Binance's Acquisition Spree Continues

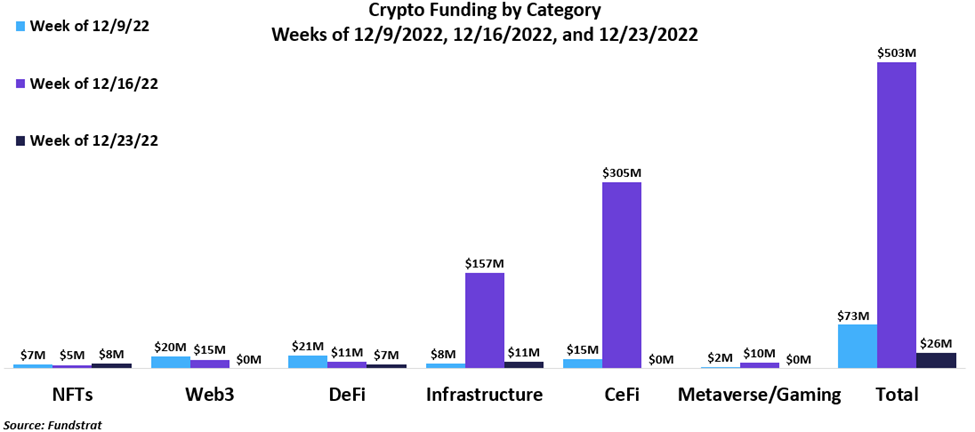

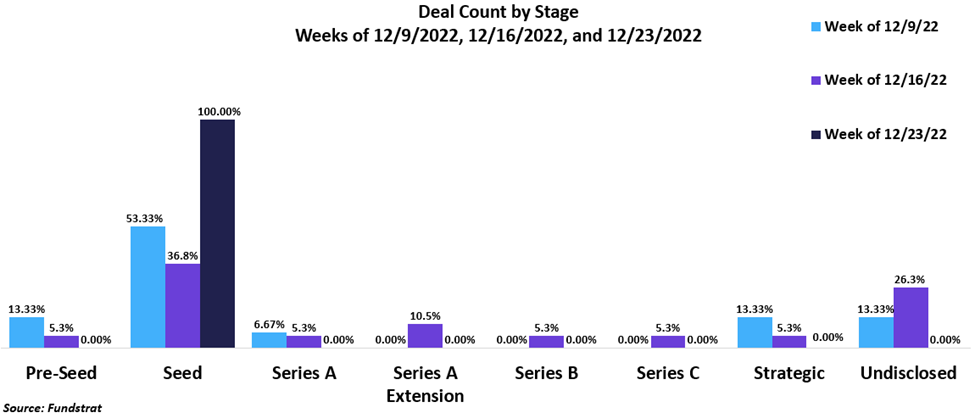

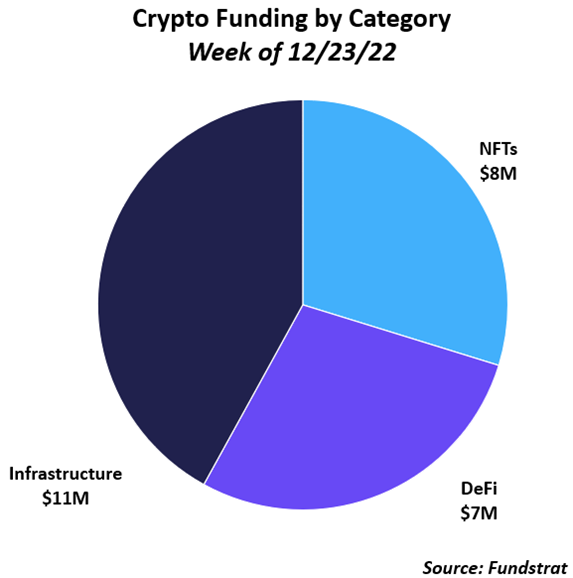

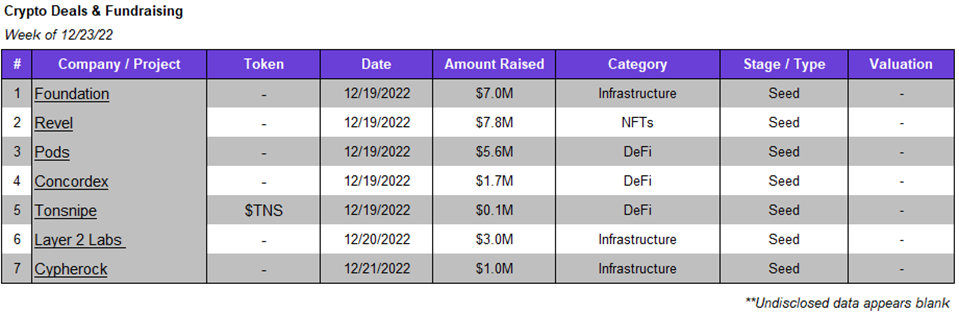

Funding dropped considerably this week, falling to $26m from $503 million last week. Infrastructure deals led funding with 42% of the capital raised. All the fundraising this week was in the seed round stage. The largest deal raised was a $7.8 million seed round by Revel, an NFT minting and trading marketplace. While NFT volume has fallen off a cliff since the high levels of activity seen late last year, many large consumer–facing firms such as Nike, Facebook, and Starbucks have continued to experiment on their potential applications for consumer activations. We go into more detail on the significance of the raise in our Deal of the Week section below.

