Week of Potential Catalysts, Lido Hit By Fake SEC Rumors

Market Update

- Equities opened higher this Monday morning on the back of easing bond yields. The $SPX and $NDQ are trading 0.6% and 1.0% higher, respectively. However, the U.S. 02Y has turned higher since this morning, now pushing back towards 4.9%. The $DXY has moved lower, assisted by increased hawkish rhetoric from the ECB. The crypto market rallied slightly in concert with equities but is stalling in the face of rate strength. The majors are marginally higher compared to 24 hours prior, with $ETH and $BTC both trading 0.3% higher. Among the top performers is $GMX (+4.8%), which performed exceptionally well throughout the deeper parts of the bear market due to the actual usage of its decentralized perps application. Among the weekend underperformers was $LDO, which, as we will touch upon below, was the victim of an unfortunate market narrative, decreasing over 10% on Saturday afternoon.

- We are keeping an eye on several key things this week, including Fed Chair Powell's testimony before Congress, new jobs data, and the commencement of oral arguments in Grayscale's lawsuit against the SEC to convert GBTC to a spot Bitcoin ETF. Powell's testimony before Congress on Tuesday and Wednesday and Friday's jobs data is expected to provide new signals on whether the U.S. central bank could reaccelerate the pace of rate hikes in response to the recent data. Grayscale's case against the SEC will be heard tomorrow, with former U.S. Solicitor General Donald B. Verrilli representing Grayscale. After rallying in mid-January, Grayscale Bitcoin Trust's ($GBTC) discount to NAV was back to 44.6% at market close on Friday. Should the hearings be interpreted to go well, GBTC could rally into the Final Decision, leaving the SEC needing to find a different reason to disallow a spot bitcoin ETF. The market appears to be pricing in a positive outcome on Monday, as GBTC has outpaced BTC since the market opened by nearly 3%.

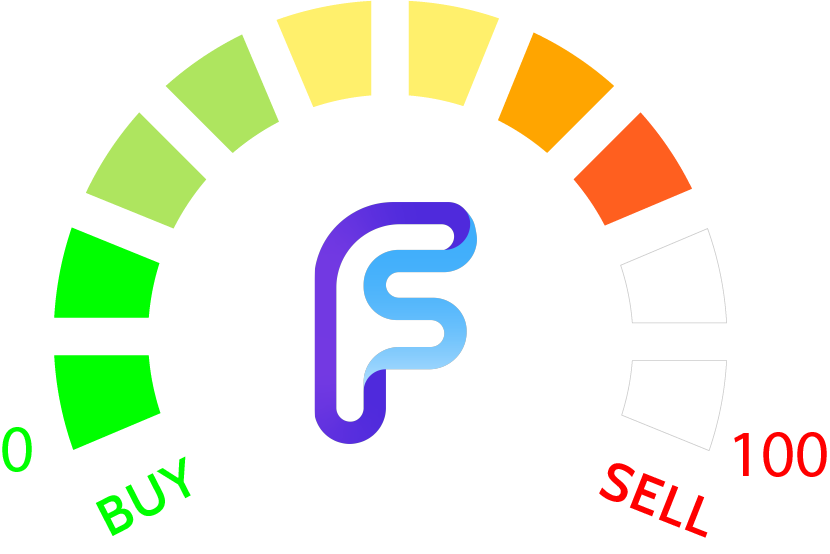

- On Saturday, Lido's $LDO token dropped by 10% following rumors that the U.S. Securities and Exchange Commission (SEC) had served the largest Ethereum staking service with a Wells Notice. A Wells Notice is a letter from the SEC sent to an individual or company notifying the recipient that it is considering bringing charges against them. David Hoffman of the Bankless crypto podcast claimed that Lido and other crypto projects had been served with Wells Notices, but he has since retracted the assertion. A Lido spokesperson declined to comment on whether the protocol had received a notice. Despite Hoffman's retraction, the market appeared to respond to his Wells remarks, as the price of LDO underperformed the market over the weekend. It's unclear how the SEC would have delivered notice to Lido, as the staking service is governed by a vast network of Lido's LDO token-holders and lacks a formal leadership structure. As you know, our team has been constructive on Lido since the start of the year, with the view that it is positioned well to benefit from Shanghai-related tailwinds. Our base case is that the asset should be able to shrug these headlines off, but of course, we will continue to assess the market's relative appetite for liquid staking tokens.

