Epicenter Stocks Rise During Choppy Week for the Market

It has been a choppy week for markets, and stocks still remain ~7% off their recent highs. And we soon enter the seasonal trade “sell Rosh Hashanah, buy Yom Kippur” (9/19-9/28) so this bumpy ride might continue. Stocks have risen relentlessly since March, so any pullback is not entirely surprising to us. And for the past few days, we have highlighted why stocks still have positive risk/reward into YE.

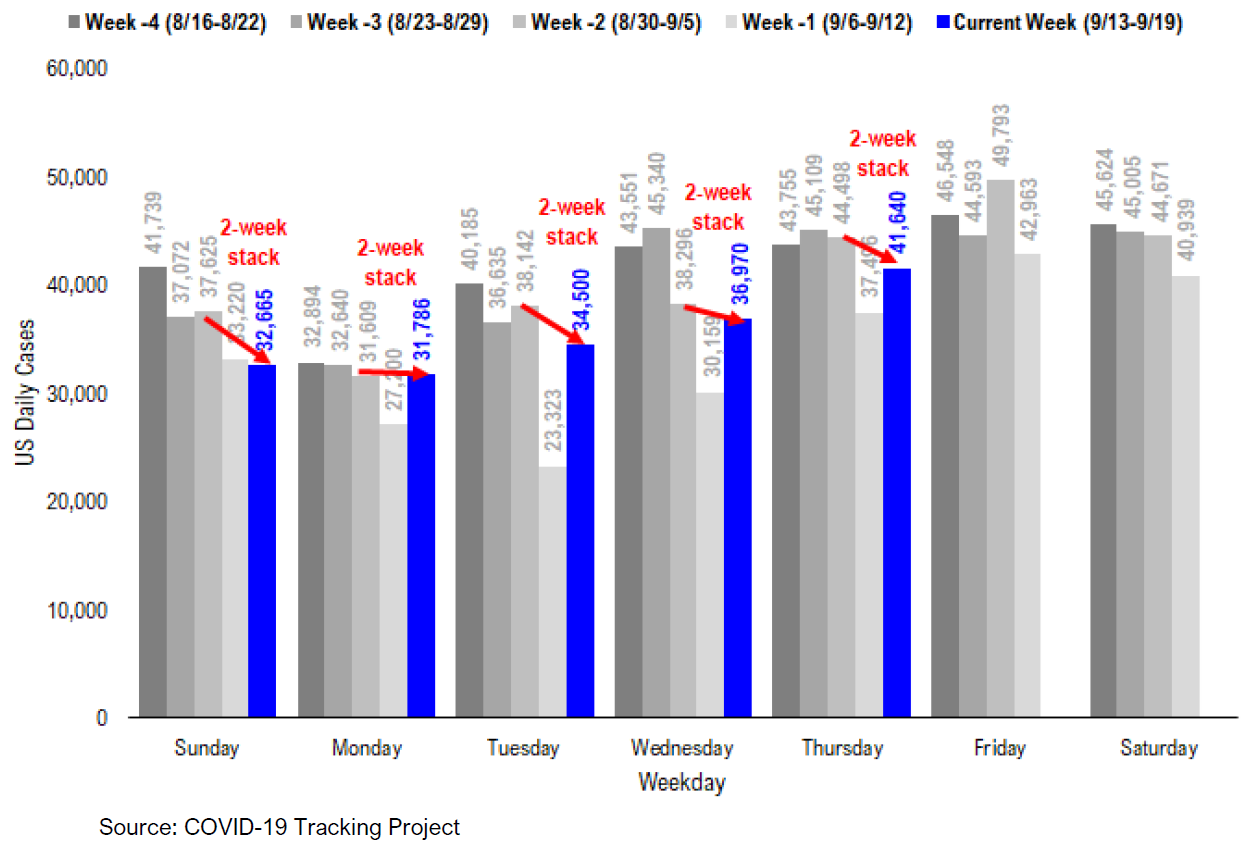

On the COVID-19 case data front, I can’t help thinking that there is some distortion in trends due to last week’s Labor Day holiday. That is, the long weekend and closures means we are seeing a catch up of this data week. And for now, the best way to put this in perspective is to look at 2-week trends (see red arrows on chart below). Therefore, I think next week will serve as a better baseline for tracking case trends as the Labor Day effect will be gone.

Periodically, we publish county-level data (Johns Hopkins data and cleaned up by our head of data science, tireless Ken). County-level data is useful because we can track underlying trends more comprehensively. This week, we revisited our metric of what % of the US that is seeing cases 75% off their peak. The ratio recently reached a new high of 60%. This is very promising as despite the fact that daily cases remain stubbornly high, the diffusion data tells us COVID-19 is still retreating.

