Signal From Noise

Research

Signal From Noise

Research

Post COVID-19, Simply Good Foods Stock Looks Appetizing

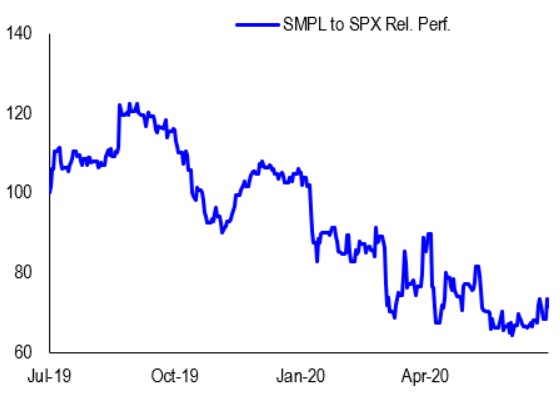

– COVID-19 panic knocked SMPL stock down 50% at one point; valuation seems appealing

– SMPL benefits from strong management; healthier snacks trend; potentially strong growth

– In a more normal post COVID-19 world, SMPL could rise 25%-30%; heavy insider buying seen

Once the COVID-19 outbreak subsides, however, SMPL should get back to its normal 20% or so growth. At around $19, I think that’s an attractive entry point long term, as I will explain below. Until COVID-19 hit, and as the February ended fiscal second quarter results indicate, SMPL was meeting its targets and showing promise. That should resume eventually.

In that quarter, SMPL’s net sales rose a healthy 83.4%, or $103.3 million, to $227.1 million. Net income fell to $10.7 million, or 11 cents per share from $12.7 million or 15 cents per share in the year ago quarter, but most of that was due to acquisition costs, including higher interest expense, of Quest Nutritional, as well as the latter’s SG&A costs. Adjusted EPS rose to 23 cents from 18 cents.

Quest should add to future sales and earnings, as well as to margins as the potential synergies kick in, which is part of the growth story. As many companies have done, SMPL rescinded guidance for the current (August end) 2020 fiscal year due to COVID-19 but kept its trailing 12-month net debt-to-adjusted EBITDA target of less than 3.7 times by fiscal year end. Currently it’s around 4 times.

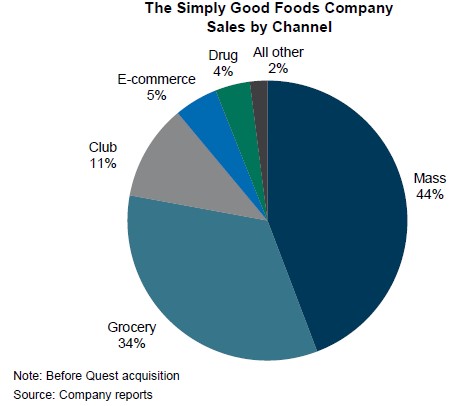

SMPL gets most of its revenue through mass market merchandizers, supermarkets, grocery and drug store outlets. The four-month economic shutdown—so far—made even food shopping more difficult than it had been. Remember the toilet paper run? For SMPL, nutrition bars represent about 50% of total sales and ready-to-drink shakes another 30%. These items are typically an on-the-go sale in retail, so during the COVID-19 panic, many such product categories were affected. This should show up in SMPL’s third quarter results, coming July 8.

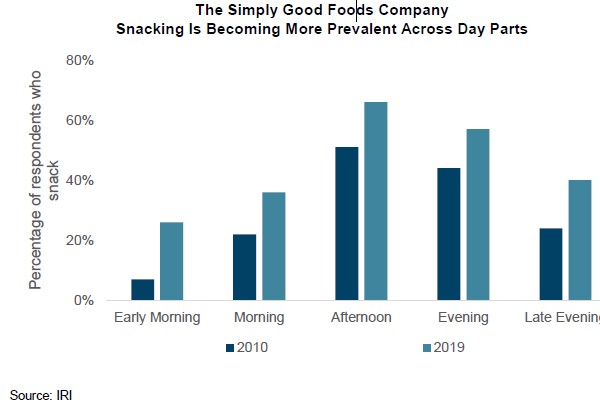

SMPL’s plan is, well, simple: provide healthier snack alternatives to a North American population that is snacking more frequently. SMPL’s main brands are Quest, SimplyProtein, and Atkins, like the Atkins Endulge line, which is designed to satisfy consumers’ cravings without the added sugar.

SMPL’s attractions are a strong management team; playing the theme of healthier snacks; brands, like Atkins, whose strengths are underappreciated; stable and potentially strong growth from a small base; debt cutting and cost synergies; and heavy insider stock buying. When the world gets back to normal, its Shares could perhaps gain 25%-30%, to the low to mid-twenties per share.

Marshall Kaplan, who runs the Fundamental Equity Advisors team at Ingalls & Synder, LLC, says SMPL’s managers are “terrific business operators,” with lots of experience at great brands, such as Hershey, Gillette, and Sarah Lee. They are successful “brand builders,” he says, and the addition of Quest Nutrition should help increase sales growth and yield potential cost cutting synergies. Quest offers snack bars, cookies, chips, etc., that are protein rich but limit sugar and carbs content.

