BitDigest May 29 · Issue #668

- Bitcoin picks up in post Goldman call panic

- The Bank of Russia is looking to put mortgages on a blockchain

- France is looking for feedback on the impact of new technologies on payments

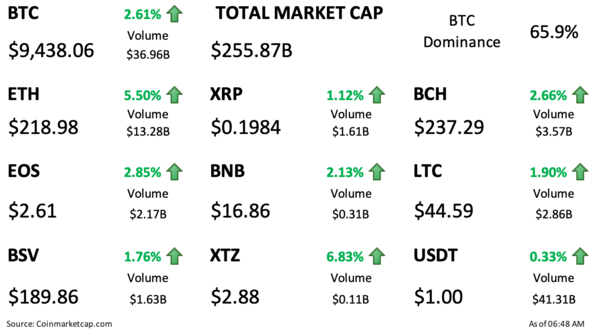

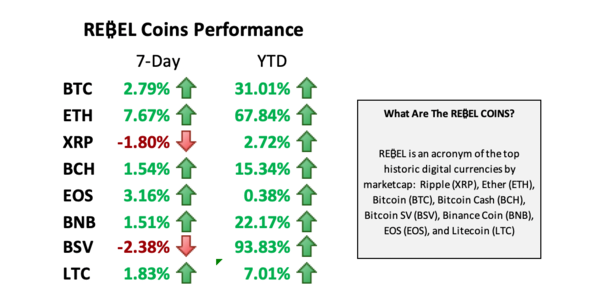

I decided to add three coins to my daily tracking list to properly account for the top 10 cryptocurrencies by marketcap. This list currently accounts for 88.5% of the total market cap of the 2,000 + different digital currencies listed on Coinmarketcap.com

Is Grayscale Increasing Activity a Threat to Bitcoin?

I have been thinking a lot about Grayscale and whether their continued buying of bitcoin is a threat to the crypto economy. Yesterday I reported that Grayscale is buying bitcoin at a rate of 1.5x the supply of new daily minted bitcoin and last night I learned that Grayscale added close to 2,000 new bitcoin to their AUM yesterday.

While these numbers are incredibly high, I think we need to look at Grayscale’s activities in context of daily trading volume. According to Coinmarketcap.com, bitcoin’s daily volume is typically over $30 billion. While I report these figure, I also look at Messari’s ‘real volume’ which reports the 24 hour volume on exchanges identified by Bitwise “as well-functioning markets.” The daily level I look for here is $5 billion. If volume trades outside this figure a mental flag goes up.

The amount of new daily minted bitcoin is 900 BTC or approximately $8.5 million so even at the 2x level this would be a considerable amount of new purchases, but in the context of daily volume, it is not a figure to be concerned by.

Update on Canaan

I have been looking into the recent sell-off of Chinese mining equipment supplier Canaan (NASDAQ: CAN) and it appears that the company’s initial share lock-up period following its November IPO has ended. Furthermore, the company just announced plans to issue an addition $12 million in shares as part of its employee incentive program. Since May 13th, CAN shares have declined 51%.

Weekend Reading (and Viewing)

- Last month digital asset manager CoinShares released a series on the Future of Capital Markets. Five different sessions address how new applications in digital currency markets could apply to traditional capital markets. The sessions include: Automating Execution and Trading Workflows, Cross Margining through a Distributed Clearing House, Decentralized Settlement Protocols, Insights from the Trading Desk, and a panel discussing the Future of Capital Markets.

- Tokeny Solutions has released “Tokenized Securities” the ultimate handbook on how to issue compliant securities on a blockchain through a securities token offering (STO).

The Headlines

Bank of Russia Wants to Put Mortgage Issuance on New State Blockchain

French Watchdog Looking to Understand Impact of Blockchain on Payments Industry

China Amends Inheritance Laws to Include Crypto

BitClave Agrees to Return ICO Proceeds

Zuckerberg Says Libra Will Help Generate More Ad Dollars

Ripple Brings RippleNet to Cloud

Nomics Introduces 'Transparent' Market Indicators

Exchange, Custody and Product News

Gemini App Integrates With Samsung Blockchain Wallet

Genesis Launches Derivatives Trading Desk

Coinbase Adds Tezos Staking in Europe and New Mobile Features

Reports you may have missed

Tether Outlines New Organizational Structure, Aptos Partners with Microsoft, Brevan Howard, and SK Telecom

Traditional markets are finding some relief in Thursdayâs trading after four consecutive sessions of losses. The SPY and QQQ have gained approximately 0.30%, while the IWM (+0.99%) is showing outsized gains. Crypto markets are finding larger relief, with $BTC rising 3.92% to $63.7k, and $ETH gaining 2.71% to exceed $3,050. Injective ($INJ) is one of the leading tokens today, gaining 9.37% following news of a partnership with JamboPhone to bring blockchain-powered financial solutions to emerging markets. JamboPhone...

Equities and crypto assets are selling off in tandem today as inflation and geopolitical fears have spooked risk assets. The SPY and QQQ have decreased by 0.46% and 0.92%, respectively, while crypto is selling off more aggressively. $BTC (-5.49%) has tested the high $59,000s and $ETH (-4.42%) is trading below $3,000. Among a sea of red, $SUI is showing relative strength, gaining 6.44% on the back of a partnership announcement with...

Risk assets remain under pressure as the DXY's relentless rally has continued, now approaching its 2023 highs, currently at 106.5. Rates continue to move higher, with the 10Y now reaching a new year-to-date high of 4.7%. Gold continues its upward march amid persistent geopolitical tensions. Crypto remains weak in the face of rising rates, geopolitical risks, and tax season. $BTC continues to range between $61K and $63K following yesterday's afternoon...

Crypto prices suffered steep declines over the weekend following news of Iran launching drone strikes at Israel. Bitcoin and Ethereum reached respective lows of $60.8k and $2.85k, while many altcoins saw drops of over 20%. Open interest (OI) across all coins on Friday was $48 billion, and after the rapid price declines, approximately 25% of that was wiped, with total OI of about $36 billion at the time of writing. $BTC...