Ordinals

Key Takeaways

- Ordinals, often referred to as "Bitcoin NFTs," have been rapidly gaining traction on the network, experiencing exponential growth since their inception just five months ago. Ordinals provide a method for attaching or "inscribing" data to individual satoshis (the smallest unit of a Bitcoin, equal to 1/100,000,000) on the Bitcoin blockchain.

- The creation of Ordinals was made possible by the SegWit and Taproot Bitcoin upgrades. While these upgrades facilitated the emergence of Ordinals, they were an unintended consequence and not something the Bitcoin community anticipated.

- The growth of Ordinals has led to a substantial increase in overall network activity, with daily transactions reaching an all-time high, and miners benefiting from increased transaction fees. Many Bitcoin holders are optimistic that the increase in miner fees will contribute to a more secure network in the future.

- Unlike Ethereum-based NFTs, Ordinals are inscribed directly onto satoshis on the blockchain. This means that Ordinals are treated like any other satoshi on the network, making them more censorship-resistant than NFTs on other Layer 1 blockchains, but also less programmable.

- However, some traditional Bitcoin holders oppose Ordinals, arguing that they detract from Bitcoin's mission as a decentralized currency and promote scams and speculation. They also believe that the increased cost for block space will raise the barrier to entry for financial transactions and may cause node bloat, leading to a more centralized network.

What are Ordinals?

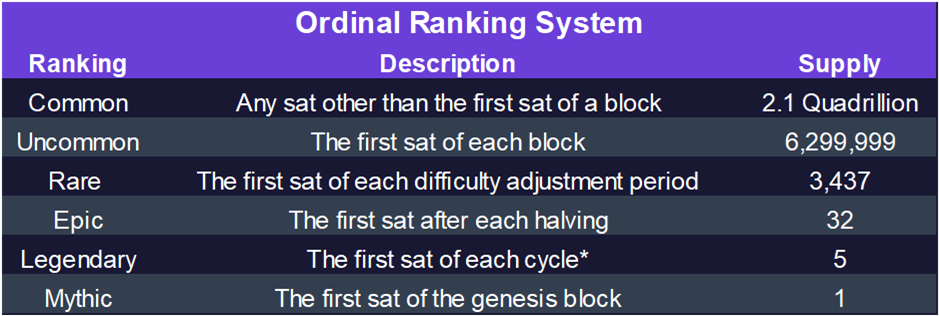

Ordinals, commonly called “Bitcoin NFTs,” have been one of the most exciting developments in the Bitcoin ecosystem this year. Technically, Ordinals are a way of attaching or “inscribing” data to individual sats or satoshis (the smallest unit of a Bitcoin at 1/100,000,000) on the Bitcoin blockchain. The term “Ordinal” is derived from Ordinal Theory, a recently developed system for numbering sats in the order they are mined. Sats from Bitcoin’s history hold some significance (for example, the sat associated with the genesis block) and are considered more valuable. This numbering system from Ordinal Theory gives the ordinals their “non-fungible” property necessary to create NFTs or Non-Fungible-Tokens, distinguishing each sat from one another.

* The ranking system of Ordinals defines a ‘cycle’ as the period between conjunctions when a halving and difficulty adjustment coincide. This happens every six halvings and the first will occur in 2032.

History of Ordinals

Building on the Bitcoin blockchain emerged long before Ordinals, dating back to 2012 with an open-source project called ‘Colored Coins.’ This project was initially designed to be a currency and introduced a way of attaching real-world assets or services to a UTXO set. While the project lost interest over time, it opened the door for innovation on the Bitcoin network.

Ordinal NFTs were made possible by the Segregated Witness (SegWit) and Taproot upgrades to the Bitcoin protocol, which occurred in 2017 and 2021. The SegWit upgrade increased block size and paved the way for the subsequent Taproot update. Taproot included multiple upgrades, including more complex scripting in the witness portion of a transaction, and removed the size limit for witness data. These upgrades significantly increased the amount of data that could be stored on-chain within each block and made it possible for Ordinal NFTs to exist.

In December 2022, Bitcoin developer Casey Rodarmor released an open-source code called ORD that runs on top of Bitcoin’s core full node. This is the technology that enabled inscriptions and ordinals to be created.

