Case Trends Positive, Market-Chop Hides Cyclical Rotation

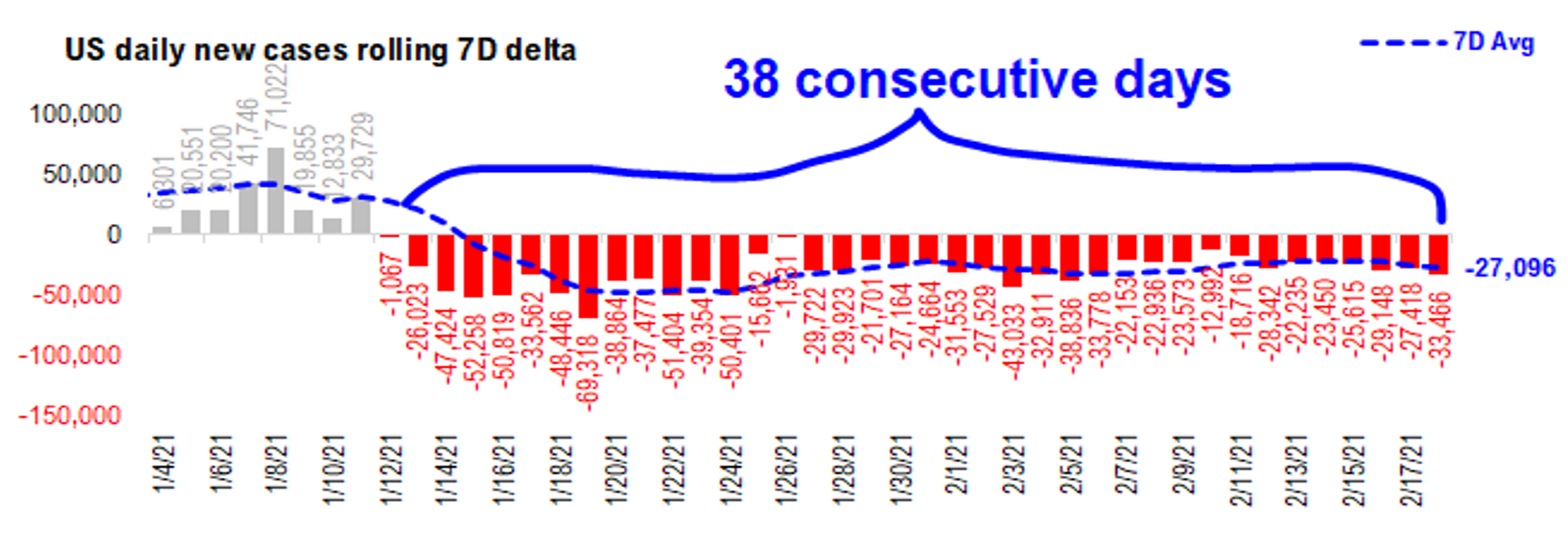

I would like to start this note by offering my thoughts and prayers to all those impacted by the current severe weather. Overall, trends in the US regarding COVID-19 are positive particularly regarding daily cases which are down 33,466 from a week ago. However, with the vast interruptions in testing due to weather there might be some under-reporting occurring.

Another complication is that it seems about 7% of total US cases are new variants. Given that some are more virulent and contagious, and that vaccines are less effective against the variants, it is a possibility that this could reverse positive progress on cases. Right now though, one of the most encouraging signs we’ve seen for a while just occurred. As Nate Silver pointed out, the daily positivity rate in the US has been below 5% for two consecutive days.

This is a big deal because it has not occurred since mid-October. If the trend continues, we could get below the 5% level before very long, which we view as a significant level. The lower positivity rate is likely not caused by temporary interruptions in testing. As we pointed out on Tuesday, it is also possible the drop in testing is accompanied by a drop in the R0 as social interaction is diminished by road closures and other issues caused by the severe weather. So, it’s difficult to say what the net effect of this winter weather will be with regards to the path of the virus.