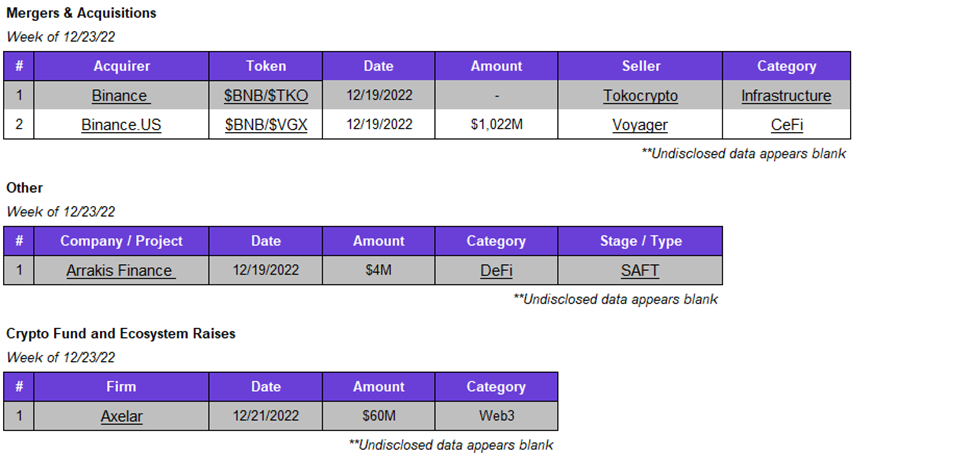

There were two acquisitions this week, both of which involved Binance. The first was affiliate Binance.US agreeing to buy bankrupt exchange Voyager’s digital assets for $1.022 billion. The transaction was equal to the fair market value of Voyager’s crypto portfolio, and an incremental $20 million consideration in addition to certain transaction related expenses up to $15 million. Binance.US CEO Brain Shroder stated their goal was to “return users their cryptocurrencies on the fastest timeline possible”. Binance also finalized the acquisition of Tokocrypto, a regulated crypto exchange in Indonesia. The world’s largest crypto exchange has continued to use acquisitions as a method of complying with country regulations, recently acquiring Japanese–regulated exchange Sakura Exchange BitCoin.

