Most Important Daily

Data and News for Digital Assets |

|

Crypto Daily Report | January 9, 2023 |

|

THIS MESSAGE IS SENT SOLELY TO MEMBERS OF FS INSIGHT |

|

| Tickers on this report: BTC, DXY, ETH, GBTC, LDO, NDQ, RPL, SOL, SPX, SWISE |

|

|

|

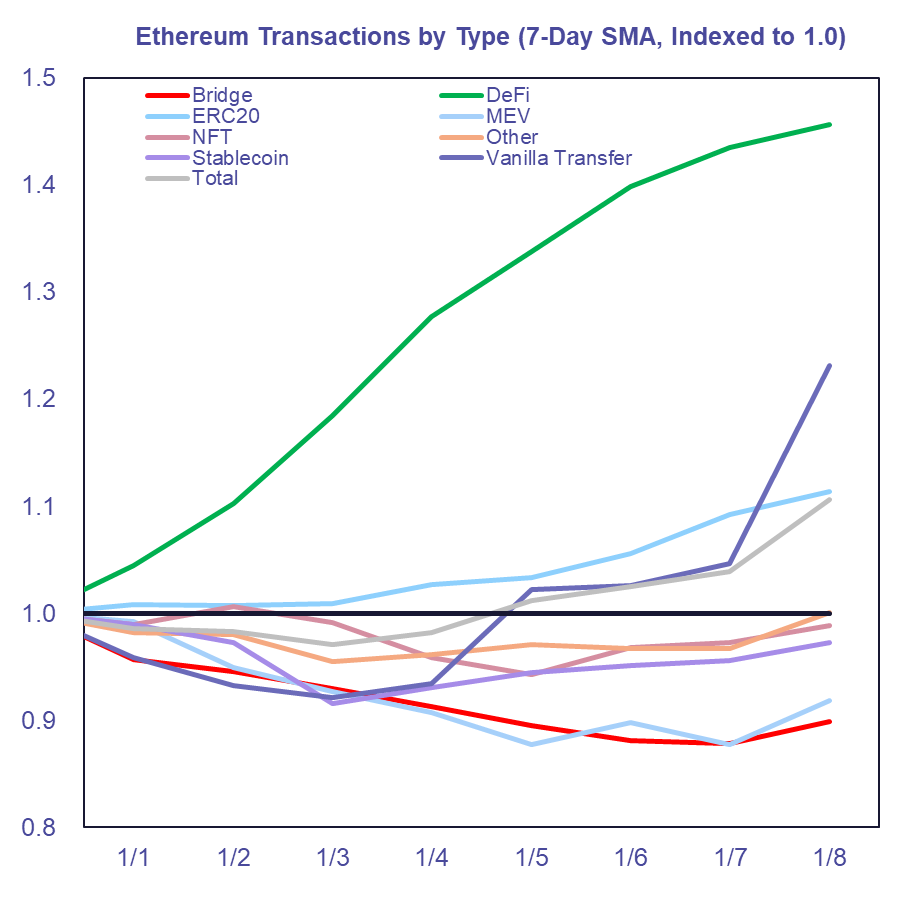

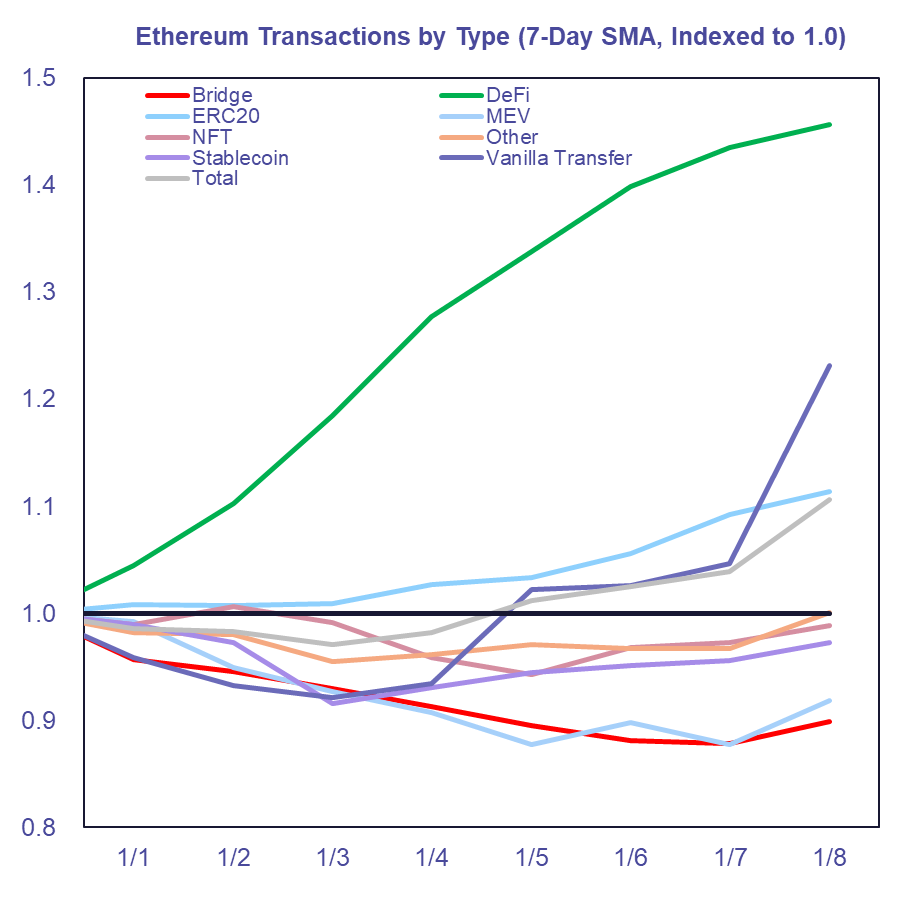

- Markets are picking up where they left off on Friday, rallying on the back of a weak ISM services report, intimating that investors might be starting to price in impending dovishness from the Fed. This was the first ISM report in 30 months to show an economic contraction within the services sector of the economy and negated market participants' wariness following the stronger-than-expected jobs report that morning. The $NDQ (+2.1%) and $SPX (+1.2%) are considerably up while rates move lower. At the time of writing, the U.S. 10Y is approaching 3.5% while the 2-year steadies just above 4.2%. The USD is trending commensurately lower, with the $DXY down 0.8% on the day. Crypto prices are finally showing signs of life as $BTC (+2.0%) and $ETH (+4.8%) rally in concert with equities. Meanwhile, $SOL (+20.0%) continues to show strength off of its bounce from $8 lows, and $LDO remains the best-performing cryptoasset in the top 50, up 58% over the previous seven days. Lido may have inspired a slight resurgence in DeFi activity on Ethereum. Below we chart the changes in the 7-day moving average of transactions on Ethereum since the start of the year segregated by transaction type. Despite the overall flat transaction levels, there has been a noticeable increase in DeFi activity that might be emanating from increased interest in liquid staking providers. Lido's TVL is up 10% on the week.

Figure: ETH Txns by Type (Source: Fundstrat, Glassnode)

- As discussed in Friday's weekly note, the Ethereum Core Developers held their first meeting of the year last week. They discussed the upcoming Shanghai network upgrade and determined which improvement proposals would be prioritized in the code updates. While there has been public debate over what initiatives developers should set their near-term sights on, the call resulted in staking withdrawals being the sole focus of this upgrade. Withdrawals are currently being tested on an exclusive testnet. The plan is for a public testnet to launch next month and a mainnet launch sometime in March. Liquid staking provider tokens have surged on the news. This focused upgrade should de-risk ETH staking immensely, as stakers will now be able to achieve liquidity if they wish to do so. As noted above, major liquid staking provider, Lido ($LDO), had one of the better first weeks of the year, rising over 50%. Other staking provider tokens, such as $RPL and $SWISE, had a similarly positive week of price action.