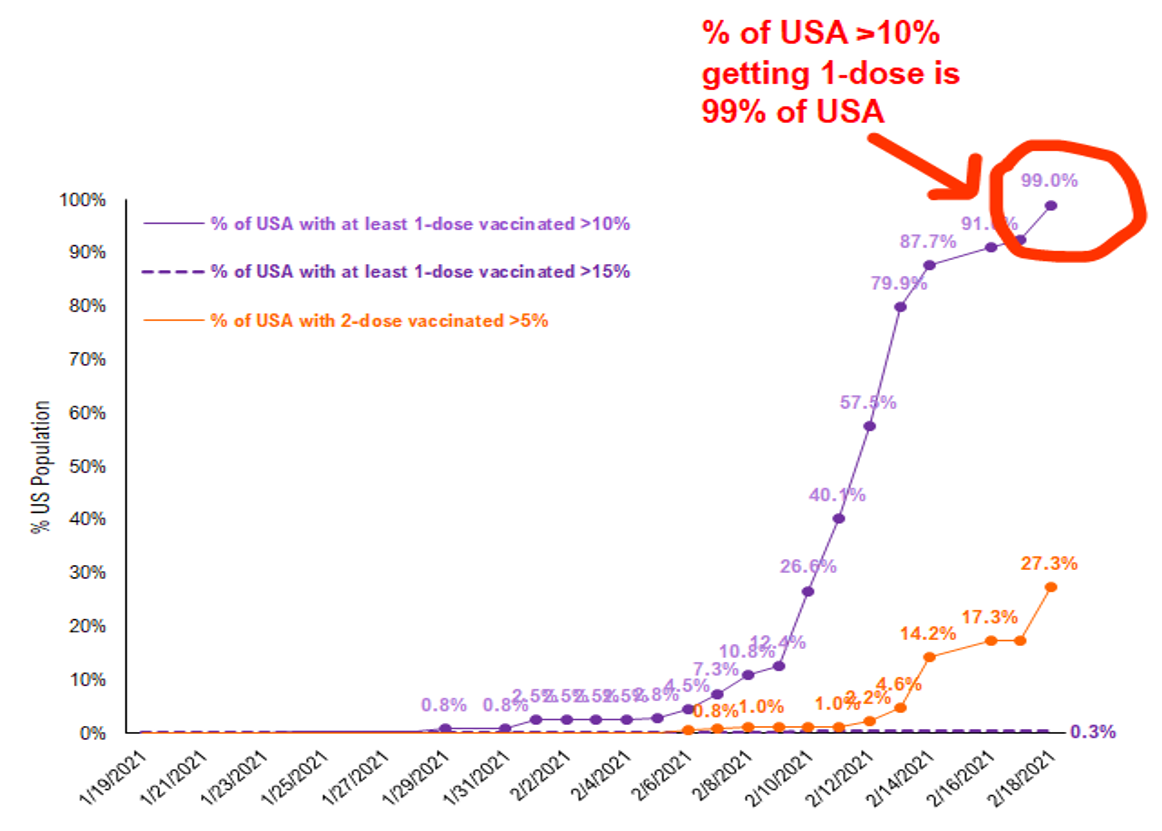

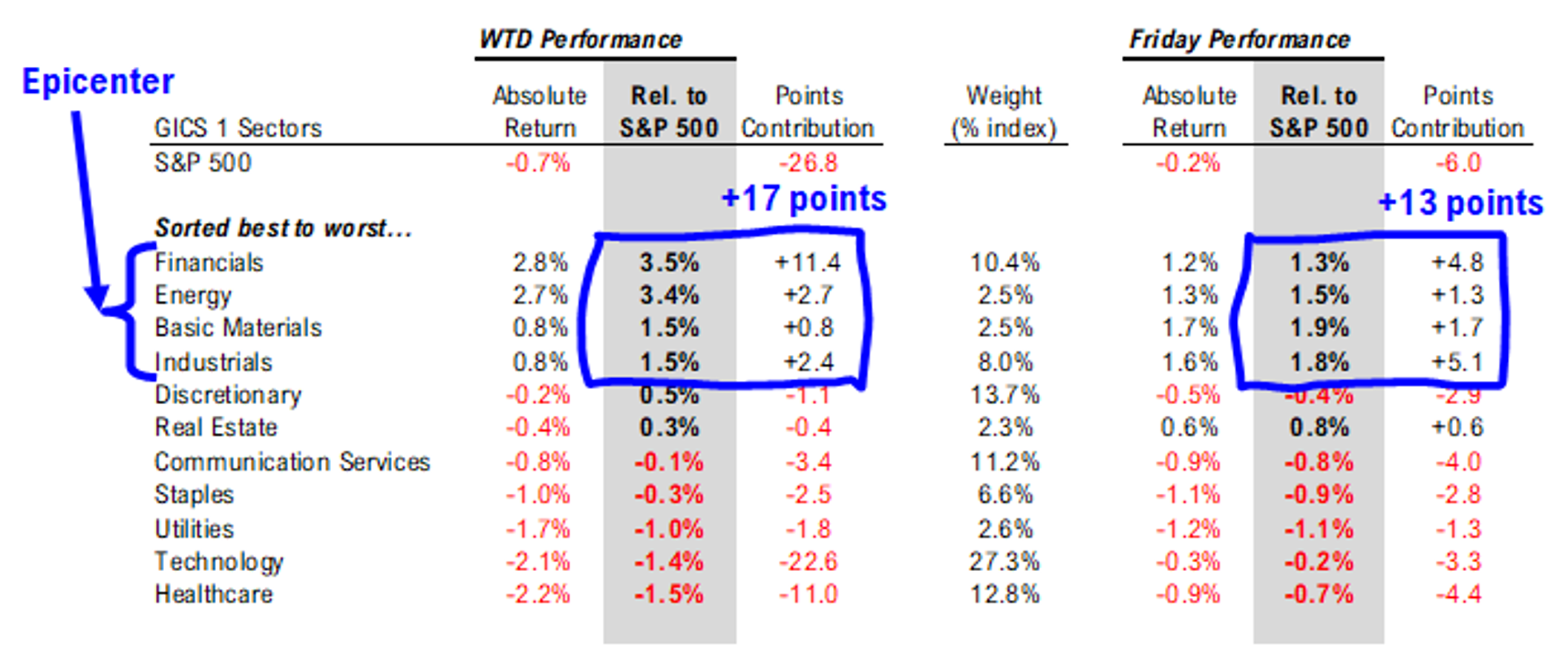

Progress also continues on vaccinations. The comments from Treasury Secretary Yellen on supporting the Biden admin’s stimulus and the moving of focus to the likely passage of the newest round of COVID-19 relief are also things that make us believe markets are still poised to shift to ‘risk-on’ despite this week’s action. What seemed like a very volatile week masked a very positive undercurrent in our estimation, cyclically sensitive stocks that should perform well in re-opening performed well and had a good week despite what happened at the index level. The drag caused by tech and health care were enough to drag the index down; however, the performance of these ‘Epicenter’ sectors in comparison to the rest of the market is decidedly positive in our estimation.

Markets rise on a wall of worry and they fall down a slope of hope as the saying goes. I have found that generally when the ‘top callers’ start calling ‘tops’ that it is a contrarian positive. Furthermore, despite the choppy market action this week at the index-level some interesting ‘risk-on’ undercurrents were going on if you look down to the GICS-1 sector level.