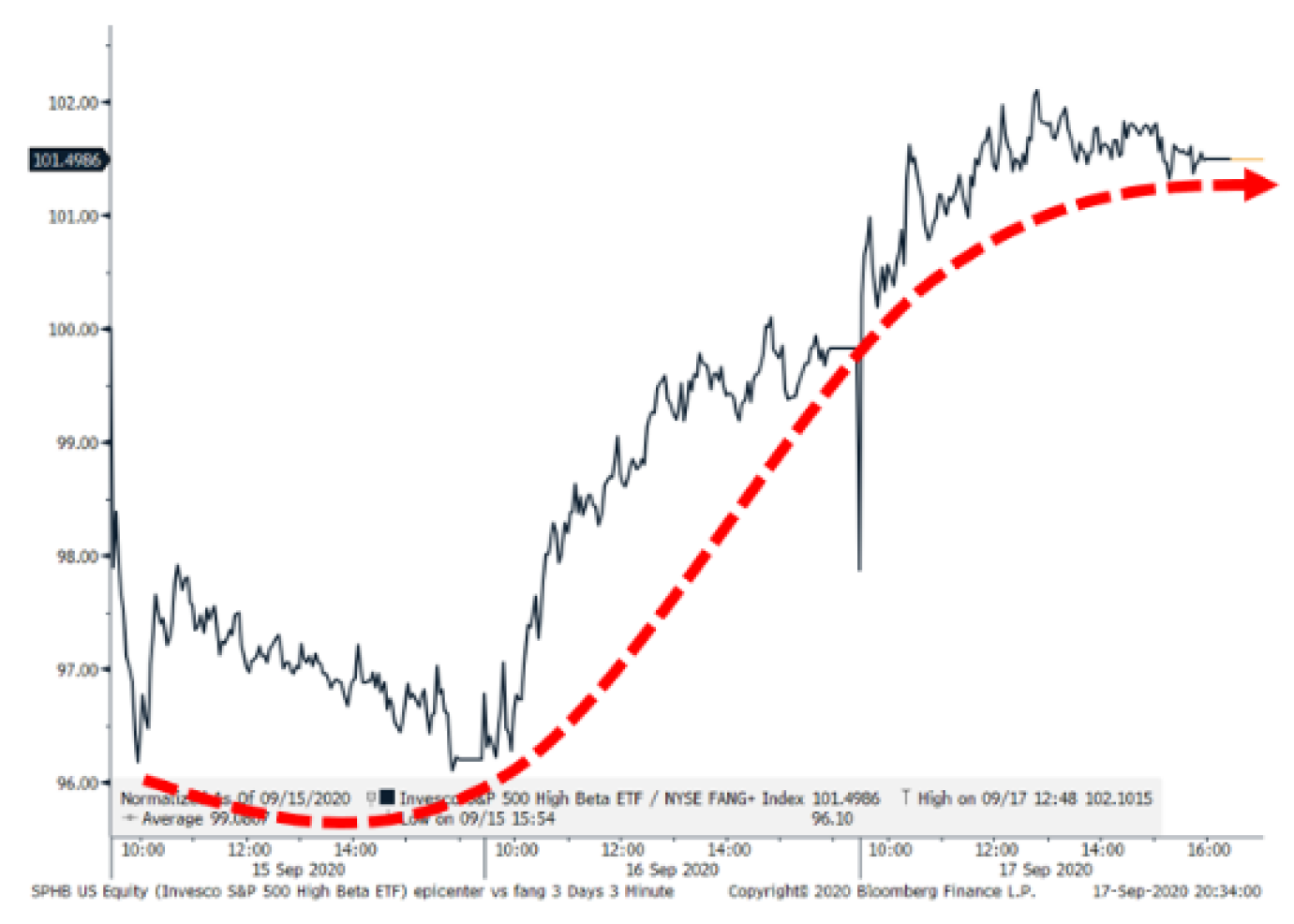

Strategy: Despite a choppy week, epicenter stocks rose during a broader sell off and this could be indicative of a telling change in market character. See chart below.

This global pandemic gauntlet is a true test for any company, but the cyclicals (aka “epicenter”) are particularly tested. After all, these companies are expected to suffer severe losses in an economic downturn. And this downturn is an outright global depression. Accordingly, I think the outlook for these stocks is strong as they will emerge as stronger businesses with higher margins and ultimately warrant higher P/E multiples.

Also of note, the bond market has been considerably more optimistic about the prospects for “epicenter” companies. Carnival and Six Flags, which are within the hardest hit industries of travel and leisure that have been obliterated by COVID-19 serve as two good examples. Carnival bonds have posted a strong recovery throughout the month of September and Six Flag bonds, which traded as low as 75 in March, are now back to par.