- Yuga Labs, the company behind the popular Bored Ape Yacht Club (BAYC) NFTs, has launched a new NFT collection called TwelveFold. The collection consists of 300 Bitcoin-themed NFTs, with 288 being auctioned off and 12 reserved for contributors, donations, and philanthropic efforts. The controversial element of the TwelveFold auction is the requirement for buyers to transfer Bitcoin to a third-party custodian, which in this case is Yuga Labs, to place their bids. This arrangement has generated criticism from some users concerned about the bidding process's security and transparency. Many cases have occurred where fraudulent NFT projects have taken users' funds without delivering on their promises. As a result, users are wary of the precedent this sets within the bitcoin NFT space and are calling for more transparency and security from Yuga. The auction began last evening and is scheduled to conclude at 6pm EST. As of 10am EST, there are 288 ordinals for sale, and the top 288 addresses are currently bidding a cumulative 76.5 BTC ($1.7 million), and the current highest bid is 2 BTC. While everyone should assess the viability of this project on their own, it is likely that these pieces will become digital grails at some point in the future.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

Decentraland took a much needed first step in bottoming out Monday, and its rise back above downtrend line resistance from late February also successfully recouped the prior lows from mid-February at 0.6148. This is a constructive development that should allow for a rally back to test and exceed February highs at 0.8426 to get underway. The entire consolidation from 2/2/23 highs has spanned 32 days, nearly exactly the time of the rally from late December 2022 into early February peaks. Additionally, $MANAUSD weakness managed to bottom at an exact 50% retracement level of the former rally from late December. Thus, from a price and time standpoint, there were reasons to expect MANAUSD might be able to bottom out this week and turn back higher. Initial resistance lies at 0.70 and the ability to surpass this level should allow for a move back to $0.84 and then $1.10-$1.13, near last August 2022 peaks. Bottom line, today's rally likely should help MANAUSD start to show some upside follow-through in the weeks to come.

Daily Important Metrics

All metrics as of March 6, 2023 10:57 AM

All Funding rates are on bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $433B | $22,441 | ↓ -0.06% | ↑ 35% | |

ETH ETH | $192B | $1,570 | ↓ -0.16% | ↑ 31% | ↓ -4.47% |

ADA ADA | $12B | $0.3324 | ↓ -2.37% | ↑ 35% | ↓ -0.81% |

DOGE DOGE | $9.8B | $0.0742 | ↓ -1.71% | ↑ 5.77% | ↓ -30% |

MATIC MATIC | $9.8B | $1.13 | ↓ -2.10% | ↑ 48% | ↑ 12% |

SOL SOL | $8.0B | $20.81 | ↓ -2.14% | ↑ 110% | ↑ 75% |

DOT DOT | $6.9B | $5.97 | ↓ -1.25% | ↑ 37% | ↑ 1.90% |

LINK LINK | $3.6B | $6.90 | ↓ -0.88% | ↑ 24% | ↓ -11% |

NEAR NEAR | $1.8B | $2.05 | ↓ -1.16% | ↑ 61% | ↑ 26% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↓ -45% | $11.60 | ↑ 3.11% | ↑ 40% | ↑ 4.47% |

| BITW | ↓ -59% | $8.55 | ↑ 1.18% | ↑ 59% | ↑ 24% |

| ETHE | ↓ -54% | $7.23 | ↑ 2.84% | ↑ 52% | ↑ 16% |

| BTCC | ↑ 0.13% | $4.16 | ↑ 0.97% | ↑ 37% | ↑ 1.83% |

News

QUICK BITS

CoinDesk Multicoin Capital’s Hedge Fund Lost 91.4% Last Year, Investor Letter Reveals The fund’s performance was severely impacted by direct exposure to now-bankrupt crypto exchange FTX and holdings in FTT and Solana-based tokens. |

