COVID Cases Stable, VIX and Credit Suggest Epicenter Upside

COVID-19 trends have been fairly stable in the past few weeks (vs the sharper declines in cases seen earlier in the year), but as we wrote about in recent weeks, daily cases is not necessarily the important benchmark. Vaccinations are increasing and averaged 3.0 million this week. Many states are moving forward with re-openings. As we noted earlier this week, it was a milestone to see CA, one of the most conservative states with regard to re-opening, announce a full re-opening by June 15th. Given CA is a good barometer for the strictest states, it seems that essentially the entire US will be open by the Summer.

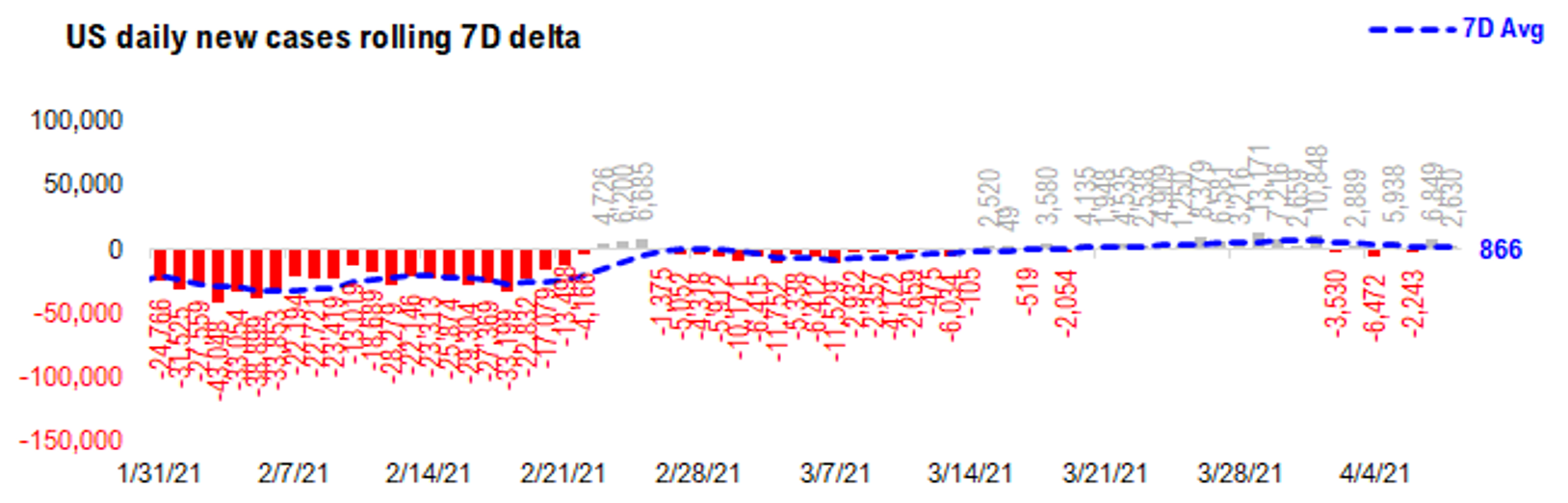

Daily cases are 73,907 vs 71,277 7D ago which is up a modest 3,630. The 7D positivity rate is 4.8%, lower from the 5% a week ago. The level of 5% is important. Hospitalized patients are up about 7.2% from a day ago, but daily deaths are still down by nearly 20% versus a week ago. So progress is a mixed picture, but it does appear that vaccine penetration is making a difference. Hospitalizations are primarily rising in CT, NK, PA, MD, MI and VT.