While I think it is perfectly reasonable for any investor to be extremely skeptical about equities into yearend 2020, I think time is best spent trying to understand the message from the market rather than projecting an opinion on it. And overall, I think the underlying message remains constructive.

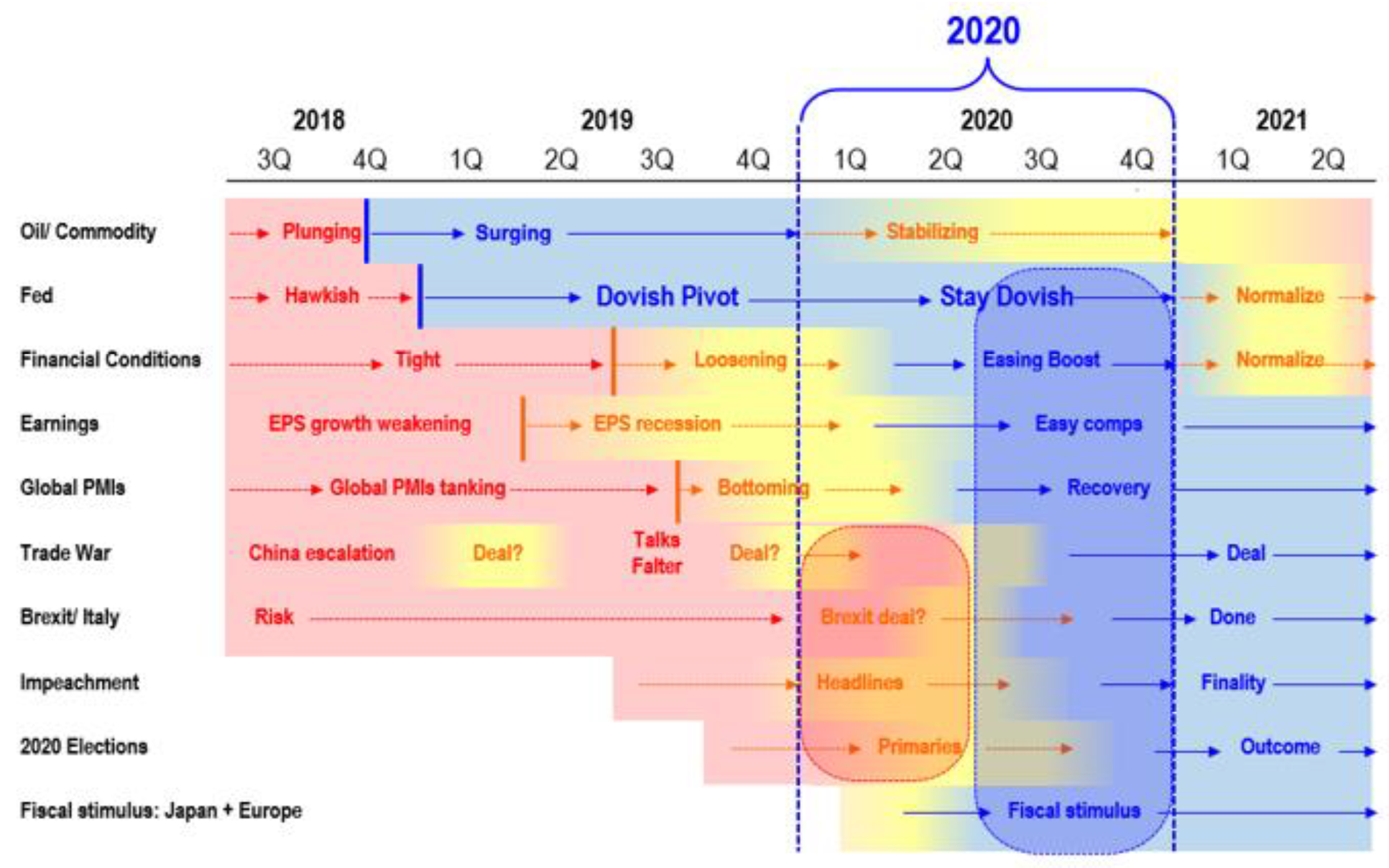

This week, the Fed re-iterated that it will be keeping rates low for a long time. Equities have undergone the “stress test of 5 lifetimes” and I see equity risk premia falling (i.e. P/Es rising). The world is more reliant on technology than it has ever been and the US is the main supplier. And finally, the demographic backdrop, which is one of the cornerstones of our research process remains highly favorable with the millennial generation entering its prime earning years and kicking off a bull market that could last 20 years.

