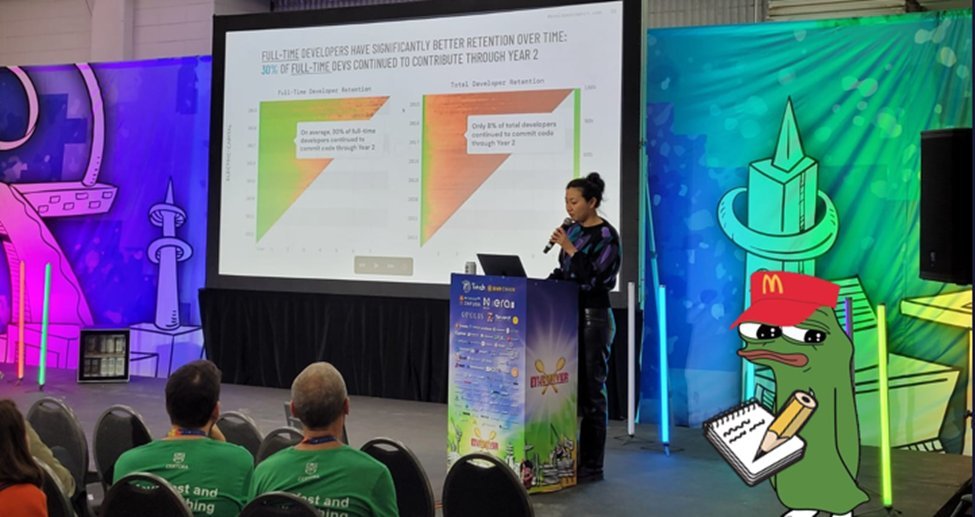

ETH Denver 2023

Key Takeaways

- We recently attended the main conference and side events spanning ETH Denver and would like to highlight some of the key themes prevalent in the space in this note.

- Interoperability, Restaking/Shared Security, Mesh Security, Treasury Management, Block Building and MEV, L2 Bridging, Virtual Machines and Liquid Staking were some of the topics discussed.

We recently attended the main conference and side events spanning throughout ETH Denver and have put together a special edition of DeFi Digest to highlight some of the protocols and themes prevalent in the digital asset space today. The panelists throughout the multi-day event ranged from Layer 1 and 2 networks, venture capital firms, dApp protocols and infrastructure service providers to provide color on topics including interoperability, modular design, security models for blockchain, and liquid staking derivatives (LSDs).

Interoperability

One of the issues discussed was the need for interoperability between the Ethereum Virtual Machines (EVM) and non-Ethereum Virtual Machines. Eclipse is making strides here by launching Polygon Solana VM, while Axelar is an IBC chain that connects Ethereum and Cosmos chains, bridges, oracles, and data availability (DA) layers that require a separate set of distributed networks to validate the data flowing through said channels.

dApps usually assume the weakest security link of the stack, which is usually the off-chain to on-chain oracle. As such, the freedom to build a distributed network doesn’t extend to bridges, oracles, and data availability layers today, because they need a separate distributed network / committee to validate the data that flows through said channels. L1s usually have a security layer inherited in consensus, which makes Ethereum the ‘most secure’ chain regardless of virtual machine or consensus mechanism. This notion of ‘inheriting the security of another chain’ is further described below in restaking.

Restaking / Shared Security

Founded by Sreeram Kannan, Eigenlayer commoditizes one of the largest distributed networks that has a significant stake (~$200b) backing it – Ethereum. Not only does this allow home stakers and liquid staking providers to re-stake ETH, it maintains Ethereum’s edge as the focal point in a multichain future while securing other dApps and L1s.

Eigenlayer commoditizes ETH staking to secure other instances (chains) or use cases (dApps) apart from its own consensus. In the most straightforward terms, ETH stakers can opt into additional slashing risk in return for extra staking rewards. EigenDA is the Eigenlayer’s hyperscaled data availability service designed for Optimistic and ZK rollups.

This inadvertently provides bridging in and out of Ethereum by running clients off-chain and having restakers certified. The trust committee solution today is one that works today but is patchy. Account abstraction will be key – dApps need to seamlessly onboard users without them being conscious of execution/consensus on the backend.

At the pace of current innovation, automated audits also need to be in place, in both Solidity, Rust, Vyper and other smart contract languages. Some use cases enabled by restaking include decentralized sequencer models and oracles bridges due to the ability to move data on the intermediate restaked layer.

Should restaking gain adoption, we view IBC chains as the primary beneficiary as most Cosmos SDK-based appchains want customizability (gas fee model, block size, block latency) for their individual use cases but desire the security of the Ethereum blockchain.

