Z2O - Decentralized Options

Key Takeaways

- Although options are one of the most popular derivatives in traditional markets, they are underutilized in crypto by most measures. Penetration has been low primarily because crypto traders prefer perpetual futures as an instrument. However, we expect this to change as crypto traders become more familiar with the derivative and as more traditional market participants onboard to crypto.

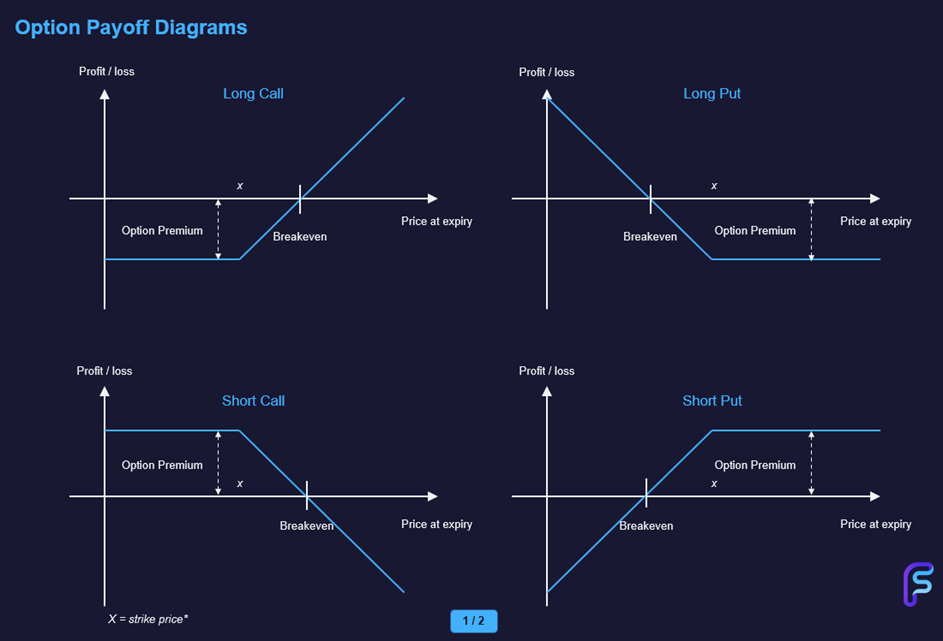

- Options are financial contracts that give holders the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a certain date. Call options give bullish holders the right to buy, while put options give bearish holders the right to sell. We explore the long and short payoff diagrams for calls and puts.

- Option premiums primarily derive their value from intrinsic value, time value, and implied volatility. Intrinsic value depends on the strike price of the option relative to the underlying price, time value depends on the length of time remaining prior to expiry, while implied volatility depends on the degree to which the underlying asset price fluctuates.