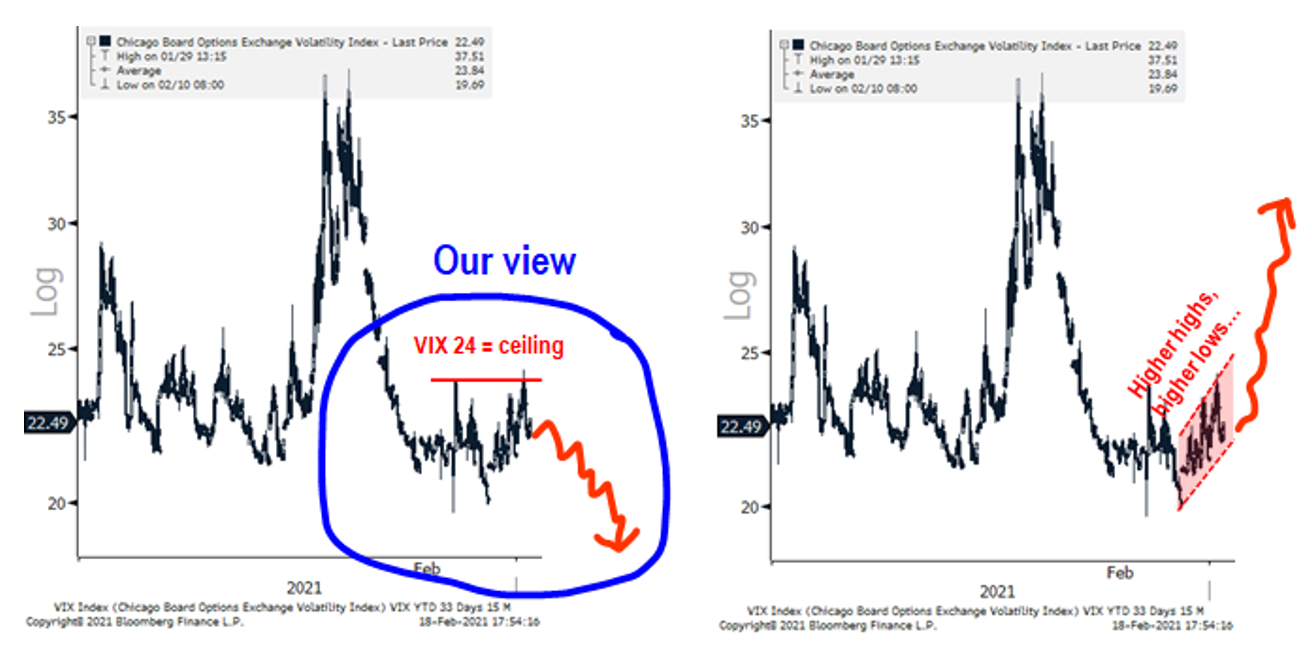

Since it appears that cyclicals are being bought and the VIX has been behaving reasonably we would assert that while certain sectors appear to be overstretched the wider market-rally will likely remain intact. Commodities are strong, economic data is strong and as our team will discuss below, we think ‘taper tantrum’ fears, at least in the short-term are overdone. Mr. Powell will likely reassure markets next week as he’s gotten quite accustomed to doing. In other words, what we might be seeing is the top being in for growth in the short-term rather than for the entire index. The fundamentals are still in place for a robust economic re-opening.

The behavior of the VIX this week despite the turmoil is supportive of this thesis; that markets took a pause this week that won’t significantly interrupt their upward trend. It was sending mixed signals, but we are of the opinion that this week was a counter-trend test of the 24 level. Last week, the VIX fell below 20 for the first time since COVID-19 roiled markets. Stocks were very choppy and it surged toward 24 before settling around 22. You could look at this in two ways; either it hit resistance at 24 and will move back below 20 or the VIX is in a channel making ‘higher highs and higher lows.’

We think that the VIX is in a counter-trend and will resume its downward move. The outperformance of ‘Epicenter’ sectors and the relatively tame behavior of the VIX given the serious selling this week suggests that the broader rally is likely still intact.

Bottom Line: We think bullish fundamentals are still in place and that you should be shifting exposure to ‘Epicenter’ names. Be sure to check out our recently revised ‘Epicenter Trifecta’ stock list.

