BitDigest October 20 · Issue #766

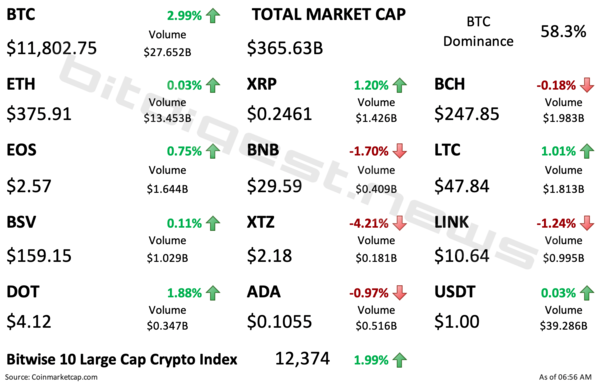

- Crypto prices inch back up with bitcoin looking to retest $12,000

- Fed Chairman said being the first to issue a sovereign digital currency is not as important as getting it right

- Mixer founder charged by FinCEN for operating without a MSB license

Crypto Fear and Greed Index

The Fear & Greed Index for bitcoin and other large cryptocurrencies remains unchanged at 56 for the week. After moving into “neutral” and then entering the “greed” range at the beginning of the month, the index has held above 50 for the past 10 days signifying improving sentiment but trader hesitation as bitcoin inches higher but leading DeFi and other new protocols begin to show significant volatility.

Time to Gloat for a Moment

Like many readers of BitDigest, I have spent the past several years talking to people, attempting to educate them about digital currencies. For the most part this has been an enjoyable experience, but on occasion you meet a naysayer who simply will not listen and accept the idea of digital money. People ask about its intrinsic value or quote Berkshire Hathaway’s Warren Buffet who called bitcoin “rat poison squared.”

One of the biggest longtime crypto defeatists has been the Bank of International Settlement’s Agustín Carstens. Carstens was one of the first central bankers to publicly speak out against digital assets calling cryptocurrencies a “combination of a bubble, a Ponzi scheme and an environmental disaster” saying he could not imagine a digital currency or other related technology “coming along any time soon that would be more efficient and generate the same level of trust” as sovereign electronic payment systems like those used in Switzerland.

Yesterday morning, the IMF held a series of webinars on digital currencies and cross-border payments and as I cover below, the story among central bankers has turned 180 degrees.

None other than Agustín Carstens spoke and said that CBDC’s are not a threat to the international monetary system and will provide much greater control to central bankers and provide the grounds to facilitate international payments, cost reduction, inclusion and efficiency gains.

To quote Nelson Mandela, “education is the most powerful weapon, which you can use to change the world.” This journey has only just begun, but it’s nice to be able to take a moment and recognize that I am among many who have helped tell this story and educate others on this new technical innovation.

What if I Get Hit By a Bus?

My son recently asked me what will happen to my digital currencies when I die or as he put it, “what will happen if you get hit by a bus?” He was not as concerned about who will receive the digital assets in my wallet, but rather what will happen to the cryptocurrencies if he does not know how to access them. This is a legitimate question and something I have given a lot of thought too.

I have tried to educate him as to how digital wallets function and have even left him written and video instructions on the steps to take to transfer crypto assets custodied on a digital wallet, but since he does not have any real experience in managing his own wallet and given the fear that he could make a mistake and potentially even send his assets to a wrong address I have considered moving some of my assets to a third party custodian.

The main reason for this decision would be to add a safety factor by using a trusted third party. Besides offering an easier process for a crypto newbie, using a third-party custodian would eliminate the single point of failure, i.e. me getting hit by a bus, or at least that is what it is supposed to do.

Given this background, I really do not understand what is happening at OKEx. There has been no news since last week. They are one of the largest digital exchanges in the world with $2.05 trillion in 24-hour volume and purportedly over $2.3 billion in bitcoin on-exchange holdings alone, yet since one person has been “out of touch” and meeting with Chinese authorities, no one else is able to authorize the withdrawal of client funds? As my son would say, what if this individual was hit by a bus? Will all funds remain locked on the exchange? I hope not.

The Headlines

US Studying CBDC and Wants to Get it Right

Digital Ruble Could Mitigate US Sanctions

Latvia Issues Crypto Warning

Switzerland Begins Blockchain Consultation Period

Top Mixer Operated without MSB Registration

Fujitsu Leading Pilot to Study Blockchain-based Identification

Line Developing CBDC Platform

Market Data

Crypto Tax Payments Still Weak

Thoughts on the Ecosystem

China Needs to Convince Shoppers to Use DCEP

French Finance Minister Says Crypto Still Has Criminal Uses

Market Not Jumping on Crypto News

Reports you may have missed

Blockchain Association Sues the SEC, Cosmos Patches Potential Reentrancy Vulnerability

U.S. Treasury rates and the DXY (-0.46%) are sliding today following weaker-than-expected S&P Flash PMI data, helping catalyze a 1% rally in equity indices. Manufacturing PMI came in at 49.9 vs. 52.0 expected, and Services PMI read 50.9 vs. 52.0 expected. Bitcoin miners have benefited as rates retreat and transaction revenue remains elevated, with $RIOT, CLSK, and $MARA showing weekly gains of 26%, 16%, and 14%, respectively. Crypto assets are mixed with BTC-2.65% ...

After significantly outperforming equities leading up to its halving event on Friday, BTC-2.65% continued its upward trend over the weekend, now trading just below $66k. ETH-1.30% has generally followed suit, although continuing to lag behind BTC, with its current price around $3200. SOL-3.89% , meanwhile, has continued its strong rebound from the recent price slide, reaching $156 yesterday, currently trading slightly below that level. The crypto market is broadly performing well...

Happy Halving Day to all. It has been another volatile 24 hours for crypto markets, with war-related headlines sending risk assets lower overnight. BTC-2.65% briefly dipped below the $60k mark but has since recouped all its losses and is now trading above $64k. ETH-1.30% followed BTC's initial drop, trading below $2900 last night, but it has now rebounded to above $3000. SOL-3.89% has shown remarkable resilience amid the turmoil, now...

Tether Outlines New Organizational Structure, Aptos Partners with Microsoft, Brevan Howard, and SK Telecom

Traditional markets are finding some relief in Thursdayâs trading after four consecutive sessions of losses. The SPY and QQQ have gained approximately 0.30%, while the IWM (+0.99%) is showing outsized gains. Crypto markets are finding larger relief, with $BTC rising 3.92% to $63.7k, and $ETH gaining 2.71% to exceed $3,050. Injective ($INJ) is one of the leading tokens today, gaining 9.37% following news of a partnership with JamboPhone to bring blockchain-powered financial solutions to emerging markets. JamboPhone...