- It has been nearly two months since Genesis Global halted client withdrawals amid market turmoil following the demise of FTX. This weekend it was reported by Bloomberg that the U.S. DOJ and SEC are investigating Digital Currency Group (DCG). Both federal entities are reportedly concerned with intercompany transfers between DCG and its Genesis subsidiary. DOJ prosecutors have requested interviews and documents from DCG and Genesis, while the SEC is also in an information-gathering phase. According to Bloomberg, neither party has been accused of any wrongdoing. Of note, Grayscale's $GBTC is up 10% against BTC so far on the year, as the discount has compressed from 46% to 41%. Whether this is a sign that traders are speculating on the redemption of the Grayscale trusts remains to be seen.

|

|

|

|

Bitcoin's "dominance" chart as shown in Trading View has reflected some underperformance over the last week which has directly coincided with a period of better relative strength out of many of the Alt-Layer 1's which have moved at a stronger pace off recent lows. As seen in this daily $BTC.D chart below the last meaningful peak in Bitcoin's market capitalization as compared to all other Cryptocurrencies, occurred in mid-October when many coins and the broader US Stock market bottomed out. A similar bottoming out happened for risk assets a few weeks ago that directly coincided with Bitcoin lagging in its movement off the lows. At present, this looks to continue for the next 2-3 days, but it's likely technically speaking, that $BTCUSD should hold support and start to turn higher by end of week, relative to others. This could directly coincide with another minor period of risk-off behavior for many assets. However, i expect any absolute weakness likely proves temporary and will translate into buying opportunities by end of month. | |

|

|

Crypto Size  Bullish signal is tied to the crypto market growing Market Cap $854B +$30B (+3.67%) BTC Dominance  38.95% (-1.55%) 38.95% (-1.55%) | Stable Coins  Increase in circulating stablecoins is a Bullish signal In Circulation $66B (-0.00%) In Exchanges $18B (+0.25%) | BTC Metrics A decrease in Bitcoin on exchanges is bullish, indicates investors are moving coins to cold storage # BTC in Exchanges 2.3M (0.02%) | Funding Rates  Positive funding rates indicate traders are Bullish Aggregate 0.0025% (-0.0055) Binance 0.0100% (0.0001) Bitfinex 0.0103% (-0.0043) Bitmex 0.0100% (0.0001) ByBit 0.0070% (-0.0030) Deribit 0.0000% (-0.0000) Huobi 0.0357% (-0.0307) Kraken 0.0034% (-0.0003) Mean 0.0025% (-0.0055) OKex -0.0052% (-0.0163) |

