Venture Funding Hits Monthly Lows

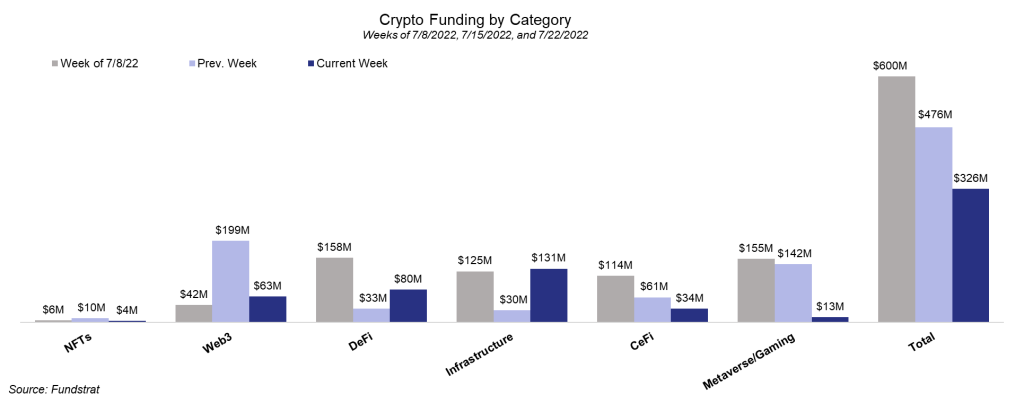

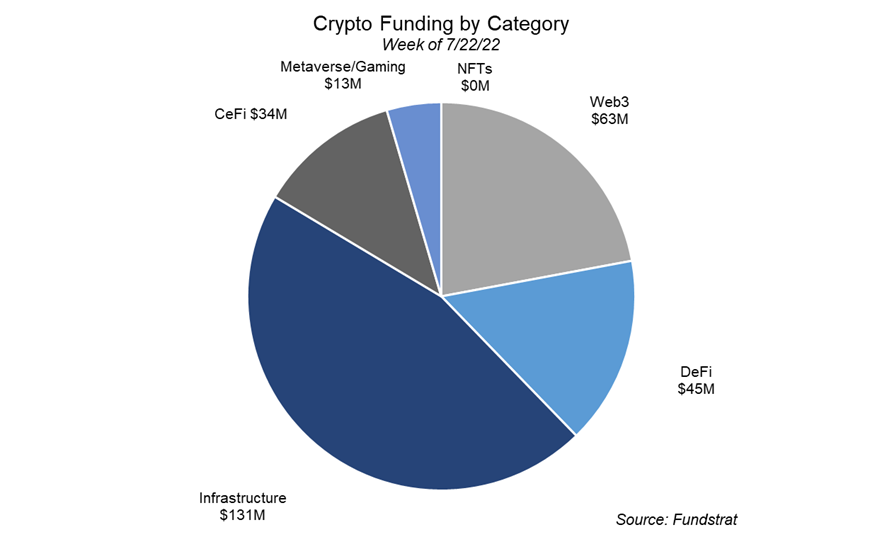

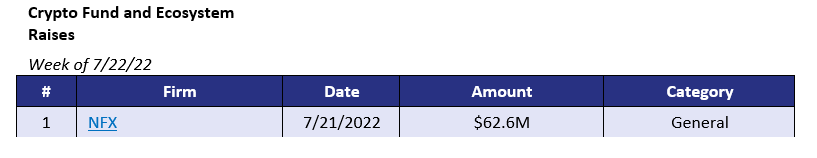

Funding fell this week, making it the lowest funded week of the month. Total deals dropped from 43 to 26, and the amount of funding decreased from $466M to $386M. Despite the decrease in funding, infrastructure had its highest deal flow all month at $131M, up from $30M last week. There were four infrastructure deals, the largest of which being Halborn, a blockchain security platform. Other infrastructure deals included Metabit, Zebedee, and Fedi. Defi also saw an uptick in investment this week, increasing from $33M to $80M. This was led by a $33M funding round for Meow, a platform backed by Tiger Global Management that allows corporate treasuries access to crypto yields. Each other category saw a decrease in investment, with Metaverse/Gaming decreasing the most from $142M to $13M. NFX, a venture capital firm with over $1 billion in total capital commitments, was the only investment fund that received funding this week. NFX added $62.61 million to its second fund for follow-on investments.

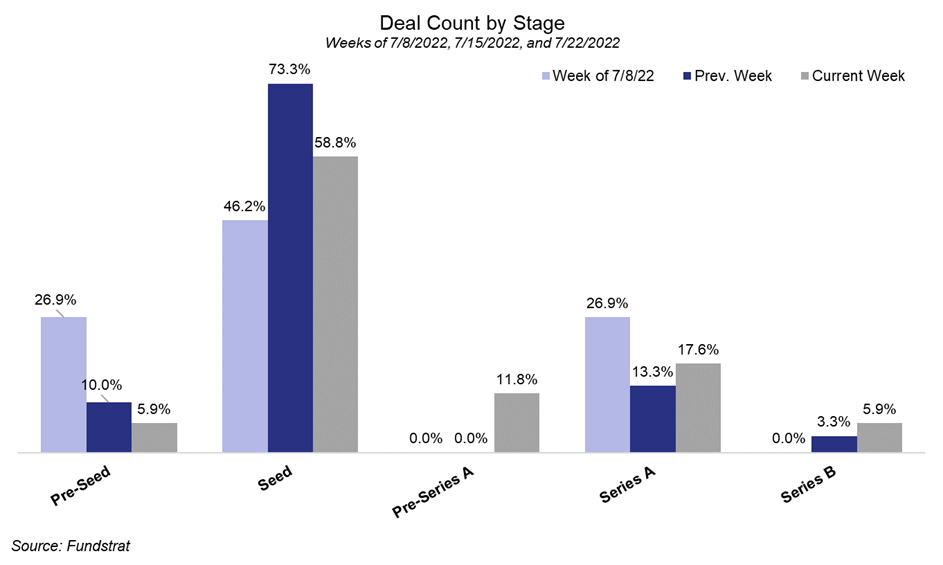

While most deals remain in the early stages (58.8% of deals this week were Seed Round), later-stage deals got more attention than usual. Series A and Series B deals accounted for 17.6% and 5.9% of deals, respectively.