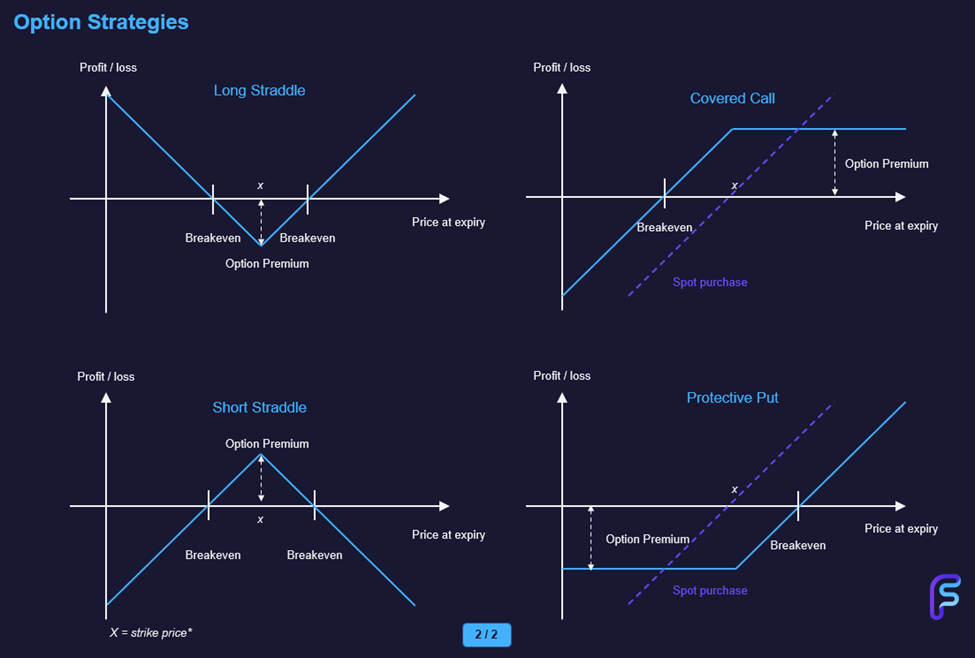

- We then present some popular option strategies and their payoff diagrams. Covered calls involve holding the underlying asset while selling OTM calls against them, protective puts involve purchasing OTM put options against an underlying position, while straddles involve simultaneously buying/selling both a call and put of the same strike price.

- Options present some advantages over other derivatives, including a fixed cost of hedging until expiry, higher cost efficiency due to gamma, and the lack of liquidation risk for long option positions.

- Despite option's advantages as an instrument, decentralized options have seen meager adoption. We contextualize options settled on blockchains and provide the case for and against them.

- Finally, we explore some of the structured products that take advantage of the composability in DeFi, including DeFi Option Vaults offered by Ribbon Finance and Atlantic Options by Dopex.

Introduction and Opportunity

Options are one of the most popular derivatives in traditional markets among institutional and retail investors. Due to their versatility, traders use options to hedge existing positions, speculate on a security’s directional moves, or generate income.

In 2021 alone, 33.3b options contracts were traded, up 35% from 2020. Much of this growth can be attributed to retail traders, who now account for 25% of option trading volumes. These retail traders were drawn to options in 2020 when a combination of COVID-19 lockdowns, stimulus checks, and a bullish stock market became the perfect storm for encouraging option activity. This growth of equity options presents a significant opportunity for crypto options, which have yet to see the same level of traction.

In fact, crypto options are underutilized by most measures. According to the CBOE, the total notional value of options volume is roughly $550b per month. This is more than twenty times the notional value of Bitcoin and Ethereum options volume, which is roughly $23b per month, according to Coinglass.

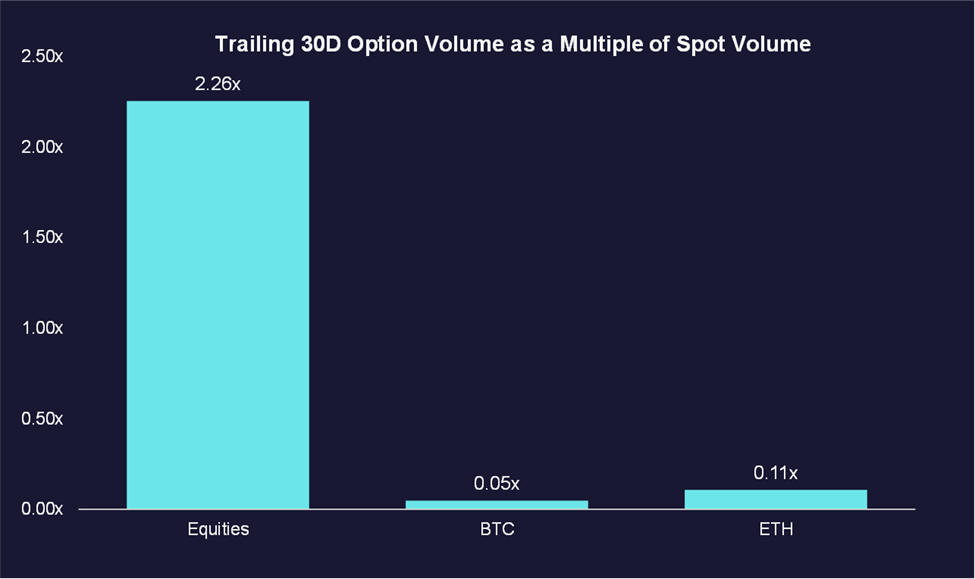

Even after accounting for differences in market size, the statistics show the penetration rate for crypto options is much lower than that of equities. Bitcoin options volume as a percentage of spot volume is below 0.05x, yet the SPX options volume as a percentage of spot volume is over 2.26x. These figures, coupled with a few catalysts detailed below, anchor the thesis for options to grow in crypto.