| SENTIMENT  | BMI: 59 (0.00%) |

| Futures All Exchanges A positive spread between Futures Prices and Spot Prices is Bullish CME BTC Price $17,245 (2.07%) Spot Basis  $-35.85 (-0.21%) $-35.85 (-0.21%) Volume 287,496 (92%) Open Interest  387,372 (-0.92%) 387,372 (-0.92%) | Options All Exchanges Higher open interest change in a bull market is bullish for the sector Volume 4,062 (4.67%) Open Interest 182,381 (0.43%) Volume Put/Call Ratio 0.4305 (-18%) Open Interest Put/Call Ratio 0.4922 (-0.78%) |

|

| | All metrics as of January 9, 2023 12:03 PM |

|

|

|

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

|---|

| BTC | $333B | $17,281 | 1.95% | 4.32% | | | ETH | $162B | $1,326 | 4.79% | 11% | 6.37% | | ADA | $11B | $0.3209 | 12% | 30% | 26% | | DOGE | $10B | $0.0781 | 8.15% | 11% | 6.97% | | MATIC | $7.6B | $0.8657 | 7.49% | 14% | 9.28% | | SOL | $6.1B | $16.56 | 20% | 67% | 63% | | DOT | $5.8B | $5.00 | 5.95% | 15% | 11% | | LINK | $3.1B | $6.18 | 6.15% | 11% | 7.00% | | NEAR | $1.4B | $1.67 | 5.33% | 31% | 27% |

All prices as of January 9, 2023 10:05 AM |

|

| Exchange Traded Products (ETPs) | |

|

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

|---|

| GBTC | -44% | $8.65 | 2.37% | 4.34% | 0.03% | | BITW | -60% | $6.36 | 3.92% | 18% | 14% | | ETHE | -53% | $6.42 | 9.18% | 35% | 31% | | BTCC | 0.20% | $3.21 | 2.56% | 5.94% | 1.63% |

All prices as of January 9, 2023 3:05 PM |

|

|

| Symbol | Market Cap | Last Price | Daily Change | Year to date | Relative to BTC YTD |

|---|

| PYPL | $216B | $78.22 | 2.28% | 9.83% | 5.51% | | SQ | $76B | $69.89 | 1.30% | 11% | 6.90% | | COIN | $65B | $39.20 | 18% | 11% | 6.46% | | SBNY | $18B | $119 | 2.06% | 3.02% | -1.29% | | HOOD | $15B | $8.56 | 3.82% | 5.22% | 0.91% | | MSTR | $6.1B | $180 | 12% | 27% | 23% | | SI | $4.2B | $12.13 | -0.86% | -30% | -35% | | MARA | $3.5B | $5.16 | 26% | 51% | 46% | | RIOT | $2.7B | $5.18 | 21% | 53% | 49% | | MOGO | $223M | $0.6588 | 7.49% | 25% | 20% |

All prices as of January 9, 2023 12:30 PM |

|

|

| | | | The exchange has staying power due to its healthy balance sheet, a proactive approach to regulatory compliance, sensible risk management and legitimacy as a public company, the report said. |

|

| | | | U.S. authorities are reportedly investigating internal transfers from Digital Currency Group to its subsidiary Genesis. |

|

|

| | | | RPC endpoints run by Solana Foundation are currently unavailable. The post Solana Foundation RPC endpoints go offline appeared first on The Block. |

|

|

| | | | Both the SEC and Alameda Research, once a creditor one of Voyager’s creditors, have questioned the legal underpinnings of the proposed deal. |

|

|

| | | | An increasing number of crypto VCs are reporting that most of their portfolio companies are holding back token launches amid weak markets and regulatory scrutiny. The post Crypto VCs say half their token bets are sidelined... |

|

|

| | | | LongHashX, the startup accelerator arm of crypto venture capital firm LongHash Ventures, has launched soulbound tokens to reward contributors. The post Crypto VC LongHash launches soulbound tokens to reward contributors ap... |

|

| | | | The biggest NFT marketplace, OpenSea, announced support for Arbitrum Nova. The post OpenSea adds support for Arbitrum Nova appeared first on The Block. |

|

|

| HACKS, EXPLOITS, AND SCAMS | |

| | | | Jo Guk-Bong, who also owns a crypto mining business, is set to take a majority stake from Leon Lin. The post Huobi Korea moves to sever ties with the mothership: News1 appeared first on The Block. |

|

| | | | Attempts to urgently sell LedgerX and FTX Japan have invited legal protest. |

|

| | | | The Justice Department said it had seized 55,273,469 shares of Robinhood and more than $20 million in U.S. currency as part of the criminal case against Sam Bankman-Fried. |

|

|

|

|