Sources of Yield

Not all yields and farms are created the same. Knowing this, how would one differentiate good yield from the bad? How do you know if the yield farm you are in is bountiful like the former picture below, or if the farm token price prints the latter[1], like the fate of many high-yielding predecessors before it? To understand the quality of the crops (yields), we have to examine the different seeds (sources) that make up the farm.

There can be many permutations and derivatives of fund flows, but most generally, yield comes from a few sources:

1. Demand for Leverage

Because of the reflexivity of crypto markets and the fact that DeFi enables secular hypothecation, demand for leverage constitutes a majority source of yield, especially during bull markets.

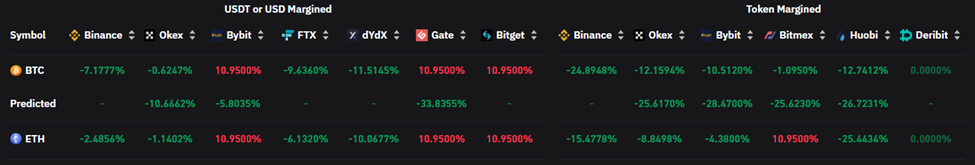

In centralized exchanges, this manifests in the form of funding rates for perpetual swaps (perps)[2], where funding rates are positive: buyers pay sellers for the privilege to be leveraged long when markets are bullish. During bear markets, funding rates are negative (as seen below), and bears pay bulls for the opportunity to be leveraged short. As of 3/9, shorts were paying longs 24.9% a year annualized to have a token-margined BTC short position on Binance.

Harvesting this yield is similar to the cash-and-carry trade in commodity markets, where one would short perps (futures) and long spot when funding (carry) rates are positive, and long perps (futures) short spot to collect funding (carry) from shorters. The best part of this strategy is that it is delta-neutral, benefitting from market periods with clear trends and pronounced bullish/bearish market biases.

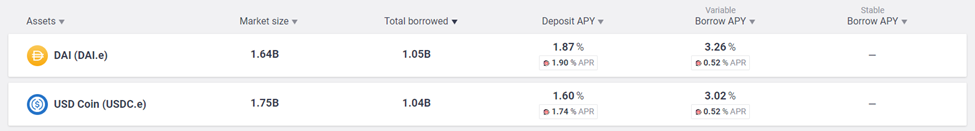

In the DeFi space, demand for leverage is also high, partially subsidized by inorganic token[3] [4] emissions. To illustrate, the figure below shows the 3.26% borrow rate for DAI on Aave (on the Avalanche network), partially subsidized by 0.52% in AVAX rewards as part of the $180m Avalanche Rush incentive program. Borrowers end up paying 2.74% net borrowing costs. This cost, subsidized by their LTV-adjusted collateral deposit[3] rates, often turns into a net gain for seekers of leverage.

Note that these Aave Avalanche figures are as of 3/10. I can only imagine the smell of the yields when they launch DeFi subnets rewards from their $290m Multiverse Program as detailed in our Crypto Weekly issue.

2. Native Protocol Activity (e.g. Fees)

The second most common source of yield is generated through actual protocol activity or fees.

