BitDigest April 15 · Issue #881

- Coinbase lists on Nasdaq closing with a $85 billion valuation

- Powell calls crypto speculative assets while questioning value of gold

- Brazil making progress on CBDC

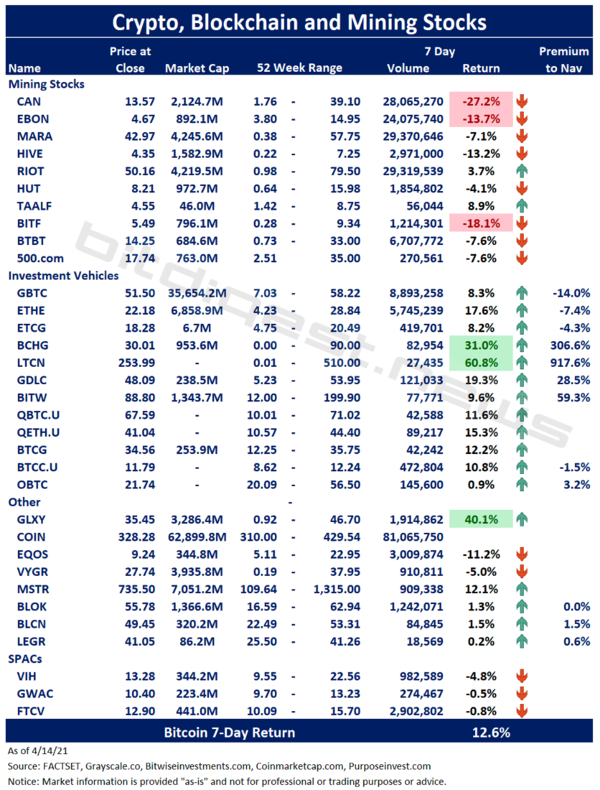

Weekly Stock Update

COIN Ends First Day with $85.7 Billion Valuation

I spent most of yesterday morning sitting at my desk, waiting for Coinbase (NASDAQ: COIN) to start trading. At 1:25 PM, COIN posted its first trade at $381, 52% above the pre-announced reference price, and I watched with excitement as prices began to post on my screen.

$385, $390, $395 within minutes COIN was gaining. It broke $400 and continued its upward trend. $410, $420, $425. COIN finally hit $429, hitting a first day high of $429.54 but that’s when the declines began suddenly falling below $400. The rest of the day saw a gradual decline, hitting a low of $310 just after 3 PM, before recovering and ending the day at $328.28.

I’ll admit, my initial exuberance turned into disappoint as I watch COIN fall from the early morning highs, but as I think about this this morning, COIN’s first day performance was really a great success and milestone to my crypto journey. A cryptocurrency exchange, a trading service for a new digital money that only a few years early was being attacked and criticized by almost everyone on Wall Street (and many looking to get their names in the news) had ended its first day with a valuation above $85 billion – an incredible success!

Looking through yesterday’s trading picture, I came away with several thoughts:

- Although a direct listing appears to be a more complicated process – at least due to the order matching on opening day – I truly believe this is the future of public listings. It maintains greater control over the valuation with the company during the final funding rounds and eliminates the risk that of a sale at a more conservative price that escalates benefiting traders and not the company during the first session.

- Ahead of COIN’s opening, publicly traded crypto stocks were down, signaling that these public alternatives to bitcoin are potentially being replaced by a better market proxy.

- I was reminded of the impact that liquidity brings to capital markets. All morning, FTX’s COIN stock-token was trading above $500, but as ‘Mr. Market’ entered the picture, the true price was immediately discovered.

- Although Coinbase received 96% of its 2020 revenue from transaction fees, CEO Brian Armstrong says the company has not seen any margin compression and does not “expect to see it in the short and the mid term;” in the long-term he says fee compression is likely, but explains that within 5 – 10 years, 50% or more of revenue could be derived from other offerings like debit cards and yield providing products.

- Lots of friends and industry colleagues were on TV and in the news speaking about this great moment in crypto’s history, but with every positive cheer and clanging of champagne glasses was the recognition that regulation is coming and will be the future topic of discussion.

- Opinions change. The idea originating by a group of ‘cypherpunks’ in the 90’s has revolutionized the financial world. My past several years of advocating for a new digital currency backed financial system is really gaining acceptance.

One last point on COIN, in celebration of yesterday’s listing and as a nod to Satoshi Nakamoto’s decision to add a message into bitcoin’s Genesis block, Coinbase had a message embedded in the bitcoin blockchain yesterday, adding “NYTimes 10/Mar/2021 House Gives Final Approval to Biden’s $1.9T Pandemic Relief Bill” into block height 679187.

The Headlines

Cryptocurrencies Are 'Vehicles for Speculation' Not Payment

Brazil Progressing on Digital Real

Macau to Amend Financial Laws to Allow Digital Yuan

Gary Gensler Confirmed to Lead SEC

EC Wants to Improve Digital Investigations to Fight Organized Crime

VanEck Launches Digital Transformation ETF

Sotheby’s Digital-Only Artwork Sale Earns $16.8 Million

Thoughts on the Ecosystem

Goldman Committed to Play Role in Crypto Innovations

Cult-like Crypto Investors Pressuring Market

Reports you may have missed

After significantly outperforming equities leading up to its halving event on Friday, BTC-0.21% continued its upward trend over the weekend, now trading just below $66k. ETH-0.82% has generally followed suit, although continuing to lag behind BTC, with its current price around $3200. SOL-0.04% , meanwhile, has continued its strong rebound from the recent price slide, reaching $156 yesterday, currently trading slightly below that level. The crypto market is broadly performing well...

Happy Halving Day to all. It has been another volatile 24 hours for crypto markets, with war-related headlines sending risk assets lower overnight. BTC-0.21% briefly dipped below the $60k mark but has since recouped all its losses and is now trading above $64k. ETH-0.82% followed BTC's initial drop, trading below $2900 last night, but it has now rebounded to above $3000. SOL-0.04% has shown remarkable resilience amid the turmoil, now...

Tether Outlines New Organizational Structure, Aptos Partners with Microsoft, Brevan Howard, and SK Telecom

Traditional markets are finding some relief in Thursdayâs trading after four consecutive sessions of losses. The SPY and QQQ have gained approximately 0.30%, while the IWM (+0.99%) is showing outsized gains. Crypto markets are finding larger relief, with $BTC rising 3.92% to $63.7k, and $ETH gaining 2.71% to exceed $3,050. Injective ($INJ) is one of the leading tokens today, gaining 9.37% following news of a partnership with JamboPhone to bring blockchain-powered financial solutions to emerging markets. JamboPhone...

Equities and crypto assets are selling off in tandem today as inflation and geopolitical fears have spooked risk assets. The SPY and QQQ have decreased by 0.46% and 0.92%, respectively, while crypto is selling off more aggressively. $BTC (-5.49%) has tested the high $59,000s and $ETH (-4.42%) is trading below $3,000. Among a sea of red, $SUI is showing relative strength, gaining 6.44% on the back of a partnership announcement with...