Investors Brace for Shapella, RNDR Shows Technical Strength

Market Update

- Investors are bracing for a week of critical economic data, including CPI and PPI data for March, which will be released on Wednesday and Thursday, respectively. Investor concerns about the possibility of another rate hike rose following Friday's robust employment data. Nonfarm payrolls saw an increase of 236,000, close to the Dow Jones estimate of 238,000, while the unemployment rate dropped to 3.5%. In addition to economic data, major banks, including JPMorgan Chase, Wells Fargo, and Citigroup, are set to report their Q1 results on Friday, which should shed additional light on the current state of the economy. Heading into Monday afternoon, the $NDQ and $SPX are trading lower by 0.9% and 0.6%, respectively, while the U.S. Dollar Index ($DXY) is up 0.7%. Both the U.S. 2Y and U.S. 10Y yields have seen marginal increases. In the crypto market, $BTC (+4.3%) has risen back above $29K, while $ETH (+3.0%) remains just below $1.9K. The standout performer is the $RNDR (+8.2%), the native token of the Render Network, a decentralized and distributed GPU rendering network. RNDR is rallying following the network's community snapshot vote approving a migration to Solana (more on its technical strength from Mark below). Liquid staking tokens Lido DAO Token ($LDO) and Rocket Pool Token ($RPL) are trading higher in anticipation of Ethereum's upcoming Shapella upgrade, currently scheduled to go live on Wednesday.

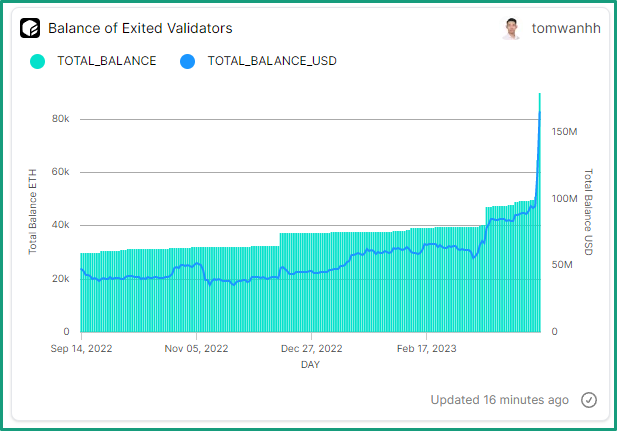

- The Ethereum network is undergoing the Shapella upgrade this week, enabling the withdrawal of approximately 18 million ETH staked to the Beacon Chain since December 2020. While concerns exist that stakers may liquidate tokens, negatively affecting the ETH price, several mitigating factors exist. For instance, stakers already have liquidity access through liquid providers and exchanges, and withdrawal queue restrictions prevent a sudden ETH influx. Further, investors de-risking behavior before this event may also reduce potential impacts. Over the intermediate term, it is right to expect a boost to the percentage of staked ETH, alleviating supply-side worries. The Shanghai upgrade is a crucial de-risking milestone in Ethereum's proof-of-stake transition. Throughout this week, we will be carefully monitoring the progress of the Shapella hard fork and the demand to exit the beacon chain. The withdrawal queue, which is already open for stakers who wish to get in line to be the first ones to leave the beacon chain, currently has 90,000 ETH (0.5% of total staked ETH), according to this sleek Flipside Crypto dashboard created by @tomwanhh.

Figure: 90k (out of 18MM) ETH In Line to Unstake

- OpenSea has launched OpenSea Pro, a marketplace with advanced trading tools, temporary zero marketplace fees, and plans for NFT-based rewards. OpenSea Pro, an expansion of the acquired Gem V2 platform, aggregates listings from over 170 NFT marketplaces and offers improved search and inventory features. The launch is a competitive move against Blur ($BLUR), which leads in NFT trading volume. OpenSea will restore its standard fee, but OpenSea Pro will have a 0% fee for a limited period and a minimum 0.5% royalty on select projects. According to on-chain data procured by a Dune dashboard created by @onures, OpenSea Pro has witnessed substantial growth in active users and trading volume following its launch. Since April 5th, OpenSea Pro has accounted for over half of all daily active users among all NFT aggregators. OpenSea Pro's trading volume has fallen in the $2.5-$4 million range since late last week, and volumes appear to be pushing towards those levels today as well.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

Following the network's migration to Solana, we've seen evidence of $RNDR turning back higher at a time when many coins remain mired in range-bound consolidation. Daily charts show the recent gradual stabilization after the initial drawdown from early February peaks where $RNDR lost more than 50% in absolute terms before bottoming and largely moving sideways. Technically speaking, the ability to exceed $1.40 should be bullish in engineering a rally back up to $1.60 and over this would be helpful towards thinking a rally back to test February highs is getting underway. Momentum has turned a bit more positive from late March but volume remains far lighter than what was seen back in early February and will be an important part towards confirming the start of a larger advance. Weakness should make RNDR more attractive to buy dips barring a decline back under $1.11 which would postpone the advance. Overall, RNDR looks like a good risk/reward, and it's expected that gains back towards February highs are likely into the back half of April.