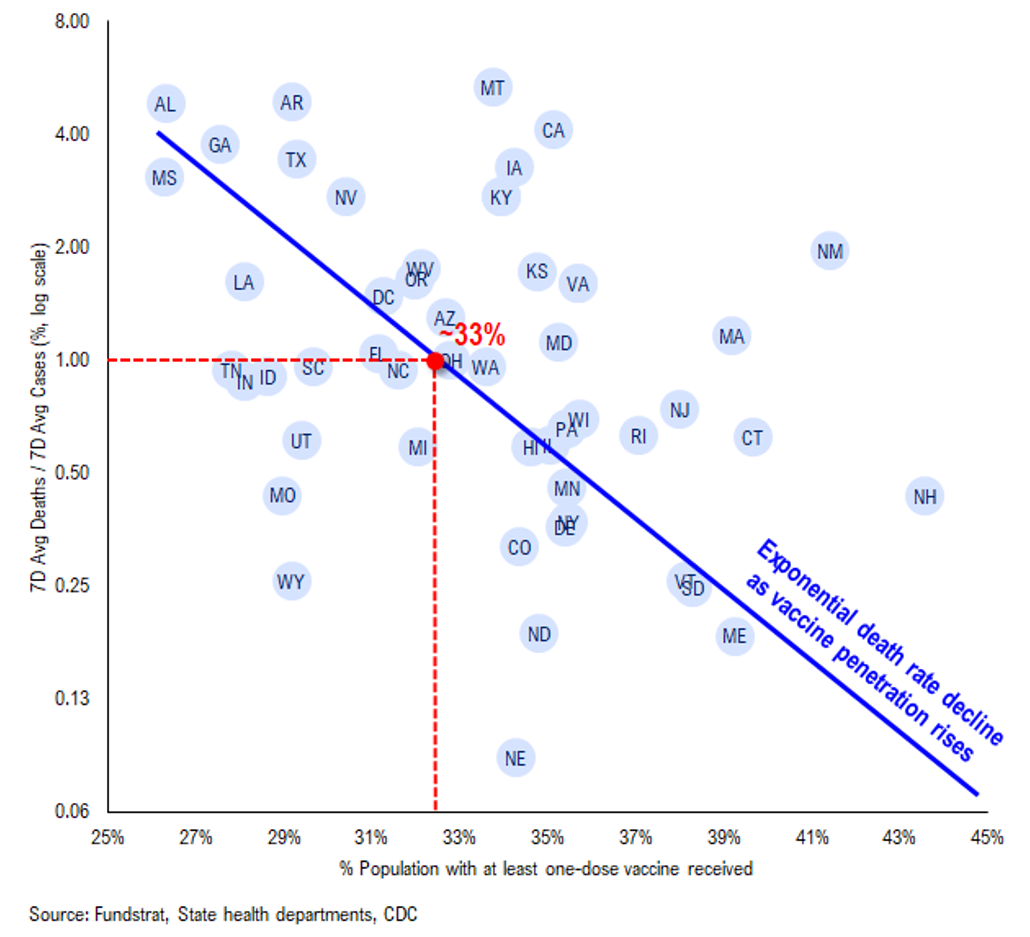

Take a look at the comparative ratio of vaccine penetration (x-axis) and the death rates (y-axis). The key to understanding the chart below is to realize the Y-axis is log scale. Thus, if this chart is true, as vaccine penetration rises, the death rate should be exponentially collapsing. Indeed, this seems to be the case. Death rates collapse when vaccine penetration reaches about 33%. States with higher vaccine penetration have seen death rates drop to .05%, or approximately 1/20 of the aggregate US level.

This is incredibly positive news and seems to be reaffirming the evidence from Israel, the vaccines are working. Coincidentally, they are also helping folks who already had COVID-19 and were having long-term symptoms. Vaccines are leading to a drop in mortality in the real world. This is promising for the re-opening timeline.

Strategy: Equities Are Acting Defensive, VIX and Credit Say “Risk On”

Since the start of 2Q2021 (April 1), equity markets have taken on a somewhat defensive tone. We expected a ‘face ripper’ rally and while the MTD of 3.1% does qualify, we were surprised to see it led by Defensive and Large-Cap Growth names. Clients have told us they’re shifting toward a quality bias because of the opinion that economic momentum has peaked. Other may worry that a market top is near given the warnings of technicians and the always unpopular specter of tax hikes.

