Venture Funding Hits Yearly Lows, but CeFi Remains Resilient

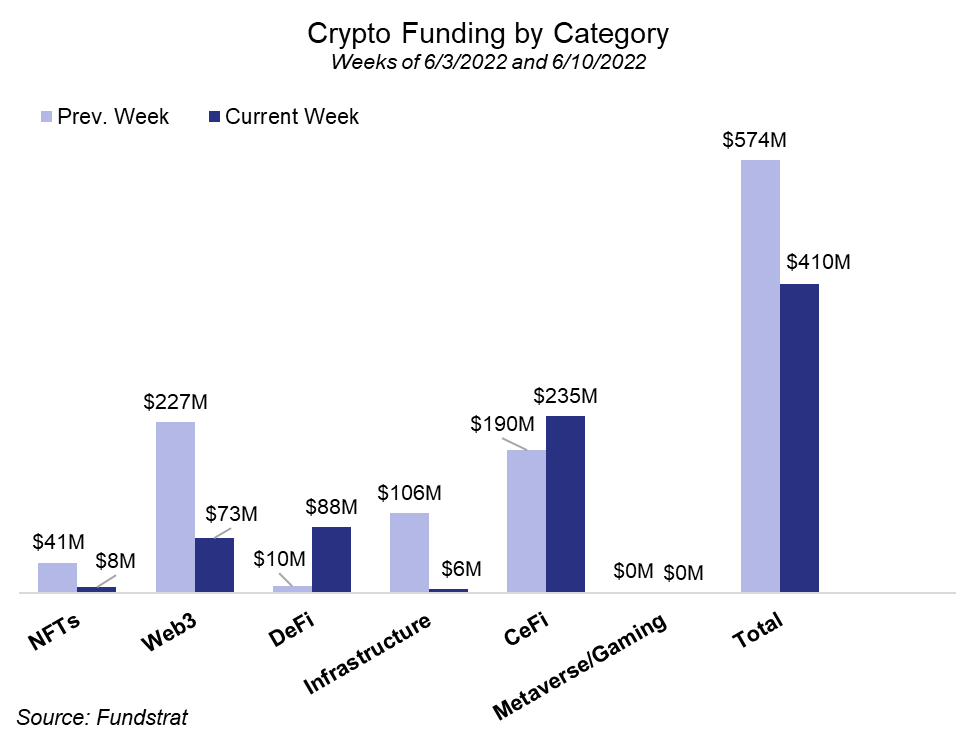

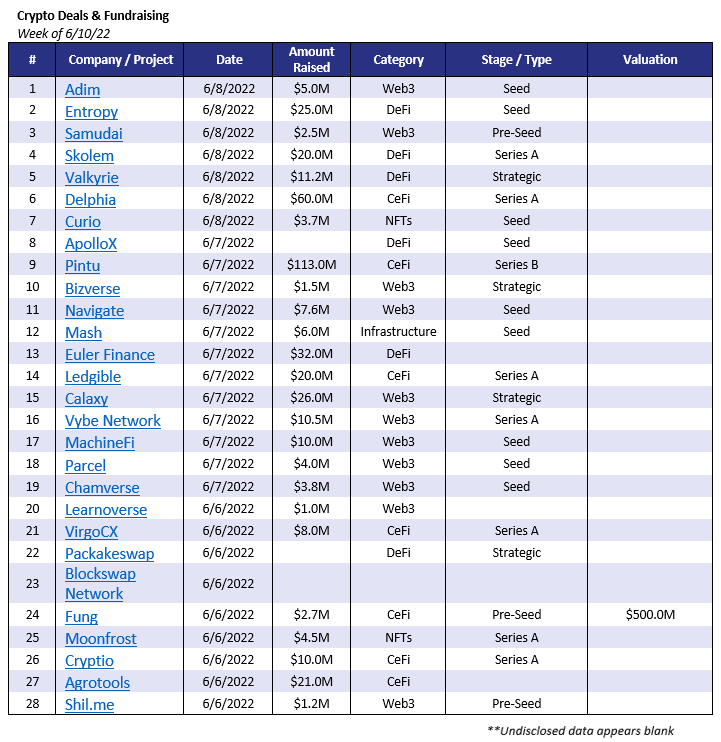

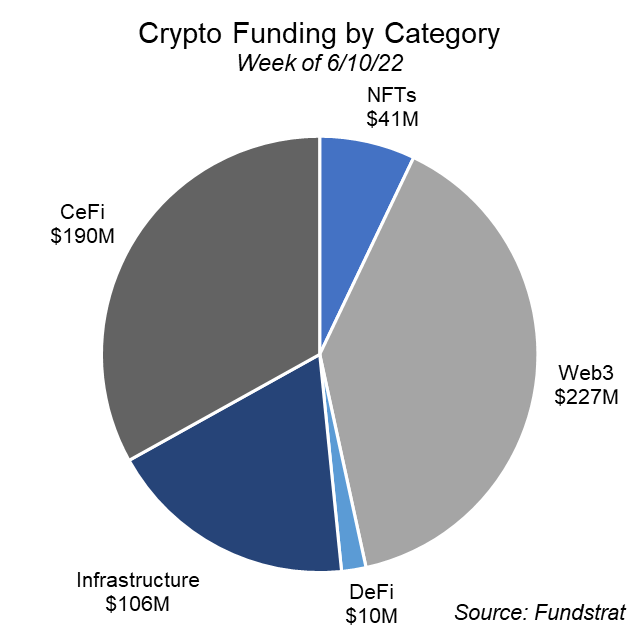

Venture funding slid lower this week, with the lowest weekly amount of money raised all year. There were 28 deals, raising a total of $410M. Despite general VC funding weakness, CeFi funding has been resilient and had made up roughly ~60% of funding for the week at $235M, an increase from last week’s CeFi financing of $190M. DeFi came in second for the most funding and rose from $10M to $88M compared to last week. Other