Deal of The Week

NFT collecting and trading platform, Revel, raised $7.8M in a seed financing round led by Dragonfly Capital with participation from Union Square Ventures, Sixth Man Ventures, and Polygon, among others. Dragonfly Capital CEO, Adi Sideman, describes Revel as a “cross between Instagram and Robinhood, wrapped in social game economics.” Revel combines the fun of social media expression with the trading opportunities of a digital marketplace. Revel will use this raise to expand its visual AI, web3, and social capabilities.

Why is this Deal of the Week?

Social media sites and NFTs have each skyrocketed in popularity in recent years. Despite this massive growth, social media sites have yet to integrate NFTs or digital collectibles fully. Much of what you can do today on sites like Twitter is limited to showing your NFT collection and using your NFT as a profile picture. Revel takes this integration to the next level by allowing creators to mint their digital collectibles on the site and allowing followers to collect and trade them. Users can mint their own collectibles by uploading photos or videos or by using Revel’s AI text-to-art function through Revel’s partnership with Stability AI. Most NFT launches today are done by big-name artists, brands, or teams. Revel makes it simple and easy for ordinary people or smaller artists to mint their NFTs and engage with their community. Revel believes this will lead to increased adoption of NFTs and the next wave of social media.

Selected Deals

Concordex is a decentralized exchange built on the Concordium blockchain aiming to provide institutional-level derivatives for its users. The company has secured $1.7M in funding through its seed round, with investor participation from Tacans Labs, Seier Capital, Skynet Trading, and others. Concordex is expected to launch in Q1 2023.

Foundation is an infrastructure-based platform that provides a secure way to store digital assets via its hardware wallet. The company has secured $7M in funding through its seed round led by Polychain Capital. In addition, the funding round also included investor participation from Lightning Ventures, Greenfield Capital, Third Prime, Unpopular Ventures, and others. Foundation intends to use the capital raised for workforce expansion and product development.

Arrakis Finance is a decentralized market-making protocol. The company has secured $4M in funding through a simple agreement for future tokens (SAFT). In addition, the funding round included investor participation from Polygon Ventures, Robot Ventures, Uniswap Labs Ventures, and Accel. Arrakis Finance intends to use the capital raised for workforce expansion and to continue developing its protocol.

Axelar, a communication-based protocol, has announced a $60M fund to support ecosystem startups within the Web3 space. More specifically, the platform is looking to fund projects emphasizing security, assist in onboarding new crypto users, and provide solutions that centralized projects cannot address. The fund includes investor participation from Collab+Currency, Dragonfly Capital, Morningstar Ventures, Lemniscap, and others.

Pods is a decentralized finance (DeFi) based platform aiming to provide structured products for digital assets. The company has secured $5.6M in funding through its seed round. In addition, the funding round included investor participation from Tomahawk, Framework Ventures, Alexia Ventures, Republic, and others.

Reports you may have missed

WEEKLY RECAP Crypto funding rose 92% from $213 million to $410 million, one of the highest weekly totals in months. The majority of funding came from two deals: Monad’s $225 million round (DotW) and Auradine’s $80 million Series B round, the first mining deal of 2024. Auradine’s Teraflux family of Bitcoin ASIC miners has set new performance and energy efficiency benchmarks and has shown robust field performance, which has helped...

WEEKLY RECAP Funding fell 27% from $282 million last week to $206 million this week across 34 deals. Triple-digit funding seems to be the new normal, as there has been a notable uptick in the private market in recent weeks. Despite the overall increase in activity, there has been a lack of CeFi-related projects in recent weeks, with just one deal in each of the last two weeks. Agora was the singular...

WEEKLY RECAP Despite a short week in observance of Good Friday, weekly funding rose 17% from $228 million to $268 million across 31 deals. March funding totaled $960 million (with three days remaining), representing the highest figures since March ’23. Monthly deal count has reached 142 thus far, similarly marking the highest tally since 2022. Gaming companies had a strong week of funding, raising $114 million, being slightly edged out...