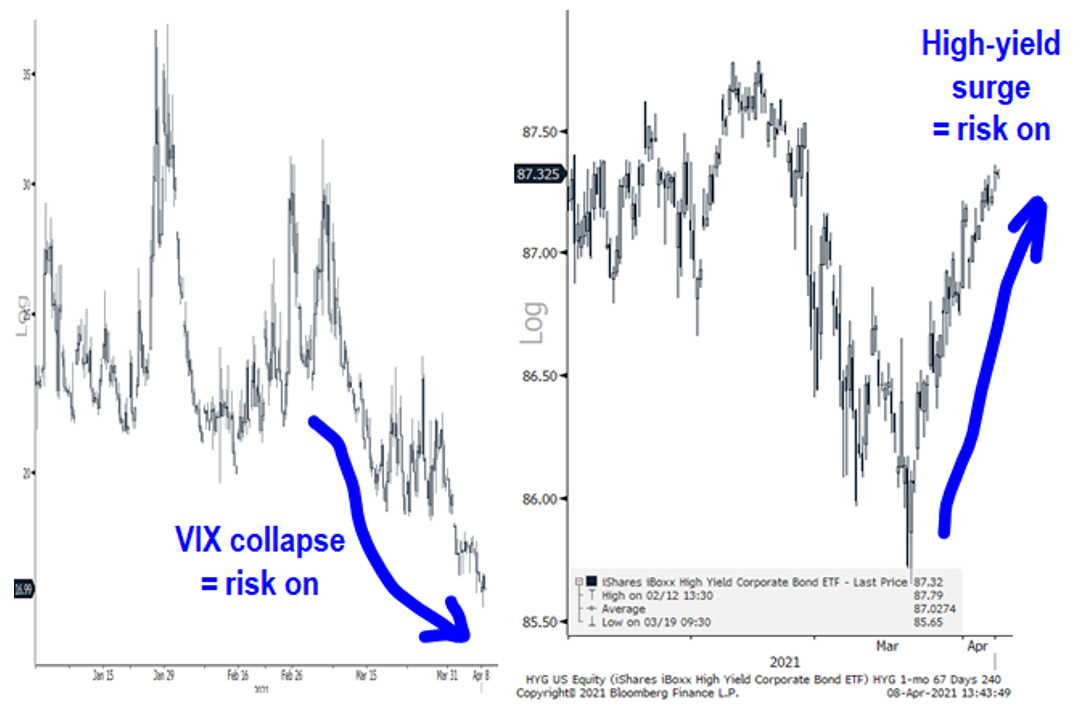

However, despite this attitude, the data is telling a different story. Remember that equity is the junior part of the capital structure. While stocks have been shifting to quality (Nasdaq 100 vs. Russel 2000) credit markets have been telling a different story. The quality shift that is being seen in stocks is not showing up in credit markets. The last two weeks has seen a divergence between with credit favoring ‘high-yield’ and the Russel 2000 lagging behind the Nasdaq. We think that credit and the VIX are saying the reversion to Tech/Defensive leadership is short-lived. Our bet is still on Epicenter having the best risk/reward.