So far, options activity has been low primarily because crypto traders prefer perpetual futures (‘perps’) as an instrument. According to Coinglass, BTC and ETH perpetual futures currently have over $30b of open interest, while options open interest occupies about a third of that. This is likely to change as more crypto traders become familiar with options and as traditional market participants (who are familiar with options) onboard to crypto.

Centralized platforms currently dominate the crypto options market. Deribit is the clear market leader, facilitating over 85% of the BTC options market share. Exchanges such as Binance, Bybit, and the CME Group, the world’s largest financial derivatives exchange, have seen Deribit’s success and launched options products for majors. Decentralized option platforms such as Ribbon and Dopex are relatively nascent. However, as we discuss later in this piece, their main product – DeFi Option Vaults – has the potential to become a core primitive.

*If you are experienced in options, feel free to skip to ‘Appetite for Decentralized Options’

Options Fundamentals

But before we dive deeper into the decentralized options ecosystem, it is worth revisiting some options fundamentals. Put simply, options are financial contracts that give holders the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a certain date[1].

Options are classified as derivatives, a type of security that derives its value from the value of some other financial instrument, in our case, digital assets. Regardless of the underlying instrument, there are only two basic types of options: calls and puts. Call options give holders the right to buy, while put options give holders the right to sell.

Followingly, purchasers of call options are bullish, expecting the underlying asset to appreciate leading up to the call’s expiration date. Sellers of call options are typically bearish, anticipating prices to fall or remain stable prior to their expiry. In the same vein, buyers of put options are bearish, projecting for the underlying to depreciate before the put’s expiration date. Sellers of puts are generally bullish, hoping for prices to go up or remain stable leading up to the put’s expiry.

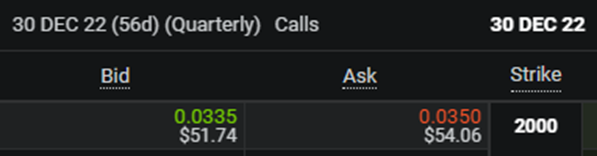

So far, it should be obvious that options have a few unique properties. To explore them, we examine an ETH-30DEC22-2000-C[2]trading at $52.90 / 0.03425 ETH (midpoint of bid/ask).

Figure: 30 DEC 22, $2k ETH Call Quotes

- Underlying Asset: ETH is the asset that underpins the value of the call option

- Expiration Date: 30 Dec 22 is the date when the option expires, after which holders can no longer exercise their options

- Strike Price: This is the price at which holders can ‘exercise’ their call options. In this case, holders can buy ETH at $2k

- Option Premium: This is the price purchasers pay to writers, quoted on a per ETH basis

A few other idiosyncratic norms apply to digital asset options. Digital asset options are typically European-style options only exercised at expiry, not anytime before. They are also cash-settled, which means any profits are paid in cash instead of transferring any asset at expiry. Most digital asset exchanges make quotes in the asset, called inverse options, but the USD equivalent is shown based on the index price. Long options positions require initial capital outlay at entry, while short options positions necessitate margins that are unique to each exchange.

Unlike equity options, digital asset option premiums are quoted on a per asset basis[3]. This premium derives its value from multiple factors, but the most relevant ones include:

- The strike price of the option relative to the actual price of the underlying asset, which is known as the intrinsic value

- The length of time remaining prior to the option’s expiration date, which determines what is called the time value

- The degree to which the price of the underlying asset fluctuates, referred to as implied volatility

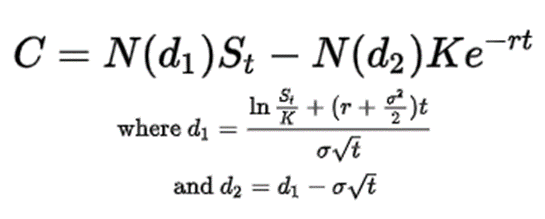

To simplify Black-Scholes (laid out in the Appendix), option pricing thus can be estimated using the formula:

In-the-money (ITM) option premiums comprise intrinsic and extrinsic value, while out-of-the-money (OTM) options only contain extrinsic value. ITM calls have strike prices below the underlying price, while OTM calls have strike prices above the underlying price. Likewise, ITM puts have strike prices above the underlying price, while OTM puts have strike prices below the underlying price. An option can also be described as at-the-money (ATM) if its strike is equivalent to the current market price of its underlying asset.

