Most Important Daily

Data and News for Digital Assets |

|

Crypto Daily Report | February 6, 2023 |

|

THIS MESSAGE IS SENT SOLELY TO MEMBERS OF FS INSIGHT |

|

| Tickers on this report: ATOM, BNB, BTC, DXY, ETH, LDO, NDQ, REP, RPL, SOL, SPX, UNI, VIX |

|

|

|

- Equities declined Monday morning, likely prompted by caution over increased hawkishness from the Fed following the strong US jobs report on Friday. The $SPX is down 0.4%, while the $NDQ is trading 0.5% lower. Bond yields increased, with the 10-year yield rising by 9 BPS and the 2-year adding 14 BPS. The $DXY (+0.5%) and the $VIX (+6.0%) have also ticked higher on the day. Meanwhile, the crypto market is rebounding quite nicely following a weekend dip, as $BTC (+0.5%) pushed back above $23k and $ETH (+1.2%) trades around $1,650 after finding support yesterday at the $1,615 level. Alts such as $SOL (-1.4%) and $ATOM (-2.6%) remain lower compared to 24 hours prior, while LSD providers, including $LDO (+10.8%) and $RPL (+8.1%), are outperforming the majority of the market. This week is undoubtedly a respite in terms of consequential data points after last week's onslaught. Fed Chair Powell's annual interview with David Rubenstein at the Economic Club of Washington on Tuesday is likely to be closely watched for clarification on his views regarding financial conditions and inflation.