This week we also updated our trifecta epicenter stock lists which is comprised of stocks that are positively levered to the economy re-opening. The list is based on favorable views from our Global Portfolio Strategist Brian Rauscher, Head of Technical Analysis Robert Sluymer, and our Quant DQM model managed by Ken Xuan. I’d highly encourage you to refer to the updated list from our research note sent out this Friday.

Bottom Line: The underlying message from the market remains constructive and we are seeing the start of the period of outperformance for the epicenter stocks.

Figure Comparative matrix of risk/reward drivers in 2020

Per FSInsight

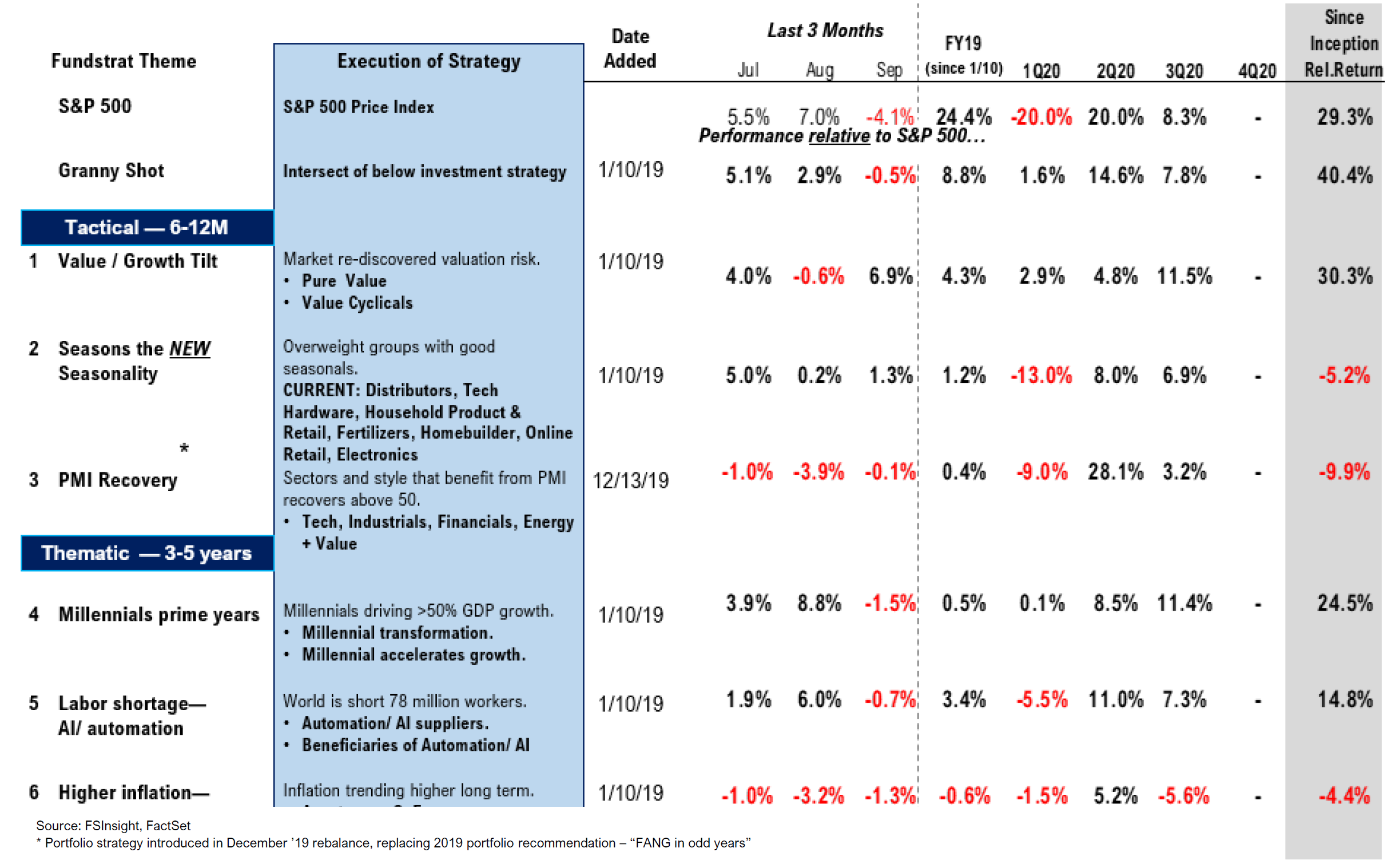

Figure: FSInsight Portfolio Strategy Summary – Relative to S&P 500

** Performance is calculated since strategy introduction, 1/10/2019