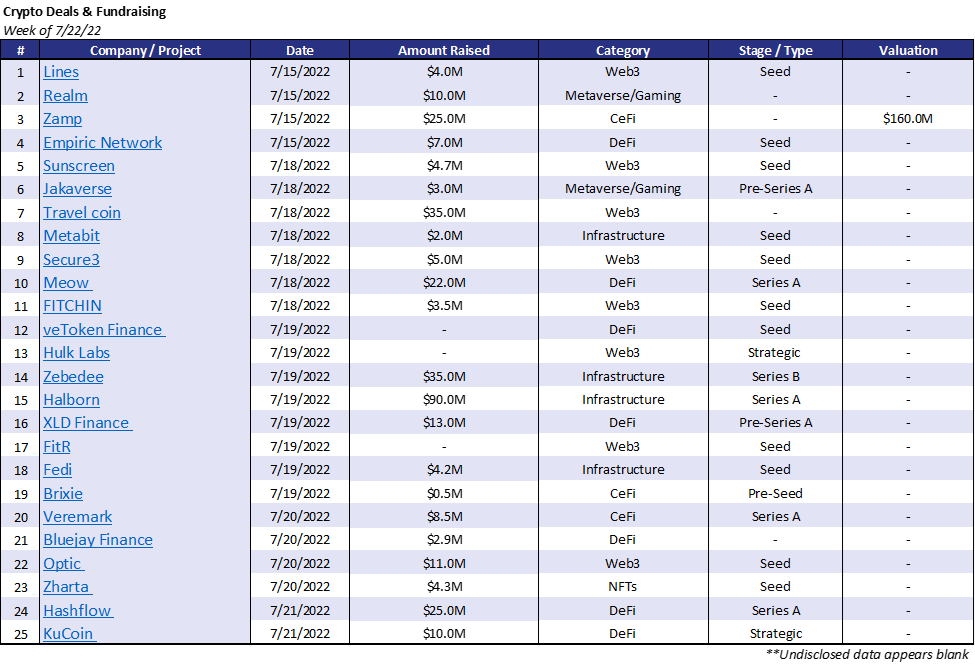

Selected Deals

Halborn is a cyber security-based service that allows ethical blockchain hackers to provide increased security to institutional clients. Its core services include security advisory, advanced penetration testing, and smart contract audits. The company has secured $90M in funding through its Series A round led by Summit Partners with participation from Castle Island Ventures, Digital Currency Group, and Brevan Howard.

Zebedee is a company that enables users to make near instant payments in Bitcoin ($BTC) in digital gaming environments. This form of payment is accomplished using the Bitcoin Lightning Network, an essential component of the platform’s payment processing infrastructure. The company has secured $35M in funding through its Series B round led by Kingsway Capital with participation from The Raine Group, Square Enix, Lakestar, and Initial Capital.

Lines, a wallet-to-wallet messaging app for Web 3.0, raised $4 million in a Seed Round led by former Twitter VP Elad Gil, with other participants including Hash3, Scalar Capital, Volt Capital, Naval Ravikant, and Balaji Srinivasan. Lines will enable users of Web3 to send messages from wallet to wallet and join chats based on tokens and NFTS you own.

Travel Coin is a Web3-based platform that provides a reward-based ecosystem within the hospitality industry. It aims to accomplish this by establishing partnerships with hotels, restaurants, and clubs and offering its customers rewards through its token ($TCOIN) on a global scale. The company has secured $35M in funding from GEM Digital.

Meow is a DeFi-based company that provides corporate treasuries with a compliant platform to access crypto investment opportunities and market yields. The company has secured $22M in funding through its Series A round led by Tiger Global with participation from QED Investors, FTX, and others. Meow plans to use the funding to expand its marketing, sales, and engineering teams to support rapid growth.

Deal of the Week

Optic, an AI-based protocol for validating NFT authenticity across all chains, raised $11 million in a Seed Round led by Kleiner Perkins and Pantera Capital. Other participants in the round included Lattice Capital, Opensea, Circle, Polygon, and Flamingo DAO, among others. Optic is working to develop an AI engine to help provide visibility into which NFTs are authentic and which are derivatives that potentially are making intellectual property (IP) violations. Optic plans to use the new capital to hire more engineers to boost its AI infrastructure.

Why is this the Deal of the Week?

The NFT market is currently flooded with derivative projects that copy the art of successful NFTs. Opensea estimated that over 80% of the NFTs on their site created using their minting tool were plagiarized works, fake collections, and spam. While some derivative projects are fun and worth looking into, they’ve become so easy to create that many of them are cash grabs. Optic’s AI engine processes the millions of new NFTs mints daily and compares them to existing NFT collections. It scans for similarities such as flipped images, color changes, and other slight distortions. Optic’s monitoring tool informs marketplaces, brands, and media companies of potential intellectual property violations. Optic’s tool is already used by Opensea as part of the company’s efforts to crack down on fraud. Shiva Rajaraman, the CPO of Opensea, stated, “Optic is way beyond other services we evaluated in terms of match recall and precision, and that’s one of the many factors that drove our decision to become a customer.”