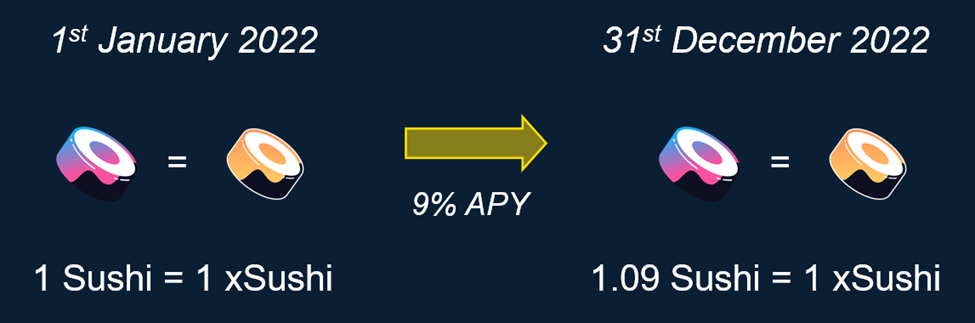

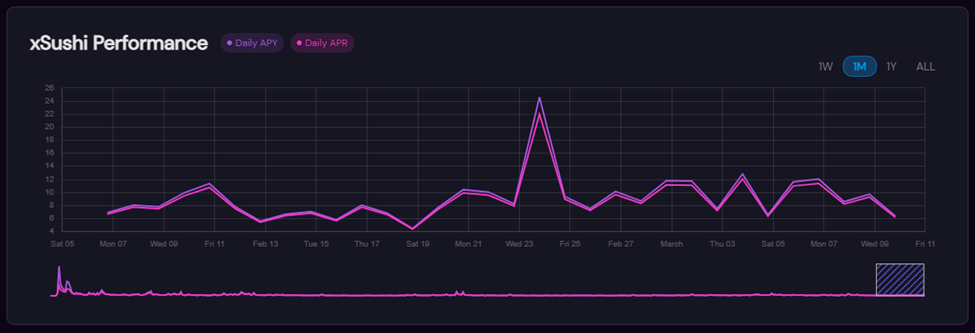

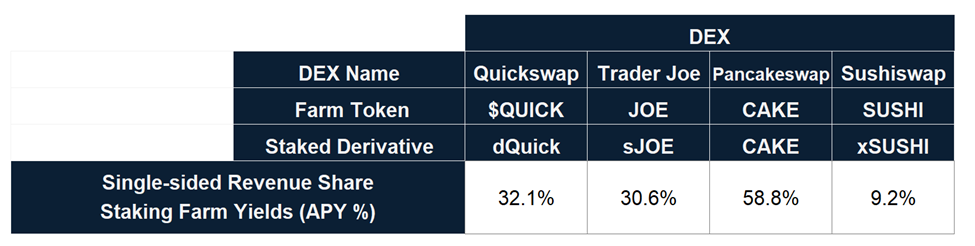

This form of yield is commonly captured via a single-sided staking farm, a concept initially pioneered by Sushiswap with side-sided[5] xSushi staking pools. Other DEXs have adopted this model – partially directing revenue streams from trading fees (0.3% per trade) to stakers of the x[DEX] token. These trading fees translate into the 9% – 59% range, dependent on other variables such as trading activity and total percentage staked across these different DEXs.

Figure: Single-sided Revenue-Share Staking Yields Across DEXs

Staking for this kind of yield is analogous to owning equity of a financial exchange, where shareholders are entitled to the profits of trading revenue net expenses. Yield from trading fees accrues to xSushi stakers via conversion rate mechanisms similar to Compound from last week’s issue.

Subsidized Aave borrowing APYs with AVAX emissions also fit into this category of yields, where users receive native token [6] of the project or Layer-1 protocol as rewards. This source of yield is organic because users earn ownership of the network by participating in it, befitting the Web 3.0 rhetoric.

By leveraging subsidized borrowing, airdrops, or other distribution mechanisms, projects can reward early adopters of their platforms. Early adopters [7] begets feedback to iterate on the product, seeding the momentum for Build-Measure-Learn feedback loops.

3. Synthetics

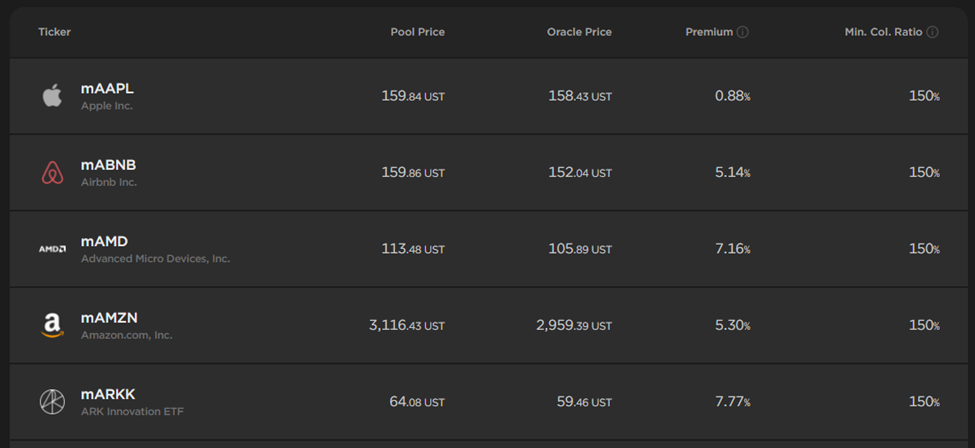

Apart from the conventional suspects in 1 and 2, synthetic markets in DeFi also constitute a significant source of yields. Synthetic equity platforms such as Mirror Protocol (MIR) allow users to borrow against UST, aUST[4], or LUNA to mint different mAssets. These mAssets can then be traded, farmed, or sold to capture the premium (yields) between the oracle and pool prices.[8]