sectors such as Infrastructure, Web3, and NFTs all dropped in funding. Metaverse/Gaming has seen the most significant reduction so far in June, received no funding in the past two weeks. Despite the lack of funding for most projects this week, there were multiple large crypto funds raised, including Valkarie Investments ($11M), Cathay Innovation ($110M), Solana Ventures ($100M), and Felix Capital ($600M).

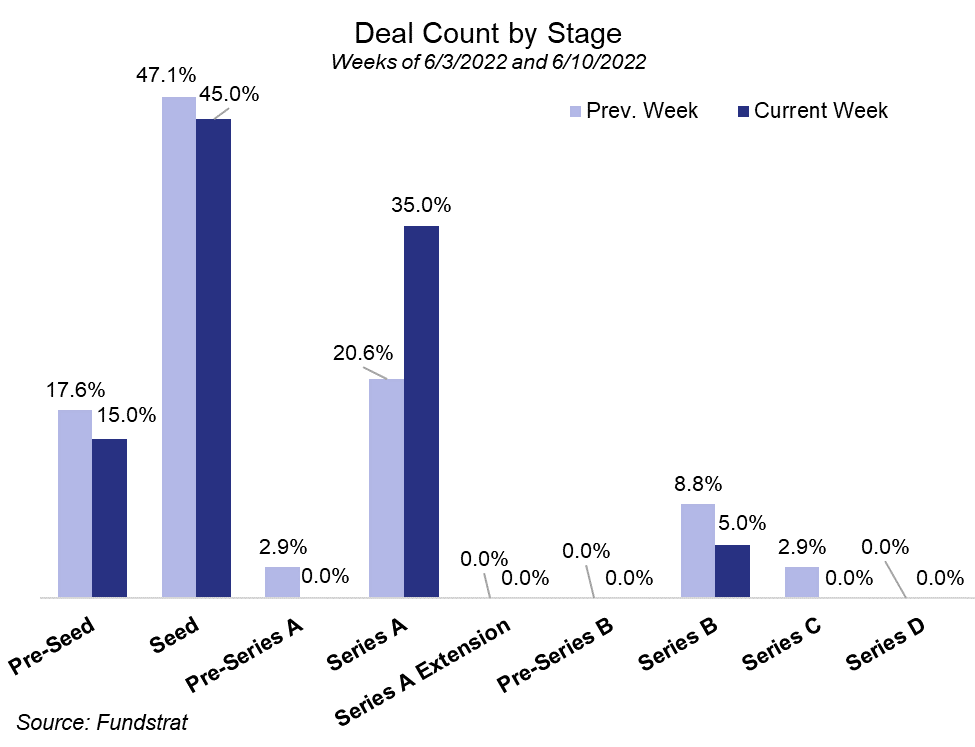

Similar to last week, the majority of the deal-making occurred in early stages. Pre-seed, Seed, and Series A Deals made up 15%, 45%, and 35% of deals, respectively