Interestingly, Ordinals were an unintended consequence of the Taproot upgrade. Despite long and thorough public discussions regarding approving the Taproot upgrade, it was never considered that something like Ordinals could be made possible due to the upgrade. This is something that more traditional Bitcoin holders view as a negative and will likely result in more scrutiny of BIPs (Bitcoin Investment Proposals), making them more difficult to pass in the future. Some believe that if an upgrade to the network can cause unforeseen consequences, the risk is too significant to make any changes. Had the community been fully aware that Ordinals would be made possible from Taproot, the proposal would likely have taken much more time to be implemented.

What are Inscriptions?

Inscriptions are the arbitrary data of the Ordinal itself. This could be an image, video, or any other piece of data that can be written to the Bitcoin blockchain. The term “inscription” comes from the data attached to an individual Satoshi being “inscribed” within that specific part of a Bitcoin transaction.

Bitcoin NFTs vs Ethereum NFTs

Despite being called Bitcoin NFTs, Ordinals differ from NFTs on other Layer 1 blockchains in a number of ways. Unlike NFTs on Ethereum or other L1s, which have their own token standard, Ordinals are created by attaching data, such as an image, to an individual satoshi (sat) on the Bitcoin blockchain. This means the Bitcoin blockchain treats ordinals like any other satoshi – they are fully on-chain and can be used for payment or network fees. Not only does this make it substantially cheaper to transact with Bitcoin NFTs, but it also makes Bitcoin NFTs more censorship resistant than Ethereum NFTs. This was made possible by Taproot increasing the limits on witness (signature) data sizes in Bitcoin transactions, allowing space to store arbitrary data as NFTs.

Meanwhile, on Ethereum and other alternative layer 1 blockchains, the NFTs are normally hosted at another location that isn’t on-chain. Some Ethereum NFTs utilize the decentralized storage system IPFS (Inter Planetary File System) to store NFT data or artwork associated with the NFT. On Ethereum, NFTs have metadata that allows creators of the NFT to make changes and updates to the NFT. Since Ordinals are entirely on-chain, once the ordinal is inscribed, there is no way to change it.

Of course, the tradeoff of programmability means that Bitcoin NFTs also do not have any royalties attached to them and are more difficult to transfer from wallet to wallet as you are moving an individual sat and wallets don’t offer sat selection.

