Signal From Noise

Research

Signal From Noise

Research

In Roiled Market, Insider Activity Could Offer Directional Clues

Signal from Noise Question & Answer articles are published occasionally as we run across investment themes and stock ideas relevant to subscribers. It’s our intention to familiarize you, if briefly, with the views of successful investment managers and analysts, some you might have read about, but, more importantly perhaps, some you might not have.

This week’s Q&A was conducted recently with Jonathan Moreland, Director of Research at New York City-based InsiderInsights.com, which began operations in 2001. I think what corporate insiders are doing is particularly relevant right now, given the over 30% drop in the equity market.

Insider selling is done for many reasons, but insider buying is usually done for one: the insider thinks there is value in his or her company’s stock. Insiders are expected to know the company’s outlook better than anyone else. You will find some insiderinsight.com stock picks below, but, perhaps more importantly, Moreland says that across the board insider buying is giving a significant long-term buy signal according to his proprietary insider indicator.

While some might say it’s just corporate managers trying to make a bad situation look better, Moreland says his system takes into account insider track records and weights their buy/sell decisions according to several factors, including how much and how correct their stock picking has been. “If the executive has a good track record, the concern about window dressing is less valid,” he says.

Q: Insider data has been around for a while. How has it changed, and what does your firm do differently?

A: I got involved with insider data in the early 1990s, when the information was still viewed as generating an exception to the Efficient Market Hypothesis. Since Sarbanes-Oxley regulations and the SEC’s EDGAR system early this century, though, the democratization of insider data has led to it becoming of mediocre use to investors who applied the old, simplistic analysis methods for investment intelligence. I’d even argue that simplistic “scores” that merely rate an insider on their average historical returns is “over and done.”

Our focus has been to use technology and embrace the depth and speed of information available on EDGAR with a combination of “expert systems” that allow us to generate more meaningful insider signals more quickly. We’ve had to stay in tune with how clients want to use both our underlying data, and all the derivative analytics we generate from it.

Q: What are common misconceptions about insider data?

A: Anyone who thinks they’re going to make money with insider data just because they have a nifty XML parser is wasting their time. Cleansing this very noisy and error-prone data feed and understanding and quantifying the behavioral aspects of the numbers recorded on SEC Form 4s takes real experience, time, and back-testing capabilities.

I’m also still surprised at how often even professionals think the dollar value of an insider trade tells them all or most of what they need to know. And when they lose money relying on that—and other—simple insider strategies, they throw their hands up and say insider data doesn’t work anymore. That’s like a growth investor expecting to make money blindly buying every stock after the company reports 100% EPS growth. Was that percentage growth from $1 to $2, or 1 cent to 2 cents? And what do the financial statement footnotes indicate about the “quality” of the earnings and revenues?

We’d all agree that that matters to real growth investors. The same added analysis is needed to determine the meaningfulness of the various numbers on SEC Form 4s. And by the way, Form 4s also have footnotes.

I’ll also throw in that too many investors think insiders signals only generate “value” investments. We combine our insider metrics with momentum, yield, high-risk sectors like biotech, and negative factors for short ideas to generate quality investment ideas across the style spectrum.

By the way, our insider signals can be used to improve returns through the use of options strategies. I’ve even talked with a few distressed bond investors who’ve made money applying our insider signals to their analysis. They logically reason that if executives think their slumping equity is still a value, the related distressed debt is even less likely to be defaulted on.

The bottom line is that we advocate using our insider signals as a first screen to determine where to focus your valuable and finite research time. Every day, stock investors have a choice of 5,000 to 10,000 stocks they could consider buying depending on their market cap and trading volume restrictions. Insiders activity can be an important factor to start your research process with.

Q: How have your insider signals been working lately?

A: I’ll say that 2019 was a good year for the profitability of our insider signals—even if you just used them for a simple long equity strategy. Of course, investors want to know about what insiders are doing right now, in the middle of a 30% market drop.

As of March 24, as I alluded to above, the broad market indicator is flashing a long term buy signal and there is clear demand for certain individual stocks after this wholesale carnage.

Last week, on March 18 the S&P 500 finally overshot its December 2018 intra-day low, and our InsiderBased Market Indicator just posted the largest weekly percentage move in its two decades plus of history. Both those facts occurring so close together has me optimistic that we’re moving along in the bottoming process for this market correction. But even if true, the coming weeks could remain very volatile. The big rebounders today could be tomorrow’s big losers if the indiscriminate selling returns. It’s called a “process” for a reason.

Our Indicator rose a stunning 98 percentage points last week, hoisting its absolute level to +41%. So after 7 weeks in a bearish trend, our Indicator has finally risen to an absolute level that has marked the bottoms of the market pullbacks in December 2018 and January 2016.