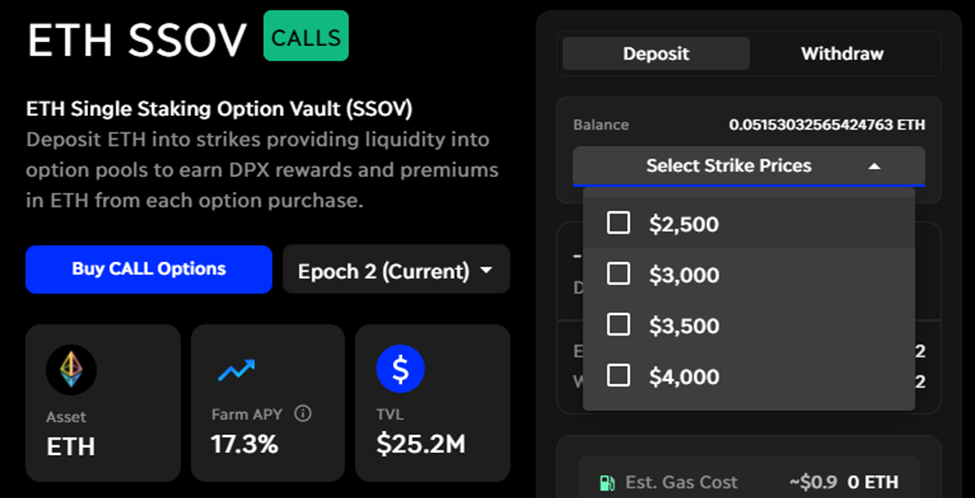

Other novel forms of crypto derivatives have also given rise to ‘yields’. These include Options platforms, where users can sell calls against their spot positions (covered call strategy) algorithmically via Ribbon Finance or for specific strikes on Dopex. This strategy is commonly known as harvesting option Theta in traditional finance.

4. Native Token Inflation

Last but certainly not least, native token inflation is a source of yield that often forms the majority of sky-high yields, yet is inorganic in that it is not dependent on any adoption metrics or product-market fit.

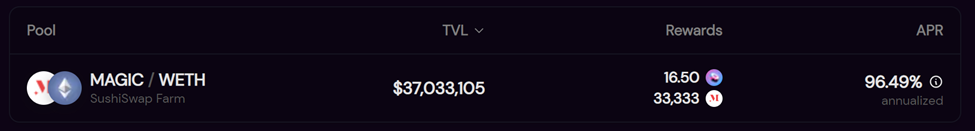

On a Layer-1 Protocol level, these yields are simply the staking rewards to PoS[9] validators. On a project level, these yields most often show up in incentivized yield farming on liquidity pools (as described in our past issue and shown below), but can take on other forms as well.

The Terra ecosystem has multiple projects (Stader Labs, Mars Protocol) that subscribe to the lockdrop[5] philosophy of emission. These mechanisms both benefit users in the form of clarity around airdrop yields, but also ecosystem growth and development via high-intent grandfathered access.

Figure: Airdrop Tokens for Staderlab Liquid Staking (Airdrop Yields c.8.7% on Luna)