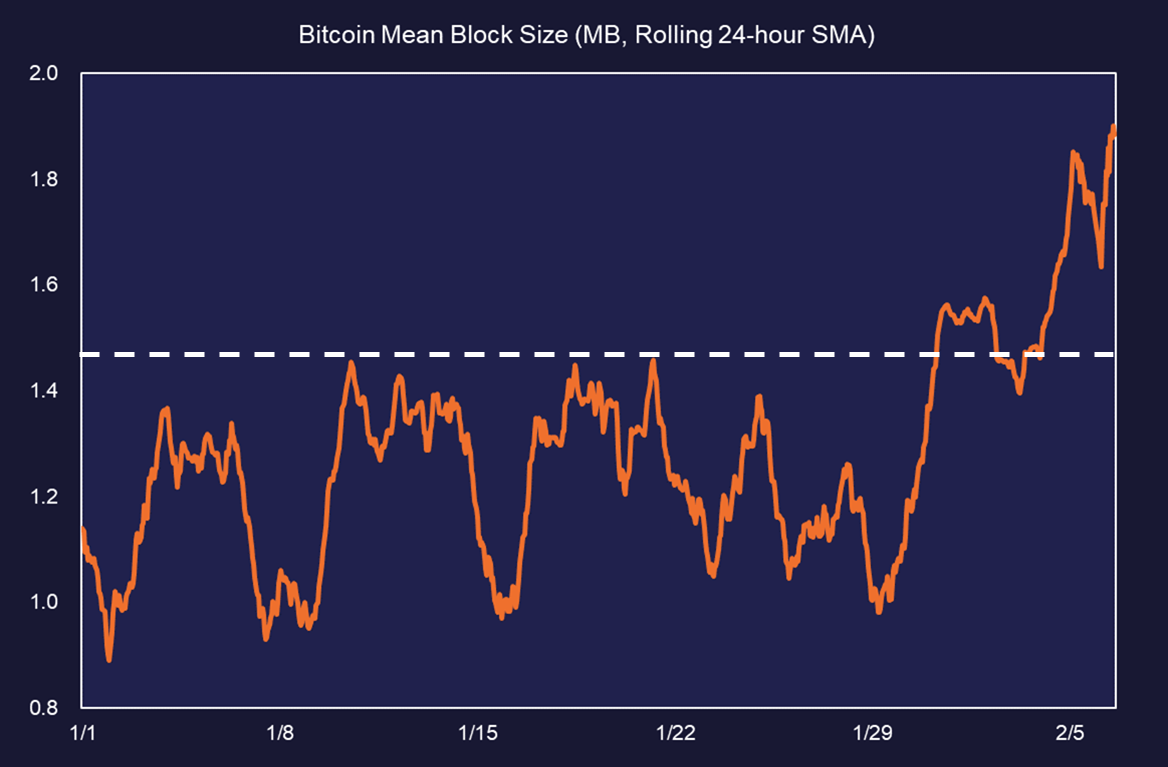

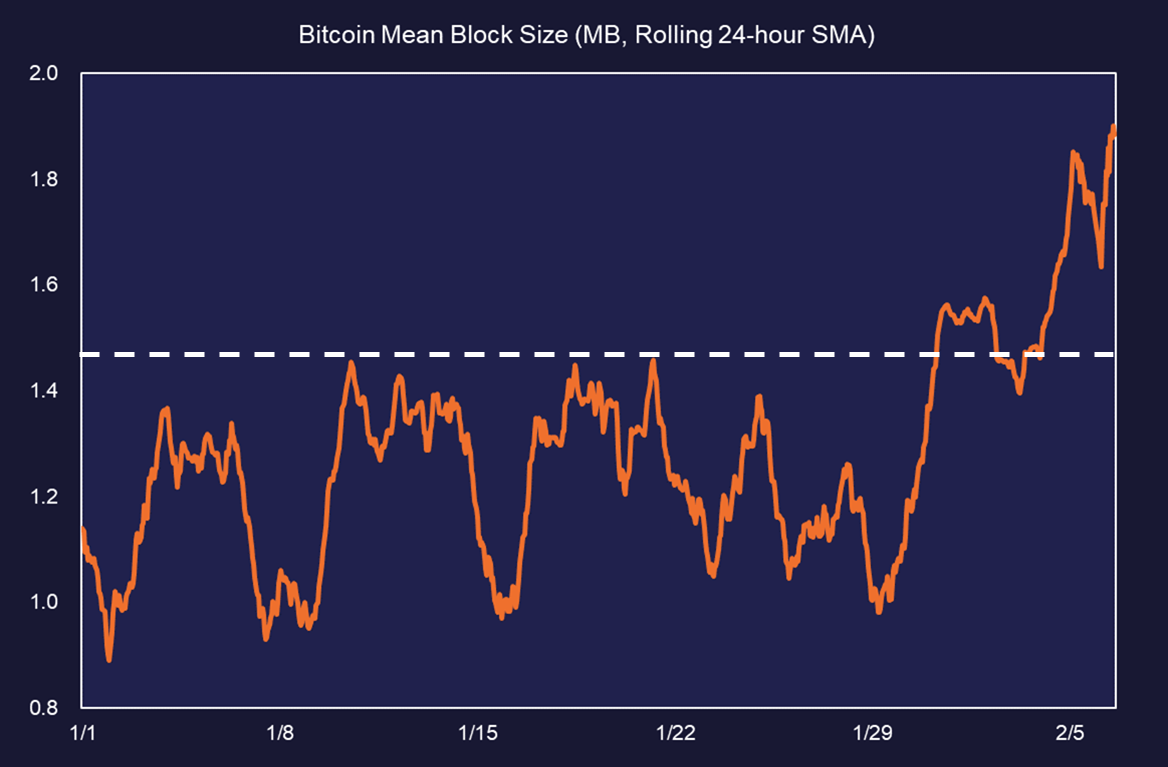

- As discussed in Friday's weekly note, Ordinals is a protocol that allows for non-fungible data to be stored on the Bitcoin blockchain. The emergence of NFTs on Bitcoin has led to increased activity and experimentation on the network, augmenting average block size and leading to higher fees per block. Despite concerns from the fundamentalist camp about the inscription of non-fungible data possibly being an affront to Bitcoin's core principles and the potential for node bloat, NFTs are undoubtedly serving as a source of demand for blockspace. As demonstrated below, the mean block size has increased since Ordinals started to gain traction towards the end of January.

Source: Fundstrat, Glassnode - Uniswap ($UNI), the leading decentralized exchange, is at the center of a contentious proposal to deploy its trading protocol on Binance's BNB Chain ($BNB). Venture capital firm Andreessen Horowitz (a16z) has deployed its entire 15 million UNI tokens to vote against the proposal, sparking a debate within the industry on whether this is healthy for the DeFi ecosystem. The firm was previously accused of centralizing DeFi protocols despite its attempts to delegate voting power. The current debate revolves around the method of deployment, with a16z preferring to use LayerZero, a bridge protocol backed by the VC firm, instead of Wormhole, backed by Jump Crypto. Those who are generally unbothered by the move by a16z claim that this is how markets should work, and those who want to change the vote should purchase more tokens. The vote is ongoing and slated to end on February 10th.

|

|

|

|

The 16% decline in Augur today shouldn't be viewed all that negatively given Sunday's (2/5) progress in breaking out of its intermediate-term downtrend from last Summer. This huge spike in the last 24 hours resulted in gains of over 50% with prices reaching the highest levels since last August, six months ago. Thus, consolidation of this large gain makes $REPUSD attractive to buy dips for higher prices in the weeks to come. Initial upside price targets lie near $16, then $19.75 which represents a 50% absolute retracement of the former high to low range from the September 2021 to December 2022. Mondays' pullback should bottom near $8 and should have a maximum retracement near $6.50 before starting to push back higher. Overall, this consolidation following the recent surge makes for a very appealing technical risk/reward. | |

|

|

Crypto Size  Bullish signal is tied to the crypto market growing Market Cap $1.08T +$9.6B (+0.90%) BTC Dominance  41.17% (-0.45%) 41.17% (-0.45%) | Stable Coins  Increase in circulating stablecoins is a Bullish signal In Circulation $68B (-0.00%) In Exchanges $17B (-0.35%) | BTC Metrics A decrease in Bitcoin on exchanges is bullish, indicates investors are moving coins to cold storage # BTC in Exchanges 2.2M (-0.11%) | Funding Rates  Positive funding rates indicate traders are Bullish Aggregate 0.0076% (-0.0010) Binance 0.0063% (-0.0037) Bitfinex 0.0040% (-0.0038) Bitmex 0.0063% (-0.0037) ByBit 0.0100% (0.0000) Deribit 0.0012% (0.0009) Huobi 0.0100% (0.0000) Kraken 0.0036% (0.0034) Mean 0.0076% (-0.0010) OKex 0.0076% (-0.0022) |

