DeFi Takes the Reins

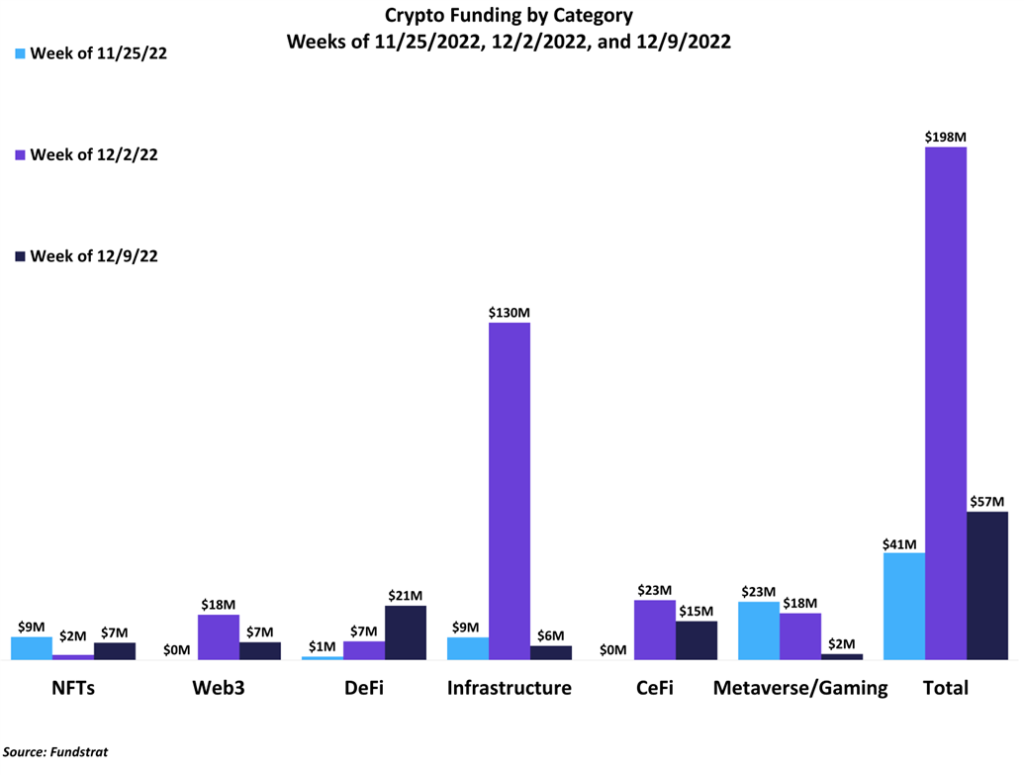

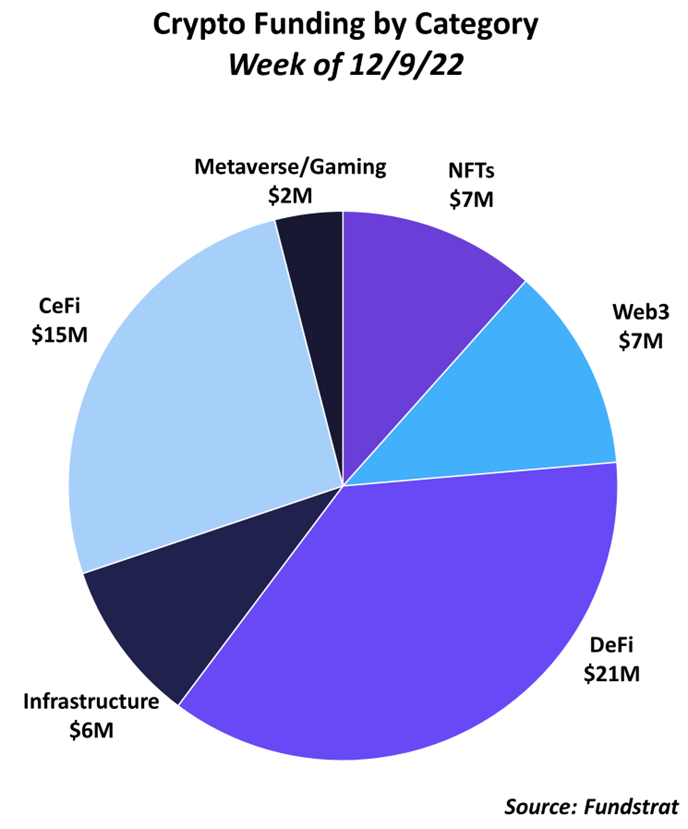

Funding saw a sharp decrease this week as we progress through the final month of the year. This week’s fundraising total was $57 million compared to $198 million last week. DeFi was the bright spot in the lackluster week, representing 37% of all fundraising. A trend is emerging around decentralized trading platforms. Perennial, a cash-settled derivatives protocol, and Panoptic, a perpetual options protocol, represented two of the three DeFi deals this week.