Growth of Ordinals

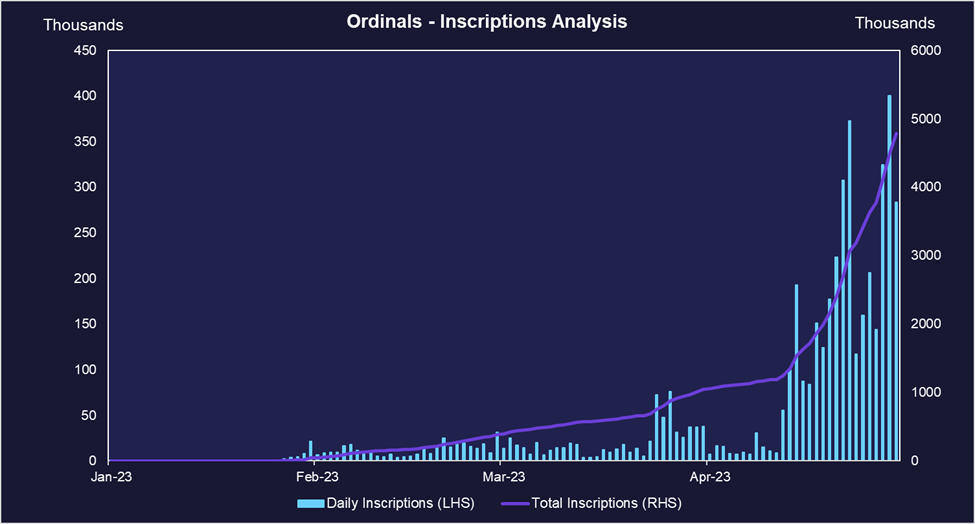

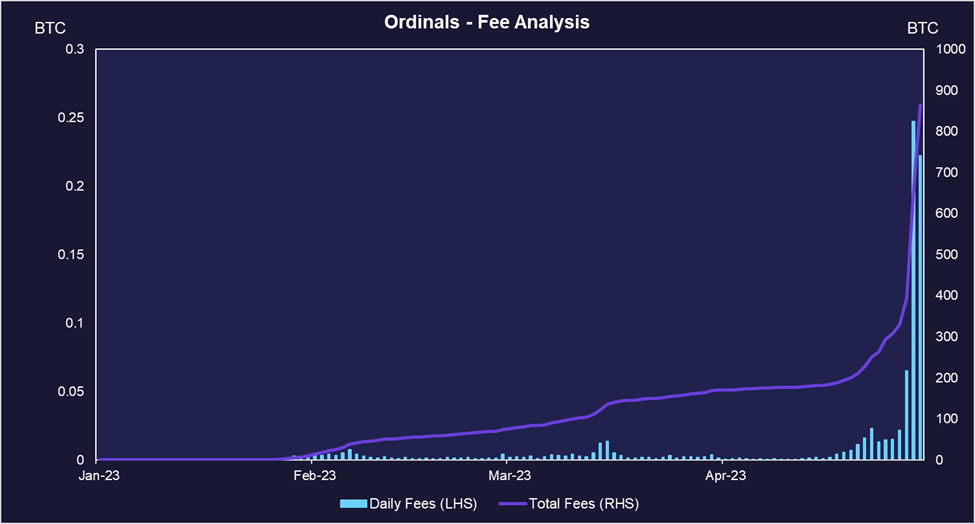

Ordinals are still nascent, having been created just four months ago. Looking at the stats of daily inscriptions and fees, we can see that their growth began accelerating in February of 2023, when Ordinal Punks and other collections started gaining traction. Ordinals rapidly went from something only a handful knew of to a new venue for collectors to speculate on rare inscriptions with hundreds of thousands of dollars. Since February, the ‘hype’ surrounding Ordinals briefly cooled off but has gone parabolic in the last couple of weeks, reaching its all-time highs at the start of May. This uptick in activity in the last couple of weeks may be centered around Bitcoin’s BRC-20 token standard. BRC-20, also known as “Bitcoin Request for Comment,” is a new token standard used to issue and transfer fungible tokens on Bitcoin. It was created in March 2023 by a pseudonymous on-chain analyst named Domo, and it uses the Ordinals protocol. At the time of writing, the combined market cap of the existing 14,079 BRC-20 tokens is $1 billion, up ~57x from the $17.5M seen a couple weeks ago.

Ordinals Ecosystem

Despite being less than six months old, an ecosystem is already forming around Ordinals. When Ordinals first gained traction in February, collectors had to make peer-to-peer transactions, often in discord servers with people they had never met. Many teams are now creating Ordinal marketplaces, research tools, and services to simplify minting an inscription. Large marketplaces from other Layer 1 blockchains, such as Magic Eden, also integrate Ordinals onto their platform.

Collections

While there are many Ordinals collections (Dune Analytics reported over 317,000 Ordinal NFTs recorded on Bitcoin from January to March 2023), some notable collections include Taproot Wizards, Ordinal Punks, and Yuga Lab’s Twelvefold collection.

Ordinal Punks

Ordinal Punks on Bitcoin pay tribute to the CryptoPunks Ethereum collection, created in June 2017. Ordinal Punks are a 100-supply PFP (Profile Picture) collection minted within the first 150 inscriptions.

Twelvefold

Twelvefold is the first Ordinal collection of Yuga Labs, the creators of the Bored Ape Yacht Club. Yuga Labs says the artwork for the collection was inspired by Bitcoin and used a 12×12 grid in a “visual allegory for the cryptography of data on the bitcoin blockchain.” There are 300 pieces in this generative art collection.

Taproot Wizards

Taproot Wizards is a collection of 2,105 wizard-themed Ordinals that was started by Udi Wertheimer, a major holder and supporter of Bitcoin. The wizard artwork dates all the way back to 2013 when a user named “mavensbot” uploaded a drawing of a Bitcoin-themed wizard on the r/Bitcoin subreddit that proceeded to go viral. Taproot has yet to mint to the public, but it has a community forming around it of Bitcoin ‘OGs’ and other influential people in the bitcoin community.

Why Ordinals Could be Good for Bitcoin

Reignite Interest in Bitcoin

Bitcoin was designed to maximize security and decentralization, and because of this, its code is difficult to change. This is why most developer activity and experimentation occurs on other Layer 1 blockchains, such as Ethereum, which are more easily programmable. Ordinals is one of the first innovations we’ve seen on Bitcoin that has gained traction with the mainstream crypto community in quite some time. This could lead to continued interest in building and innovating on the Bitcoin network and perhaps lead to a narrative shift. Today, Bitcoin’s narrative is largely centered around being a decentralized money and store of value. If development is abundant on the network, it is possible that this narrative expands or changes.