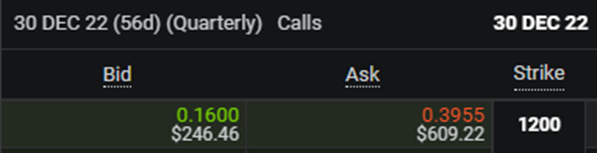

Assuming an $ETH price of $1.5k, the ETH-30DEC22-2000-C option would have no intrinsic value, deriving all of its value from time left to expiration and the volatility of ETH. Conversely, the ETH-30DEC22-1200-C option is priced at $427.85 / 0.27775 ETH (wide spreads, we know), with $300 in intrinsic value and $127.85 in time value and implied volatility.

Figure: ETH-30DEC22-1200-C Quotes

While quants can attempt to derive the exact breakdown of each component using Black-Scholes, the fundamental effects of each are:

- The more time remaining until an option’s expiration, the greater the time value portion of the option premium

- The greater the volatility of the underlying asset, the higher the implied volatility portion of the option premium

Now that we have the basics down, some popular options strategies and their payoff diagrams include:

- Covered Call: Covered calls are a strategy where investors sell OTM call options while owning an equivalent amount of the underlying asset. The strategy is typically employed to generate income (in the form of premiums) and reduces the cost-basis of investors’ spot positions. Should the underlying asset expire above the strike price of the written option, covered call writers forego any gains above the strike price.

- Protective Put: Protective puts are generally considered a risk management strategy where investors purchase OTM put options against their spot positions in the underlying asset. The strategy is usually employed when an investor is bullish on the underlying asset but also wants to hedge against potential downside. For the price of the option premium, investors are protected against downside moves below the strike price.

- Straddles: Straddles are a delta-neutral options strategy that involves simultaneously buying both a put and call option for the underlying security with the same strike price and expiration date. Traders profit when the price of the underlying rises or falls more than the premium paid for both options. Straddles are popular when investors expect strong moves in the underlying price but are unsure about the specific direction.

Options – The Derivative of Choice

Popularized by Bitmex in 2016, perpetual futures have dominated the conversation in crypto derivatives thus far. However, we remain optimistic about the future role of options in crypto for a few reasons.

Firstly, option premiums offer a fixed cost of hedging for investors with existing spot exposure. On the other hand, perps utilize a funding rate mechanism to force convergence between the perpetual contract and the underlying asset. Put simply, this funding rate has a base rate of 0.01% per eight hours, and varies according to where the futures price trades relative to the underlying spot price.

Should perpetual futures prices trade above spot prices, funding rates are positive. In this case, buyers pay sellers for the privilege of being leveraged long when markets are bullish. Conversely, when perpetual futures prices trade below that of spot, funding rates are negative – sellers pay buyers to be leveraged short when markets are bearish.

Instead of paying a variable funding rate every eight hours, exposed investors can pay a fixed option premium to be hedged until a certain expiry. While expiry dates imply that investors need to re-hedge post-expiry, option premiums are useful when market sentiment and funding rates are volatile. Numerous research efforts [1][2] are also being made to explore ‘Everlasting Options,’ the expiry-less equivalent for options.

Moreover, gamma (elaborated in appendix) as an options property translates into higher cost efficiency relative to perpetual futures, assuming a moderate amount of leverage on perps. This is because perpetual futures have a linear payoff, while options have convex payoff structures due to gamma.

Should one factor in leverage on perps (the primary reason that retail users use perps – to slide that leverage bar to 100x), then the cost-effectiveness argument becomes weaker. This is because the option buyer’s maximum capital outlay is the option premium. Option writers post a margin, similar to perps users, and are subject to liquidation.

However, with great leverage comes great responsibility. Even if perp traders realize higher cost efficiencies with margin, they are exposed to liquidation risk that option buyers are not. Throughout the duration of the position, option holders are impervious to price movements so long as the option expires ITM at expiry.

Despite these advantages of options over futures, the ease of use of futures has been an undeniable factor in its rise to prominence. The factors mentioned above, in addition to TradFi’s familiarity with options, present a strong case for options gaining future market share in crypto derivatives.