On the other hand—there’s always another hand, isn’t there—our Indicator had to rise to +90% in September 2011 and +104% during the 2008 financial crisis before those pullbacks bottomed. So we’re keeping cash at 30% despite the apparent progress in the market’s bottoming process, and I continue to wonder whether the major indices can rebound in earnest until the trend in reported coronavirus deaths levels off.

I continue to wonder whether the major indices can rebound in earnest until the trend in reported coronavirus deaths levels off. Sure, the big gainers during an up session could be tomorrow’s big losers if the indiscriminate selling returns.

Our Insider-Based Market Indicator is an “incidental” indicator, and not constructed to be a short-term trading signal. Trying to call a market top or bottom ahead of time is a sucker’s game. Our Indicator attempts to confirm—or not—longer-term market trend changes ASAP after they begin. A much more reasonable endeavor.

Moreover, just acknowledge that you are NOT going to catch the exact bottom here. Build your watch list now and get ready to buy a little something. I can’t help but notice that some individual stocks are starting to really protest their indiscriminate sell offs. some of the stocks on our Daily Ratings Reports, Recommended List, and Bullish InsiderInsights Universe are spiking by 30% and higher, even in sessions where the S&P 500 index is up by barely 1%!? That price action indicates much more than just dead-cat bounces.

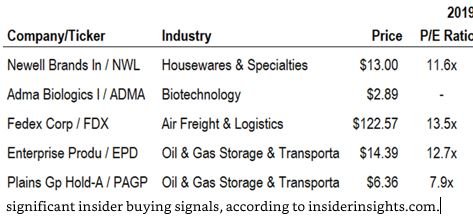

Below are some of the stocks that are flashing strong and significant insider buying signals, according to insiderinsights.com.

Newell Brands (NWL) $13.00

I would offer NWL as a “value play” based on its less-than-10-times forward EPS estimate and over 7% indicated yield. But let’s face it: the odds are that payouts and estimates are coming down for every firm after this unprecedented crisis. Still, I don’t think the market for Newell’s staple products sold under such household names as Rubbermaid , Sharpie, Paper Mate, Coleman, and Elmer’s are going away. Buying into NWL along with Carl Icahn and other insiders looks like a prudent long-term bet after this stock’s collapse.

ADMA Biologics (ADMA) @ $2.89

ADMA Biologics just graduated from “development-stage” status in the first half of 2019, with FDA approval of two products for the treatment of immunodeficient patients at risk for infection and for certain infectious diseases. Six insiders purchased over $16.5 million worth of ADMA on 2/11/20 in a recent offering, with all of them increasing their holdings notably with the buys. ADMA has rebounded to above $3 again, but with the low-end price target form the sell side at $10, this is still a good name for investors looking for a high-risk/high-reward prospect.

High-Yielding Closed-End Funds

The concentration of “Significant” insider buying in the entire financials complex has been obvious, but I’ve so-far not bit on the typical small and regional banks on my list given terminally low interest rates and the GDP-crushing economic events. I’ve actually opted for a bit more risk at this time, with high-yielding closed-end funds that are generally considered lower-risk—but which just got crushed late March: NHS, PHD, PPR, EFF, EHI, BQH, and HIO. Some investors appear to think the very financial plumbing these funds are predicated on is in trouble of breaking. Protesting that thought, the very savvy managers at Saba Capital Management bought the collapses in all of them. SABA was the incredibly smart buyer of such income generators when they swan dived in December 2018. If SABA is wrong, we all have much more to worry about than a bad month or year in the stock market.

FedEx (FDX) $122.57

Insiders at FedEx started signaling value in their out-of-favor shares in late 2019, but they obviously could not have foreseen the effects on their business of the coronavirus. But they did know about it in late March 2020, when they again bought in “Significantly” after their latest earnings conference call. A disappointing quarter and lowered guidance appears unavoidable for every firm when they next announce earnings. With its end-of-May year end, FedEx was able to meet expectations during its February-ended Q3—and its stock bounced in the aftermath.

Enterprise Products Partners LP (EPD) $14.39 & Plains GP Holdings LP (PAGP) $6.36

As with financials, insiders have significantly bought across the energy complex as the shares—more understandably than most—crater wholesale along with oil prices. The whole spectrum of energy stocks still has plenty of risk, and short-term volatility is unavoidable. But for my money right now, I like income-generating midstream plays like Enterprise Products Partners LP (EPD) and Plains GP Holdings LP (PAGP). I may not end up pocketing their present indicated yields of 11% and 20%, respectively, as payouts may need to be reduced. But I do expect to get paid—and that both will survive this carnage.

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 2c077d-0a77fd-a93b6d-20f9f5-dbf957

Already have an account? Sign In 2c077d-0a77fd-a93b6d-20f9f5-dbf957