Benchmark Crypto Indices Weekly Performance Review — April 6

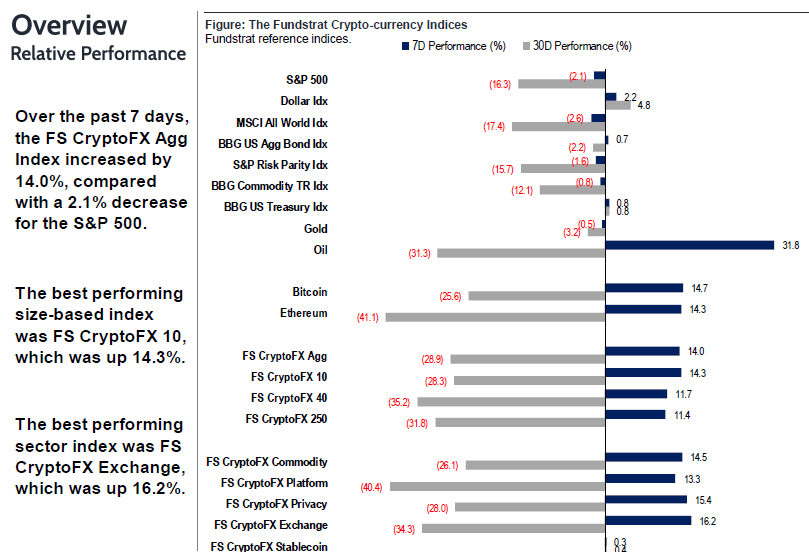

Over the past 7 days, the FS CryptoFX Agg Index increased by 14.0%, compared with a 2.1% decrease for the S&P 500. Bitcoin had four consecutive sessions of closing in the green to start last week. At one point on Thursday, Bitcoin even broke above the key trading resistance near $7,000. Overall, Bitcoin prices went up by 15%. More importantly, the sentiment of Bitcoin (and broader crypto market) seems to have recovered from the previous selloff. And as noted by our Chief Technician Robert Sluymer, the short term trend of Bitcoin turned positive last week.

Sector Rotation

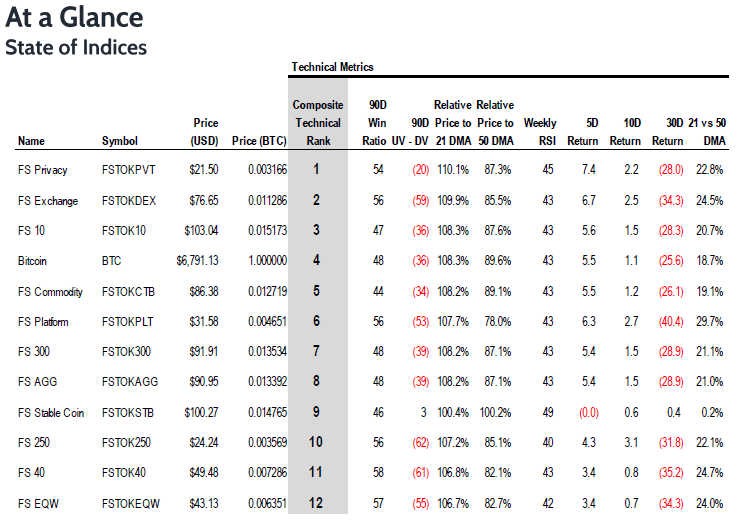

Size-based indices: The “larger caps” led last week as the FS CryptoFX Large-cap 10 (+14%) outperformed the FS CryptoFX Mid-cap 40 (+12%) while the FS CryptoFX Mid-cap 40 (+12%) outperformed the FS CryptoFX Small-cap 250 (+11%). The big two, Bitcoin (+15%) and Etheruem (+14%), are the biggest contributors to the leadership of the large-cap index.

Following being the laggard to other sector-based indices last week, FS CryptoFX Exchange index (+16.2%) was the best performing sector this week. The tokens of the three “China-originated” exchanges, Huobi Token, Binance Coin, and OKB, were the biggest drivers of the Exchange sector’s outperformance – all up about 20% over the past week. The strong momentum of the Privacy sector (+15.4%) continued and was the second-best performing sector over the past week.

Index Quarterly Rebalance

Fundstrat CryptoFX Indices have undergone a quarterly rebalance as of 3/31/2020. There has been no change in the constituents of the FS CryptoFX 10 Large-cap Index. FTX Token, Hedera Hashgraph, ICON, Algorand, Kyber Network, MonaCoin, QCash, and Status have been added into the FS CryptoFX 40 Mid-cap Index. At the same time, Maker, Insight Chain, Holo, Seele, Molecular Future, Bytom, Enjin Coin, and IOST dropped. The Aggregate index now has 720 currencies vs. 723 as of the 12/31/2019 rebalance.

For the sector-based indices, OKB and UNUS SED LEO have been added into the FS CryptoFX Exchange index. Hedera Hashgraph and Horizen have been added to the FS CryptoFX Platform Index and FS CryptoFX Privacy Index, respectively. Likewise, the FS CryptoFX Stablecoins index now includes the multi-collateral Dai.

Bitcoin halving creeping up amid Covid-19 crisis

While just about everything has been postponed in the face of the COVID-19 crisis, Bitcoin’s halving will not be. Expected to occur the week of May 18th, the much-anticipated event that investors have been vigorously debating for months is right around the corner.

We continue to view the halving as a long-term bullish event. All else equal, the halving of mining block rewards will result in less BTC supply coming onto the market. This should result in favorable net demand-supply dynamics over the long-term.

So, why does there continue to be so much debate in the community over the ultimate outcome?

While reduced supply is a positive for investors who hold bitcoin as a store of value asset, it has negative implications for certain miners, especially those with the least efficient mining hardware and the highest electricity costs. With block rewards composing about 95% of a miner’s total revenue, all else equal, halving block rewards is expected to reduce mining revenue by about 50%. Similar to how many businesses would have trouble covering their costs in the face of a 50% decline in revenue, higher cost miners can also be expected to come under serious pressure.

In the face of revenue declines and a largely unchanged cost structure, the concern is that these miners will be forced to liquidate large amounts of BTC held on their balance sheets to keep their lights on. In other words, even though there is less BTC being mined and available to be sold on the market, we could see an unusually high level of selling pressure while mining margins get squeezed.

In a scenario where BTC price, in USD terms, remains stable throughout the period, expect one of the most underappreciated features of the BTC protocol to come into play: the difficulty adjustment.

Should BTC price remain stable in USD terms, the least profitable miners can be expected to eventually close up shop, at least the time being. With mining rigs coming off the network, overall hash power will decline and, absent a difficulty adjustment, block times will creep past their usual 10-minute interval.

To return the network to equilibrium, a downward difficulty adjustment will reduce the necessary hash power needed to successfully mine a block. Therefore, miners who were still profitable post-halving will be more profitable as they now expend less electricity to earn block rewards. With greater profitability across the network, the scramble to cover costs by selling BTC will be abated. Expect this to neutralize what could be some adverse short-term structural impacts.

So, yes, there are solid arguments to be had on both sides of the halving debate. We remain in the camp that this is a long-term bullish event. Long-term supply/demand dynamics will win out over shorter-term, self-correcting, market structure changes.

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 89003c-f4cc3f-430819-51c41d-44e3d6

Already have an account? Sign In 89003c-f4cc3f-430819-51c41d-44e3d6