Appetite for Decentralized Options

Despite these seemingly obvious advantages options possess over other derivatives, decentralized options have seen meager adoption so far – below are some factors that could contribute to the appetite for the decentralized derivative.

1) Noncustodial with no counterparty risk

After what transpired with FTX early last month, ‘not your keys, not your coin’ has never rung truer in crypto. Despite FTX being viewed by most in the industry as one of the most reputable exchanges, billions of dollars of customer funds were lost due to its insolvency. But that was not the first time a centralized exchange or custodian lost customers’ funds or halted withdrawals. In 2014, Mt. Gox was hacked for a staggering 740k BTC from customers and 100k BTC from the company itself ($460m at the time). Earlier this year, Voyager and Celsius also each went insolvent, leaving millions of customers without access to their funds.

These exchanges and custodians have no SIPC insurance like a bank, depriving customers of protection in black swan events. They are also very opaque, giving customers little transparency as to whether their funds are safe and how they are being used. In the case of FTX, customers had no idea that FTX was sending customer funds to Alameda Research, a crypto hedge fund, to be put at risk.

Celsius, too, mismanaged customer funds. Customers were under the impression that Celsius was engaged in relatively safe investments and lending. In reality, they were using customer funds in highly illiquid investments and trading strategies. The customers of each of these default events have yet to receive their funds, and it is unclear whether customers will be able to retrieve their funds in the future. For reference, users of Mt. Gox still have yet to receive their assets over 11 years later.

Decentralized options (and DeFi in general) solve this, as digital assets traded on-chain are noncustodial – users’ assets remain in their wallets or in smart contracts throughout the trade, leaving little room for active mismanagement.

Given that DeFi Option Vaults (DOV) are fully collateralized, there is also zero counterparty risk as the notional amount of options written equates to deposits, negating the need for liquidations. Options being on-chain also gives the benefit of transparency, allowing users to track funds in lieu of trusting a third party.

2) No KYC / Permissionless

Those who live in parts of the world or whose country prohibits them from accessing centralized options can utilize decentralized options, making them accessible to everyone. Permissionless access to options also allows for privacy/pseudonymity, a quality that is not always possible with centralized parties.

3) Composability

Composability in DeFi refers to the ability of protocols to interact with each other in a positive-sum manner. Frequently described as “money legos,” protocols and products can leverage one another to offer new products to users.

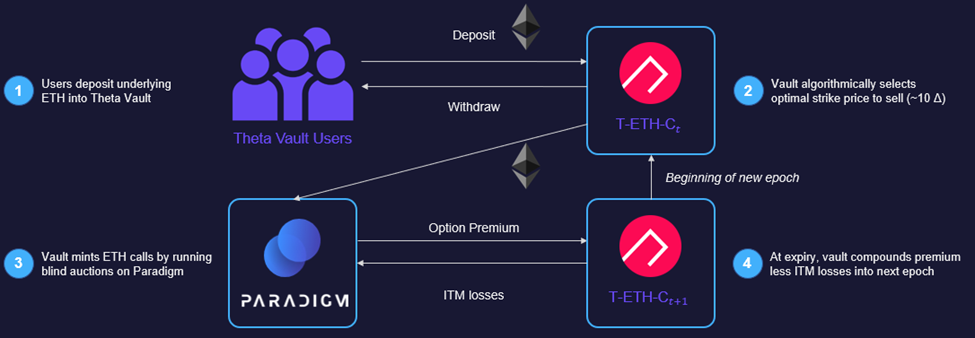

This results in efficient and creative financial products. An example would be Ribbon Finance routing their DOV deposits to Paradigm to be blind-auctioned or Atlantic Option collateral interacting with other structured products to prevent liquidations, both detailed below.

4) Alternative Source of Yield

Decentralized options vaults offer an alternative source of yield for DeFi users. Users simply deposit their tokens into these decentralized vaults to get exposure to options strategies, offering yields that can go into the double digits. Make no mistake, this yield is not risk-free – the depositors are taking on the inherent risk of the options strategy, as well as smart contract risk.