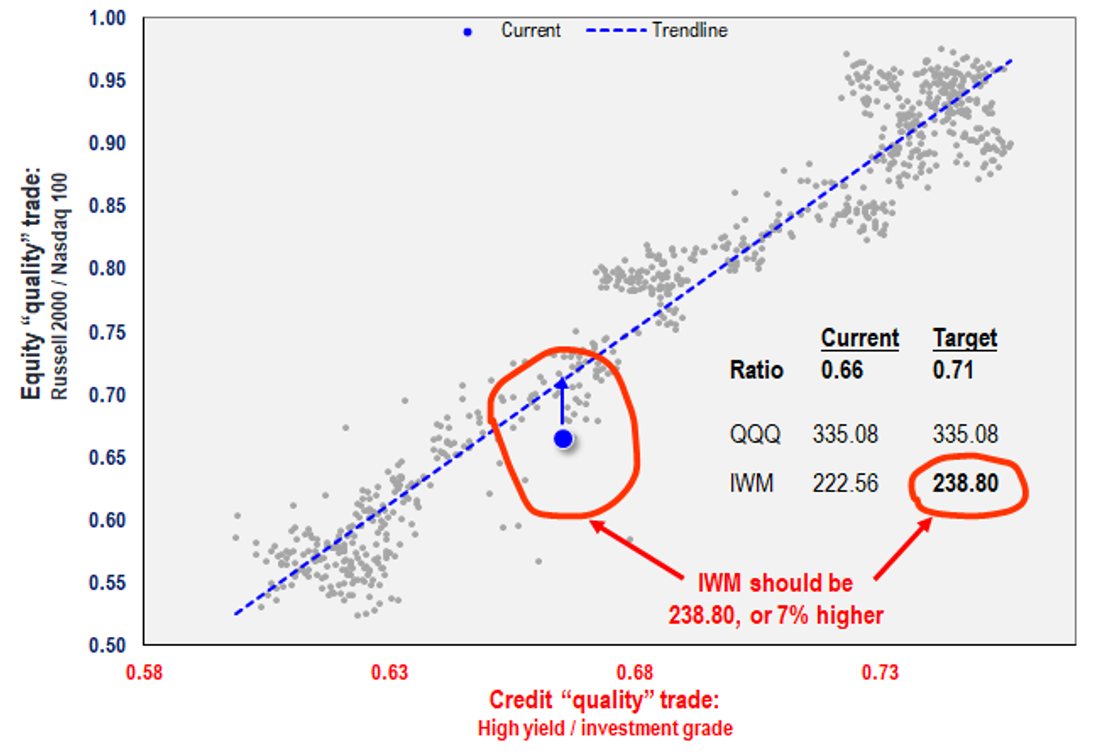

Credit and equity generally move in lockstep in terms of quality. So these two indices have moved in tandem for many years. Below is the last 3 years and it is quite evident that quality usually moves in tandem. For the past 3 years the correlation of these two indices is 94%.

So, the VIX continues its journey lower and closed today below $17. HYG is surging significantly since March. These two indicators are not suggesting we are on the verge of a slow-down in economic momentum.

The natural question is what this implies for small cap stocks. Since the correlation is so tight, we can expect equities to catch up to the quality trade in credit. Foremost, we view small caps as a good proxy for Epicenter and cyclicals because of their higher composition of cyclical stocks. There’s a 94% correlation between equity and credit ‘quality’ indices. We usually view credit as leading since it’s senior in the capital structure. The two indicators together, VIX and credit make us think small caps and Epicenter (including Energy) are due for a catch-up. Check out what the scatter plot we did based on the correlation implies. The x axis is credit and the y axis is equities and you can see that the current ratio is below the regression line. So the equity quality ratio should be .71 with QQQ at $335.08 the implied price of IWM is $238.80, an all-time high. This implies a +7% catch up coming up for small cap stocks. The catalyst could be 1Q2021 EPS season.

STRATEGY: Updating our Power Trifecta, adding net 10 stocks, now Power Trifecta 35 (*)

3 Deletions:PBCT, NVT0.13% , VNO

13 Additions:AZO0.42% , HOG0.56% , GRMN-0.85% , MGM0.90% , WH0.88% , GPS-1.28% , LB, VIRT2.38% , AGCO1.73% , OC-0.26% , UBER-2.95% .