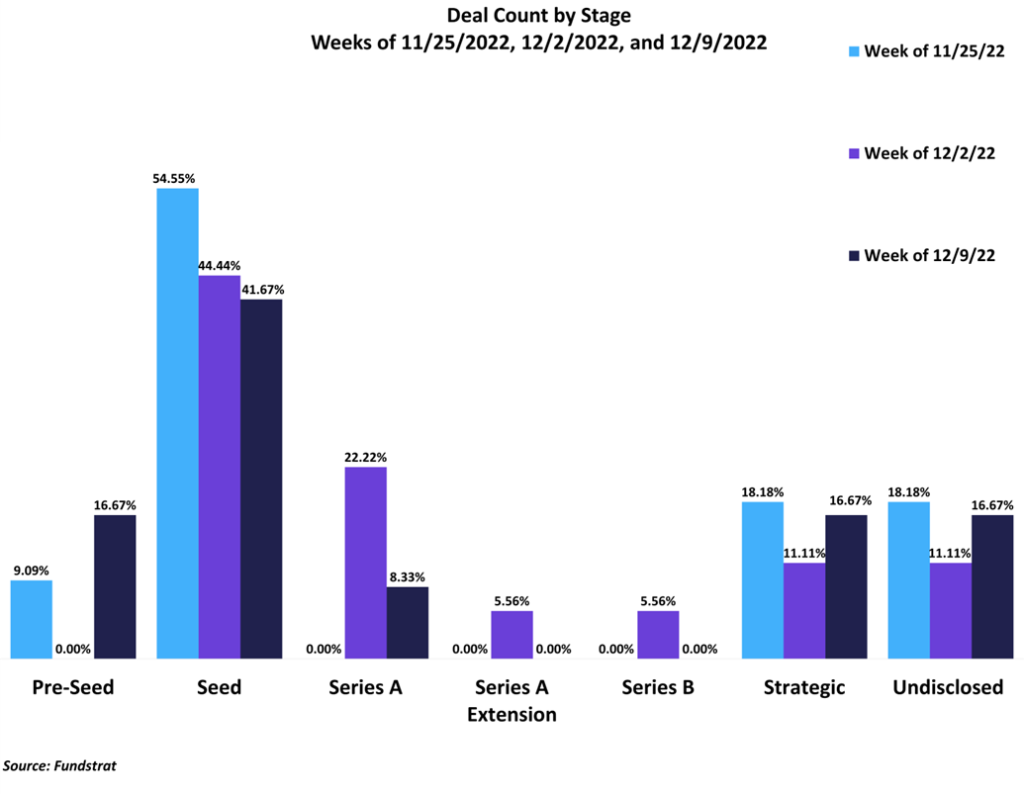

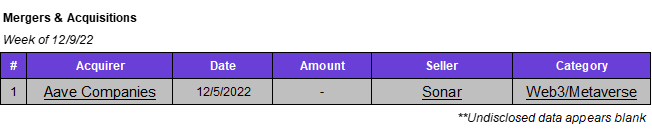

Nearly half of the deals this week were Seed round investments, with Pre-Seed and Strategic rounds being tied for the next most popular deal type. There was one acquisition this week, with Aave Companies acquiring NFT avatar company Sonar. They plan to integrate Sonar’s NFT avatars with Lens Protocol’s decentralized profile system to create a seamless digital identity. Additionally, Sonar’s executive team will join Aave’s to help continue building Web3 experiences powered by Lens.

Deal of The Week

Perennial, a cash-settled derivatives protocol that allows developers to launch any synthetic market, raised $12M in a Seed Round led by Polychain Capital and Variant, with participation from Archetype, Coinbase Ventures, and Robot Ventures, among others. Perennial offers a promising solution to decentralized derivatives – a market that has seen increasing demand.

