- After a small bounce yesterday, markets have continued their declines this week. The S&P 500 is trading just above $3,900 (-0.91%) and the Nasdaq at approximately $12,000 (-1.50%). In crypto markets, the highly anticipated “Merge” was successfully completed early this morning (more below). The positive event has seemingly turned into a sell-the-news event. $BTC has fallen back below $20,000 (-2.56%) and $ETH has dramatically fallen below $1,500 (-9.02%). Following a multi-year low last week, $BTC.D has risen back above 40.5%, potentially marking a reversal in the $ETH / $BTC trade which has outperformed over the past few months. Other layer-1 tokens are also underperforming $BTC today, with $SOL, $BNB, and $AVAX down 3.63%, 3.49%, and 3.97%, respectively. It will be interesting to watch if Bitcoin dominance increases now that The Merge is in the rear-view mirror.

- At long last, Ethereum’s upgrade from proof-of-work to proof-of-stake is complete. At almost 3:00 AM EST last night, the much-awaited “Merge” was finished. Lots of credit goes to the development team, who completed the upgrade with no major hiccups. Ethereum founder Vitalik Buterin echoed the sentiment, tweeting, “And we finalized! Happy merge all. This is a big moment for the Ethereum ecosystem. Everyone who helped make the merge happen should feel very proud today.” Ethereum’s shift away from proof-of-work vastly reduces the amount of ETH emissions required to maintain the network’s security. In our Ethereum Merge Deep Research Report, we estimated the daily ETH issuance would decrease by approximately 89%, leading to over $20 million less in daily selling pressure. The improved supply dynamics will potentially have a positive price effect price going forward. In addition to improving tokenomics, the network upgrade allows for a massive decrease in energy consumption. According to Justin Drake, an Ethereum Foundation researcher, the move to PoS reduces global electricity production by 0.2%. The improved energy-efficient network will now potentially draw the attention of ESG investors worldwide. Although the crypto community is delighted with the successful upgrade, some have already shifted their attention to Ethereum’s next upgrade called “The Surge,” which will be the next step in scaling the network’s capacity.

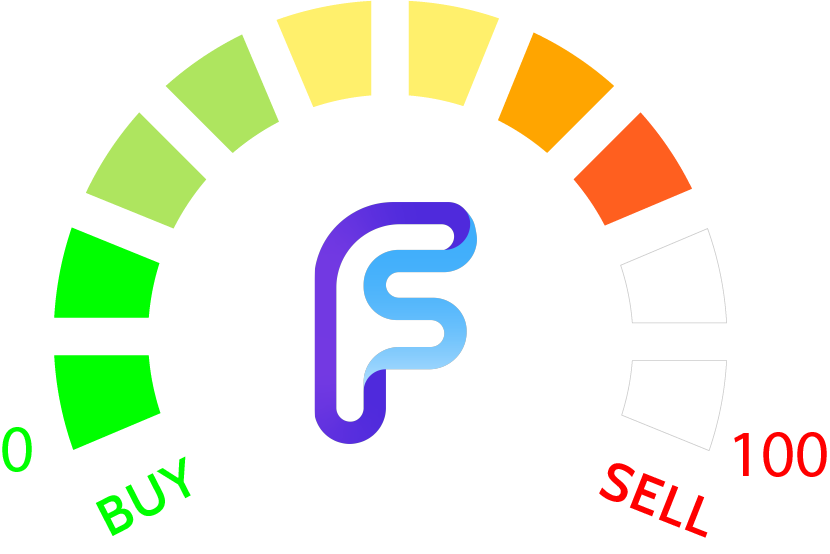

- There is no doubt that regulation is coming for crypto. With mid-term elections only months away, crypto companies such as Coinbase and FTX have increased their political efforts to ensure productive legislation. Coinbase CEO Brian Armstrong believes it’s better to get out in front and educate its users about who in Congress is supporting the industry and who is not. Yesterday, Coinbase announced a new feature for their app allowing U.S. users to gauge the sentiment of politicians on crypto assets. The tool will utilize insights from Crypto Action Network, which analyzes media statements, legislative records, and other public data to score Congress members’ views on crypto. In Armstrong’s tweets explaining the new feature, he cites that over time Coinbase wants to help pro-crypto political candidates receive donations from the crypto community directly on the Coinbase app. The move will hopefully increase political awareness and ensure that the crypto community makes its voice heard come election day.

Crypto Daily Report – September 15

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Reports you may have missed

The crypto market is pulling back from its recent surge, with $BTC falling below $65,000, $ETH trading under $3,200, and $SOL fighting to stay above $150. As expected, altcoins are also generally declining, although a few notable performers are scattered across the market. Currently, $BONK and $WIF, two prominent memecoins on Solana, are showing resilience, up 12% and 6%, respectively. Additionally, $HBAR initially doubled in price following reports that Blackrock...

Blockchain Association Sues the SEC, Cosmos Patches Potential Reentrancy Vulnerability

U.S. Treasury rates and the DXY (-0.46%) are sliding today following weaker-than-expected S&P Flash PMI data, helping catalyze a 1% rally in equity indices. Manufacturing PMI came in at 49.9 vs. 52.0 expected, and Services PMI read 50.9 vs. 52.0 expected. Bitcoin miners have benefited as rates retreat and transaction revenue remains elevated, with $RIOT, CLSK, and $MARA showing weekly gains of 26%, 16%, and 14%, respectively. Crypto assets are mixed with BTC-3.82% ...

After significantly outperforming equities leading up to its halving event on Friday, BTC-3.82% continued its upward trend over the weekend, now trading just below $66k. ETH-3.38% has generally followed suit, although continuing to lag behind BTC, with its current price around $3200. SOL-7.35% , meanwhile, has continued its strong rebound from the recent price slide, reaching $156 yesterday, currently trading slightly below that level. The crypto market is broadly performing well...

Happy Halving Day to all. It has been another volatile 24 hours for crypto markets, with war-related headlines sending risk assets lower overnight. BTC-3.82% briefly dipped below the $60k mark but has since recouped all its losses and is now trading above $64k. ETH-3.38% followed BTC's initial drop, trading below $2900 last night, but it has now rebounded to above $3000. SOL-7.35% has shown remarkable resilience amid the turmoil, now...