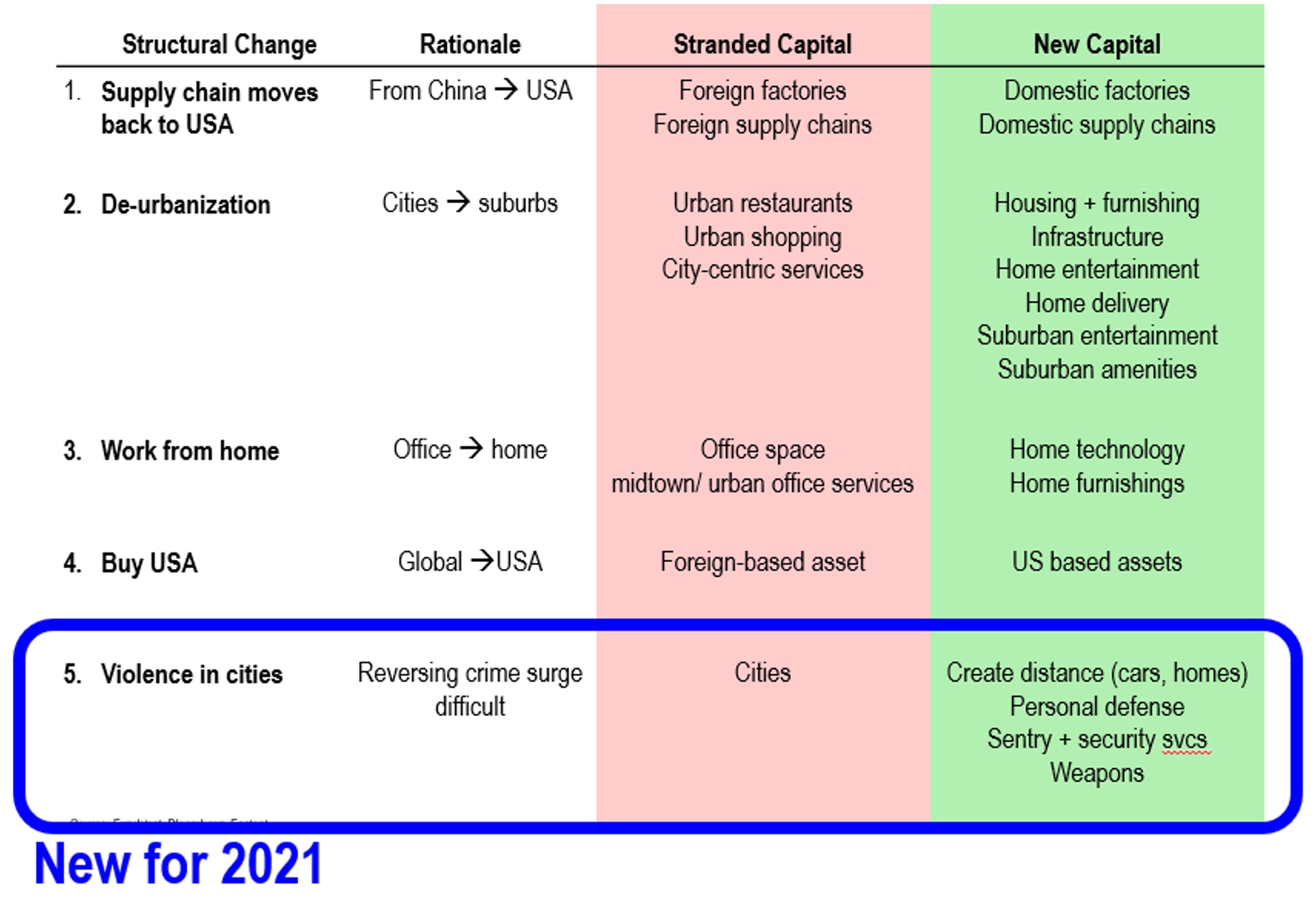

Figure: Way forward ➜ What changes after COVID-19

Per FSInsight

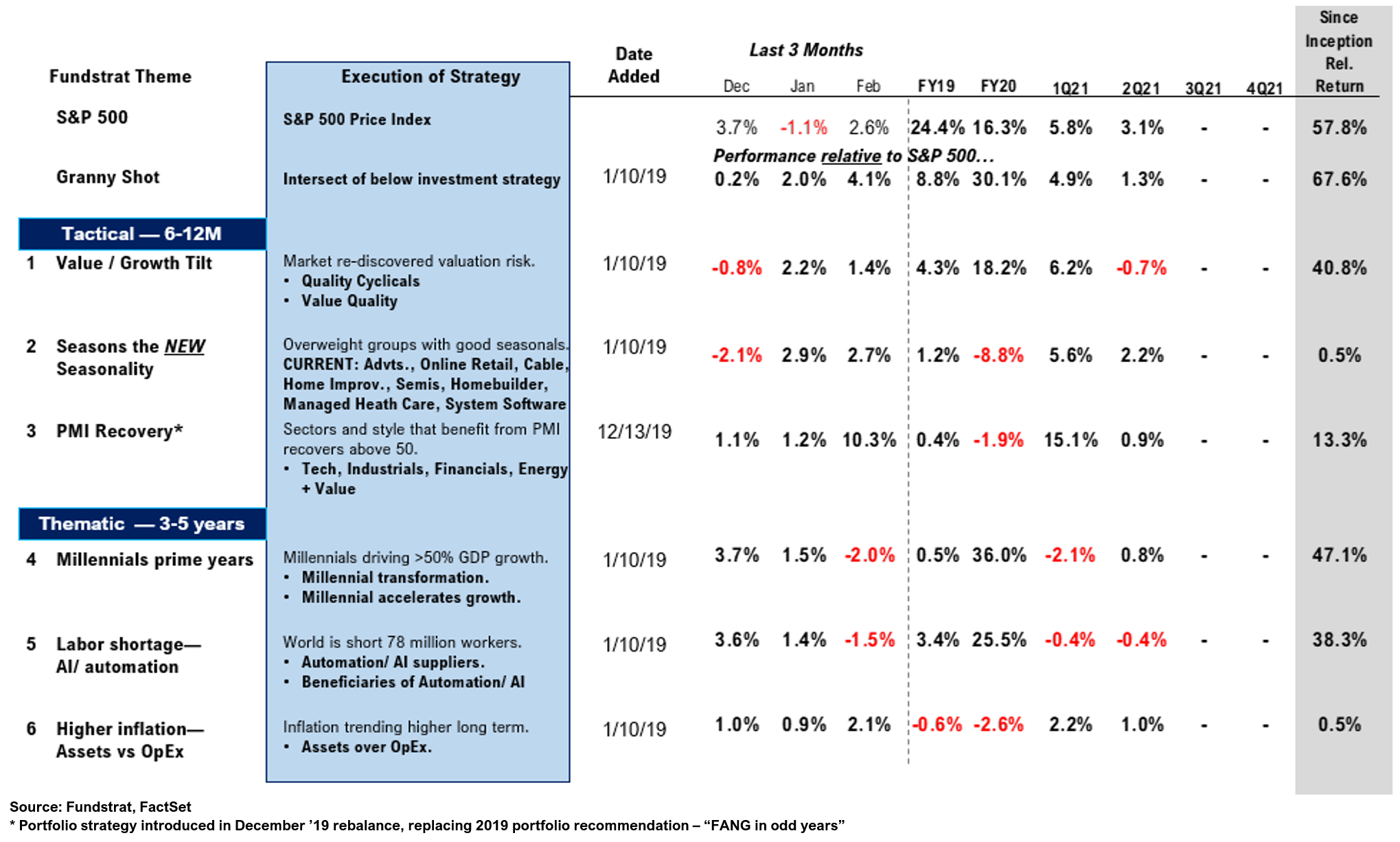

Figure: FSInsight Portfolio Strategy Summary – Relative to S&P 500

** Performance is calculated since strategy introduction, 1/10/2019

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In de23bd-3cf117-afa3be-fff5ab-2670de

Already have an account? Sign In de23bd-3cf117-afa3be-fff5ab-2670de