| SENTIMENT  | BMI: 89 (44%) |

| Futures All Exchanges A positive spread between Futures Prices and Spot Prices is Bullish CME BTC Price $22,910 (-0.59%) Spot Basis  $7.72 (0.03%) $7.72 (0.03%) Volume 935,280 (14%) Open Interest  342,571 (-1.00%) 342,571 (-1.00%) | Options All Exchanges Higher open interest change in a bull market is bullish for the sector Volume 16,000 (-9.04%) Open Interest 274,613 (1.07%) Volume Put/Call Ratio 0.4998 (-30%) Open Interest Put/Call Ratio 0.4131 (1.20%) |

|

| | All metrics as of February 8, 2023 11:58 AM |

|

|

|

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

|---|

| BTC | $442B | $22,902 | -0.43% | 38% | | | ETH | $202B | $1,648 | 0.45% | 37% | -0.76% | | ADA | $14B | $0.3910 | 0.78% | 58% | 20% | | DOGE | $12B | $0.0898 | -1.18% | 28% | -10% | | MATIC | $11B | $1.30 | 5.19% | 71% | 32% | | SOL | $8.7B | $23.20 | 0.68% | 134% | 96% | | DOT | $7.7B | $6.70 | -0.24% | 54% | 16% | | LINK | $3.6B | $7.08 | 1.07% | 27% | -11% | | NEAR | $2.3B | $2.68 | 15% | 111% | 73% |

All prices as of February 8, 2023 11:58 AM |

|

| Exchange Traded Products (ETPs) | |

|

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

|---|

| GBTC | -43% | $11.75 | -3.29% | 42% | 3.49% | | BITW | -57% | $9.22 | -0.70% | 72% | 34% | | ETHE | -51% | $7.68 | -3.46% | 61% | 23% | | BTCC | 0.32% | $4.22 | -1.86% | 39% | 1.03% |

All prices as of February 8, 2023 4:30 PM |

|

|

| Symbol | Market Cap | Last Price | Daily Change | Year to date | Relative to BTC YTD |

|---|

| PYPL | $216B | $79.72 | -4.22% | 12% | -26% | | SQ | $76B | $81.13 | -2.46% | 29% | -9.14% | | COIN | $65B | $69.44 | -2.77% | 96% | 58% | | SBNY | $18B | $136 | -2.12% | 18% | -20% | | HOOD | $15B | $10.47 | -0.76% | 29% | -9.62% | | MSTR | $6.1B | $276 | -2.79% | 95% | 57% | | SI | $4.2B | $17.39 | -5.80% | -0.06% | -38% | | MARA | $3.5B | $6.81 | -4.08% | 99% | 61% | | RIOT | $2.7B | $6.52 | -1.21% | 92% | 54% | | MOGO | $223M | $0.8581 | 0.36% | 62% | 24% |

All prices as of February 8, 2023 4:30 PM |

|

|

| | | | Lightning Network has reached an all-time high in terms of capacity or the amount of Bitcoin locked in payment channels. The post Lightning Network reaches all-time high in bitcoin capacity appeared first on The Block. |

|

|

| | | | Coinshares reported a fourth consecutive week of digital asset investment product inflows, totaling $76 million last week. The post Coinshares reports fourth consecutive week of inflows appeared first on The Block. |

|

|

| | | | Crypto bridge aggregator Li.Fi says Uniswap should adopt a more decentralized bridge selection process for cross-chain deployments. The post Li.Fi calls on Uniswap not to deploy on BNB Chain with only one bridge appeared f... |

|

| | | | Trader Joe, a decentralized exchange, has partnered with LayerZero to let users move its tokens seamlessly across blockchains. The post Trader Joe’s native token ‘joe’ goes omni-chain with LayerZero partnership appeared fi... |

|

|

| | | | Financial regulators in South Korea are working to bring security tokens into the scope of the country's capital markets rules. |

|

| | | | Firms marketing crypto in any form will need to be regulated by the UK’s Financial Conduct Authority or face legal liability. |

|

| | | | Hong Kong's Securities and Futures Commission (SFC) wants to expand its team to deal with licensing applications for the incoming VASP regime. |

|

|

| | | | The company said it expects there to be a delay in meeting the hashrate growth guidance for the first quarter. The post Bitcoin miner Riot expects growth delay due to December storm damages appeared first on The Block. |

|

|

| | | | The provider of blockchain scalability solutions will integrate the data provider’s price feeds. |

|

|

| | | | The venture firm used its 15 million UNI holding against the deployment using the Wormhole bridge. Venture capital firm Andreessen Horowitz (a16z) voted against a final proposal to deploy ... |

|

|

| HACKS, EXPLOITS, AND SCAMS | |

| | | | FTX's new management is sending messages to politicians and political groups to return donations by the end of the month. FTX's new management is seeking to recover political donations mad... |

|

|

|

|