Deal of The Week

Pintu is Indonesia’s leading crypto exchange that allows Indonesian crypto investors to on-ramp and off-ramp to crypto and offers them over 50 different crypto assets. Other features of the app include Pintu Earn which offers up to 15% APY, and Pintu Academy, an educational platform that teaches crypto traders how to invest while managing risks. Pintu recently raised $113 million in its latest Series B funding round. Investors such as Intudo Ventures, Lightspeed, Northstar Group, and Pantera Capital participated in the round. This is the third round of funding the startup has received in a little over a year.

Why Is This a Big Deal?

Despite a broad market downturn this year, Pinto has been able to more than double its user base over the past 6 months from 2 million in December to almost 5 million in May. This is even more impressive when compared to other exchanges such as Coinbase, which has had to lay off employees due to a decrease in volumes amid bearish market conditions. Pintu is registered and licensed by the Bappebti regulatory agency and is working closely within the government’s regulatory framework. This deal is a testament to crypto adoption across the globe, with Pantera Partner, Paul Veradittaki, stating in a press release, “Crypto adoption is happening everywhere, and Indonesia has proven itself to be one of the world’s most rapidly growing markets for crypto-assets”.

Deals & Fundraising

- Euler Finance, a non-custodial protocol that allows users to lend and borrow digital assets, raised $32 million in its most recent round.The round was led by Katie Haun’s Haun Ventures with other companies participating such as Variant, FTX Ventures, Jump Crypto, and Uniswap Labs Ventures.

- Ledgible, a crypto tax and accounting platform, raised $20 million in its latest Series A funding round. The round was led by asset management firm EJF Capital, with investors such as Thomson Reuters Ventures, Fenbushi US, and TTV Capital, among others, participating.

- Valkarie Investments, a specialized alternative asset management firm, has raised $11.15 million in a new strategic funding round. The round saw participation from BNY Mellon, Wedbush Financial Services, Clearsky, Ziliqa Capital, C-Squared Ventures, Belvedere Strategic Capital, and SenaHill Partners, among others.

- Tatsumeeko, an immersive fantasy MMORPG-lite game set to launch on Ethereum and Solana, today announced that it had raised $7.5 million in seed funding. The funding round was co-led by DeFiance Capital, Delphi Ventures, and BITKRAFT Ventures. Other participants in the round include Binance Labs, Animoca Brands, Dialectic, GuildFi, and more.

- Entropy, a decentralized crypto asset custodian, raised a $25 million seed round led by Andreesen Horowitz. Dragonfly Capital, Ethereal Ventures, Variant, and Coinbase Ventures, among others, joined the round. The company aims to upend the standard business model of centralized crypto custodians such as Coinbase.

- Delphia, an algo-advisor that helps individuals invest, raised $60 million dollars in a Series A fundraising round led by Multicoin Capital. Other participants included Ribbit Capital, FTX Ventures, Valor Equity Partners, FJ Labs, Lattice Ventures, and Cumberland. Delphia intends to use data contributed by users to further enhance the app’s trading algorithms that manage users’ money.

Reports you may have missed

WEEKLY RECAP Crypto funding rose 92% from $213 million to $410 million, one of the highest weekly totals in months. The majority of funding came from two deals: Monad’s $225 million round (DotW) and Auradine’s $80 million Series B round, the first mining deal of 2024. Auradine’s Teraflux family of Bitcoin ASIC miners has set new performance and energy efficiency benchmarks and has shown robust field performance, which has helped...

WEEKLY RECAP Funding fell 27% from $282 million last week to $206 million this week across 34 deals. Triple-digit funding seems to be the new normal, as there has been a notable uptick in the private market in recent weeks. Despite the overall increase in activity, there has been a lack of CeFi-related projects in recent weeks, with just one deal in each of the last two weeks. Agora was the singular...

WEEKLY RECAP Despite a short week in observance of Good Friday, weekly funding rose 17% from $228 million to $268 million across 31 deals. March funding totaled $960 million (with three days remaining), representing the highest figures since March ’23. Monthly deal count has reached 142 thus far, similarly marking the highest tally since 2022. Gaming companies had a strong week of funding, raising $114 million, being slightly edged out...