5) Smart Contract Risk

Perhaps the most significant risk to using decentralized options protocols is smart contract risk (the same kind that contributes to hacks). There have been billions of dollars stolen from DeFi protocols in the last couple of years, and there is often no recourse for retrieving stolen funds.

Options protocols are no exception – popular decentralized option protocol Opyn, was hacked in 2020 for $371k, and options protocol FinNexus was hacked in 2021 for $7.3M. One way to mitigate smart contract risk is to use decentralized insurance protocols. These protocols, such as Nexus Mutual, can provide investors some protection when using decentralized options. That is, unless the insurance protocol invests insurance premiums in undercollateralized lending pools.

6) Fees and block times

Before Layer-2 scaling solutions were launched on Ethereum, users faced high transaction fees and slow execution due to high block times. These costs cut into traders’ profitability and drove them to trade on centralized platforms with significantly lower costs. With the launch of options protocols such as Dopex on top of Layer 2s, transaction speeds and block times have been substantially improved.

7) Lack of Liquidity

On-chain options are still very much in their early stages, and they do not have nearly as much liquidity as options in traditional markets or on centralized crypto platforms such as Deribit. This makes investing in options strategies challenging for investors with large portfolios. Despite option TVL falling sharply at the beginning of 2022, it has slowly increased in the latter part of the year, signaling that the liquidity conditions are improving.

Decentralized Option Primitives

Taking advantage of the composability that DeFi offers, decentralized option protocols have created multiple new structured product primitives by partnering with other protocols or other structured products. We explore decentralized option vaults and Atlantic options below:

Option Vaults – Ribbon Finance

Having pioneered DeFi Option Vaults (DOV) as a primitive, Ribbon Finance is a platform that offers users access to structured products. DOVs do not rely on traders to become option theory experts. Instead, they allow users to simply stake their assets into vaults, which will then get deployed into automated option strategies.

The beauty of options vaults lies in their simplicity. At its core, DOV depositors trade volatility on their underlying assets by selling weekly European options and collecting their respective premiums, primarily via Paradigm. The option premiums are determined through blind auctions and underpin the weekly return for a particular week (epoch). Currently, there are two popular types of DOVs:

- Covered call: Deposit underlying, sell OTM call options on the underlying asset

- Cash-covered puts: Deposit stablecoins, sell OTM puts on the underlying asset

Using a variation of the Black-Scholes model, the strikes of these OTM options are algorithmically selected at the last minute before the corresponding option auction and typically correspond to 10 delta[4]. Option premiums (or ‘yields’) are re-invested into vaults on a rolling basis post-expiry every week, compounding yields for depositors.

By selling weekly options, the algorithm also allows for the weekly adjustment of ETH strike prices and reduces the risk of options expiring deep ITM. For context, competitors such as Dopex allow for strike selection at the expense of ease of use.

As previously mentioned, DeFi options are typically cash-settled. Should the options expire ITM, there is no transfer of the underlying – the difference between strike and expiry price will be liquidated from the deposited underlying asset to compensate the option holder. Because vaults are fully collateralized (notional sold matches deposits), there is no need for a liquidation mechanism (dissimilar to traditional option writing).

While lower relative to bull market yields, the option premiums that constitute vault yield are significant since they are ‘real.’ Throughout the ‘20 – ‘21 DeFi bull market, the primary source of yield in DeFi has been token inflation. However, relying on token issuance to attract TVL has proven to be short-sighted because it introduces significant pressure on token price when investors realize their returns.

Offering ~15 – 30% APY on collateral deposits, DOV yields are non-inflationary – it does not rely on issuing tokens to offer this yield. Instead, it monetizes the volatility of the underlying asset and investors’ need to hedge said (both upside and downside) volatility.

Moreover, DOVs solve the problem of diminishing yields in increasing pool sizes. This is because traditional LP pools allocate a fixed number of tokens (per their tokenomics) to a pool and rarely scale with size. On the other hand, the crypto option markets can accommodate the increase in deposits because it is a larger external market.

However, calling the option premium received by vault depositors ‘yield’ is a bit of a misnomer. It implies that the strategy is low-risk and passive, similar to other yielding liquidity pools. In fact, readers who remember Long-Term Capital Management remember how they wrote deep OTM options to generate superior returns. This strategy worked until it didn’t, resulting in their demise when correlated markets moved against them.