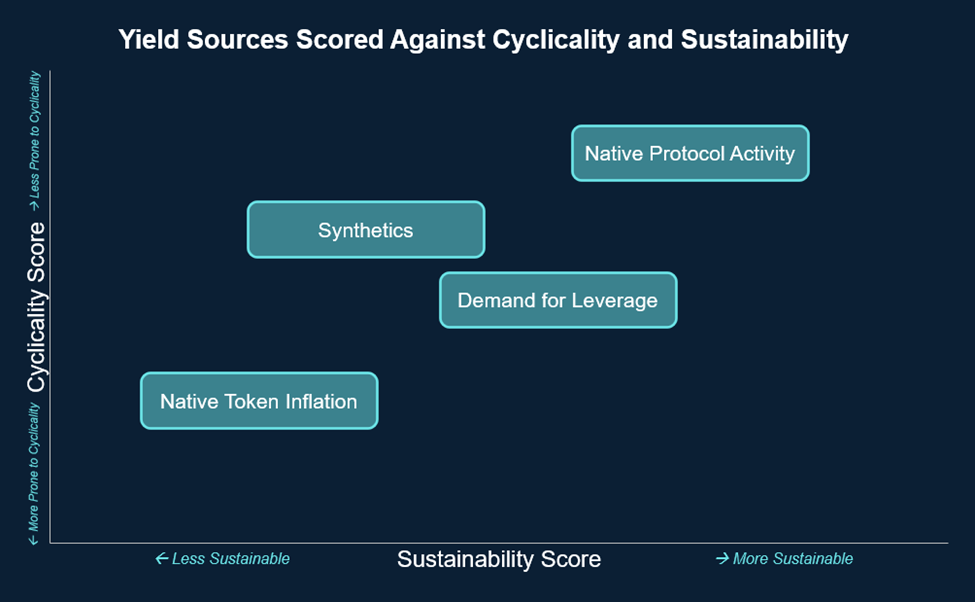

Out of the source of yields we have discussed, I attempt to assign scores to them based on ‘Cyclicality’ and ‘Sustainability’ vectors, detailed below. Cyclicality measures the source’s resilience to market conditions, while sustainability indicates its longevity.

‘Native Protocol Activity’ scores highest as organic user growth is a sustainable source of returns, while ‘Native Token Inflation’ scores lowest due to its inorganic nature. ‘Native Token Inflation’ is also subject to cyclicality risks, as yield farms are emitted in native tokens, and lower-priced native tokens in bear markets translate to lower yield. Synthetics have an irregular source of yield, as oracles and liquidity shifts may erode opportunities quickly.

Bottom Line

The efficiency gain coupled with astronomical growth in DeFi points to a paradigm shift in finance playing out before us. Yet it remains immature, with a sleuth of value capture and accrual tokenomics issues that need to be resolved before mainstream adoption. Understanding the different sources and qualities of yield will help DeFi investors better navigate the markets as yields are compressed closer to its real-world counterparts in the years to come.

[1] Some may know this price action as ‘inverted Dalai Lama’, a term dubbed by Twitter anon @HsakaTrades.

[2] Perpetual swap contracts (‘perps’) are hybrid futures without an expiration date, relying on funding rates instead of roll yield in commodities. Perps are a degen invention cater to the 24/7-nature of crypto.

[3] Net deposit rate for DAI on Aave Avax: 1.87% + 1.90% = 3.77% | LTV-adjusted Net Deposit rate: 3.77% * 1/85% LTV = 4.44%.

[4] aUST is UST deposited in Anchor Protocol, earning 20% from the Earnings Product.

[5] Lockdrops are modified versions of the airdrop with an action or non-monetary cost required, which is the opportunity cost of temporarily locking up your crypto assets.

Reports you may have missed

BRC-20 FEVER Ordinal transactions on Bitcoin have skyrocketed in the last few months, leading to an all-time high for daily transactions and pushing Bitcoin network fees to 2-year highs. The activity throttled BTC’s network so much that Binance was forced to temporarily shut down withdrawals and implement Lightening Network to service outflows without paying excessive fees. There are currently two types of Ordinal transactions on the network: 1) Ordinal NFTs...

FIGURE: PEPES WEARING CONES TO CELEBRATE NEW CURVE ECOSYSTEM PROTOCOL INVESTMENT THESIS Out of the numerous tokenomic designs that emerged (and failed) last cycle, the vote-escrowed model proved objectively most ‘feasible’, as evidenced by Curve’s dominant position in TVL amongst DEXs. Control over a protocol’s gauge emissions made sense to many, assigning real value to governance tokens. The second-order expectations that liquidity would follow did as well. However, maximizing yield...

FIGURE: PEPE UNSHETH-ING ITS ETH TO SOLVE MULTIPLE DEFI PAINPOINTS Since the Beacon Chain launch in Dec 2020, Ethereum users could stake bundles of 32 ETH to secure the network in exchange for priority fee rewards. While these staked ETH[1] are ‘productive,’ many have opted against staking given its operational complexity and illiquidity. Liquid staking projects solve for this by managing validator uptime and offering liquid staking derivatives (LSDs) to...

FIGURE: PEPE LEARNING ABOUT GHO AFTER BEING RUGGED BY UST Source: Fundstrat INTRODUCTION Founded by Stani Kuchelov, Aave (formerly LEND) is the largest DeFi lending market by TVL (~$8b across v2 and v3) and the fifth largest dApp overall. The protocol is currently live across five networks and 11 markets, hosting more than 30 assets across its platform. In July ‘22, Aave announced that they are launching their native stablecoin,...