Per FSInsight

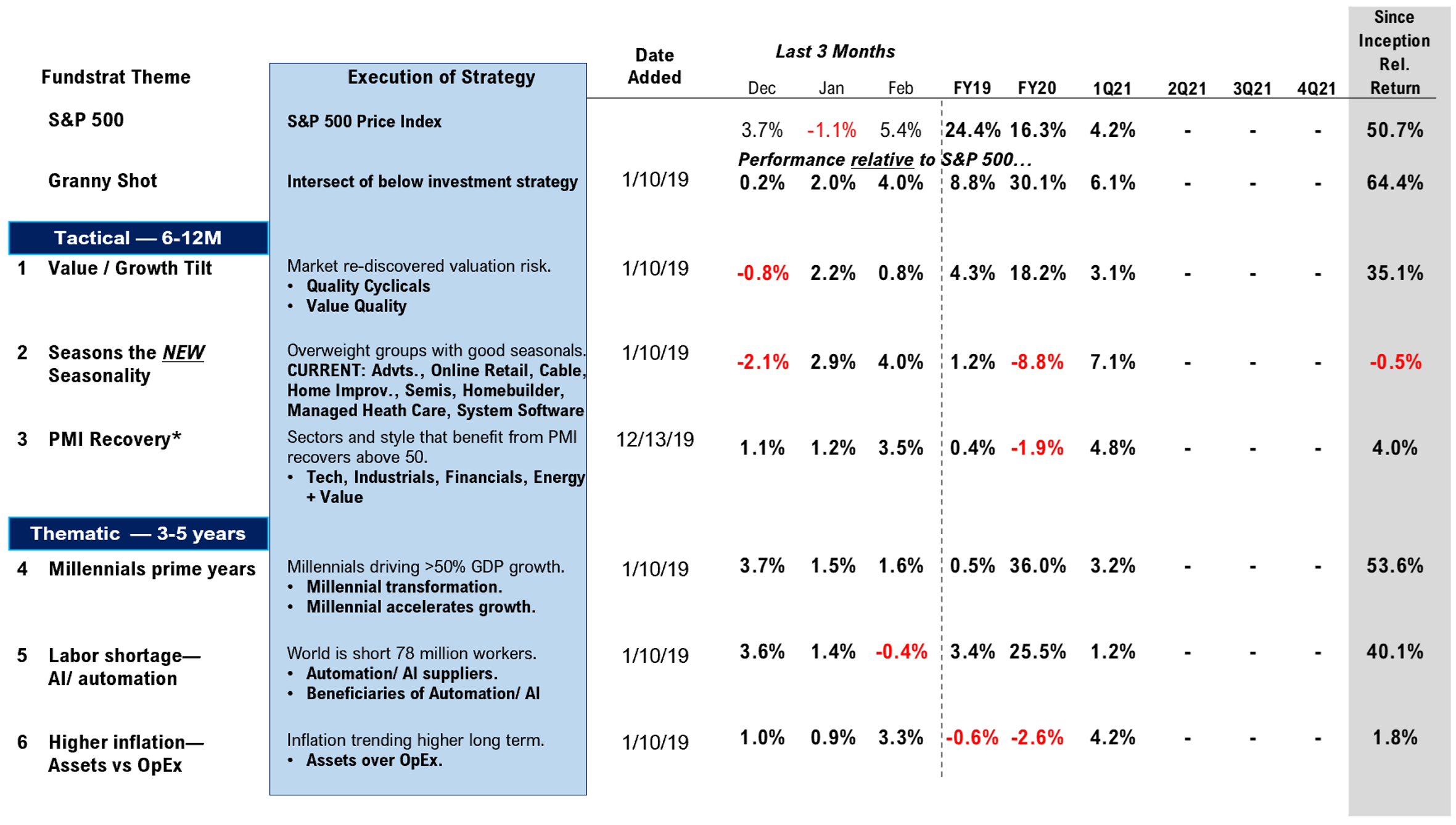

Figure: FSInsight Portfolio Strategy Summary – Relative to S&P 500

** Performance is calculated since strategy introduction, 1/10/2019