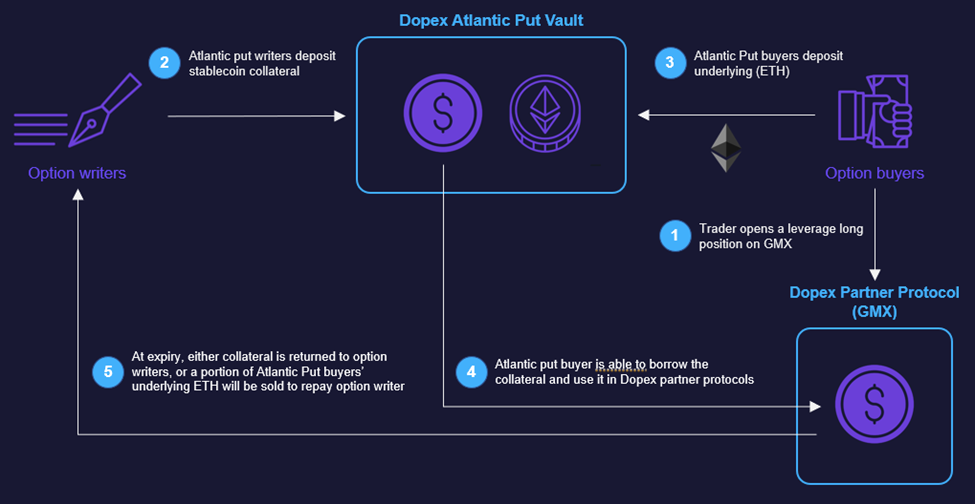

Atlantic Options – Dopex

Similar to Ribbon’s DOVs, Dopex’s main product is Single Staking Option Vaults (SSOV), allowing users to write options to generate ‘yield’ on deposited assets. Dopex builds on the idea of SSOVs with its most recent innovation – Atlantic Options.

While unreleased, Atlantic Options are a novel option supposedly aimed to improve capital efficiency in decentralized options. Unlike vanilla SSOVs, Atlantic options are a type of Single Staking Option Vault (SSOV) in which the option buyer can borrow the option writer’s collateral prior to expiry to be utilized within DeFi. This is possible because Atlantic Options are only exercisable at expiry (European) and the collateral is not directly accessible from user wallets. Instead, it is deposited in smart contracts written for different use cases and can only be put to work in Dopex partner protocols.

Due to the ability to borrow the option writer’s collateral, Atlantic options are priced higher than regular options. Premiums are a variation on Black-Scholes pricing, taking into account the remaining supply of options in the pool and time to expiry. Anytime capital is borrowed and unlocked from an option, a funding fee is paid. This fee is inversely proportional to the percent of capital remaining in the Atlantic option pool up to a maximum funding percentage set by governance.

One of Atlantic options’ highly anticipated use cases is insuring leveraged positions on GMX. Traders who utilize leverage in crypto risk losing their full position if the price moves enough against them. For example, a trader who buys ETH for $1500 with 2x leverage would have their position fully liquidated if the price were to drop to $750 (50%).

By insuring their leverage position with an Atlantic, the trader effectively reduces their liquidation price to zero. He first pays a premium to purchase an ETH/USD Atlantic Put of $800 strike (just above the liquidation price of $750), depositing the underlying (ETH) into the option contract to unlock the collateral of the Atlantic cash-covered put (USD).

Should the price of ETH drop to $800, the option writer’s collateral is unlocked from the option contract and deposited into the GMX position – effectively adding collateral and protecting the user from being liquidated. During the time the collateral is unlocked, the user pays an additional funding fee to be paid to the option writer. If the price rises back above $800 by a set amount (10% for example), the collateral is automatically moved back from the leveraged position and into the Atlantic Put.

Atlantic options providing the potential to avoid liquidation is certainly an advantage, especially in an asset class where volatility is high and price can often move to a trader’s liquidation before reversing to a level that would have put them in profit. However, Atlantic options are not cheap. In the example above, fees that need to be paid to enable liquidation-less perpetual futures positions include:

- Funding rates to GMX for the futures position

- Incentives to bots that monitor open positions to know when the price is getting close to liquidation and to transfer the option writer’s collateral

- Funding rates to the option writer when borrowing the collateral

- Option premiums to the option writer for selling the option

The claim that Atlantic options improve capital efficiency is a stretch at best. Although Atlantic option purchasers can unlock the collateral for use before expiry, they need to deposit the option’s underlying asset to do so. This ensures that the collateral loan from the seller to the buyer is fully collateralized but calls into question the need for a loan (classic over-collateralization problem). Put simply, why would the Atlantic option buyer pledge the underlying to borrow the seller’s collateral to add to their margin positions, when they can use the underlying instead?