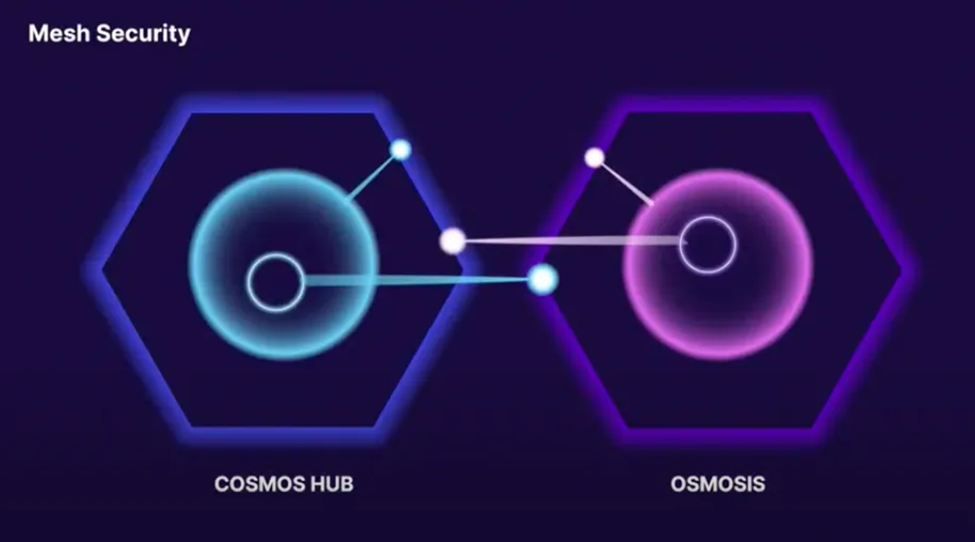

Mesh Security

An alternative to the shared security model is the mesh security model. Popularized by Osmosis, mesh security can be bootstrapped with an existing chain. It is a v3 extension to Interchain Security (ICS), intending to allow Cosmos-based chains to provide security back to the Cosmos Hub bidirectionally.

A good implementation of these include interdependent blockchains such as Osmosis and Axelar, allowing the chains to back each other. To illustrate, 6 out of top 10 assets on Osmosis are bridged by Axelar, while the $OSMO token makes up 70% of Axelar TVL. Practically, this looks like Axelar accepting validation from $OSMO validators while granting them governance rights.

The mesh security state is in nash equilibrium because aggregate emissions remain the same while security budget of both chains are increased. Existing validators are just opting into slashing risk in return for validator rewards, economically similar to re-staking offered by Eigenlayer (except Mesh Security is limited to IBC chains). In the real world, NATO is a good analogy for shared security, where each nation has their own military but NATO offers shared security to all member nation-states.

Combined with Eigenlayer and Babylon, Mesh Security allows Osmosis to inherit security from Ethereum and Bitcoin. This amplifies the stake backing Osmosis and allows concentration of voting power (due to the market cap difference), but parameters (such as hard cap on voting power) can be set to mitigate this.

Treasury Management

Apart from blockchain security design, treasury diversity was also another topic that was heavily discussed. Aera is an autonomous treasury management protocol that grow treasuries with markets while covering downside risk. The protocol was incubated by Gauntlet Network, a risk firm covering DeFi protocols that saw the market need for treasury management tooling after the bear markets.

For context, 38 DAO Treasuries are down over 50% in the past year due to poor diversification. Aera allows protocols to utilize vault guardians, who stake assets that can be slashed, to tender a portfolio for a DAO’s treasury. Vaults are customizable per protocol, which allow vault guardians to vote on a portfolio of native tokens, stablecoins, and yield-bearing tokens.

Furthermore, protocols face the ‘dumping dilemma’ when trying to manage treasury risk. Selling tokens at the top dampens public perception, as illustrated by Chainlink Labs’ open stance towards selling treasury tokens. Conversely, selling at the bottom with depressed token prices is counterproductive to maximizing budgets long term.

Block Building and MEV

Although the Merge and EIP 1559 was largely considered a success, today MEV extracts value away from the user to the validator (user > wallet > dApp > searcher > validator). However, because of the fee separation to prioritize blocks, MEV is here to stay. Post-merge, there has been renewed conversation around how to bring economic value back to the source, users.

Proposer builder separation (PBS) routes value back to the user (via ETH token appreciation and PoS yield) by formalizing the process to build blocks. Builders pay ETH to reorder blocks and extract maximal value, which then gets burnt and value socialized across stakers.

Followingly, builder margin equates to MEV extracted per block less costs paid to reorder transaction. 45% of blocks that are routed through proposers have positive margin, while 25% breakeven. The remaining 30% incur negative builder margin because of CEX-DEX arbitrage that aren’t visible on-chain.