Decrypt.co Binance Team Fretted Over Binance.US Ties, Tried to Recruit Gary Gensler: WSJ A Telegram group chat reveals the Binance team's skittishness over regulatory scrutiny. |

MARKET DATA

The Block Crypto lender Celsius converts almost 23,000 WBTC into bitcoin Beleaguered crypto lender Celsius converted 22,962.8 WBTC into bitcoin on Feb. 28, according to a regulatory filing. The post Crypt... |

The Block Coinshares reports fourth consecutive week of digital asset investment product outflows Bitcoin continues to see the greatest outflows, while shorts on the cryptocurrency are seeing inflows. The post Coinshares reports f... |

DOSE OF DEFI

CoinDesk DeFi Exchange PancakeSwap to Deploy Version 3 on BNB Smart Chain in April, Burns $27M in CAKE PancakeSwap V3 will offer new features such as improved liquidity provisioning, competitive trading fees, trading incentives and enhancement for yield farming t... |

CRYPTO INFRASTRUCTURE

CoinDesk Crypto Banking Firm BCB Readies U.S. Dollar Payments to Plug Silvergate Gap BCB Group CEO Oliver von Landsberg-Sadie said he hopes to have dollar fiat-to-crypto rails in place and ready to go live early in the second quarter. |

The Block Kraken is on track to launch bank ‘very soon’ despite regulatory ‘weird place’ Kraken's chief legal officer says the exchange's banking relationships are secure. The post Kraken is on track to launch bank ‘very... |

REGULATION

CoinDesk Australian Crypto Regulations Likely to Be Delayed Until Mid-2024: Report Australian laws to regulate the crypto industry and protect retail customers could take more than a year, government documents indicate. |

HACKS, EXPLOITS, AND SCAMS

Coin Telegraph Babel wants to repay creditors via special ‘recovery coins’: Report Babel reportedly owes $524 million worth of Bitcoin, Ether and other tokens due to “risky trading activities” by co-fo... |

Reports you may have missed

It has been a challenging day for crypto prices, with $BTC giving back yesterday's gains to fall to $68.5k, $ETH declining to $3,500, and $SOL currently trading around $176. Most altcoins are also experiencing downturns. The lone standout among large cap crypto assets today is $TON, which is rallying on rumors of USDT launching on the TON Network. Equity indices also faced a drawdown earlier in the day, sliding after...

Crypto assets are building on the weekendâs gains. $BTC (+3.47%) eclipsed $72.7k this morning before paring gains to approximately $71.8k. $ETH (+5.58%) is showing relative strength today, gaining to $3,650, helping the ETHBTC ratio reclaim the .05 mark. Last weekâs ETF net flows totaled $484 million, displaying the continued demand for exposure among traditional investors. Equity indices are relatively flat today, with the SPY and QQQ both gaining about 0.05%...

Despite March Non-Farm Payrolls blowing expectations out of the water (303k vs 214k exp.), equity indices are rebounding, with the SPY and QQQ gaining 1.23% and 1.50%, respectively. Although crypto assets held up during yesterdayâs equity sell-off, they fell overnight, with $BTC (-1.06%) reaching the low $66,000s before rebounding to $67.7k at the time of writing. $ETH (-0.53%) is trading slightly above $3k as the ETHBTC ratio has fallen below .05%,...

Flows Turn Positive and Coinbase Premium Returns, PayPal Enables Free International Transfers with PYUSD

The trading day began on a positive note, with rates decreasing and risk assets rallying following disinflationary pricing data from the latest ISM services PMI report. However, equity indices relinquished their gains and dipped into the red late in the trading session, influenced by comments from Fed President Neel Kashkari, which implied the Fed was concerned over persistently high inflation. Crypto rallied along with equities in the morning, and has...