As such, Atlantic Options can be used during periods of high volatility when traders want to undertake significant directional risk yet want to be hedged in case they are wrong, but don’t want to use the underlying asset to do so. If the market were to go sideways for an extended period, the fees would eat away at any profits in GMX’s long positions.

Bottom Line

Given its market size in traditional finance, versatility as an instrument, and familiarity among traditional finance entities, options have the opportunity to gain market share in crypto derivatives. Option vaults have been the primary primitive in decentralized options with some level of traction, with newer products taking advantage of vaults by building atop them. Nevertheless, when evaluating shiny new instruments, investors should discern product risks and protocol claims before investing.

*Special thanks to JB DeGroft for his help in writing this piece.

Appendix

Based on the Black-scholes model, option greeks measure the sensitivity of option prices to different parameters.

Specifically, they are:

- Theta (t): how much option prices decay as it approaches expiry

- Vega (σ): how much option prices move for every 1% change in implied volatility

- Implied volatility measures the current market price for volatility, while realized volatility shows the actual price differential for a given underlying over a defined historical period

- Rho (r): how much option prices move relative to interest rate changes

- Delta: how much option prices move for every $1 change in the price of the underlying asset

- One way to look at it is the likelihood that an option will expire in-the-money (ITM)

- Another way is the number of underlying behaves like. E.g. delta of 0.50

- Gamma: how much delta moves for every $1 change in price of the underlying asset

[1] This describes American style options. Digital asset options are typically European style options, which are exercised at expiry and not anytime before. This is done automatically and no action from the trader is required.

[2] The symbol of an options contract consists of Underlying asset-Expiry date-Strike price-Option’s type (C – call/ P – put).

[3] Chicago Merchantile Exchange (CME) offers a “full-size” Bitcoin contract for which the underlying is 5 Bitcoin and a “micro” contract for 0.1 Bitcoin.

[4] Please refer to the Appendix section for a breakdown of Option greeks.

Reports you may have missed

Fundstrat’s recently launched Crypto Core Strategy offers subscribers a digestible tool to manage their crypto portfolio, with the goal of outperforming bitcoin. For those looking to amplify the returns of their long positions, this complementary issue of DeFi Digest strives to cast light on some of the best risk-adjusted yields. We first describe our methodology to filter for yield opportunities, then dive into the protocols offering the yields, and describe...

FIGURE: A TEAM OF PEPES CONCOCTING THE PERFECT TOKENOMICS Tokenomics (a portmanteau for token and economics) represents the monetary policy of tokens that directly contributes to their price fluctuations. In bull markets, tokenomics were given utmost priority, sometimes constituting full theses for investment decisions. When the euphoria wears off in the bear, however, founders and market participants are left realizing that tokenomics can delay a weak project’s demise, but cannot...

FIGURE: PEPE SIMPSON REMINDING HIMSELF THAT FDV IS NO LONGER A MEME In light of recent events, it’s safe to assume that crypto winter has come to an end and that we have officially entered crypto’s ice age. SBF et al not only defrauded investors of Alameda Research and customers of FTX, their actions also destroyed ~600m in TVL from the Solana ecosystem. FIGURE: SOLANA PROJECTS BY TVL Source: DeFiLlama,...

FIGURE: PEPE CROSSING BRIDGES TO EXPLORE ALTERNATE LAYER 1S / LAYER 2S Although ETH remains the dominant Layer 1 for most on-chain activity, alternate Layer 1s have demonstrated product-market fit throughout the bull market run of ‘20/’21. Solana ($SOL) emerged as the ‘high-throughput chain’ focused on complex DeFi / gaming, BNB Chain ($BNB) offers easy fiat on/off-ramps through Binance CEX, while Avalanche ($AVAX) and Cosmos ($ATOM) are building application-specific blockchains...