Daily Important Metrics

All metrics as of April 10, 2023 12:57 PM

All Funding rates are on bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $562B | $29,042 | ↑ 4.10% | ↑ 75% | |

ETH ETH | $228B | $1,893 | ↑ 2.95% | ↑ 58% | ↓ -17% |

ADA ADA | $14B | $0.3922 | ↑ 1.04% | ↑ 59% | ↓ -16% |

DOGE DOGE | $12B | $0.0839 | ↑ 0.98% | ↑ 20% | ↓ -56% |

MATIC MATIC | $10B | $1.12 | ↑ 2.48% | ↑ 47% | ↓ -29% |

SOL SOL | $8.0B | $20.54 | ↑ 2.09% | ↑ 107% | ↑ 32% |

DOT DOT | $7.3B | $6.24 | ↑ 1.75% | ↑ 44% | ↓ -32% |

LINK LINK | $3.8B | $7.33 | ↑ 3.18% | ↑ 32% | ↓ -43% |

NEAR NEAR | $1.8B | $2.03 | ↑ 4.24% | ↑ 60% | ↓ -15% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↓ -36% | $17.06 | ↑ 5.24% | ↑ 106% | ↑ 30% |

| BITW | ↓ -57% | $10.79 | ↓ -0.09% | ↑ 101% | ↑ 26% |

| ETHE | ↓ -49% | $9.29 | ↑ 0.32% | ↑ 95% | ↑ 20% |

| BTCC | ↓ -0.08% | $5.39 | ↑ 4.26% | ↑ 78% | ↑ 2.58% |

News

QUICK BITS

The Block Mt Gox repayment window has opened, but repayments ‘will take some time’ The deadline for Mt Gox creditors to provide their repayment information has now passed, opening the window for repayments to be made. ... |

REGULATION

The Block Paxos’s national banking charter application expired, but it may try again Paxos's long-running application for a national banking charter expired last week. The stablecoin issuer is considering whether to try again. ... |

Coin Telegraph Decentralized exchange dYdX announces 'winding down' of services for Canadian users “We hope that the regulatory climate in Canada will change over time to allow us to resume services in the country," s... |

FUNDRAISING AND M&A

Coin Telegraph Bitget launches $100M Web3 fund for crypto projects in Asia Bitget's new fund will receive $100 million as an initial investment to support the next generation of Web3 projects. ... |

NFTS

The Block OpenSea Pro overtakes rival Blur in key metric as volumes and addresses surge New and active daily addresses surged following OpenSea Pro's launch — meant to rival upstart NFT marketplace Blur — but competition remains fierce. ... |

MINING

The Block Bitcoin difficulty and hash rate mark all-time highs as miner revenue increases While Bitcoin's network difficulty and hash rate increased, so has Bitcoin miner revenue — though profitability remains below all-time highs. ... |

HACKS, EXPLOITS, AND SCAMS

CoinDesk Sushi DEX Recovers 100 Ether After Millions Lost on Weekend Exploit ‘White hat’ hackers are working to recover more of the stolen funds as of Monday. |

Decrypt.co Hackers Rob South Korean Exchange of $13M in Bitcoin, Ethereum, Other Assets South Korean cryptocurrency exchange GDAC has reported it lost nearly a quarter of its assets due to a hacking attack. |

Reports you may have missed

It has been a challenging day for crypto prices, with $BTC giving back yesterday's gains to fall to $68.5k, $ETH declining to $3,500, and $SOL currently trading around $176. Most altcoins are also experiencing downturns. The lone standout among large cap crypto assets today is $TON, which is rallying on rumors of USDT launching on the TON Network. Equity indices also faced a drawdown earlier in the day, sliding after...

Crypto assets are building on the weekendâs gains. $BTC (+3.47%) eclipsed $72.7k this morning before paring gains to approximately $71.8k. $ETH (+5.58%) is showing relative strength today, gaining to $3,650, helping the ETHBTC ratio reclaim the .05 mark. Last weekâs ETF net flows totaled $484 million, displaying the continued demand for exposure among traditional investors. Equity indices are relatively flat today, with the SPY and QQQ both gaining about 0.05%...

Despite March Non-Farm Payrolls blowing expectations out of the water (303k vs 214k exp.), equity indices are rebounding, with the SPY and QQQ gaining 1.23% and 1.50%, respectively. Although crypto assets held up during yesterdayâs equity sell-off, they fell overnight, with $BTC (-1.06%) reaching the low $66,000s before rebounding to $67.7k at the time of writing. $ETH (-0.53%) is trading slightly above $3k as the ETHBTC ratio has fallen below .05%,...

Flows Turn Positive and Coinbase Premium Returns, PayPal Enables Free International Transfers with PYUSD

The trading day began on a positive note, with rates decreasing and risk assets rallying following disinflationary pricing data from the latest ISM services PMI report. However, equity indices relinquished their gains and dipped into the red late in the trading session, influenced by comments from Fed President Neel Kashkari, which implied the Fed was concerned over persistently high inflation. Crypto rallied along with equities in the morning, and has...