding is off to a slow start in 2023, with only five deals this week and a total of ~$7M in funding (two deals did not report the funding amount, so the actual number is a bit higher). It’s worth noting that this is in large part due to a lack of deal activity around the holidays – last week’s funding was also low at just $1M of funding. Three of the five deals were infrastructure-related, and there was one Web3 and one DeFi deal. The largest deal this week was MSafe, which raised $5 million in a seed round led by Jump Crypto.

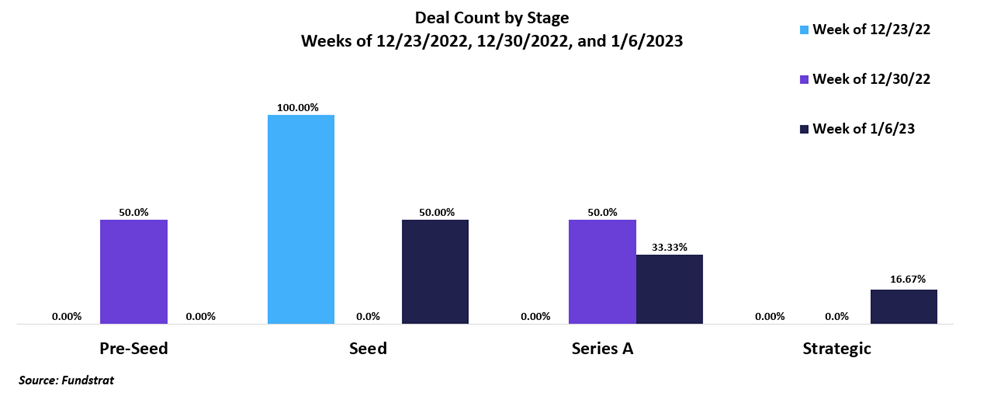

Deals remain mainly in the early stages – with seed deals accounting for 50% of deals this week.

Deal of the Week:

MSafe, a wallet services provider built on Move, raised $5 million in a Seed round led by Jump Crypto. Other investors included Circle Ventures, Coinbase Ventures, Superscrypt, and Redpoint Ventures, among others. MSafe is led by CEO Wendy Fu, who previously worked with Meta on the company’s Diem project and was a founding member of the Novi wallet. MSafe is focused on providing a scalable wallet solution for mass Web3 adoption. It plans to use the capital to grow its team, develop its product portfolio, and scale existing product adoption.

Why is this the Deal of the Week?

MSafe is the first multi-sig non-custodial wallet built on Move. After deploying its wallet on Aptos in October, MSafe has seen increased adoption from developers and consumers across the ecosystem. MSafe’s wallet solution eliminates single points of failure and risks associated with single signature authorization of fund transfers while enhancing security through its proprietary chain-level security system. Additionally, MSafe enables users and developers to integrate with the complete Move ecosystem.

Aside from being a secure wallet for consumers, MSafe has multiple use cases for protocols such as treasury or fund management, smart contract deployment and updates, protocol admin controls, and dApp store integration. As an early mover in Move infrastructure, MSafe is well suited to benefit as more developers continue to build using the new programming language. MSafe is also preparing more product offerings, including an enterprise solution, DAO tooling integration, cross-chain asset support, and an app store.

Selected Deals

Galaxy Digital, a digital asset-based financial services firm, has agreed to acquire Helios Bitcoin Mining Facility from Argo Blockchain. The purpose of the acquisition is to expand its mining services and operations. With the purchase, Galaxy Digital also plans to incorporate a new revenue stream through hosting third-party miners. In addition, the acquisition is reportedly valued at $65M.

Centbee is a centralized finance (CeFi) based platform focusing on blockchain payments. The platform has secured $1M in funding through its Pre-Series A round led by Calvin Ayre. Centbee intends to use the capital raised to improve its operational and technical capabilities.

Odsy Network is an infrastructure-based platform aiming to secure the Web3 economy. The platform plans to accomplish this through the use of cryptography. The company has secured an undisclosed amount of funding through a round led by Tykhe Block Ventures.

Ondefy is a decentralized finance (DeFi) based platform aiming to increase adoption within the space. The platform plans to accomplish this through its “Main App” and “Smart Ramp” features. The company has secured $1M in funding through its seed round. The funding round included investor participation from Stake Capital, White Loop Capital, Paraswap, Angel DAO, and others.

Reports you may have missed

WEEKLY RECAP Crypto funding rose 92% from $213 million to $410 million, one of the highest weekly totals in months. The majority of funding came from two deals: Monad’s $225 million round (DotW) and Auradine’s $80 million Series B round, the first mining deal of 2024. Auradine’s Teraflux family of Bitcoin ASIC miners has set new performance and energy efficiency benchmarks and has shown robust field performance, which has helped...

WEEKLY RECAP Funding fell 27% from $282 million last week to $206 million this week across 34 deals. Triple-digit funding seems to be the new normal, as there has been a notable uptick in the private market in recent weeks. Despite the overall increase in activity, there has been a lack of CeFi-related projects in recent weeks, with just one deal in each of the last two weeks. Agora was the singular...

WEEKLY RECAP Despite a short week in observance of Good Friday, weekly funding rose 17% from $228 million to $268 million across 31 deals. March funding totaled $960 million (with three days remaining), representing the highest figures since March ’23. Monthly deal count has reached 142 thus far, similarly marking the highest tally since 2022. Gaming companies had a strong week of funding, raising $114 million, being slightly edged out...