Why is this the Deal of the Week?

The DeFi space is currently in its very early stages, with many protocols that are effective but relatively inefficient compared to their centralized competitors. Perennial aims to take DeFi to the next level by increasing both efficiency and composability for derivatives. At its core, Perennial acts as a peer-to-pool derivatives AMM where liquidity providers (makers) perpetually offer to take the other side of any user’s (takers) position in exchange for a funding rate. This is similar to Uniswap’s AMM model but for derivatives, which provides far greater optionality. Perennial provides zero slippage, is MEV-resistant, and has low fees. In addition to this, Perennial has a user-friendly infrastructure for developers that lets them experiment with new composable derivatives products. These products could range from a simple hedging mechanism to a new, innovative way to trade NFTs or other digital assets with leverage. Perennial hopes this functionality and composability will lead to decentralized derivatives growing into a significantly larger market.

Selected Deals

Shibuya is a Web3-based platform focusing on an anime series called “White Rabbit.” The platform is unique as it allows its users to vote on the story’s direction along with funding future content through purchasing non-fungible tokens (NFTs). The company has secured $6.9M in funding through its seed round, co-led by Variant Fund and Andreessen Horowitz Crypto. In addition, the funding round also included investor participation from Kevin Durant, Joe Tsai, Stani Kulechov, and others. Shibuya intends to use the capital raised for workforce expansion to release new and additional content.

Liquid Factory is an infrastructure-based platform that focuses on helping its users unlock liquidity. The company has secured $1.25M in funding through a round co-led by KuCoin Labs and Republic Capital. In addition, the funding round also included investor participation from Lapin Digital, Acheron Trading, IDG Capital, and others. Liquid Factory intends to use the capital raised to further advance its liquidity-unlocking capabilities in the NFT, GameFi, and DeFi spaces.

Bitwave is a centralized finance (CeFi) based platform aiming to assist its users by offering compliance, accounting, and tax services specifically for digital assets. The company has secured $15M in funding through its Series A round, co-led by Blockchain Capital and Hack VC. In addition, the funding round also included investor participation from Alumni Ventures Blockchain Fund, Pulsar Trading, Valor Equity Partners, SignalFire, and others. Bitwave intends to use the capital raised primarily to launch its new product Bitwave Institutional, which will cater to helping digital asset firms with bookkeeping.

Panoptic is a decentralized finance (DeFi) based protocol that provides users the ability to trade perpetual options. The company has secured $4.5M in funding through its seed round led by Gumi Cryptos Capital. In addition, the funding round also included investor participation from Coinbase Ventures, Jane Street, Blizzard Fund, Uniswap Labs Ventures, and others. Panoptic intends to use the capital raised for workforce expansion, product development, and auditing services.

360 Mining is an infrastructure-based platform focusing on Bitcoin mining. In addition to mining Bitcoin, the platform also generates revenue through traditional electricity and gas sales. The company has raised $2.25M in funding through a round that included investor participation from BT Growth Capital and Luxor. 360 Mining intends to use the capital raised to increase its mining capacity and natural gas production.

Reports you may have missed

WEEKLY RECAP Crypto funding rose 92% from $213 million to $410 million, one of the highest weekly totals in months. The majority of funding came from two deals: Monad’s $225 million round (DotW) and Auradine’s $80 million Series B round, the first mining deal of 2024. Auradine’s Teraflux family of Bitcoin ASIC miners has set new performance and energy efficiency benchmarks and has shown robust field performance, which has helped...

WEEKLY RECAP Funding fell 27% from $282 million last week to $206 million this week across 34 deals. Triple-digit funding seems to be the new normal, as there has been a notable uptick in the private market in recent weeks. Despite the overall increase in activity, there has been a lack of CeFi-related projects in recent weeks, with just one deal in each of the last two weeks. Agora was the singular...

WEEKLY RECAP Despite a short week in observance of Good Friday, weekly funding rose 17% from $228 million to $268 million across 31 deals. March funding totaled $960 million (with three days remaining), representing the highest figures since March ’23. Monthly deal count has reached 142 thus far, similarly marking the highest tally since 2022. Gaming companies had a strong week of funding, raising $114 million, being slightly edged out...