Ordinals may also lead to a boom of culture and adoption of the Bitcoin network, as we saw with NFTs on Ethereum in 2021. The 2021 NFT boom on Ethereum brought many people to the network who wouldn’t have otherwise participated when most applications on Ethereum were DeFi focused and had a steeper learning curve, a disadvantage for those with little finance experience. Collections on Ethereum, like Crypto Punks and Bored Ape Yacht Club, brought in a diverse cohort of investors ranging from art collectors to celebrities to professional athletes. A similar dynamic could take shape with Ordinals and Bitcoin.

Increases Fees for Miners and Improves Network Security

Ordinals have quickly become one of the key drivers for blockspace demand on the Bitcoin network, generating over $5 million in fees in the past three months. While there are downsides to fees, the positive is that Bitcoin fees help to ensure the network’s security. The network is currently secured by both Bitcoin’s block rewards and transaction fees. Transaction fees become especially important over time as the block reward to miners decreases and eventually hits zero. If transaction fees are too low when the block rewards run out, miners would have less incentive to continue mining, leading to a less secure network. Currently, fees alone are not enough to secure the Bitcoin network. This makes the increased demand for fees from Ordinals something that could actually improve Bitcoin’s security in the long run and make it a better form of money and store of value.

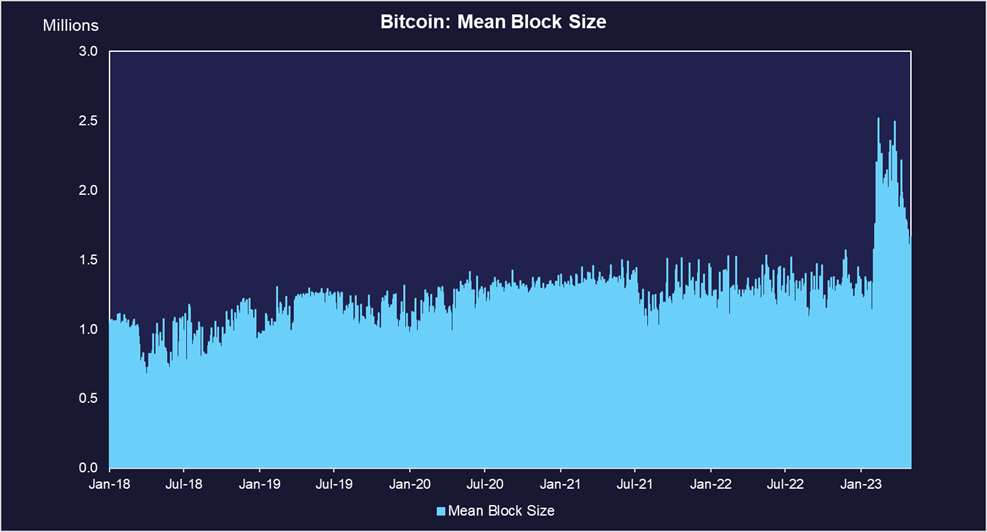

As you can see in the chart above, Ordinals have led to a huge increase in Bitcoin’s mean block size, doubling it in less than a month from ~1 million to over 2 million. This is indicative of a significant increase in demand for Bitcoin blockspace.