Today, 97% of all blocks are routed through proposers, with corresponding externalities including censorship, front-running and sandwiching. Censorship involves submitting MEV transactions to kick the censored transaction off the mempool perpetually, while front-running may include tracking a wallet and acting before it during an NFT mint. Lastly, sandwiching entails front-running and selling right after to capture arbitrage profits.

L2 Bridging

Although intra-L2 bridging / communication is unequivocally important, protocols have differed in their solutions thus far. Polymer brings IBC to all chains by routing through IBC packets, while Catalyst outsources sequencer activity entirely to decentralized parties. Astria utilizes shared sequencers that separate ordering from the execution of blocks, relying on a committee of light client to vote on the state root of the canonical chain.

Conversely, modular rollups like Celestia do not inherit the trust assumptions of whichever consensus used because they run proofs themselves and do not have a ‘canonical’ chain per se. Modular data availability layers do not express a view on fraud or validity proofs, they simply provide data for the transaction to execute.

When bridging between optimistic L2s, rollups implement fraud proof periods to safeguard against fraudulent transaction finality (Optimism has a 7 day transaction finality period). However, if both rollups utilize a shared DA layer, sequencers can run the fraud proofs themselves and achieve ‘soft and fast’ finality.

Ultimately, the best bridging tech doesn’t win, what will win is what feels the most seamless and secure. Security and trust are an important facet for bridges, with customizability and composability coming at a far second.

Virtual Machines

Among the smart contract layers, EVM compatibility is the most dominant trait shared amongst the demographic (100 EVM vs 66 non-EVM). But the Ethereum Virtual Machine has been known to not be very zk-friendly as it is cost-contrained at the circuit level.

While most live rollups today utilize fraud proofs, we are growing closer to zkEVMs with Polygon, zkSync, Starkware and Scroll (announced testnet 2 days before ETH Denver). While the Solana VM currently cannot be implemented as an optimistic rollup, Eclipse is trying to bridge EVM and SVM, starting with Polygon SVM.

Compatibility with the EVM is a growth hack since most users interact with EVM-compatible blockchains, but composability makes cross-VM execution possible for gaming and app-specific rollups. Although there are a myriad of programming languages for blockchains, it is difficult to incentivize builders to adopt a particular language without tying it to a ‘default’ VM.

Liquid Staking

Arguably one of the most anticipated events post-merge is the Shanghai upgrade, which will enable the 1:1 redemption of ETH staked in 32-unit bundles to secure the chain. Conceptually, Shanghai will diminish illiquidity risk for staked Ethereum and establish the effective ‘risk-free rate’ for ETH. Prior to the upgrade in April, markets have favored liquid staking derivatives (LSDs) as they offer liquidity to staked Ether, negating the opportunity cost between securing the chain and participating in DeFi.

Amongst the liquid staking providers, the Stakewise v3 upgrade will allow solo stakers to participate in delegated staking. Moreover, the upgrade will add utility to the $SWISE token, allowing it to be used for insurance against slashing events. This ~1% APY in cost synergy can even be passed on as more yield to users.

17.5m (14.5% of circ supply) staked ETH will be withdrawable post-Shanghai in a queue, with approximately a maximum of 10% of staked ETH to be withdrawn per month. Staked ETH might plummet in the near term as unlocks are enabled (currently ~15%), but Shanghai primarily derisked the illiquidity component of ETH staking today, so long-term staked ETH securing the chain should increase, especially relative to other chains.

While newer LSD protocols with novel designs around user onboarding and tokenomics are emerging, the LSD market should converge towards an oligopoly given that the service is relatively homogenous. As such, we view YFI’s yETH to be well-positioned as an aggregator of LSD exposure.

It is not entirely clear how restaking mentioned above with Eigenlayer will affect LDO’s dominant market share as the protocol does not support restaking today. Decentralization will probably improve given that solo node operators are more nimble with Eigenlayer.

Before Shanghai goes live in April, however, there are still liquidity considerations for these LSDs that are essentially staked ETH in wrappers. Especially given that some of these LSDs are collateral for lending protocols, liquidity depth is necessary for liquidations. Post-Shanghai, liquidity requirements will also increase because of withdrawals from Shanghai.

Because peg stability is crucial, it makes sense for liquidity-rich incumbents like Curve who have the liquidity advantage to consider entering the LSD market. Instead of directing CRV incentives to help maintain the pegs of other LSDs, it can make its own LSD and incentivize protocol-owned liquidity in the LSD:ETH pool. This is analogous to Aave launching the GHO stablecoin due to its cost of liquidity advantage.