There is also a strong endorsement from insiders. At SMPL the insider picture is “bullish” according to Insiderinsights.com, which follows such activity, with nine different executives or board members buying since the stock’s lows in March.

Atkins might seem an over the hill brand, but it isn’t, Kaplan avers, with serious growth potential. He’s seconded by broker William Blair, which wrote, in an initiation of SMPL coverage on June 24 with an Outperform rating, that in its proprietary survey Atkins possesses above-average brand awareness, scores well on consumer satisfaction, and provides a foundation for acquiring new users. The broker suggested the addressable audience for the Atkins brand could be four times as large as the current amount through expansion of its focus to include a greater proportion of consumers who prefer a self-directed approach in lowering carbohydrate intake.

Consumer research firm IRI says Atkins generated more than $700 million in measured retail channels last year, growing at an 8% CAGR since 2015. In 2019, snack bars grew at 12% and shakes 11%. William Blair also believes that Atkins aligns well with increasingly important consumer preferences for quality ingredients, clean label and healthy foods, variety and on-the-go convenience. That could be more interesting in a post-COVID-19 world. Atkins—and eventually Quest—could further penetrate other distribution channels such as convenience and club stores.

Additionally, there’s category potential. Nutritious snacking is a growing market. (See nearby chart.) According to William Blair, SMPL’s categories in measured channels are worth $5 billion-$6 billion, growing at a mid-single-digit annual rate SMPL is expected to produce $800 million in sales this fiscal year. On an all-channel basis including specialty, online, and club, Simply Good’s target market is closer to $10 billion.

Still there’s COVID-19, but more lately things appear to be getting less bad, and that’s good. In report Monday, broker Jefferies noted SMPL retail channel trends for the last four weeks ended were down about 4% against the year ago, versus down 12% in the last 12 weeks. SMPL has a healthy balance sheet, with debt to equity around 23%, and net debt of about $600 million. Wall Street EPS consensus has, understandably, come down, but strong 15%-20% growth is still expected. Analysts expect 81cents EPS in fiscal 2020, 96 cents in 2021 and $1.12 in 2022. Given SMPL is expected to grow significantly faster than the market, I think a 20-22 PE, a few points better than the current 19 forward PE is warranted. When COVID-19 recedes, investors might come to agree.

On July 8, the company will report results for the fiscal third quarter. The stock could fall if the quarter is soft and that might be a better time to buy the shares. However, that should be balanced against a possible better-than-expected quarter and the stock could rise.

Where I could be wrong: Unfortunately, COVID-19 could last longer than I expect. Wal Mart Stores (WMT) represents 44% of total sales, which is a double-edged sword.

Bottom Line: Pre-COVID-19, SMPL was growing at about 20% annually and I expect that should resume once the outbreak is contained.

Prior “Signals”

| Date | Topic | Subject / Ticker | The Signal |

| 6/24/20 | Stock | Lam Research, Applied Materials | Lam Research, Applied Materials Set to Reap IoT Harvest |

| 6/17/20 | Stock | Nordic Semiconductor (Nod.NO) | Continued IoT Growth Good News for Nordic Semiconductor |

| 6/10/20 | Stock | Helmerich & Payne (HP) | Helmerich & Payne Stock Could Energize Your Portfolio |

| 6/3/20 | Options | Van Hulzen Asset Management | For Income Seekers, Why Covered Calls Top Junk Bond ETFs |

| 5/27/20 | Stock | JP Morgan Chase (JPM) | Why JPMorgan Chase Belongs in Portfolios Post-COVID-19 |

| 5/20/20 | Stock | Horizon (HZNP) | Horizon Therapeutics Is Inexpensive; 2 Drugs Show Promise |

| 5/13/20 | Stock | Bank OZK (OZK) | ‘Plain Vanilla’ Bank OZK Could Be Long Term Opportunity |

| 5/6/20 | Stock | Graham Holdings (GHC) | Post COVID-19, Graham Holdings Could Return to Growth |

| 4/29/20 | Stock | Pacira (PCRX) | Pacira To Benefit from Surgery Trend Away from Opioids |

| 4/22/20 | Stock | Avalara (AVLR) | Avalara Stock Could Benefit from Catalysts Boosting Amazon |

| 4/15/20 | Stock | First Republic (FRC) | First Republic Stock Looks Cheap in Post COVID-19 World |

| 4/8/20 | Stock | Galapagos (GLPG) | If Galapagos Arthritis Drug Is Approved, Stock Looks Cheap |

| 4/1/20 | Stock | DaVita (DVA) | In Uncertain Markets, DaVita’s Stable Rev/EPS Look Attractive |

| 3/25/20 | Q&A | InsiderInsights | In Roiled Market, Insider Activity Could Offer Directional Clues |

| 3/18/20 | Market | US Stock Market | Market Discounts Recession; GDP, EPS Growth Worries Mount |

| 3/11/20 | Market | COVID-19 | COVID-19 Worry Overblown; Market Discounts Recession |

| 3/4/20 | Stock | iHeartMedia (IHRT) | iHeartMedia Stock Could Rise on Cost Cuts, Digital Revenue |

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 5af728-1226b8-44f48b-2f3d85-0066c7

Already have an account? Sign In 5af728-1226b8-44f48b-2f3d85-0066c7