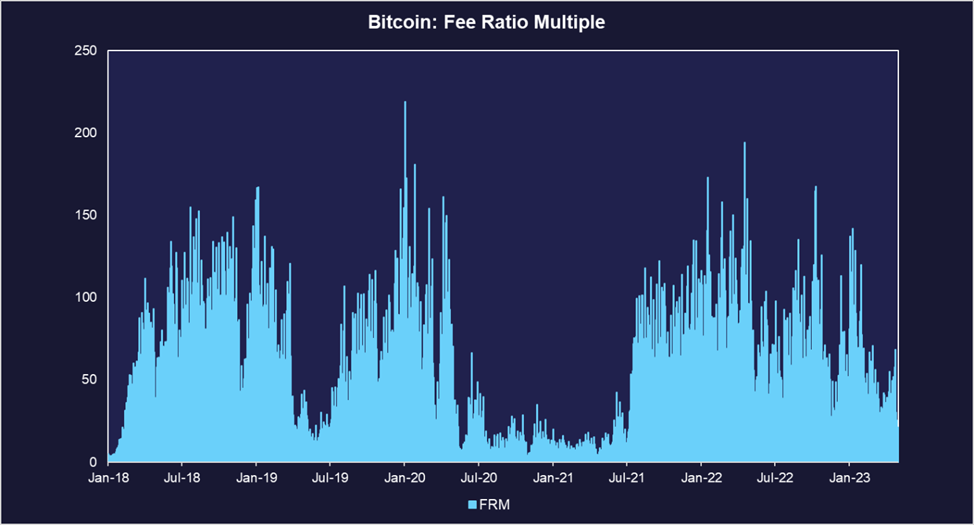

The Bitcoin Fee Ratio Multiple (FRM) is defined as the ratio between the total miner revenue (block rewards + transaction fees) and transaction fees. Ordinals have helped to bring this ratio down to levels not seen since the summer of 2021. This is due to transaction fees making up a relatively higher payment amount to miners than block rewards.

Why Ordinals Could be Bad For Bitcoin

Not the Core Ethos of Bitcoin

Some of the more traditional holders of Bitcoin, or “Bitcoin Maximalists,” have viewed Ordinals as a threat to Bitcoin’s original purpose of a decentralized currency. While Ordinals alone won’t stop Bitcoin from being a decentralized currency, Maximalists believe that the use of Ordinals and Inscriptions on Bitcoin distracts from the core ethos and encourages scams and speculation. The original intention of Bitcoin, as described in Satoshi’s whitepaper, is to function as a “peer-to-peer electronic cash system.” Therefore, some within the Bitcoin community argue that favoring the recording of arbitrary data over financial transactions in the blockchain conflicts with this purpose. In addition, some node operators may not want to download the data associated with inscriptions since anything can be inscribed, including data that may be offensive or illegal. To avoid this, node operators could opt to run a pruned node, eliminating the need to download and store old transactions with a sufficiently high number of confirmations.

Another argument against Ordinals is that by using satoshis and giving them unique inscriptions, you are reducing the fungibility of those satoshis and damaging their ability to be used as money. However, due to how many sats there are (2.4 quadrillion), these fears are likely to be overblown given the sheer number of inscriptions necessary to change any meaningful amount of the Bitcoin supply. Furthermore, simply because there is an inscription on a sat doesn’t mean that it can’t be used in the same manner as other sats for transactions or transfers.

Increased Cost of Block Space

Some Bitcoin community members have voiced concerns that the demand for inscriptions can result in higher costs for block space, which could increase the hardware requirements for full nodes, reducing the number of people who can afford to run full nodes and harming decentralization. If inscriptions consistently use the block space to fill the entire 4MB of space, it would add nearly 210.4 GB of data each year, which is a manageable cost but could still be considered expensive in areas where technology isn’t cheaply available.

Conclusion

Ordinals and inscriptions are among the most interesting developments emerging from the Bitcoin network. While there is plenty of reasonable skepticism to be had, it’s hard to deny the interest and usage that Ordinals have picked up in such a short time. Despite Ordinal’s nascency, collectors and speculators have shelled out hundreds of thousands of dollars for single pieces, showing they believe there is a bright future for Ordinals ahead. With that being said, it is still being determined whether Ordinals will have the same staying power as NFTs on Ethereum, given how nascent they are.

Reports you may have missed

WHAT IS BITCOIN MINING? Bitcoin is known as a proof-of-work (PoW) network. PoW networks require “miners” to solve computational puzzles to add blocks to the blockchain. Miners who supply more computational power to the network have a higher chance of processing a block, and successful miners are compensated with Bitcoin tokens. Transactions on the Bitcoin network are grouped into blocks, and then block data is put through a cryptographic algorithm...

INTRODUCTION Blockchain networks initially were more like closed-loop systems, meaning the value created and traded on-chain was confined to crypto native assets. As technology has developed, blockchains and the real world are becoming more intertwined. Crypto protocols and TradFi institutions alike are looking to tokenize real-world assets and benefit from transaction efficiencies, cost savings, interoperability, composability, and transparency. Protocols have already begun bringing assets like dollars and treasuries on-chain while...